Professional Documents

Culture Documents

December 2003 ACCA Paper 2.5 Questions

Uploaded by

Ulanda2Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

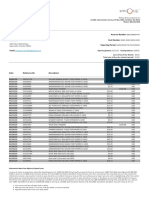

December 2003 ACCA Paper 2.5 Questions

Uploaded by

Ulanda2Copyright:

Available Formats

Financial Reporting

(International Stream)

PART 2 THURSDAY 4 DECEMBER 2003

QUESTION PAPER Time allowed 3 hours This paper is divided into two sections Section A This ONE question is compulsory and MUST be answered THREE questions ONLY to be answered

Section B

Paper 2.5(INT)

Section A This ONE question is compulsory and MUST be attempted 1 Highmoor, a public listed company, acquired 80% of Slowmoors ordinary shares on 1 October 2002. Highmoor paid an immediate $2 per share in cash and agreed to pay a further $120 per share if Slowmoor made a profit within two years of its acquisition. Highmoor has not recorded the contingent consideration. The balance sheets of the two companies at 30 September 2003 are shown below: Highmoor $ million $ million 585 225 nil 810 Slowmoor $ million $ million 172 113 140 225

Tangible non-current assets Investments (note (ii)) Software (note (iii))

Current assets Inventory Accounts receivable Tax asset Bank Total assets

185 195 1nil 120

1,200 1,010

42 36 80 nil

158 383

Equity and liabilities Capital and reserves: Ordinary shares of $1 each Accumulated profits 1 October 2002 Accumulated profits profit/loss for year

1400 230 100 1330 730 150 (35)

100 115 215

Non-current liabilities 12% loan note 8% Inter company loan (note (ii)) Current liabilities Accounts payable Taxation Overdraft Total equity and liabilities

1nil 1nil 210 170 1nil

nil

135 145 171 1nil 117

180

1,280 1,010

188 383

The following information is relevant: (i) At the date of acquisition the fair values of Slowmoors net assets were approximately equal to their book values. (ii) Included in Highmoors investments is a loan of $50 million made to Slowmoor. On 28 September 2003, Slowmoor paid $9 million to Highmoor. This represented interest of $4 million for the year and the balance was a capital repayment. Highmoor had not received nor accounted for the payment, but it had accrued for the loan interest receivable as part of its accounts receivable figure. There are no other intra group balances. (iii) The software was developed by Highmoor during 2002 at a total cost of $30 million. It was sold to Slowmoor for $50 million immediately after its acquisition. The software had an estimated life of five years and is being amortised by Slowmoor on a straight-line basis.

(iv) Due to the losses of Slowmoor since its acquisition, the directors of Highmoor are not confident it will return to profitability in the short term. (v) For the purposes of realising any negative goodwill, in its acquisition plan, Highmoor had estimated at the date of acquisition that Slowmoor would make losses of $15 million (of which $12 million would be attributable to Highmoor) before returning to profitability. The remaining weighted average useful life at the date of acquisition of the acquired depreciable non-monetary assets can be taken as four years (straight-line basis). The group accounting policy for any positive goodwill is to write it off on a straight-line basis over a period of four years. (vi) Highmoor uses the allowed alternative treatment in IAS 22 Business Combinations to account for the fair value of identifiable assets and liabilities on acquisition. Required: (a) Prepare the consolidated balance sheet of Highmoor as at 30 September 2003, explaining your treatment of the contingent consideration. (20 marks) (b) Describe the circumstances in which negative goodwill may arise. Your answer should refer to the particular issues of the above acquisition. (5 marks) (25 marks)

[P.T.O.

Section B THREE questions ONLY to be attempted 2 The following extracted balances relate to Tourmalet at 30 September 2003: $000 Ordinary shares of 20 cents each Accumulated profits at 1 October 2002 Revaluation reserve at 1 October 2002 6% Redeemable preference shares 2005 Trade accounts payable Tax Land and buildings at valuation (note (iii)) 150,000 Plant and equipment cost (note (v)) 98,600 Investment property valuation at 1 October 2002 (note (iv)) 10,000 Depreciation 1 October 2002 land and buildings Depreciation 1 October 2002 plant and equipment Trade accounts receivable 31,200 Inventory 1 October 2002 26,550 Bank 3,700 Sales revenue (note (i)) Investment income (from properties) Purchases 158,450 Distribution expenses 26,400 Administration expenses 23,200 Interim preference dividend 900 Ordinary dividend paid 2,500 531,500 $000 50,000 47,800 18,500 30,000 35,300 2,100

9,000 24,600

313,000 1,200

531,500

The following notes are relevant: (i) Sales revenue includes $50 million for an item of plant sold on 1 June 2003. The plant had a book value of $40 million at the date of its sale, which was charged to cost of sales. On the same date, Tourmalet entered into an agreement to lease back the plant for the next five years (being the estimated remaining life of the plant) at a cost of $14 million per annum payable annually in arrears. An arrangement of this type is deemed to have a financing cost of 12% per annum. No depreciation has been charged on the item of plant in the current year. (ii) The inventory at 30 September 2003 was valued at cost of $285 million. This includes $45 million of slow moving goods. Tourmalet is trying to sell these to another retailer but has not been successful in obtaining a reasonable offer. The best price it has been offered is $2 million. (iii) On 1 October 1999 Tourmalet had its land and buildings revalued by a firm of surveyors at $150 million, with $30 million of this attributed to the land. At that date the remaining life of the building was estimated to be 40 years. These figures were incorporated into the companys books. There has been no significant change in property values since the revaluation. $500,000 of the revaluation reserve will be realised in the current year as a result of the depreciation of the buildings. (iv) Details of the investment property are: Value 1 October 2002 Value 30 September 2003 $10 million $98 million

The company adopts the fair value method in IAS 40 Investment Property of valuing its investment property. (v) Plant and equipment (other than that referred to in note (i) above) is depreciated at 20% per annum on the reducing balance basis. All depreciation is to be charged to cost of sales.

(vi) The above balances contain the results of Tourmalets car retailing operations which ceased on 31 December 2002 due to mounting losses. The results of the car retailing operation, which is to be treated as a discontinuing operation, for the year to 30 September 2003 are: $000 Sales 15,200 Cost of sales 16,000 Operating expenses 13,200 The operating expenses are included in administration expenses in the trial balance. Tourmalet is still paying rentals for the lease of its car showrooms. The rentals are included in operating expenses. Tourmalet is hoping to use the premises as an expansion of its administration offices. This is dependent on obtaining planning permission from the local authority for the change of use, however this is very difficult to obtain. Failing this, the best option would be early termination of the lease which will cost $15 million in penalties. This amount has not been provided for. (vii) The balance on the taxation account in the trial balance is the result of the settlement of the previous years tax charge. The directors have estimated the provision for income tax for the year to 30 September 2003 at $92 million. Required: (a) Comment on the substance of the sale of the plant and the directors treatment of it. (b) Prepare the Income Statement; and (5 marks) (17 marks)

(c) A Statement of Changes in Equity for Tourmalet for the year to 30 September 2003 in accordance with current International Accounting Standards. (3 marks) Note: A balance sheet is NOT required. Disclosure notes are NOT required. (25 marks)

[P.T.O.

IAS 37 Provisions, Contingent Liabilities and Contingent Assets was issued in 1998. The Standard sets out the principles of accounting for these items and clarifies when provisions should and should not be made. Prior to its issue, the inappropriate use of provisions had been an area where companies had been accused of manipulating the financial statements and of creative accounting. Required: (a) Describe the nature of provisions and the accounting requirements for them contained in IAS 37. (6 marks) (b) Explain why there is a need for an accounting standard in this area. Illustrate your answer with three practical examples of how the standard addresses controversial issues. (6 marks) (c) Bodyline sells sports goods and clothing through a chain of retail outlets. It offers customers a full refund facility for any goods returned within 28 days of their purchase provided they are unused and in their original packaging. In addition, all goods carry a warranty against manufacturing defects for 12 months from their date of purchase. For most goods the manufacturer underwrites this warranty such that Bodyline is credited with the cost of the goods that are returned as faulty. Goods purchased from one manufacturer, Header, are sold to Bodyline at a negotiated discount which is designed to compensate Bodyline for manufacturing defects. No refunds are given by Header, thus Bodyline has to bear the cost of any manufacturing faults of these goods. Bodyline makes a uniform mark up on cost of 25% on all goods it sells, except for those supplied from Header on which it makes a mark up on cost of 40%. Sales of goods manufactured by Header consistently account for 20% of all Bodylines sales. Sales in the last 28 days of the trading year to 30 September 2003 were $1,750,000. Past trends reliably indicate that 10% of all goods are returned under the 28-day return facility. These are not faulty goods. Of these 70% are later resold at the normal selling price and the remaining 30% are sold as sale items at half the normal retail price. In addition to the above expected returns, an estimated $160,000 (at selling price) of the goods sold during the year will have manufacturing defects and have yet to be returned by customers. Goods returned as faulty have no resale value. Required: Describe the nature of the above warranty/return facilities and calculate the provision Bodyline is required to make at 30 September 2003: (i) for goods subject to the 28 day returns policy; and (8 marks)

(ii) for goods that are likely to be faulty.

(d) Rockbuster has recently purchased an item of earth moving plant at a total cost of $24 million. The plant has an estimated life of 10 years with no residual value, however its engine will need replacing after every 5,000 hours of use at an estimated cost of $75 million. The directors of Rockbuster intend to depreciate the plant at $24 million ($24 million/10 years) per annum and make a provision of $1,500 ($75 million/5,000 hours) per hour of use for the replacement of the engine. Required: Explain how the plant should be treated in accordance with International Accounting Standards and comment on the Directors proposed treatment. (5 marks) (25 marks)

This is a blank page. Question 4 begins on page 8.

[P.T.O.

Comparator assembles computer equipment from bought in components and distributes them to various wholesalers and retailers. It has recently subscribed to an interfirm comparison service. Members submit accounting ratios as specified by the operator of the service, and in return, members receive the average figures for each of the specified ratios taken from all of the companies in the same sector that subscribe to the service. The specified ratios and the average figures for Comparators sector are shown below. Ratios of companies reporting a full years results for periods ending between 1 July 2003 and 30 September 2003 Return on capital employed 221% Net assets turnover 18 times Gross profit margin 30% Net profit (before tax) margin 125% Current ratio 16:1 Quick ratio 09:1 Inventory holding period 46 days Accounts receivable collection period 45 days Accounts payable payment period 55 days Debt to equity 40% Dividend yield 6% Dividend cover 3 times Comparators financial statements for the year to 30 September 2003 are set out below: Income statement $000 Sales revenue 2,425 Cost of sales (1,870) Gross profit 555 Other operating expenses (215) Operating profit 340 Interest payable (34) Exceptional item (note (ii)) (120) Profit before taxation 186 Income tax (90) Profit after taxation 96 Extracts of changes in equity: Accumulated profits 1 October 2002 179 Net profit for the period 96 Dividends paid (interim $60,000; final $30,000) (90) Accumulated profits 30 September 2003 185

Balance Sheet Non-current assets (note (i)) Current Assets Inventory Accounts receivable Bank

$000

$000 540

275 320 nil

595 1,135 150 185 335 300

Share Capital and Reserves Ordinary shares (25 cents each) Accumulated profits

Non-current liabilities 8% loan notes Current liabilities Bank overdraft Trade accounts payable Taxation 65 350 85

500 1,135

Notes (i) The details of the non-current assets are: Cost $000 At 30 September 2003 3,600

Accumulated depreciation $000 3,060

Net book value $000 540

(ii) The exceptional item relates to losses on the sale of a batch of computers that had become worthless due to improvements in microchip design. (iii) The market price of Comparators shares throughout the year averaged $600 each. Required: (a) Explain the problems that are inherent when ratios are used to assess a companys financial performance. Your answer should consider any additional problems that may be encountered when using interfirm comparison services such as that used by Comparator. (7 marks) (b) Calculate the ratios for Comparator equivalent to those provided by the interfirm comparison service. (6 marks) (c) Write a report analysing the financial performance of Comparator based on a comparison with the sector averages. (12 marks) (25 marks)

[P.T.O.

(a) (i)

IAS 12 Income Tax was issued in 1996 and revised in 2000. It details the requirements relating to the accounting treatment of deferred tax.

Required: Explain why it is considered necessary to provide for deferred tax and briefly outline the principles of accounting for deferred tax contained in IAS 12 Income Tax. (5 marks) (ii) Bowtock purchased an item of plant for $2,000,000 on 1 October 2000. It had an estimated life of eight years and an estimated residual value of $400,000. The plant is depreciated on a straight-line basis. The tax authorities do not allow depreciation as a deductible expense. Instead a tax expense of 40% of the cost of this type of asset can be claimed against income tax in the year of purchase and 20% per annum (on a reducing balance basis) of its tax base thereafter. The rate of income tax can be taken as 25%. Required: In respect of the above item of plant, calculate the deferred tax charge/credit in Bowtocks income statement for the year to 30 September 2003 and the deferred tax balance in the balance sheet at that date. (6 marks) Note: work to the nearest $000. (b) Bowtock has leased an item of plant under the following terms: Commencement of the lease was 1 January 2002 Term of lease 5 years Annual payments in advance $12,000 Cash price and fair value of the asset $52,000 at 1 January 2002 Implicit interest rate within the lease (as supplied by the lessor) 8% per annum (to be apportioned on a time basis where relevant). The companys depreciation policy for this type of plant is 20% per annum on cost (apportioned on a time basis where relevant). Required: Prepare extracts of the income statement and balance sheet for Bowtock for the year to 30 September 2003 for the above lease. (5 marks) (c) (i) Explain why events occurring after the balance sheet date may be relevant to the financial statements of the previous period. (4 marks)

(ii) At 30 September 2003 Bowtock had included in its draft balance sheet inventory of $250,000 valued at cost. Up to 5 November 2003, Bowtock had sold $100,000 of this inventory for $150,000. On this date new government legislation (enacted after the year end) came into force which meant that the unsold inventory could no longer be marketed and was worthless. Bowtock is part way through the construction of a housing development. It has prepared its financial statements to 30 September 2003 in accordance with IAS 11 Construction Contracts and included a proportionate amount of the total estimated profit on this contract. The same legislation referred to above (in force from 5 November 2003) now requires modifications to the way the houses within this development have to be built. The cost of these modifications will be $500,000 and will reduce the estimated total profit on the contract by that amount, although the contract is still expected to be profitable. Required: Assuming the amounts are material, state how the information above should be reflected in the financial statements of Bowtock for the year ended 30 September 2003. (5 marks) (25 marks)

End of Question Paper

10

You might also like

- December 2003 ACCA Paper 2.5 AnswersDocument16 pagesDecember 2003 ACCA Paper 2.5 AnswersUlanda2100% (2)

- Dipifr 2004 Dec QDocument8 pagesDipifr 2004 Dec QAhmed Raza MirNo ratings yet

- Chapter 009 Test BankDocument13 pagesChapter 009 Test Banknadecho1No ratings yet

- IAS 33 - Earnings Per Share PDFDocument3 pagesIAS 33 - Earnings Per Share PDFRafaelLeeNo ratings yet

- Cost of CapitalDocument4 pagesCost of Capitalshan50% (2)

- Financial Statement Analysis ControlDocument7 pagesFinancial Statement Analysis ControlTareq MahmoodNo ratings yet

- 06 JUNE AnswersDocument13 pages06 JUNE AnswerskhengmaiNo ratings yet

- Day 1Document11 pagesDay 1Abdullah EjazNo ratings yet

- Corporate Finance PDFDocument185 pagesCorporate Finance PDFrodgington duneNo ratings yet

- I 04.05studentDocument20 pagesI 04.05studentKhánh Huyền0% (2)

- Earnings Per ShareDocument30 pagesEarnings Per ShareTanka P Chettri100% (1)

- IAS 33 - Earnings Per ShareDocument26 pagesIAS 33 - Earnings Per ShareTD2 from Henry HarvinNo ratings yet

- Ch01 SMDocument33 pagesCh01 SMcalz_ccccssssdddd_550% (1)

- IAS 02: Inventories: Requirement: SolutionDocument2 pagesIAS 02: Inventories: Requirement: SolutionMD Hafizul Islam Hafiz100% (1)

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Ratios - Profitability, Market &Document46 pagesRatios - Profitability, Market &Jess AlexNo ratings yet

- Tutorial 3 Cost of CapitalDocument1 pageTutorial 3 Cost of Capitaltai kianhongNo ratings yet

- Ifrs CasesDocument23 pagesIfrs CasesDan SimpsonNo ratings yet

- 2 Risk&ReturnDocument23 pages2 Risk&ReturnFebson Lee MathewNo ratings yet

- Investment Analysis and Portfolio Management Christmas Worksheet 2009Document2 pagesInvestment Analysis and Portfolio Management Christmas Worksheet 2009farrukhazeemNo ratings yet

- Based On Session 5 - Responsibility Accounting & Transfer PricingDocument5 pagesBased On Session 5 - Responsibility Accounting & Transfer PricingMERINANo ratings yet

- AFR Revision - Qns-AnsDocument63 pagesAFR Revision - Qns-AnsDownloder UwambajimanaNo ratings yet

- Lecture 7 Adjusted Present ValueDocument19 pagesLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Cost Volume ProfitDocument4 pagesCost Volume ProfitProf_RamanaNo ratings yet

- CHAPTER 4 - AssociatesDocument11 pagesCHAPTER 4 - AssociatesSheikh Mass JahNo ratings yet

- IFRS 2 - Share Based Payment1Document7 pagesIFRS 2 - Share Based Payment1EmmaNo ratings yet

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Document5 pagesQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- Horngren ch06Document45 pagesHorngren ch06Moataz MaherNo ratings yet

- BUSI 353 S18 Assignment 4 SOLUTIONDocument2 pagesBUSI 353 S18 Assignment 4 SOLUTIONTanNo ratings yet

- Ilovepdf MergedDocument15 pagesIlovepdf MergedRakib KhanNo ratings yet

- Ias 33 Eps F7Document27 pagesIas 33 Eps F7Sai Manikanta Pedamallu100% (1)

- Mock Exam QuestionsDocument21 pagesMock Exam QuestionsDixie CheeloNo ratings yet

- F8 Workbook Questions & Solutions 1.1 PDFDocument188 pagesF8 Workbook Questions & Solutions 1.1 PDFLinkon PeterNo ratings yet

- BUSI 353 S18 Assignment 5 SOLUTIONDocument5 pagesBUSI 353 S18 Assignment 5 SOLUTIONTan100% (2)

- Earn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFDocument1 pageEarn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFAnbu jaromiaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument32 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita TamangNo ratings yet

- Chap 4 - IAS 36 (Questions)Document4 pagesChap 4 - IAS 36 (Questions)Kamoke LibraryNo ratings yet

- 2.4 Earnings Per ShareDocument40 pages2.4 Earnings Per ShareMinal Bihani100% (1)

- Chapter 12 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document16 pagesChapter 12 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- AFR - Question BankDocument31 pagesAFR - Question BankDownloder UwambajimanaNo ratings yet

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionDocument11 pagesChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGNo ratings yet

- Consolidated Financial Statements and Outside Ownership: Chapter OutlineDocument44 pagesConsolidated Financial Statements and Outside Ownership: Chapter OutlineJordan Young100% (2)

- Assignment 5 - CH 10 - The Cost of Capital PDFDocument6 pagesAssignment 5 - CH 10 - The Cost of Capital PDFAhmedFawzy0% (1)

- Tutorial Mfrs 116: Property Plant and Equipment Identification, Classification and Recognition of ElementDocument11 pagesTutorial Mfrs 116: Property Plant and Equipment Identification, Classification and Recognition of ElementAnonymous 2eDJ16No ratings yet

- Accounting For LeasesDocument4 pagesAccounting For LeasesSebastian MlingwaNo ratings yet

- Homework Chapter 18 and 19Document7 pagesHomework Chapter 18 and 19doejohn150No ratings yet

- BUSI 353 S18 Assignment 3 All RevenueDocument5 pagesBUSI 353 S18 Assignment 3 All RevenueTanNo ratings yet

- IAS 16 Property Plant EquipmentDocument4 pagesIAS 16 Property Plant EquipmentMD Hafizul Islam HafizNo ratings yet

- FAR-I Borrowing Cost IAS-23 Sir MMDocument7 pagesFAR-I Borrowing Cost IAS-23 Sir MMarhamNo ratings yet

- Chapter 8.6Document3 pagesChapter 8.6CarlosnyNo ratings yet

- Telecom Egypt Credit RatingDocument10 pagesTelecom Egypt Credit RatingHesham TabarNo ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingEniola OgunmonaNo ratings yet

- Chapter 06 Intercompany Profit Transactions Plant AssetsDocument28 pagesChapter 06 Intercompany Profit Transactions Plant AssetsJonathan VidarNo ratings yet

- MACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionDocument8 pagesMACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionFadzai MhepoNo ratings yet

- CH 4 Classpack With SolutionsDocument24 pagesCH 4 Classpack With SolutionsjimenaNo ratings yet

- B5: Problem Solving: P.O.Box 10378 Mwanza-TanzaniaDocument9 pagesB5: Problem Solving: P.O.Box 10378 Mwanza-TanzaniaSHWAIBU SELLANo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Dipifr 2003 Dec QDocument10 pagesDipifr 2003 Dec QWesley JenkinsNo ratings yet

- December 2002 ACCA Paper 2.5 QuestionsDocument11 pagesDecember 2002 ACCA Paper 2.5 QuestionsUlanda2No ratings yet

- PCL Annual Report 2015Document132 pagesPCL Annual Report 2015Ulanda2No ratings yet

- Exam Timetable Sept 2016 PDFDocument1 pageExam Timetable Sept 2016 PDFUlanda2No ratings yet

- December 2002 ACCA Paper 2.5 QuestionsDocument11 pagesDecember 2002 ACCA Paper 2.5 QuestionsUlanda2No ratings yet

- Malawi Cargo CentreDocument11 pagesMalawi Cargo CentreUlanda2100% (1)

- Legal NoticeDocument2 pagesLegal NoticeJimmy FernandisNo ratings yet

- Dynamics AX Retail and POS NET Training - 2.0Document50 pagesDynamics AX Retail and POS NET Training - 2.0nguyenpphuoctanNo ratings yet

- Digiskills Batch 4 E-Commerce AssignmentDocument3 pagesDigiskills Batch 4 E-Commerce Assignmentcarryon66No ratings yet

- Berger BCG MatrixDocument21 pagesBerger BCG MatrixMoinuddin Ahmed33% (3)

- AqualisaDocument19 pagesAqualisaReza Kusuma100% (1)

- Transaction History: Name: Account Number: Address: Card Number: Reporting Period: EmailDocument2 pagesTransaction History: Name: Account Number: Address: Card Number: Reporting Period: EmailCarybel DiazNo ratings yet

- Us Retail SGA Book of Metrics 021010Document20 pagesUs Retail SGA Book of Metrics 021010DaengMaduppaNo ratings yet

- MK CVDocument3 pagesMK CVlalitchauha_nNo ratings yet

- Shantelle Stamoulis PortfolioDocument5 pagesShantelle Stamoulis Portfolioshantelle3254No ratings yet

- Chapman Feit R For Marketing Research Book TalkDocument30 pagesChapman Feit R For Marketing Research Book TalkBom VillatuyaNo ratings yet

- OB AssignmentDocument30 pagesOB AssignmentSugufta ZehraNo ratings yet

- Summer Training Report ON "Working Capital Finance of HDFC Bank"Document50 pagesSummer Training Report ON "Working Capital Finance of HDFC Bank"Anil Batra100% (1)

- Module 1 MCQS: Ankita Agarwal, Asst. Prof., BIITMDocument7 pagesModule 1 MCQS: Ankita Agarwal, Asst. Prof., BIITMSaisrita PradhanNo ratings yet

- Company Name Order Date Product AmountDocument52 pagesCompany Name Order Date Product AmountDaniel KaminskiNo ratings yet

- A Project Report Submitted in The Partial Fulfillment of The Requirements For The Award of The Degree ofDocument69 pagesA Project Report Submitted in The Partial Fulfillment of The Requirements For The Award of The Degree ofSachinGoel67% (3)

- What Are The Four Competitive StrategiesDocument21 pagesWhat Are The Four Competitive StrategiesjohariakNo ratings yet

- YouGov International FMCG Report 2021Document58 pagesYouGov International FMCG Report 2021zoya shahidNo ratings yet

- Notice: Antidumping: Carbazole Violet Pigment 23 From— MalaysiaDocument4 pagesNotice: Antidumping: Carbazole Violet Pigment 23 From— MalaysiaJustia.comNo ratings yet

- 1283 337 3027 1 10 20180308 PDFDocument25 pages1283 337 3027 1 10 20180308 PDFFariz PradanaNo ratings yet

- Assessing Electronic Service Quality Using E-S-QUAL and E-RecS-QUAL ScalesDocument8 pagesAssessing Electronic Service Quality Using E-S-QUAL and E-RecS-QUAL ScalesAlifia Afina ZaliaNo ratings yet

- Hill 2e Closing Case Ch04Document4 pagesHill 2e Closing Case Ch04Afrin Azad MithilaNo ratings yet

- Diagnostic Exam in EntrepreneurshipDocument6 pagesDiagnostic Exam in Entrepreneurshipmerlyn m romerovNo ratings yet

- SWOT AnalysisDocument4 pagesSWOT AnalysisWilson VerardiNo ratings yet

- Virgin Mobile UK: ESMT Case StudyDocument26 pagesVirgin Mobile UK: ESMT Case StudyRicky Correa CarmonaNo ratings yet

- 1301828-Marketing Management Assignment 1Document1 page1301828-Marketing Management Assignment 1Syed Toseef AliNo ratings yet

- Audit Scope - HariDocument444 pagesAudit Scope - HarisridhoolaNo ratings yet

- Maersk Line - B2B Social Media-"It's Communication, Not Marketing"Document23 pagesMaersk Line - B2B Social Media-"It's Communication, Not Marketing"Cesar Arango Gomez100% (2)

- Proposal 2017-Kaira BanaagDocument3 pagesProposal 2017-Kaira BanaagKaira BanaagNo ratings yet

- Staples)Document14 pagesStaples)Lau Ka Kit Kelvin100% (1)

- AAKCBA - TLP-Teaching Lesson Plan - Retail ManagementDocument4 pagesAAKCBA - TLP-Teaching Lesson Plan - Retail ManagementRidwan MohsinNo ratings yet