Professional Documents

Culture Documents

Additional Cases - AMLA

Uploaded by

paewoonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Additional Cases - AMLA

Uploaded by

paewoonCopyright:

Available Formats

Kuala Lumpur, 10 January 2011 Perpetrator of ponzi scheme jailed The Securities Commission Malaysia (SC) today secured

a deterrent sentence against Raja Noor Asma Raja Harun, the director of FX Capital Consultant and FX Consultant, for operating a ponzi scheme that duped over 4000 investors of more than RM100 million. The sentence of five-years jail term and a fine of RM5 million (in default, six months imprisonment) meted out by the Kuala Lumpur Sessions Court marks one of the heaviest punishment against a capital market offender, reflecting the gravity of the offence. On 21 December 2010, after the prosecution had called 18 witnesses, Raja Noor Asma pleaded guilty to four counts of fraud for employing a scheme to defraud investors and trading in futures contracts on behalf of others without a licence. The SCs investigations revealed that more than RM100 million had been raised from some 4,000 investors throughout Malaysia between February 2007 and May 2008 under the pretext that the money would be used to trade in Crude Palm Oil Futures. For taking part in money laundering activities, Raja Noor Asma was also convicted of 50 counts under the Anti Money Laundering and Terrorism Financing Act 2001 (AMLATFA) and sentenced to two years imprisonment for each of the AMLATFA charges, which are to run concurrently. The court ordered the two-year jail term to run consecutive to the five-year imprisonment imposed for the fraud charges. The court also instructed approximately RM8.3 million frozen under AMLATFA to be forfeited. The SC, which carried out the trial jointly with the Attorney General's Chambers, had urged the court to impose a deterrent sentence as the scheme involved a large amount of investors' funds. The custodial sentence meted out by the court serves as a stern warning to future offenders that violation of the public trust will not be treated lightly by the courts.

The public is also reminded to be extremely cautious of any investment scheme which promises unusually high returns. Investors are also reminded to only invest with individuals or companies licensed by the SC. The SC remains committed to protecting investors and upholding public confidence in the capital market, and will continue to take all measures to fight illegal investment activities that threaten investors and the Malaysian capital market. SECURITIES COMMISSION MALAYSIA

Kuala Lumpur, 26 February 2007 SC Warns Investors Of Cambridge Capital Trading Internet Scam Froze RM1.6 Million And Closed Websites The Securities Commission (SC) has frozen two Malaysian bank accounts amounting to RM1.6 million, closed two websites and questioned several individuals believed to be connected to a global Internet investment scam run by Cambridge Capital Trading. The SC investigated the scam for possible breaches of the Anti Money Laundering Act 2001 (AMLA). This was triggered by a request for assistance from the Dubai Financial Services Authority (DFSA), which was carrying out its own investigations. Investigations by the SC led to a restraining order on the signatories of two Malaysian bank accounts, linked to the Internet scam, from any dealings with the respective bank accounts. The SC also secured the assistance of the National ICT Security and Emergency Response Centre (NISER) to close two websites linked to Cambridge Capital Trading that were hosted via an Internet Service Provider (ISP) in Malaysia. The SC warned investors against the fraudulent investment scheme operated by Cambridge Capital Trading, which has thus far targeted Australian and Singaporean investors. The scam operators have been cold calling the public to invest in a host of products that are purportedly traded on the fictitious Dubai Options Exchange. Investors are reminded to be on guard against cold calls from Cambridge Capital Trading. They should be wary of the claims on Cambridge Capital Trading and Dubai Options Exchange's websites, www.cambridgecapitaltrading.com and www.dubaiex.com, which are still accessible as they are now hosted by a foreign ISP. In addition, investors are also cautioned on a third fake website link to Cambridge Capital Trading, the United Arab Emirates Commodity Futures Board or www.uaecfb.com. Members of the public are advised to alert the SC immediately if they receive such cold calls by contacting the Complaints Department at: Tel: +603-6204 8999 Fax: +603-6204 8991 E-mail: aduan@seccom.com.my The public should be vigilant against possible Internet investment scams and only invest through parties licensed by the SC. They should also check with the SC or other relevant authorities on the licensing status of any local or foreign company before investing through such companies.

SECURITIES COMMISSION April 2010 - PP v Haron Jambari and Nik Abdul Aziz Nik Mohd Amin. Haron, a remisier attached to Arab-Malaysian Securities Sdn Bhd, was charged for making a false statement of a material fact to his client, Majlis Agama Islam Wilayah Persekutuan, in relation to the purchase of Petronas Dagangan Bhd (PDB) shares, under section 87A(c) of the SIA. Haron was also charged for criminal breach of trust involving RM2 million of Baitulmal funds, under section 409 of the Penal Code. Nik, an accountant at Majlis Agama Islam Persekutuan, was charged for abetting Haron in making a false statement to his employer on the purchase of PDB shares, under section 87A of the SIA read together with section 40 of the same Act. Nik was also charged for criminal breach of trust of the same funds and for corrupt practices. The Sessions Court convicted both accused persons on the charges. Both the accused were sentenced to three years' imprisonment and RM1 million fine (in default, two years imprisonment), for the off ence under section 87A and four years' imprisonment and two strokes of whipping for the off ence of criminal breach of trust. Nik was also sentenced to a two-year imprisonment for the off ence of corrupt practices. Both accused appealed and the High Court dismissed their appeal and upheld the convictions. They then appealed to the Court of Appeal. The hearing of the appeal at the Court of Appeal was fixed on 20 and 21 July 2010.

uala Lumpur, 10 January 2011

Perpetrator of ponzi scheme jailed The Securities Commission Malaysia (SC) today secured a deterrent sentence against Raja Noor Asma Raja Harun, the director of FX Capital Consultant and FX Consultant, for operating a ponzi scheme that duped over 4000 investors of more than RM100 million. The sentence of five-years jail term and a fine of RM5 million (in default, six months imprisonment) meted out by the Kuala Lumpur Sessions Court marks one of the heaviest punishment against a capital market offender, reflecting the gravity of the offence. On 21 December 2010, after the prosecution had called 18 witnesses, Raja Noor Asma pleaded guilty to four counts of fraud for employing a scheme to defraud investors and trading in futures contracts on behalf of others without a licence. The SCs investigations revealed that more than RM100 million had been raised from some 4,000 investors throughout Malaysia between February 2007 and May 2008 under the pretext that the money would be used to trade in Crude Palm Oil Futures. For taking part in money laundering activities, Raja Noor Asma was also convicted of 50 counts under the Anti Money Laundering and Terrorism Financing Act 2001 (AMLATFA) and sentenced to two years imprisonment for each of the AMLATFA charges, which are to run concurrently. The court ordered the two-year jail term to run consecutive to the five-year imprisonment imposed for the fraud charges. The court also instructed approximately RM8.3 million frozen under AMLATFA to be forfeited. The SC, which carried out the trial jointly with the Attorney General's Chambers, had urged the court to impose a deterrent sentence as the scheme involved a large amount of investors' funds. The custodial sentence meted out by the court serves as a stern warning to future offenders that violation of the public trust will not be treated lightly by the courts.

The public is also reminded to be extremely cautious of any investment scheme which promises unusually high returns. Investors are also reminded to only invest with individuals or companies licensed by the SC. The SC remains committed to protecting investors and upholding public confidence in the capital market, and will continue to take all measures to fight illegal investment activities that threaten investors and the Malaysian capital market. SECURITIES COMMISSION MALAYSIA

You might also like

- Week 6 CasesDocument25 pagesWeek 6 CasesSyrille ClementineNo ratings yet

- Bank Secrecy PDFDocument6 pagesBank Secrecy PDFDwight BlezaNo ratings yet

- Amla To Ra 10586Document34 pagesAmla To Ra 10586Parubrub-Yere TinaNo ratings yet

- 2019 Bar Notes On Anti-Money Laundering PDFDocument10 pages2019 Bar Notes On Anti-Money Laundering PDFAnonymous kiom0L1Fqs100% (1)

- 3 Salient Features of AMLADocument9 pages3 Salient Features of AMLAParubrub-Yere TinaNo ratings yet

- Anti Money Laundering LawDocument49 pagesAnti Money Laundering LawAsru RojamNo ratings yet

- The Red Flags of Money Laundering and Malaysian Cases On Money LaunderingDocument10 pagesThe Red Flags of Money Laundering and Malaysian Cases On Money LaunderingAmeer Shafiq100% (1)

- Project Report BobDocument30 pagesProject Report Bobmegha rathore100% (1)

- AMLA SummaryDocument5 pagesAMLA SummaryPentelPeinNo ratings yet

- Anti Money LaunderingDocument8 pagesAnti Money LaunderingStephen Mallari100% (1)

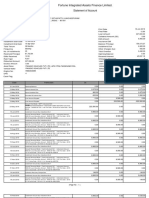

- Statement of Account for Mohansri ADocument2 pagesStatement of Account for Mohansri ASanthosh SehwagNo ratings yet

- Anti-Money Laundering Act of 2001, As Amended (Republic Act 9160, 9194, 10167, 10365, 10927)Document17 pagesAnti-Money Laundering Act of 2001, As Amended (Republic Act 9160, 9194, 10167, 10365, 10927)Anny YanongNo ratings yet

- 1 Qualitative MethodsDocument52 pages1 Qualitative MethodspaewoonNo ratings yet

- Briefer On The Anti-Money Laundering Act of 2001Document8 pagesBriefer On The Anti-Money Laundering Act of 2001Kit AlbertNo ratings yet

- Kyc Aml PolicyDocument8 pagesKyc Aml PolicyKang Dye100% (1)

- Banking LawsDocument67 pagesBanking LawsPatricia Ann CaubaNo ratings yet

- Efficio Survey Reveals Procurement ChallengesDocument13 pagesEfficio Survey Reveals Procurement ChallengesAditya JohariNo ratings yet

- O Republic vs. SandiganbayanDocument3 pagesO Republic vs. SandiganbayanmlicudineNo ratings yet

- AMLA Briefer on Money Laundering and AMLC PowersDocument7 pagesAMLA Briefer on Money Laundering and AMLC PowersIzzy Martin MaxinoNo ratings yet

- Banking Laws Bank Secrecy Law PurposeDocument9 pagesBanking Laws Bank Secrecy Law PurposeTrevor Del MundoNo ratings yet

- Anti Money Laundering SlidesDocument33 pagesAnti Money Laundering SlidesvalmadridhazelNo ratings yet

- My Report Internal AssessmentDocument18 pagesMy Report Internal AssessmentGlenn John BalongagNo ratings yet

- SEC warns public against unregistered Ploutos Coin ICODocument3 pagesSEC warns public against unregistered Ploutos Coin ICOAlexander Julio ValeraNo ratings yet

- PBNT VCDocument2 pagesPBNT VCSafi Ud Din KhanNo ratings yet

- Enforcement and Investor Protection Department: Sec AdvisoryDocument2 pagesEnforcement and Investor Protection Department: Sec AdvisoryMelvin John BanzueloNo ratings yet

- KAPA Officials Summoned To DOJ To Face Raps: Republic Act No. 8799, The Securities Regulation Code (SRC)Document3 pagesKAPA Officials Summoned To DOJ To Face Raps: Republic Act No. 8799, The Securities Regulation Code (SRC)Frances Luz BorjaNo ratings yet

- 2020PressRelease - SEC Warns Against Forsage Other Schemes PDFDocument3 pages2020PressRelease - SEC Warns Against Forsage Other Schemes PDFJohn Louie NunezNo ratings yet

- Forex Scheme Woes: Investors Fall For Plans That Promise Up To 250% Returns, Raising Questions About Their SustainabilityDocument13 pagesForex Scheme Woes: Investors Fall For Plans That Promise Up To 250% Returns, Raising Questions About Their SustainabilitymuthukjNo ratings yet

- ACCOUNTANCY FOR LAWYERS ASSIGNMENT No.1Document8 pagesACCOUNTANCY FOR LAWYERS ASSIGNMENT No.1mj2017017675No ratings yet

- Baviera v. Standard Chartered BankDocument14 pagesBaviera v. Standard Chartered BankRobby DelgadoNo ratings yet

- 2022advisory - Unregistered Cryptocurrency ExchangesDocument2 pages2022advisory - Unregistered Cryptocurrency ExchangesRyan SombilonNo ratings yet

- AMLA NotesDocument5 pagesAMLA NotesRyDNo ratings yet

- Enforcement and Investor Protection Department: Sec AdvisoryDocument3 pagesEnforcement and Investor Protection Department: Sec AdvisoryBryar wayNo ratings yet

- Tutorial 05 - Topic 7Document12 pagesTutorial 05 - Topic 7tan JiayeeNo ratings yet

- 117096-2007-Standard Chartered Bank v. Senate Committee20180323-1159-1yvkboiDocument11 pages117096-2007-Standard Chartered Bank v. Senate Committee20180323-1159-1yvkboiJia ChuaNo ratings yet

- SEC Advisory OnecashDocument2 pagesSEC Advisory OnecashBobby Olavides SebastianNo ratings yet

- CFTC Charges "My Forex Funds" With Fraudulently Taking Over $300 Million From Customers Hoping To Become Professional Traders - CFTCDocument2 pagesCFTC Charges "My Forex Funds" With Fraudulently Taking Over $300 Million From Customers Hoping To Become Professional Traders - CFTCBernardo CoutoNo ratings yet

- AMLA Lesson on Covered Institutions and TransactionsDocument2 pagesAMLA Lesson on Covered Institutions and TransactionsJornel MandiaNo ratings yet

- Week 1 ReviewDocument4 pagesWeek 1 ReviewRed Pirate MCNo ratings yet

- 2019PressRelease Hold Departure Order Issued Against KAPA Scam Operators 07042019Document2 pages2019PressRelease Hold Departure Order Issued Against KAPA Scam Operators 07042019Nikki GarciaNo ratings yet

- Investments and Banking Law CasesDocument43 pagesInvestments and Banking Law CasesmisskangNo ratings yet

- SEC AdvisoryDocument1 pageSEC AdvisoryJJ De Peralta Bueno IIINo ratings yet

- Maneja Hannah Midel M. BSA 3 7Document4 pagesManeja Hannah Midel M. BSA 3 7Gene SapitNo ratings yet

- Senate inquiry into SCB sale of unregistered securitiesDocument12 pagesSenate inquiry into SCB sale of unregistered securitiesNikko Franco TemplonuevoNo ratings yet

- PiledDocument37 pagesPiledcolenearcainaNo ratings yet

- Banking Laws Course SyllabusDocument23 pagesBanking Laws Course SyllabusErika TanguilanNo ratings yet

- Bank Secrecy, Unclaimed Funds, PDIC and AMLADocument14 pagesBank Secrecy, Unclaimed Funds, PDIC and AMLAThe Brain Dump PHNo ratings yet

- SEC Advisory PhilcrowdDocument2 pagesSEC Advisory PhilcrowdBobby Olavides SebastianNo ratings yet

- Course - Money Laundering Through The Gambling IndustryDocument4 pagesCourse - Money Laundering Through The Gambling Industryaida aNo ratings yet

- PMEX CommodityDocument6 pagesPMEX CommodityUzair UmairNo ratings yet

- What Are Considered Unlawful Activities Under The AMLA, As Amended?Document7 pagesWhat Are Considered Unlawful Activities Under The AMLA, As Amended?RRT6068No ratings yet

- Audit in CIS EnvironmentDocument5 pagesAudit in CIS EnvironmentKathlaine Mae ObaNo ratings yet

- Prevention of Money Laundering Act Boon or Bane by Dev P BhardwajDocument11 pagesPrevention of Money Laundering Act Boon or Bane by Dev P BhardwajLatest Laws TeamNo ratings yet

- Bank Nizwa Summary Prospectus (English)Document13 pagesBank Nizwa Summary Prospectus (English)Mwangu KibikeNo ratings yet

- Petition Against Starcomms PP and Chapel Hill Denham - 180512 - Morgan CapitalDocument10 pagesPetition Against Starcomms PP and Chapel Hill Denham - 180512 - Morgan CapitalProshareNo ratings yet

- Frauds in Banking Sector & IPO Scam 2003-05Document12 pagesFrauds in Banking Sector & IPO Scam 2003-05narendra1501No ratings yet

- 7 +amlaDocument43 pages7 +amla4ztynvtvqxNo ratings yet

- Combating People Smuggling Bill ExplainedDocument118 pagesCombating People Smuggling Bill ExplainedAtif Hameed MaharNo ratings yet

- Kasus Pasar Modal Di MalaysiaDocument12 pagesKasus Pasar Modal Di MalaysiaArsip KerjaNo ratings yet

- AMLA Obligations and ReportingDocument13 pagesAMLA Obligations and ReportingEunice KanapiNo ratings yet

- Blockchain and Cryptocurrency: Recent Legal and Regulatory Developments - Corporate LawDocument3 pagesBlockchain and Cryptocurrency: Recent Legal and Regulatory Developments - Corporate LawChristos FloridisNo ratings yet

- C.mrkets CatDocument5 pagesC.mrkets CatKelvin NgigeNo ratings yet

- G.R. No. 138949 - Union Bank of The Philippines v. SecuritiesDocument11 pagesG.R. No. 138949 - Union Bank of The Philippines v. SecuritiesKaren Gina DupraNo ratings yet

- Commercial Law Aspects of Residential Mortgage Securitisation in AustraliaFrom EverandCommercial Law Aspects of Residential Mortgage Securitisation in AustraliaNo ratings yet

- Relevance Lost - The Rise and Fall of Activity Based CostingDocument13 pagesRelevance Lost - The Rise and Fall of Activity Based CostingMike FoekensNo ratings yet

- AFC713 Midterm Exam - SolutionsDocument3 pagesAFC713 Midterm Exam - SolutionspaewoonNo ratings yet

- Factor Analysis SPSSDocument3 pagesFactor Analysis SPSSpaewoonNo ratings yet

- Dnfbps in AmlcftDocument17 pagesDnfbps in AmlcftpaewoonNo ratings yet

- Conceptual FrameworkDocument17 pagesConceptual Frameworkpaewoon100% (1)

- Understanding Data Mining Techniques and Their Importance in Future PlanningDocument19 pagesUnderstanding Data Mining Techniques and Their Importance in Future PlanningpaewoonNo ratings yet

- Dnfbps in AmlcftDocument17 pagesDnfbps in AmlcftpaewoonNo ratings yet

- AUD721 Seminar on Auditor Liability CaseDocument11 pagesAUD721 Seminar on Auditor Liability CasepaewoonNo ratings yet

- New FATF Recommendations 2012Document9 pagesNew FATF Recommendations 2012paewoonNo ratings yet

- Presentation Envronmental Audit Geng AjanDocument14 pagesPresentation Envronmental Audit Geng AjanpaewoonNo ratings yet

- AUD721 Seminar on Auditor Liability CaseDocument11 pagesAUD721 Seminar on Auditor Liability CasepaewoonNo ratings yet

- AUD721 Seminar on Auditor Liability CaseDocument11 pagesAUD721 Seminar on Auditor Liability CasepaewoonNo ratings yet

- Fraud Case Study 1Document14 pagesFraud Case Study 1paewoonNo ratings yet

- Slides Royal Bank Geng Ajan PunyeDocument12 pagesSlides Royal Bank Geng Ajan PunyepaewoonNo ratings yet

- About XeroxDocument5 pagesAbout XeroxpaewoonNo ratings yet

- Master of Business Administration: Narsee Monjee Institute of Management StudiesDocument5 pagesMaster of Business Administration: Narsee Monjee Institute of Management StudiesDivyanshu ShekharNo ratings yet

- Bosch Performance by Ratio AnalysisDocument34 pagesBosch Performance by Ratio AnalysisSantosh KumarNo ratings yet

- Assets Liobililies Owner's Equity: Balance SheetsDocument2 pagesAssets Liobililies Owner's Equity: Balance SheetsVARGAS PALOMINO KIARA PAMELANo ratings yet

- Monthly Registration Stats 2015 - DecemberDocument3 pagesMonthly Registration Stats 2015 - DecemberBernewsAdminNo ratings yet

- Understanding Working Capital Needs and Financing OptionsDocument66 pagesUnderstanding Working Capital Needs and Financing OptionsAamit KumarNo ratings yet

- Land Records - A Basic Survey - OutlineDocument2 pagesLand Records - A Basic Survey - Outlineapi-295009102No ratings yet

- Annual Report of The Secretary of WarDocument1,017 pagesAnnual Report of The Secretary of Warzandro antiolaNo ratings yet

- Tugas Kelompok 6 Bahasa Inggris Niaga Economic Started With GDocument10 pagesTugas Kelompok 6 Bahasa Inggris Niaga Economic Started With GrizkyNo ratings yet

- Control Account Revision NotesDocument30 pagesControl Account Revision NotesOckouri BarnesNo ratings yet

- Final Accounts Problems and Solutions - Final Accounts QuestionsDocument20 pagesFinal Accounts Problems and Solutions - Final Accounts QuestionshafizarameenfatimahNo ratings yet

- Homework 6Document6 pagesHomework 6LiamNo ratings yet

- Maintenance and replacement of internal fixtures at residential areaDocument40 pagesMaintenance and replacement of internal fixtures at residential areamvs srikarNo ratings yet

- Accounting Conceptual FrameworkDocument4 pagesAccounting Conceptual FrameworkUmmu ZubairNo ratings yet

- SLLC - 2021 - Acc - Lecture Note - 02Document60 pagesSLLC - 2021 - Acc - Lecture Note - 02Chamela MahiepalaNo ratings yet

- Build Operate Transfer Scheme EtcDocument4 pagesBuild Operate Transfer Scheme EtcRehan YakobNo ratings yet

- P5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cDocument28 pagesP5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cAkshat ShahNo ratings yet

- N - Chandrasekhar Naidu (Pronote)Document3 pagesN - Chandrasekhar Naidu (Pronote)raju634No ratings yet

- Initiation of InternationalisationDocument13 pagesInitiation of InternationalisationRazvan LabuscaNo ratings yet

- Level of Financial Literacy (HUMSS 4, Macrohon Group)Document37 pagesLevel of Financial Literacy (HUMSS 4, Macrohon Group)Charyl MorenoNo ratings yet

- Leuthold Group - From August 2015Document10 pagesLeuthold Group - From August 2015ZerohedgeNo ratings yet

- Asia Pacific MarketView Q1 2018 FINALDocument18 pagesAsia Pacific MarketView Q1 2018 FINALPrima Advisory SolutionsNo ratings yet

- Abakada v. ErmitaDocument351 pagesAbakada v. ErmitaJm CruzNo ratings yet

- Ismatullah Butt: Curriculum VitaeDocument4 pagesIsmatullah Butt: Curriculum VitaebuttismatNo ratings yet

- Chapter 3 Credit ManagementDocument37 pagesChapter 3 Credit ManagementTwinkle FernandesNo ratings yet

- Model By-Laws For The Regulated Non-Withdrawable Deposit Taking Non-Wdt Sacco Societies in KenyaDocument59 pagesModel By-Laws For The Regulated Non-Withdrawable Deposit Taking Non-Wdt Sacco Societies in KenyaAmos NjeruNo ratings yet

- Bank Management Financial Services Rose 9th Edition Solutions ManualDocument23 pagesBank Management Financial Services Rose 9th Edition Solutions Manualkevahuynh4vn8d100% (27)