Professional Documents

Culture Documents

Tax Declaration Form - Ye. 31.03.2014 - All

Uploaded by

Paymaster ServicesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Declaration Form - Ye. 31.03.2014 - All

Uploaded by

Paymaster ServicesCopyright:

Available Formats

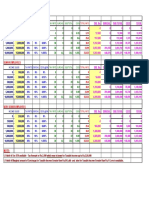

TAX DECLARATION FORM FOR INCOME TAX RELIEF - Y.E. 31.03.

2014

NAME OF COMPANY: EMPLOYEE CODE NO.

(As appears on the Pay Slip)

LOCATION: PAN:

(Form without PAN is INVALID)

NAME OF EMPLOYEE:

Rs. (No paise)

RENT PAID BY EMPLOYEE ( FOR HRA COMPUTATION PURPOSE ) For 1 2 3 4 5 6 7 8 9

employees who have joined during the year, the rent amount should only be from date of joining the company till the year end. For Others it should be for the full year.

SEC.80D - MEDICLAIM PREMIUM (Max. Rs.35,000 = 15,000 + 20,000 ) Sec.80DD Handicapped or Sec.80U Disability SEC. 80CCC - JEEVAN SURAKSHA / OTHER PENSION SCHEMES 80E - EDUCATION LOAN INTEREST (Only Interest Component) LOSS UNDER THE HEAD "INCOME FROM HOUSE PROPERTY" INTEREST PAID IN RESPECT OF SELF-OCCUPIED PROPERTY

Interest on Loans taken after 01.04.1999 (Max. Rs.1,50,000)

INTEREST PAID IN RESPECT OF NEW SELF-OCCUPIED PROPERTY (Loan taken after 01.04.2013 & Loan Less than 25 Lakh.) UNITS OF MUTUAL FUND [ Section 10(23D) ]

10 FIXED DEPOSIT WITH SCHEDULE BANK MORE THAN 5 YEARS. 11 LIFE INSURANCE PREMIA (by LIC or any other Insurer) - LIP 12 ULIP / DHANRAKSHA 13 PUBLIC PROVIDENT FUND - PPF (Max. Rs.1,00,000) 14 HOUSING LOAN REPAYMENT - PRINCIPAL AMOUNT 15 NATIONAL SAVINGS CERTIFICATE SERIES - NSC 16 ACCRUED INTEREST ON NSC 17 TUITION FEES PAID TO UNIVERSITY, COLLEGE, SCHOOL 18 INFRASTRUCTURE BONDS (As per old Scheme)

I hereby declare that the information given above is correct and true in all respects and I request the company to allow me the appropriate Income-tax exemption / relief. I undertake to produce to the company, LATEST BY JANUARY 1, 2014, OR prior to leaving the company, appropriate documentary evidence in respect of payments mentioned above. Failing this, I agree that the company wil be free to cancel the exemption allowed and to recover from me the additional Income-tax arising there from.

(As per Rules)

Signature of Employee:

(Form without SIGNATURE is INVALID)

Date:

NAME OF EMPLOYEE: (in block letters)

You might also like

- Only Tax Slabs - Fy 2017-18Document2 pagesOnly Tax Slabs - Fy 2017-18Paymaster ServicesNo ratings yet

- Proof of Investment - Y.E. 31.03.2011Document5 pagesProof of Investment - Y.E. 31.03.2011Paymaster ServicesNo ratings yet

- New - Cost Inflation IndexDocument1 pageNew - Cost Inflation IndexPaymaster ServicesNo ratings yet

- Detailed Tax Slabs - FY 2017-18Document1 pageDetailed Tax Slabs - FY 2017-18Paymaster ServicesNo ratings yet

- Proof of Investment - Y.E. 31.03.2011Document5 pagesProof of Investment - Y.E. 31.03.2011Paymaster ServicesNo ratings yet

- LTA DeclarationDocument1 pageLTA DeclarationPaymaster ServicesNo ratings yet

- Cost Inflation IndexDocument1 pageCost Inflation IndexPaymaster ServicesNo ratings yet

- Key Highlights of The Finance Budget - 2017Document1 pageKey Highlights of The Finance Budget - 2017Paymaster ServicesNo ratings yet

- Marginal Relief To Income Tax - Fy 2016-17Document2,489 pagesMarginal Relief To Income Tax - Fy 2016-17Paymaster ServicesNo ratings yet

- LTA Claim Form - Period 1.jan.2006 To 31.dec.2009Document1 pageLTA Claim Form - Period 1.jan.2006 To 31.dec.2009Paymaster Services100% (1)

- Perquisite Details - Y.E. 2017Document4 pagesPerquisite Details - Y.E. 2017Paymaster ServicesNo ratings yet

- Tax Proof Summary Form For Tax Relief - Ye 31.03.2017Document1 pageTax Proof Summary Form For Tax Relief - Ye 31.03.2017Paymaster ServicesNo ratings yet

- Profession Tax Challan - MaharashtraDocument1 pageProfession Tax Challan - MaharashtraPaymaster ServicesNo ratings yet

- Gratuity Types & Tax ExemptionsDocument1 pageGratuity Types & Tax ExemptionsPaymaster Services100% (1)

- Form 16 & Form 12ba Details - F.Y. Ending 31.03.2017Document3 pagesForm 16 & Form 12ba Details - F.Y. Ending 31.03.2017Paymaster ServicesNo ratings yet

- Key Features of Finance Budget For Financial Year - 2012-13Document18 pagesKey Features of Finance Budget For Financial Year - 2012-13Paymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Document1 pageTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Document1 pageTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesNo ratings yet

- ITR-3 For Assessment Year 2011-12, Financial Year 2010-11Document7 pagesITR-3 For Assessment Year 2011-12, Financial Year 2010-11Paymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief - Ye 31.03.2017Document1 pageTax Declaration Form For Tax Relief - Ye 31.03.2017Paymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Document1 pageTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesNo ratings yet

- ITR 1 Sahaj For Assesment Year 2011-12, Financial Year 2010-11Document6 pagesITR 1 Sahaj For Assesment Year 2011-12, Financial Year 2010-11Paymaster ServicesNo ratings yet

- ITR - 2 For Assessment Year 2011-12, Financial Year 2010-11Document8 pagesITR - 2 For Assessment Year 2011-12, Financial Year 2010-11Paymaster ServicesNo ratings yet

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Document1 pageTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesNo ratings yet

- Budget Speech by Finance Minister On 28 February, 2011Document35 pagesBudget Speech by Finance Minister On 28 February, 2011Paymaster ServicesNo ratings yet

- Key Features of Indian Union Budget FY - 2011-12Document23 pagesKey Features of Indian Union Budget FY - 2011-12Paymaster ServicesNo ratings yet

- Employee State Insurance - ESICDocument3 pagesEmployee State Insurance - ESICPaymaster ServicesNo ratings yet

- Taxability of GiftsDocument6 pagesTaxability of GiftsPaymaster ServicesNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)