Professional Documents

Culture Documents

Note On Public Issue

Uploaded by

Krish KalraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Note On Public Issue

Uploaded by

Krish KalraCopyright:

Available Formats

TIBREWALA ELECTRONICS LIMITED NOTE ON PUBLIC ISSUE

(A) INTRODUCTION Every Company needs funds for its business. Funds requirement can be for short term or for long term. To meet short term requirements, the may approach banks, lenders & may even accept fixed deposits from public/shareholders. To meet its long term requirements, funds can be raised either through loans from lenders, Banks, Institutions etc. (which carry financial burden) or through issue of capital. Capital can be raised through private placement of shares, public issue, right issue etc. Public issue means raising funds from public. Promoters of the Company may have plans for the Company, which may require infusion of money. The main purpose of the public issue, amongst others, is to raise money through public and get its shares listed at any of the recognized stock exchanges in India. ADVANTAGES OF PUBLIC ISSUE Money non-refundable except in the case of winding up or buy back of shares. No financial burden i.e. no fixed rate of interest payable. However, in order to service the equity, dividend may be paid. Enhance shareholders value if the Company performs well. Greater Transferability. Trading & Listing of securities at stock exchanges. Better liquidity of securities. Helps building reputation of promoters, Company & its products/services, provided the Company performs well.,

DIS-ADVANTAGES OF PUBLIC ISSUE Time consuming process. Expensive. Several legal formalities. Involvement of many intermediateries. Transparency requirements and public disclosure of information may lead to lack of privacy. Continuous compliance of provisions of listing agreement and other legal requirements. Constant scrutiny of performance by investors. May lead to takeover of the company Securities of the Company may be made subjective to speculative attacks.

APPLICABLE LAWS Provisions of the Companies Act, 1956. Securities Contracts (Regulations) Act, 1956. SEBI rules & regulations Compliance of Listing Agreement with the concerned stock exchanges after the listing of securities. RBI regulations in case of foreign/NRI equity participation.

(B) ENTRY NORMS-WHO CAN COME OUT WITH A PUBLIC ISSUE Entry norms for the Public Issue are governed by the SEBI Guidelines, SEBI (Disclosure for Investor and Protection) Guidelines, 2000. SEBI, keeping in view the objective of greater transparency, investor protection and development of capital market, has from time to time amended the entry norms for Companies to come out with the public issue. Entry norms are categorized into the following: 1. Unlisted Companies 2. Listed Companies. UNLISTED COMPANIES Unlisted Companies are those public limited Companies which are presently not listed at any of the recognized stock exchanges in India. The shares of such Companies are therefore not traded at any stock exchanges in India. Presently, there are two options available for the unlisted companies to come out with public issue: 1ST OPTION The Company has net tangible assets of at least Rs. 3 crores in each of the preceding 3 full years of which not more than 50% is held in monetary assets. It should have a track record of distributable profits for at least 3 out of immediately 5 years and The pre-issue net worth (i.e. net worth before the issue) should be at least Rs. 1.00 crore in each of the preceding 3 years.

The issue size (includes offer to public, firm allotment, promoters contribution through offer documents) should not exceed 5 times its pre-issue net worth as per the last available audited accounts. 2nd OPTION An unlisted Company not complying with any of the conditions specified above may make initial public offer if it meets both the following conditions:

The issue is made through the book-building process, with at least 50% of the issue size being allotted to Qualified Institutional Buyers (QIBs) failing which the full subscription monies shall be refunded. OR

He project has at least 15% participation by Financial Institutions/Scheduled commercial banks of which at least 10% comes from appraiser. In addition to this, at least 10% of the issue size shall be allotted to QIBs, failing which the full subscription monies shall be refunded. AND

The minimum post-issue face value capital of the Company shall be Rs. 10 crore. OR

There shall be a compulsory market-making for at least 2 years.

LISTED COMPANIES Listed Companies are those which are presently listed on any one or more recognized Stock Exchange in India. The securities of such companies are traded on such stock exchange where they are traded. All listed companies can come out with further public issue provided the net worth of the Company after the proposed issue is less than 5 times the net worth prior to the issue. (C) ROLE OF SEBI-REGULATORY BODY The SEBI Act came in to force on 30th January 1992 and with its establishment, all public issues are governed by the rules & regulations issued by SEBI. SEBI was formed to promote fair dealing in issue of securities and to ensure that the capital markets function efficiently, transparently and economically in the better interests of both the issuers and the investors. The promoters should be able to raise funds at a relatively low cost. At the same time, investors must be protected from unethical practices and their rights must be safeguarded so that there is a steady flow of savings in to the market. There must be proper regulation and code of conduct and fair practice by intermediaries to make them competitive and professional. Under the umbrella of SEBI, companies issuing shares are free to fix the premium provided adequate disclosure is made in the offer documents. Focus being the greater investor protection, SEBI has become a vigilant watchdog.

(D) ROLE OF INTERMEDIARIES Many intermediaries are involved in connection with the public issue. Following are the intermediaries who have to be registered with SEBI and must have valid certificate from SEBI to act as an intermediaries: Merchant Bankers Registrar & Share Transfer Agents Bankers to the issue Underwriters Stock Brokers and sub-brokers Depositories.

Merchant Bankers Play the most vital role amongst all intermediaries. They assist the Company right from preparing prospectus to the listing of securities at the stock exchanges. Merchant bankers have to satisfy themselves about the correctness and propriety of all the information provided in the prospectus. It is mandatory for them to carry due diligence for all the information provided in the prospectus and they must issue a certificate to this effect to SEBI. A Company may appoint more than one Merchant Banker provided the Merchant Bankers are properly structured. Underwriters Are those intermediaries who underwrite the securities offered to the public. In case there is undersubscription (in short, the company does not receive good response from public and amount received from is less than the size), underwriters subscribe to the unsubscribed amount so that the issue is successful. Registrar & Transfer Agent Processes all applications received from the public and prepare the basis of allotment. The dispatch of share certificates/refund orders are handled by them. Bankers to the Issue Are banks which accept application from the public on behalf of the Company. These applications are then forwarded to Registrar & Share Transfer Agent for further processing. Stock Brokers & Sub-brokers Are those intermediaries who through their contacts/sources invite the public for subscribing shares for which they get commission.

Depositories Are those intermediaries who holds securities in dematerialized form on behalf of the shareholders. (E) PROSPECTUS prospectus is the most important document for the Company to come out with a public issue. Pursuant to section 2(36) of the Companies Act, 1956, Prospectus means any document described or issued as a prospectus and includes any notice, circular, advertisement or other document inviting deposits from public or inviting offers from public for subscription or purchase of any share in or debentures of a body corporate. Prospectus is a document by way of which the investor gets all the information pertaining to the Company in which they are going to invest. It gives the detailed information about the Company, Promoter/Directors, group companies, capital structure, terms of the present issue, details of proposed project, particulars of the issue etc. Vetting by SEBI/Stock Exchanges A Company can not come out with public issue unless draft prospectus is filed with SEBI. A company cannot file prospectus directly with SEBI. It has to be filed through a merchant banker. After the preparation of prospectus, the merchant banker along with the due diligence certificates and other compliances sends the same to SEBI for vetting. SEBI on receiving the same, scrutinizes it and may suggest changes within 21 days of receipt of prospectus. (earlier the situation was that the company was required to obtain acknowledgement card from SEBI) However, now the concept of obtaining acknowledgement card has been removed and the company can come out with public issue any time within 365 days from the date of the letter from SEBI or if no letter is received from SEBI, within 365 days from the date of expiry of 21 days of submission of prospectus with SEBI. If the issue size is up to Rs. 20.00 crores, then the merchant bankers are required to file prospectus with the regional office of SEBI falling under the jurisdiction in which the registered office of the Company is situated. If the issue size is more than Rs. 20 crores, merchant bankers are required to file prospectus at SEBI, Mumbai office. Prospectus is also required to be filed with the concerned stock exchanges along with the application for listing its securities. Presently, Companies approaching the stock exchanges for public issues should obtain in-principal approval from such stock exchanges.

Date of Prospectus and ROC Card After making changes, if any made by SEBI / Stock Exchanges, the final Prospectus duly signed by all the Directors (Or by Authorized Representatives through its Power of Attorney) must be filed with ROC along with the copy of all material documents. ROC may suggest changes which should also be reported to SEBI/Stock Exchanges. The date on which ROC Card is obtained is the date of the prospecus. (F) PROMOTERS CONTRIBUTION & LOCK-IN REQUIREMENT Some specific provisions have been inserted with regard to the contribution of the promoters in the capital of the Company. Promoters contribution should be a minimum 20% of the post issue capital. In order to calculate the minimum 20%, following shares allotted to promoters during last 3 years before filing prospectus with SEBI will not be included: Shares acquired for consideration other than cash and revaluation of assets or capitalization of intangible assets. Shares allotted on account of bonus issue, out of revaluation reserves or reserves without accrual of cash resources. Shares allotted at a price lower than the price at which equity is being offered to public during the preceding one year. Applications received for less than Rs. 25000 per applicant in case of each individual and Rs. 1 lakh from firms and companies.

Promoters Contribution to be brought in before the issue Promoters are required to bring the full amount of promoters contribution at least one day prior to the opening of public issue and should be kept in an escrow account with a scheduled bank. The said amount shall be released after the finalization of the basis of allotment with the proceeds of public issue. However, if the promoters contribution has been brought prior to the public issue and has been utilized by the Company, the Company is required to insert cash flow statement in the prospectus in this regard disclosing the use of such fund received from the promoters. If the minimum promoters contribution exceed Rs. 100 crores, the promoters are required to bring at least Rs. 100 crores before the opening date of public issue and the balance contribution can be bought by the promoters in advance on pro rata before calls are made to the public. Lock in Requirements The eligible promoters contribution is locked in for 3 years. The entire pre-issue share capital, other than that locked-in as promoters contribution, shall be locked-in for a period of one year.

All the securities issued on firm allotment basis shall be locked-in for a period of one year. The date of the lock-in shall be reckoned from the date of commencement of commercial production or the date of allotment in the public issue, whichever is later. The shares held by promoters and are loked-in may be pledged with banks or financial institutions for loans, provided the pledge of shares is one of the terms of the sanction of loan. The locked-in shares held by promoters can be transferred between promoters provided they are disclosed as promoters in the prospectus and there would be no change in the period of lock-in.

(G) RESERVATION AND FIRM ALLOTMENT Public issue should be at least 25% of the post issue capital (in case of unlisted company) Public issue should be at least 25% of the issue size (in case of listed company) The above is relaxed in case of public issue of unlisted companies in information technology sector where at least 10% of the securities may be offered to public subject to (i) 20 lacs securities are offered to public and (ii) issue size is minimum Rs. 50 crores. The Company can reserve shares in the issue on competitive basis wherein allotment of shares is made in proportion to the shares applied for by the concerned reserved categories which can be categorized as follows: 1. Permanent Employees including working directors and in case of new company the permanent employees of promoting company. 2. Shareholders of the promoting company in case of new company and shareholders of group companies in case of existing company. 3. Indian Mutual Funds 4. FIIs including NRIs and OCB. 5. Indian & multilateral development institutions 6. Scheduled Banks. The Company is allowed to make firm allotment to the following: 1. 2. 3. 4. 5. 6. Indian and Multilateral Development Financial institutions. Indian Mutual Funds FII Permanent /regular employees of the Company. Scheduled banks Merchant Bankers (subject to 5% of issue size)

The aggregate of reservations and firm allotment of employees can not exceed 10% of issue size.

(H) PROCEDURE FOR THE PUBLIC ISSUE In short, if the Company has satisfied the entry norms, it should approach a merchant banker with whom Memorandum of Understanding (MOU) has to be executed. The Merchant Banker shall carry due diligence for the all the information provided in the prospectus. The obligations are divided into pre-issue and post-issue which are as follows:Pre-Issue Obligations (i.e. before the opening of issue) Board Resolution for approving the draft prospectus and related resolutions. Shareholders Resolution pursuant to Section 81 (1A) of the Companies Act, 1956. Filing form 23 with ROC for passing special resolution for issuing of shares as above. Appointment of intermediaries and entering into MOU with them. Due diligence by a merchant banker Submission of all required papers / documents with merchant bankers. Preparation of draft prospectus in consultation with merchant banker and submitting the same with SEBI along with the fees & other requirements and submitting the same with stock exchanges as per guidelines. Receipt of queries from SEBI / stock exchanges, if any and make changes in prospectus, if required. Reply to SEBI/stock exchanges in connection with changes in prospectus. Obtaining in-principle approval from stock exchanges. File final prospectus with SEBI/Stock Exchanges/ ROC Statutory Advertisements Submission of 1% security deposit with the Regional Stock Exchanges. Depositing Promoters Contribution in the issue in a separate Bank Account.

Post-Issue Obligations (i.e. After the Closure of issue) Collection of Application forms and processing the same at the Registrar & Share Transfer Agent in consultation with Merchant Banker. Separate Account be opened for the applications received from Public. Submitting 3-day post issue monitoring report with SEBI from Merchant Banker. Basis of allotment in consultation with regional stock exchange. Post issue advertisement Dispatch of share certificates/refund orders File form 2 for return of allotment with ROC. Entering in to listing agreement. Obtaining permission from Stock Exchanges for listing of securities. Commencement of trading of securities. 78-days post issue monitoring report to be submitted by merchant banker with SEBI. Redressal of Investors Grievances.

Application to SEBI/Stock Exchanges for refund of security deposit.

Some Important Issues pertaining to Public Issues Companies can freely price its securities. Company can not come out with public issue unless all its existing partly paid up shares, if any, are made fully paid up. Before filing the final prospectus, the Company can keep a price band of maximum 20%, it means that if the Company is not sure of the issue price, it may keep a floor price with a price band of 20%. Companies are now free to determine the denomination of shares. Net offer to public should be at least 25% of the issue size. Public issue should be opened for at least 3 working days and not more than 10 working days. The minimum amount to be received from each investor should be Rs. 2000/-. Promoters may at its discretion arrange for buy back facility or safety net facilities in the prospectus subject to the maximum 1000 shares per allotted. The validity of such scheme, if any shall be at least 6 months from the date of dispatch of certificates. Company can come out with an issue within 365 days from the date of observation letter received from SEBI or where such letter is not received, issue can come out with in 365 days from the 22 nd day of the date of filing of the prospectus. Company is required to appoint Compliance Officer to directly liaise with SEBI/Stock Exchanges to comply with various laws and investors complaints related matters. Trading of securities of all new public issues will be in dematerialized form ony. The refund orders, demat credit, allotment and submission of listing documents to stock exchanges should be completed within 2 working days of finalization of basis of allotment.

You might also like

- How to amend Articles and By-laws in the PhilippinesDocument3 pagesHow to amend Articles and By-laws in the PhilippinesHARLEY TANNo ratings yet

- License All Reports Brookings InstituteDocument134 pagesLicense All Reports Brookings InstitutePA Work LicenseNo ratings yet

- Florida Rules of Appellate ProcedureDocument192 pagesFlorida Rules of Appellate ProcedurejkbrinsoNo ratings yet

- Sources of international law - Custom and its elementsDocument5 pagesSources of international law - Custom and its elementsFarhat YunusNo ratings yet

- Thesis OfwDocument3 pagesThesis Ofwyazi080% (1)

- La Tondena Distillers Vs CADocument2 pagesLa Tondena Distillers Vs CAJL A H-Dimaculangan100% (1)

- Complaint Affidavit - MurderDocument4 pagesComplaint Affidavit - Murderkarlonov100% (3)

- Culpable Homicide & Exceptions To s300Document59 pagesCulpable Homicide & Exceptions To s300Khairul Iman82% (11)

- Revision Questions and Answer For End Semester ExaminationDocument7 pagesRevision Questions and Answer For End Semester ExaminationFaheem Easa Abdulla Moosa33% (3)

- Commercial Bill MarketDocument25 pagesCommercial Bill Marketapeksha_606532056No ratings yet

- Nature and Significance of Capital Market ClsDocument20 pagesNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- EDDocument8 pagesEDNaganandaKu67% (3)

- Objectives and Functions of SEBI in Regulating Indian Securities MarketDocument13 pagesObjectives and Functions of SEBI in Regulating Indian Securities MarketNishat ShaikhNo ratings yet

- Capital Market Clearing and Settlement ProcessDocument9 pagesCapital Market Clearing and Settlement ProcessTushali TrivediNo ratings yet

- Role of District Industrial Centers in Entrepreneurship DevelopmentDocument5 pagesRole of District Industrial Centers in Entrepreneurship DevelopmentPinky KusumaNo ratings yet

- IFM InsightsDocument37 pagesIFM Insights9832155922No ratings yet

- Service Guarantee PPT VikasDocument8 pagesService Guarantee PPT VikasAbhishek Kumawat (PGDM 18-20)No ratings yet

- New Issue MarketDocument18 pagesNew Issue Marketoureducation.inNo ratings yet

- Bse and NseDocument15 pagesBse and NseChinmay P Kalelkar50% (2)

- AUDIT BasicDocument10 pagesAUDIT BasicKingo StreamNo ratings yet

- Theories of RetailDocument24 pagesTheories of RetailSiddhartha DeshmukhNo ratings yet

- DIC FunctionsDocument2 pagesDIC FunctionsBhava Rotaract0% (1)

- Powered by Ninja X SamuraiDocument2 pagesPowered by Ninja X SamuraiArkadeep TalukderNo ratings yet

- PCA & RD Bank PDFDocument86 pagesPCA & RD Bank PDFmohan ks100% (2)

- Entrepreneurship Assignment 1Document3 pagesEntrepreneurship Assignment 1Anonymous 0zM5ZzZXCNo ratings yet

- Organizational Structure, Development of Banks in IndiaDocument54 pagesOrganizational Structure, Development of Banks in Indiaanand_lamani100% (1)

- IFM M.Com NotesDocument36 pagesIFM M.Com NotesViraja GuruNo ratings yet

- Indian Manager's Attitudes Towards Business EthicsDocument10 pagesIndian Manager's Attitudes Towards Business EthicsGaurav Srivastava100% (2)

- Synergy and Dysergy: Understanding Positive and Negative EffectsDocument2 pagesSynergy and Dysergy: Understanding Positive and Negative EffectsTitus ClementNo ratings yet

- Inter-Firm ComparisonDocument5 pagesInter-Firm Comparisonanon_672065362100% (1)

- Asset and LiabilityDocument30 pagesAsset and LiabilitymailsubratapaulNo ratings yet

- Investment Analysis and Portfolio Management (Mba 3RD Sem)Document30 pagesInvestment Analysis and Portfolio Management (Mba 3RD Sem)priyank chourasiyaNo ratings yet

- Excise Clearance For ExportsDocument10 pagesExcise Clearance For ExportsRadhakrishna UppalapatiNo ratings yet

- Corporate Governance:CG Mechanism, CG System, Good CG, Land Mark in The Emergence of CG: CG Committees, World Bank On CG, OECD PrincipleDocument22 pagesCorporate Governance:CG Mechanism, CG System, Good CG, Land Mark in The Emergence of CG: CG Committees, World Bank On CG, OECD PrincipleRashmi Ranjan Panigrahi100% (3)

- BBA 603 Entrepreneurship GuideDocument20 pagesBBA 603 Entrepreneurship Guideaditya mishraNo ratings yet

- Notes Micro FinanceDocument9 pagesNotes Micro Financesofty1980No ratings yet

- Increased Concern of HRMDocument30 pagesIncreased Concern of HRMAishwarya Chachad33% (3)

- Legal and Procedural Aspects of MergerDocument8 pagesLegal and Procedural Aspects of MergerAnkit Kumar (B.A. LLB 16)No ratings yet

- Responsibility CentersDocument6 pagesResponsibility CentersNitesh Pandita100% (1)

- Chapter 08Document16 pagesChapter 08piyu100% (1)

- Tax Management With Reference To - Repair, Replace, Renewal or RenovationDocument4 pagesTax Management With Reference To - Repair, Replace, Renewal or RenovationAkhil1101No ratings yet

- Clearance or Permission For Establishing Industries: Prepared By:-Pankaj Preet SinghDocument22 pagesClearance or Permission For Establishing Industries: Prepared By:-Pankaj Preet SinghpreetsinghjjjNo ratings yet

- 5.calculation of EPSDocument6 pages5.calculation of EPSVinitgaNo ratings yet

- Auditing VouchingDocument6 pagesAuditing VouchingDivakara ReddyNo ratings yet

- EXIMDocument17 pagesEXIMTrichy MaheshNo ratings yet

- Corporate Governance in India & Sebi Regulations: Presented byDocument15 pagesCorporate Governance in India & Sebi Regulations: Presented byMolu WaniNo ratings yet

- MBFS Question Bank & AnswersDocument17 pagesMBFS Question Bank & AnswersArunkumar JwNo ratings yet

- Introduction to Profit Management ConceptsDocument16 pagesIntroduction to Profit Management ConceptsmussaiyibNo ratings yet

- 2016 CRP-Question Paper SolvedDocument17 pages2016 CRP-Question Paper SolvedKomala0% (1)

- Audit OF Public Sector Undertakings: Learning OutcomesDocument36 pagesAudit OF Public Sector Undertakings: Learning OutcomesMenuka SiwaNo ratings yet

- Consumer FinanceDocument17 pagesConsumer FinanceVaishali Trivedi OjhaNo ratings yet

- Presentation on Amalgamation and Merger of BanksDocument14 pagesPresentation on Amalgamation and Merger of BanksKrishnakant Mishra100% (1)

- Interconnected Stock Exchange (ISE)Document9 pagesInterconnected Stock Exchange (ISE)Anoop KoshyNo ratings yet

- QuestionnaireDocument2 pagesQuestionnairelokeshjain85No ratings yet

- Meaning of Financial ServicesDocument4 pagesMeaning of Financial Servicesmarvels fanNo ratings yet

- W IPRODocument26 pagesW IPROSamad Bilgi50% (2)

- Presentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDDocument12 pagesPresentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDEra ChaudharyNo ratings yet

- Entrepreneurs Definitions and FunctionsDocument10 pagesEntrepreneurs Definitions and FunctionsmuntaquirNo ratings yet

- Pre Issue ManagementDocument19 pagesPre Issue Managementbs_sharathNo ratings yet

- Final Accounts of Banking Company (Lecture 01Document8 pagesFinal Accounts of Banking Company (Lecture 01akash gautamNo ratings yet

- Start & Manage Small Biz in Oman, Essential Skills & Business Plan TemplateDocument2 pagesStart & Manage Small Biz in Oman, Essential Skills & Business Plan TemplatekunalbrabbitNo ratings yet

- Basic Concepts of Income TaxDocument4 pagesBasic Concepts of Income Taxkyunki143No ratings yet

- UNIT-4 Mergers, Diversification and Performance EvaluationDocument13 pagesUNIT-4 Mergers, Diversification and Performance EvaluationRavalika PathipatiNo ratings yet

- Factors Affecting Indian Retail MarketDocument3 pagesFactors Affecting Indian Retail MarketKeerthana LakshmiNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Mechant Banking Cha-2 by Saidul AlamDocument7 pagesMechant Banking Cha-2 by Saidul AlamSaidul AlamNo ratings yet

- Securities & Exchange Board of IndiaDocument27 pagesSecurities & Exchange Board of IndiaApoorva MahajanNo ratings yet

- Nirma University Institute of Law B.A.LL.B. (Hons.) Course VII SemesterDocument17 pagesNirma University Institute of Law B.A.LL.B. (Hons.) Course VII SemesterKrish KalraNo ratings yet

- Our Rights When ArrestedDocument11 pagesOur Rights When ArrestedHarie JamesNo ratings yet

- The Mutual Fund Is Better Investment PlanDocument27 pagesThe Mutual Fund Is Better Investment PlanKrish KalraNo ratings yet

- General IHL Overview - IAC - RevisedDocument57 pagesGeneral IHL Overview - IAC - RevisedKrish KalraNo ratings yet

- CR.P.C KrishDocument5 pagesCR.P.C KrishKrish KalraNo ratings yet

- NTPC v. Wig BrothersDocument41 pagesNTPC v. Wig BrothersKrish KalraNo ratings yet

- CC No 43211 2019 Jitender Gandhi Vs Gaurav Phawa Page No 1 12 On 3 September 2022Document9 pagesCC No 43211 2019 Jitender Gandhi Vs Gaurav Phawa Page No 1 12 On 3 September 2022aishwarya tiwariNo ratings yet

- DrugDocument42 pagesDrugdeniel.ahmadNo ratings yet

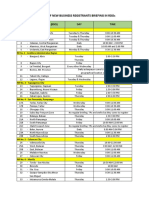

- Schedule of New Business Registrants Briefings by Revenue District OfficeDocument4 pagesSchedule of New Business Registrants Briefings by Revenue District OfficeNarkSunderNo ratings yet

- Castaneda v. AlemanyDocument3 pagesCastaneda v. AlemanyDaley CatugdaNo ratings yet

- Host Agreement Between Good Chemistry and WorcesterDocument8 pagesHost Agreement Between Good Chemistry and WorcesterAllison ManningNo ratings yet

- 1.sarmiento Vs ComelecDocument3 pages1.sarmiento Vs ComelecRhoddickMagrataNo ratings yet

- Kinds of ObligationDocument21 pagesKinds of Obligationjeraldtomas12No ratings yet

- Soliman V FernandezDocument5 pagesSoliman V FernandezarnyjulesmichNo ratings yet

- 2020 08 24 Mauritius Final Country ReportDocument373 pages2020 08 24 Mauritius Final Country ReportLiam charlesNo ratings yet

- Law of Crimes: Mens Rea Under IpcDocument18 pagesLaw of Crimes: Mens Rea Under IpcTanmay DubeyNo ratings yet

- Dallah Vs GOPDocument7 pagesDallah Vs GOPAwais AliNo ratings yet

- 960 SP Physics 2012Document135 pages960 SP Physics 2012Mohd SharulniZamNo ratings yet

- Civil Trial ProcedureDocument18 pagesCivil Trial ProcedureCeasar EstradaNo ratings yet

- License and Affiliation Agreement: B. LA Licensing AgreementDocument19 pagesLicense and Affiliation Agreement: B. LA Licensing AgreementWilliamsburg GreenpointNo ratings yet

- Doctrine of Ultra ViresDocument28 pagesDoctrine of Ultra ViresNaveen Das100% (6)

- Judge's Abuse of Disabled Pro Per Results in Landmark Appeal: Disability in Bias California Courts - Disabled Litigant Sacramento County Superior Court - Judicial Council of California Chair Tani Cantil-Sakauye – Americans with Disabilities Act – ADA – California Supreme Court - California Rules of Court Rule 1.100 Requests for Accommodations by Persons with Disabilities – California Civil Code §51 Unruh Civil Rights Act – California Code of Judicial Ethics – Commission on Judicial Performance Victoria B. Henley Director – Bias-Prejudice Against Disabled Court UsersDocument37 pagesJudge's Abuse of Disabled Pro Per Results in Landmark Appeal: Disability in Bias California Courts - Disabled Litigant Sacramento County Superior Court - Judicial Council of California Chair Tani Cantil-Sakauye – Americans with Disabilities Act – ADA – California Supreme Court - California Rules of Court Rule 1.100 Requests for Accommodations by Persons with Disabilities – California Civil Code §51 Unruh Civil Rights Act – California Code of Judicial Ethics – Commission on Judicial Performance Victoria B. Henley Director – Bias-Prejudice Against Disabled Court UsersCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNo ratings yet

- Institutions and StrategyDocument28 pagesInstitutions and StrategyFatin Fatin Atiqah100% (1)

- Robert & Linda Provost, Plaintiffs-Appellants-Cross-Appellees v. The City of Newburgh, Ulysses Otero and Patrick Sorrentino, John Roper, Defendant-Appellee-Cross-Appellant, 262 F.3d 146, 2d Cir. (2001)Document26 pagesRobert & Linda Provost, Plaintiffs-Appellants-Cross-Appellees v. The City of Newburgh, Ulysses Otero and Patrick Sorrentino, John Roper, Defendant-Appellee-Cross-Appellant, 262 F.3d 146, 2d Cir. (2001)Scribd Government DocsNo ratings yet

- Service Letter: BeechcraftDocument17 pagesService Letter: Beechcraftahmed.19.77.4.5No ratings yet

- (CLJ) Court TestimonyDocument51 pages(CLJ) Court TestimonyEino DuldulaoNo ratings yet

- Simplehuman v. Eko Development Et. Al.Document31 pagesSimplehuman v. Eko Development Et. Al.PriorSmartNo ratings yet

- Steal or I'Ll Call You A Thief Criminal' Tribes of India, Susan AbrahamDocument4 pagesSteal or I'Ll Call You A Thief Criminal' Tribes of India, Susan AbrahamSaurabh MisraNo ratings yet

- The Travelers Indemnity Company v. United States of America For The Use of Construction Specialties Company, 382 F.2d 103, 10th Cir. (1967)Document4 pagesThe Travelers Indemnity Company v. United States of America For The Use of Construction Specialties Company, 382 F.2d 103, 10th Cir. (1967)Scribd Government DocsNo ratings yet