Professional Documents

Culture Documents

Case For CFP

Uploaded by

G Rakesh ChowdaryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case For CFP

Uploaded by

G Rakesh ChowdaryCopyright:

Available Formats

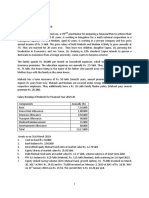

Case B: (Reference Date: 1st April 2012) Gurpreet Das, aged 43 years, having twins Roshan and Geet

t of age 14 years, is a software engineer in a company based in Mumbai. His spouse passed away recently. Both his children study in the 8 th Standard. He has approached you, a CFPCM practitioner, for preparing a financial plan for his family. He has shared the following financial information with you: Gurpreets Assets & Liabilities (As on 31st March, 2012 unless otherwise specified in foot notes) Assets Equity MF schemes portfolio Balanced MF schemes portfolio Equity shares portfolio1 Gold Jewelry Gold ETF2 PPF A/c.3 Equity linked savings scheme4 Physical Gold (coins/bars) Car Liquid fund scheme Corporate bonds5 Bank account Gurpreet6 Liabilities Car loan7 Credit Cards Salary Income Basic Salary Dearness Allowance HRA Special Allowance Variable Salary (Bonus) Regular Outgoings Household Expenses Car Loan EMI Other cash outflows Term Plan Insurance premium

1

(Rs. Lakh) : : : : : : : : : : : : 26.47 9.78 25.92 2.17 3.21 7.87 15.75 11.25 7.50 5.25 1.50 103.25

: :

6.61 0.72 Annual (Rs. lakh)

: : : : :

34.00 9.00 5.00 0.90 6.20 Monthly (Rs.)

: :

1,40,000 19,567 Annual

20,516 (Total Cover Rs. 80 lakh)

Total cost Rs. 15 lakh. Last purchase made in May, 2010 Invested Rs. 1.6 lakh on 17 July 2006 in the NFO of Gold ETF 3 st Account maturing on 1 April, 2018 4 Invested Rs. 74,000 every year for 6 years from 2000 to 2005 5 investments are stated at their original investment amount 6 Received funds amounting to Rs. 99 lakh from redemption of investments in the name of his wife 7 Taken in August 2011 at 11.5% p.a. on reducing monthly balance basis for a term of 4 years

2

Endowment Insurance premium8 Health Insurance Premium

: :

80,333 (Sum assured Rs. 20 lakh) 27,631 (Annual 2 policies/ Total cover Rs. 20 lakh)

You, in consultation with Gurpreet, have crystallized the following financial goals for his family and the preliminary Roadmap to achieve them: 1. Send both the children to a Boarding School immediately Outlay Rs. 5.15 lakh per child per annum for 4 years To be met year on year basis by investing a suitable corpus today. 2. Buy a house within one year Outlay of Rs. 75 lakh Take a loan for 15-year term. 3. Send Roshan for Higher Education abroad. The estimated outlay is Rs. 1.3 crore then for 5 years. To send Geet for a 4-year course in fashion technology. The current cost is Rs. 100,000 per year. 4. Retirement Corpus To be accumulated in 17 years Corpus to sustain inflation adjusted annuity for 25 years post-retirement. 5. Undertake a trip abroad with both kids on his attaining 53 years of age. The current cost of such trip is Rs. 10 Lakh. 6. To accumulate funds for Geets marriage at her age of 25. 7. Suitable Estate Planning to cover all his physical and financial assets. Life Parameters Gurpreets expected life : 85 years

Assumptions regarding long-term pre-tax returns on various asset classes 1. 2. 3. 4. 5. Equity & Equity MF schemes/ Index ETFs Balanced MF schemes Bonds/Govt. Securities/ Debt MF schemes Liquid MF schemes Gold & Gold ETF : : : : : 11.00% p.a. 9.00% p.a. 7.00% p.a. 5.50% p.a. 7.50% p.a.

Assumptions regarding economic factors: 1. Inflation 2. Expected return in Risk free instruments 3. Real Estate appreciation : : : 5.50% p.a. 6.50% p.a. 8.00% p.a.

Cost Inflation Index:

1981-82 1982-83 1983-84 1984-85 1985-86 100 109 116 125 133 1986-87 1987-88 1988-89 1989-90 1990-91 140 150 161 172 182 1991-92 1992-93 1993-94 1994-95 1995-96 199 223 244 259 281 1996-97 1997-98 1998-99 1999-00 2000-01 305 331 351 389 406 2001-02 2002-03 2003-04 2004-05 2005-06 426 447 463 480 497 2006-07 2007-08 2008-09 2009-10 2010-11 519 551 582 632 711 2011-12 2012-13 785 852

Term of 15 years, Purchased on 15 March, 2007.

th

You might also like

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFP Mock Test Retirement PlanningDocument9 pagesCFP Mock Test Retirement PlanningDeep Shikha100% (4)

- How small caps can become big multibaggersDocument138 pagesHow small caps can become big multibaggersBharat Sahni0% (2)

- Case Study - 1 - Financial PlanningDocument4 pagesCase Study - 1 - Financial PlanningJyoti GoyalNo ratings yet

- Case Study For CFP Final ModuleDocument3 pagesCase Study For CFP Final ModuleImran Ansari0% (2)

- SAP FICO Interview QuestionDocument31 pagesSAP FICO Interview Questionrasrazy100% (1)

- Manage Finances Life Stages (40Document56 pagesManage Finances Life Stages (40sweetest toothacheNo ratings yet

- The Business Plan and Executive Summary513Document22 pagesThe Business Plan and Executive Summary513Bharat SahniNo ratings yet

- Markets Move FirstDocument385 pagesMarkets Move FirstBharat Sahni100% (1)

- Financial Plan Goals, Assets, and Life Parameters for Roger G D'MelloDocument12 pagesFinancial Plan Goals, Assets, and Life Parameters for Roger G D'MellotarangtgNo ratings yet

- How To Make Money In Stocks Value Investing StrategiesFrom EverandHow To Make Money In Stocks Value Investing StrategiesNo ratings yet

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- Financial Plan tailored for your goals and protectionDocument16 pagesFinancial Plan tailored for your goals and protectionJames AndersonNo ratings yet

- Anand Sahib - LONGDocument210 pagesAnand Sahib - LONGBharat Sahni100% (1)

- SAP FICO Configuration MaterialDocument20 pagesSAP FICO Configuration Materialpwalenb123462% (26)

- Personal Financial Planning-Case StudiesDocument5 pagesPersonal Financial Planning-Case StudiesAniruddha Ghosh0% (1)

- Personal Wealth Management Plan for Ms. Sahanubhuti VanaspatiDocument9 pagesPersonal Wealth Management Plan for Ms. Sahanubhuti VanaspatiAditya GulatiNo ratings yet

- Case Study For CFPDocument1 pageCase Study For CFPsinghanshu21100% (2)

- Retirement BenefitsDocument4 pagesRetirement BenefitsJona FranciscoNo ratings yet

- Agra Notes For Finals (Focal Point - Pointers) JPD PDFDocument25 pagesAgra Notes For Finals (Focal Point - Pointers) JPD PDFSammy EscañoNo ratings yet

- NLIU PROJECT EXAMINES PAYMENT OF GRATUITY UNDER SECTION 4(1)(BDocument17 pagesNLIU PROJECT EXAMINES PAYMENT OF GRATUITY UNDER SECTION 4(1)(BRansher Vikram SinghNo ratings yet

- FPSBI/M-VI/01-01/10/SP-21: 1 FPSB India / PublicDocument11 pagesFPSBI/M-VI/01-01/10/SP-21: 1 FPSB India / Publicbhaw_shNo ratings yet

- CFP RaipDocument3 pagesCFP RaipsinhapushpanjaliNo ratings yet

- Gurpreet 2020Document3 pagesGurpreet 2020Aditya BohraNo ratings yet

- Case BDocument2 pagesCase BKajolNo ratings yet

- SP-1 NewDocument6 pagesSP-1 NewPrashin PatelNo ratings yet

- Case: Roger: (Reference Date: 1st April, 2019)Document6 pagesCase: Roger: (Reference Date: 1st April, 2019)Krish BhutaNo ratings yet

- Financial Plan for Mahesh and Neelam DesaiDocument2 pagesFinancial Plan for Mahesh and Neelam DesaiBharat SahniNo ratings yet

- Case ADocument2 pagesCase ALamka VijayNo ratings yet

- Ref Date 1/4/17 Sahanubhuti SP-2 Pattern Question Bank (15 Questions: 2 HRS)Document4 pagesRef Date 1/4/17 Sahanubhuti SP-2 Pattern Question Bank (15 Questions: 2 HRS)preeti chhatwalNo ratings yet

- Priti CaseDocument3 pagesPriti Casecarry minatteeNo ratings yet

- Gurpreet Case StudyDocument3 pagesGurpreet Case StudyAditya BohraNo ratings yet

- Case A Ashwin 34yDocument2 pagesCase A Ashwin 34yshreya sahuNo ratings yet

- CFP Case StudyDocument2 pagesCFP Case StudyPankaj SrivastavaNo ratings yet

- Financial plan for Ashwin and familyDocument3 pagesFinancial plan for Ashwin and familyAditya BohraNo ratings yet

- Charitable and Religious TrustsDocument32 pagesCharitable and Religious TrustsSandeep BorseNo ratings yet

- Case - DDocument2 pagesCase - Dmoneshivangi29No ratings yet

- Security Analysis and Portfolio Management: - Prof. Samidha AngneDocument44 pagesSecurity Analysis and Portfolio Management: - Prof. Samidha AngneSudhir Kumar AgarwalNo ratings yet

- Case CDocument3 pagesCase Cnaveen0037No ratings yet

- Mahehs 2019Document3 pagesMahehs 2019Aditya BohraNo ratings yet

- Chintan CaseDocument3 pagesChintan Caseaadi sharmaNo ratings yet

- Marketing of Financial Services Assignment-2: Submitted By: Suyash Rastogi Mba-M&S Sec-D (38) A0102212164Document4 pagesMarketing of Financial Services Assignment-2: Submitted By: Suyash Rastogi Mba-M&S Sec-D (38) A0102212164Suyash RastogiNo ratings yet

- 3.debt - BasicsDocument17 pages3.debt - BasicsDebjani SinghaNo ratings yet

- Case Study 7Document2 pagesCase Study 7.No ratings yet

- Annual ReportDocument83 pagesAnnual ReportHari PrasadNo ratings yet

- Mirae Asset Funds Speak April 2014Document15 pagesMirae Asset Funds Speak April 2014Prasad JadhavNo ratings yet

- Ca 2 (1415)Document6 pagesCa 2 (1415)Free BooksNo ratings yet

- FPSB India / Public 1: FPSBI/M-VI/04-01/09/SP-12Document13 pagesFPSB India / Public 1: FPSBI/M-VI/04-01/09/SP-12bhaw_shNo ratings yet

- Sahanubhuti UniqueDocument10 pagesSahanubhuti UniquePrashanth JogimuttNo ratings yet

- Sample Case StudYDocument11 pagesSample Case StudYArun SahooNo ratings yet

- PMMF Asset AllocationDocument3 pagesPMMF Asset Allocationrachna91No ratings yet

- Financial and Capital Market Services Assignment: Individual StatusDocument4 pagesFinancial and Capital Market Services Assignment: Individual StatusJAMES ABY RCBSNo ratings yet

- NFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688Document5 pagesNFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688kuchbhisochoNo ratings yet

- Guidance Notes 2Document12 pagesGuidance Notes 2bhaw_shNo ratings yet

- FEIA Unit-1 NewDocument8 pagesFEIA Unit-1 NewMansi Vats100% (2)

- Mutual FundDocument13 pagesMutual FundMd ThoufeekNo ratings yet

- CS 3Document12 pagesCS 3Mallika VermaNo ratings yet

- Investment PlanningDocument231 pagesInvestment PlanningKamna Deepak ThorveNo ratings yet

- INDEPTH - September 2011Document17 pagesINDEPTH - September 2011Vivek BnNo ratings yet

- ValueResearchFundcard BirlaSunLifeIncomePlus 2013jul17Document6 pagesValueResearchFundcard BirlaSunLifeIncomePlus 2013jul17Chiman RaoNo ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- Probable Solution For Questions Asked - Current Batch - March 2015Document30 pagesProbable Solution For Questions Asked - Current Batch - March 2015aditiNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument6 pagesInstitute of Actuaries of India: ExaminationsmailrahulrajNo ratings yet

- RBI rules NBFCs banksDocument18 pagesRBI rules NBFCs bankspreeti chhatwalNo ratings yet

- NRK Sandesham May 2013Document6 pagesNRK Sandesham May 2013ninju1No ratings yet

- St. Kabir Institute of Professional Studies End Term Examination marketing financial productsDocument4 pagesSt. Kabir Institute of Professional Studies End Term Examination marketing financial productsKetan BhoiNo ratings yet

- FMPSDocument2 pagesFMPSAman RenaNo ratings yet

- Special Consideration As Per OHCDocument3 pagesSpecial Consideration As Per OHCBharat SahniNo ratings yet

- Portfolio CheckupDocument84 pagesPortfolio CheckupBharat SahniNo ratings yet

- Where Everyday Is An April Fool's DayDocument6 pagesWhere Everyday Is An April Fool's DayBharat SahniNo ratings yet

- Why-Most Investors Are Mostly Wrong Most of The TimeDocument3 pagesWhy-Most Investors Are Mostly Wrong Most of The TimeBharat SahniNo ratings yet

- 70 Times Better Than The Next MicrosoftDocument3 pages70 Times Better Than The Next MicrosoftBharat SahniNo ratings yet

- When To Borrow, and When Not ToDocument5 pagesWhen To Borrow, and When Not ToBharat SahniNo ratings yet

- Sample Bplan ReportDocument29 pagesSample Bplan Reportash_1982No ratings yet

- Trust MR Market, Not The Credit RatingDocument3 pagesTrust MR Market, Not The Credit RatingBharat SahniNo ratings yet

- When Trends Are Not DestinyDocument1 pageWhen Trends Are Not DestinyBharat SahniNo ratings yet

- Understanding Dilution: Earnings Per Share DilutionDocument4 pagesUnderstanding Dilution: Earnings Per Share DilutionBharat SahniNo ratings yet

- MCDDocument65 pagesMCDFrancisco Javier CazaresNo ratings yet

- Sikh Rehat Maryada (Sikh Code of Conduct and Conventions) (English)Document25 pagesSikh Rehat Maryada (Sikh Code of Conduct and Conventions) (English)nss1234567890No ratings yet

- Haldiram PPT 110113235127 Phpapp01Document17 pagesHaldiram PPT 110113235127 Phpapp01Bharat SahniNo ratings yet

- Onlinemarketingstrategy 090828040645 Phpapp01Document43 pagesOnlinemarketingstrategy 090828040645 Phpapp01Maryem YaakoubiNo ratings yet

- The Truth About Risk and ReturnDocument5 pagesThe Truth About Risk and ReturnBharat SahniNo ratings yet

- Overcoming The Fear of The UnknownDocument5 pagesOvercoming The Fear of The UnknownBharat SahniNo ratings yet

- The Hidden Risk in ICICI BondsDocument3 pagesThe Hidden Risk in ICICI BondsBharat SahniNo ratings yet

- Sap FicoDocument6 pagesSap FicoBharat SahniNo ratings yet

- Interview QutDocument4 pagesInterview QutBharat SahniNo ratings yet

- SAP FICO Online TrainingDocument6 pagesSAP FICO Online TrainingBharat SahniNo ratings yet

- E ShopaidDocument2 pagesE ShopaidBharat SahniNo ratings yet

- The Relatively Unpopular Large CompanyDocument6 pagesThe Relatively Unpopular Large CompanyBharat SahniNo ratings yet

- The South Sea BubbleDocument6 pagesThe South Sea BubbleBharat SahniNo ratings yet

- The Pizza Theory of Business ValuationDocument3 pagesThe Pizza Theory of Business ValuationBharat SahniNo ratings yet

- Speech Good WillDocument4 pagesSpeech Good WillPawlo De JesusNo ratings yet

- PPR 218 Key Steps To Retirement Income PlanningDocument9 pagesPPR 218 Key Steps To Retirement Income PlanningMaria CeciliaNo ratings yet

- LRTA v. AlvarezDocument16 pagesLRTA v. AlvarezAira Mae P. LayloNo ratings yet

- Sampann User ManualDocument28 pagesSampann User Manualanon_53098100No ratings yet

- Actuarial PracticeDocument36 pagesActuarial PracticekunlekokoNo ratings yet

- Pension Risk Lifecycles: A Framework for ERMDocument4 pagesPension Risk Lifecycles: A Framework for ERMMuhammad AlkahfiNo ratings yet

- 1344938487binder2Document34 pages1344938487binder2CoolerAdsNo ratings yet

- Insurance & Risk ManagementDocument8 pagesInsurance & Risk ManagementJASONM22No ratings yet

- The VINDICTIVE Politician Spread Rumors About His Opponent. Which of The Following Is An Antonym of The Capitalized Word? A. RevengefulDocument3 pagesThe VINDICTIVE Politician Spread Rumors About His Opponent. Which of The Following Is An Antonym of The Capitalized Word? A. RevengefulJaycelyn BaduaNo ratings yet

- 4the Retirement Problem (Part 2) - Varsity by ZerodhaDocument9 pages4the Retirement Problem (Part 2) - Varsity by ZerodhaOwner JustACodeNo ratings yet

- Form 11Document1 pageForm 11Ankit SharmaNo ratings yet

- Pension Fund 1992-2022Document9 pagesPension Fund 1992-2022DominikNo ratings yet

- 1Document10 pages1Sai Krishna DhulipallaNo ratings yet

- Pension and Other Retirement BenifitsDocument8 pagesPension and Other Retirement BenifitsVikas GuptaNo ratings yet

- Major Port Trusts (Adaptation of Rules) Regulations, 1964Document249 pagesMajor Port Trusts (Adaptation of Rules) Regulations, 1964Latest Laws TeamNo ratings yet

- Novartis NPS Employee Awareness Presentation PDFDocument33 pagesNovartis NPS Employee Awareness Presentation PDFMohan CNo ratings yet

- How To Generate Killer Big Ideas and Unique Hooks in Under 30 Minutes - Stefan GeorgiDocument128 pagesHow To Generate Killer Big Ideas and Unique Hooks in Under 30 Minutes - Stefan GeorgiCarla MirandaNo ratings yet

- Nexus - Month of April - p20Document36 pagesNexus - Month of April - p20has_gorganiNo ratings yet

- Personal Finance 12th Edition Ebook PDFDocument61 pagesPersonal Finance 12th Edition Ebook PDFronald.robotham75498% (43)

- Germany Vs Singapore by Andrew BaeyDocument12 pagesGermany Vs Singapore by Andrew Baeyacs1234100% (2)

- Group InsuranceDocument60 pagesGroup Insurancedanialraza67% (3)

- DOL FOIA Response Re: Bloomberg Leif Olson SmearDocument114 pagesDOL FOIA Response Re: Bloomberg Leif Olson SmearPhil KerpenNo ratings yet

- Planning Personal Finances: Unit 1Document28 pagesPlanning Personal Finances: Unit 1Prathamesh KhopkarNo ratings yet

- SNGPLDocument26 pagesSNGPLAli HassanNo ratings yet

- I Barnes - MIRF-withdrawalretreanchmentretDocument8 pagesI Barnes - MIRF-withdrawalretreanchmentretridbastraNo ratings yet