Professional Documents

Culture Documents

Banking Cases

Uploaded by

Audrey DeguzmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Cases

Uploaded by

Audrey DeguzmanCopyright:

Available Formats

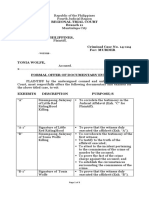

Home 1935 , Case Digest , G.R. No.

. L-43191 , Juris Doctor , Negotiable Instruments Case Digest , Negotiable Instruments Law Negotiable Instruments Case Digest: Gullas v. PNB (1935) Negotiable Instruments Case Digest: Gullas v. PNB (1935) Labels: 1935, Case Digest, G.R. No. L-43191, Juris Doctor, Negotiable Instruments Case Digest, Negotiable Instruments Law G.R. No. L-43191 November 13, 1935 Lessons Applicable: Notice of Dishonor (Negotiable Instrument) FACTS: August 2, 1933: Treasurer of the US for the United States Veterans Bureau issued a Warrant in the amount of $361, payable to the order of Francisco Sabectoria Bacos Atty. Paulino Gullas and Pedro Lopez signed as endorsers of this check cashed by the Philippine National Bank dishonored by Insular Treasurer outstanding balance of Attorney Gullas on the books of the bank was P509 August 20, 1933: Attorney Gullas left his residence for Manila so the notices of dishonor informing him that the amount of $366 was applied to his outstanding balance were not received by him August 31, 1933: Upon his return to Cebu, he received the notice of dishonor and paid the balance Inconveniences to Atty. Gullas: insurance unpaid due to lack of credit periodicals in the vicinity gave prominence to the news to the great mortification of Gullas ISSUE: W/N the bank had the right to automatically credit Gullas account and it was not prejudicial to him HELD: NO. Pay Gullas nominal damage of P250 it has been held a long line of authorities that notice of dishonor is in order to charge all indorser and that the right of action against him does not accrue until the notice is given GR: a bank has a right of set off of the deposits in its hands for the payment of any indebtedness to it on the part of a depositor However this may be, as to an indorser the situation is different, and notice should actually have been given him in order that he might protect his interests. BPI vs. IAC, 206 SCRA 408, February 21, 1992 Posted by Pius Morados on August 22, 2012 (Bank; Negligence; Meticulous Care in treatment of accounts) Facts: When the respondent spouses opened their joint current account, the new accounts teller of the bank by mistake, placed the old existing separate personal account number of Arthur Canlas on the deposit slip for the new joint checking account of the spouses so that the initial deposit for the joint checking account was miscredited to Arthurs personal account . Because of this, one of the checks issued by one of the spouse was dishonoured for insufficient funds prompting private respondents to file a complaint for damages against petitioner bank. Petitioner bank argues that it is not considered negligent and liable for damages on account of the inadvertence of its bank employee considered that it was an honest mistake and not tainted with malice and bad faith. Issue: WON the petitioner bank was guilty of gross negligence in the handling of private respondents bank account. Held: There is no merit in petitioners argument that it should not be considered negligent, much

less held liable for damages on account of the inadvertence of its bank employee for Article 1173 of the Civil Code only requires it to exercise the diligence of a good father of a family. As a business affected with public interest and because of the nature of its functions, the bank is under obligation to treat the accounts of its depositors with meticulous care, always having in mind the fiduciary nature of their relationship (Simex vs CA, 183 SCRA 360). Simex International Inc. vs. CA [G.R. No. 88013 March 19, 1990] Post under case digests, Commercial Law at Monday, February 27, 2012 Posted by Schizophrenic Mind Facts: Simex International is a private corporation engaged in the exportation of food products. It buys these products from various local suppliers and then sells them abroad, particularly in the United States, Canada and the Middle East. Most of its exports are purchased by the petitioner on credit. Simex is a depositor of TRB and maintained a checking account in its Cubao branch. Simex maintained an account in the amount of P100,000.00, thus increasing its balance as of that date to P190,380.74. Subsequently, the petitioner issued several (8) checks against its deposit but was surprised to learn later that they had been dishonored for insufficient funds. As a consequence, actions on the pending orders of SIMEX with the other suppliers (California Manufacturing Comp., Malabon Longlife Trading Corp., etc.) whose checks were dishonored was deferred. And thus made these companies send demand letters to SIMEX threatening prosecution if the checks were not made good. SIMEX complained to TRB and found out that the sum of P100,000.00 deposited had not been credited. The error was rectified on June 17, 1981, and the dishonored checks were paid after they were re-deposited. SIMEX sent demand letter for reparation against TRB, which was not met, thus a complaint was filed in CFI Rizal by SIMEX. The court denied the moral & exemplary damages but upheld and ordered TRB to pay for nominal damages in the amount of P20,000.00 plus attys fees & costs, which was then affirmed by the CA. The CA found with the trial court that the private respondent was guilty of negligence but agreed that the petitioner was nevertheless not entitled to moral damages. It said: The essential ingredient of moral damages is proof of bad faith (De Aparicio vs. Parogurga, 150 SCRA 280). Indeed, there was the omission by the defendant-appellee bank to credit appellant's deposit of P100,000.00 on May 25, 1981. But the bank rectified its records. It credited the said amount in favor of plaintiff-appellant in less than a month. The dishonored checks were eventually paid. These circumstances negate any imputation or insinuation of malicious, fraudulent, wanton and gross bad faith and negligence on the part of the defendant-appellant. It is this ruling that is faulted in the petition now before us. Issue: Whether or not TRB is guilty of negligence which warrants SIMEX reparation for damages. Held: YES. Award SIMEX with moral damages (P20,000) and exemplary damages (P50,000). The initial carelessness of the respondent bank, aggravated by the lack of promptitude in repairing its error, justifies the grant of moral damages. This rather lackadaisical attitude toward the complaining depositor constituted the gross negligence, if not wanton bad faith, that the respondent court said had not been established by the petitioner. There was also prejudice suffered by SIMEX in the fact that the petitioner's credit line was canceled and its orders were not acted upon pending receipt of actual payment by the suppliers. Its business declined. Its reputation was tarnished. Its standing was reduced in the business community. All this

was due to the fault of the respondent bank which was undeniably remiss in its duty to the petitioner. We shall recognize that the petitioner did suffer injury because of the private respondent's negligence that caused the dishonor of the checks issued by it. The immediate consequence was that its prestige was impaired because of the bouncing checks and confidence in it as a reliable debtor was diminished. In the case at bar, it is obvious that the respondent bank was remiss in that duty and violated that relationship. What is especially deplorable is that, having been informed of its error in not crediting the deposit in question to the petitioner, the respondent bank did not immediately correct it but did so only one week later or twenty-three days after the deposit was made. It bears repeating that the record does not contain any satisfactory explanation of why the error was made in the first place and why it was not corrected immediately after its discovery. Such ineptness comes under the concept of the wanton manner contemplated in the Civil Code that calls for the imposition of exemplary damages. SALVACION vs CENTRAL BANK 278 SCRA 27 FACTS: Greg Bartelli, an American tourist, was arrested for committing four counts of rape and serious illegal detention against Karen Salvacion. Police recovered from him several dollar checks and a dollar account in the China Banking Corp. He was, however, able to escape from prison. In a civil case filed against him, the trial court awarded Salvacion moral, exemplary and attorneys fees amounting to almost P1,000,000.00. Salvacion tried to execute the judgment on the dollar deposit of Bartelli with the China Banking Corp. but the latter refused arguing that Section 11 of Central Bank Circular No. 960 exempts foreign currency deposits from attachment, garnishment, or any other order or process of any court, legislative body, government agency or any administrative body whatsoever. Salvacion therefore filed this action for declaratory relief in the Supreme Court.

ISSUE: Should Section 113 of Central Bank Circular No. 960 and Section 8 of Republic Act No. 6426, as amended by PD 1246, otherwise known as the Foreign Currency Deposit Act be made applicable to a foreign transient? HELD: The provisions of Section 113 of Central Bank Circular No. 960 and PD No. 1246, insofar as it amends Section 8 of Republic Act No. 6426, are hereby held to be INAPPLICABLE to this case because of its peculiar circumstances. Respondents are hereby required to comply with the writ of execution issued in the civil case and to release to petitioners the dollar deposit of Bartelli in such amount as would satisfy the judgment. RATIO: Supreme Court ruled that the questioned law makes futile the favorable judgment and award of damages that Salvacion and her parents fully deserve. It then proceeded to show that the economic basis for the enactment of RA No. 6426 is not anymore present; and even if it still exists, the questioned law still denies those entitled to due process of law for being unreasonable and oppressive. The intention of the law may be good when enacted. The law failed to anticipate the iniquitous effects producing outright injustice and inequality such as the case before us. The SC adopted the comment of the Solicitor General who argued that the Offshore Banking

System and the Foreign Currency Deposit System were designed to draw deposits from foreign lenders and investors and, subsequently, to give the latter protection. However, the foreign currency deposit made by a transient or a tourist is not the kind of deposit encouraged by PD Nos. 1034 and 1035 and given incentives and protection by said laws because such depositor stays only for a few days in the country and, therefore, will maintain his deposit in the bank only for a short time. Considering that Bartelli is just a tourist or a transient, he is not entitled to the protection of Section 113 of Central Bank Circular No. 960 and PD No. 1246 against attachment, garnishment or other court processes. Further, the SC said: In fine, the application of the law depends on the extent of its justice. Eventually, if we rule that the questioned Section 113 of Central Bank Circular No. 960 which exempts from attachment, garnishment, or any other order or process of any court, legislative body, government agency or any administrative body whatsoever, is applicable to a foreign transient, injustice would result especially to a citizen aggrieved by a foreign guest like accused Greg Bartelli. This would negate Article 10 of the New Civil Code which provides that in case of doubt in the interpretation or application of laws, it is presumed that the lawmaking body intended right and justice to prevail. BPI vs Court of Appeals, 538 SCRA 184, GR No. 123498, November 23, 2007 Posted by Pius Morados on January 12, 2012 (Negotiable Instruments Money as a medium of exchange) Facts: Franco opened 3 accounts with BPI with the total amount of P2,000,000.00. The said amount used to open these accounts is traceable to a check issued by Tevesteco. The funding for the P2,000,000.00 check was part of the P80,000,000.00 debited by BPI from FMICs account (with a deposit of P100,000,000.00) and credited to Tevestecos account pursuant to an Authority to Debit which was allegedly forged as claimed by FMIC. Tevesteco effected several withdrawals already from its account amounting to P37,455,410.54 including the P2,000,000.00 paid to Franco. Franco issued two checks which were dishonoured upon presentment for payment due to garnishment of his account filed by BPI. BPI claimed that it had a better right to the amounts which consisted of part of the money allegedly fraudulently withdrawn from it by Tevesteco and ending up in Francos account. BPI urges us that the legal consequence of FMICs forgery claim is that the money transferred by BPI to Tevesteco is its own, and considering that it was able to recover possession of the same when the money was redeposited by Franco, it had the right to set up its ownership thereon and freeze Francos accounts. Issue: WON the bank has a better right to the deposits in Francos account. Held: No. Significantly, while Article 559 permits an owner who has lost or has been unlawfully deprived of a movable to recover the exact same thing from the current possessor, BPI simply claims ownership of the equivalent amount of money, i.e., the value thereof, which it had mistakenly debited from FMICs account and credited to Tevestecos, and subsequently traced to Francos account. Money bears no earmarks of peculiar ownership, and this characteristic is all the more manifest in the instant case which involves money in a banking transaction gone awry. Its primary function is to pass from hand to hand as a medium of exchange, without other evidence of its title. Money, which had been passed through various transactions in the general course of banking business, even if of traceable origin, is no exception.

FIRESTONE TIRE V. CA 353 SCRA 601 FACTS: Fojas Arca and Firestone Tire entered into a franchising agreement wherein the former had the privilege to purchase on credit the latters products. In paying for these products, the former could pay through special withdrawal slips. In turn, Firestone would deposit these slips with Citibank. Citibank would then honor and pay the slips. Citibank automatically credits the account of Firestone then merely waited for the same to be honored and paid by Luzon Development Bank. As this was the circumstances, Firestone believed in the sufficient funding of the slips until there was a time that Citibank informed it that one of the slips was dishonored. It wrote then a demand letter to Fojas Arca for the payment and damages but the latter refused to pay, prompting Firestone to file an action against it. HELD: The withdrawal slips, at the outset, are non-negotiable. Hence, the rule on immediate notice of dishonor is non-applicable to the case at hand. Thus, the bank was under no obligation to give immediate notice that it wouldn't make payment on the subject withdrawal slips. Citibank should have known that withdrawal slips are not negotiable instruments. It couldn't expect then the slips be treated like checks by other entities. Payment or notice of dishonor from respondent bank couldn't be expected immediately in contrast to the situation involving checks. In the case at bar, Citibank relied on the fact that LDB honored and paid the withdrawal slips which made it automatically credit the account of Firestone with the amount of the subject withdrawal slips then merely waited for LDB to honor and pay the same. It bears stressing though that Citibank couldn't have missed the non-negotiable character of the slips. The essence of negotiability which characterizes a negotiable paper as a credit instrument lies in its freedom to be a substitute for money. The withdrawal slips in question lacked this character. The withdrawal slips deposited were not checks as Firestone admits and Citibank generally was not bound to accept the withdrawal slips as a valid mode of deposit. Nonetheless, Citibank erroneously accepted the same as such and thus, must bear the risks attendant to the acceptance of the instruments. Firestone and Citibank could not now shift the risk to LDB for their committed mistake. G.R. No. 135882 June 27, 2001 MARQUEZ VS. DESIERTO FACTS: Petitioner Marquez received an Order from the Ombudsman Aniano A. Desierto to produce several bank documents for purposes of inspection in camera relative to various accounts maintained at Union Bank of the Philippines, Julia Vargas Branch, where she is the branch manager. The accounts to be inspected were involved in a case pending with the Ombudsman entitled, FactFinding and Intelligence Bureau (FFIB) v. Amado Lagdameo, et al. The basis of the Ombudsman ordering an in camera inspection of the accounts is a trail managers checks purchased by one George Trivinio, a respondent in OMB-097-0411, pending with the office of the Ombudsman by virtue of its power to investigate and to require the production and inspection of records and documents granted to it by RA No.6770. The Ombudsman issued an order directing petitioner to produce the bank documents relative to

accounts in issue in line of her persistent refusal to comply with Ombudsman's order which they sais as an unjustified, and is merely intended to delay the investigation of the case; constitutes disobedience of or resistance to a lawful order issued by this office punishable as Indirect under R.A. 6770. Petitioner together with Union Bank of the Philippines filed a petition for declaratory relief, prohibition and injunctions8 with the Regional Trial Court, Makati City, against the Ombudsman. The lower court denied petitioner's petition. On August 21, 1998, petitioner received a copy of the motion to cite her for contempt, filed with the Office of the Ombudsman by Agapito B. Rosales, Director, Fact Finding and Intelligence Bureau (FFIB). Petitioner filed with the Ombudsman an opposition to the motion to cite her in contempt on the ground that compliance with the Ombudsmans orders would be in violation of RA. No. 1405. But petitioners motion for reconsideration was dismissed. Hence, the present petition. ISSUE: Whether or not an in camera inspection of the questioned account is allowed as an exception to the law on secrecy of bank deposits (R.A. No.1405) HELD: The order of the Ombudsman to produce for in camera inspection the subject accounts with the Union Bank of the Philippines, Julia Vargas Branch, is based on a pending investigation at the Office of the Ombudsman against Amado Lagdameo, et. al. for violation of R.A. No. 3019, Sec. 3 (e) and (g) relative to the Joint Venture Agreement between the Public Estates Authority and AMARI. We rule that before an in camera inspection may be allowed, there must be a pending case before a court of competent jurisdiction. Further, the account must be clearly identified, the inspection limited to the subject matter of the pending case before the court of competent jurisdiction. The bank personnel and the account holder must be notified to be present during the inspection, and such inspection may cover only the account identified in the pending case. In the case at bar, there is yet no pending litigation before any court of competent authority. Whats existing is an investigation by the Office of the Ombudsman. In short, what the office of the ombudsman would wish to do is to fish for additional evidence to formally charge Amado Lagdameo, et. al., with the Sandiganbayan. Clearly, there was no pending case in court which would warrant the opening of the bank account for inspection. Zone of privacy are recognized and protected in our laws. Invasion of privacy is an offense in special laws like the Anti-Wiretapping Law, the Secrecy of Bank Deposits Act, and the Intellectual Property Code. IN VIEW WHEREOF, we GRANT the petition. We order the Ombudsman to cease and desist from requiring Union Bank Manager Lourdes T. Marquez, or anyone in her place to comply with the order dated October 14, 1998, and similar orders. No cost Case Digest on Mellon Bank v. Magsino et. al. GR No. 71479, 18 October 1990 November 11, 2010 Case Digest on Mellon Bank v. Magsino et. al. GR No. 71479, 18 October 1990 This case involves the erroneous transfer of US $1,000,000 to Victoria Javier instead of US $1,000 only. Dolores Ventosa requested the transfer of $1000 from the First National Bank of West

Virginia, USA to Victoria Javier in Manila through the Prudential Bank. Accordingly, the First National Bank requested the petitioner, Mellon Bank, to effect the transfer. Unfortunately, the wire sent by Mellon Bank to Manufacturers Hanover Bank, a correspondent of Prudential Bank, indicated the amount transferred as US $1,000,000.00 instead of US $1,000.00. Hence, Manufacturers Hanover Bank transferred one million dollars less bank charges of $6.30 to the Prudential Bank for the account of Victoria Javier. Javier opened a new dollar account in Prudential Bank and deposited $999,943. Immediately, thereafter, Javier and her husband made withdrawals from the account, deposited them in several banks only to withdraw them later in an apparent plan to conceal, launder and dissipate the erroneously sent amount. One of the things they bought was real property in California, USA which was the subject of an action for recovery by Mellon Bank. Later, it filed a case in the Philippines for the recovery of the whole amount, including the purchase price of the real property located in the US. Among other things, private respondents raised the issue of whether or not, by virtue of the principle of election of remedies, an action filed in California, USA, to recover real property located therein and to constitute a constructive trust on said property precludes the filing in our jurisdiction of an action to recover the purchase price of said real property. SC ruled that the filing of a recovery suit in the US does not preclude the filing of an action in the Philippines for the recovery of the purchase price. With regard to our subject matter, Erlinda Baylosis of the Philippine Veterans Bank and Pilologo Red, Jr. of Hongkong and Shanghai Banking Corporation were required to give testimonies with regard to the deposits and checks issued by the private respondents Javier, et. al.. These testimonies were questioned for being immaterial and irrelevant as well as covered by RA 1405 on confidentiality. SC said: Private respondents protestations that to allow the questioned testimonies to remain on record would be in violation of the provisions of RA 1405 on the secrecy of bank deposits is unfounded. Section 2 of said law allows the disclosure of bank deposits in cases where the money deposited is the subject matter of the litigation. Inasmuch as the civil case is aimed at recovering the amount converted by the Javiers for their own benefit, necessarily, an inquiry into the whereabouts of the illegally acquired amount extends to whatever is concealed by being held or recorded in the name of persons other than the one responsible for the illegal acquisition. Equitable vs NG, Dec. 19, 2007 Respondents Ng Sheung Ngor, Ken Appliance Division, Inc. and Benjamin E. Go filed an action for annulment and/or reformation of documents and contracts against petitioner Equitable PCI Bank (Equitable) and its employees, Aimee Yu and Bejan Lionel Apas, in the Regional Trial Court (RTC), Branch 16 of Cebu City. They claimed that Equitable induced them to avail of its peso and dollar credit facilities by offering low interest rates so they accepted Equitable's proposal and signed the bank's pre-printed promissory notes on various dates beginning 1996. They, however, were unaware that the documents contained identical escalation clauses granting Equitable authority to increase interest rates without their consent. Equitable, in its answer, asserted that respondents knowingly accepted all the terms and conditions contained in the promissory notes. In fact, they continuously availed of and benefited from Equitable's credit facilities for five years. THE PROMISSORY NOTES WERE VALID It is erroneous, to conclude that contracts of adhesion are invalid per se. They are, on the contrary, as binding as ordinary contracts. A party is in reality free to accept or reject it. A contract of adhesion becomes void only when the dominant party takes advantage of the weakness of the other party, completely depriving the latter of the opportunity to bargain on equal footing. That was not the case here. As the trial court noted, if the terms and conditions offered by Equitable had been truly prejudicial to respondents, they would have walked out and negotiated with another bank at the first available instance. But they did not. Instead, they continuously availed of Equitable's credit facilities for five long years.

ESCALATION CLAUSE VIOLATED THE PRINCIPLE OF MUTUALITY OF CONTRACTS Article 1308 of the Civil Code holds that a contract must bind both contracting parties; its validity or compliance cannot be left to the will of one of them. For this reason, we have consistently held that a valid escalation clause provides: 1. that the rate of interest will only be increased if the applicable maximum rate of interest is increased by law or by the Monetary Board; and 2. that the stipulated rate of interest will be reduced if the applicable maximum rate of interest is reduced by law or by the Monetary Board (de-escalation clause). With regard to the proper rate of interest, in New Sampaguita Builders v. Philippine National Bank we held that, because the escalation clause was annulled, the principal amount of the loan was subject to the original or stipulated rate of interest. Upon maturity, the amount due was subject to legal interest at the rate of 12% per annum. Consequently, respondents should pay Equitable the interest rates of 12.66% p.a. for their dollar-denominated loans and 20% p.a. for their pesodenominated loans from January 10, 2001 to July 9, 2001. Thereafter, Equitable was entitled to legal interest of 12% p.a. on all amounts due. THERE WAS NO EXTRAORDINARY DEFLATION Article 1250. In case an extraordinary inflation or deflation of the currency stipulated should intervene, the value of the currency at the time of the establishment of the obligation shall be the basis of payment, unless there is an agreement to the contrary. For extraordinary inflation (or deflation) to affect an obligation, the following requisites must be proven: 1. that there was an official declaration of extraordinary inflation or deflation from the Bangko Sentral ng Pilipinas (BSP); 2. that the obligation was contractual in nature; 3. that the parties expressly agreed to consider the effects of the extraordinary inflation or deflation. Despite the devaluation of the peso, the BSP never declared a situation of extraordinary inflation.Moreover, although the obligation in this instance arose out of a contract, the parties did not agree to recognize the effects of extraordinary inflation (or deflation). The RTC never mentioned that there was a such stipulation either in the promissory note or loan agreement. Therefore, respondents should pay their dollar-denominated loans at the exchange rate fixed by the BSP on the date of maturity. China Banking Corporation v. CA, G.R. No. 140687, December 18, 2006 D E C IS IO N (1st Division) CHICO-NAZARIO, J.: I. THE FACTS

A complaint for recovery of sums of money and annulment of sales of real properties and shares of stock was filed by Jose Gotianuy against his son-in-law, George Dee, and his daughter, Mary Margaret Dee. Jose Gotianuy accused his daughter Mary Margaret Dee of stealing, among his other properties, US dollar deposits with Citibank N.A. amounting to not less than P35,000,000.00 and US$864,000.00. Mary Margaret Dee received these amounts from Citibank N.A. through checks which she allegedly deposited at China Banking Corporation (China Bank).

Jose Gotianuy died during the pendency of the case before the trial court. He was substituted by his other daughter, Elizabeth Gotianuy Lo. The latter presented six US Dollar checks withdrawn by Mary Margaret Dee from Jose Gotianuys US dollar placement with Citibank. In the course of the trial, the lower court ordered two employees of petitioner China Bank to testify and disclose in whose name the dollar fund was deposited. The CA affirmed the trial courts order; thus, China Bank appealed to the Supreme Court. II. THE ISSUE May the Citibank dollar checks with Jose Gotianuy and/or Mary Margaret Dee as payees, which were deposited with petitioner China Bank, be looked into notwithstanding the law on secrecy of foreign currency deposits? Corollarily, may Jose Gotianuy be considered a depositor who is entitled to seek an inquiry over the said foreign currency deposits? III. THE RULING [The Supreme Court DENIED the petition, AFFIRMED the decision of the CA pro hac vice, and REMANDED the case to the trial court for continuation of hearing with utmost dispatch consistent with this ruling.] YES, the Citibank dollar checks with Jose Gotianuy and/or Mary Margaret Dee as payees, which were deposited with petitioner China Bank, may be looked into notwithstanding the law on secrecy of foreign currency deposits. Sec. 8 of R.A. 6426, the Foreign Currency Deposit Act, provides that all authorized foreign currency deposits are considered absolutely confidential in nature and may not be inquired into. Under the same provision, there is only one exception to this rule, that is, when disclosure is allowed upon the written permission of the depositor. In this case, Jose Gotianuy was considered by the Court as a co-depositor of Mary Margaret Dee. The Court reasoned that since Jose Gotianuy is the named co-payee of Mary Margaret Dee in the subject checks, which were deposited in China Bank, then Jose Gotianuy is likewise a depositor thereof. On that basis, no written consent from Mary Margaret Dee is necessary for the examination of the foreign currency deposits. As the owner of the funds unlawfully taken and which are undisputably now deposited with China Bank, Jose Gotianuy has the right to inquire into the said deposits. A depositor, in cases of bank deposits, is one who pays money into the bank in the usual course of business, to be placed to his credit and subject to his check or the beneficiary of the funds held by the bank as trustee. On this score, the observations of the Court of Appeals are worth reiterating: Furthermore, it is indubitable that the Citibank checks were drawn against the foreign currency account with Citibank, NA. The monies subject of said checks originally came from the late Jose Gotianuy, the owner of the account. Thus, he also has legal rights and interests in the CBC account where said monies were deposited. More importantly, the Citibank checks (Exhibits "AAA" to "AAA-5") readily demonstrate (sic) that the late Jose Gotianuy is one of the payees of said checks. Being a co-payee thereof, then he or his estate can be considered as a co-depositor of said checks. Ergo, since the late Jose Gotianuy is a co-depositor of the CBC account, then his request for the assailed subpoena is tantamount to an express permission of a depositor for the disclosure of the name of the account holder. The April 16, 1999 Order perforce must be sustained. (Emphasis supplied.) In the complaint of Jose Gotianuy, he alleged that his US dollar deposits with Citibank were illegally taken from him. On the other hand, China Bank employee Cristuta Labios testified that Mary Margaret Dee came to China Bank and deposited the money of Jose Gotianuy in Citibank US dollar checks to the dollar account of her sister Adrienne Chu. This fortifies the Courts conclusion

that an inquiry into the said deposit at China Bank is justified. At the very least, Jose Gotianuy as the owner of these funds is entitled to a hearing on the whereabouts of these funds. All things considered and in view of the distinctive circumstances attendant to the present case, the Court was constrained to render a limited pro hac vice ruling. Clearly it was not the intent of the legislature when it enacted the law on secrecy on foreign currency deposits to perpetuate injustice. This Court is of the view that the allowance of the inquiry would be in accord with the rudiments of fair play, the upholding of fairness in our judicial system and would be an avoidance of delay and time-wasteful and circuitous way of administering justice. Digest 5:EMMANUEL B. AZNAR vs. CITIBANK, N.A., (Philippines) G.R. No. 164273 March 28, 2007 EMMANUEL B. AZNAR, Petitioner, vs. CITIBANK, N.A., (Philippines), Respondent. Facts: The herein petitioner, Emmanuel B. Aznar, is a prominent businessman and entrepreneur in Cebu. He decided to treat his wife together with their grandchildren for an Asian Tour using his Citibank credit card. He deposited P485,000 to his account to increase his ordinary credit limit from P150,000 to P635,000. He bought tickets to Kuala Lumpur amounting to P235,000. When they were in Kuala Lumpur, they decided to purchases things to which the credit card was dishonoured for over the limit. Eventually the agency further dishonoured the card and even mentioned that the petitioner be a swindler. In that note, they decided to go back Philippines and instantly filed a complaint for damages. The lower court initially dismissed the complaint on the ground that their was no proper authentication as to the print out of the computer generated document presented as evidence before the court. The petitioner filed a motion for the re-raffle of the case, raising the contention that the judge was also a holder of Citibank credit card. The judge later acceded with the contention of petitioner and ordered for the company to pay enormous amount of damages to the plaintiff. When the case was elevated before the CA the latter denied such. Issue: Whether or not the print out of the computer generated document was properly authenticated to be admissible before the court? Held: No, the Supreme Court mentioned the following: Section 5, Rule 10 of the Rules of Civil Procedure cannot be excluded as it qualifies as electronic evidence following the Rules on Electronic Evidence which provides that print-outs are also originals for purposes of the Best Evidence Rule; Section 20 of Rule 132 of the Rules of Court. It provides that whenever any private document offered as authentic is received in evidence, its due execution and authenticity must be proved either by (a) anyone who saw the document executed or written; or (b) by evidence of the genuineness of the signature or handwriting of the maker. Pertinent sections of Rule 5 read: Section 1. Burden of proving authenticity. The person seeking to introduce an electronic document in any legal proceeding has the burden of proving its authenticity in the manner provided in this Rule. Section 2. Manner of authentication. Before any private electronic document offered as authentic is received in evidence, its authenticity must be proved by any of the following means: (a) By evidence that it had been digitally signed by the person purported to have signed the same; (b) by evidence that other appropriate security procedures or devices as may be authorized by the Supreme Court or by law for authentication of electronic documents were applied to the document; or (c) By other evidence showing its integrity and reliability to the satisfaction of the judge.

Indeed there was no proper authentication of the electronic evidence presented by the petitioner before the court which is the print out of the computer generated document where on it printed that the card was over the limit. During the trial the petitioner mentioned that desk officer phoned someone and eventually the hard copy was given to him signed by one named Nubi, however such was not witnessed by the petitioner or he does not have personal knowledge of such authentication. The high court denied the petition. Iu j

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Solved CSS MCQS of Business AdministrationDocument32 pagesSolved CSS MCQS of Business AdministrationThe CSS Point86% (102)

- Petitioner vs. vs. Respondents: First DivisionDocument11 pagesPetitioner vs. vs. Respondents: First DivisionmichelledugsNo ratings yet

- USA Vs TehranDocument4 pagesUSA Vs TehranJovennaCirilleBaluyutNo ratings yet

- Petitioners Vs Vs Respondents Arturo S. Santos For Petitioners. Conrado R. Mangahas & Associates For RespondentsDocument5 pagesPetitioners Vs Vs Respondents Arturo S. Santos For Petitioners. Conrado R. Mangahas & Associates For RespondentsAudrey DeguzmanNo ratings yet

- Vat PDFDocument81 pagesVat PDFAudrey DeguzmanNo ratings yet

- BankingDocument1 pageBankingAudrey DeguzmanNo ratings yet

- 12.3) Gatchalian vs. Court of AppealsDocument4 pages12.3) Gatchalian vs. Court of AppealsAudrey DeguzmanNo ratings yet

- WelcomeDocument5 pagesWelcomeCatNo ratings yet

- File 26-07-2017, 3 26 58 AmDocument70 pagesFile 26-07-2017, 3 26 58 AmAudrey DeguzmanNo ratings yet

- People Vs Chi ChanDocument2 pagesPeople Vs Chi ChanAudrey Deguzman100% (1)

- A.M. No. rtj-94-1208 PDFDocument3 pagesA.M. No. rtj-94-1208 PDFAudrey DeguzmanNo ratings yet

- Sunga Vs Comelec 125629 March 25, 1998 J. Bellosillo en BancDocument5 pagesSunga Vs Comelec 125629 March 25, 1998 J. Bellosillo en BancAudrey DeguzmanNo ratings yet

- 12.2) Arao vs. Comelec PDFDocument9 pages12.2) Arao vs. Comelec PDFAudrey DeguzmanNo ratings yet

- 53 - Lim, Jr. v. Spouses LazaroDocument4 pages53 - Lim, Jr. v. Spouses LazaroAudrey DeguzmanNo ratings yet

- Affidavit of Loss of Identification CardDocument2 pagesAffidavit of Loss of Identification CardAudrey DeguzmanNo ratings yet

- People V Enojas DigestDocument2 pagesPeople V Enojas DigestAudrey DeguzmanNo ratings yet

- People V Enojas DigestDocument13 pagesPeople V Enojas DigestAudrey DeguzmanNo ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument9 pagesPetitioner Vs Vs Respondent: Second DivisionSarah C.No ratings yet

- 06) Trail SmelterDocument16 pages06) Trail SmelterresjudicataNo ratings yet

- George Katon vs. Manuel Palanca JRDocument6 pagesGeorge Katon vs. Manuel Palanca JRAudrey DeguzmanNo ratings yet

- BJDC Construction v. Lanuzo To Star Two V KoDocument10 pagesBJDC Construction v. Lanuzo To Star Two V KoAudrey DeguzmanNo ratings yet

- G.R. No. 115022 PDFDocument3 pagesG.R. No. 115022 PDFAudrey DeguzmanNo ratings yet

- MemorialDocument6 pagesMemorialAudrey DeguzmanNo ratings yet

- Applicant 1 - Annotated PDFDocument7 pagesApplicant 1 - Annotated PDFAudrey DeguzmanNo ratings yet

- Laborcases 1Document45 pagesLaborcases 1Audrey DeguzmanNo ratings yet

- Docu Evid For Prac CourtDocument9 pagesDocu Evid For Prac CourtAudrey DeguzmanNo ratings yet

- Tax 2 Digest (0406) GR 108576 012099 Cir Vs CaDocument3 pagesTax 2 Digest (0406) GR 108576 012099 Cir Vs CaAudrey Deguzman100% (1)

- Add4 Elem Red ScriptDocument16 pagesAdd4 Elem Red ScriptAudrey DeguzmanNo ratings yet

- Tax 2 Digest (0205) GR l147295 021607 Cir Vs AcesiteDocument2 pagesTax 2 Digest (0205) GR l147295 021607 Cir Vs AcesiteAudrey Deguzman100% (1)

- Docu Evid For Prac CourtDocument9 pagesDocu Evid For Prac CourtAudrey DeguzmanNo ratings yet

- Sample Formal Offer ProsecutionDocument3 pagesSample Formal Offer ProsecutionAudrey DeguzmanNo ratings yet

- Appraisal - SeminarDocument8 pagesAppraisal - Seminarxz wyNo ratings yet

- Project Proposal For Manufacture of Potato ChipsDocument7 pagesProject Proposal For Manufacture of Potato ChipsSajibungambaNo ratings yet

- AST Chapter 2Document4 pagesAST Chapter 2ElleNo ratings yet

- Acctg132 - Prelim ExaminationDocument5 pagesAcctg132 - Prelim ExaminationRalph Ernest HulguinNo ratings yet

- Band Agreement - 2021 (2) .Docx - 1Document8 pagesBand Agreement - 2021 (2) .Docx - 1Gerard Albert PanlilioNo ratings yet

- EE4Document40 pagesEE4Jeiel Valencia0% (1)

- All About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Document10 pagesAll About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Biswa Prakash NayakNo ratings yet

- What Is Financing?: The Account. Bank Overdraft Is Made For Convenience in Order To PurchaseDocument3 pagesWhat Is Financing?: The Account. Bank Overdraft Is Made For Convenience in Order To PurchaseKim GuibaoNo ratings yet

- British PoundDocument5 pagesBritish PoundnishimoniNo ratings yet

- Project Report On Portfolio ManagementDocument118 pagesProject Report On Portfolio ManagementMohan Chakradhar100% (1)

- 2014-15 PFS WorkbookDocument24 pages2014-15 PFS Workbookmakarina1No ratings yet

- Bond Analysis and ValuationDocument76 pagesBond Analysis and ValuationMoguche CollinsNo ratings yet

- NBE DirectivesDocument7 pagesNBE DirectivesAfework Atnafseged100% (3)

- Unit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovDocument5 pagesUnit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovMarcusNo ratings yet

- Al n14 Corporate Reporting Exam PaperDocument18 pagesAl n14 Corporate Reporting Exam Paperzilchhour0% (1)

- Finance STPDocument30 pagesFinance STPayushithakur918No ratings yet

- Wells FargoDocument240 pagesWells FargocandyannieNo ratings yet

- AE112 - Module 9Document11 pagesAE112 - Module 9DJAN IHIAZEL DELA CUADRANo ratings yet

- 2257 Chapter 21Document3 pages2257 Chapter 21melody shayanwakoNo ratings yet

- Financial PerformanceDocument6 pagesFinancial PerformanceRammee AnuwerNo ratings yet

- Chap 001Document14 pagesChap 001Adi Susilo100% (1)

- Lecture Notes - Chapter 15: Sole Trader and Partnership Fss Under Uk GaapDocument34 pagesLecture Notes - Chapter 15: Sole Trader and Partnership Fss Under Uk GaapThương ĐỗNo ratings yet

- Sample Paper 2 PDFDocument12 pagesSample Paper 2 PDFKeemie PolackNo ratings yet

- S3 Ch2 More About Percentages QDocument12 pagesS3 Ch2 More About Percentages QF2D 10 FUNG SZE HANGNo ratings yet

- Financial Acctg Reporting 1 Chapter 10Document18 pagesFinancial Acctg Reporting 1 Chapter 10Charise Jane ZullaNo ratings yet

- Summer Internship Project Report - Arun Thakur (50) & Arjun VigDocument141 pagesSummer Internship Project Report - Arun Thakur (50) & Arjun VigArun Thakur100% (2)

- Determinants of Interest RatesDocument7 pagesDeterminants of Interest RatesRENZ ALFRED ASTRERONo ratings yet

- Registered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Document1 pageRegistered Address: HDFC Bank Ltd. HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai-400013Shokeen KhanNo ratings yet