Professional Documents

Culture Documents

BB40 280213

Uploaded by

Fred MaunzeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BB40 280213

Uploaded by

Fred MaunzeCopyright:

Available Formats

February 2013

Sector Allocation

Equally Weighted Top40 Exchange Traded Fund

Bringing balance to your portfolio in one easy step

The Nedbank BettaBeta Equally Weighted Top40 Exchange Traded Fund (BBEWT40 ETF) tracks the BettaBeta Equally Weighted Top40 Index, calculated independently by the FTSE/JSE. This index is comprised of the same companies as the FTSE/JSE Top40 index (the large cap equity index of the JSE Securities Exchange), but they are held in equal proportions of 2.5% each (as at the quarterly rebalancing date). The index is rebalanced in line with the quarterly review of the FTSE/JSE Africa Index Series and underlying constituents mirror the changes in the FTSE/JSE Top40 Index. Institutional investors looking for liquidity and diversification compared to the domestic equity market (Botswana) can invest in this ETF as it has Local Asset Status, and Individual Investors wanting a balanced lower risk equity investment will find this equally suitable. Note: all performance data in this fact sheet is in Pula (BWP) terms, unless specified otherwise.

Market commentary

Inner circle: Market cap weighted Outer circle: Equally weighted Key Information Share code BBET40 (JSE) BettaBeta (BSE) Sector Exchange Traded Funds Benchmark FTSE/JSE Africa Equally Weighted Top40 Index Risk L LM Medium to high (MH) M MH H

The strong start to the year in developed market equities continued in February as several markets toyed with life-time highs. The Nikkei continued to lead the pack with another 3.8% gain for the month. But performance intra-month was quite volatile as investors try to pre-empt the end of QE. Emerging markets by contrast, stumbled somewhat as the CRB index declined by 3.6%. The spot price of Gold lost 4.6%, the biggest decline in more than a year. Politics was relatively high on the agenda in Europe, where investors are looking at election results as a gauge of the (lack of) acceptance of austerity. Despite a plethora of negative news stories about South Africa, foreign investors were net buyers of the domestic equity market to the tune of R8.1bn, the biggest monthly number since Nov-2010! It was further supported by another R3.8bn inflow into the domestic bond market. The inflows were supportive of the Rand it strengthened by an estimated 1.3% on a tradeweighted basis. But this strength would have not have been noted by those that only monitor the R/$ rate, as the greenback strengthened significantly against both the Pound (by 4.4%) and the Euro (by 3.8%). Both the FTSE/JSE Top40 index and the Equally weighted Top40 (ETOP) index declined by 2.4% in February. It is not surprising to see both the best and worst performing Top40 share list dominated by stock-specific, results-related stories, as February is reporting season on the JSE. On the upside: Bidvest (BVT, 11.3%), Growthpoint (GRT, 8.6%), Mondi (MNP, 7.8%; MND, 7.4%), Imperial (IPL, 6.2%) and Remgro (REM, 4.1%) and on the downside, Assore (ASR, 24.2%), Implats (IMP, -14.4%), Goldfields (GFI, -13.8%), Anglogold-Ashanti (ANG, -11.5%) and Intu Property (ITU, -10.8%) formerly known as Capital Shops (CSO).

Management fees Maximum 0.30% (incl. in TER) Total expense ratio (TER) 0.39% p.a. Income distribution Quarterly in March, June, September and December Liquidity Daily

Historical performance indexed to 1000 at 31-Dec-02

Contact us Lyn Brooks LynBrooks@NedbankCapital.co.za +27 11 294 4747 Nerina Visser NVisser@NedbankCapital.co.za +27 11 294 3217 Nedgroup Beta Solutions BetaSolutions@nedbank.co.za www.bettabeta.co.za

10 largest companies in TOPI by free float market capitalisation comparative weights of different indices (%)

Company BIL BHP Billiton SAB SABMiller CFR Richemont AGL Anglo American MTN MTN Group SOL Sasol NPN Naspers SBK Standard Bank Group FSR Firstrand Limited OML Old Mutual

BBEWT40 (ETOP) 2.5 2.8 2.7 2.5 2.4 2.6 2.7 2.4 2.6 2.6

Top40 (TOPI) 13.5 11.3 7.9 7.8 6.8 5.1 4.9 3.8 2.8 2.7

CAPI40 (CTOP) 10.0 10.7 8.4 8.2 7.1 5.4 5.1 4.0 2.9 2.8

SWIX40 (DTOP) 6.3 3.5 3.7 4.9 10.6 6.0 5.7 6.0 4.4 2.1

Return and risk metrics for different Top40-based indices since Dec-02 (p.a.) BBEWT40 Top40 CAPI40 SWIX40 Total return (%) 23.3 22.5 23.3 22.9 Risk (%) 22.3 25.6 24.3 24.6 Risk-adjusted return 1.05 0.88 0.96 0.93 The role of investment banks as ETF issuers

Capitalising on the major trend of the separation of alpha and beta fund management, investment banks, due to their superior structuring and trading skills, are successfully entering passive fund management, including ETFs. The major cost advantage of ETFs over competing products also makes this one of the most attractive growth areas over the next decade in the investment industry. In addition, the development of the ETF industry internationally offers an excellent template of the dynamics and opportunity set for the domestic market. The research, structuring and trading skill set of investment banks, combined with their ability to develop value-adding trading/derivative products on the back of ETFs, places them at a significant advantage to traditional fund managers to develop beta fund management profitably.

About Bettaeta Bettaeta is a range of beta building

block portfolios and funds offered by Beta Solutions in the Nedbank Capital Global Markets division. Our close affiliation to the Nedbank Group enhances our end-to-end operational abilities and allows us to leverage off the group synergies and reputation. We distinguish ourselves from our peers by the utilisation of a combination of existing and customised beta building blocks to derive lasting solutions for our clients. As a result we have a transparent and rules based passive fund management style. A combination of allocation to these products together with true alpha strategies allows for a significant level of tactical asset allocation possibilities for our clients.

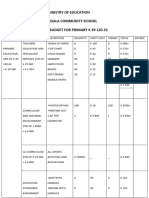

Sector allocation

Pricing structure of portfolio

The Manager is entitled to charge certain fees calculated as a percentage of the assets under management. The manager is permitted to charge both an upfront fee in connection with the expenditure incurred and administration performed by it in respect of the creation, issue and sale of securities, as well as an exit fee in connection with the expenditure incurred and administration performed by it in respect of the repurchase of securities. Such fees will be expressed as a percentage of the consideration received from an investor and charged on a sliding scale dependent on the size of the investment. The upfront fee will not exceed 50 bps and the exit fee will not exceed 100 bps. The Manager may choose at any stage to waive some or all of the upfront fees, exit fees and/or management fees charged in respect of an investment in the BettaBeta Collective Investment Scheme. As with all ETFs, all taxes, duties, administration, transaction and custody charges and brokerage fees will be for the investors account. These on-going costs are expected to result in a total expense ratio of not more than 50 bps p.a. (currently 39 bps).

2013 Beta Solutions (Proprietary) Limited. This document has been approved by Beta Solutions (Proprietary) Limited (Beta Solutions). It should not be considered as an offer or solicitation of an offer to sell, buy or subscribe for any securities or any derivative instrument or any other rights pertaining thereto (financial instruments). Some of the information contained herein has been obtained from public sources (i ncluding but not limited to data vendors such as I-Net and Bloomberg and the internet) and persons who Beta Solutions believes to be reliable. This document is not guaranteed for accuracy, completeness or otherwise. It may not be considered as advice, a recommendation or an offer to enter into or conclude any transactions. Securities or financial instruments mentioned herein may not be suitable for all investors. Securities of emerging and mid-size growth companies typically involve a higher degree of risk and more volatility than the securities of more established companies. Beta Solutions recommends that independent tax, accounting, legal and financial advice be sought should any party seek to place any reliance on the information contained herein or for purposes of determining the suitability of the products for the investor as mentioned in this document. Beta Solutions and its officers, directors, agents, advisors and employees, including persons involved in the preparation or issuance of this document, may from time to time act as manager or co-manager of a public offering or otherwise deal in, hold or act as market-makers or advisors or brokers in relation to the financial instruments which are the subject of this document or any related derivatives. Unless expressly stipulated as such, Beta Solutions makes no representation or warranty in this document. Neither Beta Solutions nor any of its officers, directors, agents, advisors or employee accepts any liability whatsoever, howsoever arising, for any direct or consequential loss arising from any use of this document or its contents. The information contained in this document may not be construed as legal, accounting, regulatory or tax advice and is given without any liability whatsoever. Past performance is no guarantee of future returns. Any modelling or back-testing data contained in this document should not be construed as a statement or projection as to future performance. This document is being made available in the Republic of South Africa to persons. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of Beta Solutions. Nedbank Capital is a division of Nedbank Limited Reg No 1951/000009/06, an authorised financial services provider (licence number 9363), 135 Rivonia Road, Sandown, Sandton, 2196, South Africa. We subscribe to the Code of Banking Practice of The Banking Association South Africa and, for unresolved disputes, support resolution through the Ombudsman for Banking Services. We are a registered credit provider in terms of the National Credit Act (NCR Reg No NCRCP16).

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hierarchy of The Inchoate Crimes: Conspiracy Substantive CrimeDocument18 pagesHierarchy of The Inchoate Crimes: Conspiracy Substantive CrimeEmely AlmonteNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthShelby AntonioNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Survey On Multicarrier Communications Prototype PDFDocument28 pagesA Survey On Multicarrier Communications Prototype PDFDrAbdallah NasserNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Danh Sach Khach Hang VIP Diamond PlazaDocument9 pagesDanh Sach Khach Hang VIP Diamond PlazaHiệu chuẩn Hiệu chuẩnNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Human Resource Management by John Ivancevich PDFDocument656 pagesHuman Resource Management by John Ivancevich PDFHaroldM.MagallanesNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Types of MemoryDocument3 pagesTypes of MemoryVenkatareddy Mula0% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Product Guide TrioDocument32 pagesProduct Guide Triomarcosandia1974No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 3.13 Regional TransportationDocument23 pages3.13 Regional TransportationRonillo MapulaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Sun Nuclear 3D SCANNERDocument7 pagesSun Nuclear 3D SCANNERFranco OrlandoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Amel Forms & Logging SheetsDocument4 pagesAmel Forms & Logging SheetsisaacNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- LICDocument82 pagesLICTinu Burmi Anand100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 7Document101 pages7Navindra JaggernauthNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Concept of ElasticityDocument19 pagesThe Concept of ElasticityVienRiveraNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Between:-Mr. Pedro Jose de Vasconcelos, of Address 14 CrombieDocument2 pagesBetween:-Mr. Pedro Jose de Vasconcelos, of Address 14 Crombiednd offiNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- MWG Installation 7.6.2 IG INSTALLATION 0516 en - PDDocument64 pagesMWG Installation 7.6.2 IG INSTALLATION 0516 en - PDjbondsrNo ratings yet

- Copeland PresentationDocument26 pagesCopeland Presentationjai soniNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Review of Accounting Process 1Document2 pagesReview of Accounting Process 1Stacy SmithNo ratings yet

- TOEFLDocument6 pagesTOEFLSekar InnayahNo ratings yet

- Minor Ailments Services: A Starting Point For PharmacistsDocument49 pagesMinor Ailments Services: A Starting Point For PharmacistsacvavNo ratings yet

- The Concept of Crisis PDFDocument10 pagesThe Concept of Crisis PDFJohann RestrepoNo ratings yet

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesNo ratings yet

- Flow Chart For SiFUS Strata Title ApplicationDocument5 pagesFlow Chart For SiFUS Strata Title ApplicationPhang Han XiangNo ratings yet

- Health Informatics SDocument4 pagesHealth Informatics SnourhanNo ratings yet

- Vice President Enrollment Management in Oklahoma City OK Resume David CurranDocument2 pagesVice President Enrollment Management in Oklahoma City OK Resume David CurranDavidCurranNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Revit 2019 Collaboration ToolsDocument80 pagesRevit 2019 Collaboration ToolsNoureddineNo ratings yet

- Application of ARIMAX ModelDocument5 pagesApplication of ARIMAX ModelAgus Setiansyah Idris ShalehNo ratings yet

- 1.mukherjee - 2019 - SMM - Customers Passion For BrandsDocument14 pages1.mukherjee - 2019 - SMM - Customers Passion For BrandsnadimNo ratings yet

- PHP IntroductionDocument113 pagesPHP Introductionds0909@gmailNo ratings yet

- Health, Safety & Environment: Refer NumberDocument2 pagesHealth, Safety & Environment: Refer NumbergilNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)