Professional Documents

Culture Documents

Ratios

Uploaded by

akhilgupta02Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratios

Uploaded by

akhilgupta02Copyright:

Available Formats

What do Financial Ratios tell us

Liquidity Ratios 1. Current Ratio= Current Assets/Current Liabilities

Higher the current ratio, the higher the likelihood that a firm will be able to pay its bills. So, from the creditors point of view, higher is better. However, from a shareholders point of view this is not always the case. Current assets usually have a lower expected return than do fixed assets, so the shareholders would like to see that only the minimum amount of the companys capital is invested in current assets. Of course, too little investment in current assets could be disastrous for both creditors and owners of the firm 2. Quick Ratio (Acid Test Ratio)= (Current Assets-Inventory)/Current Liabilities Quick ratio will always be less than the current ratio. This is by design. However, a quick ratio that is too low relative to the current ratio may indicate that inventories are higher than they should be. Efficiency Ratios 3. Inventory Turnover Ratio= Cost of Goods Sold/ Inventory The inventory turnover ratio measures the number of dollars of sales that are generated per dollar of inventory. It also tells us the number of times that a firm replaces its inventories during a year. Generally, high inventory turnover is considered to be good because it means that storage costs are low, but if it is too high the firm may be risking inventory outages and the loss of customers.

4. Accounts Receivable Turnover Ratio=Credit Sales/Account Receivables higher is generally better, but too high might indicate that the firm is denying credit to creditworthy customers (thereby losing sales). If the ratio is too low, it would suggest that the firm is having difficulty collecting on its sales. This is particularly true if we find that accounts receivable are increasing faster than sales over a prolonged period 5. Average Collection Period=Accounts Receivable/(Annual Credit Sales/360)

lower is usually better, but too low may indicate lost sales. this ratio actually provides us with the same information as the accounts receivable turnover ratio

6. Fixed Asset Turnover Ratio=Sales/Net Fixed Assets 7. Total Asset Turnover Ratio=Sales/Total Assets the total asset turnover ratio describes how efficiently the firm is using its assets to generate sales. We can interpret the asset turnover ratios as follows: Higher is better. However, you should be aware that some industries will naturally have lower turnover ratios than others. For example, a consulting business will almost surely have a very low fixed asset turnover ratio describes the dollar amount of sales that are generated by each dollar invested in fixed assets

investment in fixed assets, and therefore a high fixed asset turnover ratio. On the other hand, an electric utility will have a large investment in fixed assets and a low fixed asset turnover ratio Leverage Ratios: These ratios describe the degree to which the firm uses debt in its capital structure. This is important information for creditors and investors in the firm. Creditors might be concerned that a firm has too much debt and will therefore have difficulty in repaying loans. Investors might be concerned because a large amount of debt can lead to a large amount of volatility in the firms earnings 8. Total Debt Ratio: Total Debt/ Total Assets=(Total Assets-Total Equity)/Total Assets 9. Long Term Debt Ratio=Total Long Term Debt/Total Assets 10. Long Term Debt to Total Capitalization=LTD/(LTD+Common Equity+Preferred Equity) Note that common equity is the total of common stock and retained earnings.

11. Debt to Equity Ratio: Total Debt/Total Equity 12.

13.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HR Policies Group Presentation (Kritika Maloo)Document12 pagesHR Policies Group Presentation (Kritika Maloo)kritika malooNo ratings yet

- Name: Rishita Madhyani Roll No: 24 Tybbi Annual Report of Bata India LTDDocument9 pagesName: Rishita Madhyani Roll No: 24 Tybbi Annual Report of Bata India LTDRishita MadhyaniNo ratings yet

- Gurpyar (MAIN PROJECT)Document54 pagesGurpyar (MAIN PROJECT)jellymaniNo ratings yet

- Dremer Corporation: On June 1, 20X5, The Books of Dremer Corporation Show Assets With BookDocument1 pageDremer Corporation: On June 1, 20X5, The Books of Dremer Corporation Show Assets With BookLouiza Kyla AridaNo ratings yet

- Mango Fashion Campaign LaunchDocument21 pagesMango Fashion Campaign LaunchTaimur MirNo ratings yet

- 5 Little Known Profitable BusinessesDocument34 pages5 Little Known Profitable BusinessesFidelisNo ratings yet

- ERP Implementation in the Fashion IndustryDocument6 pagesERP Implementation in the Fashion IndustryDhruv SabNo ratings yet

- VirenDocument20 pagesVirenYASH DESAINo ratings yet

- Rimini Street Ebook 12 Clients Using BDRDocument16 pagesRimini Street Ebook 12 Clients Using BDREverson SAPNo ratings yet

- The Role of Rfid in The Supply-ChainDocument11 pagesThe Role of Rfid in The Supply-ChainWalid GradaNo ratings yet

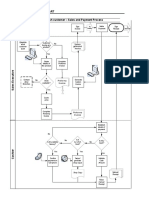

- As-Is-Flow Process Chart: No System Generated InvoiceDocument10 pagesAs-Is-Flow Process Chart: No System Generated Invoicepeter mulilaNo ratings yet

- Ipsas 23: Revenue From Non Exchange TransactionsDocument11 pagesIpsas 23: Revenue From Non Exchange TransactionsHace AdisNo ratings yet

- HBL MID Partnership and CorporationDocument2 pagesHBL MID Partnership and CorporationginalynNo ratings yet

- Week 3 & 4 - Demand AnalysisDocument16 pagesWeek 3 & 4 - Demand AnalysisBhavika ChughNo ratings yet

- 20190212092028-DLT Application Process and Fee Structure PublicDocument8 pages20190212092028-DLT Application Process and Fee Structure PublicAbdullah MutaharNo ratings yet

- Upc Q-19002814 - Ups ApcDocument1 pageUpc Q-19002814 - Ups ApcSherlie HalcomNo ratings yet

- Name: Shamal Vivek Singh ID: s11172656: Af314 AssignmentDocument8 pagesName: Shamal Vivek Singh ID: s11172656: Af314 AssignmentShamal SinghNo ratings yet

- Introduction Understanding Competition and EnvironmentDocument11 pagesIntroduction Understanding Competition and EnvironmentbullworthinNo ratings yet

- Purchasing ManagementChapter 2Document91 pagesPurchasing ManagementChapter 2Sarmad HassanNo ratings yet

- Membership Application Form KCCIDocument4 pagesMembership Application Form KCCIGhulam Raza AsifNo ratings yet

- Government AccountingDocument3 pagesGovernment AccountingMariella CatacutanNo ratings yet

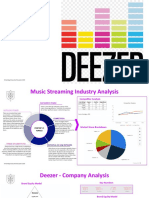

- Strategy - Creation of A CompanyDocument13 pagesStrategy - Creation of A CompanyJoana ToméNo ratings yet

- SCM301 MDocument55 pagesSCM301 MVu Dieu LinhNo ratings yet

- Marketing Plan: © Ashridge Executive Education 2020Document7 pagesMarketing Plan: © Ashridge Executive Education 2020Antonio CesaroNo ratings yet

- Career Planning at StarbucksDocument12 pagesCareer Planning at StarbucksbushraNo ratings yet

- NS Homes Brochure - 13 PagesDocument13 pagesNS Homes Brochure - 13 PagesRaj SinghNo ratings yet

- Chap-9 Financial ManagementDocument19 pagesChap-9 Financial ManagementManik KainthNo ratings yet

- Strategic Management June 2022 ExaminationDocument10 pagesStrategic Management June 2022 ExaminationShruti MakwanaNo ratings yet

- Invigilators Assignment For Sem-II Final ExamDocument271 pagesInvigilators Assignment For Sem-II Final ExamtatekNo ratings yet

- Hotel Ownership Models and Affiliation TypesDocument3 pagesHotel Ownership Models and Affiliation TypesAlie GurreaNo ratings yet