Professional Documents

Culture Documents

Bahasa Inggris Paragraf M.ajie Laksono

Uploaded by

kartikasandiutamiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bahasa Inggris Paragraf M.ajie Laksono

Uploaded by

kartikasandiutamiCopyright:

Available Formats

BAHASA INGGRIS SOFTSKILL

MUHAMMAD AJIE LAKSONO

NPM : 14212855 KELAS : 1EA18

BANKING SECTOR IN INDONESIA

The effect of monetary policy will first be felt by the banking sector, which is then transferred to the real sector. Monetary policy is essentially a policy that aims to achieve internal balance of high economic growth, price stability, equitable development and external balance (balance of payments) as well as the achievement of macroeconomic objectives, namely to stabilize the economy can be measured by employment, stability price as well as a balanced international balance of payments. If the stability in economic activity is interrupted, then monetary policy can be used to recover stability. To achieve this goal, the Bank seeks to regulate the balance between the supply of money in inventory that inflation can be controlled well, the achievement of full employment and fluency in the supply / distribution of goods. Monetary policy is conducted in the interest rate instrument, statutory reserves, and foreign exchange market intervention as a last resort for banks to borrow money when experiencing liquidity problems. 1.BankingMonetaryPolicyFrameworkinIndonesia With the abandonment of crawling band system and adopted a floating exchange rate system after the economic crisis in 1997/98, the monetary policy framework focused on price stability, with a target of creation of base money (inflation targeting lite). Since July 2005, the monetary policy framework enhanced with the principles of Inflation Targeting Framework. With this framework, Bank Indonesia announced explicit inflation target to the public and monetary policy directed to achieving the inflation target set by the Government. In order to achieve the inflation target, monetary policy is carried forward looking, meaning that changes in the monetary policy stance is performed through the evaluation of future inflation is still in accordance with the inflation target has been announced. Within this framework, monetary policy is also characterized by a policy of transparency and accountability to the public.

Operationally, the monetary policy stance is reflected by setting the policy rate (BI Rate) which is expected to affect interest rates and money market deposit rates and lending rates. Changes in interest rates will ultimately affect output and inflation. http://gemmaaktuaria.com/?p=145 Implementation of the ITF in Indonesia following the basic principle that the ITF is a framework, not the rule. With this principle, monetary policy is not implemented rigidly. The implementation of monetary policy is also considering development goals, especially broader economic growth. In contrast to the principle of full discretionary, ITF requires that discretionary policy in the implementation of monetary policy is limited. With these basic principles, Bank Indonesia monetary policy with the principal elements: a. First, the interest rate (BI-rate) is used as an operational target for monetary replace the money supply. It is based on a consideration of the weakening of the relationship between the money supply to the rate of inflation. b. Second, monetary policy strategies are reinforced with pre-emptive or forward looking. These basic elements as well as a great challenge for Bank Indonesia considering inflation in Indonesia is more influenced by inflation expectations are adaptive. Monetary policy needs to be consistent to the final target will be achieved or avoid the time-inconsistency policy. Without strong consistency, future policy received less attention from the public. Society will again use adaptive expectations and / or provide relatively small portion of the policy measures that will be taken forward and perform optimization in decision-making. Indonesian Banking Architecture (API) is a basic framework of the Indonesian banking system that is comprehensive and also provide direction, shape, and structure of the banking industry for a period of five to ten years. The policy direction of the development of the banking industry in the future will come in the API and formulated based on the goal of achieving a

healthy banking system, strong and efficient in order to create a stable financial system in order to help promote national economic growth. With the need for national banks and the blue print as a continuation of the restructuring program which has been running since 1998, Bank Indonesia on January 9, 2004 has been launched as an overall framework API development policy towards Indonesia's banking industry in the future. The launch of the API is not apart from the efforts of the Government and Bank Indonesia to rebuild the economy of Indonesia through the publication of a white paper in accordance with the Government Decree No.. 5 of 2003, where the API to be one of the major programs in the white paper.

Criticism of the desire to have a more robust banking fundamentals and taking into account inputs obtained in implementing the API for the past two years, the Bank Indonesia feels the need to refine the program of events listed in the API. Completion of API activity programs are not apart from the developments happening on the national and international economy. Improvements to the API programs include strategies include more specific information about the development of Islamic banking, BPR, and SMEs in the future so that the API is expected to have a more comprehensive program of activities and a comprehensive banking system as a whole includes related commercial banks and rural banks, both conventional and Islamic, as well as the development of MSMEs.

You might also like

- Research Paper On Monetary Policy of PakistanDocument7 pagesResearch Paper On Monetary Policy of Pakistanefeh4a7z100% (1)

- Bank IndonesiaDocument7 pagesBank IndonesiaHABIBUL WAHID HARMADANNo ratings yet

- Course: FINC6189 Introduction To Financial Market and Fin-Tech Effective Period: September 2021Document67 pagesCourse: FINC6189 Introduction To Financial Market and Fin-Tech Effective Period: September 2021Stivon LayNo ratings yet

- Monetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheDocument7 pagesMonetary Policy Instruments: Description: in India, Monetary Policy of The Reserve Bank of India Is Aimed at Managing TheKikujo KikuNo ratings yet

- The Transmission Mechanisms of Monetary Policy in IndonesiaDocument24 pagesThe Transmission Mechanisms of Monetary Policy in IndonesiaFåd WāNo ratings yet

- Monetary Policy of BangladeshDocument11 pagesMonetary Policy of BangladeshGobinda sahaNo ratings yet

- MONETARY POLICY OBJECTIVES AND APPROACHESDocument2 pagesMONETARY POLICY OBJECTIVES AND APPROACHESMarielle Catiis100% (1)

- The Impact of Monetary Policies On The Performance of Deposit Money Bank in NigeriaDocument14 pagesThe Impact of Monetary Policies On The Performance of Deposit Money Bank in NigeriaMUHAMMADU SANI SHEHUNo ratings yet

- MONETARY POLICY PRESENTATIONDocument8 pagesMONETARY POLICY PRESENTATIONHussain RizviNo ratings yet

- Group3 - Monetory & Credit PolicyDocument23 pagesGroup3 - Monetory & Credit PolicyDivya SinghNo ratings yet

- MBA510 AssignmentDocument10 pagesMBA510 AssignmentNafiz Al SayemNo ratings yet

- Chapter - 3 Reserve Bank of India: Monetary Policy and InstrumentsDocument10 pagesChapter - 3 Reserve Bank of India: Monetary Policy and Instrumentsanusaya1988No ratings yet

- Assignment On Monetary Policy in BangladeshDocument6 pagesAssignment On Monetary Policy in BangladeshAhmed ImtiazNo ratings yet

- MONETARY POLICY COMPARISONDocument8 pagesMONETARY POLICY COMPARISONNahla Hening AstisiwiNo ratings yet

- Money and BankingDocument16 pagesMoney and BankingJakir_bnkNo ratings yet

- KEBIJAKAN MAKROPUDENSIAL BANK INDONESIA UNTUK MENDORONG PEMBIAYAAN INKLUSIF - HARI MURTI & HARDINI TRISTYA - Id.enDocument7 pagesKEBIJAKAN MAKROPUDENSIAL BANK INDONESIA UNTUK MENDORONG PEMBIAYAAN INKLUSIF - HARI MURTI & HARDINI TRISTYA - Id.enHari MurtiNo ratings yet

- Monetary Policy: SingaporeDocument6 pagesMonetary Policy: SingaporeHarshit Kothari100% (1)

- Assignment On:: Role of Interest Groups in Monetary PolicyDocument8 pagesAssignment On:: Role of Interest Groups in Monetary PolicyIbrahim KholilNo ratings yet

- Contours Monetary PolicyDocument16 pagesContours Monetary PolicyRajiv DayaramaniNo ratings yet

- V1 Tej Sir Final Concept Note PHD Sangam NeupaneDocument7 pagesV1 Tej Sir Final Concept Note PHD Sangam NeupanegharmabasNo ratings yet

- BSP's Role in Monetary Policy and Price Stability in the PhilippinesDocument49 pagesBSP's Role in Monetary Policy and Price Stability in the PhilippinesSimone Reyes50% (2)

- Evolution of Monetary Policy in India Early PhaseDocument15 pagesEvolution of Monetary Policy in India Early PhaseNitesh kuraheNo ratings yet

- BBEK 4303 - PRINCIPLES OF MACROECONOMICS - AssignmentDocument15 pagesBBEK 4303 - PRINCIPLES OF MACROECONOMICS - AssignmentChen WoonNo ratings yet

- Reserve Bank of India Act, 1934: Non-Official DirectorsDocument6 pagesReserve Bank of India Act, 1934: Non-Official DirectorsRajesh Thakur JeetuNo ratings yet

- Monetary Policy and Exchange Rate Frameworks: The Indian ExperienceDocument16 pagesMonetary Policy and Exchange Rate Frameworks: The Indian ExperienceGagandeep SinghNo ratings yet

- Money and Banking AssignmentDocument3 pagesMoney and Banking AssignmentMegha MaitreyiNo ratings yet

- Perry Warjiyo, Indonesia, Stabilizing The Exchange Rate Along Its FundamentalDocument11 pagesPerry Warjiyo, Indonesia, Stabilizing The Exchange Rate Along Its FundamentalQarinaNo ratings yet

- 576 1195 1 SM PDFDocument20 pages576 1195 1 SM PDFirwandkNo ratings yet

- Government's Strategy in Maintaining The Economy During The Covid-19 PendemicDocument9 pagesGovernment's Strategy in Maintaining The Economy During The Covid-19 PendemicAZZAHRA SHAULA FEBRINA -No ratings yet

- VRMFDocument20 pagesVRMFVinay ReddyNo ratings yet

- Central Bank of The PhilippinesDocument5 pagesCentral Bank of The PhilippinesBERNALDEZ NESCEL JOYNo ratings yet

- Monetary Policy in India - BlackbookDocument65 pagesMonetary Policy in India - BlackbookKinnari SinghNo ratings yet

- Monetary Policy in New ZealandDocument3 pagesMonetary Policy in New ZealandRoshNo ratings yet

- Fiscal Policy of BangladeshDocument16 pagesFiscal Policy of BangladeshMdSumonMiaNo ratings yet

- Monetary Policy of BangladeshDocument26 pagesMonetary Policy of Bangladeshsuza054No ratings yet

- Prince Monetary PolicyDocument12 pagesPrince Monetary Policyrohit707No ratings yet

- Model of Vietnam's Central BankDocument6 pagesModel of Vietnam's Central BankMy Nguyễn Thị TràNo ratings yet

- The Effectiveness of Central Bank Policy in Order To Maintain Economic Stability in Indonesia: Due To The Covid-19 PandemicDocument13 pagesThe Effectiveness of Central Bank Policy in Order To Maintain Economic Stability in Indonesia: Due To The Covid-19 PandemicAbdul Adhim MustaqimNo ratings yet

- Monetary policy refers to the management of a countryDocument5 pagesMonetary policy refers to the management of a countryB I N O D ツNo ratings yet

- Business Economics-716Document15 pagesBusiness Economics-716Pratham ShahNo ratings yet

- Government'S Strategy in Maintaining The Economy During The Covid-19 PendemicDocument5 pagesGovernment'S Strategy in Maintaining The Economy During The Covid-19 PendemicAZZAHRA SHAULA FEBRINA -No ratings yet

- Top of FormDocument14 pagesTop of Formprnjlgoswami86No ratings yet

- Impacts & Implications of Bangladesh's Monetary PoliciesDocument11 pagesImpacts & Implications of Bangladesh's Monetary PoliciesMD Rifat ZahirNo ratings yet

- Article 3.0Document9 pagesArticle 3.0Vinish ChandraNo ratings yet

- Monetary Policy Framework of Ethiopia Main EditedDocument18 pagesMonetary Policy Framework of Ethiopia Main EditedAlayou YirgaNo ratings yet

- RBI MONETARY POLICYDocument15 pagesRBI MONETARY POLICYGurvi SinghNo ratings yet

- Why Is The BSP The Main Government Agency Responsible For Promoting Price StabilityDocument4 pagesWhy Is The BSP The Main Government Agency Responsible For Promoting Price StabilityMarielle CatiisNo ratings yet

- Monetary Policy in Cambodia: August 29, 2011 2 CommentsDocument21 pagesMonetary Policy in Cambodia: August 29, 2011 2 CommentsZavieriskNo ratings yet

- Monetary & Fiscal PolicyDocument10 pagesMonetary & Fiscal Policyaruna koliNo ratings yet

- Makerere University Business SchoolDocument6 pagesMakerere University Business SchoolCeacer Julio SsekatawaNo ratings yet

- FM 130 Philippine Monetary PolicyDocument5 pagesFM 130 Philippine Monetary PolicyHerminio NiepezNo ratings yet

- All Print Macro Nad MicroDocument15 pagesAll Print Macro Nad MicrosmitaNo ratings yet

- 0777Document10 pages0777REFALDI R. IHSANNo ratings yet

- Assignment Topic: Pakistan Monetary Policy in Last 5 DecadesDocument10 pagesAssignment Topic: Pakistan Monetary Policy in Last 5 DecadesIsra ChaudhryNo ratings yet

- Statement Kebijaksanaan Moneter - Teguh SihonoDocument17 pagesStatement Kebijaksanaan Moneter - Teguh SihonolincerprojectNo ratings yet

- Examination of Monetary Policy and Financial Performance of Deposit Money Bank in NigeriaDocument71 pagesExamination of Monetary Policy and Financial Performance of Deposit Money Bank in NigeriaDaniel ObasiNo ratings yet

- Monetary Policy (Assignment)Document5 pagesMonetary Policy (Assignment)Waleed AamirNo ratings yet

- Bank of Ghana: Curriculum VitaeDocument12 pagesBank of Ghana: Curriculum VitaeAhmed El-GamelNo ratings yet

- Monetary Policy Impact on Nigerian Bank ProfitabilityDocument74 pagesMonetary Policy Impact on Nigerian Bank ProfitabilityKENNETH EPPENo ratings yet

- Foreign Bank Which Operates in IndonesiaDocument2 pagesForeign Bank Which Operates in IndonesiakartikasandiutamiNo ratings yet

- Foreign Bank Which Operates in IndonesiaDocument2 pagesForeign Bank Which Operates in IndonesiakartikasandiutamiNo ratings yet

- Job Conditions (Ria Komala)Document3 pagesJob Conditions (Ria Komala)kartikasandiutamiNo ratings yet

- Foreign Bank Which Operates in IndonesiaDocument2 pagesForeign Bank Which Operates in IndonesiakartikasandiutamiNo ratings yet

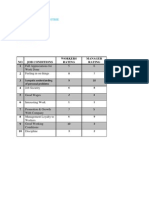

- How Managers and Workers Rated Ten Job Conditions Softskill 3Document4 pagesHow Managers and Workers Rated Ten Job Conditions Softskill 3kartikasandiutamiNo ratings yet

- Writing 3 Foreign Bank Which Operates in Indonesia (Ria Komala)Document4 pagesWriting 3 Foreign Bank Which Operates in Indonesia (Ria Komala)kartikasandiutamiNo ratings yet

- Softskill Task Tanggal 14 Juni (Dhisa Dwi S)Document5 pagesSoftskill Task Tanggal 14 Juni (Dhisa Dwi S)kartikasandiutamiNo ratings yet

- How Managers and Workers Rated Ten Job ConditionsDocument4 pagesHow Managers and Workers Rated Ten Job ConditionskartikasandiutamiNo ratings yet

- Softskill Writing 3 (Dhisa Dwi S)Document2 pagesSoftskill Writing 3 (Dhisa Dwi S)kartikasandiutamiNo ratings yet

- Bank Asing Sudah JadiDocument2 pagesBank Asing Sudah JadikartikasandiutamiNo ratings yet

- Foreign Bank Which Operates in IndonesiaDocument2 pagesForeign Bank Which Operates in IndonesiakartikasandiutamiNo ratings yet

- Foreign Bank Which Operates in IndonesiaDocument2 pagesForeign Bank Which Operates in IndonesiakartikasandiutamiNo ratings yet

- Conversation Ami2Document3 pagesConversation Ami2kartikasandiutamiNo ratings yet

- Dialog 2 - Engglish 2 Softskill Agung Dwi SaputraDocument3 pagesDialog 2 - Engglish 2 Softskill Agung Dwi SaputrakartikasandiutamiNo ratings yet

- Foreign Bank Which Operates in IndonesiaDocument2 pagesForeign Bank Which Operates in IndonesiakartikasandiutamiNo ratings yet

- Bahasa InggrisDocument2 pagesBahasa InggriskartikasandiutamiNo ratings yet

- Softskill - Engglish 2 High Cost Economic in Indonesia Agung Dwi SaputraDocument3 pagesSoftskill - Engglish 2 High Cost Economic in Indonesia Agung Dwi SaputrakartikasandiutamiNo ratings yet

- Softskill-English 2 The High Cost Economic Kartika Sandi UtamiDocument4 pagesSoftskill-English 2 The High Cost Economic Kartika Sandi UtamikartikasandiutamiNo ratings yet

- ConversationDocument2 pagesConversationkartikasandiutamiNo ratings yet

- Conversation Ami2Document3 pagesConversation Ami2kartikasandiutamiNo ratings yet

- Nama: Eri Putra Deva KELAS: 1EA18 NPM: 12212518Document2 pagesNama: Eri Putra Deva KELAS: 1EA18 NPM: 12212518kartikasandiutamiNo ratings yet

- Conversation Ami2Document3 pagesConversation Ami2kartikasandiutamiNo ratings yet

- Nama: Eri Putra Deva KELAS: 1EA18 NPM: 12212518Document2 pagesNama: Eri Putra Deva KELAS: 1EA18 NPM: 12212518kartikasandiutamiNo ratings yet

- Development of Banking in IndonesiaDocument1 pageDevelopment of Banking in IndonesiakartikasandiutamiNo ratings yet

- Tugas Writing SoftskillDocument4 pagesTugas Writing SoftskillkartikasandiutamiNo ratings yet

- Bahasa InggrisDocument2 pagesBahasa InggriskartikasandiutamiNo ratings yet

- ConversationDocument2 pagesConversationkartikasandiutamiNo ratings yet

- Softskill Bahasa Inggris M.ajie - LaksonoDocument3 pagesSoftskill Bahasa Inggris M.ajie - LaksonokartikasandiutamiNo ratings yet

- Banking Sector in Indonesia (Devi Andriyani)Document1 pageBanking Sector in Indonesia (Devi Andriyani)kartikasandiutamiNo ratings yet

- Solutions Manual: Tax Consequences of Home OwnershipDocument52 pagesSolutions Manual: Tax Consequences of Home Ownershipkaka2015No ratings yet

- Clifford Appasamy, Matthew Lamport, Boopendra Seetanah, Raja Vinesh SannasseeDocument50 pagesClifford Appasamy, Matthew Lamport, Boopendra Seetanah, Raja Vinesh SannasseeKristen NallanNo ratings yet

- A STUDY ON LOANS & ADVANCES OF STATE BANK OF INDIADocument98 pagesA STUDY ON LOANS & ADVANCES OF STATE BANK OF INDIAShanu shriNo ratings yet

- TCF GapDocument3 pagesTCF Gapmm_mayfairNo ratings yet

- Modified Multiple ChoiceDocument3 pagesModified Multiple ChoiceJun RectoNo ratings yet

- Mba Dissertation On Banking SecurityDocument78 pagesMba Dissertation On Banking Securitychada12345No ratings yet

- Caltex vs. Pnoc Shipping and Transport CorporationDocument2 pagesCaltex vs. Pnoc Shipping and Transport CorporationGela Bea BarriosNo ratings yet

- Sale of GoodsDocument27 pagesSale of GoodsPavel Shibanov100% (3)

- The World Bank For Official Use Only: Report NoDocument84 pagesThe World Bank For Official Use Only: Report Noamirali_bhimaniNo ratings yet

- Sage 50 Resource GuideDocument185 pagesSage 50 Resource GuideshubizNo ratings yet

- SDR Special Aug2016 DEFDocument10 pagesSDR Special Aug2016 DEFCurve123No ratings yet

- Sixth Street Management - Defendant FindingsDocument89 pagesSixth Street Management - Defendant FindingsScrap The YardNo ratings yet

- Understand how banks assess creditworthiness through key parametersDocument4 pagesUnderstand how banks assess creditworthiness through key parametersrs9999No ratings yet

- Whole Life InsuranceDocument14 pagesWhole Life InsuranceSushma DudyallaNo ratings yet

- Long Quiz On Co-Ownership & Possession 2 RW9Document4 pagesLong Quiz On Co-Ownership & Possession 2 RW9Chicklet ArponNo ratings yet

- Analysis of Residential Mortgage-Backed Securities: Chapter SummaryDocument26 pagesAnalysis of Residential Mortgage-Backed Securities: Chapter SummaryasdasdNo ratings yet

- Service Contract Annex IDocument8 pagesService Contract Annex IyjankoyNo ratings yet

- Petitioner,: Judicial AffidavitDocument7 pagesPetitioner,: Judicial Affidavitbarrystarr1No ratings yet

- Developing CountriesDocument3 pagesDeveloping CountriesYvonne BehNo ratings yet

- Basic Accounting Concepts and PrinciplesDocument4 pagesBasic Accounting Concepts and Principlesalmyr_rimando100% (1)

- 3M TSN 2015 - Provisional Remedies CompleteDocument63 pages3M TSN 2015 - Provisional Remedies CompleteCid Benedict PabalanNo ratings yet

- Mark Scheme (Results) January 2010: GCE O Level Economics (7120/01)Document14 pagesMark Scheme (Results) January 2010: GCE O Level Economics (7120/01)Ruquia ArjumandNo ratings yet

- BOND VALUATION - Kelompok 5 UpdateDocument67 pagesBOND VALUATION - Kelompok 5 UpdateRemano GitzkyNo ratings yet

- Dewan Housing Finance Corporation Limited 4 QuarterUpdateDocument7 pagesDewan Housing Finance Corporation Limited 4 QuarterUpdatesandyinsNo ratings yet

- NISM Series IX Merchant Banking Workbook February 2019 PDFDocument211 pagesNISM Series IX Merchant Banking Workbook February 2019 PDFBiswajit SarmaNo ratings yet

- Buyers CreditDocument2 pagesBuyers Creditrao_gmailNo ratings yet

- Secretary's Certificate For Account Opening (Domestic Corporation)Document3 pagesSecretary's Certificate For Account Opening (Domestic Corporation)JACQUE ARCENALNo ratings yet

- Introduction To Alternative InvestmentsDocument44 pagesIntroduction To Alternative Investmentscdietzr100% (1)

- Capital Markets Foundation CourseDocument190 pagesCapital Markets Foundation Courseanubhav100% (1)

- Air Arabia 2017 Financial StatementsDocument62 pagesAir Arabia 2017 Financial StatementsRatika AroraNo ratings yet