Professional Documents

Culture Documents

Introduction To EPC Contract

Uploaded by

Eslam AshourOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To EPC Contract

Uploaded by

Eslam AshourCopyright:

Available Formats

Introduction In October 1999, FIDIC produced a totally new set of standard forms of contract alongside those that were

in use at that time. The new set comprises the following four contract forms: 1. The Construction Contract (Conditions of Contract for Building and Engineering Works, Designed by the Employer) General Conditions, Guidance for the Preparation of the Particular Conditions, Forms of Tender, Contract Agreement, and Dispute Adjudication Agreement, referred to in this text as the 1999 Red Book; 2. The Plant and Design-Build Contract (Conditions of Contract for Electrical and Mechanical Plant, and for Building and Engineering Works, Designed by the Contractor) General Conditions, Guidance for the Preparation of the Particular Conditions, Forms of Tender, Contract Agreement and Dispute Adjudication Agreement, referred to in this text as the 1999 Yellow Book; 3. The EPC and Turnkey Contract (Conditions of Contract for EPC Turnkey Projects) General Conditions, Guidance for the Preparation of the Particular Conditions, Forms of Tender, Contract Agreement and Dispute Adjudication Agreement, referred to in this text as the 1999 Silver Book; and 4. The Short Form of Contract Agreement, General Conditions, Rules for Adjudication and Notes for Guidance, referred to in this text as the 1999 Green Book. The old set is divided into the Red and Yellow forms on the basis of the type of the project to be constructed. The new forms are divided on the basis of who designs the project. Whilst the 1999 Red, Yellow and Silver books are similar in many areas, they are in fact three separate and distinct forms of contract. The 1999 forms differ on the basis of the allocation of the design function and the existence of an engineer: the 1999 Red Book for a project designed by the employer (or designed on his behalf) with an engineer in place; and the 1999 Yellow Book for a project designed by the contractor with an engineer in place. The Silver Book was drafted for a project designed by the contractor but with no engineer in place; as the Silver Book eliminates the formal role of the engineer altogether and replaces it by that of the employer himself. There is also a time limit under sub-clause 20.1 for the engineer under the 1999 Red and Yellow Books, and the employer under the Silver Book, to respond to the notification of a contractors claim. The DAB in the 1999 Yellow and Silver Books is appointed by the date 28 days after a party gives notice of its intention to refer a dispute to a DAB, sub-clause 20.2, while the DAB in the 1999 Red Book is appointed by the date stated in the Appendix to Tender, which proposes 28 days after the commencement date. It is worth noting here that the Silver Book is totally new and, to a large extent, forms a departure from FIDICs established policy of providing standard forms of contract with balanced risk allocation. The risks in the Silver Book are mostly allocated to the contractor. This imbalance would obviously cause a large

increase in the cost of the project, but perhaps a more stable final cost figure. The Silver Book can be distinguished from the other forms of contract by the absence of the function of the Engineer. The distinguishing characteristics of the Silver Book should not be taken as a criticism of its concept and application. In particular, the Silver Book was conceived in response to the need created by those who favored the use of private finance for infrastructure projects, and grew as a result of the demands associated with BOT or BOOT projects and with the new ideas of mixing together design, construction and operation. This entailed demanding a fixed, lump-sum contract price with little or no risk of an increase if and when unexpected events took place. Of course, privately financed projects require financial viability with an assured return on the funds advanced. Therefore, although demanding a fixed, lump sum contract price means that the employer would be paying a higher price for the construction of the project, he would not normally object to having to do so if he were assured of an acceptable return on his total investment that would compensate for this additional cost. FIDICs 1999 Red, Yellow and Silver Books are very similar in format. They each contain 20 clauses, 17 of which have common titles and all of which have similar wording where the concepts match. The three clauses that carry different titles are: Clause 3 The Engineer in the 1999 Red and Yellow Books is changed to The Employers Administration in the Silver Book; Clause 5 Nominated Subcontractors in the 1999 Red Book is changed to Design in the 1999 Yellow and Silver Books; and Clause 12 Measurement and Evaluation in the 1999 Red Book is changed to Tests after Completion in the 1999 Yellow and Silver Books. Although the number of clauses in each of these three forms of contract has been drastically reduced from 72 in the Fourth Edition of the Red Book, and 51 in the Third Edition of the Yellow Book, the number of words in each of the new forms has largely increased. However, the wording is simpler and clearer than in the older Books. The sentences are shorter and express fewer ideas, making them easier to understand.

Details As discussed above, the new Silver Book is a newcomer to the field. To understand the philosophy and reasons behind its conception, it is best to quote from the authoritative paper written by the chairman of FIDICs Contracts Committee and leader of the Task Group that prepared the FIDIC 1999 Conditions of Contract. Not only is it a fact of life that many employers have always demanded fixed, lump sum contract prices, and that FIDIC did not have a suitable standard form to cater for such demand, but in recent years the trend has been towards private financing (not only of private investment and speculative projects, but also of public infrastructure projects). The prerequisites for obtaining private finance for a project are vastly different from those of obtaining government or other public money. Private financing requires that the project is independently viable in financial terms, and that there will be, so far as possible, an assured return on the finance provided. The lenders on a BOT or similar project will do their calculations showing the outlay over the construction period and the income over the succeeding operation period. For the return to be reasonably assured, the bases for their calculations will have to be

as firm as possible. If the construction work costs more than reckoned (inclusive of any contingency allowance), then the calculations will not hold. If the construction time is longer than planned, then the income will not begin to come in on time, and the calculations will not hold. Therefore, such lenders have to ensure that the risks of cost and time overruns of the construction contract are limited as far as humanly possible. Such lenders are aware that contractors will have to charge a premium for carrying the additional risks necessary to provide the required greater security of construction cost and time. The premium in certain cases may reasonably be large. However, they would rather accept such premium and include it in their calculations before embarking on the project, than discover later on that the project is no longer viable and that they are incurring an overall loss. Thus, the Silver Book has been and is intended to be used for special projects. It is worthwhile to note that although the format is the same in all three books, the 1999 Red, Yellow and Silver Books, the Silver Book can be distinguished by the absence of the Engineer and by its imbalanced allocation of the risks, a shift of a wide range of risks to the contractor. These distinguishing characteristics of the Silver Book should not be taken as a criticism of its concept and application. In particular, the Silver Book was conceived in response to the need created by those in favour of using private finance for infrastructure projects, and grew as a result of the demands associated with Build, Own and Transfer (BOT), or Build, Own, Operate and Transfer (BOOT) projects, and with the idea of mixing together design, construction and operation. This response entailed demanding a fixed, lump-sum contract price with little or no risk of an increase in cost if and when unexpected events took place. Of course, private finance requires a financially viable project with an assured return on the funds advanced. Although demanding a fixed, lump-sum contract with most of the risks being allocated to the contractor means that the employer would be paying a higher price for the construction of the project, he would not normally object to having to do so if he were assured of an acceptable return on his total investment outlay. In essence, under the Silver Book, the contractor has to take on board not only strict liability for design and the fitness for purpose standard of performance and liability, but he is also allocated the risk of any error, inaccuracy or omission of any kind in the employers requirements. As in the Yellow Book, the employers requirements are set out in a document by that name specifying the purpose, scope, and/or design, and/or other technical criteria, for the works. The Silver Book, if and when used, ought to be entered into with the utmost care, with all eyes open, focusing on the risks that have been shifted, from a balanced contract between the parties to one where the risks are mostly allocated to the contractor. It is intended for projects where extensive negotiations are entered into prior to the award of contract. The method of procurement has to be adopted to suit that concept. The criteria for risk allocation of control over the risk and/or its consequences is not used in the Silver Book. These risks are spread over a number of the sub-clauses of the Silver Book: 3.1, 3.5, 4.7, 4.12, 5.1, 5.8, 8.4, 17.3 and 20.1, which are dealt with below.

The 1999 Silver Book: the shifted risks:

The Silver Book is closer in content to the 1999 Yellow Book than to the 1999 Red Book, mainly because of the allocation of the design function to the contractor in both the Silver and Yellow Books. By a comparison with the 1999 Yellow Book, the following sections identify the risks that have been traditionally allocated to the employer and now allocated to the contractor. Sub-clause 3.1: The Employers Administration The Employers Representative

You might also like

- The Magnificent 10 For Men by MrLocario-1Document31 pagesThe Magnificent 10 For Men by MrLocario-1Mauricio Cesar Molina Arteta100% (1)

- Present Tense Exercises. Polish A1Document6 pagesPresent Tense Exercises. Polish A1Pilar Moreno DíezNo ratings yet

- Contracts, Biddings and Tender:Rule of ThumbFrom EverandContracts, Biddings and Tender:Rule of ThumbRating: 5 out of 5 stars5/5 (1)

- Estimating Engineering Hours from Project DataDocument9 pagesEstimating Engineering Hours from Project DataMartín Diego MastandreaNo ratings yet

- The Law of SchedulesDocument15 pagesThe Law of ScheduleshusktechNo ratings yet

- Standard BoQ (UAE - DoT) - CESMM4 PDFDocument554 pagesStandard BoQ (UAE - DoT) - CESMM4 PDFNektarios Matheou86% (44)

- Contract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalFrom EverandContract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalNo ratings yet

- Contract Strategies for Major Projects: Mastering the Most Difficult Element of Project ManagementFrom EverandContract Strategies for Major Projects: Mastering the Most Difficult Element of Project ManagementNo ratings yet

- Contract Strategy For Design Management in The Design and Build SystemDocument10 pagesContract Strategy For Design Management in The Design and Build SystemchouszeszeNo ratings yet

- Construction Law in the United Arab Emirates and the GulfFrom EverandConstruction Law in the United Arab Emirates and the GulfRating: 4 out of 5 stars4/5 (1)

- A Practical Guide to Disruption and Productivity Loss on Construction and Engineering ProjectsFrom EverandA Practical Guide to Disruption and Productivity Loss on Construction and Engineering ProjectsRating: 5 out of 5 stars5/5 (1)

- Aace International's: Certified Forensic Claim Consultant™ (CFCC™) Certification Study GuideDocument20 pagesAace International's: Certified Forensic Claim Consultant™ (CFCC™) Certification Study GuideKhaled AbdelbakiNo ratings yet

- Managing Risk in EPC ContractsDocument20 pagesManaging Risk in EPC ContractspoundingNo ratings yet

- Bioassay Techniques For Drug Development by Atta-Ur RahmanDocument214 pagesBioassay Techniques For Drug Development by Atta-Ur RahmanEmpress_MaripossaNo ratings yet

- AACE International - Certification Paper - 52284Document37 pagesAACE International - Certification Paper - 52284fareed_imadiNo ratings yet

- 10 Things To Know About FidicDocument7 pages10 Things To Know About FidicJaswin JonsonNo ratings yet

- Simple Format Construction ClaimsDocument3 pagesSimple Format Construction ClaimspanjemadjoNo ratings yet

- FIDIC Sub-Clause 3.5 ExplainedDocument9 pagesFIDIC Sub-Clause 3.5 ExplainedYashveer TakooryNo ratings yet

- Assessing Extension of Time Delays on Major ProjectsDocument20 pagesAssessing Extension of Time Delays on Major ProjectsSiawYenNo ratings yet

- SCL - Delay Disruption Protocol 2nd Edition by CM (R5)Document31 pagesSCL - Delay Disruption Protocol 2nd Edition by CM (R5)ILTERIS DOGAN100% (1)

- Allocating Risk in An EPC Contract - Patricia GallowayDocument13 pagesAllocating Risk in An EPC Contract - Patricia Gallowayjorge plaNo ratings yet

- Commentary:: Amending Clause 13.1 of FIDIC - Protracted NegotiationsDocument2 pagesCommentary:: Amending Clause 13.1 of FIDIC - Protracted NegotiationsArshad MahmoodNo ratings yet

- Risk Allocations in Construction ContractsDocument10 pagesRisk Allocations in Construction ContractsMdms PayoeNo ratings yet

- Engineering, Procurement and Construction (ECP) ContractsDocument124 pagesEngineering, Procurement and Construction (ECP) ContractsPopeyeNo ratings yet

- Toc - 44r-08 - Risk Analysis RangDocument4 pagesToc - 44r-08 - Risk Analysis RangdeeptiNo ratings yet

- Introduction To FIDIC Conditions of Contract: Dr. Mirosław J. Skibniewski, A.J. Clark Chair ProfessorDocument46 pagesIntroduction To FIDIC Conditions of Contract: Dr. Mirosław J. Skibniewski, A.J. Clark Chair ProfessorNeni Sumiatty100% (1)

- Case Study of Delay Impact Analysis of Lost Productivity in Construction ProjectsDocument2 pagesCase Study of Delay Impact Analysis of Lost Productivity in Construction ProjectsGeorge NunesNo ratings yet

- FCCMDocument2 pagesFCCMMohanna Govind100% (1)

- Cornes and Lupton's Design Liability in the Construction IndustryFrom EverandCornes and Lupton's Design Liability in the Construction IndustryNo ratings yet

- Introduction To FIDIC Dispute Adjudication Board Provisions (Owen - 2004)Document61 pagesIntroduction To FIDIC Dispute Adjudication Board Provisions (Owen - 2004)shady_sherif100% (3)

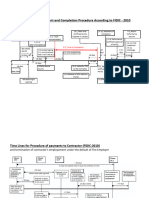

- Flow Charts of FIDIC-2010Document7 pagesFlow Charts of FIDIC-2010Irshad Ali Durrani100% (1)

- Fidic Variation PDFDocument268 pagesFidic Variation PDFjohnpaul100% (1)

- EPC Vs EPCMDocument4 pagesEPC Vs EPCMNemanja KlisaraNo ratings yet

- FIDIC delay and disruption standardsDocument7 pagesFIDIC delay and disruption standardsMohammad FayazNo ratings yet

- Pacing DelayDocument5 pagesPacing DelayChelimilla Ranga ReddyNo ratings yet

- Deciding JCT Contract PDFDocument43 pagesDeciding JCT Contract PDFchamil_dananjayaNo ratings yet

- Does Better Scheduling Drive Execution Success?Document9 pagesDoes Better Scheduling Drive Execution Success?AcumenNo ratings yet

- Fidic UpdateDocument3 pagesFidic Updatefhsn84No ratings yet

- Guide To FIDIC EPC ConditionsDocument35 pagesGuide To FIDIC EPC ConditionsZiad Zouheir Namani100% (1)

- Mega Project Construction Contracts - An Owner's PerspectiveDocument16 pagesMega Project Construction Contracts - An Owner's Perspectivesevero97No ratings yet

- Construction Claims and Responses: Effective Writing and PresentationFrom EverandConstruction Claims and Responses: Effective Writing and PresentationNo ratings yet

- Increased Size: FIDIC Redbook 2017 Vs 99 - Top 11 ChangesDocument3 pagesIncreased Size: FIDIC Redbook 2017 Vs 99 - Top 11 ChangesDangi DilleeRamNo ratings yet

- Gemmell - R - The Quantification of Loss Caused by Disruption - Thomson Reuters - 31 BCL 390Document17 pagesGemmell - R - The Quantification of Loss Caused by Disruption - Thomson Reuters - 31 BCL 390Jijo PjNo ratings yet

- Sub-Clause 4.7 - Notice of Items of Reference For Setting OutDocument2 pagesSub-Clause 4.7 - Notice of Items of Reference For Setting Outkhiem44No ratings yet

- Fidic - Condictions of Contract For Epc-Turnkey ProjectsDocument49 pagesFidic - Condictions of Contract For Epc-Turnkey Projectssharon gradosNo ratings yet

- Drafting EPC Contract TermsDocument8 pagesDrafting EPC Contract Termsaugustaq100% (2)

- Construction Claim - ILQ - Fall - 2014Document72 pagesConstruction Claim - ILQ - Fall - 2014A SetiadiNo ratings yet

- Vdocuments - MX Fidic Conditions of Contract For Underground Works U 2019 Athe Emerald BookDocument43 pagesVdocuments - MX Fidic Conditions of Contract For Underground Works U 2019 Athe Emerald Bookshengkai zhangNo ratings yet

- An Introduction To FIDIC and FIDIC Contract BooksDocument15 pagesAn Introduction To FIDIC and FIDIC Contract Booksaniket100% (1)

- The Prevention Principle After Muliplex V HoneywellDocument11 pagesThe Prevention Principle After Muliplex V HoneywellbarryroNo ratings yet

- ..AACE InternationalDocument3 pages..AACE International891966No ratings yet

- Contract Administration GuildlinesDocument117 pagesContract Administration GuildlinesEslam Ashour100% (1)

- The NEC4 Engineering and Construction Contract: A CommentaryFrom EverandThe NEC4 Engineering and Construction Contract: A CommentaryNo ratings yet

- A Comparison of NEC and FIDIC by Rob GerrardDocument4 pagesA Comparison of NEC and FIDIC by Rob GerrardbappanaduNo ratings yet

- LIQUIDATED-DAMAGES-Case Studies-Anamul HoqueDocument11 pagesLIQUIDATED-DAMAGES-Case Studies-Anamul HoqueMuhammad Anamul HoqueNo ratings yet

- Symphonological Bioethical Theory: Gladys L. Husted and James H. HustedDocument13 pagesSymphonological Bioethical Theory: Gladys L. Husted and James H. HustedYuvi Rociandel Luardo100% (1)

- EPC or EPCM Contracts: Which One Can Drive Stronger Outcomes For Project Owners?Document7 pagesEPC or EPCM Contracts: Which One Can Drive Stronger Outcomes For Project Owners?Đặng Trung AnhNo ratings yet

- RISK IN FidicDocument53 pagesRISK IN FidicANASNo ratings yet

- A Practical Guide To Compensation EventsDocument2 pagesA Practical Guide To Compensation EventssharfutajNo ratings yet

- AACE Journal On Concurrent DelayDocument10 pagesAACE Journal On Concurrent DelayManoj LankaNo ratings yet

- FIDIC's New Standard Forms of Construction Contract - An Introduction - C.R. SeppalaDocument7 pagesFIDIC's New Standard Forms of Construction Contract - An Introduction - C.R. SeppalaHubert BonamisNo ratings yet

- Contracts and Contract Law: Prepared and Presented BY: Prof. Khem DallakotiDocument11 pagesContracts and Contract Law: Prepared and Presented BY: Prof. Khem DallakotiSujan SinghNo ratings yet

- MPL Article Managing An NEC3 ProgrammeDocument9 pagesMPL Article Managing An NEC3 Programmecv21joNo ratings yet

- Management PhrasesDocument1 pageManagement PhrasesEslam AshourNo ratings yet

- 1 by 50Document3 pages1 by 50Eslam AshourNo ratings yet

- Concurrently DelayedDocument6 pagesConcurrently DelayedEslam AshourNo ratings yet

- British Steel V Cleveland Bridge (1981) 24 BLR 94, Robert Goff J.Document1 pageBritish Steel V Cleveland Bridge (1981) 24 BLR 94, Robert Goff J.Eslam AshourNo ratings yet

- Article 19Document18 pagesArticle 19Eslam AshourNo ratings yet

- Tunnelling Journal 6-2017 - Dispute Adjudication BoardsDocument4 pagesTunnelling Journal 6-2017 - Dispute Adjudication BoardsEslam AshourNo ratings yet

- Delay Analysis 1Document8 pagesDelay Analysis 1Eslam AshourNo ratings yet

- Agreement Sub-ConsultancyDocument4 pagesAgreement Sub-ConsultancyEslam AshourNo ratings yet

- Inspection Report Materials Delivered Project SiteDocument1 pageInspection Report Materials Delivered Project SiteEslam AshourNo ratings yet

- HOWES - Alan - Patrick CV PDFDocument6 pagesHOWES - Alan - Patrick CV PDFEslam AshourNo ratings yet

- Field Sketch IssueDocument1 pageField Sketch IssueEslam AshourNo ratings yet

- Income Taxes: Foreign Operating Companies - Branch OfficesDocument2 pagesIncome Taxes: Foreign Operating Companies - Branch OfficesEslam AshourNo ratings yet

- Estimated ScheduleDocument6 pagesEstimated ScheduleEslam AshourNo ratings yet

- Acknowledgment FormDocument1 pageAcknowledgment FormEslam AshourNo ratings yet

- Question 2: (Your Answers Should Be Taken From FIDIC 99, As May Be Applicable)Document2 pagesQuestion 2: (Your Answers Should Be Taken From FIDIC 99, As May Be Applicable)Eslam AshourNo ratings yet

- LOBST Example PDFDocument3 pagesLOBST Example PDFEslam AshourNo ratings yet

- Management PhrasesDocument1 pageManagement PhrasesEslam AshourNo ratings yet

- MENASOL 2010 Hela CheikhrouhouDocument20 pagesMENASOL 2010 Hela CheikhrouhouEslam AshourNo ratings yet

- Solution of Case 14 PDFDocument8 pagesSolution of Case 14 PDFEslam AshourNo ratings yet

- BechtelDocument10 pagesBechtelEslam AshourNo ratings yet

- AmCham Egypt - Online Services - Tenders Alert Service (TAS) 1111Document2 pagesAmCham Egypt - Online Services - Tenders Alert Service (TAS) 1111Eslam AshourNo ratings yet

- Management PhrasesDocument1 pageManagement PhrasesEslam AshourNo ratings yet

- Sample Letter of RecommendationDocument1 pageSample Letter of RecommendationEslam AshourNo ratings yet

- Script - TEST 5 (1st Mid-Term)Document2 pagesScript - TEST 5 (1st Mid-Term)Thu PhạmNo ratings yet

- B767 WikipediaDocument18 pagesB767 WikipediaxXxJaspiexXx100% (1)

- Grammar Level 1 2013-2014 Part 2Document54 pagesGrammar Level 1 2013-2014 Part 2Temur SaidkhodjaevNo ratings yet

- Module 1 in Contemporary Arts First MonthDocument12 pagesModule 1 in Contemporary Arts First MonthMiles Bugtong CagalpinNo ratings yet

- 6 Lesson Writing Unit: Personal Recount For Grade 3 SEI, WIDA Level 2 Writing Kelsie Drown Boston CollegeDocument17 pages6 Lesson Writing Unit: Personal Recount For Grade 3 SEI, WIDA Level 2 Writing Kelsie Drown Boston Collegeapi-498419042No ratings yet

- Chippernac: Vacuum Snout Attachment (Part Number 1901113)Document2 pagesChippernac: Vacuum Snout Attachment (Part Number 1901113)GeorgeNo ratings yet

- Selloooh X Shopee HandbookDocument47 pagesSelloooh X Shopee Handbooknora azaNo ratings yet

- Georgetown University NewsletterDocument3 pagesGeorgetown University Newsletterapi-262723514No ratings yet

- Portfolio HistoryDocument8 pagesPortfolio Historyshubham singhNo ratings yet

- Introduction To ResearchDocument5 pagesIntroduction To Researchapi-385504653No ratings yet

- Bach Invention No9 in F Minor - pdf845725625Document2 pagesBach Invention No9 in F Minor - pdf845725625ArocatrumpetNo ratings yet

- Midterm Exam ADM3350 Summer 2022 PDFDocument7 pagesMidterm Exam ADM3350 Summer 2022 PDFHan ZhongNo ratings yet

- Building Materials Alia Bint Khalid 19091AA001: Q) What Are The Constituents of Paint? What AreDocument22 pagesBuilding Materials Alia Bint Khalid 19091AA001: Q) What Are The Constituents of Paint? What Arealiyah khalidNo ratings yet

- Understanding Malaysian Property TaxationDocument68 pagesUnderstanding Malaysian Property TaxationLee Chee KheongNo ratings yet

- Calvo, G (1988) - Servicing The Public Debt - The Role of ExpectationsDocument16 pagesCalvo, G (1988) - Servicing The Public Debt - The Role of ExpectationsDaniela SanabriaNo ratings yet

- LIN 1. General: Body Electrical - Multiplex Communication BE-13Document2 pagesLIN 1. General: Body Electrical - Multiplex Communication BE-13Roma KuzmychNo ratings yet

- Evirtualguru Computerscience 43 PDFDocument8 pagesEvirtualguru Computerscience 43 PDFJAGANNATH THAWAITNo ratings yet

- Diagram Illustrating The Globalization Concept and ProcessDocument1 pageDiagram Illustrating The Globalization Concept and ProcessAnonymous hWHYwX6No ratings yet

- I CEV20052 Structureofthe Food Service IndustryDocument98 pagesI CEV20052 Structureofthe Food Service IndustryJowee TigasNo ratings yet

- AGIL KENYA For Web - tcm141-76354Document4 pagesAGIL KENYA For Web - tcm141-76354Leah KimuhuNo ratings yet

- PNP TELEPHONE DIRECTORY As of JUNE 2022Document184 pagesPNP TELEPHONE DIRECTORY As of JUNE 2022lalainecd0616No ratings yet

- ITN v7 Release NotesDocument4 pagesITN v7 Release NotesMiguel Angel Ruiz JaimesNo ratings yet

- Q3 Week 7 Day 2Document23 pagesQ3 Week 7 Day 2Ran MarNo ratings yet

- Expectations for Students and ParentsDocument15 pagesExpectations for Students and ParentsJasmine TaourtiNo ratings yet

- Krittika Takiar PDFDocument2 pagesKrittika Takiar PDFSudhakar TomarNo ratings yet

- MAT 1100 Mathematical Literacy For College StudentsDocument4 pagesMAT 1100 Mathematical Literacy For College StudentsCornerstoneFYENo ratings yet