Professional Documents

Culture Documents

Human Response Management

Uploaded by

Ivan ClarkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Human Response Management

Uploaded by

Ivan ClarkCopyright:

Available Formats

Delhi Business Review ? Vol. 1, No.

2, July - December 2000

ACCOUNTING INFORMATION SYSTEM FOR HUMAN RESPONSE MANAGEMENT

Ajay Kumar Singh

CCOUNTING Information System (AIS) is a complex and fast growing area particularly in the field where human asset is involved. The information pertaining to Human Asset (HA) is something which is difficult to measure is the general belief. The result is that managers take decisions on the basis of whatever information is made available to them. One wrong decision regarding the most valuable asset (HA) may ruin the organisation and at present there is no generally accepted comprehensive HAA model which provides information for both cost and value of Human beings in the organization that can be used by the decision makers. Human Asset Accounting Information System (HAAIS) should be able to make a distinction between efficient and inefficient employees; effective and ineffective employees; experienced and inexperienced employees; et.al. There is virtually no comprehensive information system which helps the decision makers in taking decisions like, (a) whether to retain this employee or to fire him; (b) whether to give increments to the employees or to reduce their pay packets; (c) Impact of empowerment and Job satisfaction on the contribution made by employees; (d) Impact of team work, synergy, and organisation culture on the overall performance; et.al. Further at the conceptual level also there is a need to develop models which can satisfy the above-mentioned needs. Some of the issues which requires immediate attention needs to be discussed. The value of human resource depends upon the contribution in achieving organisational goals. However, it is difficult to measure separately the contributions made by different assets to the output. The assets other than human are recorded at the cost incurred in getting the right to use and hold those assets as a surrogate measure of value but Human Resource Assets are deprived off this treatment. Although the periodic reporting principle makes it obligatory to classify between revenue expenses and capital expenditures on the basis of their expected benefits, so as to show the Capital Expenditures as Assets of the Organisation at the date of financial reporting and match the current costs with the current benefits to show the profits during the period being reported, the expenditures incurred on Human Resource Assets are charged from the Income Statement in the year of expenditure under the present practices. This would have been correct, had there been no periodic reporting so that at the end of the venture whatever more is left is profit (less is loss). But due to the longer uncertain life of the business concerns, periodic reporting is necessary, hence the need for classifying between capital and revenue. To make the above objectively verifiable the Accountants generally use historical cost by assuming the Going Concern Concept. The Going Concern concept of accounting says that the principles of accounting can effectively be applied and used only when we assume that the business has a life which is not definite. If this is

Ajay Kumar Singh

so, one logical deduction can be that the job positions shall also continue for a period which is not definite. That means the job positions held by human beings are utilised by the organisations for a longer period. It, therefore, can be concluded that benefits received by the organisation, from human acting as a resource holding different job positions, are for a longer period. The identification of benefits and the costs involved in continuously getting these long term benefits are the major elements of Human Resource Accounting. The matching of the costs involved with the benefits from Human Resource in the relevant period and capitalisation of the residual costs are required for financial reporting for which no model exists which is generally acceptable to accountants. Many people accept while giving speaches that Human Resource Asset is the most important asset of the organisation, even then this asset could not find place in the Balance Sheet of Companies which is a contravention of the convention of disclosure. The author conducted a research study (Singh 1996) which is an attempt to analyse the perceptions of the human resources regarding various aspects of human resource accounting, interpret their perceptions, to suggest and recommend the changes required for further improvement in the field of accountancy.

Research Methodology

The study is based primarily on the use of primary data generated through structured questionnaire and personal interviews.

Administration of the Questionnaire

The questionnaire was issued to the executives personally by the researcher with the assurance that the information and opinion expressed in this survey shall be exclusively used for research purposes only and shall be kept strictly confidential. The organisations were also assured of confidentiality. The primary data was collected from 1991-92 to 1994-95.

Sample Size

In a study of this kind, generalisations of results with a fair degree of validity are possible when the samples are drawn from different organisations spread out through the length and breadth of the country. However, due to constraints of resources and time sample was drawn from organisations located in twenty six important cities covering twelve states. Business Organisations representing a wide range of activities such as manufacturing, mining, construction, and service activities numbering 225 were covered. These organisations were taken on the basis of Judgment sampling in order to make the study more representative. Out of 428 questionnaires issued to the executives, 264 were received and out of these 225 were fully answered giving a response rate of 62 % which can be termed as satisfactory in view of the long and comprehensive nature of the questionnaire.

Sample Classification

The sample selected for the research study covered the following four broad categories of organisations belonging to public and private sectors: 1. 2. 3. 4. Private Sector Service Company/Organisation (PSSC); Government Sector Service Company/Organisation (GSSC); Private Sector Manufacturing Company/Organisation (PSMC); Government Sector Manufacturing Company/Organisation (GSMC).

Delhi Business Review ? Vol. 1, No. 2, July - December 2000

Statistical Technique

Perceptions of the people can not be measured precisely hence a non - parametric statistical test namely Chi-square has been used for analysing and interpreting the data generated through structured questionnaire and personal interviews. Chi-square test has been used to test whether there is significant difference of opinion between the respondents of four sectors or not. The scale index (mean) has been calculated to find the average score on five point scale to make the analysis meaningful.

Major Findings

The study has classified various aspects pertaining to Human Resource into three broad categories: I II Acquisition of Human Resource Development of Human Resource

III Retention of Human Resource

Acquisition of Human Resource

1. The accounting practices of the sample organisations reveal that almost all the organisations debit fully to the Profit & Loss account the cost incurred on acquisition and development of Human Resource. The criteria for showing assets in the Balance Sheet is long term benefits rather than ownership of the asset. Human Resource serves the organisation for a long time hence it makes a case for showing it in the Balance Sheet and the cost of acquisition should be allocated over the period of benefits. The Profit and Loss Account and the Balance Sheet based on historical cost and matching of cost and revenue principle can not show a true and fair view unless cost aspect of Human Resource is duly incorporated. The salaries and other compensation paid to the Human Resource in an Organisation is actually the cost incurred by the Organisation and value to the individual from his point of view. Whereas Value of Human Resource for the Organisation should be perceived in terms of the contributions made by him/her to the Organisation which is useful for management accounting. Replacement cost of Human Resource is useful while taking Human Resource turnover decisions and opportunity cost for Human Resource retention decisions. The service contract between the employee and the Organisation binds both the parties and the liability to pay at regular intervals arises at the time of contract, hence Human Resource should be shown as Assets like the ones purchased on hire purchase basis are being shown in the Balance Sheet. A proper allocation of acquisition, development, and retention cost incurred on Human Resource should be charged from the Profit and Loss Account and the balance be transferred to the Balance Sheet.

2.

3.

4.

5.

6.

7.

8.

Ajay Kumar Singh

II

Development of Human Resource

1. The skills of Human Resource improve after attending training and/or development programmes. Approximately 29%improvement was found in the 20 skills tested before and after training & development programmes. The combined scale index (Mean) increased from 3.2484 to 4.1908 which is about 29%. The duration of benefits from updation, learning, training and development programmes in terms of increase in productivity is generally for a period more than a year which on an average lasts between two to three years.

2.

III Retention of Human Resource

1. The organisation intends to retain HR while acquiring, deploying, and developing them. The Organisation provides other facilities like housing, medical, transport, LTC, canteen, recreation, etc. also to retain the existing HR. In turn, organisation gets the benefits like, punctuality, healthy HR, etc.

Conclusions

1. The Organisation intends to retain Human beings and they also respond to the efforts of the Organisation in this regard. Hence it can be concluded that Human beings stay in the Organisation for a relatively longer period provided he/she is satisfied with the compensation and the work climate available to him. Training and Development programmes result in increasing productivity which is relatively stable and lasts for a period more than a year, hence the cost incurred on these programmes should be capitalised and allocated over a period of benefits received. The Profit and Loss Account and the Balance Sheet based on historical cost and matching of cost and revenue principle can not show a true and fair view unless cost aspect of Human beings is duly incorporated. The benefits from Human Asset will accrue for a long period of time, hence the cost incurred on Human Asset : acquisition, development and retention should be properly capitalised and only duly allocated portion should be incorporated in the Profit and Loss account. The capitalised portion of Human Asset cost should be shown in the Balance Sheet on the basis of expected future benefits as we show assets purchased under hire purchase scheme in the Balance Sheet. The value of Human Asset is purely related to the contributions made by the Human Asset for the Organisation which is more relevant for Management Accounting instead of financial accounting based on historical cost and matching of cost and revenue. Hence it is of no practical relevance to use cost as a surrogate measure of value of Human Resource for showing it as additional information which some of the Organisations are doing. The replacement cost and opportunity cost of Human Asset is relevant for Human Asset turnover and retention decisions respectively.

2.

3.

4.

5.

In the light of this study, the author has tried to provide a new framework which is being explained now.

Delhi Business Review ? Vol. 1, No. 2, July - December 2000

At the outset, I would like to place the paradigm shift that is taking place in this field. The increasing awareness among human beings is compelling organisations to put greater and greater emphasis on human aspect of any management decision. This has led to a shift in focus from Personnel Management to Human Resource Management (HRM) in the later half of the 20th Century. The last two decades of the 20th Century have witnessed a shift from HRM to Human Resource Development (HRD), a buzzword of the 20th Century. The buzzword of the 21st Century is going to be Human Development (HD). (Singh 1998) HRD treats human beings primarily as an input in the production process - a means (resource) rather than an end. HD treats humans as end rather than means to an end i.e., a resource. Welfare approaches look at human beings as beneficiaries and not as agents of change in the development process. It puts people at the center of its concern. The term Human Development (HD) is more relevant in this context which focuses in a systems framework all issues in society - whether economic growth, trade, employment, political freedom or cultural values from the perspective of people. It focuses on enlarging human choices which in principle are infinite and can change over time leading to enhancement of human capital. A similar focus (welfare economics) has been given by Professor Amartya Sen, the Nobel Prize winner in Economics for 1998. It is clear from the above that the word human resource needs to be redesignated and that is why the author prefers to use the term Human Capital instead of Human Resource. The present paper highlights the important dimensions of Human Asset Information System (HAIS) which is broader than HRIS.

Human Asset Information System (HAIS)

Brien (1995) has made a distinction between the traditional systems and HRIS in simple terms which is explained below. Traditionally, the organisations used computer based information systems to: produce pay roll, maintain personnel records, and analyse the use of personnel in business operations. training and development, health, safety, and security.

Many organisations have gone beyond these traditional functions and have developed HRIS which also supports: recruitment and hiring, job placement, performance appraisals,

Ajay Kumar Singh

employee benefits analysis, training and development, health, safety, and security.

The present paper tries to provide a new paradigm under a new nomenclature i.e., HAAIS. HAAIS is a subystem of MIS of an organisation and must be integrated to the main system to get better results. HAAIS can further be subdivided into different sub-sub-systems in the following manner (Fig. 1):

HAAIS

HAFAIS

HAMAIS

HAACIS

HDCIS

HRCIS

HDSIS

DHRCIS

IHRCIS

Fig. 1: HAAIS in a Systems Framework

A. Human Asset Financial Accounting Information System (HAFAIS)

1. 2. 3. Human Asset Acquisition Cost Information System (HAACIS) Human Development Cost Information System (HDCIS) Human Retention Cost Information System (HRCIS) (a) Direct Human Retention Cost Information System (DHRCIS) (b) Indirect Human Retention Cost Information System (IHRCIS)

B. Human Asset Management Accounting Information System (HCMAIS)

1. Human Decision Support Information System (HDSIS)

Delhi Business Review ? Vol. 1, No. 2, July - December 2000

Box 1: Recommendations of Study (Singh 1997) 1. The Institute of Management Accountants, Institute of Certified Public Accountants and Institute of Chartered Accountants of India (ICAI) should take initiative by making regulatory provisions regarding Human Asset Accounting and may take into consideration the recommendations of the study given below. The Academia may also investigate further dimensions of this problem in addition to absorbing the recommendations which are relevant to ICPA, IMA, and ICAI from their academic point of view. There should be a separate accounting head of Human Asset in the Balance Sheet and sub heads of acquisition cost, development cost and retention cost and all the costs pertaining to the Human Asset should be covered on the basis of historical cost and accrual concept. The allocated portion of acquisition, development, and retention cost should be taken to the Profit and Loss Account of the current year. The value of Human Asset is purely related to the contributions made by the Human Asset for the Organisation which is more relevant for Management Accounting instead of financial accounting based on historical cost and matching of cost and revenue. Hence it is of no practical relevance to use cost as a surrogate measure of value of Human Resource for showing it as additional information which some of the Organisations are doing. The replacement cost and opportunity cost of Human Resource is relevant for Human Resource turnover and retention decisions respectively and should be used for taking managerial decisions in this regard.

2.

3. 4.

5.

It is clear from the above that the most important asset of the organisation is not accounted for properly by the Accounting Information Systems that are present now and there is a need to radically transform information systems to incorporate the human capital. The decisions regarding Human Asset can not be taken properly unless the relevant, timely, and accurate information regarding HA is made available to the decision makers. Hence the need for proper information system which can account for Human Resource. In the light of the above, we can now understand more clearly HAAIS and its subsystems.

Human Asset Financial Accounting Information System (HAFAIS)

HAFAIS is an information system which provides information pertaining to various dimensions of human capital/asset within the broad principles of financial accounting to the users of accounting information. The sub-systems of HCFAIS are: 1. Human Asset Acquisition Cost Information System (HCACIS) Acquisition Cost or Historical Cost or Outlay Cost or Original Cost refers to the expenditure incurred by the organisation in recruiting, hiring, training, familiarisation and developing human assets. It is just like the concept of original cost for other assets. The acquisition cost is capitalised and written off over the period for which the employee remains with the Organisation. If the human asset leaves the organisation pre-maturely, the whole of the amount not written off is fully charged from the income of the current year. If the useful life exceeds the original estimates, revisions are made in the amortisation schedule. The current practice as shown in the findings of the study is to write off the whole amount in the year of

Ajay Kumar Singh

expenditure from the income statement is just contrary to the Matching of Cost and Revenue Concept of financial accounting. 2. Human Development Cost Information System (HDCIS) The research findings have proved that the benefits from developing human beings is for a longer period and is generally for a period more than a year, hence it needs to be capitalised and allocated as per a suitable method. If the person leaves the organisation prior to that period, then the whole of the amount not written off is fully charged from the income of that year. The current accounting practice as shown in the findings of the study is to write off the whole amount in the year of expenditure from the income statement which is contrary to the Matching of Cost and Revenue Concept of financial accounting. This may affect the decision to develop a person or not, hence there is a need to provide the decision makers the complete information about the cost involved and the benefits including the period of those benefits. Non availability of such information may hamper the development of human asset in the organisation which otherwise may give competitive edge to the organisation. 3. Human Retention Cost Information System (HRCIS) The compensation package of an employee is made in such a manner that the person is motivated to remain in the organisation for a longer period of time. The current accounting practice is to write off the whole amount of direct compensation from the income statement. Many indirect cost involved are recorded under different heads which do not reflect the true and fair view leading to incorrect decision making. HRCIS can be further sub-divided into: (a) Direct Human Retention Cost Information System (DHRCIS) (b) Indirect Human Retention Cost Information System (IHRCIS) (a) Direct Human Retention Cost Information System (DHRCIS): The total amount which is paid to the employee of an organisation as a part of the compensation package forms part of the direct cost and should be debited to the income statement as is rightly done but the account head needs to be Direct Human Retention Cost (DHRC). (b) Indirect Human Retention Cost Information System (IHRCIS): There are various other costs which the organisation incurs but are not recorded as per the actual use like house provided to the employees is shown under Land and Building account but it is neither factory nor office building. The basic idea of constructing a house or township is to attract and retain talent in the organisation but the cost of that is never taken into consideration for decisions pertaining to human asset.The depreciation of such assets should form part of IHRCIS. The right decisions pertaining to human asset/capital can be taken only if we are able to provide complete information incorporating all aspects including indirect cost.

Human Asset Management Accounting Information System (HAMAIS)

Financial Accounting is basically concerned with historical cost whereas Management Accounting takes into account both the historical cost and the future/projected cost as well as the value of human beings. The decision can not be taken properly regarding

Delhi Business Review ? Vol. 1, No. 2, July - December 2000

anything unless we are able to do cost benefit analysis and for that both the cost and value of the human beings becomes important. HCMAIS is an information system which provides information pertaining to various dimensions of human capital/asset to the decision makers. HCMAIS can make use of Decision Support System (DSS) and develop the same for supporting decisions pertaining to human beings also which may be termed as: 1. Human Decision Support Information System (HDSIS): HDSIS is a subsystem of Decision Support System (DSS) which focuses on decisions related to human aspects like acquisition, development, retention, et. al. Hence it becomes necessary to understand the generic and conceptual components (Fig. 2) and elements of DSS which holds true for HDSIS.

Model Management Dialog Management Data Management Decision Maker(s) [User(s)]

Internal Data

External Data Conceptual Components of DSS Decision Maker(s) [User(s)]

Terminal

Data Base

User-system Interface

Decision Models

Fig. 2: General and Conceptual Components of DSS

Ajay Kumar Singh

An aid in decision making and implementation; succinctly put, the DSS serves as an Executive Mind-Support System. P.G.W. Keen & G.R. Wagner DSS is a computer-based information system used to support decision-making activities in situations where it is not possible or not desirable to have an automated system perform the entire decision process. M.J. Ginzberg & E.A. Stohr (a) Dialog Management Sub-System It provides and manages the framework in which outputs are presented to the user and in which inputs are specified by the user. Dialog is two way: output representations(menus, reports, charts) define the context for and prompt subsequent user inputs. Elements (i) User Interface

It is concerned with syntactic aspects of interaction,the interfacing with specific input and output devices, & issues relating to style of interaction (is the dialog menu driven?). (ii) Request Constructor It provides two-way transformations between usersrequests and specific modeling and data access repertory. It translates users reqiests for data to valid data base queries, and users model references to corresponding model-invoking commands. It also translates requests issued by the model base subsystem for the incorporation of user-supplied parameters in a specific model. (iii) Control Guarantees the smooth operation of the Dialog Management subsystem; determines the mode of systems use, which can vary between System Prompted mode and completely User-driven mode. This reflects the structure level of the supported decision situation(system-prompted mode for highly structured situation;user driven mode where no provided by the system). (b) Data Management Sub-System Data management sub-system provides the ability to store, retrieve, and manipulate data (internal and external). (i) DBMS DBMS provides such services as data sharing and integration, data definitions, data manipulation (handling queries), and data integrity (e.g.Protection, recovery,etc.).

Delhi Business Review ? Vol. 1, No. 2, July - December 2000

It also shields the other subsystem of DSS from physical aspects of access to the data base. (ii) Query Facility It serves as the front end element of the data management subsystem and as the subsystems interface to the model management and dialog management subsystems. (iii) Data Directory Data directory contains meta-data (i.e., data on the data in data base). (iv) Staging It provides access to sources of data that are external to the DSS. It is an interface between the DBMS element and its DSS-specific data base and other organisational data bases (e.g., those maintained by TPS) or remote data bases. Its structure reflects the nature of external data sources from which data is extracted. If remote data bases are to be accessed, some data communications facility is included in the staging element. (c) Model Management Subsystem There are various models in every field which help in generating alternatives that must be analysed and understood for better decision making. There are various cost and value based models which help in finding different facets of human beings in the organisation. The author has developed a model which has been discussed in brief at the end of the paper. Output from these models can (a) make the decision (b) propose the decision (c) estimate the consequences of proposed decision Any support beyond direct access to raw data invokes the application of a model. The ability to invoke, run, change, combine, and inspect models is a core service of DSS. Elements (i) Model Base Management System (MBMS)

MBMS provides storage and retrieval facilities for programmed models. It supports the generation of models, perusal of models, updating of model parameters, and restructuring of models.

?

Model Directory: Model directory provides information about models in response to users inquiries, or in support of the model executors efforts to integrate several models into a supermodel. Staging: It extracts models from remote, on line computerised model bases.

Ajay Kumar Singh

(ii) Modelling Command Processor It provides interface between model and dialog management subsystem. It accepts and interprets modeling instructions from the query facility element of dialog subsystem. Interpreted instructions are then routed to the corresponding elements:inquiries about models are forwarded to MBMS; model building instructions to the model executor. (iii) Model Executor It controls the actual running of models by linking together attachable models retrieved from the model base. It also interacts with the request constructor element of dialog subsystem to obtain from the user, the parameters and data that are needed by the models being run. (iv) Data Base Interface It connects the model and data management subsystems. It allows running models to retrieve data from data base and to store outputs on data base. It translates model requests for data into valid data query formats, and query outputs to internal data structure of model. Hence, HDSIS is a user friendly information system to provide decision support to managers pertaining to all the aspects of human capital/asset. Various authors (Hermanson 1964; Hekinian et. al. 1967; Likert 1967; Brummet,Flamholtz and Pyle 1968; Likert 1968; Flamholtz 1971; Giles and Robinson 1972; Lev & Schwartz 1972; Flamholtz 1973; Morse 1973; Friedman 1974; Jaggi, Bikki and Lau 1974; Chakraborty 1976; Ogan 1976; Watson 1978; Dave 1987) have contributed towards the development of model base which can be used by HDSIS and more models can be developed to suit the requirements of the specific decision making requirements of an organisation. The author has developed a model which has been discussed below:

Human Asset Valuation Model

There are various models which attempt to find the value of Human Resource but are not generally accepted by the accountants. The model given below is an attempt to present a comprehensive model which takes into account various factors that are important to the Human Asset Accounting Information System. The model given below tries to provide information for both HAFAIS and HAMAIS. The model tries to segregate all the historical costs incurred as well as committed to be incurred in future for the purposes of HAFAIS, since the financial accounting is based on historical cost concept. This would entitle the HA information a place in the Income Statement and the Balance Sheet. Other factors which are relevant for management accounting are also taken into consideration as they help the management for the decision making purposes. The HA value shall be calculated each year and almost all the factors shall be reassessed each year. The Human Asset (HA) Valuation Model is divided into two stages: 1. 2. Measurement of Value of Each Individual Measurement of Total Human Asset Value.

Delhi Business Review ? Vol. 1, No. 2, July - December 2000

1. Measurement of Value of Each Individual: The Value of each individual working in an organisation is based on the contributions made by that person to the organisation for which organisation incurs certain costs. The costs incurred by the organisation is generally less than the contributions made by HA. X1 where: X1 AC DC = Value of one employee having number 1 = Acquisition Cost = Development Cost = {[(AC+DC+CRC)*KPAI*JSI ]+[ FRC * PAI ] }*{ EI }

CRC = Current Retention Cost (Gross Emoluments including maintenance and separation cost) KPAI = Current Performance Appraisal Index (Key Performance Areas Index) JSI = Job Satisfaction Index

FRC = Future Retention Cost (Future Gross Emoluments including maintenance and separation cost) PAI EI = Potential Appraisal Index = Experience Index Total Experience 2

EI

+ Organisational Experience

2. Measurement of Total Human Resource Value (THRV) THRV where: X1, X2, ...Xn OCI = = Employees of the organisation from 1 to n. Organisational Climate Index Organisations Efficiency Industry Efficiency Industrys Labour Turnover Organisations Labour Turnover = (X1+X2+X3+........+Xn) (OCI) (EFI) (LTI) (LUI) (OPE)

EFI

Efficiency Index

LTI

Labour Turnover Index =

Ajay Kumar Singh

LUI

Labour Unrest Index

Industrys Labour Unrest Organisations Labour Unrest Organisations Output Per Employee Industrys Output Per Employee

OPE

Output Per Employee

Methodology

1. Calculation of Acquisition Cost (AC)

Acquisition Cost refers to the cost which is incurred in acquiring the rights to use the services of a person in the organisation e.g., recruitment cost, selection cost, etc.. AC shall be calculated for each individual and if more than one person is employed by one recruitment process then the cost shall be allocated equally among each person employed otherwise if only one person is employed then the whole cost shall be allocated to that individual.

2.

Calculation of Development Cost (DC)

DC refers to training and development cost incurred on HR by the organisation. If DC pertaining to each individual is available then it will be shown directly, otherwise the total DC of each programme shall be allocated equally among the people who have undergone that particular training and development programme. If this information is also not available then the total DC of the year shall be allocated equally among the people who have undergone some kind of training and/or development process.

3.

Calculation of Current Retention Cost (CRC)

CRC is the historical cost incurred on HR in a particular accounting period/year for retaining HR which includes maintenance (salary, perks, LTA, medical and other benefits) and separation cost directly attributable to each individual.

4.

Current Performance Appraisal Index [Key Performance Areas Index] (KPAI)

Current Performance Appraisal Index refers to the rating of each HR on the basis of his/her performance/ contributions in the year in question. For the sake of convenience, existing Individual Performance Appraisal based on KPAs (70 % weightage) and team work (30 % weightage) which is scaled from 1 to 10 has been accepted as it is and converted into a scale of 0 to 2, where 1 stands for average performance, <1 stands for below average, and >1 for above average.

5.

Job Satisfaction Index (JSI)

A structured questionnaire shall be used for measuring the job satisfaction index of each HR, which shall be converted into a scale of 0 to 2 as expained in point number 4.

6.

Future Retention Cost (FRC)

Future Retention Cost refers to the costs committed by the organisation at the time of contract of service/ appointment which is to be incurred on HR from time to time. It includes maintenance (salary, perks, LTA, medical and other benefits) and separation cost directly attributable to each individual which is payable in future. It takes into account regular increments based on his performance.

Delhi Business Review ? Vol. 1, No. 2, July - December 2000

7.

Potential Appraisal Index (PAI)

Potential Appraisal measures the future potential contributions of HR to the organisation. For the sake of convenience present proforma of Personality Traits Assessment, being used in the organisation, shall be used for the measurement of PA index and shall be converted into a scale of 0 to 2 as explained in point number 4. But standard weights for each parameter and each job shall be developed to find the weighted average index of the potential appraisal.

8.

Experience Index (EI)

Experience earned by a person during his service life makes him/her more efficient and effective which is generally evident in the contributions made by that HR. Hence any model which does not take into account EI and is based on future earnings of the HR shows higher values for younger people and lower values for experienced people. The present model overcomes this limitation by incorporating EI.

9.

Total Human Resource Value (THRV)

After having calculated HR Values for all emoployees by the above method, we add all the individual values and multiply the total value with, OCI, EFI, LTI, LUI, and OPE. OCI is an organisational factor which shall be measured by the use of primary data using a structured questionnaire. In the second stage OCI may be separately measured for each level in the organisational hierarchy. Other indexes take into consideration the organisational and environmental factors on selected parameters. Hence Total HR value is not the simple addition of individual values of all the employees of the organisation. It may be more or less depending upon the organisational and environmental factors. Suitable probability techniques will be used to incorporate the probability of promotion, death, exit, etc. provided the statistics for the same is available in the organisation.

Assumptions:

1. There is generally a contract of service made when a person joins an organisation which is a mutual agreement between the organisation and the employee that if both are satisfied with each other then the organisation shall retain the person throughout the serviceable life and the HR in return shall provide services to the organisation. That means the commitment to pay throughout the life (both serviceable life and life after retirement) takes place at the time of contract of service. As per the historical cost concept of financial accounting, if a commitment to pay is made then the total cost can be treated as the asset and the allocation of cost can be made as per the use. In the light of the above the future cost to be incurred on HR is not discounted and is taken in actual rupee terms. 2. Cost incurred on human resource is generally less than the value of human resource and both are highly co-related. Value is based on the contributions made by an individual to the organisation. Hence indices like KPAI, JSI, PAI, and EI are used to convert cost into value. These indices pertain to the individual and help in taking into account the contributions (past, present, and future) made by him. 3. Total HR value is not the simple aggregation of individual HR values but is affected by organisational and environmental factors like OCI, EFI, LTI, LUI, and OPE. 4. The HR has been classified into four categories (A, B, C, and D) and it has been assumed that an employee will remain in the same category for his remaining servicef life in the organisation. But this does not mean that if an employee changes his category then it will

Ajay Kumar Singh

not be reflected. Each year current category will be framed which will be assumed for the future serviceable life in the manner explained above. 5. It has been assumed that the policy of rate of increment for each category (A, B, C, and D), gradewise is constant for one year. That means the current policy of increment has been assumed to remain constant for the purposes of calculation of HR value for 1997. However, any change in the policy shall be duly incorporated while calculating the HR value for the forthcoming years as they cannot be predicted in advance. 6. It has been assumed that experience within the organisation is more relevant and important as compared to experience outside the organisation. Hence more weightage has been given to the former and less to the later.

Conclusion

The present paper is an attempt to provide a comprehensive framework including a new model based on empirical research which may be used for decision making pertaining to human asset to manage their responses. The HAAIS has been classified under two broad areas, i.e., HA Financial Accounting Information System (HAFAIS) and HA Management Accounting Information System (HAMAIS). HAFAIS focuses on the inconsistencies in the generally accepted accounting principles (GAAP) and provides a model that is compatible with the accounting principles and hence can be integrated in the annual reports of organizations. HAMAIS provides relevant information that can be used for taking any type of decision pertaining to human beings of the organisation. It can be concluded that it is the human beings who can reengineer the organisation on the path of success, hence decision makers should take due recognition of the same by developing information systems which can provide relevant information about human assets. The information system should consider both the cost and value of human beings and should be able to make inter-firm and intra-firm comparisons making use of external information including global benchmarks as well. The author visualizes that human asset would get due recognition in corporate reporting and decision making apart from a shift from Human Resource Management to Human Response Management.

References

Brien, James A. (1995). Management Information System: A Managerial End User Perspective, Galgotia Publications Pvt. Ltd., New Delhi. Brummet, R.L., Eric Flamholtz and William C. Pyle (1968). Human Resource Measurement: A challenge for Accountants, The Accounting Review, April, pp. 217-224. Chakraborty, S.K. (1976). Human Asset Accounting: The Indian Context in Topics in Accounting and Finance, Oxford University Press. Dave, Shiv Kumar (1987). Towards a Comprehensive Model for Human Resources Accounting, The Chartered Accountant of I.C.A. of India, June. Flamholtz, Eric G. (1971). A Model for Human Resource Valuation - A Stochastic Process with Service Rewards, The Accounting Review, April. Flamholtz, Eric, G. (1973). Human Resource Accounting: Measuring Positional Replacement Costs, Human Resource Management, Spring. Friedman, A. and B. Lev (1974). Surrogate Measure for the Firms Investments in Human Resources, Journal of Accounting Research, Vol.12 No. 2 Autumn, pp. 235-250. Giles, W.J. and D. F. Robinson (1972). Human Asset Accounting, Institute of Personnel Management and Institute of Cost and Management Accountants, London. Hekinian, James S., and Curtis H. Jones (1967). Put People on Your Balance Sheet, Harvard Business Review, January-February, pp.105-113.

Delhi Business Review ? Vol. 1, No. 2, July - December 2000

Hermanson, Roger H. (1964). Accounting for Human Assets, Occasional Paper No.14, Graduate School of Business Administration, Michigan State University. Jaggi, Bikki and Hon Shiang Lau (1974). Towards a Model for Human Resource Valuation, Accounting Review, April, pp. 321- 329. Lev, Baruch and A.B.A. Schwartz (1972). On the Use of the Economic Concept of Human Capital in Financial Statements: A Reply,The Accounting Review, January, pp. 103-112. Likert, Rensis (1967). The Human Organisation: Its Management and Value, McGraw Hill Book Co., New York, pp. 146-147. Likert, Rensis, and David G. Bowers (1968). Organizational Theory and Human Resource Accounting, American Psychologist, September. Morse, W.J. (1973). A Note on the Relationship Between Human Assets and Human Capital, The Accounting Review, July. Ogan, P. (1976). Human Resource Value Model for Professional Service Organizations, The Accounting Review, April. Singh, Ajay Kumar, (1996). Accounting for Human Resources: Acquisition, Development and Retention, unpublished Ph.D. thesis awarded by the University of Delhi, Delhi. Singh, Ajay Kumar, (1997). HRD: Vision and Directions in the 21st Century, in Ajay Kumar Singh (ed), Delhi: Society for Professional Development and Research. pp.1-18. Singh, Ajay Kumar, (1998). Management: Global Perspectives and Strategies for the Coming Millenium , Pranjana, Vol.1, No.1, pp. 3-24. Watson, David (1978). Art of Putting People on Balance Sheet, Accountancy, March, pp.42-46.

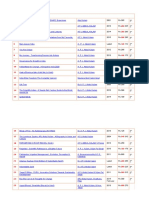

You might also like

- Human Resource Accounting: Data of Human Resources and Communicating The Information To The Interested Parties"Document10 pagesHuman Resource Accounting: Data of Human Resources and Communicating The Information To The Interested Parties"keziafernandesNo ratings yet

- Hra For Managing Human Resources: Decision MakingDocument11 pagesHra For Managing Human Resources: Decision MakinglovleshrubyNo ratings yet

- Term Paper On HraDocument30 pagesTerm Paper On HraDeidre StuartNo ratings yet

- Human Resource AccountingDocument5 pagesHuman Resource AccountingMadhurima MitraNo ratings yet

- Human Resource AccountingDocument11 pagesHuman Resource AccountingAkshay KocherNo ratings yet

- Man Power Plann & Re-Sourcin Set1Document9 pagesMan Power Plann & Re-Sourcin Set1Rajini GrNo ratings yet

- Hras Midterm NotesDocument8 pagesHras Midterm NotesENGR ABRAR IMTIAZNo ratings yet

- A Well Developed HRIS Offers The Following AdvantagesDocument19 pagesA Well Developed HRIS Offers The Following Advantagesvarun karthikNo ratings yet

- Module V AFMDocument13 pagesModule V AFMshuklayuvaan22No ratings yet

- Human Resources Accounting and AuditDocument10 pagesHuman Resources Accounting and AuditYuvaraj DhamodharanNo ratings yet

- Human Resource AccountingDocument7 pagesHuman Resource AccountingAkriti JaiswalNo ratings yet

- Rationale of Human Resource Valuation and AuditingDocument2 pagesRationale of Human Resource Valuation and AuditingRaj Kumar100% (1)

- HR AccontingDocument22 pagesHR AccontingAvishNo ratings yet

- Human Resource AccountingDocument50 pagesHuman Resource AccountingDaksh GoyalNo ratings yet

- Assignment Mu0010 Mba 3 Spring 2014Document12 pagesAssignment Mu0010 Mba 3 Spring 2014Mandar RaneNo ratings yet

- The Valuation of Human ResourcesDocument11 pagesThe Valuation of Human ResourcesIra IbrahimNo ratings yet

- Meaning:: Human Resource Accounting: Meaning, Definition, Objectives and Limitations!Document12 pagesMeaning:: Human Resource Accounting: Meaning, Definition, Objectives and Limitations!rajiv baggaNo ratings yet

- HRACM Assignment III - Infosys Case Study PDFDocument4 pagesHRACM Assignment III - Infosys Case Study PDFsupriya sonkusareNo ratings yet

- Bac 302 AssignmentDocument12 pagesBac 302 Assignmentwamalwamichael8No ratings yet

- HRACM Assignment III - Infosys Case StudyDocument4 pagesHRACM Assignment III - Infosys Case Studysupriya sonkusareNo ratings yet

- HR Audit NotesDocument5 pagesHR Audit NotesNehaChaudharyNo ratings yet

- HCM Unit-IiDocument23 pagesHCM Unit-IiPrasadarao YenugulaNo ratings yet

- Human Resource Accounting Mid Term Chapter 1 2 4Document32 pagesHuman Resource Accounting Mid Term Chapter 1 2 4HasanKhanNo ratings yet

- HR AuditDocument5 pagesHR AuditVikram SahaNo ratings yet

- HRA NotesDocument19 pagesHRA NotesatulbhasinNo ratings yet

- Hasan Ul Moin 503 PP (68-84)Document17 pagesHasan Ul Moin 503 PP (68-84)International Journal of Management Research and Emerging SciencesNo ratings yet

- Importance, Objectives, Methods, Limitations of Human Resource AccountingDocument3 pagesImportance, Objectives, Methods, Limitations of Human Resource AccountingKrutartha Sarathi Samantaray63% (8)

- HR Valuation and AccountingDocument10 pagesHR Valuation and AccountingSanskar YadavNo ratings yet

- Priyanka - Activitas - HR AnalyticsDocument90 pagesPriyanka - Activitas - HR AnalyticsPriyankaNo ratings yet

- Human Resouse Accounting Nature and Its ApplicationsDocument12 pagesHuman Resouse Accounting Nature and Its ApplicationsParas JainNo ratings yet

- Human Resource Accounting: Masoud Ghorban HosseiniDocument5 pagesHuman Resource Accounting: Masoud Ghorban HosseiniInternational Organization of Scientific Research (IOSR)No ratings yet

- Human Resource Accounting in NTPC-3Document4 pagesHuman Resource Accounting in NTPC-3Pashmeen KaurNo ratings yet

- HRA-Introduction and HR Costs and Financial ReportingDocument25 pagesHRA-Introduction and HR Costs and Financial ReportingCollin EdwardNo ratings yet

- HR AccountingDocument19 pagesHR AccountingPhuong TranNo ratings yet

- Human Resource AccountingDocument16 pagesHuman Resource AccountingASHMEET KAUR MARWAHNo ratings yet

- HRM 5Document30 pagesHRM 5gagangowda3753No ratings yet

- HRA - Definition, Objectives, Advantages & DisadvantagesDocument4 pagesHRA - Definition, Objectives, Advantages & DisadvantagesArghya D Punk100% (1)

- Study of Human Resource Accounting Practices: April 2018Document4 pagesStudy of Human Resource Accounting Practices: April 2018Priyanka YadavNo ratings yet

- Prestige Institute of Management, Gwalior: Class Presentation of Strategic HRM On Human Resource AccountingDocument14 pagesPrestige Institute of Management, Gwalior: Class Presentation of Strategic HRM On Human Resource AccountingMegha NairNo ratings yet

- Essentials of HRMDocument7 pagesEssentials of HRMPrashant SinghNo ratings yet

- Human Resource Valuation in Infosys: Employees (No.)Document4 pagesHuman Resource Valuation in Infosys: Employees (No.)Hitesh ShahNo ratings yet

- HR Accounting Imp, ObjDocument3 pagesHR Accounting Imp, ObjRejil Rajan KariyalilNo ratings yet

- Part BDocument4 pagesPart BPartha BiswasNo ratings yet

- Human Capital ManagementDocument6 pagesHuman Capital ManagementSai DNo ratings yet

- ROI in HRDocument7 pagesROI in HRStephen KingNo ratings yet

- Human Resource Accounting and Its Effect On Organizational Growth: (A Case Study of Steel Authority of India LTD.)Document7 pagesHuman Resource Accounting and Its Effect On Organizational Growth: (A Case Study of Steel Authority of India LTD.)Divakara ReddyNo ratings yet

- HRM 5Document40 pagesHRM 5jana kNo ratings yet

- 1.2 Legal Frame Work of Reporting 1.3 Human Resource Report: Over View 1.4 A Case Study On Bhel 1.5 Findings and Suggestion 1.6 ConclusionDocument8 pages1.2 Legal Frame Work of Reporting 1.3 Human Resource Report: Over View 1.4 A Case Study On Bhel 1.5 Findings and Suggestion 1.6 ConclusionChandrika DasNo ratings yet

- Course Title: Accounting For Managers Course: MBA 18102 CR Session: Spring 2020 Unit IV. Human Resource Accounting and Its ApproachesDocument6 pagesCourse Title: Accounting For Managers Course: MBA 18102 CR Session: Spring 2020 Unit IV. Human Resource Accounting and Its ApproachesLeo SaimNo ratings yet

- Human Resource Costs' Influence On Financial Performance of Nigerian Consumer Goods CompanyDocument11 pagesHuman Resource Costs' Influence On Financial Performance of Nigerian Consumer Goods CompanyaijbmNo ratings yet

- Human Resources Accounting and AuditDocument14 pagesHuman Resources Accounting and AuditsasaravanaNo ratings yet

- Name: Dhingia Pooja KishorkumarDocument25 pagesName: Dhingia Pooja Kishorkumarpoojadhingia100% (1)

- MB0043 - Human Resource ManagementDocument15 pagesMB0043 - Human Resource ManagementSachith Lal100% (1)

- Human Resource Accounting: Objectives of The StudyDocument18 pagesHuman Resource Accounting: Objectives of The StudyAshok KumarNo ratings yet

- FM AssignmentDocument5 pagesFM AssignmentSAPDHRUVNo ratings yet

- MGT 351 Final ReportDocument21 pagesMGT 351 Final ReportSaifur Rahman0% (1)

- MU0010Document8 pagesMU0010mohit jainNo ratings yet

- Human Resource Planning & Development2007Document17 pagesHuman Resource Planning & Development2007Jalal NhediyodathNo ratings yet

- Loksewa Preparation Guide Arithmatic ReasoningDocument2 pagesLoksewa Preparation Guide Arithmatic ReasoningIvan ClarkNo ratings yet

- Ration and AverageDocument2 pagesRation and AverageIvan ClarkNo ratings yet

- SeriesDocument2 pagesSeriesIvan ClarkNo ratings yet

- Time & WorkDocument2 pagesTime & WorkIvan ClarkNo ratings yet

- Profit and LossDocument2 pagesProfit and LossIvan ClarkNo ratings yet

- PercentageDocument2 pagesPercentageIvan ClarkNo ratings yet

- Employee Retention in Banking Industry of Nepal1Document36 pagesEmployee Retention in Banking Industry of Nepal1Aparna Kalla Mendiratta33% (3)

- Aa L B 1567072397Document1 pageAa L B 1567072397Ivan ClarkNo ratings yet

- Pra Band Ha PatraDocument16 pagesPra Band Ha PatraHanu ManNo ratings yet

- Annual Report 070-71-Eng PDFDocument92 pagesAnnual Report 070-71-Eng PDFIvan ClarkNo ratings yet

- Insurance Form PDFDocument7 pagesInsurance Form PDFIvan ClarkNo ratings yet

- Bad Uwa 20710319Document2 pagesBad Uwa 20710319Ivan ClarkNo ratings yet

- Theis Writing GuidelineDocument28 pagesTheis Writing GuidelineSajak MaharjanNo ratings yet

- Insurance FormDocument7 pagesInsurance FormIvan ClarkNo ratings yet

- 2071 07 11Document2 pages2071 07 11Ivan ClarkNo ratings yet

- Project Report Small Business For BBSDocument32 pagesProject Report Small Business For BBSBhairab Pd. Pandey86% (64)

- Nepali ThesisDocument21 pagesNepali ThesisIvan ClarkNo ratings yet

- A Case StudyDocument8 pagesA Case StudyIvan Clark100% (1)

- Assignment 2 Research ProposalDocument8 pagesAssignment 2 Research ProposalIvan Clark0% (1)

- Syllabus Electronics Comm 2nd PaperDocument2 pagesSyllabus Electronics Comm 2nd PaperRajiv AmatyaNo ratings yet

- Impact of Employee Participation On Job Satisfaction in Nepalese Commercial Banks Rishi Ram Chapagai Page 39-51Document13 pagesImpact of Employee Participation On Job Satisfaction in Nepalese Commercial Banks Rishi Ram Chapagai Page 39-51Ivan ClarkNo ratings yet

- 2071 05 21Document2 pages2071 05 21Ivan ClarkNo ratings yet

- 13nirnaya Web Okhaldhunga0710319Document3 pages13nirnaya Web Okhaldhunga0710319Ivan ClarkNo ratings yet

- K - X/L K - WFG Sfof (No - DFGJ F) T LJSF Ljefu, Egf (Tyf 5gf) 6 ZFVFDocument3 pagesK - X/L K - WFG Sfof (No - DFGJ F) T LJSF Ljefu, Egf (Tyf 5gf) 6 ZFVFIvan ClarkNo ratings yet

- Mirror Image Non Verbal ReasoningDocument23 pagesMirror Image Non Verbal Reasoning09captainhook100% (1)

- Bhuwan Raj ChatautDocument3 pagesBhuwan Raj ChatautIvan ClarkNo ratings yet

- MBA ThesisDocument90 pagesMBA Thesiskamilatta50% (2)

- Federalism in NepalDocument8 pagesFederalism in NepalIvan ClarkNo ratings yet

- LM X and Transformational TheoriesDocument23 pagesLM X and Transformational TheorieslengocthangNo ratings yet

- Compensation & Benifits Nobin Ojha Mpa I 1Document13 pagesCompensation & Benifits Nobin Ojha Mpa I 1Ivan ClarkNo ratings yet

- Claim &: Change ProposalDocument45 pagesClaim &: Change ProposalInaam Ullah MughalNo ratings yet

- Athena 60 Installation Manual EN 2022.07.03Document30 pagesAthena 60 Installation Manual EN 2022.07.03joaquin.cadondonNo ratings yet

- TN Vision 2023 PDFDocument68 pagesTN Vision 2023 PDFRajanbabu100% (1)

- Polymeric Nanoparticles - Recent Development in Synthesis and Application-2016Document19 pagesPolymeric Nanoparticles - Recent Development in Synthesis and Application-2016alex robayoNo ratings yet

- Meike SchalkDocument212 pagesMeike SchalkPetra BoulescuNo ratings yet

- Curriculum Vitae: Personal InformationDocument3 pagesCurriculum Vitae: Personal InformationMira ChenNo ratings yet

- Reply To Pieta MR SinoDocument9 pagesReply To Pieta MR SinoBZ RigerNo ratings yet

- Skype OptionsDocument2 pagesSkype OptionsacidwillNo ratings yet

- PHD Thesis - Table of ContentsDocument13 pagesPHD Thesis - Table of ContentsDr Amit Rangnekar100% (15)

- L 1 One On A Page PDFDocument128 pagesL 1 One On A Page PDFNana Kwame Osei AsareNo ratings yet

- Alice (Alice's Adventures in Wonderland)Document11 pagesAlice (Alice's Adventures in Wonderland)Oğuz KarayemişNo ratings yet

- Logic of English - Spelling Rules PDFDocument3 pagesLogic of English - Spelling Rules PDFRavinder Kumar80% (15)

- Statistics NotesDocument7 pagesStatistics NotesAhmed hassanNo ratings yet

- Dummies Guide To Writing A SonnetDocument1 pageDummies Guide To Writing A Sonnetritafstone2387100% (2)

- PT - Science 5 - Q1Document4 pagesPT - Science 5 - Q1Jomelyn MaderaNo ratings yet

- KalamDocument8 pagesKalamRohitKumarSahuNo ratings yet

- Jurnal UlkusDocument6 pagesJurnal UlkusIndri AnggraeniNo ratings yet

- Europe Landmarks Reading Comprehension Activity - Ver - 1Document12 pagesEurope Landmarks Reading Comprehension Activity - Ver - 1Plamenna Pavlova100% (1)

- Engineering Graphics and Desing P1 Memo 2021Document5 pagesEngineering Graphics and Desing P1 Memo 2021dubethemba488No ratings yet

- National Bank Act A/k/a Currency Act, Public Law 38, Volume 13 Stat 99-118Document21 pagesNational Bank Act A/k/a Currency Act, Public Law 38, Volume 13 Stat 99-118glaxayiii100% (1)

- Principles of Communication PlanDocument2 pagesPrinciples of Communication PlanRev Richmon De ChavezNo ratings yet

- Security Questions in UPSC Mains GS 3 2013 2020Document3 pagesSecurity Questions in UPSC Mains GS 3 2013 2020gangadhar ruttalaNo ratings yet

- Conrad John's ResumeDocument1 pageConrad John's ResumeTraining & OD HRODNo ratings yet

- Political and Institutional Challenges of ReforminDocument28 pagesPolitical and Institutional Challenges of ReforminferreiraccarolinaNo ratings yet

- Motion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALDocument157 pagesMotion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALOdzer ChenmaNo ratings yet

- (Methods in Molecular Biology 1496) William J. Brown - The Golgi Complex - Methods and Protocols-Humana Press (2016)Document233 pages(Methods in Molecular Biology 1496) William J. Brown - The Golgi Complex - Methods and Protocols-Humana Press (2016)monomonkisidaNo ratings yet

- Nikulin D. - Imagination and Mathematics in ProclusDocument20 pagesNikulin D. - Imagination and Mathematics in ProclusannipNo ratings yet

- International Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Document5 pagesInternational Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Raul CuarteroNo ratings yet

- Science Project FOLIO About Density KSSM Form 1Document22 pagesScience Project FOLIO About Density KSSM Form 1SarveesshNo ratings yet

- EDCA PresentationDocument31 pagesEDCA PresentationToche DoceNo ratings yet