Professional Documents

Culture Documents

Obillos v CIR Tax Ruling

Uploaded by

Ace Gregory AceronOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Obillos v CIR Tax Ruling

Uploaded by

Ace Gregory AceronCopyright:

Available Formats

Obillos v CIR G.R. No. L-68118 October 29, 1985 FACTS: 1. On March1973 Jose Obillos, Sr.

completed payment on two lots located at Greenhills, San Juan, Rizal. The next day he transferred his rights to his four children, the petitioners, to enable them to build their residences. The company sold the two lots to petitioners for P178,708.12 on March 13 2. In 1974, the petitioners resold them to the Walled City Securities Corporation and Olga Cruz Canda for the total sum of P313,050. They derived from the sale a total profit of P134,341.88 or P33,584 for each of them. They treated the profit as a capital gain and paid an income tax on one-half thereof or of P16,792. 3. In April 1980, the CIR required the four petitioners to pay corporate income tax on the total profit of P134,336 in addition to individual income tax on their shares thereof. The petitioners are being held liable for deficiency income taxes and penalties totalling P127,781.76 on their profit of P134,336, in addition to the tax on capital gains already paid by them. 4. The Commissioner acted on the theory that the four petitioners had formed an unregistered partnership or joint venture within the meaning of sections 24(a) and 84(b) of the Tax Code (Collector of Internal Revenue vs. Batangas Trans. Co., 102 Phil. 822). ISSUE: Whether or not the petitioners had created an unregistered partnership. HELD: NO. To regard the petitioners as having formed a taxable unregistered partnership would result in oppressive taxation and confirm the dictum that the power to tax involves the power to destroy. That eventuality should be obviated. As testified by Jose Obillos, Jr., they had no such intention. They were co-owners pure and simple. To consider them as partners would

obliterate the distinction between a co-ownership and a partnership. The petitioners were not engaged in any joint venture by reason of that isolated transaction. Their original purpose was to divide the lots for residential purposes. If later on they found it not feasible to build their residences on the lots because of the high cost of construction, then they had no choice but to resell the same to dissolve the co-ownership. The division of the profit was merely incidental to the dissolution of the co-ownership which was in the nature of things a temporary state. It had to be terminated sooner or later. Article 1769(3) of the Civil Code provides that "the sharing of gross returns does not of itself establish a partnership, whether or not the persons sharing them have a joint or common right or interest in any property from which the returns are derived". There must be an unmistakable intention to form a partnership or joint venture. In the instant case, what the Commissioner should have investigated was whether the father donated the two lots to the petitioners and whether he paid the donor's tax (See Art. 1448, Civil Code). We are not prejudging this matter. It might have already prescribed.

You might also like

- Revalida - Fria - 08. Garcia Vs PalDocument2 pagesRevalida - Fria - 08. Garcia Vs PalRS SuyosaNo ratings yet

- Admin DigestsDocument6 pagesAdmin DigestsXavier Alexen AseronNo ratings yet

- 7.infante V CunananDocument1 page7.infante V CunananReinNo ratings yet

- Fernando Santos, Petitioner vs. Spouses Arsenio and Nieves Reyes, Respondents.Document2 pagesFernando Santos, Petitioner vs. Spouses Arsenio and Nieves Reyes, Respondents.yaneedeeNo ratings yet

- Estate Will ProbateDocument9 pagesEstate Will ProbateChristian John Dela CruzNo ratings yet

- 08 Lim v. PeopleDocument1 page08 Lim v. PeopleGuian LimNo ratings yet

- CITESpptDocument25 pagesCITESpptEileen Kay A. Mañibo100% (1)

- Legal Ethics-Canon 1Document4 pagesLegal Ethics-Canon 1AJ BeltranNo ratings yet

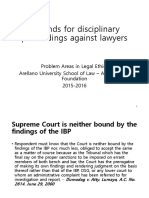

- U - Grounds For Disciplinary Proceedings Against LawyersDocument72 pagesU - Grounds For Disciplinary Proceedings Against LawyerssigfridmonteNo ratings yet

- ATAP - Cases Week 4 To 6Document2 pagesATAP - Cases Week 4 To 6jef comendadorNo ratings yet

- Insular Drug V PNB - GR 38816 - Nov 3 1933Document2 pagesInsular Drug V PNB - GR 38816 - Nov 3 1933Jeremiah ReynaldoNo ratings yet

- BPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988Document1 pageBPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988Jon SantosNo ratings yet

- Moran Vs CaDocument9 pagesMoran Vs CaJan Jason Guerrero LumanagNo ratings yet

- Ownership Dispute and Jurisdiction Despite Fee IssuesDocument2 pagesOwnership Dispute and Jurisdiction Despite Fee IssuesRose Ann CalanglangNo ratings yet

- Arbitration Law Midterms JurisprudenceDocument9 pagesArbitration Law Midterms JurisprudenceGanielaNo ratings yet

- Agency and Partnership - Course Outline-2Document2 pagesAgency and Partnership - Course Outline-2Colleen GuimbalNo ratings yet

- 2 Munasque Vs CADocument2 pages2 Munasque Vs CANova MarasiganNo ratings yet

- Aguila Vs CADocument6 pagesAguila Vs CAPatrick RamosNo ratings yet

- Last Chance Doctrine Torts CaseDocument3 pagesLast Chance Doctrine Torts CaseFrances Therese RoxasNo ratings yet

- PAT Digest Part 2 Escueta V LimDocument10 pagesPAT Digest Part 2 Escueta V LimBananaNo ratings yet

- V Intl Commercial Arbit Case Digests 6Document5 pagesV Intl Commercial Arbit Case Digests 6Darlene GanubNo ratings yet

- Dela Vina v. CollectorDocument2 pagesDela Vina v. CollectorBenedick LedesmaNo ratings yet

- Case DigestsDocument1 pageCase DigestsPortia WynonaNo ratings yet

- 06 Forfom Development Corporation vs. Philippine National RailwaysDocument1 page06 Forfom Development Corporation vs. Philippine National Railwaysmayton30No ratings yet

- Prime Vs LazatinDocument8 pagesPrime Vs LazatinMaceda KadatuanNo ratings yet

- Heirs of Tan Eng Kee vs. CADocument21 pagesHeirs of Tan Eng Kee vs. CAMichelle Montenegro - AraujoNo ratings yet

- Estates Reyes V CIR (CTA)Document2 pagesEstates Reyes V CIR (CTA)Frederick Xavier LimNo ratings yet

- Digest 4 Goquiolay VsDocument1 pageDigest 4 Goquiolay VsErvien A. MendozaNo ratings yet

- Cheng V GenatoDocument5 pagesCheng V GenatoDonna IsubolNo ratings yet

- Facts:: Gonzales, As Agent of Spouses Salvador, Could Validly Receive The Payments of Spouses RabajaDocument2 pagesFacts:: Gonzales, As Agent of Spouses Salvador, Could Validly Receive The Payments of Spouses RabajaLari dela RosaNo ratings yet

- Atty Sabitsana Conflicting Interests CaseDocument1 pageAtty Sabitsana Conflicting Interests CaseGabriel CruzNo ratings yet

- Dual citizenship and eligibility for public officeDocument14 pagesDual citizenship and eligibility for public officeJoanna MilesNo ratings yet

- Case ComparisonDocument3 pagesCase ComparisonAndrade Dos LagosNo ratings yet

- E. Characteristics and Nature of Insurance Contracts - 6 CasesDocument7 pagesE. Characteristics and Nature of Insurance Contracts - 6 CasesJohn Ceasar Ucol ÜNo ratings yet

- People Vs TeeDocument4 pagesPeople Vs TeeClarisseAccadNo ratings yet

- CITES Briefing NotesDocument3 pagesCITES Briefing NotescamilleteruelNo ratings yet

- Metrobank v. CabilzoDocument2 pagesMetrobank v. CabilzoSam ReyesNo ratings yet

- Angeles Couple vs Secretary of Justice and MercadoDocument1 pageAngeles Couple vs Secretary of Justice and Mercadobei_behNo ratings yet

- Batch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Document55 pagesBatch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Jc RobredilloNo ratings yet

- #1 Pamplona V Moreto FactsDocument11 pages#1 Pamplona V Moreto FactsDanica Irish RevillaNo ratings yet

- Quiroga vs. Parsons Hardware DigestDocument1 pageQuiroga vs. Parsons Hardware Digestjp HidalgoNo ratings yet

- Saunar vs. Executive Secretary - Full TextDocument13 pagesSaunar vs. Executive Secretary - Full TextMichael Prince del RosarioNo ratings yet

- Digests Sec 1-13Document7 pagesDigests Sec 1-13Chic PabalanNo ratings yet

- Case Digest: BPI FAMILY SAVINGS BANK v. GOLDEN POWER DIESEL SALES CENTER PDFDocument2 pagesCase Digest: BPI FAMILY SAVINGS BANK v. GOLDEN POWER DIESEL SALES CENTER PDFDownloaderManNo ratings yet

- Germann & Co. vs. Donaldson, Sim & Co. power of attorney validityDocument3 pagesGermann & Co. vs. Donaldson, Sim & Co. power of attorney validityCampbell HezekiahNo ratings yet

- Philippine Steam Navigation Not Liable for Cargo Lost in Customs Warehouse FireDocument3 pagesPhilippine Steam Navigation Not Liable for Cargo Lost in Customs Warehouse FireInter_vivosNo ratings yet

- Guinea vs. Guinea-BissauDocument2 pagesGuinea vs. Guinea-BissauClarebeth Recaña RamosNo ratings yet

- CBP Oversteps Authority in Imposing Stabilization TaxDocument3 pagesCBP Oversteps Authority in Imposing Stabilization TaxAiken Alagban LadinesNo ratings yet

- 11 - KWOK v. PHILIPPINE CARPET MANUFACTURING - MangontawarDocument2 pages11 - KWOK v. PHILIPPINE CARPET MANUFACTURING - MangontawarNor-hidaya MangontawarNo ratings yet

- Crisanta Miguel Vs MontanezDocument2 pagesCrisanta Miguel Vs MontanezNormita SechicoNo ratings yet

- Jorda v. BitasDocument3 pagesJorda v. Bitasaudreydql5No ratings yet

- Barangay Sindalan v. CA examines public use in expropriationDocument4 pagesBarangay Sindalan v. CA examines public use in expropriationLab LeeNo ratings yet

- GONZALO PUYAT V ARCO AMUSEMENT COMPANYDocument2 pagesGONZALO PUYAT V ARCO AMUSEMENT COMPANYrhodz 88No ratings yet

- Heirs of Jose Lim vs. LimDocument12 pagesHeirs of Jose Lim vs. LimJerome ArañezNo ratings yet

- G.R. No. 127347. November 25, 1999. Alfredo N. Aguila, JR., Petitioner, vs. Honorable Court of Appeals and Felicidad S. Vda. de Abrogar, RespondentsDocument10 pagesG.R. No. 127347. November 25, 1999. Alfredo N. Aguila, JR., Petitioner, vs. Honorable Court of Appeals and Felicidad S. Vda. de Abrogar, RespondentsCarmela SalazarNo ratings yet

- Bagatsing v Ramirez - Local Tax Code Prevails for Tax Ordinance PublicationDocument1 pageBagatsing v Ramirez - Local Tax Code Prevails for Tax Ordinance PublicationJay SuarezNo ratings yet

- Martinez v. Ong Pong CoDocument4 pagesMartinez v. Ong Pong CoFayda CariagaNo ratings yet

- Summary of Just Mercy: A Story of Justice and Redemption by Bryan Stevenson (Fireside Reads)From EverandSummary of Just Mercy: A Story of Justice and Redemption by Bryan Stevenson (Fireside Reads)No ratings yet

- OBILLOS Vs CIRDocument1 pageOBILLOS Vs CIRKrisjan Marie Sedillo OsabelNo ratings yet

- Jose P. Obillos, JR., Et - Al vs. CIRDocument1 pageJose P. Obillos, JR., Et - Al vs. CIRVel JuneNo ratings yet

- Sarona vs NLRC ruling on piercing corporate veilDocument2 pagesSarona vs NLRC ruling on piercing corporate veilAce Gregory Aceron100% (3)

- Sales de Gonzaga v. Crown Life Insurance rulingDocument1 pageSales de Gonzaga v. Crown Life Insurance rulingAce Gregory AceronNo ratings yet

- Insurance Digests - August 3, 2013Document16 pagesInsurance Digests - August 3, 2013Ace Gregory AceronNo ratings yet

- The Cuban QuarantineDocument2 pagesThe Cuban QuarantineAce Gregory AceronNo ratings yet

- Go vs. CA Case Digest - Warrantless Arrest and Right to Preliminary InvestigationDocument4 pagesGo vs. CA Case Digest - Warrantless Arrest and Right to Preliminary InvestigationAce Gregory Aceron100% (1)

- Admin-Luego Vs CSCDocument1 pageAdmin-Luego Vs CSCAce Gregory AceronNo ratings yet

- INSURANCE-F.F. Cruz & Co. v. Court of AppealsDocument1 pageINSURANCE-F.F. Cruz & Co. v. Court of AppealsAce Gregory AceronNo ratings yet

- Betito vs. BenipayoDocument1 pageBetito vs. BenipayoAce Gregory AceronNo ratings yet

- Azuela Vs CADocument3 pagesAzuela Vs CAJunderen Jay Regencia Poncardas100% (1)

- Case Digest For Crimpro - Feb 15Document19 pagesCase Digest For Crimpro - Feb 15Ace Gregory AceronNo ratings yet

- Special Proceeding Reviewer (Regalado)Document36 pagesSpecial Proceeding Reviewer (Regalado)Faith Laperal91% (11)

- Tables - SuccessionDocument6 pagesTables - SuccessionMiGay Tan-Pelaez100% (5)

- Agency Cases - June 21Document41 pagesAgency Cases - June 21Ace Gregory AceronNo ratings yet

- CIR Vs FortuneDocument4 pagesCIR Vs FortuneAce Gregory AceronNo ratings yet

- Philam Mining Inc. vs. Court of Tax AppealsDocument1 pagePhilam Mining Inc. vs. Court of Tax AppealsAce Gregory AceronNo ratings yet

- Ownership of Church PropertiesDocument3 pagesOwnership of Church PropertiesAce Gregory AceronNo ratings yet

- Tables - SuccessionDocument6 pagesTables - SuccessionMiGay Tan-Pelaez100% (5)

- Palanca Vs CIRDocument1 pagePalanca Vs CIRAce Gregory AceronNo ratings yet

- Agency Cases - June 21Document41 pagesAgency Cases - June 21Ace Gregory AceronNo ratings yet

- Criminal Procedure ReviewerDocument51 pagesCriminal Procedure ReviewerJingJing Romero94% (156)

- Evidence Cases - July 17Document92 pagesEvidence Cases - July 17Ace Gregory AceronNo ratings yet

- Partnership Memory Aid AteneoDocument13 pagesPartnership Memory Aid AteneoMiko Hayashi100% (1)

- My Tax Espresso Newsletter Feb2023Document21 pagesMy Tax Espresso Newsletter Feb2023Claudine TanNo ratings yet

- Sample Assignment 1-1Document20 pagesSample Assignment 1-1Nir IslamNo ratings yet

- T24 Accounting Introduction - R15Document119 pagesT24 Accounting Introduction - R15Jagadeesh JNo ratings yet

- Case Study - Sugar BowlDocument5 pagesCase Study - Sugar BowlAbdur RahmanNo ratings yet

- Options Exposed PlayBookDocument118 pagesOptions Exposed PlayBookMartin Jp100% (4)

- ProspectingDocument40 pagesProspectingCherin Sam100% (1)

- The Airline IndustryDocument8 pagesThe Airline IndustryDan Hardy100% (1)

- Principles of Economics - 1 - 2Document81 pagesPrinciples of Economics - 1 - 2KENMOGNE TAMO MARTIALNo ratings yet

- Advanced Performance Management (APM) : Strategic Professional - OptionsDocument11 pagesAdvanced Performance Management (APM) : Strategic Professional - OptionsNghĩa VõNo ratings yet

- LECTURE-03c Source of CapitalsDocument55 pagesLECTURE-03c Source of CapitalsNurhayati Faiszah IsmailNo ratings yet

- Pert 4 ExcelDocument8 pagesPert 4 ExcelSagita RajagukgukNo ratings yet

- IAS 2 Inventories SummaryDocument16 pagesIAS 2 Inventories SummaryCorinne GohocNo ratings yet

- Islamic Core Banking Solution OverviewDocument16 pagesIslamic Core Banking Solution OverviewnadeemuzairNo ratings yet

- First workshop unit overviewDocument2 pagesFirst workshop unit overviewSachin Avishka PereraNo ratings yet

- Bank StatementDocument1 pageBank StatementLatoya WilsonNo ratings yet

- SERVICE QUALITY AND MEASUREMENT SEM 6 CH 1-Ilovepdf-CompressedDocument16 pagesSERVICE QUALITY AND MEASUREMENT SEM 6 CH 1-Ilovepdf-CompressedDj kakaNo ratings yet

- Loan Functions of BanksDocument6 pagesLoan Functions of BanksMark AmistosoNo ratings yet

- Lecture Notes - 2 - The Hospitality and Tourist Market and SegmentationDocument5 pagesLecture Notes - 2 - The Hospitality and Tourist Market and SegmentationDaryl VenturaNo ratings yet

- Tugas 5Document17 pagesTugas 5Syafiq RamadhanNo ratings yet

- 2016 QP Paper 1 PDFDocument16 pages2016 QP Paper 1 PDFAfra SadafNo ratings yet

- Marketing Plan For Ready-Made Canned Foo PDFDocument10 pagesMarketing Plan For Ready-Made Canned Foo PDFHussain0% (1)

- Technical Efficiency of KsfeDocument3 pagesTechnical Efficiency of KsfeGokul HarikrishnanNo ratings yet

- Benefits of Corporate Social ResponsibilityDocument12 pagesBenefits of Corporate Social Responsibilityleong kuan lokNo ratings yet

- CSR Practices of Indian Public Sector BanksDocument6 pagesCSR Practices of Indian Public Sector BankssharadiitianNo ratings yet

- GST Detailed AnalysisDocument10 pagesGST Detailed AnalysisKritibandhu SwainNo ratings yet

- SOP Guidelines For AustraliaDocument1 pageSOP Guidelines For AustraliaShivam ChadhaNo ratings yet

- Chapter 4Document5 pagesChapter 4Syl AndreaNo ratings yet

- India's Leading Infrastructure Companies 2017Document192 pagesIndia's Leading Infrastructure Companies 2017Navin JollyNo ratings yet

- Senario Case StudyDocument19 pagesSenario Case Studymaya100% (1)

- Strategic Plan 2016-2019: A Place for People to ProsperDocument20 pagesStrategic Plan 2016-2019: A Place for People to ProsperKushaal SainNo ratings yet