Professional Documents

Culture Documents

REVENUE MEMORANDUM CIRCULAR NO. 40-2004 Issued On July 1, 2004

Uploaded by

Kyrzen NovillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

REVENUE MEMORANDUM CIRCULAR NO. 40-2004 Issued On July 1, 2004

Uploaded by

Kyrzen NovillaCopyright:

Available Formats

REVENUE MEMORANDUM CIRCULAR NO.

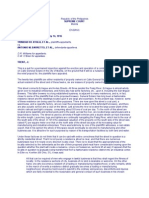

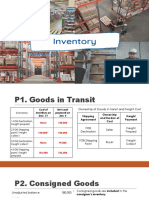

40-2004 issued on July 1, 2004 circularizes the full text of Department of Finance Order No.17-04, which contains guidelines to implement the registration of Barangay Micro Business Enterprises and the availment of tax incentives under R.A. No. 9178, otherwise known as the Barangay Micro Business Enterprises (BMBEs) Act of 2002. All BMBEs registered with the Office of the Treasurer of each city or municipality shall be exempted from Income Tax for income arising from the operation of the enterprise. Interest, commissions and discounts derived from the loans by the Land Bank of the Philippines (LBP), Development Bank of the Philippines (DBP), Peoples Credit and Finance Corporation (PCFC) and Small Business Guarantee and Finance Corporation (SBGFC) granted to BMBEs as well as loans extended by the Government Service Insurance System (GSIS) and Social Security System (SSS) to their respective memberemployees under the Act shall also be exempt from Gross Receipts tax (GRT). One can register as a BMBE if it is a business entity or enterprise, whether operated as a sole proprietorship or a corporation, partnership, cooperative or association, organized/incorporated and existing under Philippine laws whose business activities are barangay-based and micro-business in nature and scope. The total assets of BMBEs, real or personal, inclusive of those arising from loans but exclusive of the land on which the particular business entitys office, plant and equipment are situated, shall not be more than Three Million Pesos (P 3,000,000.00). Among other qualifications, a business enterprise shall be considered barangaybased if the majority of its employees are residents of the municipality where its principal place of business is located. It shall be considered micro-business in nature and scope if its principal activity is primarily for livelihood, or determined by the Small and Medium Enterprises Development (SMED) Council or Department of Trade and Industry (DTI) as a priority area for development or government assistance; the enterprise is not a branch, subsidiary, division or office of a large scale enterprise; and its policies and business modus operandi are not determined by a large scale enterprise or by persons who are not owners or employees of the enterprise. After determining the eligibility of the business entity or enterprise, the Office of the City or Municipal Treasurer shall register the business entity or enterprise as a BMBE and issue a Certificate of Authority (CA) using BMBE Form 02. The CA shall be effective for a period of two (2) years, subject, however, to the provisions in Sec. 8 of the Order, and renewable for a period of two (2) years for every renewal. The Treasurer shall indicate in the CA the date when the registration of the BMBE commences. A duly registered BMBE shall be exempt from Income Tax on income arising purely from its operations as such BMBE: Provided, That this Income Tax exemption shall not apply to the following: (a) Interest, including those from any currency bank deposit and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements; (b) Royalties; (c) Prizes and other winnings; (d) Cash and/or property dividends;

(e) Capital gains from the sale of shares of stock not traded through the stock exchange; (f) Capital gains from the sale or other disposition of real property; (g) The share of an individual in the net income after tax of an association, a joint account, or a joint venture or consortium; (h) The share of an individual in the distributable net income after tax of a taxable partnership of which he is a partner; (i) Income from the practice of profession received directly from the clients or from the professional partnership of which the individual is a partner; (j) Compensation; and (k) All other forms of passive income and income from revenues not effectively connected with or arising from operations of the BMBEs as such. For the purpose of exemption from Income Tax, the total assets of the BMBE, which shall not exceed Three Million Pesos (P 3,000,000.00), shall include all kinds of properties, both personal properties and real properties (but excluding land on which the particular business entitys office, plant and equipment are situated) that are owned and used/to be used, or even if not owned but used/to be used, by the BMBE and/or its affiliates for the conduct of its/their business/es. To avail the tax incentives, the BMBE shall register as such BMBE with the BIR Revenue District Office where the principal office or place of business of the BMBE is located. Its application for registration shall be supported by the following documents: (a) Copy of the BMBEs Certificate of Authority duly authenticated by the Office of the City or Municipal Treasurer; (b) Sworn Statement of the values of assets owned and/or used/to be used by the BMBE and/or its affiliates reflecting the current values thereof. The Sworn Statement shall be supported by pertinent information and documents such as acquisition cost, date of acquisition and depreciated value for existing assets, etc. (c) Certified list of branches, sales outlets, places of production, warehouse and storage places, or such other facility owned and/or operated by the BMBE indicating their respective addresses, whether located in the same municipality or city where the principal place of business is located, or elsewhere. (d) Certified list of affiliates, indicating addresses, line of business and responsible officers thereof; and (e) Latest Audited Financial Statement, or Account Information Form or its equivalent containing data lifted from audited financial statements.

You might also like

- Dof Order No. 17-04Document10 pagesDof Order No. 17-04matinikkiNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- BMBE SeminarDocument60 pagesBMBE SeminarBabyGiant LucasNo ratings yet

- DOF - Department Order No. 17 - 04Document12 pagesDOF - Department Order No. 17 - 04jjvii8No ratings yet

- Republic Act 9178 or The Barangay Micro Business Enterprises Act of 2002Document13 pagesRepublic Act 9178 or The Barangay Micro Business Enterprises Act of 2002tineponna051121No ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- An Easy Guide To Taxation For Startup EntrepreneursDocument16 pagesAn Easy Guide To Taxation For Startup EntrepreneursChristine P. ToledoNo ratings yet

- Taxation Barangay Micro Business Enterprises (Bmbes) : Lecture NotesDocument1 pageTaxation Barangay Micro Business Enterprises (Bmbes) : Lecture NotesBryan Christian MaragragNo ratings yet

- Barangay Micro Business Enterprise Act summaryDocument6 pagesBarangay Micro Business Enterprise Act summaryJerlmilline Serrano JoseNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Non-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Document2 pagesNon-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Fairy Ann PeñanoNo ratings yet

- Benefits of Registering as a Barangay Micro Business Enterprise (BMBEDocument16 pagesBenefits of Registering as a Barangay Micro Business Enterprise (BMBEGerson CastroNo ratings yet

- Tax exemptions and incentives for minimum wage earners, BMBEs, cooperatives, non-profit entitiesDocument2 pagesTax exemptions and incentives for minimum wage earners, BMBEs, cooperatives, non-profit entitiesdailydoseoflawNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- BMBEs (RA 9178)Document5 pagesBMBEs (RA 9178)tagabantayNo ratings yet

- AMENDED REVENUE REGULATION ON PRIMARY REGISTRATION, UPDATES AND CANCELLATION (39 CHARACTERSDocument127 pagesAMENDED REVENUE REGULATION ON PRIMARY REGISTRATION, UPDATES AND CANCELLATION (39 CHARACTERSDa Yani ChristeeneNo ratings yet

- Case DigestsDocument67 pagesCase DigestsCattleyaNo ratings yet

- Ra 9178Document5 pagesRa 9178Amy Olaes DulnuanNo ratings yet

- The SolopreneurDocument6 pagesThe Solopreneurjun junNo ratings yet

- March BIR RulingsDocument13 pagesMarch BIR Rulingscarlee014No ratings yet

- Boost Barangay BusinessesDocument13 pagesBoost Barangay BusinessesRenalyn MadeloNo ratings yet

- RMC No. 18-2023v2Document7 pagesRMC No. 18-2023v2Sean AndersonNo ratings yet

- Ra 9178 BmbeDocument5 pagesRa 9178 BmbeBrian James RubioNo ratings yet

- Module 3 Tax Preferences Available For Sole Proprietorship BusinessDocument7 pagesModule 3 Tax Preferences Available For Sole Proprietorship Businessangclaire47No ratings yet

- Taxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's ObjectiveDocument3 pagesTaxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's Objectivekris mNo ratings yet

- How To Register As A Barangay Micro Business Enterprise BMBE in The Philippines Business Tips PhilippinesDocument15 pagesHow To Register As A Barangay Micro Business Enterprise BMBE in The Philippines Business Tips PhilippinesJoana Rose DimacaliNo ratings yet

- Bmbe CompleteDocument61 pagesBmbe Completedarla1008No ratings yet

- Register as a BMBE and Get Tax ExemptionDocument4 pagesRegister as a BMBE and Get Tax ExemptionRyanNo ratings yet

- Guidelines for Tax Exemption of Non-Profit Corps Under Section 30Document9 pagesGuidelines for Tax Exemption of Non-Profit Corps Under Section 30Togz MapeNo ratings yet

- BMBEs (RA 9178), IRRDocument5 pagesBMBEs (RA 9178), IRRtagabantayNo ratings yet

- BIR facilitates income tax filing for BMBE taxpayersDocument1 pageBIR facilitates income tax filing for BMBE taxpayersJoseph EleazarNo ratings yet

- Basic Overview of Corporate Income Taxation in the PhilippinesDocument7 pagesBasic Overview of Corporate Income Taxation in the PhilippinesMae Katherine Grande Lumbria100% (1)

- RR No. 07-12Document53 pagesRR No. 07-12Nash Ortiz LuisNo ratings yet

- Preferential TaxationDocument9 pagesPreferential TaxationMNo ratings yet

- Bir RR 7-2012Document24 pagesBir RR 7-2012alexandra_lorenceNo ratings yet

- Tax Ruling on VAT Invoice RequirementsDocument8 pagesTax Ruling on VAT Invoice RequirementsturtlesareawesomexxNo ratings yet

- Bir TaxDocument97 pagesBir TaxVincent De VeraNo ratings yet

- Week 16 and 17 Tax Incentives and BMBEDocument28 pagesWeek 16 and 17 Tax Incentives and BMBEwatanabe200412No ratings yet

- Cooperatives Taxability & Tax ExemptionDocument146 pagesCooperatives Taxability & Tax Exemptionschin9867% (3)

- Tax ReviewerDocument17 pagesTax ReviewerSab CardNo ratings yet

- How To Register As A Barangay Micro Business Enterprise (BMBE) in The Philippines?Document7 pagesHow To Register As A Barangay Micro Business Enterprise (BMBE) in The Philippines?iamacrusaderNo ratings yet

- RA - 6810.pdf Filename - UTF-8''RA 6810 PDFDocument27 pagesRA - 6810.pdf Filename - UTF-8''RA 6810 PDFRio AborkaNo ratings yet

- Ra 9178Document11 pagesRa 9178Rahul HumpalNo ratings yet

- Barangay Micro Business Enterprise (Bmbe)Document56 pagesBarangay Micro Business Enterprise (Bmbe)Anne Secretbox100% (4)

- Bmbe ReportDocument5 pagesBmbe Reportshe lacks wordsNo ratings yet

- Other Exempt Income Under The Nirc and Special LawsDocument2 pagesOther Exempt Income Under The Nirc and Special LawsAllia AntalanNo ratings yet

- Dti Ao No 01 S of 2003Document4 pagesDti Ao No 01 S of 2003RaymondNo ratings yet

- Module 3 - Preferential Taxation P1Document5 pagesModule 3 - Preferential Taxation P1Bella RonahNo ratings yet

- Taxation: Far Eastern University - ManilaDocument4 pagesTaxation: Far Eastern University - ManilacamilleNo ratings yet

- Income Taxation Chapter 1 5f420b5e2c985Document154 pagesIncome Taxation Chapter 1 5f420b5e2c985Kim DiezNo ratings yet

- BMBE Law, IRR and Forms - Document TranscriptDocument8 pagesBMBE Law, IRR and Forms - Document TranscriptLansingNo ratings yet

- Chapter 16 - BMBEDocument4 pagesChapter 16 - BMBEayotaenggNo ratings yet

- Radio Laws Element 2Document1 pageRadio Laws Element 2Kyrzen NovillaNo ratings yet

- Review 1Document2 pagesReview 1Kyrzen NovillaNo ratings yet

- Element IIIDocument1 pageElement IIIKyrzen NovillaNo ratings yet

- Answer: Common Collector Answer: Bell Answer: 30 GHZ To 300 GHZ Answer: Siemens Answer: Stranded Answer: Lagging Power Factor Answer: 2 MetersDocument2 pagesAnswer: Common Collector Answer: Bell Answer: 30 GHZ To 300 GHZ Answer: Siemens Answer: Stranded Answer: Lagging Power Factor Answer: 2 MetersKyrzen NovillaNo ratings yet

- Radio Laws Element 2Document1 pageRadio Laws Element 2Kyrzen NovillaNo ratings yet

- Lladoc v. CIRDocument6 pagesLladoc v. CIRKyrzen NovillaNo ratings yet

- Dison Vs PosadasDocument3 pagesDison Vs PosadasJonna Maye Loras CanindoNo ratings yet

- Radio LawsDocument6 pagesRadio Lawsjoebanpaza1100% (4)

- Lladoc v. CIRDocument6 pagesLladoc v. CIRKyrzen NovillaNo ratings yet

- To Kill A Mocking BirdDocument2 pagesTo Kill A Mocking BirdKyrzen NovillaNo ratings yet

- Lladoc v. CIRDocument6 pagesLladoc v. CIRKyrzen NovillaNo ratings yet

- Supreme Court rules on proposed brewery near Manila residencesDocument36 pagesSupreme Court rules on proposed brewery near Manila residencesKyrzen NovillaNo ratings yet

- Year End AdjustmentDocument25 pagesYear End AdjustmentKyrzen NovillaNo ratings yet

- Year-End Adjustment NewDocument27 pagesYear-End Adjustment NewKyrzen Novilla0% (1)

- Year-End Adjustment NewDocument27 pagesYear-End Adjustment NewKyrzen Novilla0% (1)

- Rule 45Document3 pagesRule 45Eljohn GirangNo ratings yet

- Rule 45Document3 pagesRule 45Eljohn GirangNo ratings yet

- Vat UpdatesDocument12 pagesVat UpdatesKyrzen NovillaNo ratings yet

- ProfessionalDocument26 pagesProfessionalEljohn GirangNo ratings yet

- Module ObjectivesDocument9 pagesModule ObjectivesKyrzen NovillaNo ratings yet

- Module ObjectivesDocument9 pagesModule ObjectivesKyrzen NovillaNo ratings yet

- Module ObjectivesDocument9 pagesModule ObjectivesKyrzen NovillaNo ratings yet

- Accounting defined as economic info systemDocument11 pagesAccounting defined as economic info systemKyrzen NovillaNo ratings yet

- T-Accounts E. Tria Systems ConsultantDocument8 pagesT-Accounts E. Tria Systems ConsultantAnya DaniellaNo ratings yet

- 2011HB 06651 R00 HBDocument350 pages2011HB 06651 R00 HBPatricia DillonNo ratings yet

- Central Excise ScopeDocument2 pagesCentral Excise Scopeapi-3822396100% (3)

- A Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeDocument143 pagesA Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeRathod JayeshNo ratings yet

- Taxmann - Budget Highlights 2022-2023Document42 pagesTaxmann - Budget Highlights 2022-2023Jinang JainNo ratings yet

- Gram Yojana (Gram Priya) 10 Years Rural Postal Life Insurance Age at Entry Yrs Annual Rs Halfyearly Rs Quarterly Rs Monthly Age at Entry YrsDocument2 pagesGram Yojana (Gram Priya) 10 Years Rural Postal Life Insurance Age at Entry Yrs Annual Rs Halfyearly Rs Quarterly Rs Monthly Age at Entry YrsPriya Ranjan KumarNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- Marriott's History from Root Beer Stand to Global Hotel GiantDocument25 pagesMarriott's History from Root Beer Stand to Global Hotel GiantNaveen KumarNo ratings yet

- National Open University of Nigeria: Prepared byDocument17 pagesNational Open University of Nigeria: Prepared byMAVERICK MONROENo ratings yet

- BMWDocument52 pagesBMWDuje Čipčić100% (3)

- Typing Book by Vivaan SharmaDocument52 pagesTyping Book by Vivaan SharmaSanjay Rai100% (1)

- Ratio Analysis Pankaj 180000502015Document64 pagesRatio Analysis Pankaj 180000502015PankajNo ratings yet

- Financial Analysis - Marketing - Circa Lynnwood 100% (2023 - 10 - 31 10 - 38 - 56 UTC)Document13 pagesFinancial Analysis - Marketing - Circa Lynnwood 100% (2023 - 10 - 31 10 - 38 - 56 UTC)SiyabongaNo ratings yet

- Bfi AssignmentDocument5 pagesBfi Assignmentrobliao31No ratings yet

- Federal ReserveDocument21 pagesFederal ReserveMsKhan0078No ratings yet

- KPMG - Target Operating ModelDocument2 pagesKPMG - Target Operating ModelSudip Dasgupta100% (1)

- SS 2 SlidesDocument31 pagesSS 2 SlidesDart BaneNo ratings yet

- Neal 1990 - The Rise of Financial Capitalism.Document289 pagesNeal 1990 - The Rise of Financial Capitalism.george100% (1)

- Company Report - Venus Remedies LTDDocument36 pagesCompany Report - Venus Remedies LTDseema1707No ratings yet

- Investing in Sustainable DevelopmentDocument156 pagesInvesting in Sustainable DevelopmentIanDavidBocioacaNo ratings yet

- Government Support Options: Laura Kiwelu Norton Rose FulbrightDocument15 pagesGovernment Support Options: Laura Kiwelu Norton Rose FulbrightE BNo ratings yet

- Is LM and General EquilibrimDocument28 pagesIs LM and General EquilibrimBibek Sh Khadgi100% (2)

- EBITDA On Steroids - Private Equity InternationalDocument8 pagesEBITDA On Steroids - Private Equity InternationalAlexandreLegaNo ratings yet

- Engineering EconomyDocument23 pagesEngineering EconomyFaten Nabilla Nordin100% (1)

- Accounting and FinanceDocument5 pagesAccounting and FinanceHtoo Wai Lin AungNo ratings yet

- Central Surety and Lnsurance Company, Inc. vs. UbayDocument5 pagesCentral Surety and Lnsurance Company, Inc. vs. UbayMarianne RegaladoNo ratings yet

- LIC Jeevan Anand Plan PPT Nitin 359Document11 pagesLIC Jeevan Anand Plan PPT Nitin 359Nitin ShindeNo ratings yet

- Chapter 8 Risk and Return: Principles of Managerial Finance, 14e (Gitman/Zutter)Document24 pagesChapter 8 Risk and Return: Principles of Managerial Finance, 14e (Gitman/Zutter)chinyNo ratings yet

- International Finance "Report On The Case Study of Prul"Document7 pagesInternational Finance "Report On The Case Study of Prul"Saima Kausar100% (1)

- Joint Venture in Insurance Company in IndiaDocument37 pagesJoint Venture in Insurance Company in IndiaSEMNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- The Hidden Wealth Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth Nations: The Scourge of Tax HavensRating: 4.5 out of 5 stars4.5/5 (40)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)