Professional Documents

Culture Documents

SAP: Bangladesh Perspective

Uploaded by

Afif Al FattahOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

SAP: Bangladesh Perspective

Uploaded by

Afif Al FattahCopyright:

Structural Adjustment Program:

Bangladesh Perspective

Afif Abdul Fattah Spring 2012

Structural Adjustment Program: Bangladesh Perspective

GEN 214 Development Studies Section -1

Submitted To Touhida Tasnima Assistant Professor Department of Social Sciences East West University

Submitted By Afif Abdul Fattah ID#2009-3-10-069

Submission Date March 11, 2012

In the early 1980s, World Bank (WB) and International Monetary Firm (IMF) recognized that short term stabilization policies prescribed to address economic crisis in developing countries were ineffective because these problems were originated from deep rooted structural weaknesses. Consequently, the Bank and the Fund devised several programs to resolve this crisis through granting concessional but highly conditional loans which were collectively known as Structural Adjustment Program (SAP). Bangladesh was one of the very first countries amongst the 35 to receive structural adjustment assistance. Following is a brief discussion on the impact of SAP in Bangladesh. Internal Policy Reform Privatization of State Firms: After the liberation in 1971, 92% of the manufacturing industries were nationalized. Under the SAP initiative, Government privatized 247 companies during 1975-1981 and 125 companies during 1981-1991 (Bhattacharya and Titumir, 2001). The total aggregated loss of six major state owned corporations was TK. 1044.23 million. The result of privatization was mixed; although some large corporations turned to be profitable, majority of small companies continued to incur losses and finally disappeared. One survey point it out that out of 13 privatized company 2 were profitable and 11 were unprofitable during 1991 (Akash and Sobhan, 1999). The privatization program also had a social cost in the form of disemployement. Removal of State Subsidies: Under SAP, subsidies were reduced or removed in three forms i) export subsidies, ii) public expenditure subsidies, iii) subsidies on agricultural input and iv) cash subsidy to monetized food distribution. However, Bangladesh hasnt reduced the subsidy cumulatively. During 1998, total subsidy was 0.2 % of GDP but in 2008 it has increased to 1.1% of GDP (Ministry of Finance). However, in some sectors the reduction of subsidy troubled the production. For instance, during 1999 Jute subsidy was 22% of total subsidy but in 2008 it was only 3%. Consequently, jutemade-goods production had decreased from 480,925 MT to 295,287 MT during the same period. Improvements in Tax System: In accordance with SAP, GOB has undertaken several tax reforms; such as, introducing VAT in 1991 (Zohir, 1997) and limiting tax holidays. During 1987 to 1999, tax revenue was increased from 7.16% to 11.34% of total GDP (Bhattacharya and Titumir, 2001). Removal of Wage Control: GOB had taken a very liberal approach in Wage Control to advocate competiveness in the labor market. If we compare wage rate indices in urban of FY82-FY86 (prereform) with FY86-FY90 and FY90-FY94, we can see the indices increased in manufacturing sector by 23, 13, 6 and in construction sector 6, 13, -7 during the periods respectively (Bhattacharya and Titumir, 2001). Although a negative growth rate in wage might give the impression of an increased employment but that was not the case for Bangladesh. As a result, urban poverty had further increased in these periods. Reduced Government Workforce: After the mid 80s, Bangladesh reduced government workforce through privatization programs of State Owned Enterprises (SOEs). For instance, during 1996-1997, about eighty nine thousand workers had been retrenched and most of these workers didnt get a job.

However, reduction in government workforce accompanied two benefits; i) it increased growth opportunity for private sectors and ii) it reduced public expenditure.

External Policy Reform Currency Devaluation: Under SAP, the Bank and the Fund advised to devalue Taka to enhance export competitiveness and to contain import growth. Consequently, GOB devalued Taka by 5.6 % between 1990 and 1996. However, Bangladeshs export is heavily dependent on import and due to devaluation of Taka, import became costlier. Thus, the effect was frustrating for export industry. Moreover, devaluation further leads to inflation. A study by Jamsheduzzaman (1998) showed that there was 0.564% rise in inflation for 1% devaluation over a period of two months. Removal or Reduction in Tariffs and Quotas: Trade liberalization through the reduction or elimination of tariffs and quotas is the major goal of SAP. From 1991-2002, the number of Quantitative Restrictions (QRs) was brought down from 239 to 124 items and the number of banned items was reduced from 135 to 5 (Bhattacharya and Titumir, 2001). In the meantime, the maximum tariff rate was also brought down from 350% to 37.5%. Consequently, these initiatives leaded to the rise in the Economic Openness Index form 19% to 35% in the period of 1991-1999. As majority of our manufacturing industry was dependent on the import of capital and intermediate goods, reduction in import tariff accelerated the demand for these goods. Notably, in FY94-FY95 and FY95-FY96, the growth rates for the import of capital goods were 48.9% and 39% respectively and for the import of intermediate goods were 28.8% and 19.3%. A study by Serajul Houqe (2005) reveled that, the reduction in the tariff reduced the Consumer Price Index (CPI) by 3.93%, which was equally reduced nominal wage rate. Accordingly, the demand for labor, hence the aggregate employment, increased by 1.52%. Encouraging Foreign Investment: In general, Bangladesh is one of the most liberal investment regimes in South Asia, placing no limits in foreign equity participation (OECD, 2005). Thus, Bangladesh didnt require to take much separate reforms to encourage foreign investment. Foreign investments were encouraged trough trade and exchange rate liberalization and privatization. From 1998 to 2007, total DFI inflow was $5,510 million and 46% of this investment went to infrastructure sector, 27% to manufacturing industry and 27% to service industry (Hossain, 2007). FDI inflow has affected the balance of payment positively.

In conclusion, we can see that structural adjustment policies have a very mixed effect on the socioeconomic condition of Bangladesh. In general, SAP has not been very successful in removing many of the structural weaknesses, in ensuring sustainable growth and in arresting further marginalization of the poor.

References Bhattacharya, D., & Titumir, R. A. M. (2001). Bangladeshs Experience with Structural Adjustment: Learning from a Participatory Exercise. Second National Forum of SAPRI Bangladesh. Retrieved from http://www.saprin.org/bangladesh/research/BDS.pdf Hoque, S. (2005). The Impact of Tariff Reduction on Bangladesh Economy: a Computable General

Equilibrium Assessment.

Retrieved from http://mpra.ub.uni-muenchen.de/16246/1/MPRA_paper_16246.pdf Hossain, A. M. (2007). Impact of Foreign Direct Investment on Bangladeshs Balance of Payments: Some Policy Implications. Rtrived from http://notunprojonmo.com/wp-content/uploads/2011/07/E18-pn0805.pdf Jamsheduzzaman, (1998). Current Inflation Situation in Bangladesh . Internal unpublished working paper of the Research Department, Bangladesh Bank. Ministry of Finance. Bangladesh Economy: Recent Macroeconomic Trend. (n.d). Retrieved from http://www.mof.gov.bd/en/budget/rw/fiscal_sector.pdf OECD, (2005). Trade and Structural Adjustment: Embracing Globalization. Sobhan, R., & Akash, M. M. (1999). Outcome of Privatisation: The Search for a Policy. CPD. Zohir, C. S. (1997). Macroeconomic Performance During Adjustment: The Case of Bangladesh, The Bangladesh Development Studies. 25. 99-128.

You might also like

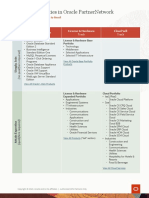

- VMware Solution Provider Program Guide ENDocument5 pagesVMware Solution Provider Program Guide ENAfif Al FattahNo ratings yet

- Resell Opportunities in Oracle Partnernetwork: Products Available For Partners To ResellDocument1 pageResell Opportunities in Oracle Partnernetwork: Products Available For Partners To ResellJoseph JosefNo ratings yet

- Microsoft SBC - English PDFDocument31 pagesMicrosoft SBC - English PDFAfif Al FattahNo ratings yet

- GIV 2017 AGM Invite EN PDFDocument16 pagesGIV 2017 AGM Invite EN PDFAfif Al FattahNo ratings yet

- GTDC - Priming Partnerships For Changing ChannelsDocument10 pagesGTDC - Priming Partnerships For Changing ChannelsAfif Al FattahNo ratings yet

- GTDC Report - Tech Distribution 2025 1Document14 pagesGTDC Report - Tech Distribution 2025 1Afif Al FattahNo ratings yet

- Rsa Securid Appliance: A Convenient and Cost-Effective Two-Factor Authentication SolutionDocument2 pagesRsa Securid Appliance: A Convenient and Cost-Effective Two-Factor Authentication SolutionAfif Al FattahNo ratings yet

- Kuehne + Nagel Singapore Graduate Program 2018Document11 pagesKuehne + Nagel Singapore Graduate Program 2018Afif Al FattahNo ratings yet

- PGCPS-AcctgProcManual JUN14EditionDocument280 pagesPGCPS-AcctgProcManual JUN14EditionRamesh ManiNo ratings yet

- EMC SVR-I1U-1208 Server Installation and Maintenance Guide: P/N 300-013-549 REV 02 June, 2013Document30 pagesEMC SVR-I1U-1208 Server Installation and Maintenance Guide: P/N 300-013-549 REV 02 June, 2013Afif Al FattahNo ratings yet

- Rsa Netwitness Logs & Packets: Detect Unknown Threats. Reduce Dwell Time. Accelerate ResponseDocument9 pagesRsa Netwitness Logs & Packets: Detect Unknown Threats. Reduce Dwell Time. Accelerate ResponseAfif Al FattahNo ratings yet

- NW CoverDocument1 pageNW CoverAfif Al FattahNo ratings yet

- Rsa Netwitness Platform Professional Services: Accelerate Time-To-Value & Maximize RoiDocument7 pagesRsa Netwitness Platform Professional Services: Accelerate Time-To-Value & Maximize RoiAfif Al FattahNo ratings yet

- Rsa Netwitness Endpoint: Detect Threats Faster. Reduce Dwell Time. Automate ResponseDocument2 pagesRsa Netwitness Endpoint: Detect Threats Faster. Reduce Dwell Time. Automate ResponseAfif Al FattahNo ratings yet

- Assingment 1Document15 pagesAssingment 1Afif Al FattahNo ratings yet

- Form For The Description of Birth Registration - Bangladesh PDFDocument1 pageForm For The Description of Birth Registration - Bangladesh PDFAfif Al FattahNo ratings yet

- 2012 Lessons Learned For Banks in BangladeshDocument2 pages2012 Lessons Learned For Banks in BangladeshAfif Al FattahNo ratings yet

- Commercial Bank of CeylonDocument1 pageCommercial Bank of CeylonAfif Al FattahNo ratings yet

- Changes ChallengesDocument12 pagesChanges ChallengesAfif Al FattahNo ratings yet

- Hedge Fund Stock Trading in The Financial Crisis of 2007Document2 pagesHedge Fund Stock Trading in The Financial Crisis of 2007Afif Al FattahNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- A Qualitative Analysis On The Ups and Downs in The Capital Market of Bangladesh (2010-2011)Document42 pagesA Qualitative Analysis On The Ups and Downs in The Capital Market of Bangladesh (2010-2011)Afif Al Fattah100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PAL V PALEADocument21 pagesPAL V PALEAKym AlgarmeNo ratings yet

- CCS (Leave) RulesDocument53 pagesCCS (Leave) Rulespoojasikka196380% (5)

- 4.ferres, Connell & Travaglione (2004) - Co-Worker Trust As A Social Catalyst For Constructive Employee AttitudesDocument20 pages4.ferres, Connell & Travaglione (2004) - Co-Worker Trust As A Social Catalyst For Constructive Employee AttitudesTeo MNo ratings yet

- Dessler hrm16 PPT 04Document59 pagesDessler hrm16 PPT 04عبدالرحمنNo ratings yet

- International Journal of Organisational Innovation Final Issue Vol 7 Num 3 January 2015Document161 pagesInternational Journal of Organisational Innovation Final Issue Vol 7 Num 3 January 2015Vinit DawaneNo ratings yet

- DeepStar Business and Operating PlanDocument22 pagesDeepStar Business and Operating PlanmikeseqNo ratings yet

- Spousal Work Permit Tutorial June 1Document2 pagesSpousal Work Permit Tutorial June 1sureshkanna2No ratings yet

- Case 1Document8 pagesCase 1Pratibha SeshamNo ratings yet

- Andhra Pradesh Minimum Wages Revised Draft W e F 01-04-2012 To 30-09-2012Document185 pagesAndhra Pradesh Minimum Wages Revised Draft W e F 01-04-2012 To 30-09-2012Maddipatla Rajendra Durgapathi NaiduNo ratings yet

- Eps-I-009 (Accident & Incident Reporting System)Document20 pagesEps-I-009 (Accident & Incident Reporting System)Tfk BajaNo ratings yet

- Ethics Chapter1 MergedDocument56 pagesEthics Chapter1 MergedCherrielyn Dela CruzNo ratings yet

- Maternity Benefit Act 1961Document13 pagesMaternity Benefit Act 1961Sumit KumarNo ratings yet

- Daryl Ann F. AbundaDocument6 pagesDaryl Ann F. AbundaKaguraNo ratings yet

- Neeyamo Placement Product Specalist 2024 PuneDocument14 pagesNeeyamo Placement Product Specalist 2024 Punevismayramesh129No ratings yet

- Chapter Five-Macroeconomic PolicyDocument24 pagesChapter Five-Macroeconomic Policynotes.mcpuNo ratings yet

- "Job Satisfaction": "Apollo Hospitals" VisakhapatnamDocument91 pages"Job Satisfaction": "Apollo Hospitals" Visakhapatnamdeva kiranNo ratings yet

- 2020 Salary Survey Highlight ReportDocument5 pages2020 Salary Survey Highlight ReportJoeNo ratings yet

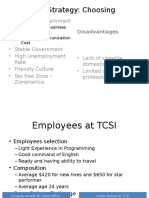

- Locational Strategy: Choosing Uruguay: - Access To GovernmentDocument3 pagesLocational Strategy: Choosing Uruguay: - Access To GovernmentVasu GandhiNo ratings yet

- Truman Loyalty Oath 1947Document4 pagesTruman Loyalty Oath 1947Anonymous nYwWYS3ntV100% (1)

- PEACE CORP AGENCY ANALYSIS - EditedDocument8 pagesPEACE CORP AGENCY ANALYSIS - EditedJames KimaniNo ratings yet

- SM5-Case 10-Vick's Pizza CorpDocument3 pagesSM5-Case 10-Vick's Pizza CorpMohamed ZakaryaNo ratings yet

- Caste System in IndiaDocument13 pagesCaste System in Indiazeeshanahmad1110% (1)

- Hult Prize 2019 ChallengeDocument24 pagesHult Prize 2019 ChallengeManar HosnyNo ratings yet

- Basic Occupational Safety and Health - MeDocument16 pagesBasic Occupational Safety and Health - MeTyler O'connor100% (1)

- The Key Challenges of Youth in EthiopiaDocument5 pagesThe Key Challenges of Youth in EthiopiaPremier Publishers100% (2)

- Envoy Filing H1B Onboarding GuideDocument11 pagesEnvoy Filing H1B Onboarding GuideRamesh Babu PindigantiNo ratings yet

- Research ProjectDocument55 pagesResearch ProjectRio De LeonNo ratings yet

- Public AdminstrationDocument19 pagesPublic AdminstrationUjjwal AnandNo ratings yet

- Daunting Problems of Micro, Small, and Medium Enterprises (MSMEs) in India: An Entrepreneurial PerceptionDocument27 pagesDaunting Problems of Micro, Small, and Medium Enterprises (MSMEs) in India: An Entrepreneurial PerceptionHimachalamDasarajuNo ratings yet

- A Study On DBBL LoanDocument31 pagesA Study On DBBL LoanRashed HossainNo ratings yet