Professional Documents

Culture Documents

Exhibit 19ZZC

Uploaded by

OSDocs2012Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exhibit 19ZZC

Uploaded by

OSDocs2012Copyright:

Available Formats

Case 2:10-md-02179-CJB-SS Document 8963-82 Filed 03/20/13 Page 1 of 3

Exhibit 19ZZC

Case 2:10-md-02179-CJB-SS Document 8963-82 Filed 03/20/13 Page 2 of 3

What BPs Experts Want

Summary of Declarations Submitted by BP in Support of BPs February 3, 2013 Draft Motion for Reconsideration Professional Services Claimants (Mr. Oustalniol)

1. Do not allow use of financial statements prepared under a non-accrual basis of accounting. [Settlement Agreement requires claimants to submit contemporaneous financial records and does not require accrual accounting.] 2. Require financial data to be analyzed to match revenue with corresponding expenses. [Claims Administrator to use objective test not a subjective analysis.] 3. Financial statements need to be evaluated in order to synchronize the revenues earned with the corresponding expenses. [BP Told Court and Class Counsel no analysis required.] 4. Historical financial performance in the relevant time periods must be assessed. [BP Told Court and Class Counsel no subjective assessment or additional documentation required.] 5. Require claimant to supply all available additional contemporaneous information that would allow the Claims Administrator to match revenues and expenses. [Not required documentation agreed to.] Construction Claims (Mr. Hall)

1. Require all bid sheets and cost estimates for each project. [Not required documentation agreed to.] 2. Allow use of only annual or year-end P&L statements. [Settlement specifically requires submission and use of contemporaneous monthly P&L statements.]

Case 2:10-md-02179-CJB-SS Document 8963-82 Filed 03/20/13 Page 3 of 3

3. Use only annual Variable Profit Margin. [Would render meaningless entire Compensation Framework in Settlement Agreement.] Agricultural Claims (Mr. Finch)

1. Must inquire into claimants business practice to determine the use of grain elevator storage, crop management practices and study market for crop. [Pure subjective individual adversarial investigation requiring documents not required.] 2. Do not allow use of case-based financial statements. They are deemed to be inaccurate and inappropriate for loss calculations although they comply with all IRS regulations. [Settlement Agreement requires use of claimants contemporaneous monthly P&Ls and Federal Tax Returns.] 3. Cannot use financial statements must require further reviewing of underlying data. [Settlement Agreement requires use of financial statements with no subjective review of underlying data.] 4. Claims Administrator will have to determine the months in Benchmark Year(s) that have comparable economic activity. There will have to be some analysis performed. [Settlement Agreement does not give Claims Administrator that authority. Claimant selects the months. No documentation is required that would be needed for such a subjective evaluation. Claimants were told there would be no hidden subjective analysis.] 5. Shift the burden of proving comparable economic activity. [Adversarial process is created out of a settlement.] 6. Confirms that a supplemental review would be required for the vast majority of the agricultural claims. [Documentation not required, Claims Administrator not authorized; subjective process; everything but simple, straightforward, transparent process.]

You might also like

- Tax2 RemediesDocument15 pagesTax2 RemediesValianted07No ratings yet

- ESIC New Inspection Policy 2008Document3 pagesESIC New Inspection Policy 2008smindustryNo ratings yet

- Simplified GST Returns and FormatsDocument54 pagesSimplified GST Returns and Formatsdinesh kasnNo ratings yet

- Tutorial 8 Q & ADocument3 pagesTutorial 8 Q & Achunlun87No ratings yet

- Completing Quality AuditsDocument20 pagesCompleting Quality AuditsIsmail MarzukiNo ratings yet

- VAT Refund Audit ProgramDocument5 pagesVAT Refund Audit ProgramCha Gamboa De LeonNo ratings yet

- Audit Mannual - PPT FinalDocument25 pagesAudit Mannual - PPT FinalitelsindiaNo ratings yet

- Lecture - 9 - Completing The Audit PDFDocument48 pagesLecture - 9 - Completing The Audit PDFShiaab AladeemiNo ratings yet

- 7 Illustrative Bank Branch Audit Programme For The Year Ended March 31 2017Document15 pages7 Illustrative Bank Branch Audit Programme For The Year Ended March 31 2017Paul DoroinNo ratings yet

- Acconts Payable PDFDocument17 pagesAcconts Payable PDFN Tarun ManjunathNo ratings yet

- At at 1st Preboard Oct08Document12 pagesAt at 1st Preboard Oct08Czarina CasallaNo ratings yet

- Tessce08062017 AnDocument15 pagesTessce08062017 Angrj RajakNo ratings yet

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- LssDocument16 pagesLsspranithroyNo ratings yet

- Chapter 30 - AnswerDocument9 pagesChapter 30 - AnswerjhienellNo ratings yet

- Bank Audit RelatedDocument6 pagesBank Audit RelatedNikhil Kharat NiCkNo ratings yet

- PLM Coa Report 2012Document3 pagesPLM Coa Report 2012Bok ParceNo ratings yet

- Exhibit 07BDocument14 pagesExhibit 07BOSDocs2012No ratings yet

- F3FFA Chapter 5 Day Book PDFDocument40 pagesF3FFA Chapter 5 Day Book PDFMd Enayetur RahmanNo ratings yet

- Chapter 30 - Answer Key AuditDocument9 pagesChapter 30 - Answer Key AuditMariaNo ratings yet

- Revisiting The Rules On Claiming Withholding Tax CreditsDocument3 pagesRevisiting The Rules On Claiming Withholding Tax Creditsarnelo sarmientoNo ratings yet

- Audit Notes CH 1 & 2Document5 pagesAudit Notes CH 1 & 2DoWorkCPANo ratings yet

- GST - ReturnsDocument30 pagesGST - ReturnsAniket Rastogi100% (2)

- TBCH16Document6 pagesTBCH16Charlene MinaNo ratings yet

- Budgetary ControlDocument11 pagesBudgetary ControlDurga Prasad NallaNo ratings yet

- Notes Compleeting Audit and Post Audit ResponsibilitiesDocument5 pagesNotes Compleeting Audit and Post Audit ResponsibilitiesSherlock HolmesNo ratings yet

- ESI Form 5 - Half Yearly ReturnDocument6 pagesESI Form 5 - Half Yearly ReturnAshim Agarwal100% (1)

- Asses MentDocument4 pagesAsses MentEngr. Md. Ishtiak HossainNo ratings yet

- Handbook 5.12 Federal Tax Liens HandbookDocument41 pagesHandbook 5.12 Federal Tax Liens HandbookPaulStaplesNo ratings yet

- Ito New Delhi Vs M S Paragon XT New Delhi On 14 March 2019Document29 pagesIto New Delhi Vs M S Paragon XT New Delhi On 14 March 2019ashish poddarNo ratings yet

- 12-Casiguran Aurora 2010 Part3-Status of PY's RecommendationsDocument7 pages12-Casiguran Aurora 2010 Part3-Status of PY's RecommendationsKasiguruhan AuroraNo ratings yet

- Substantive Audit Program ARDocument3 pagesSubstantive Audit Program ARderfred00No ratings yet

- Audit Programme For Accounts ReceivableDocument5 pagesAudit Programme For Accounts ReceivableDaniela BulardaNo ratings yet

- Substantive Procedures (Combined) 2Document23 pagesSubstantive Procedures (Combined) 2mtolamandisaNo ratings yet

- Taxguru - in-GST Audit GSTR-9C Practical Checklist Alongwith Audit ProcessDocument3 pagesTaxguru - in-GST Audit GSTR-9C Practical Checklist Alongwith Audit ProcesschetudaveNo ratings yet

- 18 Completing The AuditDocument7 pages18 Completing The Auditrandomlungs121223No ratings yet

- Audit I Reporting WF in ClassDocument27 pagesAudit I Reporting WF in ClasskevinNo ratings yet

- Audit of Sole ProprietorDocument9 pagesAudit of Sole ProprietorPrincess Bhavika100% (1)

- Professional Training ReportDocument10 pagesProfessional Training Reportjaya sreeNo ratings yet

- Assurance Principles, Professional Ethics and Good GovernanceDocument6 pagesAssurance Principles, Professional Ethics and Good GovernanceDanielle Nicole MarquezNo ratings yet

- Law Society of Saskatchewan: Form Ta-5R Accountant'S Report (Random)Document8 pagesLaw Society of Saskatchewan: Form Ta-5R Accountant'S Report (Random)dsffsdfsdfNo ratings yet

- Auditing Lecture Notes Chapter 24 Completing AuditDocument2 pagesAuditing Lecture Notes Chapter 24 Completing AuditHortense JiangNo ratings yet

- ACCT3014 Lecture12 s12013Document41 pagesACCT3014 Lecture12 s12013thomashong313No ratings yet

- General Procedure of Business Audit Under Maharashtra VAT ActDocument20 pagesGeneral Procedure of Business Audit Under Maharashtra VAT Actdeepakpahuja_1991No ratings yet

- Auditing 2&3 Theories Reviewer CompilationDocument9 pagesAuditing 2&3 Theories Reviewer CompilationPaupauNo ratings yet

- Mock exam paper with ACCG340 Auditing questionsDocument16 pagesMock exam paper with ACCG340 Auditing questionsannezhou90No ratings yet

- CPA Auditing 2 - Notes FR HomeworkDocument10 pagesCPA Auditing 2 - Notes FR Homeworkpambia200050% (2)

- Taxguru - in-SOP For Finance Accounts For Construction Infrastructure CompanyDocument14 pagesTaxguru - in-SOP For Finance Accounts For Construction Infrastructure CompanyChandan ChatterjeeNo ratings yet

- Engagement-Proposal BVC 2022 DraftDocument6 pagesEngagement-Proposal BVC 2022 DraftGeram ConcepcionNo ratings yet

- Auditing Theories and Problems Quiz WEEK 2Document16 pagesAuditing Theories and Problems Quiz WEEK 2Van MateoNo ratings yet

- Class Practice Qs 2 - Accounting ConceptsDocument8 pagesClass Practice Qs 2 - Accounting ConceptsAhmed P. FatehNo ratings yet

- Professional Ethics and Professional Accounting SystemDocument22 pagesProfessional Ethics and Professional Accounting SystemAdarsh ShetNo ratings yet

- Illustrative Bank Branch Audit Programme For The Year Ended March 31, 2019Document21 pagesIllustrative Bank Branch Audit Programme For The Year Ended March 31, 2019rahul giriNo ratings yet

- Exhibit 05Document2 pagesExhibit 05OSDocs2012No ratings yet

- INCOME TAX DEPT OFFICE ASSESSMENTDocument3 pagesINCOME TAX DEPT OFFICE ASSESSMENTGeetu DhimanNo ratings yet

- Session Paper - 6 (Questions & Answers), For Overall Discussion On Principles of Taxation of CLDocument3 pagesSession Paper - 6 (Questions & Answers), For Overall Discussion On Principles of Taxation of CLProgga MehnazNo ratings yet

- Accountancy For LawyersDocument5 pagesAccountancy For Lawyerssiddarth kumar80% (5)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- DOJ Pre-Trial Statement On QuantificationDocument14 pagesDOJ Pre-Trial Statement On QuantificationwhitremerNo ratings yet

- 2013-9-18 Aligned Parties Pre-Trial Statement Doc 11411Document41 pages2013-9-18 Aligned Parties Pre-Trial Statement Doc 11411OSDocs2012No ratings yet

- 2013-9-11 BPs Phase II PreTrial Reply Memo For Source Control Doc 11349Document13 pages2013-9-11 BPs Phase II PreTrial Reply Memo For Source Control Doc 11349OSDocs2012No ratings yet

- HESI's Post-Trial BriefDocument52 pagesHESI's Post-Trial BriefOSDocs2012No ratings yet

- State of LAs Post Trial Brief Phase I (Doc. 10462 - 6.21.2013)Document23 pagesState of LAs Post Trial Brief Phase I (Doc. 10462 - 6.21.2013)OSDocs2012No ratings yet

- BP Pre-Trial Statement On QuantificationDocument13 pagesBP Pre-Trial Statement On Quantificationwhitremer100% (1)

- 2013-09-05 BP Phase 2 Pre-Trial Memo - Source ControlDocument13 pages2013-09-05 BP Phase 2 Pre-Trial Memo - Source ControlOSDocs2012No ratings yet

- BP's Post-Trial BriefDocument72 pagesBP's Post-Trial BriefOSDocs2012No ratings yet

- To's Post-Trial BriefDocument57 pagesTo's Post-Trial BriefOSDocs2012No ratings yet

- To's Proposed FOF and COLDocument326 pagesTo's Proposed FOF and COLOSDocs2012No ratings yet

- BP's Proposed Findings - Combined FileDocument1,303 pagesBP's Proposed Findings - Combined FileOSDocs2012No ratings yet

- HESI's Proposed FOF and COLDocument335 pagesHESI's Proposed FOF and COLOSDocs2012No ratings yet

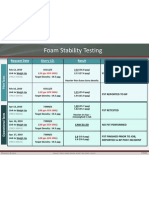

- Foam Stability Testing: Request Date Slurry I.D. Result CommentsDocument1 pageFoam Stability Testing: Request Date Slurry I.D. Result CommentsOSDocs2012No ratings yet

- State of ALs Post Trial Brief Phase I (Doc. 10451 - 6.21.2013)Document22 pagesState of ALs Post Trial Brief Phase I (Doc. 10451 - 6.21.2013)OSDocs2012No ratings yet

- USAs Proposed Findings Phase I (Doc. 10460 - 6.21.2013)Document121 pagesUSAs Proposed Findings Phase I (Doc. 10460 - 6.21.2013)OSDocs2012No ratings yet

- April 20, BLOWOUT: BP Misreads Logs Does Not IdentifyDocument22 pagesApril 20, BLOWOUT: BP Misreads Logs Does Not IdentifyOSDocs2012No ratings yet

- USAs Post Trial Brief Phase I (Doc. 10461 - 6.21.2013)Document49 pagesUSAs Post Trial Brief Phase I (Doc. 10461 - 6.21.2013)OSDocs2012No ratings yet

- PSC Post-Trial Brief (Phase One) (Doc 10458) 6-21-2013Document72 pagesPSC Post-Trial Brief (Phase One) (Doc 10458) 6-21-2013OSDocs2012100% (1)

- Arnaud Bobillier Email: June 17, 2010: "I See Some Similarities With What Happened On The Horizon"Document5 pagesArnaud Bobillier Email: June 17, 2010: "I See Some Similarities With What Happened On The Horizon"OSDocs2012No ratings yet

- Macondo Bod (Basis of Design)Document23 pagesMacondo Bod (Basis of Design)OSDocs2012No ratings yet

- Exterior: Circa 2003Document1 pageExterior: Circa 2003OSDocs2012No ratings yet

- Plaintiffs Proposed Findings and Conclusions (Phase One) (Doc 10459) 6-21-2013Document199 pagesPlaintiffs Proposed Findings and Conclusions (Phase One) (Doc 10459) 6-21-2013OSDocs2012No ratings yet

- Driller HITEC Display CCTV Camera System: Source: TREX 4248 8153Document1 pageDriller HITEC Display CCTV Camera System: Source: TREX 4248 8153OSDocs2012No ratings yet

- DR Gene: CloggedDocument1 pageDR Gene: CloggedOSDocs2012No ratings yet

- Circa 2003Document1 pageCirca 2003OSDocs2012No ratings yet

- Laboratory Results Cement Program Material Transfer TicketDocument13 pagesLaboratory Results Cement Program Material Transfer TicketOSDocs2012No ratings yet

- Circa 2003Document1 pageCirca 2003OSDocs2012No ratings yet

- End of Transmission: Transocean Drill Crew Turned The Pumps Off To InvestigateDocument1 pageEnd of Transmission: Transocean Drill Crew Turned The Pumps Off To InvestigateOSDocs2012No ratings yet

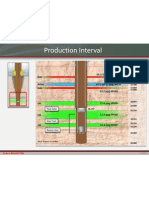

- Production Interval: 14.1-14.2 PPG M57B Gas Brine GasDocument1 pageProduction Interval: 14.1-14.2 PPG M57B Gas Brine GasOSDocs2012No ratings yet

- Webster:: Trial Transcript at 3975:2-4Document1 pageWebster:: Trial Transcript at 3975:2-4OSDocs2012No ratings yet

- Copper Mining and Women's Role in Zambia's Miners' StrugglesDocument11 pagesCopper Mining and Women's Role in Zambia's Miners' StrugglesBoris PichlerbuaNo ratings yet

- S.Noname of CompanyDocument11 pagesS.Noname of CompanyramNo ratings yet

- IT Doesnt MatterDocument5 pagesIT Doesnt MatterHava MalokuNo ratings yet

- Energy Reports: Prachuab Peerapong, Bundit LimmeechokchaiDocument13 pagesEnergy Reports: Prachuab Peerapong, Bundit LimmeechokchaikhaledNo ratings yet

- 2012 BTS 1 AnglaisDocument4 pages2012 BTS 1 AnglaisΔαμηεν ΜκρτNo ratings yet

- Reso To Open Account PoblacionDocument3 pagesReso To Open Account PoblacionBrgy Singon TubunganNo ratings yet

- Canned Snakes Mechanical Goats and SpittDocument11 pagesCanned Snakes Mechanical Goats and SpittLuiz Córdova Jr.No ratings yet

- Formulation of Marketing Strategies To Improve Market Share of LGDocument10 pagesFormulation of Marketing Strategies To Improve Market Share of LGRiddhi Shah0% (1)

- Starbucks Vs Ethiopia Corporate Strategy and Ethical Sourcing in The Coffe Industry PDFDocument11 pagesStarbucks Vs Ethiopia Corporate Strategy and Ethical Sourcing in The Coffe Industry PDFTSEDEKENo ratings yet

- B-TEVTA 5. CPEC Demand Trades Its OutcomesDocument229 pagesB-TEVTA 5. CPEC Demand Trades Its OutcomesTahir shah100% (1)

- BWN To AsnDocument7 pagesBWN To Asnuwzennrheemlpro.comNo ratings yet

- MutiaraVille New PhaseDocument20 pagesMutiaraVille New PhaseBernard LowNo ratings yet

- Module III (Exam 2) - Retirement Planning and Employee Benefits (RPEB)Document6 pagesModule III (Exam 2) - Retirement Planning and Employee Benefits (RPEB)Saied MastanNo ratings yet

- MBSA1523 Managerial Economics Group 4 Presentation 1 PPT SlidesDocument21 pagesMBSA1523 Managerial Economics Group 4 Presentation 1 PPT SlidesPIONG MENG ZIAN MBS211233No ratings yet

- Notice: Initiation of Antidumping Duty Investigation: Circular Welded Austenitic Stainless Pressure Pipe From The Peoples Republic of ChinaDocument6 pagesNotice: Initiation of Antidumping Duty Investigation: Circular Welded Austenitic Stainless Pressure Pipe From The Peoples Republic of ChinaJustia.comNo ratings yet

- Tourism Complete Notes AQA Geography GcseDocument5 pagesTourism Complete Notes AQA Geography GcseMisterBlueSkyNo ratings yet

- Estado de Cuenta Mes Mayo 2021 Banesco 963Document16 pagesEstado de Cuenta Mes Mayo 2021 Banesco 963carlos blancoNo ratings yet

- XAS-356 Manual Atlas CopcoDocument9 pagesXAS-356 Manual Atlas CopcoGustavo Roman50% (2)

- Form TR 20 Gaz TAbill 2018 2Document2 pagesForm TR 20 Gaz TAbill 2018 2abc100% (1)

- CH 14 SimulationDocument85 pagesCH 14 SimulationaluiscgNo ratings yet

- Malthusianism WikipediaDocument16 pagesMalthusianism WikipediavalensalNo ratings yet

- BI in FMCGDocument30 pagesBI in FMCGrajatdeshwal100% (1)

- Forex Card RatesDocument2 pagesForex Card RatesKrishnan JayaramanNo ratings yet

- BYD Case StudyDocument12 pagesBYD Case StudyELIZANo ratings yet

- Maria Mies - Dynamics of Sexual Division of Labour and Capital AccumulationDocument10 pagesMaria Mies - Dynamics of Sexual Division of Labour and Capital Accumulationzii08088No ratings yet

- Hallstead Solution 2Document5 pagesHallstead Solution 2Rishabh VijayNo ratings yet

- Locke's Theory of Capitalist AppropriationDocument18 pagesLocke's Theory of Capitalist AppropriationpraktenNo ratings yet

- 2022 Term 2 JC 2 H1 Economics SOW (Final) - Students'Document5 pages2022 Term 2 JC 2 H1 Economics SOW (Final) - Students'PROgamer GTNo ratings yet

- Cardinal Utility AnalysisDocument27 pagesCardinal Utility AnalysisGETinTOthE SySteMNo ratings yet

- MukeshDocument24 pagesMukeshvirendramahavarNo ratings yet