Professional Documents

Culture Documents

Ccfylv: Ch. 2 Practice Quiz

Uploaded by

Frank LovettOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ccfylv: Ch. 2 Practice Quiz

Uploaded by

Frank LovettCopyright:

Available Formats

--

c

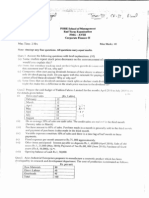

Ch. 2 Practice Quiz

1. Abair Company's manufacturing overhead is 20% of its total conversion costs. If direct labor is

$38,000 and if direct materials are $35,000, the manufacturing overhead is:

A) $18,250

$9,500

$8,750

D) $152,000

Answer: B Level : Hard LO: 1

DL +

t>L +

CO n.V :;

\)l :;

s

CCfYLV. if-It 5 (fD

A

10

2. A manufacturing company prepays its insurance coverage for a three-year period. The premium for

the three years is $3,000 and is paid at the beginning of the first year. Three-fourths of the premium

applies to factory operations and one-fourth applies to selling and administrative activities. What

amounts should be considered product and period costs respectively for the first year of coverage?

Product Period

A) $1,000 $0

8) $250 $750

c

C ~

D

$225

0

$750 ~ ~ ~ ~ ::>

Answer: D Level : Hard LO: 2

2

3. Last month a manufacturing company had the following operating results:

Beginning finished goods inventory $72,000

Ending finished goods inventory $66,000

Sales $465,000

Gross margin $88,000

C ____ A) the manufactured for the month?

B) $459,000

C) $383,000

D) $377,000

Answer: A Level: Hard LO: 3,4

i-

S 61JV

F&-

+

-

C&-5{r

l

""J{3

17

,

l}.

-

CVO

C,-S

hb

3

Clyde Company has provided the following data for the month of November:

Inventories November 7 November 30

Raw materials $17,000 ?

Work in process $14,000 $12,000

Finished goods ? $9,000

Additional Data:

+

Sales revenue

$102,000 11

Direct labor costs $10,000

Manufacturing overhead costs

$12,000

Selling expenses

\ $14,000 \

Administrative expenses

L$16,000

Cost of goods manufactured $40,000 .

Raw materials purchases

$10,000 1r0 (-\-O--t---

4.

$11,000

$2 , 00

. Is inventory was:

C) $10,000

D) $12,000

Answer: A Level: Hard LO: 2,4

5. If the net operating income was $40,000, then the beginning finished goods inventory was:

A) $22,000 D L

8) $9,000

C) $42,000

$6 ,000 :> \ ( 0

nswer: Level: Hard LO: 2,3,4

(OO<l)

10 J,

5a..le-s

- cC:r-S

1Y

......-:--

------

-to

G-M

- S.J-Rr

( I t+ /b)

\------",1 ..

-

rJf If-o

4

--

At a sales volume of 30,000 units, Carne Company's total fixed costs are $30,000 and total variable costs

are $45,000. The relevant range is 20,000 to 40,000 units.

6. If Carne Company were to sell 32,000 units, the total expected cost would be:

A ~ r5000

0 78:000 J

C) $80,000

D) $77,000

Answer: B Level: Easy LO: 5

V ~ - - 9

30

(

n-c

3 ~ 6GJO

5

vc

1ft;;; 0l5U

I , 5

t1, s= >

l ~

~ M

~ 0, 60-0

'3 1 QlIO

Fe

!VI.

5

7. Bill Pope has developed a new device that is so exciting he is considering quitting his job in order to

produce and market it on a large-scale basis. Bill will rent a garage for $300 per month for production

purposes. Utilities will cost $40 per month. Bill has already taken an industrial design course at the local

community college to help prepare for this venture. The course cost $300. Bill will rent production

equipment at a monthly cost of $800. He estimates the material cost per unit will be $5, and the labor cost

will be $3. He will hire workers and spend his time promoting the product. To do this he will quit his job

which pays $3,000 per month. Advertising and promotion will cost $900 per month.

Required:

Complete the chart below by placing an "X" under each heading that helps to identify the cost involved.

There can be "Xs" placed under more than one heading for asingle cost, e.g., a cost might be a sunk cost,

an overhead cost and a product cost; there would be an "X" placed under each of these headings opposite

the cost.

....,

rJl

0

C)

.f'

t:

::::;

.....,

'

0

a.

a.

0

.;...)

rJl

0

C)

~

t:

::::;

U)

"'-'

rJl

0

C)

0

..0

C\l

.

'

C\l

>

.....,

rJl

0

C)

"0

0

x

u..,

co Cil

.S 0

~ C )

...... -0

C,) C\l

~ ~

::::;...c

t: 03

C\l >

20

-'

rJl

0

C)

....,

C,)

::::;

-0

0

'

Q..

-'

rJl

0

C)

00

c

.

-

0

U)

*

-'

rJl

0

C)

-

C\l

''=;

C

0

I

r2

:'::

0

Garage rent

X"

)("

'f..

~

Utilities

X

)(

X

.I(

Cost of the industrial design course

X

Equipment rented

K X ~ )(

Material cost

~ X )/

Labor cost X. x:. y

Present salary )( >(

Advertising X

X

X

* Between the alternatives of going into business to make the device or not going into business to make the

device.

5

-----

8. Lettman Corporation has provided the following partial listing of costs incurred during November:

l'vlarketing sal aries ..... .. .. . ... . .. .. . $45.000

Property taxes, factory ...... .... . ... . $9,000 trod

Admil1lstrative travel .. . .. .. .. ..... .. 'Pe-Y" $98,000

Sales conunissions .. .. .. .. ... .. . .. ... F..,.,....... $48,000

Indirect labor .. $38,000

Direct materials .. $165 .000 prJ

Advertising.. . $138,000

Depreciation of productIOn equipment.. . $39,000

Direct labor ... $87.000

Required:

a. What is the total amount of product cost listed above? Show your work.

b. What is the total amount of period cost listed above? Show your work.

6

9. Corio Corporation reports that atGn activity level of 3,800 variable cost is $221 ,461)nd its

total fixed cost is $94,848.

Required:

For he activity level of 3,900 units compute: (a) the total variable cost; (b) the total fixed cost; (c) the total

cost; d) the average variable cost per unit; (e) the average fixed cost per unit; and (D the average total cost

per unit. Assume that this activity level is within the relevant range.

vc. 'f 'f -:- '3 f GO v-N.;/s. !f e.--f f4"-

"3Q6"O

cr)

-

Fe. (...) L

9if

,flft" *.3)..

-

Toto.) l{) t'f'L . bo

=-

7

--

10. Slonaker Inc. has provided the following data concerning its maintenance costs:

'i

l'vIachme-Hours lvIaintenance Cost

April ... .... .. .... .... ..

May .. .... ... .. . ... . .

$JD,289

June ... . .. .. .. .... . ..

July . +7e!1

A u gust. L'0'\..\1 5,717 $30,078

September

5,809 $30,388

nO I

December

s;.;.cJ ,3 I 8

Management believes that maintenance cost is a mixed cost that depends on machine-hours.

Required:

Estimate the variable cost per machine-hour and the fixed cost per month using the high-low method. Show

your work!

$ -f3 (:)I 07f

D '1 - ') 11 7

M I'" MI.t

:1 5. "37

( x ')

0-.+

:::::-6L

+ f'3."':Jl

( )7'7 ')

4""30 01 f

::

I

6'vt/d'

rJ

- --1 =:

fl )., +-

{ 1:n ( X )

8

11. Whitman Corporation, a merchandising company, reported sales of 7,400,units for May at a selling

price of $677 per unit. The cost of goods sold (all variable) was $441 per unit and the variable selling

expense was $54 per unit. The total fixed selling expense was $155,600. The variable administrative

expense was $24 per unit and the total fixed administrative expense was $370,400.

Required:

a. Prepare a contribution format income statement for May.

b. Prepare a traditional format income statement for May. .

9

Whitman Corporation, a merchandising company, reported sales of 7,400 units for May at a

selling price of $677 per unit. The cost of goods sold (all variable) was $441 per unit and the

variable selling expense was $54 per unit. The total fixed selling expense was $155,600. The

variable administrative expense was $24 per unit and the total fixed administrative expense

was $370,400.

Required:

a. Prepare a contribution format income statement for May.

b. Prepare a traditional format income statement for May

a. Contribution Format Income Statement

Saks (7AnO $677 per unit) ... .. .. .. .. .. ...... .... .. ..... .... ....... ... . S5J)09.800

\'ariablc c:xpenses:

Cost of goods sold (7AOO units $4-J.l pcr uni!) .. . .... .. .... .... . ..

\'ariable selling expensc (7AOO units $54 per unit) '" '''''' '' '' 399.600

\-[lriable administrati\ 'c eXpl!llsc: (7.-1-00 units $24 per umt). 177.600 3.840.600

Contribution m.argin .. .. .... . ..... ........... . 1.169,200

expcn::;cs:

Fixcd sc:lling expense ............ .. .. .................................... .... ... .. . 155,600

Fiwd adrninistrati \ 'c expense.. ....... ... .. .. .. .... .... .. . ... ..... ... " .. .. 370..1.00 526,000

Net operating income ........ ....... .. .. ... ................ ... ....... ..

b. Traditional Format Income Statement

Sales (7AOO units $677 per unit) ....... . .... ... .. .. ... ... .. ....... . . $5,009.800

Co:>t of goods sold (7AOO units $441 per unit)..... .. . .... ............... .. 3.263,400

C:n:oss margin.. ... .. ... .. ... .. .. .... ...... ....... ......................... . 1,746 . .400

Selling and aclministrati\'e expenses:

SeIling expense ((7.400 units $54 per unit) + $155,(00) $555.200

Acll11inistrati \e expense (7AOO units $24 per unit) I $:> 70 AOO). 548.000 1.10:> .200

Net operating incol1le

AACSB. Anal )'!ic

AICPA BB: Cnlical Thinking

AlCP;J FN: Measurement

Bloom '5 : ApplicatIOn

Learnrng ObJectl\'e: 02-05 Prepare income statements f or a merchandising company using the traditional and contributionforma!s

Level: Medium

You might also like

- The Catholic Encyclopedia, Volume 2 PDFDocument890 pagesThe Catholic Encyclopedia, Volume 2 PDFChristus vincit SV67% (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Preliminary Examination MC (Q)Document9 pagesPreliminary Examination MC (Q)Vanessa HaliliNo ratings yet

- Doctrines On Persons and Family RelationsDocument69 pagesDoctrines On Persons and Family RelationsCarla VirtucioNo ratings yet

- Absorption and Variable Costing Reviewer EphDocument4 pagesAbsorption and Variable Costing Reviewer Ephephraim100% (1)

- QS07 - Class Exercises SolutionDocument8 pagesQS07 - Class Exercises Solutionlyk0texNo ratings yet

- Strategic cost management self-testDocument7 pagesStrategic cost management self-testAlyssa CaddawanNo ratings yet

- FInal Exam KeyDocument27 pagesFInal Exam KeyQasim AtharNo ratings yet

- Units in Beginning Inventory 0 Units ProducedDocument25 pagesUnits in Beginning Inventory 0 Units ProducedAli Wiz KhalifaNo ratings yet

- Chapter 3: Job CostingDocument4 pagesChapter 3: Job CostingmurtleNo ratings yet

- Sample MAS 3rd Evals KEY Set BDocument13 pagesSample MAS 3rd Evals KEY Set BJoanna MNo ratings yet

- JA, Ueet: Chapter 6: Variable CostingDocument14 pagesJA, Ueet: Chapter 6: Variable CostingAngel VenableNo ratings yet

- Flexible Budgetand Activity Based CostingDocument13 pagesFlexible Budgetand Activity Based CostingLhorene Hope DueñasNo ratings yet

- Chapters 11 & 12Document4 pagesChapters 11 & 12Manal ElkhoshkhanyNo ratings yet

- Handout Part Two March 31-2Document19 pagesHandout Part Two March 31-2Mohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- Review Sheet Exam 2Document17 pagesReview Sheet Exam 2photo312100% (1)

- CVP AnalysisDocument7 pagesCVP AnalysisSyeda Fakiha Ali100% (2)

- 1.05 Cost Accumulation SystemsDocument37 pages1.05 Cost Accumulation SystemsmymyNo ratings yet

- Flexible Budget and VarianceDocument8 pagesFlexible Budget and VarianceLhorene Hope DueñasNo ratings yet

- Chapter 2 Problems Part BDocument4 pagesChapter 2 Problems Part BAbdisalan AliNo ratings yet

- Practice ProblemsDocument4 pagesPractice ProblemsshaiwanaNo ratings yet

- Financial Accounting Questions and Solutions Chapter 3Document7 pagesFinancial Accounting Questions and Solutions Chapter 3bazil360No ratings yet

- 2010-03-22 081114 PribumDocument10 pages2010-03-22 081114 PribumAndrea RobinsonNo ratings yet

- Pop Quiz For AccountingDocument2 pagesPop Quiz For AccountingダニエルNo ratings yet

- Cost Accounting Exam Good For 2 Hours OnlyDocument6 pagesCost Accounting Exam Good For 2 Hours OnlyCaptain Jellyfish MasterNo ratings yet

- Chapters 6-12 Managerial Accounting ProblemsDocument7 pagesChapters 6-12 Managerial Accounting ProblemsVivek BhattNo ratings yet

- BACOSTMX Module 2 Learning Activity 2Document7 pagesBACOSTMX Module 2 Learning Activity 2lc100% (1)

- ADL 56 Cost & Management Accounting V2Document8 pagesADL 56 Cost & Management Accounting V2solvedcareNo ratings yet

- ACC 231 Pre TestDocument4 pagesACC 231 Pre TestM ANo ratings yet

- Practice Problems For Midterm - Spring 2017Document6 pagesPractice Problems For Midterm - Spring 2017Derny FleurimaNo ratings yet

- Test2 ReviewDocument14 pagesTest2 ReviewalolhasNo ratings yet

- UNIVERSIDAD DE MANILA MIDTERM EXAMDocument6 pagesUNIVERSIDAD DE MANILA MIDTERM EXAMShiela Mae Pon AnNo ratings yet

- 621904314547 (2)Document6 pages621904314547 (2)Furkan NazırNo ratings yet

- Trimester 3Document14 pagesTrimester 3Tanya MalikNo ratings yet

- Management Accounting HWDocument5 pagesManagement Accounting HWHw SolutionNo ratings yet

- Accounting - Unit2 - Paper1 - 2001Document7 pagesAccounting - Unit2 - Paper1 - 2001Shevon Williams0% (1)

- Management Advisory Services - MidtermDocument7 pagesManagement Advisory Services - MidtermROB101512No ratings yet

- Assignment of Accounting 2022Document8 pagesAssignment of Accounting 2022sakhawatNo ratings yet

- ACCT 346 Final ExamDocument7 pagesACCT 346 Final ExamDeVryHelpNo ratings yet

- Managerial Accounting ProjectDocument5 pagesManagerial Accounting ProjectAyaz AbroNo ratings yet

- End of Semester Assessment Acct213Document5 pagesEnd of Semester Assessment Acct213crisleycampos0% (1)

- F5 CKT Mock1Document8 pagesF5 CKT Mock1OMID_JJNo ratings yet

- AMA SET 36Document6 pagesAMA SET 36uroojfatima21299No ratings yet

- Saage SG Fma RevisionDocument21 pagesSaage SG Fma RevisionNurul Shafina HassanNo ratings yet

- Chapter 01 Test Bank Cost AccDocument5 pagesChapter 01 Test Bank Cost AccNada AlhenyNo ratings yet

- FInal Exam KeyDocument27 pagesFInal Exam KeyQasim AtharNo ratings yet

- FInal Exam KeyDocument27 pagesFInal Exam KeyQasim AtharNo ratings yet

- Problem Sheet 7ADocument3 pagesProblem Sheet 7AMuztoba AliNo ratings yet

- Liquidity and Solvency Ratios: Google vs Yahoo 2015Document57 pagesLiquidity and Solvency Ratios: Google vs Yahoo 2015cvilalobos198527100% (1)

- Problems 1Document6 pagesProblems 1Russel BarquinNo ratings yet

- ĐỀ lần 1 - ĐỀ 4Document13 pagesĐỀ lần 1 - ĐỀ 4buitrantuuyen2003No ratings yet

- Midterm 1+ 2 (T NG H P)Document13 pagesMidterm 1+ 2 (T NG H P)Shen NPTDNo ratings yet

- Cost 531 2021 AssignmentDocument10 pagesCost 531 2021 AssignmentWaylee CheroNo ratings yet

- MI1 TestDocument9 pagesMI1 TestĐỗ Hoàng DungNo ratings yet

- Costing Methods for Manufacturing BusinessesDocument6 pagesCosting Methods for Manufacturing BusinessesJohn Elly Cadigoy CoproNo ratings yet

- Chapter Problems: High-Low Method EstimatesDocument2 pagesChapter Problems: High-Low Method EstimatesYvonne TotesoraNo ratings yet

- Course Work On Overheads EtcDocument5 pagesCourse Work On Overheads EtcAkello SuzanNo ratings yet

- D) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryDocument9 pagesD) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryPhương Thảo HoàngNo ratings yet

- Managerial Accounting Exam ReviewDocument9 pagesManagerial Accounting Exam ReviewZyraNo ratings yet

- Multiple Choice Answer On The Scantron Provided ONLYDocument10 pagesMultiple Choice Answer On The Scantron Provided ONLYGiovana Marie Balasquide100% (1)

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideFrom EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideNo ratings yet

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet

- 2011 Grade Exam ResultDocument19 pages2011 Grade Exam ResultsgbulohcomNo ratings yet

- International Buffet Menu Rm45.00Nett Per Person Appertizer and SaladDocument3 pagesInternational Buffet Menu Rm45.00Nett Per Person Appertizer and SaladNorasekin AbdullahNo ratings yet

- CEI KAH OCT v1Document1 pageCEI KAH OCT v1Francis Ho HoNo ratings yet

- Nifty Technical Analysis and Market RoundupDocument3 pagesNifty Technical Analysis and Market RoundupKavitha RavikumarNo ratings yet

- Retail investment: Addressing timing and pricing issues through SIPsDocument52 pagesRetail investment: Addressing timing and pricing issues through SIPsMauryanNo ratings yet

- Pub. 127 East Coast of Australia and New Zealand 10ed 2010Document323 pagesPub. 127 East Coast of Australia and New Zealand 10ed 2010joop12No ratings yet

- Law, Rhetoric, and Irony in The Formation of Canadian Civil Culture (PDFDrive)Document374 pagesLaw, Rhetoric, and Irony in The Formation of Canadian Civil Culture (PDFDrive)Dávid KisNo ratings yet

- Software Project Sign-Off DocumentDocument7 pagesSoftware Project Sign-Off DocumentVocika MusixNo ratings yet

- Techm Work at Home Contact Center SolutionDocument11 pagesTechm Work at Home Contact Center SolutionRashi ChoudharyNo ratings yet

- Words and Lexemes PDFDocument48 pagesWords and Lexemes PDFChishmish DollNo ratings yet

- Hwa Tai AR2015 (Bursa)Document104 pagesHwa Tai AR2015 (Bursa)Muhammad AzmanNo ratings yet

- Growth of Royal Power in England and FranceDocument6 pagesGrowth of Royal Power in England and FrancecharliNo ratings yet

- Handout On Reed 1 Initium Fidei: An Introduction To Doing Catholic Theology Lesson 4 Naming GraceDocument8 pagesHandout On Reed 1 Initium Fidei: An Introduction To Doing Catholic Theology Lesson 4 Naming GraceLEILA GRACE MALACANo ratings yet

- Non Disclosure Agreement - 3Document3 pagesNon Disclosure Agreement - 3Atthippattu Srinivasan MuralitharanNo ratings yet

- The Bogey BeastDocument4 pagesThe Bogey BeastMosor VladNo ratings yet

- New Wordpad DocumentDocument2 pagesNew Wordpad DocumentJia JehangirNo ratings yet

- TallerDocument102 pagesTallerMarie RodriguezNo ratings yet

- Sweetlines v. TevesDocument6 pagesSweetlines v. TevesSar FifthNo ratings yet

- Maxwell McCombs BioDocument3 pagesMaxwell McCombs BioCameron KauderNo ratings yet

- Lesson 2 The Chinese AlphabetDocument12 pagesLesson 2 The Chinese AlphabetJayrold Balageo MadarangNo ratings yet

- A Practical Guide To The 1999 Red & Yellow Books, Clause8-Commencement, Delays & SuspensionDocument4 pagesA Practical Guide To The 1999 Red & Yellow Books, Clause8-Commencement, Delays & Suspensiontab77zNo ratings yet

- Learn Jèrriais - Lesson 1 2Document19 pagesLearn Jèrriais - Lesson 1 2Sara DavisNo ratings yet

- HRM Assessment (Final Copy) - Home Loan Experts Nepal - EMBA Fall 2020Document33 pagesHRM Assessment (Final Copy) - Home Loan Experts Nepal - EMBA Fall 2020Rajkishor YadavNo ratings yet

- Micro - Welfare EconomicsDocument14 pagesMicro - Welfare EconomicsTanvi ShahNo ratings yet

- Penyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di MalaysiaDocument12 pagesPenyebaran Fahaman Bertentangan Akidah Islam Di Media Sosial Dari Perspektif Undang-Undang Dan Syariah Di Malaysia2023225596No ratings yet

- 50 Simple Interest Problems With SolutionsDocument46 pages50 Simple Interest Problems With SolutionsArnel MedinaNo ratings yet

- RIZAL Childhood ScriptDocument3 pagesRIZAL Childhood ScriptCarla Pauline Venturina Guinid100% (2)