Professional Documents

Culture Documents

Akuntansi

Uploaded by

er4sallOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Akuntansi

Uploaded by

er4sallCopyright:

Available Formats

Problem 4-2 Write Journal entries for the following transactions that occurred at Woodside Company during May

and explain how each would be disclosed in Woodsides financial Statements. 1. The company prepaid $ 14,340 rent for the period May 1 October 31. Dr. Prepaid rent $ 14,340 Cr. Cash $ 14,340 2. Sales discounts and allowances were $34,150. Dr. Sales discounts and allowances $ 34,150 Cr. Provision for sales discounts and allowances $ 34,150 3. A loan for $ 3,500 at 12 percent interest continued to be owed to the company by one of its employees, who made no payments related to this loan during May. Dr. Interest receivable $ 420 Cr. Interest income $ 420 4. Depreciation expense was $ 13,660. Dr. Depreciation expense $ 13,660 Cr. Accumulated depreciation $ 13,660 5. Customers paid $ 2,730 for services they will not receive until sometime in June. Dr. Cash $ 2,730 Cr. Deferred Revenue $ 2,730 6. The company purchased $ 172 worth of stamps and used $ 100 worth of them. Dr. Stamp expense $ 100 Dr. Stamp inventory $ 72 Cr. Cash $ 172 7. The Allowance for Doubtful Accounts was increased by $ 1,350, reflecting a new estimate of uncollectible accounts. Dr. Bad debt expense $ 1,350 Cr. Allowance for doubtful accounts $1,350

Case 4-3 Copies Express Copies Express was incorporated on November 20, 2009, and began operating on January 2, 2010. The balance sheet as of the beginning of operations is shown in Exhibit 1. In preparing financial statements for the first year of operations, the accountant reviewed the record of cash receipts and cash disbursements for Copies Express. This information appears in Exhibit 2. In addition, the accountant examined certain other information relative to operations. These additional items appear in Exhibit 3.

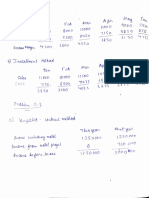

Exhibit 1 Copies Express, Inc. Balance Sheet As of January 2, 2010 Assets Cash Supplies Building and equipment Land Total Liabilites and Owners' Equity Accounts payable Bank loan Capital stock Total $2,000 24,400 300,000 12,000 338,400 $10,400 24,000 304,000 338,400

Exhibit 2 Copies Express, Inc. Cash Receipts and Disbursements : 2010 Cash receipts: Cash Sales Collect accounts receivable Total Cash dibursement: Wages and salaries Heat, light , power Additional supplies Selling and administration Interest (Note 1) Payment - bank lian (12/31) Payment - accounts payable Total

$176,450 64,750 241,200

$85,750 15,000 52,600 28,375 2,880 12,000 10,400 207,005

Exhibit 3 Other Information Relative to Operations 1. At the end of 2010, Copies Express owed $ 9,875 to suppliers for the purchase of photocopy supplies for which it had not yet paid. 2. The yearly depreciation expense on the buildings and equipment was $ 15,000. 3. At the end of 2010, Copies Espress was owed $ 11,000 for copying services by customers who had not ye paid. Copies Express expected that all of these customers would pay within 30 days. 4. An inventory taken of the supplies at year-end revealed that the years cost of supplies was $60,250. 5. Income taxes for 2010 were expected to be $ 11,593. They were unpaid as of December 31, 2010. Questions 1. Prepare an income statement for 2010 and a balance sheet as of December 31,2010. 2. Be prepared to explain the derivation of each number of these financial statements. 1. Dr. Cash Cr. Sales 2. Dr. Account receivable Cr. Sales Dr. Cash Cr. Account receivable 3. Dr. Wages and salaries expense Cr. Cash $ 176,450 $ 176,450 $ 67,750 $67,750 $ 64,750 $64,750 $ 85,750 $ 85,750

4. Dr. Heat, light , power expense Cr. Cash 5. Dr. Supplies inventory Cr. Cash 6. Dr. Selling and administration expense Cr. Cash 7. Dr. Interest expense Cr. Cash 8. Dr. Bank loan Cr. Cash 9. Dr. Accounts payable Cr. Cash 10. Dr. Supplies inventory Cr. Accounts Payable 11. Dr. Depreciation expense Cr. Accumulated depreciation 12. Dr. Accounts receivable Cr. Sales 13. Dr. Cost of supplies used Cr. Supplies inventory 14. Dr. Taxes expense Cr. Taxes payable 15. Dr. Income Summary Cr. Retained earnings

$ 15,000 $ 15,000 $ 52,600 $ 52,600 $ 28,375 $ 28,375 $ 2,880 $ 2,880 $ 12,000 $ 12,000 $ 10,400 $10,400 $ 9,875 $ 9,875 $ 15,000 $ 15,000 $ 11,000 $ 11,000 $ 60,250 $60,250 $ 11,593 $ 11,593 $ 33,352 $ 33,352

You might also like

- Musician Work AgreementDocument3 pagesMusician Work Agreementucf100% (4)

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- Credit Card Processing GlossaryDocument14 pagesCredit Card Processing Glossarykintirgum100% (1)

- PC DepotDocument2 pagesPC DepotJohn Carlos WeeNo ratings yet

- Income Statements 2010Document10 pagesIncome Statements 2010Shivam GoelNo ratings yet

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Joan Holtz (A) Case Revenue Recognition QuestionsDocument5 pagesJoan Holtz (A) Case Revenue Recognition QuestionsAashima GroverNo ratings yet

- Chap004 SolutionsDocument7 pagesChap004 Solutionsdavegeek100% (1)

- (Case 6-7) 5-1 Stern CorporationDocument1 page(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- Maynard CompanyDocument5 pagesMaynard CompanyNikitha Andrea SaldanhaNo ratings yet

- Chemalite Income StatementDocument10 pagesChemalite Income StatementManoj Singh0% (1)

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocument23 pagesAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Financial Statement Analysis: Amerbran Company (BDocument37 pagesFinancial Statement Analysis: Amerbran Company (BZati Ga'in100% (1)

- Maynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income StatementDocument2 pagesMaynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income Statementriya lakhotiaNo ratings yet

- Sales Promotion Process DTI DAO 2 Series of 1993 Consumer Act of The PhilippinesDocument12 pagesSales Promotion Process DTI DAO 2 Series of 1993 Consumer Act of The PhilippinesJanette Toral100% (3)

- Lone Pine Cafe Balance SheetsDocument15 pagesLone Pine Cafe Balance SheetsCynthia Anggi Maulina100% (1)

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- QED Electronics - Problem 3.7Document1 pageQED Electronics - Problem 3.7ivanyongforexNo ratings yet

- Sales ForecastingDocument36 pagesSales ForecastingshayandasguptaNo ratings yet

- Lewis Corporation case study: Analysis of inventory valuation methodsDocument7 pagesLewis Corporation case study: Analysis of inventory valuation methodsSudeep ShahNo ratings yet

- Chap 006Document15 pagesChap 006Neetu RajaramanNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Accounting Final SyllabusDocument8 pagesAccounting Final SyllabusRoufRobin0% (1)

- Financial Statement Framework for Evaluating Financial PerformanceDocument9 pagesFinancial Statement Framework for Evaluating Financial PerformanceMalik Fahad YounasNo ratings yet

- BCG Matrix ExplainedDocument31 pagesBCG Matrix ExplainedUtkarsh SrivastavaNo ratings yet

- 376 Frenzel Vs CatitoDocument1 page376 Frenzel Vs CatitoJan Mar Gigi GallegoNo ratings yet

- Lorenzo Shipping CorpDocument9 pagesLorenzo Shipping Corphigh protectorNo ratings yet

- Long-Lived Nonmonetary Assets and Their Amortization: Changes From Eleventh EditionDocument11 pagesLong-Lived Nonmonetary Assets and Their Amortization: Changes From Eleventh Editioner4sallNo ratings yet

- Maria Case - FinalDocument2 pagesMaria Case - FinalChakri MunagalaNo ratings yet

- Management Accounting - I (Section A, B &H) Term I (2021-22)Document3 pagesManagement Accounting - I (Section A, B &H) Term I (2021-22)saurabhNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Grand Jean CompanyDocument6 pagesGrand Jean Companyrajat_singla100% (8)

- Sample Strategy MapsDocument10 pagesSample Strategy MapsAimon ItthiNo ratings yet

- 2008 Greenfield GuidebookDocument30 pages2008 Greenfield GuidebookLuis Haruo TakahashiNo ratings yet

- Customer Satisfaction of Aanchal Dairy ProductsDocument32 pagesCustomer Satisfaction of Aanchal Dairy ProductsMohit Jamwal0% (1)

- Grand Jeans Case (Assign 2)Document5 pagesGrand Jeans Case (Assign 2)arn01dNo ratings yet

- Draft of Cooper ContractDocument7 pagesDraft of Cooper Contractmpoke50% (2)

- Case Study 4 - 3 Copies ExpressDocument8 pagesCase Study 4 - 3 Copies ExpressJZ0% (1)

- Final Exam Paper (C) 2020.11 OpenDocument3 pagesFinal Exam Paper (C) 2020.11 OpenKshitiz NeupaneNo ratings yet

- CASE 8 - Norman Corporation (A) (Final)Document3 pagesCASE 8 - Norman Corporation (A) (Final)Katrizia FauniNo ratings yet

- Save Mart and Copies Express CaseDocument7 pagesSave Mart and Copies Express CaseanushaNo ratings yet

- Basic Concepts of Accounting (Balance Sheet)Document12 pagesBasic Concepts of Accounting (Balance Sheet)badtzmaru0506No ratings yet

- Maynard Company Balance Sheet AnalysisDocument2 pagesMaynard Company Balance Sheet AnalysisArchin Padia100% (1)

- CASE SUMMARY Waltham Oil and LubesDocument2 pagesCASE SUMMARY Waltham Oil and LubesAnurag ChatarkarNo ratings yet

- Stern Corporation (B)Document3 pagesStern Corporation (B)Rahul SinghNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Case 5-3Document2 pagesCase 5-3ragil1988No ratings yet

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDocument4 pagesCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNo ratings yet

- Date Details of Transaction Capital Acc. Payable Notes PayableDocument3 pagesDate Details of Transaction Capital Acc. Payable Notes PayablerudypatilNo ratings yet

- Case ChemaliteDocument1 pageCase ChemaliteRosario PhillipsNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Medieval Case SolutionDocument7 pagesMedieval Case SolutionTarry BerryNo ratings yet

- Chapter 3 SolutionsDocument8 pagesChapter 3 SolutionsSol S.No ratings yet

- Bon Voyage Travel June TransactionsDocument18 pagesBon Voyage Travel June TransactionsbhaviniiNo ratings yet

- Joan HoltzDocument10 pagesJoan HoltzKarlo PradoNo ratings yet

- Problem 13-1 - Chapter 13 - SolutionDocument6 pagesProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- Maria HernandezDocument2 pagesMaria HernandezUjwal Suri100% (1)

- Chemalite Cash Flow StatementDocument2 pagesChemalite Cash Flow Statementrishika rshNo ratings yet

- Balance Sheet BasicsDocument20 pagesBalance Sheet BasicsSarbani Mishra0% (1)

- Marvin Co Financial StatementsDocument4 pagesMarvin Co Financial StatementsVaibhav KathjuNo ratings yet

- Maynard Solutions Ch04Document17 pagesMaynard Solutions Ch04Anton VitaliNo ratings yet

- Financial Reporting and Analysis: Assignment - 1Document8 pagesFinancial Reporting and Analysis: Assignment - 1Sai Chandan Duggirala100% (1)

- Case Analysis 3 1 Maynard BusinessDocument6 pagesCase Analysis 3 1 Maynard BusinessDAVE RYAN DELA CRUZNo ratings yet

- Chemalite Inc - Assignment - AccountingDocument2 pagesChemalite Inc - Assignment - Accountingthi_aar100% (1)

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Document33 pagesChapter 12: Corporate Valuation and Financial Planning: Page 1nouraNo ratings yet

- Case 4-4 Octane SS - PurwaningrumDocument5 pagesCase 4-4 Octane SS - PurwaningrumPurwaningrum Gunantoko50% (4)

- Latihan UTS AKUNDocument32 pagesLatihan UTS AKUNchittamahayantiNo ratings yet

- ARS Waltham Case TransactionsDocument2 pagesARS Waltham Case TransactionsRajnikaanth SteamNo ratings yet

- Exercises 1Document8 pagesExercises 1Altaf HussainNo ratings yet

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesNguyen VyNo ratings yet

- UntitledDocument12 pagesUntitledMaykel BolañosNo ratings yet

- ACCOUNTING FOR DECISION MAKING MID TERM EXAMDocument5 pagesACCOUNTING FOR DECISION MAKING MID TERM EXAMumer12No ratings yet

- Chapter 1 - 2 Problems Problem 1: RequiredDocument5 pagesChapter 1 - 2 Problems Problem 1: RequiredManpreet SinghNo ratings yet

- Installed ChromeDocument1 pageInstalled Chromeer4sallNo ratings yet

- 2003 Identification of Problem North Country AutoDocument2 pages2003 Identification of Problem North Country Autoer4sallNo ratings yet

- S0167668713000851 - 1 s2.0 S0167668713000851 MainDocument11 pagesS0167668713000851 - 1 s2.0 S0167668713000851 Mainer4sallNo ratings yet

- Technological Forecasting & Social Change: Sami Gharbi, Jean-Michel Sahut, Frédéric TeulonDocument7 pagesTechnological Forecasting & Social Change: Sami Gharbi, Jean-Michel Sahut, Frédéric Teuloner4sallNo ratings yet

- Twittermarketingforbrands 121214135622 Phpapp02Document24 pagesTwittermarketingforbrands 121214135622 Phpapp02er4sallNo ratings yet

- 1 s2.0 S0261560613000405 Main - PDF 3f - Tid 3d 26acdnat 3d1400641827Document20 pages1 s2.0 S0261560613000405 Main - PDF 3f - Tid 3d 26acdnat 3d1400641827er4sallNo ratings yet

- EVA Hub - Dengan ModalDocument12 pagesEVA Hub - Dengan ModalworosulartiNo ratings yet

- Hennessy, 2004. Tobin's Q, Debt Overhang & Investment JFDocument26 pagesHennessy, 2004. Tobin's Q, Debt Overhang & Investment JFer4sallNo ratings yet

- WP Strategic AlignmentDocument15 pagesWP Strategic Alignmenter4sallNo ratings yet

- Analisis Perataan Laba (Income Smoothing) Faktor Yang Mempengaruhinya Dan Pengaruhnya Terhadap Return Dan Risiko Saham Perusahaan Go Public Di Bursa Efek JakartaDocument6 pagesAnalisis Perataan Laba (Income Smoothing) Faktor Yang Mempengaruhinya Dan Pengaruhnya Terhadap Return Dan Risiko Saham Perusahaan Go Public Di Bursa Efek JakartaCristiano Hamdiansyah SempadianNo ratings yet

- Lamont Polk Requejo, 2001. FC & Stock ReturnsDocument0 pagesLamont Polk Requejo, 2001. FC & Stock Returnser4sallNo ratings yet

- Lettau, Ludvigson 2002. Time Varying Risk Premia Coct of Cap Alter Impli Q TheoryDocument36 pagesLettau, Ludvigson 2002. Time Varying Risk Premia Coct of Cap Alter Impli Q Theoryer4sallNo ratings yet

- Wei & Zhang, 2008 Ownership Structure, Cash Flow, and Capital Investment - Evidence From East Asian Economies Before The Financial CrisisDocument15 pagesWei & Zhang, 2008 Ownership Structure, Cash Flow, and Capital Investment - Evidence From East Asian Economies Before The Financial Crisiser4sallNo ratings yet

- Jiptummpp GDL Jou 2009 Brianballo 17100 The+futu GDocument20 pagesJiptummpp GDL Jou 2009 Brianballo 17100 The+futu Ger4sallNo ratings yet

- Vilasuso & Minkler, 2001. Agency Cost, Asset Spec, Cap StructDocument15 pagesVilasuso & Minkler, 2001. Agency Cost, Asset Spec, Cap Structer4sallNo ratings yet

- Graham & Harvey 2001 The Theory and Practice of Corporate Finance Evidence From The FieldDocument53 pagesGraham & Harvey 2001 The Theory and Practice of Corporate Finance Evidence From The Fielder4sall100% (1)

- MIDocument4 pagesMIer4sallNo ratings yet

- Ferson, Sarkissian, Simin, 1999. Alpha Factor Aset Pricing Model JFMDocument20 pagesFerson, Sarkissian, Simin, 1999. Alpha Factor Aset Pricing Model JFMer4sallNo ratings yet

- Jiptummpp GDL Jou 2009 Sasongkobu 17097 The+prac eDocument21 pagesJiptummpp GDL Jou 2009 Sasongkobu 17097 The+prac eer4sallNo ratings yet

- Value Network - Phone IndustryDocument27 pagesValue Network - Phone Industryer4sallNo ratings yet

- SNA VIII Solo Corporate Social Responsibility DisclosureDocument17 pagesSNA VIII Solo Corporate Social Responsibility DisclosureLycia Indriyani100% (2)

- Grand Jeans CaseDocument6 pagesGrand Jeans Casepayal_pNo ratings yet

- NorthDocument6 pagesNorther4sallNo ratings yet

- Analysis of Walker and Company's Strategic Issues and Profit PlanDocument9 pagesAnalysis of Walker and Company's Strategic Issues and Profit Planer4sallNo ratings yet

- Budgeting ApproachesDocument2 pagesBudgeting Approacheser4sall0% (1)

- Conclusion of Human Resource Management, KJPP-RHPDocument3 pagesConclusion of Human Resource Management, KJPP-RHPer4sallNo ratings yet

- Final Project PDFDocument35 pagesFinal Project PDFRiya Desai100% (1)

- Kwitansi KomputerDocument2 pagesKwitansi KomputerDhany HermayantoNo ratings yet

- Tupperware UttamDocument22 pagesTupperware UttamUttam Kr PatraNo ratings yet

- CH 07Document63 pagesCH 07Ivhy Cruz Estrella100% (5)

- 4 Types of Pricing MethodsDocument25 pages4 Types of Pricing MethodsHavish P D SulliaNo ratings yet

- RD010 Current Financial and Operating StructureDocument11 pagesRD010 Current Financial and Operating StructureRakesh RadhakrishnanNo ratings yet

- How To Write A Business Plan For A Self-Sufficient School: Manual 8Document45 pagesHow To Write A Business Plan For A Self-Sufficient School: Manual 8Arpit SetyaNo ratings yet

- 10.14.2017 Quiz 1 (Audit of Inventory)Document5 pages10.14.2017 Quiz 1 (Audit of Inventory)PatOcampoNo ratings yet

- Air Extras 00Document3 pagesAir Extras 00daygsNo ratings yet

- Memasspo Memassrq Memasssa Memassin Memasscontract XK99: Mass MaintenanceDocument3 pagesMemasspo Memassrq Memasssa Memassin Memasscontract XK99: Mass MaintenanceSmith F. JohnNo ratings yet

- Craft Documentation Gota PattiDocument28 pagesCraft Documentation Gota PattiKriti KumariNo ratings yet

- 7 Factors That Will Influence Your Product Pricing StrategyDocument4 pages7 Factors That Will Influence Your Product Pricing StrategyLvarsha NihanthNo ratings yet

- MKT Project-Beer IndiaDocument15 pagesMKT Project-Beer Indiaarindam_das100% (25)

- E.digital v. Dexxon Groupe Holding Et. Al.Document7 pagesE.digital v. Dexxon Groupe Holding Et. Al.Patent LitigationNo ratings yet

- Keith Path To Buy A HomeDocument13 pagesKeith Path To Buy A HomeKeith GoeringerNo ratings yet

- Purchase OrderDocument7 pagesPurchase OrderRisa IchaNo ratings yet

- 15 Profit Andprofit and Loss Formulas Loss Aptitude Questions With SolutionsDocument7 pages15 Profit Andprofit and Loss Formulas Loss Aptitude Questions With SolutionsNikhil KumarNo ratings yet

- Class DiagramDocument4 pagesClass Diagramapi-235769548No ratings yet

- (D2) The Cybertech ProjectDocument9 pages(D2) The Cybertech ProjectAsram JamilNo ratings yet

- Mock Exam 1 - Chapters 1 - 4Document8 pagesMock Exam 1 - Chapters 1 - 4Thomas Matheny100% (1)