Professional Documents

Culture Documents

Proof of travel not required for LTA claims: SC

Uploaded by

yagayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proof of travel not required for LTA claims: SC

Uploaded by

yagayCopyright:

Available Formats

1.

Proof of travel not required for claiming LTA: Supreme Court

Employers, while assessing the conveyance and leave & travel allowance (LTA) claims of their staff, are under no statutory obligation to collect supporting evidence and furnish them to tax authorities, the Supreme Court said on Wednesday. A bench comprising Justice SH Kapadia and Justice Aftab Alam said that assessee employers are under no statutory obligation to collect bills and details to prove that the employees had utilized the amounts obtained against these claims on travel and related expenses. According to prevailing rules, if claims on LTA and conveyance are not supported by journey bills, they would be taxed. For instance, on an LTA allowance of Rs 1 lakh, if documentary proof such as air tickets, taxi vouchers and other public transport bills are submitted only for Rs 50,000, then tax is applicable on the rest of the amount. Regardless of the amount an executive is entitled to as LTA, tax laws allow air tickets only in the domestic sector for the claim. The apex court order came in a plea by companies including Larsen &Toubro and ITI. In its defense, the revenue department had argued that assessee companies were under statutory obligation under Income Tax Act, 1961, and relevant rules, to collect documentary proof to show that their employee(s) had actually utilized the amount paid towards the leave travel concession and conveyance allowance. Rejecting the plea, the court in its order said: The beneficiary of exemption under Section 10(5) (of the Income Tax Act) is an individual employee. There is no circular of Central Board of Direct Taxes (CBDT) requiring the employer under Section 192 to collect and examine the supporting evidence to the declaration to be submitted by an employee(s).

Taxability of Leave Travel Allowance (LTA)

Leave Travel Allowance (LTA) is the most common element of compensation adopted by employers to remunerate employees due to the tax benefits attached to it. Section 10(5) of the Income-Tax Act, 1961, read with Rule 2B, provides for the exemption and outlines the conditions subject to which LTA is exempt. Through this write-up, I want to shed light on the taxability and some other interesting relevant aspects which you as a salaried employee must keep in mind. Who and what is covered? Exemption of Fare Only - LTA exemption can be claimed where the employer provides LTA to employee for leave to any place in India taken by the employee and their family. Such exemption is limited to the extent of actual travel costs incurred by the employee. Travel has to be undertaken within India and overseas destinations are not covered for exemption. Exemption on Actual Expense - For example, where an employer provides LTA of Rs 25,000, but an employee spends only Rs 20,000 on the travel cost, then the exemption is limited to only Rs. 20,000. Travel cost means the cost of travel and does not include any other expenses such as food, hotel stay etc. The meaning of family for the purposes of exemption includes spouse and children and parents, brothers and sisters who are wholly or mainly dependent on you. An individual would not be able to claim the exemption in relation to his parents, brother or sisters unless they are wholly or mainly dependent on the individual. Further, exemption is not available for more than two children of an individual born after October 01, 1998.

This restriction does not apply in respect of children born before this date, and also in cases where an individual, after having one child, begets multiple children (twins or triplets or quadruplets, etc.) on the second occasion. The term Child includes a step-child and an adopted child of the individual. Is exemption available every year? No. The tax rules provide for an exemption only in respect of two journeys performed in a block of four calendar years. The current block runs from 2010-2013. If an individual does not use their exemption during any block on any one or on both occasions, their exemption can be carried over to the next block and used in the calendar year immediately following that block. In such cases, the journey performed to claim such exemption will not be counted for the purposes of regulating future exemptions allowable for the succeeding block. For example, Mr. X joins an organization on April 1, 2008 and is entitled to a LTA of Rs 30,000 per annum (financial year 2008-09). X undertook a journey in December 2008 and used his exemption. However, for his LTA entitlement for 2009-10, he did not undertake a journey during the calendar year 2009. He can undertake the journey in 2010 to claim the exemption in relation to the LTA. He would also be able to use the LTA benefit for two other journeys which he can undertake in the current block 2010-13 in relation to his LTA entitlement for future years. Proof of travel Recently Supreme Court has held in the case of Larsen & Toubro and ITI 181 Taxmann 71that employers are under no statutory obligation to collect bills and details to prove that the employees had utilized the amounts obtained against these claims on travel and related expenses. Employers while assessing the travel allowance claims do not need to collect proof of travel to submit to the tax authorities. Though it is not mandatory for employers to demand proof, they still have the right to demand documentary proof depending on its policy. The Judgment of Supreme Court has only moved the responsibility from the employer to the employee, the assessing officer can still ask for the employee to provide details of travel. The individual however needs to keep copies for his or her own records. Such proofs are helpful at the time of the audit of the tax return of the individual. Proof of travel could be, for example, tickets, boarding passes, invoice of travel agent, duty slip etc. During the Fringe Benefit tax (FBT) regime, provision of paid holidays, including travel cost to any place, stay expenses etc. were subject to FBT in the hands of employers and were not taxable in the hands of individuals. Many employers extended the paid holiday benefit instead of LTA. Now with the elimination of FBT , with effect from. April 1, 2009, paid holiday benefit is fully taxable in the hands of employees and, therefore, employers are reintroducing the LTA element by withdrawing the paid holidays benefit. Does claiming LTA in alternate years mean that the two year entitlement gets added together?

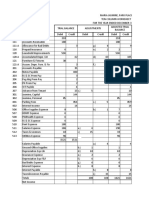

It does. If you are entitled to an LTA of Rs.10,000 per year and do not utilize it for the the first year it is carried forward to the next year. In the second year you can claim the entire amount (Rs.20,000) as tax exempt provided you spend it according to the specification in LTA tax laws as detailed above. Carry over concession for Leave Travel Allowance Leave Travel Allowance (LTA) comes with a carry forward feature. You can carry forward your Leave Travel Allowance in the situation that it has not been used. It can be brought forward and claimed in the first year of the next block. Amount Exempted 1. Journey performed by Air - Economy Air fair of National carrier by the shortest route or the amount spent whichever is less will be exempt 2. Journey performed by Rail A.C. first class rail fare by shortest route.or amount spent whichever is less will be exempt. 3. Place of origin and destination place of journey connected by rail but journey performed by other mode of transport - A.C. first class rail fare by shortest route or amount spent whichever is less. 4. Place of origin& destination not connected by rail(partly/fully) but connected by other recognised Public transport system - First class or deluxe class fare by shortest route or amount spent whichever is less. 5. Place of origin& destination not connected by rail(partly/fully) and not connected by other recognised Public transport system also AC first class rail fare by shortest route (as the journey had been performed by rail) or the amount actually spent ,whichever is less. Section 192 of the Income Tax Act:The Supreme Court held that an employer is under no obligation to collect and examine the supporting evidence to a declaration submitted by an employee to the effect that he has actually utilised the amounts for the specified purposes in deciding the liability to TDS u/s. 192. This was decided by SC in the case of ITI Limited 221 CTR 619. Same was also confirmed in the case of CIT v Larsen & Toubro 181 Taxmann 71.

You might also like

- CH 2 ExercisesDocument4 pagesCH 2 ExercisesAnonymous Jf9PYY2E80% (1)

- Leave Travel AllowanceDocument12 pagesLeave Travel AllowanceRahul SinghNo ratings yet

- AFAR 2 - SUMMATIVE TEST (CONSOLIDATED) THEORIESDocument23 pagesAFAR 2 - SUMMATIVE TEST (CONSOLIDATED) THEORIESVon Andrei Medina100% (1)

- Anjo LTD Case For Variance AnalysisDocument14 pagesAnjo LTD Case For Variance AnalysisRohan Raj Mishra100% (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- PBA Vs CADocument11 pagesPBA Vs CANorma WabanNo ratings yet

- Oracle Fusion HRMS For UAE Payroll Setup White Paper Rel11Document173 pagesOracle Fusion HRMS For UAE Payroll Setup White Paper Rel11FerasHamdanNo ratings yet

- Salary Structure CalculatorDocument6 pagesSalary Structure CalculatorNisha_Yadav_6277No ratings yet

- LEAVE TRAVEL ALLOWANCE POLICYDocument6 pagesLEAVE TRAVEL ALLOWANCE POLICYVipin SinghNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Definition and Nature of Management ControlDocument4 pagesDefinition and Nature of Management ControlAlma Calvelo Musni100% (2)

- State Audit Code of The Philippines (P.D. 1445)Document37 pagesState Audit Code of The Philippines (P.D. 1445)Monique del Rosario100% (3)

- p176 Maria JasmineDocument9 pagesp176 Maria JasmineIsaiah Valencia100% (1)

- CIR vs. DLSU TaxDocument3 pagesCIR vs. DLSU TaxCedric ChingNo ratings yet

- Note On Salary TaxDocument10 pagesNote On Salary TaxnatarajevNo ratings yet

- LTA PolicyDocument2 pagesLTA PolicyAnuradha ParasaramNo ratings yet

- Page 1 of 1 Proof of Travel Not Required For Claiming LTA: SCDocument1 pagePage 1 of 1 Proof of Travel Not Required For Claiming LTA: SCrajendrapNo ratings yet

- Hindalco LTA Policy: Tax Rules and Claim Process in 38 CharactersDocument7 pagesHindalco LTA Policy: Tax Rules and Claim Process in 38 CharactersSharun JacobNo ratings yet

- What Is Leave Travel Allowance or LTADocument3 pagesWhat Is Leave Travel Allowance or LTAMukesh UpadhyeNo ratings yet

- 4thSem ImportantArea of Tax SunitaSaha 03May2020Document59 pages4thSem ImportantArea of Tax SunitaSaha 03May2020Sumat SharmaNo ratings yet

- LTC Procedural Norms PDFDocument5 pagesLTC Procedural Norms PDFsk_kannan26No ratings yet

- Taxation ProjectDocument12 pagesTaxation ProjectVeronicaNo ratings yet

- Tax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLDocument7 pagesTax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLmansiNo ratings yet

- Section 10Document42 pagesSection 10Mrigendra MishraNo ratings yet

- Salary Structure CalculatorDocument7 pagesSalary Structure CalculatorSwati ModoNo ratings yet

- Notes On LTA, Car Lease and Home InternetDocument3 pagesNotes On LTA, Car Lease and Home InternetRiu TypoNo ratings yet

- Note On Medical and Lta - 2010-11Document2 pagesNote On Medical and Lta - 2010-11Raj_Malhotra_9479No ratings yet

- Transfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Document11 pagesTransfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Vishal DubeyNo ratings yet

- Taxation Project 1Document15 pagesTaxation Project 1VeronicaNo ratings yet

- A Guide To Your Personal Income TaxDocument7 pagesA Guide To Your Personal Income TaxRekha SinghNo ratings yet

- Third Time Cess Payable On DTA Clearances From EOU To DTADocument4 pagesThird Time Cess Payable On DTA Clearances From EOU To DTAbijuprasadNo ratings yet

- 10 MUST Knows About LTADocument2 pages10 MUST Knows About LTAarsudhindraNo ratings yet

- CIR v. DLSU - CONSTI IIDocument4 pagesCIR v. DLSU - CONSTI IIJan Chrys MeerNo ratings yet

- Particula Rs of Journey Block Year 2014-17 Block Year 2018-21Document4 pagesParticula Rs of Journey Block Year 2014-17 Block Year 2018-21Priyank JainNo ratings yet

- Deloitte Tax Alert - Tax Is Deductible at Source On Year-End Provisions Created For Ascertained LiabilitiesDocument4 pagesDeloitte Tax Alert - Tax Is Deductible at Source On Year-End Provisions Created For Ascertained LiabilitiesRajuNo ratings yet

- LTA Claim FormDocument2 pagesLTA Claim FormVikas YadavNo ratings yet

- Finance & Accounts: Indian Institute of Technology IndoreDocument16 pagesFinance & Accounts: Indian Institute of Technology IndoreRajesh K. VishwakarmaNo ratings yet

- GST-603 Unit-3Document23 pagesGST-603 Unit-3GauharNo ratings yet

- LTC RelatedDocument4 pagesLTC RelatedDheeraj SharmaNo ratings yet

- LTC - Procedural Requirements - NewDocument3 pagesLTC - Procedural Requirements - NewKausik GangopadhyayNo ratings yet

- LTA Policy SummaryDocument4 pagesLTA Policy SummaryRavi KumarNo ratings yet

- Service Tax AssignmentDocument9 pagesService Tax AssignmentRahat AdenwallaNo ratings yet

- Tax DigestDocument7 pagesTax DigestPhilip UlepNo ratings yet

- Institute of Nuclear Medicine and Allied Sciences (INMAS), TimarpurDocument24 pagesInstitute of Nuclear Medicine and Allied Sciences (INMAS), TimarpurRambres SainiNo ratings yet

- Reimbursement Guidelines FY2122Document3 pagesReimbursement Guidelines FY2122Ravi TejaNo ratings yet

- Leave Travel Allowance Rules & Exemption GuideDocument11 pagesLeave Travel Allowance Rules & Exemption GuideRuhita ThakurNo ratings yet

- Tax Brief - June 2012Document8 pagesTax Brief - June 2012Rheneir MoraNo ratings yet

- FAQ Reimbursement and Investment ProofsDocument8 pagesFAQ Reimbursement and Investment ProofsPrashant TiwariNo ratings yet

- Everything You Need to Know About Using LTA for Tax BenefitsDocument4 pagesEverything You Need to Know About Using LTA for Tax BenefitsBathina Srinivasa RaoNo ratings yet

- Taxation Law Project Provides Insights Into Fringe Benefits TaxDocument16 pagesTaxation Law Project Provides Insights Into Fringe Benefits TaxRakshit JoshiNo ratings yet

- BASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmanDocument14 pagesBASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmansaadmansheedyNo ratings yet

- Bir Ruling 047-2013Document8 pagesBir Ruling 047-2013Ar Yan SebNo ratings yet

- Tax GuideDocument27 pagesTax GuideanjaliNo ratings yet

- Allowances and Minmum Wage ActDocument22 pagesAllowances and Minmum Wage ActjinujithNo ratings yet

- Taxiation AssignmentDocument9 pagesTaxiation AssignmentNoman AreebNo ratings yet

- Question and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofDocument6 pagesQuestion and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofAnamika VatsaNo ratings yet

- So Just What Is Fringe Benefit Tax?Document5 pagesSo Just What Is Fringe Benefit Tax?jasrajaNo ratings yet

- Tax Income From SalaryDocument12 pagesTax Income From SalarybilalkmlNo ratings yet

- Tax Deduction at SourceDocument4 pagesTax Deduction at SourcevishalsidankarNo ratings yet

- Income From SalaryDocument18 pagesIncome From SalaryKejal JainNo ratings yet

- DT InterviewDocument37 pagesDT Interviewanjali aggarwalNo ratings yet

- SBI LFC Circular PDFDocument10 pagesSBI LFC Circular PDFGuru SrinivasanNo ratings yet

- Leave Travel Allowance Policy Effective April 2020Document6 pagesLeave Travel Allowance Policy Effective April 2020Ajay MaryaNo ratings yet

- Tax Deducted at Source ExplainedDocument31 pagesTax Deducted at Source ExplainedShaleenPatniNo ratings yet

- GratuatyDocument10 pagesGratuatymurugesh_mbahitNo ratings yet

- Cir Vs MitsubishiDocument3 pagesCir Vs MitsubishiPacta Sunct ServandaNo ratings yet

- Compendium OF Rules On Advances TO Government ServantsDocument76 pagesCompendium OF Rules On Advances TO Government ServantspenusilaNo ratings yet

- Fly Ash Delhi TribunalDocument3 pagesFly Ash Delhi TribunalyagayNo ratings yet

- A Brief Guide To Starting A Home Based Business: by Ian NicholsonDocument65 pagesA Brief Guide To Starting A Home Based Business: by Ian NicholsonfavouredsoulNo ratings yet

- Glossary Incoterms CourseDocument2 pagesGlossary Incoterms CourseyagayNo ratings yet

- Man Learns To Light FireDocument2 pagesMan Learns To Light FireyagayNo ratings yet

- Never Give UpDocument1 pageNever Give UpyagayNo ratings yet

- 21 Useful Charts 12-13 PDFDocument20 pages21 Useful Charts 12-13 PDFsanind12No ratings yet

- Disarming The Value KillersDocument18 pagesDisarming The Value KillersyagayNo ratings yet

- Father of NationDocument2 pagesFather of NationyagayNo ratings yet

- TMT India Predictions 2013Document36 pagesTMT India Predictions 2013yagayNo ratings yet

- Rule 5 of Point of Taxation RulesDocument1 pageRule 5 of Point of Taxation RulesyagayNo ratings yet

- Tmi IdDocument8 pagesTmi IdyagayNo ratings yet

- Press Release Wed 2013Document3 pagesPress Release Wed 2013yagayNo ratings yet

- DreamsDocument1 pageDreamsyagayNo ratings yet

- People Confuse Goals With Dreams and Wishes. Dreams and Wishes Are Nothing More Than Desires. Desires Become A Reality When They Are Supported byDocument1 pagePeople Confuse Goals With Dreams and Wishes. Dreams and Wishes Are Nothing More Than Desires. Desires Become A Reality When They Are Supported byyagayNo ratings yet

- Best Ways To Get Better Grades in Exams FoundDocument1 pageBest Ways To Get Better Grades in Exams FoundyagayNo ratings yet

- e-BRC Doc 1 2 2Document26 pagese-BRC Doc 1 2 2yagayNo ratings yet

- Press ReleasesDocument4 pagesPress ReleasesyagayNo ratings yet

- Survey Search and SeizureDocument130 pagesSurvey Search and SeizureyagayNo ratings yet

- CIT (1959) 37 ITR 66 (SC) .: Business ExpenditureDocument4 pagesCIT (1959) 37 ITR 66 (SC) .: Business ExpenditureyagayNo ratings yet

- Transport Subsidy SchemeDocument8 pagesTransport Subsidy SchemeyagayNo ratings yet

- CFORM TITLEDocument3 pagesCFORM TITLEyagayNo ratings yet

- Idtx 08 2012Document2 pagesIdtx 08 2012yagayNo ratings yet

- Hong Kong Budget 2013 14Document1 pageHong Kong Budget 2013 14yagayNo ratings yet

- Nedfi 23february2010Document3 pagesNedfi 23february2010yagayNo ratings yet

- Raj Television Network and OrsDocument17 pagesRaj Television Network and OrsyagayNo ratings yet

- Meryl Streep David Strathairn Architect Joseph Mazzello Salmon RiverDocument3 pagesMeryl Streep David Strathairn Architect Joseph Mazzello Salmon RiveryagayNo ratings yet

- FAQsDocument13 pagesFAQsyagayNo ratings yet

- A Brief Note On Tax Collected at Source Under Income Tax Act 1961Document2 pagesA Brief Note On Tax Collected at Source Under Income Tax Act 1961yagayNo ratings yet

- America Invents Act: Important Changes For PCT Applicants: WWW - Wipo.int/pct/enDocument28 pagesAmerica Invents Act: Important Changes For PCT Applicants: WWW - Wipo.int/pct/enyagayNo ratings yet

- Ashwani Chopra Family SettlementDocument12 pagesAshwani Chopra Family SettlementyagayNo ratings yet

- NFSA Tax Incentive GuideDocument13 pagesNFSA Tax Incentive GuideAnonymous Pb39klJNo ratings yet

- Taxation 2015 CasesDocument21 pagesTaxation 2015 CasesErika Mae GumabolNo ratings yet

- CPG ReviewerDocument57 pagesCPG ReviewerLuis LopezNo ratings yet

- Capital Gains Taxation in India: An OverviewDocument7 pagesCapital Gains Taxation in India: An OverviewshanikaNo ratings yet

- IAS 20 Summary NotesDocument5 pagesIAS 20 Summary NotesShiza ArifNo ratings yet

- Corse Cod: ACT328 Section: 1 Name: Shaheed AhmedDocument3 pagesCorse Cod: ACT328 Section: 1 Name: Shaheed AhmedSidad KurdistaniNo ratings yet

- Week 6Document8 pagesWeek 6Richelle GraceNo ratings yet

- Responsibility Accounting and Transfer PricingDocument2 pagesResponsibility Accounting and Transfer PricingLaraNo ratings yet

- Relazione Finanziaria Annuale Al 30 Giugno 2020 - Web - EngDocument133 pagesRelazione Finanziaria Annuale Al 30 Giugno 2020 - Web - Engyogesh kumarNo ratings yet

- FMII Review of FM I Assignment 1Document1 pageFMII Review of FM I Assignment 1Muhammad HamzaNo ratings yet

- Annual Report 2015Document390 pagesAnnual Report 2015Anonymous 7CxwuBUJz3No ratings yet

- Partnership Return Guide 2017Document90 pagesPartnership Return Guide 2017Sutraraj175No ratings yet

- 1 Villanueva vs. City of IloiloDocument26 pages1 Villanueva vs. City of IloiloAustine CamposNo ratings yet

- Ashok Leyland DCF TempletDocument9 pagesAshok Leyland DCF TempletSourabh ChiprikarNo ratings yet

- College of Accountancy and Business Administration: Partnership Operation Changes in CapitalDocument6 pagesCollege of Accountancy and Business Administration: Partnership Operation Changes in CapitalVenti AlexisNo ratings yet

- VDA DE RACHO Vs ILAGANDocument1 pageVDA DE RACHO Vs ILAGANJanex TolineroNo ratings yet

- Sales & Service TaxDocument13 pagesSales & Service TaxWeiling TanNo ratings yet

- Aima0106 Strategy PaperDocument11 pagesAima0106 Strategy PaperMichael VersageNo ratings yet

- Income Statement of Mahaweli Reach HotelDocument7 pagesIncome Statement of Mahaweli Reach Hotelदेवीना गिरीNo ratings yet

- Chapter 1Document15 pagesChapter 1Jape PreciaNo ratings yet

- FM SolvedDocument16 pagesFM SolvedHridesh BadaniNo ratings yet