Professional Documents

Culture Documents

Chapter 22

Uploaded by

Tin ManOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 22

Uploaded by

Tin ManCopyright:

Available Formats

SOLUTIONS TO TEXT PROBLEMS:

Quick Quizzes 1. Buyers of life insurance will likely have higher than the average death rates. Because those with greater risks of death are more likely to buy life insurance, the price of life insurance will reflect the costs of a riskier-than-average person. Thus, buyers with low risk of death will find the price of life insurance to be too high and will not choose to purchase it. Moral hazard is the tendency of a person who is imperfectly monitored to engage in dishonest or otherwise undesirable behavior. A person with a high risk of death may be aware of his risk but not reveal this information to the insurance company. Adverse selection is the tendency for the mix of unobserved attributes to become undesirable from the standpoint of an uninformed party. In this case, the insurance company ends up insuring only those individuals who have high risks of death. A life insurance company may require that all applicants submit to a medical examination to deal with these problems. 2. According to the median voter theorem, if each voter chooses a point closest to his preferred point, the district vote will reflect the preferences of the median voter. Therefore, the district will end up with a student-teacher ratio of 10:1. 3. Human decision making can differ from the rational human being of conventional economic theory in three important ways: (1) people arent always rational, (2) people care about fairness, and (3) people are inconsistent over time. Questions for Review 1. Moral hazard is the tendency of a person who is imperfectly monitored to engage in dishonest or otherwise undesirable behavior. To reduce the severity of this problem, an employer may respond with (1) better monitoring, (2) paying efficiency wages, or (3) delaying part of a workers compensation. 2. Adverse selection is the tendency for the mix of unobserved attributes to become undesirable from the standpoint of an uninformed party. Examples of markets in which adverse selection might be a problem include the market for used cars and the market for insurance. 3. Signaling is an action taken by an informed party to reveal private information to an uninformed party. Job applicants may use a college diploma as a signal of ability.

Screening is an action taken by an uninformed party to induce an informed party to reveal information. A life insurance company may require applicants to submit to a health examination so that the company will have more information on the persons risk of death. 4. Condorcet noticed that the majority rule will fail to produce transitive properties for society. 5. The median voters preferences will beat out any other proposal in a two-way race because the median voter will have more than half of the voters on his side. 6. Two volunteers are chosen and a coin toss determines which volunteer is Player A and which is Player B. Player A proposes a split of a sum of money and then Player B decides whether to accept or reject the proposal. If Player B accepts, the sum of money is divided as outlined in the proposal. If Player B rejects the proposal, each player gets nothing. Conventional economic theory predicts that Player A will offer only $1 to Player B and keep the remainder for himself. This is predicted to occur because Player A knows that Player B will be better of with $1 than with $0. However, in reality, Player B generally rejects small proposals that he considers unfair. If Player A considers this, he will likely offer Player B a more substantial amount. Problems and Applications 1. a. The landlord is the principal and the tenant is the agent. There is asymmetric information because the landlord does not know how well the tenant will take care of the property. Having a tenant pay a security deposit increases the likelihood that the tenant will take care of the property in order to receive his deposit back. b. The stockholders of the firm (the owners) are the principals and the top executives are the agents. The firms owners do not know in advance how well the top executives will perform their duties. Tying some of the executives compensation to the value of the firm provides incentive for the executives to work hard to increase the value of the firm. c. The insurance company is the principal and the customer is the agent. Insurance companies do not know whether the car owner is likely to leave the vehicle parked with the keys in it or park it in a high crime area. Individuals who will go to the trouble of installing anti-theft equipment are more likely to ensure that their vehicle is taken care of. Offering a discount on insurance premiums will induce car owners to install such devices.

2.

Individuals who are relatively healthy may decide to forgo purchasing the policy if the premium rises. Thus, the insurance company is left with only those policyholders who are relatively unhealthy. This means that the firms revenues may in fact fall, but its costs could remain the same. Therefore, the firms profits could fall.

3.

Saying "I love you" is likely not a good signal. To be an effective signal, the signal must be costly. In fact, the signal must be less costly, or more beneficial, to the person with the higher-quality product. Simply professing one's love does not meet this requirement.

4.

If insurance companies were not allowed to determine if applicants are HIV-positive, more individuals who are HIV-positive would be able to purchase insurance, but that insurance would be very expensive. Covering these individuals would raise the cost of providing health insurance and the company would have to raise premiums for all. Thus, individuals who are not HIV-positive would be forced to pay more for health insurance and may drop coverage. Insurance companies would be left insuring only those who are ill (including those who are HIV-positive) increasing the adverse selection problem. The number of individuals without health insurance would likely rise as a result.

5.

If the needy are given cash, they can use the cash to purchase whatever they most desire. This will increase their utility by more than if the government predetermines what they need. However, if the government is worried about how these individuals may spend the cash and wants to ensure that the needy receive proper nutrition, they may want to provide free meals at a soup kitchen instead.

6.

Ken is violating the property of independence of irrelevant alternatives. Adding a choice of strawberry after he chooses vanilla over chocolate should not induce him to change his mind and prefer chocolate.

7.

It is possible that a minority of voters is willing to contribute large sums of money to a candidate who supports their viewpoint. Running a political campaign is very expensive and a candidate may be able to gain support through expensive advertising. Thus, the candidate may choose to support the views of those individuals who can help finance his campaign.

8.

More than likely the two stands will locate at the center of the beach. Thus, they will always be closest for at least half of the beach goers.

9.

An earthquake occurring in California does not increase the probability that another will occur. Thus, nothing that affects the benefits from such insurance has really changed. The individuals are simply putting more emphasis than necessary on the event. However, if it were true that the individuals had no idea of the possible risks until the earthquake occurred, then purchasing the insurance would be a rational

thing to do.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Chapter 24Document3 pagesChapter 24Tin ManNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Chapter 23Document4 pagesChapter 23Tin ManNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter 21Document16 pagesChapter 21Tin ManNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Quick solutions to text problems and quizzes on compensating differentials, discrimination, and human capitalDocument5 pagesQuick solutions to text problems and quizzes on compensating differentials, discrimination, and human capitalTin ManNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter 20Document5 pagesChapter 20Tin ManNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Chapter 18Document11 pagesChapter 18Tin ManNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Scholars of Hadith Methodology in Dealing With The Two Sahihs: The Criticized Ahadith As A Model. Ammar Ahmad Al-HaririDocument37 pagesScholars of Hadith Methodology in Dealing With The Two Sahihs: The Criticized Ahadith As A Model. Ammar Ahmad Al-HaririSalah KhanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Chapter 08Document18 pagesChapter 08soobraNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Euro4 vehicle diesel engines 199 - 397 kW (270 - 540 hpDocument6 pagesEuro4 vehicle diesel engines 199 - 397 kW (270 - 540 hpBranislava Savic63% (16)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- No.6 Role-Of-Child-Health-NurseDocument8 pagesNo.6 Role-Of-Child-Health-NursePawan BatthNo ratings yet

- Mama Leone's Profitability AnalysisDocument6 pagesMama Leone's Profitability AnalysisLuc TranNo ratings yet

- Main Hoon Na - WikipediaDocument8 pagesMain Hoon Na - WikipediaHusain ChandNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- E Learning: A Student Guide To MoodleDocument16 pagesE Learning: A Student Guide To MoodleHaytham Abdulla SalmanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Principles of SamplingDocument15 pagesPrinciples of SamplingziggerzagNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Biomechanics of Advanced Tennis: January 2003Document7 pagesBiomechanics of Advanced Tennis: January 2003Katrien BalNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- HP 5973 Quick ReferenceDocument28 pagesHP 5973 Quick ReferenceDavid ruizNo ratings yet

- Zhihua Yao - Dignaga and The 4 Types of Perception (JIP 04)Document24 pagesZhihua Yao - Dignaga and The 4 Types of Perception (JIP 04)Carlos Caicedo-Russi100% (1)

- Estwani ISO CodesDocument9 pagesEstwani ISO Codesनिपुण कुमारNo ratings yet

- Critique On A Film Director's Approach To Managing CreativityDocument2 pagesCritique On A Film Director's Approach To Managing CreativityDax GaffudNo ratings yet

- Color Codes and Irregular Marking-SampleDocument23 pagesColor Codes and Irregular Marking-Samplemahrez laabidiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Keberhasilan Aklimatisasi Dan Pembesaran Bibit Kompot Anggrek Bulan (Phalaenopsis) Pada Beberapa Kombinasi Media TanamDocument6 pagesKeberhasilan Aklimatisasi Dan Pembesaran Bibit Kompot Anggrek Bulan (Phalaenopsis) Pada Beberapa Kombinasi Media TanamSihonoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Wika Type 111.11Document2 pagesWika Type 111.11warehouse cikalongNo ratings yet

- Eudragit ReviewDocument16 pagesEudragit ReviewlichenresearchNo ratings yet

- Power Bi ProjectsDocument15 pagesPower Bi ProjectssandeshNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Ne 01 20 09 2018Document436 pagesNe 01 20 09 2018VaradrajNo ratings yet

- The Wafer-God and the Bloody History of the VaticanDocument58 pagesThe Wafer-God and the Bloody History of the VaticanMin Hotep Tzaddik BeyNo ratings yet

- Operation Guide For The Mercedes-Benz GLA/CLADocument5 pagesOperation Guide For The Mercedes-Benz GLA/CLASantosh TalankarNo ratings yet

- Castel - From Dangerousness To RiskDocument10 pagesCastel - From Dangerousness To Riskregmatar100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- 4 - Complex IntegralsDocument89 pages4 - Complex IntegralsryuzackyNo ratings yet

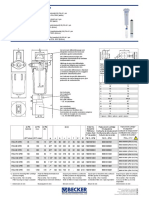

- Medical filter performance specificationsDocument1 pageMedical filter performance specificationsPT.Intidaya Dinamika SejatiNo ratings yet

- Shimano Brakes ManualDocument36 pagesShimano Brakes ManualKon Arva100% (1)

- LLM DissertationDocument94 pagesLLM Dissertationjasminjajarefe100% (1)

- 277Document18 pages277Rosy Andrea NicolasNo ratings yet

- Startups Helping - India Go GreenDocument13 pagesStartups Helping - India Go Greensimran kNo ratings yet

- 3 Steel Grating Catalogue 2010 - SERIES 1 PDFDocument6 pages3 Steel Grating Catalogue 2010 - SERIES 1 PDFPablo MatrakaNo ratings yet

- Quality CircleDocument33 pagesQuality CircleSudeesh SudevanNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)