Professional Documents

Culture Documents

COA Acctg Cir Let 2007-001

Uploaded by

Misc EllaneousOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COA Acctg Cir Let 2007-001

Uploaded by

Misc EllaneousCopyright:

Available Formats

REPUBLIC OF THE PHILIPPINES COMMISSION ON AUDIT

Commonwealth Avenue, Quezon City, Philippines

ACCOUNTING CIRCULAR LETTER

No. : 2007-001 Date: January 19, 2007

TO

: Heads of Financial Management Services, Chief Accountants/Heads of Accounting Units, Budget Officers/Heads of Budget Units of National Government Agencies (NGAs) and All Others Concerned

SUBJECT : Guidelines on the Submission of Year-End Financial Statements and Other Reports/Schedules for Inclusion in the Annual Financial Report (AFR) for NGAs for FY 2006 and Onwards

1.0 RATIONALE The Commission on Audit is mandated under Article IX-D of the 1987 Philippine Constitution to submit to the Office of the President and the Congress, an annual report on the financial condition and on the results of operations of all agencies of the government not later than September 30 of each year. 2.0 PURPOSE This Accounting Circular Letter is issued to prescribe guidelines and procedures for all NGAs on the following: 2.1 Submission of year-end financial statements and other reports/schedules in printed and digital (diskette or compact disc) copies for inclusion in the AFR for FY 2006 and onwards ; and 2.2 Conversion of accounts in compliance to COA Accounting Circular No. 2006-001 dated November 9, 2006. 3.0 GUIDELINES AND PROCEDURES 3.1 The Chief Accountant/Head of Accounting Unit shall submit directly to Government Accountancy and Financial Management Information System (GAFMIS) Sector, this Commission and Audit Team Leader (ATL)/Auditor concerned, the following year-end financial statements and

reports/schedules in printed and digital copies on or before February 14, of each year pursuant to GAFMIS Circular Letter No. 2003-007 dated December 19, 2003: a. Pre-Closing Trial Balance b. Post-Closing Trial Balance c. Detailed and Condensed Statements of Income and Expenses d. Detailed and Condensed Balance Sheets e. Statement of Changes in Government Equity f. Statement of Cash Flows (Direct Method) g. Notes to Financial Statements h. Statement of Management Responsibility i. Detailed Breakdown of Obligations j. Detailed Breakdown of Disbursements k. Report of Income National Government Books l. Report of Income Regular Agency Books m. Regional Breakdown of Income n. Regional Breakdown of Expenses o. Schedule/Aging of Accounts Payable p. Schedule/Aging of Accounts Receivable q. Schedules of Public Infrastructures/Reforestation Projects 3.2 The printed and digital copies of the reports required under 3.1 of this Accounting Circular Letter shall be stamped received by the ATL/Auditor to ensure that the data submitted to GAFMIS Sector are the same data submitted to the ATL/Auditor for the Annual Audit Report preparation. 3.3 The Budget Officer/Head of Budget Unit shall submit the Statement of Allotments, Obligations and Balances (SAOB) and Detailed Breakdown of Obligations of the current year to GAFMIS Sector in printed and digital copies. 3.4 The Budget Officer/Head of Budget Unit shall also submit a List of Not Yet Due and Demandable Obligations (Annex A). Such obligations which are not yet recorded as liabilities are agencies valid commitments based on approved contracts/purchase orders where projects are not yet implemented and/or goods are not yet delivered. The same shall be disclosed in the Notes to Financial Statements. 3.5 In compliance to COA Accounting Circular No. 2006-001 dated November 9, 2006, the following cash transactions shall be analyzed and the accounts shall be reclassified to the appropriate account: Transactions 1. Cash Advance for Payroll recorded as Appropriate Account Payroll Fund (Code 106) Account Description Cash advances to disbursing officers

Cash - Disbursing Officers

for salaries and wages and other benefits of officers and employees Advances to Officers Cash advances and Employees (Code granted for travel and 148) for special purpose/time-bound undertaking

2. Cash Advance for Special Purpose/Time - bound Undertaking recorded as Cash Disbursing Officers or as Due from Officers and Employees 3. Fund Transfer to Field Offices

Central/Head Office (CO/HO) Book:

Fund transfer to field offices covering budgetary requirements for Subsidy to RO/ Current Operating Branches (Code 872) Expenses (PS, MOOE and FE) Regional Offices/ Branches Book: Subsidy from CO/HO (Code 653)

For this purpose, a Journal Entry Voucher shall be prepared using the foregoing account titles and codes. 4.0 PENALTY CLAUSE Failure of the officials/employees concerned to comply with the requirements of this Accounting Circular Letter shall cause the automatic suspension of the payment of their salaries and other emoluments until they have complied therewith. Violation of this provision for at least three (3) times shall subject the offender to administrative disciplinary action imposed under Section 55, Chapter 10, Title 1.B, Book V of Executive Order No. 292, the Administrative Code of 1987. 5.0 SAVING CLAUSE Cases not covered in this Accounting Circular Letter shall be referred to the GAFMIS Sector, this Commission, for resolution. 6.0 REPEALING CLAUSE

All circulars, memoranda and other issuances or parts thereof which are inconsistent with the provisions of this Accounting Circular Letter are hereby rescinded/repealed accordingly. 7.0 EFFECTIVITY This Accounting Circular Letter shall take effect immediately.

You might also like

- COA Accounting CL2007-002Document3 pagesCOA Accounting CL2007-002Robehgene Atud-JavinarNo ratings yet

- Coa C2015-004Document3 pagesCoa C2015-004Robelle RizonNo ratings yet

- Coa C99-004Document14 pagesCoa C99-004bolNo ratings yet

- COA CIRCULAR NO. 96 006 May 2 1996Document3 pagesCOA CIRCULAR NO. 96 006 May 2 1996Marcellanne VallesNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- Coa C2006-003Document2 pagesCoa C2006-003Russel SarachoNo ratings yet

- Commission On Audit: 2t/rp:uhlir NFDocument4 pagesCommission On Audit: 2t/rp:uhlir NFJuan Luis LusongNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceHanabishi RekkaNo ratings yet

- Revenue Memorandum Order No. 1-2016Document5 pagesRevenue Memorandum Order No. 1-2016Denise CruzNo ratings yet

- Coa C2017-004Document14 pagesCoa C2017-004RonnelMananganCorpuzNo ratings yet

- C92-375 - Closing and Opening of Books of Accounts Due To Merging, Conso, & TransferDocument8 pagesC92-375 - Closing and Opening of Books of Accounts Due To Merging, Conso, & TransferHoven MacasinagNo ratings yet

- CebuCity ES08Document7 pagesCebuCity ES08Jess JessNo ratings yet

- Finance Depatment Notifications-2002 (55-164)Document96 pagesFinance Depatment Notifications-2002 (55-164)Humayoun Ahmad Farooqi100% (1)

- 7082179Document40 pages7082179Marry Shane BetonioNo ratings yet

- Coa C2017-004Document8 pagesCoa C2017-004Tom Louis HerreraNo ratings yet

- RMC No 68-2017 PDFDocument2 pagesRMC No 68-2017 PDFPatrick John Castro BonaguaNo ratings yet

- Granting, Utilization and Liquidation of Cash AdvancesDocument8 pagesGranting, Utilization and Liquidation of Cash Advancesduskwitch100% (1)

- San Miguel Executive Summary 2011Document12 pagesSan Miguel Executive Summary 2011Justine CastilloNo ratings yet

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDocument15 pagesREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNo ratings yet

- New Government Accounting System (Ngas) : Mr. Antonio P. Retrato, Cpa Chief Accountant Odc, PNPDocument56 pagesNew Government Accounting System (Ngas) : Mr. Antonio P. Retrato, Cpa Chief Accountant Odc, PNPRainier NabarteyNo ratings yet

- Assignment Account ProcedureDocument24 pagesAssignment Account ProcedureAshraf Ali0% (1)

- Accounting Handbook For Regional Controllers PDFDocument66 pagesAccounting Handbook For Regional Controllers PDFAntara DeyNo ratings yet

- Commission On Audit Circular No 96-011 - Delayed Submission of Banc ReconDocument3 pagesCommission On Audit Circular No 96-011 - Delayed Submission of Banc ReconAr LineNo ratings yet

- COA - Chart of AccountsDocument54 pagesCOA - Chart of AccountsJeffrey Camiguing100% (1)

- Updates On Accounting and Auditing Reforms PDFDocument85 pagesUpdates On Accounting and Auditing Reforms PDFkenvysNo ratings yet

- GaDocument39 pagesGaRomeo Baldevia100% (1)

- Coa 2016-006Document8 pagesCoa 2016-006Genesis Caesar ManaliliNo ratings yet

- COA Circular 2020-001 DTD January 8, 2020 Revised Chart of AccountsDocument2 pagesCOA Circular 2020-001 DTD January 8, 2020 Revised Chart of AccountssssancoberNo ratings yet

- Report of Disbursement - 1st QuarterDocument2 pagesReport of Disbursement - 1st Quartertesdaro12No ratings yet

- RMC No. 10-2020Document2 pagesRMC No. 10-2020Volt LozadaNo ratings yet

- Coa Circular 97-002 (Cash Advance)Document9 pagesCoa Circular 97-002 (Cash Advance)Abajoy Albinio100% (2)

- Coa C97-001Document5 pagesCoa C97-001anon_640773580No ratings yet

- Govt Accounts NotesDocument11 pagesGovt Accounts NotesManoj SainiNo ratings yet

- Principles of Accounting in New Accounting ModelDocument43 pagesPrinciples of Accounting in New Accounting ModelMudassar Nawaz100% (1)

- RMO 11-2005 (Corrected Version)Document12 pagesRMO 11-2005 (Corrected Version)simey_kizhie07No ratings yet

- Oton Executive Summary 2017Document5 pagesOton Executive Summary 2017Franz FulhamNo ratings yet

- Commercial Account MannualDocument51 pagesCommercial Account MannualRohit VermaNo ratings yet

- NGAS LectureDocument56 pagesNGAS LectureVenianNo ratings yet

- 27 EtdsDocument29 pages27 EtdsSuhag PatelNo ratings yet

- eSRE PRIMER PDFDocument20 pageseSRE PRIMER PDFBelenReyes100% (1)

- Ddo ChecklistDocument14 pagesDdo ChecklistJuan David MateusNo ratings yet

- Saaodb 2014 1st QTRDocument2 pagesSaaodb 2014 1st QTRtesdaro12No ratings yet

- OdionganDocument7 pagesOdionganJohn Claude TabanNo ratings yet

- 2016-006 Write OffDocument7 pages2016-006 Write OffHaryeth CamsolNo ratings yet

- Budgetcircular2010 11Document109 pagesBudgetcircular2010 11Vikas AnandNo ratings yet

- Quezon Executive Summary 2021 PDFDocument4 pagesQuezon Executive Summary 2021 PDFEsnar de Castro Jr.No ratings yet

- Budget Call Circular 2015-2016: Government of Pakistan Finance Division IslamabadDocument50 pagesBudget Call Circular 2015-2016: Government of Pakistan Finance Division IslamabadArshad Khan AfridiNo ratings yet

- Revenue Memorandum Order No. 4-2007: I. BackgroundDocument7 pagesRevenue Memorandum Order No. 4-2007: I. BackgroundtoniNo ratings yet

- Santa Maria Executive Summary 2016Document10 pagesSanta Maria Executive Summary 2016Brene Joseph LuzNo ratings yet

- Fin e 224 2020 PDFDocument8 pagesFin e 224 2020 PDFGowtham RajNo ratings yet

- CamDocument537 pagesCamNag RajanNo ratings yet

- MRD 2015Document191 pagesMRD 2015Russel SarachoNo ratings yet

- DOF DBM COA Joint Circular 1 2000Document7 pagesDOF DBM COA Joint Circular 1 2000fred_barillo09No ratings yet

- Rmo 28-07Document31 pagesRmo 28-07nathalie velasquezNo ratings yet

- Commission On Audit Circular No. 92-89E March 8, 1992 TO: All Heads of Departments, Chiefs of Bureaus and Offices of The NationalDocument7 pagesCommission On Audit Circular No. 92-89E March 8, 1992 TO: All Heads of Departments, Chiefs of Bureaus and Offices of The NationalFrances Diane Arnaiz SegurolaNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Conflict of Laws Paras and Salonga Reviewer PDFDocument40 pagesConflict of Laws Paras and Salonga Reviewer PDFMisc Ellaneous100% (14)

- Conflict of Laws - REVIEWERDocument54 pagesConflict of Laws - REVIEWERcherylmoralesnavarro81% (16)

- Conflict of LawsDocument19 pagesConflict of LawsMiGay Tan-Pelaez94% (18)

- 2013 COMMERCIAL LAW EXAM MCQsDocument6 pages2013 COMMERCIAL LAW EXAM MCQsMisc EllaneousNo ratings yet

- Taxation Ii-Reviewer PDFDocument31 pagesTaxation Ii-Reviewer PDFMisc Ellaneous0% (1)

- Conflicts Sempio Diy Book ReviewerDocument22 pagesConflicts Sempio Diy Book ReviewerLawrence VillamarNo ratings yet

- Ateneo Central Bar Operations 2007 Civil Law Summer ReviewerDocument15 pagesAteneo Central Bar Operations 2007 Civil Law Summer ReviewerMiGay Tan-Pelaez85% (13)

- Consumer Lending Audit Program For ACUIADocument8 pagesConsumer Lending Audit Program For ACUIAMisc EllaneousNo ratings yet

- BIR Revenue Regulation No. 02-98 Dated 17 April 1998Document74 pagesBIR Revenue Regulation No. 02-98 Dated 17 April 1998wally_wanda93% (14)

- LANDBANK 2009 2010 Sustainability ReportDocument52 pagesLANDBANK 2009 2010 Sustainability ReportMisc Ellaneous100% (1)

- Coa Lo Doc & CR Rev SheetDocument8 pagesCoa Lo Doc & CR Rev SheetMisc EllaneousNo ratings yet

- Digested Case - PartnershipDocument5 pagesDigested Case - PartnershipMisc Ellaneous100% (3)

- Genocide - Bblical Vs Current IssueDocument18 pagesGenocide - Bblical Vs Current IssueMisc EllaneousNo ratings yet

- Crim Law & Proc Feb - 2013 SC DecisionDocument15 pagesCrim Law & Proc Feb - 2013 SC DecisionMisc EllaneousNo ratings yet

- 2012 Supreme Court Decisions On Political LawDocument130 pages2012 Supreme Court Decisions On Political LawMisc EllaneousNo ratings yet

- M2004-014 AnnexesDocument3 pagesM2004-014 AnnexesLino GumpalNo ratings yet

- Circular Date: 1.0 RatiomtleDocument8 pagesCircular Date: 1.0 RatiomtleMisc EllaneousNo ratings yet

- Crim Law & Proc Dec-2012 SC DecisionsDocument2 pagesCrim Law & Proc Dec-2012 SC DecisionsMisc EllaneousNo ratings yet

- Uraccs CSC MC 19 s1999Document15 pagesUraccs CSC MC 19 s1999Misc EllaneousNo ratings yet

- Grno July: July Philippine Supreme Court Decisions On Commercial LawDocument2 pagesGrno July: July Philippine Supreme Court Decisions On Commercial LawMisc EllaneousNo ratings yet

- Eo 298Document7 pagesEo 298Carl Mark A. GanhinhinNo ratings yet

- Paytm - One 97 Communications Limited ProspectusDocument497 pagesPaytm - One 97 Communications Limited Prospectuschiranjeevimd2991 MDNo ratings yet

- Sample Board Policies and ProceduresDocument21 pagesSample Board Policies and Proceduresobx4everNo ratings yet

- SIP Report PDFDocument31 pagesSIP Report PDFAnushka MadanNo ratings yet

- Popular Industries: EdappallyDocument79 pagesPopular Industries: EdappallyAlex John MadavanaNo ratings yet

- General Manager or Transportation Dispatcher or Sales ManagerDocument2 pagesGeneral Manager or Transportation Dispatcher or Sales Managerapi-77310405No ratings yet

- Out PDFDocument16 pagesOut PDFsuharditaNo ratings yet

- Assignment Contractor Ledger PracticeDocument32 pagesAssignment Contractor Ledger Practicefareha riazNo ratings yet

- Cmo 54-1991Document8 pagesCmo 54-1991mick_15No ratings yet

- ExpenditureCycle (Purchase Order - Receiving Report - Voucher)Document3 pagesExpenditureCycle (Purchase Order - Receiving Report - Voucher)Queen ValleNo ratings yet

- Theories ReceivableDocument26 pagesTheories ReceivableMark Gelo WinchesterNo ratings yet

- Jeena SikhoDocument301 pagesJeena Sikhovishal jainNo ratings yet

- Bookkeeping Vs AccountingDocument7 pagesBookkeeping Vs AccountingEfren VillaverdeNo ratings yet

- Ammonia Code Guide FinalDocument230 pagesAmmonia Code Guide FinalSami ThirunavukkarasuNo ratings yet

- Accounting Information Systems - CourseWork - 2023-2024Document2 pagesAccounting Information Systems - CourseWork - 2023-2024jasminekaur2023No ratings yet

- Questions Test - 1Document41 pagesQuestions Test - 1Majdi Fahmi Alkayed100% (1)

- Cooperative Functions and ResponsibilitiesDocument14 pagesCooperative Functions and Responsibilitiesportia sollano100% (1)

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- Circ Ual TionDocument17 pagesCirc Ual Tionselvam311No ratings yet

- A Study On Budgetary Control Management With Reference To Bescal Steel Industries (2018-2022)Document93 pagesA Study On Budgetary Control Management With Reference To Bescal Steel Industries (2018-2022)Santhiya SriramNo ratings yet

- Introduction To Management AccountingDocument33 pagesIntroduction To Management Accountingsimranarora2007100% (1)

- SUGI Annual Report 2014Document149 pagesSUGI Annual Report 2014Widya HayuNo ratings yet

- Internal Quality Audit Rev 00Document26 pagesInternal Quality Audit Rev 00Keith AmorNo ratings yet

- Quality Manual: " Quality Is Delivered by People, To People, Through People"Document20 pagesQuality Manual: " Quality Is Delivered by People, To People, Through People"Danish SakhawatNo ratings yet

- SAP Closing Cockpit PDFDocument32 pagesSAP Closing Cockpit PDFviru2all100% (1)

- Hyundai Settlement of Class ActionDocument5 pagesHyundai Settlement of Class ActionABC Action News25% (4)

- Verification of Plant & Machinery, Patents andDocument9 pagesVerification of Plant & Machinery, Patents andKarun NairNo ratings yet

- Procedures On Management System Certification: 1. PurposeDocument20 pagesProcedures On Management System Certification: 1. PurposeRohit SoniNo ratings yet

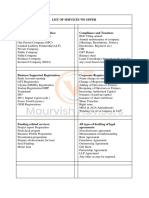

- Maurvish AdvisorsDocument2 pagesMaurvish Advisorsmrignagoel.dmpinstituteNo ratings yet

- Mas Mcqs All Topics 20 1 9Document72 pagesMas Mcqs All Topics 20 1 9Princess Diane RamirezNo ratings yet

- F-PUR-06 Vendor Accreditation Form - Rev03Document6 pagesF-PUR-06 Vendor Accreditation Form - Rev03Rhannie GarciaNo ratings yet