Professional Documents

Culture Documents

Mutual Fund Systematic Risk For Bull and Bear Markets An Empirical Examination

Uploaded by

marianapaisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutual Fund Systematic Risk For Bull and Bear Markets An Empirical Examination

Uploaded by

marianapaisCopyright:

Available Formats

American Finance Association

Mutual Fund Systematic Risk for Bull and Bear Markets: An Empirical Examination Author(s): Frank J. Fabozzi and Jack C. Francis Reviewed work(s): Source: The Journal of Finance, Vol. 34, No. 5 (Dec., 1979), pp. 1243-1250 Published by: Blackwell Publishing for the American Finance Association Stable URL: http://www.jstor.org/stable/2327248 . Accessed: 14/03/2012 07:24

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at . http://www.jstor.org/page/info/about/policies/terms.jsp JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Blackwell Publishing and American Finance Association are collaborating with JSTOR to digitize, preserve and extend access to The Journal of Finance.

http://www.jstor.org

THE JOURNAL OF FINANCE * VOL. XXXIV, NO. 5 * DECEMBER 1979

Mutual Fund Systematic Risk for Bull and Bear Markets: An Empirical Examination

PH.D., C.F.A.and JACK C. FRANCIS, PH.D.* FRANK J. FABOZZI,

I. Introduction

THE QUESTIONOF THE STABILITYof the systematic risk, or beta coefficient, for

mutual funds over bull and bear market conditions has been debated in the literature [22, 23, 24, 25, 28, 29]. The issue is particularly relevant when evaluating the market-timing and security selection ability of the fund manager. If beta does differ with market conditions, the use of beta estimated from the entire period can result in different conclusions about the skills of the fund manager under different market conditions. For example, suppose that a fund manager correctly adjusts the fund's beta in anticipation of a bull market. Hence, the beta for the bull period would be greater than the beta estimated from using both bull and bear market periods. If the beta for the entire time period is employed to evaluate investment performance, good investment performance in the bull period may be due solely to market-timing ability rather than security selection ability. By using the beta for the entire time period, no allowance is made for the increased risk exposure. In order to properly test for the security selection ability, the bull period beta should be employed if it differs from the beta for the entire period.' The purpose of this paper is to test whether the betas for 85 open-end investment companies (called simply mutual funds hereafter) differ in bull and bear market periods.2 The next section explains the statistical model that will be used in this study. In the third section the data base and bull-bear market definitions are described. The results are presented in the fourth section. Section V contains conclusions.

* Associate Professor of Finance, Hofstra University and Professor of Economics and Finance, B. M. Baruch College, CUNY. We wish to thank the referee for his helpful comments. 'To illustrate this point, let b, denote the portfolio data for the i-th mutual fund over the entire period and b, denote the beta for the bull market data for the same mutual fund. Using the capital asset pricing model, the expected return in the bull market based on beta for the entire period is: E(r1eIb,) = rr + b,(rm. - rf.) where r1e,rr and rm* represent the fund's return, the risk-free rate and the market return in the bull market respectively. If the fund's beta is correctly adjusted upward in anticipation of a bull market, b,. > b, and a bull period does occur such that (rm. - rr) exceeds zero, then E(r,. Ib,) < E(r, I b,). Although the ability of the fund's manager to time the market is good in this illustration, the ability to outperform the market on a risk-adjusted basis via security selection is measured by the difference between the actual and expected return. Given the observed return, r,., it is possible for [r,. E (r. Ib, )] to be greater than zero while [r, -E (r, Ib, )] to be less than zero. In the first case, the fund has "beat the market" whereas in the second case, the market has "beat the fund." This error in evaluating fund performance is due to the use of the incorrect risk-adjusted expected return. No problem would exist if b, and b,. are equal, however (as, in fact, is the case reported herein). 2Several studies have examined the intertemporal stability of a fund's beta. Campanella [2], Pogue

1243

1244

The Journal of Finance H. Test Formulation

The single-index market model (SIMM) is presented in equation

r1t = a1 + birmt + u,t

(1).3

(1)

r, = continuously compounded single period rate of return for the ith mutual fund during the tth period, including the change in the net asset value per share, capital gains disbursements and cash dividends during the period; rmt= continuously compounded single period rate of return from the Standard and Poor's 500 market index in period t, including the change in the price level and cash dividend from the index [9]; a, = alpha regression intercept for the ith mutual fund; bi = beta regression coefficient for the ith mutual fund; and, U,t = residual error for the ith mutual fund in the tth period, E(u,t) = 0. To test whether a fund's alpha intercept and/or beta systematic risk measure differ statistically in bull and bear market conditions, equation (2) can be used. r1t= Ail + A2,Dt + Biirmt+ B2iDtrmt + e,, for E(e,t)

=

(2)

where Dt is a binary (or dummy) variable which is unity if the tth period is a bull market and zero otherwise.4 The coefficients of the binary variables, A21and B2,, mneasurethe differential effects of bull market conditions on the alpha, A1l, and beta, B1, respectively. Equation (2) permits a test of the hypothesis that a parameter of the SIMM is equal in bull and bear market conditions by testing to see if the corresponding differential coefficient is statistically different from zero.5

and Conway [16], Mains [15] and Jensen [11] investigated the stability of beta for mutual funds by correlating estimates in different periods. Klemkosky and Maness [13] tested for structural change in systematic risk levels over successive two and four year time periods using a dummy variable regression model. These studies arbitrarily partition the time periods. Kon and Jen [14] have employed a switching regression model to determine if at some point in time beta changes. They found that there was substantial risk level nonstationarity exhibited by the 49 mutual funds they examined. 3Treynor [27] refers to the relationship between the fund's return and the market's return as the characteristic line. Sharpe [20] called it the single-index market model. Services such as Fundscope and Wiesenberger simply report estimates of bull and bear market betas from two separate SIMM regressions. Since all estimates of beta are subject to estimation error, the fact that the two estimates are numerically different when observed over two different markets does not prove that the estimates are statistically different. Essentially, all preceding empirical research dealing with beta systematic risk statistics has been limited to the partial equilibrium approach of analyzing individual securities interactions with a security market index. Professor Roll has suggested [18] that a general equilibrium analysis of the risk-return capital market theory is more relevant. Roll would include commodities, art objects, investments in human capital and other assets in the general equilibrium model he suggests. The validity of Roll's general equilibrium suggestions are acknowledged. But, the validity and importance of the preceding partial equilibrium analysis is not diminished by Roll's suggestions and insights. 4 The intercept of equation (1) would be Jensen's measure of performance if the variables are measured in excess return form (that is, risk premiums over the risk-free rate, rf,). Thus in equation (2), A2,, the differential alpha, would represent the differential performance in bull markets if excess returns were used. The results using this excess return formulation are also reported in this study. 5 Equation (2) allows for both a shifting alpha and a shifting beta. Regressions were also run

Mutual Fund Systematic Risk

1245

Treynor and Mazuy [28] tested for changes in a fund's systematic risk by estimating equation (3). (3) + for E(e ,) + r, = a, + birmt Cir2mt eit If c- is statistically significant and positive, then the fund's manager is considered to have changed the fund's beta in the correct direction. For the 57 funds examined by Treynor and Mazuy [28], only one fund exhibited a positive and significant value for c1.6

Im. Data and Bull-Bear Definitions

Monthly rates of return were computed for 85 mutual funds for the 73 month period from December 1965 to December 1971.7 Since there is a question as to whether any particular type of fund (for example, balanced, growth, or income) or size of fund is more likely to change its beta, a representative sample of the different types of funds was employed.8 Table 1 provides a breakdown of the funds sampled in this study by the type of fund as provided by Wiesenberger [32] pp. 104-115.9 As can be seen, the 85 funds represent about 35% of the funds reported by Wiesenberger that fell into the five categories shown on Table 1. Excluding the smaller growth fund category,

allowing only one of the parameters to shift. The methodology was replicated using the following two models: + ea, r, = Al + Bilrmt+ B2irmtDt and + e,, r, = A,, + A2JD,+ Barmt (B) (A)

Equation (A) allows for only a shifting beta in bull markets while equation (B) permits only the alpha to shift. The results were not different from those reported. 'The time period covered in their study was the ten year period beginning in 1953 and ending in 1962. Annual rates of return were employed. 7The authors exercised no control over the selection of the 85 mutual funds. The sample was left over from an earlier mutual fund study published by one of the authors (which had no bearing whatsoever on this study). But, the 73 month sample period was selected to correspond as closely as possible with the 72 month sample period used in a similar study of individual NYSE common stocks [5]. This study and [5] used all of the same months, except for one additional month which was used in this study-December 1965. 8According to Treynor and Mazuy [28] "If the management of a balanced fund elects to change the Fund's volatility, it can shift the relative proportions of debt and equity or change the average volatility of the equity portion, or both. However, stock funds and growth funds, which are commonly considered to consist primarily of equity securities, are obviously not free to alter their volatilities by shifting the relative proportions of debt and equity (although they can alter the average volatility of the common stocks held). For this reason, it is sometimes argued that a balanced fund is more likely to make frequent changes in fund volatility.... In addition, it is sometimes argued that smaller funds will have less difficulty in changing their portfolio composition quickly when a change in volatility is desired." 9The value of a mutual fund's stated investment objective, as provided by Wiesenberger, as a market risk surrogate has been questioned by Reints and Vandenberg [17] and Friend, Blume and Crockett [7]. Campanella's [2], p. 68 results indicate that mutual fund risk levels tend to increase the riskier the fund's asserted category. Recently, Klemkosky [12] provided evidence which indicates consistency between the objective classifications and market risk.

1246

The Journal of Finance

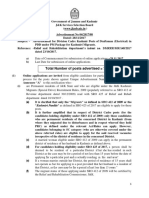

Table 1

Distribution of Sample Funds by Type of Fund

No. (%) of Funds in Sample No. in Population Reported by Wiesenbergerh % of Sample Funds to Population

Types of Fund'

Growth Funds 1. Large growth funds (1968 year end assets over $300 million)

2. Smaller growth funds

10 (11.8%)

21 (24.7%)

22

109

45.5%

19.3

Other Diversified Common Stock Funds (Growth-Income Funds) Balaniced Funds Income Funds Total

a b

30 (35.3%) 13 (15.3%) 11 (12.9%) 85 (100.0%)

55 27 29 242

54.5 48.1 37.9 35.1%

See pages 40-44 of [32] for definitions. Based on number of mutual funds reported on pages 104-115 of [32].

the other four categories are represented by at least 37%of each of their respective populations. Three definitions of bull and bear markets were used for the empirical tests reported below. The first definition is based on the bull and bear markets given in the investment textbook by Cohen, Zinbarg and Zeikel [4], pp. 464-465. Their categorization of each month is based on market trends. Forbes [31] employs an identical categorization in examining the investment performance of mutual funds. The second definition is similar (almost, but not quite, identical) to the categorization provided by Wiesenberger [33] for the years 1968-1971. Over this 1968-71 time period, Wiesenberger defines four bull and four bear market periods based on market trends. A comparison of the Forbes and Wiesenberger categorizations is illustrated in the investment textbook by Smith and Eiteman [26] pp. 486-487. For the time period prior to 1968, bull and bear market periods are categorized using the first definition [4 and 31]. The third definition is based on monthly market movements and ignores market trends. Using this definition, a positive monthly return for the market is defined as an up-market while a negative return is defined as a down-market."0 Even if the beta of individual securities are stable over bull and bear market conditions [5], there are still reasons to suspect that the fund's beta may change even if the fund manager does not plan to change the portfolio risk. First, the beta of individual securities may be intertemporally unstable [1, 6]. Second,

? Because of confusion about how to classify each peak and each trough month in the two market trend definitions, equation (2) was estimated several ways for each trend definition. The turning point months were classified differently. In one instance, these months were eliminated. The results were robust with respect to the treatment of these months. The results reported in this paper include 45 bull and 28 bear months for the first market trend definition and 42 bull and 31 bear months for the Wiesenberger classification of market trends. The up-down definition includes 43 bull and 30 bear months. Several tests were also performed to determine if the magnitude of the change provided a better partition for bull and bear markets. A similar test was used in [5]. Regardless of the test to discriminate up and down markets, the results were unchanged. In [5] the first and third definitions of bull and bear markets were employed to test the stability of the parameters of the SIMM for individual stocks.

Mutual Fund Systematic Risk

1247

changes in the relative market value weights of individual securities in the portfolio will change the portfolio beta, which is simply a weighted average beta, even if the individual security betas are unchanged. Therefore, in order to determine if the number of funds with shifting betas is due to a planned change in risk exposure, 85 random portfolios were created as a benchmark. Because of Blume's [1] findings that portfolio betas regress toward the mean over time, the portfolios were constructed so as to have the same distribution of betas (estimated from equation (1) above) as the 85 mutual funds.'1 The random portfolios consisted for 20 stocks selected from 700 New York Stock Exchange stocks. Initially, each stock was given equal weight in these 85 unmanaged portfolios. Since a control sample of unmanaged portfolios was sought to make comparisons with the managed portfolios, the random portfolios were not rebalanced each month. IV. Empirical Results A summary of the regression results for equation (2) for the 85 mutual funds and random portfolios is presented in Table 2. These summary statistics are discussed below. IV. A. The Beta Differential The number of random portfolios or mutual funds expected to exhibit a significant shift in a parameter based on normal sampling theory should not exceed eight if the parameter is invariant to market conditions.12 As can be seen in Table 2, the number of random portfolios for which the differential beta was significant did not exceed eight for any of the three definitions. The stability of the beta coefficient for the random portfolios over the two market conditions is not surprising in light of the findings for individual stocks [5]. Examining the mutual funds, in only one instance, the first definition of market conditions, did the number of mutual funds exceed the number expected from normal sampling theory. In this case the number of funds was only one greater than the number expected. The number of funds, however, was not statisticaUy different from the number of random portfolios exhibiting a shift in this parameter.'3

" The distribution for the beta coefficient from equation (1) for the 85 mutual funds was as follows: (.10 < bi < .25 = 1), (.25 < b, < .50 = 2), (.50 < b, < .75 = 12), (.75 < b, < .85 = 10), (.85 < b, < .95 = 15), (.95 < b, 1.05 = 19), (1.05 < b, < 1.15 = 11), (1.15 < b, < 1.25 = 8), (1.25 < b, < 1.50 = 5), (1.50 < b, < 1.75 = 1), (b1 > 1.75 = 1). The random portfolios were constructed so as to have the same distribution for beta. 12 See page 568 of [30] for the test employed. The null hypothesis is that the number of shifts is 5%. The alternative hypothesis is that the percentage observed exceeds 5%.A one-tail test at the 5%level of significance was employed. Because of the small sample size, the continuity correction was applied. 3 A hypothesis test was performed to determine if the percentage of mutual funds that exhibited a significant shift in a parameter differed significantly from the control sample of random (or unmanaged) portfolios. The t-test used for comparing two sample percentages is given on page 586 of [30]. The hypothesis that the percentage of mutual funds exhibiting a significant differential differs from the corresponding percentage for the random portfolios was rejected in all cases at the 5% level of significance.

1248

The Journal of Finance

Table 2

Statistical Summary of Equation 2 for 85 Mutual Funds and Random Portfolios

Mutual Funds Significant at 5%b Percentage 3.5% 96.5% 10.6% 9.4% 97.6% 5.9% 4.7% 95.3% 4.7% Random Portfolios Significant at 5%b Percentage 4.7% 98.8% 8.2% 5.9% 98.8% 7.1% 5.9% 97.6% 9.4%

Definition Used Cohen, Zinbarg and Zeikel [4] and Forbes [31] Wiesenberger [33]

Coefficient Testeda A2, # 0 B1, # 0 B2, # 0 A2, # 0 Bi, # 0 B2, # 0 A2, # 0 Bi, 0 0 B2, # 0

Number of Funds 3 82 9 8 83 5 4 81 4

Number of Funds 4 84 7 5 84 6 5 83 8

Up-down

A t-test is used to test for the significance of the coefficient. A two-tail test was used since the alternative hypothesis is that the coefficient tested is not equal to zero.

b

For all three definitions, one fund, the Philadelphia Fund, exhibited a significant differential beta. This fund is of interest for another reason. Of all the funds that did exhibit a significant beta differential, this was the only fund whose beta increased in bull markets. In other words, all other funds that were observed to have a significant beta differential exhibited a perverse shift during bull markets. The results for equation (2) were also compared with the Treynor-Mazuy formulation given by equation (3). Five of the mutual funds exhibited a significant value for ci at the 5%level of significance. Each of these five funds also exhibited a significant differential beta using one of the three definitions for market conditions.'4 Again, only one fund, the Philadelphia Fund, exhibited a beneficial curvature (namely, a positive c,). These results suggest that mutual fund managers have not outguessed the market. When statistically significant shifts were observed in the fund's beta, the change was generally perverse. IV. B. The Alpha Differential When alpha was examined using all three market definitions, the percentage found significant did not differ from the percentage expected from normal sampling theory. Not a single fund exhibited a significant differential alpha which was significant under all three definitions. When the SIMM is estimated in excess return form, alpha in equation (1) is defined as Jensen's [10] measure of performance.* When using excess return variables, the differential alpha in equation (2) measures the differential performance in bull markets. When equation (2) was estimated using the excess return form for all three definitions, the results were identical with respect to the beta

14 Four of the five funds were significant using the up-down definition. Three were common when either of the two market trend definitions were used. * See footnote 1.

Mutual Fund Systematic Risk

1249

differential.'5 That is, every fund that exhibited a significant differential beta using rmt also had a significant differential using excess returns. The differential alphas shifted less when the excess return form was used. Hence, using Jensen's measure of performance, the replicated results do not indicate that performance differed in the two markets.'6

V. Conclusions

Treynor and Mazuy [28] previously offered preliminary evidence that mutual fund managers did not reduce the fund's beta in bearish markets and increase it in bullish times in order to earn higher risk-adjusted returns for shareholders. This study used more discriminating methods and found additional evidence that mutual fund managers did not shift their fund's beta to take advantage of market movements. There are three reasons to explain why mutual fund managers have not been observed to increase the fund's beta when market conditions change from bearish to bullish. First, evidence that a significant number of New York Stock Exchange (NYSE) stocks have random beta coefficients exists [6]. As a result, an adept portfolio manager might buy an asset which had a historical beta of, say, 1.3 and be disappointed in its performance in a bull market because its beta dropped to, say, .7 because of random coefficient changes. Moreover, Blume [1] has shown that betas tend to regress toward the mean beta. A second reason a mutual fund manager may not shift the fund's beta during bullish periods is simply because the manager is unable to foresee changes in the condition of the market. Thus, the manager may not endeavor to trade on risk premiums as market conditions changed. Or, if the portfolio manager does attempt to change risk-classes but the change is done ineptly (to the shareholders' misfortune) this could also result in some of the insignificant differential portfolio betas changes reported above. Finally, even though a mutual fund manager may be able to correctly anticipate that the market is moving in a certain direction, the cost of changing the fund's target beta may not be justified given the expected value of the gain from revising the portfolio's beta [3]. The model employed in this paper was also measured in excess return form so that Jensen's [10] measure of performance could be compared for bull and bear markets. The results did not indicate a difference in performance as the market conditions changed.

REFERENCES 1. M. E. Blume. "On the Assessment of Risk." Journal of Finance (March 1971). 2. F. B. Campanella. The Measurement of Portfolio Risk Exposure. (Lexington, Mass.: Lexington Books, 1972). 3. A. H. Chen, F. C. Jen and S. Zionts. "The Optimal Portfolio Revision Policy." Journal of Business (January 1971). The monthly Treasury bill rate wav used as a proxy for the risk-free rate of return. Up-down markets were defined in two ways. The first used the same rule as before, that is, rm, > 0. The second defined an up-market as (rm, - rf,) > 0. 6 When equation (1) was estimated, eleven funds had a value for the Jensen performance measure, that was statistically significant. For these funds, a, was positive.

1250

The Journal of Finance

4. J. B. Cohen, E. D. Zinbarg, and A. Zeikel, Investment Analysis and Portfolio Management. R.D. Irwin Co., Revised Edition (1973). 5. F. J. Fabozzi and J. C. Francis, "Stability Tests for Alphas and Betas Over Bull and Bear Market Conditions." Journal of Finance (September 1977). 6. F. J. Fabozzi and J. C. Francis. "Beta as a Random Coefficient." Journal of Financial and Quantitative Analysis (March 1978). 7. I. Friend, M. Blume and J. Crockett. Mutual Funds and Other Institutional Investors (New York, N.Y.: McGraw-Hill, 1970). 8. D. Gujarati. "Use of Dummy Variables in Testing for Equality Between Sets of Coefficients in Two Linear Regressions." The American Statistician (February 1970). 9. R. G. Ibbotson and Rex Sinquefield. Stocks, Bonds, Bills and Inflation: The Past (1926-76) And The Future (1977-2000). Financial Analysts Research Foundation, 1977, market returns from page 85. 10. M. C. Jensen. "The Performance of Mutual Funds in Period 1954-64." Journal of Finance (May 1968). 11. M. C. Jensen. "Risk, the Pricing of Capital Assets, and the Evaluation of Investments Portfolios." Journal of Business (April 1969). 12. R. C. Klemkosky. "Additional Evidence on the Risk Level Discriminatory Powers of the Wiesenberger Classifications." Journal of Business (January 1976). 13. R. C. Klemkosky and T. S. Maness. "The Predictability of Real Portfolio Risk Levels." Journal of Finance (May 1978). 14. S. J. Kon and F. C. Jen. "Estimation of Time-Varying Systematic Risk and Performance For Mutual Fund Portfolios: An Application of Switching Regressions." Journal of Finance (May 1978). 15. N. E. Mains. "Are Mutual Fund Beta Coefficients Stationary?" (Unpublished Working Paper, Investment Company Institute, Washington, D.C. October 1972). 16. G. A. Pogue and W. Conway. "On the Stability of Mutual Fund Beta Values." (Unpublished Working Paper, MIT, Sloan School of Management June 1972). 17. W. W. Reints and P. A. Vandenberg. "A Comment on the Risk Level Discriminatory Powers of the Wiesenberger Classifications." Journal of Business (April 1973). 18. Richard Roll. "A Critique of the Asset Pricing Theory's Tests: Part I: On Past and Potential Testability of the Theory." Journal of Financial Economics, Volume 4, Number 2 (March 1977). 19. W. F. Sharpe. "Capital Asset Prices: A Theory of Equilibrium Under Conditions of Risk." Journal of Finance (September 1964). 20. W. F. Sharpe. "A Simplified Model for Portfolio Analysis: Management Science (January 1963). 21. W. F. Sharpe. "Mutual Fund Performance." Journal of Business (July 1965). 22. W. F. Sharpe. "Sideways Betas: Futher Comments." Journal of Portfolio Management (Summer 1976). 23. A. Silver. "Beta: Up, Down, and Sideways." Journal of Portfolio Management (Summer 1975). 24. A. Silver. "Sideways Betas: Response." Journal of Portfolio Management (Winter, 1978). 25. A. Silver. "Sideways Betas: Further Comments." Journal of Portfolio Management (Summer, 1976). 26. K. V. Smith and D. K. Eiteman, Essentials of Investing (R. D. Irwin, 1974). 27. J. L. Treynor. "How To Rate Management of Investment Funds." Harvard Business Review (January-February 1965). 28. J. L. Treynor and K. K. Mazuy. "Can Mutual Funds Outguess The Market?" Harvard Business Review (July-August 1966). 29. J. P. Williamson. "Sideways Betas: Criticism." Journal of Portfolio Management (Winter 1976). 30. T. Yamane. Statistics, second edition (Harper & Row Publishers, Inc., 1967). 31. "1972 Forbes Mutual Fund Ratings." Forbes (August 1973). 32. Investment Companies 1969, Arthur Wiesenberger Services, 29th Annual Edition. 33. Investment Companies 1973, Arthur Wiesenberger Services, 33rd Annual Edition.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Investment Slide 1Document17 pagesInvestment Slide 1ashoggg0% (1)

- Home Office, Branch and Agency Accounting: Problem 11-1: True or FalseDocument13 pagesHome Office, Branch and Agency Accounting: Problem 11-1: True or FalseVenz Lacre100% (1)

- Organizational Strategy - Apple Case StudyDocument31 pagesOrganizational Strategy - Apple Case StudyJamesNo ratings yet

- Toppamono Cap.2Document24 pagesToppamono Cap.2rhidalgo0% (1)

- HAJI ALI IMPORT EXPORT-Exim-Islampur-395Document8 pagesHAJI ALI IMPORT EXPORT-Exim-Islampur-395Eva AkashNo ratings yet

- Chapter 7 Risk and Return Question and Answer From TitmanDocument2 pagesChapter 7 Risk and Return Question and Answer From TitmanMd Jahid HossainNo ratings yet

- Value Based Questions in Economics Class XIIDocument8 pagesValue Based Questions in Economics Class XIIkkumar009No ratings yet

- The Impact of Firm Growth On Stock Returns of Nonfinancial Firms Listed On Egyptian Stock ExchangeDocument17 pagesThe Impact of Firm Growth On Stock Returns of Nonfinancial Firms Listed On Egyptian Stock Exchangealma kalyaNo ratings yet

- Worksheet 1.2 Simple and Compound Interest: NameDocument6 pagesWorksheet 1.2 Simple and Compound Interest: NameRenvil Igpas MompilNo ratings yet

- Monthly GK Digest June PDFDocument26 pagesMonthly GK Digest June PDFakshaykumarNo ratings yet

- National Bank of Pakistan Internship ReportDocument58 pagesNational Bank of Pakistan Internship Reportbbaahmad89No ratings yet

- CRP List For MM29 - 09Document50 pagesCRP List For MM29 - 09Kaustav PalNo ratings yet

- Ias 38 - TSVHDocument37 pagesIas 38 - TSVHHồ Đan ThụcNo ratings yet

- What Is A Sales BudgetDocument5 pagesWhat Is A Sales BudgetCyril Jean-BaptisteNo ratings yet

- All Sections of Companies Act 2013Document66 pagesAll Sections of Companies Act 2013RICHA SHARMANo ratings yet

- Bulkowsky PsicologiaDocument41 pagesBulkowsky Psicologiaamjr1001No ratings yet

- RSK CVDocument2 pagesRSK CVRanveer Singh KissoondoyalNo ratings yet

- Chapter 05 Consolidation of Less Than WHDocument93 pagesChapter 05 Consolidation of Less Than WH05 - Trần Mai AnhNo ratings yet

- Summative Test in Math (Part Ii) Quarter 1Document1 pageSummative Test in Math (Part Ii) Quarter 1JAY MIRANDANo ratings yet

- Draftsman (Electrical)Document7 pagesDraftsman (Electrical)suhail ahmadNo ratings yet

- K. Accenture, Inc. vs. CIR, GR No. 190102, 11 JULY 2012Document11 pagesK. Accenture, Inc. vs. CIR, GR No. 190102, 11 JULY 2012Christopher ArellanoNo ratings yet

- FIM Chapter 4Document16 pagesFIM Chapter 4Surafel BefekaduNo ratings yet

- ConsolidateDocument40 pagesConsolidatePopeye AlexNo ratings yet

- 2.2. PPE IAS16 - Practice - EnglishDocument12 pages2.2. PPE IAS16 - Practice - EnglishBích TrâmNo ratings yet

- Iesco Online Billl PDFDocument2 pagesIesco Online Billl PDFAsad AliNo ratings yet

- Curriculum Vitae Anis Abidi: Membership in Professional SocietiesDocument3 pagesCurriculum Vitae Anis Abidi: Membership in Professional SocietiesJalel SaidiNo ratings yet

- Howard Marks Market Health Outlook ChecklistDocument1 pageHoward Marks Market Health Outlook ChecklistGlenn BuschNo ratings yet

- ACC3022H+2021+Nov+2021 Scenario+and+RequiredDocument13 pagesACC3022H+2021+Nov+2021 Scenario+and+RequiredkateNo ratings yet

- Challenges Facing Entrepreneurs in Thika CountyDocument10 pagesChallenges Facing Entrepreneurs in Thika CountySenelwa AnayaNo ratings yet

- 9 2023 1 06 27 AmDocument1 page9 2023 1 06 27 Amowei prosperNo ratings yet