Professional Documents

Culture Documents

SCM by Chopra

Uploaded by

Lalit ChhimwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SCM by Chopra

Uploaded by

Lalit ChhimwalCopyright:

Available Formats

1

utdallas.edu/~metin

Supply Chain Management

Introduction

2

utdallas.edu/~metin

Outline

What is supply chain management?

A supply chain strategy framework

Components of a SCM

Major obstacles and common problems

Seven Eleven Japan

3

utdallas.edu/~metin

Traditional View: Supply Chains in

the Economy (1990, 1996)

Freight Transportation $352, $455 B

Transportation manager in charge

Transportation software

Inventory Expense $221, $311 B

Inventory manager in charge

Inventory software

Administrative Expense $27, $31 B

Logistics related activity 11%, 10.5% of GNP

$898 B spent domestically for SC activities in 1998.

$1,160 B of inventory in the US economy in the early 2000s.

Transportation and inventory managers

4

utdallas.edu/~metin

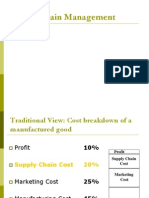

Traditional View: Cost breakdown of a

manufactured good

Profit 10%

Supply Chain Cost 20%

Marketing Cost 25%

Manufacturing Cost 45%

Profit

Supply Chain

Cost

Marketing

Cost

Manufacturing

Cost

Effort spent for supply chain activities are invisible to the customers.

5

utdallas.edu/~metin

What can Supply Chain Management do?

Estimated that the grocery industry could save $30 billion (10% of operating

cost) by using effective logistics and supply chain strategies

A typical box of cereal spends 104 days from factory to sale

A typical car spends 15 days from factory to dealership

Faster turnaround of the goods is better?

Laura Ashley (retailer of women and children clothes) turns its inventory 10

times a year five times faster than 3 years ago

inventory is emptied 10 times a year, or an item spends about 12/10 months in the

inventory.

To be responsive, it relocated its main warehouse next to FedEx hub in Memphis, TE.

National Semiconductor used air transportation and closed 6 warehouses, 34%

increase in sales and 47% decrease in delivery lead time.

6

utdallas.edu/~metin

Magnitude of Supply Chain Management

Compaq estimates it lost $0.5 B to $1 B in sales in 1995

because laptops were not available when and where

needed

P&G (Proctor&Gamble) estimates it saved retail

customers $65 M (in 18 months) by collaboration

resulting in a better match of supply and demand

When the 1 gig processor was introduced by AMD

(Advanced Micro Devices), the price of the 800 meg

processor dropped by 30%

7

utdallas.edu/~metin

Importance of SCM understood by some

AMR Research:

"The biggest issue enterprises face today is intelligent visibility of their

supply chains-both upstream and down"

Forrester Research:

"Companies need to sense and proactively respond to unanticipated variations

in supply and demand by adopting emerging technologies such as intelligent

agents. To boost their operational agility, firms need to transform their static

supply chains into adaptive supply networks

Gartner Group:

By 2004, 90% of enterprises that fail to apply supply-chain management

technology and processes to increase their agility will lose their status as

preferred suppliers

Open ended statement. Agility can be increased continuously.

8

utdallas.edu/~metin

Top 25

Supply Chains

AMR research http://www.amrresearch.com

publishes reports on supply chains

and other issues.

The Top 25 supply chains report comes

out in Novembers.

The table on the right-hand side is from

The Second Annual Supply Chain

Top 25 prepared by Kevin Riley and

Released in November 2005.

9

utdallas.edu/~metin

SCM Generated Value

Minimizing supply chain costs

while keeping a reasonable service level

customer satisfaction/quality/on time delivery, etc.

This is how SCM contributes to the bottom line

SCM is not strictly a cost reduction paradigm!

10

utdallas.edu/~metin

A picture is better than 1000 words!

How many words would be better than 3 pictures?

- A supply chain consists of

- aims to Match Supply and Demand,

profitably for products and services

SUPPLY SIDE DEMAND SIDE

The right

Product

Higher

Profits

The right

Time

The right

Customer

The right

Quantity

The right

Store

The right

Price

=

+ + + + +

- achieves

Supplier Manufacturer Distributor Retailer Customer

Upstream

Downstream

11

utdallas.edu/~metin

Detergent supply chain:

Customer wants

detergent

Albertsons

Supermarket

Third

party DC

P&G or other

manufacturer

Plastic cup

Producer

Chemical

manufacturer

(e.g. Oil Company)

Tenneco

Packaging

Paper

Manufacturer

Timber

Industry

Chemical

manufacturer

(e.g. Oil Company)

12

utdallas.edu/~metin

Flows in a Supply Chain

Customer

Material

Information

Funds

The flows resemble a chain reaction.

Supplier

13

utdallas.edu/~metin

SCM in a Supply Network

Supply Chain Management (SCM) is concerned with the management and control of

the flows of material, information, and finances in supply chains.

Supply

Demand

Products and Services

Cash

Supply Side OEM Demand Side

THAILAND INDIA MEXICO TEXAS US

N-Tier Suppliers Suppliers Logistics Distributors Retailers

Information

The task of SCMis to design, plan, and execute the activities at the different stages

so as to provide the desired levels of service to supply chain customers profitably

14

utdallas.edu/~metin

Importance of Supply Chain Management

In 2000, the US companies spent $1 trillion (10% of GNP) on supply-related

activities (movement, storage, and control of products across supply chains).

Source: State of Logistics Report

Eliminating inefficiencies in supply chains can save millions of $.

Tier 1

Supplier

Manufacturer Distributor Retailer Customer

Inefficient

logistics

High

stockouts

Ineffective

promotions

Frequent Supply shortages

High landed costs to

the shelf

High inventories

through the chain

Low order fill

rates

Glitch-Wrong Material,

Machine is Down

effect snowballs

15

utdallas.edu/~metin

This image cannot currently be displayed.

Supply

Sources:

plants

vendors

ports

Regional

Warehouses:

stocking

points

Field

Warehouses:

stocking

points

Customers,

demand

centers

sinks

Purchase

Inventory

Transportation

Inventory

A Generic Supply Chain

16

utdallas.edu/~metin

Cycle View of Supply Chains

Customer Order

Cycle

Replenishment Cycle

Manufacturing Cycle

Procurement Cycle

Customer

Retailer

Distributor

Manufacturer

Supplier

Any cycle

0. Customer arrival

1. Customer triggers an order

2. Supplier fulfils the order

3. Customer receives the order

17

utdallas.edu/~metin

Push vs Pull System

What instigates the movement of the work in the system?

In Push systems, work release is based on downstream demand

forecasts

Keeps inventory to meet actual demand

Acts proactively

e.g. Making generic job application resumes today (e.g.: exempli gratia)

In Pull systems, work release is based on actual demand or the

actual status of the downstream customers

May cause long delivery lead times

Acts reactively

e.g. Making a specific resume for a company after talking to the recruiter

18

utdallas.edu/~metin

Push/Pull View of Supply Chains

Procurement,

Manufacturing and

Replenishment cycles

Customer Order

Cycle

Customer

Order Arrives

Push-Pull boundary

PUSH PROCESSES PULL PROCESSES

19

utdallas.edu/~metin

Examples of Supply Chains

Dell / Compaq

Dell buys some components for a product from its suppliers

after that product is purchased by a customer. Extreme case of a

pull process

Zara, Spains answer to Italys Benetton

Sells apparel with a short design-to-sale cycle, avoids markdowns.

Toyota / GM / Volkswagen, in the course notes

McMaster Carr / W.W. Grainger, sell auto parts

Amazon / Barnes and Noble

Frozen food industry/Fast food industry/5 star restaurants

Internet shopping: Webvan / Peapod

20

utdallas.edu/~metin

SCM Strategy

21

utdallas.edu/~metin

Mission-Strategy-Tactics-Decisions

Mission, Mission statement

The reason for existence of an organization

Strategy

A plan for achieving organizational goals

Tactics

The actions taken to accomplish strategies

Operational decisions

Day to day decisions to support tactics

22

utdallas.edu/~metin

Life Strategy for Ted

Ted is an undergrad. He would like to have a career in business, have

a good job, and earn enough income to live comfortably

Mission: Live a good life

Goal: Successful career, good income

Strategy: Obtain a masters degree

Tactics: Select a college and a concentration

Operations: Register, buy books, take

courses, study, graduate, get a job

23

utdallas.edu/~metin

Linking SC and Business Strategy

New

Product

Development

Marketing

and

Sales

Operations Distribution Service

Finance, Accounting, Information Technology, Human Resources

Competitive (Business) Strategy

Product Development Strategy

-Portfolio of products

-Timing of product introductions

Marketing Strategy

-Frequent discounts

-Coupons

Supply Chain Strategy

24

utdallas.edu/~metin

Strategies:

Product Development

It relates to Technologies for future

operations (via patents) and Set

of products/services

Be the technology leader

IBM workstations

Offer many products

Dell computers

Offer products for locals

Tatas Nano at $2500=100000 rupees

Production at Singur, West Bengal, India;

l x w x h=3.1 x 1.5 x 1.6 meters;

Top speed: 105km/hr;

Engine volume 623 cc;

Mileage 50 miles/gallon;

Annual sales target 200,000.

25

utdallas.edu/~metin

Strategies

Marketing and sales strategy relates to positioning, pricing and

promotion of products/services

e.g. Never offer more than 40% discount

e.g. EDLP = every day low price

At Wal-Mart

e.g. Demand smoothing via coupons

BestBuy

Supply chain management strategy relates to procurement,

transportation, storage and delivery

e.g. Never use more than 1 supplier for every input

e.g. Never expedite orders just because they are late

e.g. Always use domestic suppliers within the sales season not in advance.

26

utdallas.edu/~metin

Fitting the SC to the customer or vice versa?

Understand the customer Wishes

Understand the Capabilities of your SC

Match the Wishes with the Capabilities

Challenge: How to meet extensive Wishes

with limited Capabilities?

27

utdallas.edu/~metin

Achieving Strategic Fit: Consistent SCM

and Competitive strategies

Fit SC to the customer

Understanding the Customer

Range of demand, pizza hut stable

Production lot size, seasonal products

Response time, organ transplantation

Service level, product availability

Product variety

Innovation

Accommodating

poor quality

Implied (Demand)

Uncertainty for SC

Implied trouble

for SC

28

utdallas.edu/~metin

Contributors to Implied Demand Uncertainty

Low

High

Price Responsiveness

Customer Need

Implied Demand Uncertainty

Commodities

Detergent

Long lead time steel

Customized products

High Fashion Clothing

Emergency steel,

for maintenance/replacement

Short lead times, product variety,

distribution channel variety, high rate of innovation and

high customer service levels all increase

the Implied Demand Uncertainty

29

utdallas.edu/~metin

Understanding the Supply Chain:

Cost-Responsiveness Tradeoff

High

Low

Low

High

Responsiveness (in time, high service level and product variety)

Cost in $

Efficiency frontier

Inefficient

Fix responsiveness

Impossible

Inefficiency Region

Why decreasing slope (concave) for the efficiency frontier?

30

utdallas.edu/~metin

Achieving Strategic Fit: Wishes vs. Capabilities

Implied

uncertainty

spectrum

Responsive

(high cost)

supply chain

Efficient

(low cost)

supply chain

Certain

demand

Uncertain

demand

Responsivenes

spectrum

Lunch buffet

<Low margin>

Gourmet dinner

<High margin>

31

utdallas.edu/~metin

Loosing the strategic fit: Webvan

Webvan started a merger with HomeGrocer in Sept 2000 and

completed in May 2001.

Declared bankruptcy in July 2001. Why?

Webvan was so behemoth that could deliver anything to anyone anywhere

that it lost sight of a more mundane task: pleasing grocery customers day

after day.

Short to midterm cash mismanagement. Venture capital of $1.2 B run out.

Merger costs: duplicated work force, integration of technology, realignment

of facilities.

Peapod has the same business model but more focused in terms of

service and locations. It actually survives with its parent company

Royal Aholds (Dutch Retailer) cash.

Delivers now at a fee of $6.95 within a day.

32

utdallas.edu/~metin

Top 10 Retailers Reported in 2008 First 4

Source www.deloitte.com/dtt/cda/doc/content/dtt_2008globalpowersofretailing.pdf

33

utdallas.edu/~metin

Top 10 Retailers Reported in 2008 First 5-10

34

utdallas.edu/~metin

Big retailers Strategy

Wal-Mart: Efficiency

Target: More quality and service

Carrefour: International, ambiance

K-Mart: Confused.

Squeezed between Target and Wal-Mart

Reliance on coupon sales

Do coupons stabilize or destabilize a Supply chain?

K-Mart and Sears merged in November 2004.

Now called Sears Holdings.

K-Mart gets cash

Sears gets presence outside malls

35

utdallas.edu/~metin

Other Factors

Multiple products in a SC. Multiple customers for a given product

Separate supply chains or Tailored supply chains

e.g. Barnes and Noble: Retailing and/or e-tailing

Product and/or customer classes

e.g. UTD library loans books for 6 months (2 weeks) to faculty (students)

Customer segmentation by pricing

Competitors: more, faster and global

UTD online programs compete globally

Product life cycle (shortening)

SCM strategy moves toward efficiency and low implied uncertainty as products age

e.g. Air travel is becoming more efficient

e.g. Southwest airlines lead the drive for efficiency

e.g. Airbus announced A380 accommodating 555-800 people on Jan 17, 2005.

e.g. Flat screen TV producer of AU Optronics of Taiwan was looking for ways to make its

SC more efficient in June 2004.

Replacement sales

Selling to replace broken units.

e.g. AC replacement is about 50% of the market.

Macroeconomic factors for visibility

Forecasting Home Depot sales from S&P 500 price index.

Positive correlation is detected.

36

utdallas.edu/~metin

Achieving Strategic Fit over a Lifecycle

Responsive

(high cost)

supply chain

Efficient

(low cost)

supply chain

Certain

demand

Uncertain

demand

37

utdallas.edu/~metin

Integration

Integration is the central theme in SCM

Building synergies by integrating business functions,

departments and companies

38

utdallas.edu/~metin

Strategic Scope

Suppliers

Manufacturer Distributor Retailer Customer

Competitive

Strategy

Product Dev.

Strategy

Supply Chain

Strategy

Marketing

Strategy

39

utdallas.edu/~metin

Supply Chain Drivers and Obstacles

40

utdallas.edu/~metin

Drivers of Supply Chain Performance

Efficiency Responsiveness

Inventory Transportation Facilities

Information

Supply chain structure

Logistical

Drivers

How to achieve

Sourcing Pricing

Cross-

Functional

Drivers

41

utdallas.edu/~metin

1. Inventory

Convenience: Cycle inventory

No customer buys eggs one by one

Unstable demand: Seasonal inventory

Bathing suits

Xmas toys and computer sales

Randomness: Safety inventory

20% more syllabi than the class size were available in the

first class

Compaqs loss in 95

Pipeline inventory

Work in process or transit

42

utdallas.edu/~metin

Littles law

Long run averages = Expected values

I = R . T

I=Pipeline inventory;

R=output per time=throughput;

T=delay time=flow time

Flow time? Thruput? Pipeline (work in process) Inventory?

10/minute

Spend 1 minute

43

utdallas.edu/~metin

2. Transportation

Air

Truck

Rail

Ship

Pipeline

Electronic

44

utdallas.edu/~metin

3. Facilities

Production

Flexible vs. Dedicated

Flexibility costs

Production: Remember BMW: a sports car disguised as a sedan

Service: Can your instructor teach music as well as SCM?

Sports: A playmaker who shoots well is rare.

Inventory-like operations: Receiving, Prepackaging,

Storing, Picking, Packaging, Sorting, Accumulating,

Shipping

Job Lot Storage: Need more space. Reticle storage in fabs.

Crossdocking: Wal-Mart

45

utdallas.edu/~metin

4. Information

Role in the supply chain

The connection between the various stages in the supply chain

Crucial to daily operation of each stage in a supply chain

E.g., production scheduling, inventory levels

Role in the competitive strategy

Allows supply chain to become more efficient and more

responsive at the same time (reduces the need for a trade-off)

Information technology

Andersen Windows

Wood window manufacturer, whose customers can choose from a library of

50,000 designs or create their own. Customer orders automatically sent to

the factory.

46

utdallas.edu/~metin

Characteristics of the Good Information

Information Global

Scope

Coordinated

Decisions

Supply Chain

Success

Strategy Analytical Models $$$

Information

Accurate?

Accessible?

Up-to-date?

In the Correct form?

If not, database restricted ability. How difficult is it to import data into SAP?

47

utdallas.edu/~metin

Quality of Information

Information drives the decisions:

Good information means good decisions

IT helps: MRP, ERP, SAP, EDI

Relevant information?

How to use information?

48

utdallas.edu/~metin

Information Technology in a Supply

Chain: Legacy Systems

Supplier Customer Retailer Distributor Manufacturer

Strategic

Planning

Operational

49

utdallas.edu/~metin

Information Technology in a Supply Chain:

ERP Systems

Supplier Customer Retailer Distributor Manufacturer

Strategic

Planning

Operational

ERP Potential

ERP

Potential

ERP

50

utdallas.edu/~metin

Information Technology in a Supply Chain:

Analytical Applications

Supplier Customer Retailer Distributor Manufacturer

Strategic

Planning

Operational

Supplier

Apps

SCM

MES

Dem Plan

Transport execution &

WMS

APS

Transport & Inventory

Planning

CRM/SFA

51

utdallas.edu/~metin

ERP Systems

Wider focus

Push (MRP) versus Pull (demand information transmitted

quickly throughout the supply chain)

Real-time information

Coordination and Information sharing

Transactional IT

Expensive and difficult to implement

About 25% of ERP installations are cancelled within a year

About 70% of ERP installations go over the budget

52

utdallas.edu/~metin

IT Push

0

100

200

300

400

500

1965 1973 1981 1989 1997

IT investment($B)

53

utdallas.edu/~metin

Supply Chain Software Push

See Top 100 under /articles.html

Source Kanakamedala,

Ramsdell, Srivatsan (2003).

McKinsey Quarterly, No 1.

54

utdallas.edu/~metin

5. Sourcing

Role in the supply chain

Set of processes required to purchase goods and services in a supply chain

Supplier selection, single vs. multiple suppliers, contract negotiation

Role in the competitive strategy

Sourcing is crucial. It affects efficiency and responsiveness in a supply chain

In-house vs. outsource decisions- improving efficiency and responsiveness

TI: More than half of the revenue spent for sourcing.

Cisco sources: Low-end products (e.g. home routers) from China.

Components of sourcing decisions

In-house versus outsource decisions

Supplier evaluation and selection

Procurement process:

Every department of a firm buy from suppliers independently, or all together.

EDS to reduce the number of officers with purchasing authorization.

55

utdallas.edu/~metin

6. Pricing

Role in the supply chain

Pricing determines the amount to charge customers in a supply chain

Pricing strategies can be used to match demand and supply

Price elasticity: Do you know yours?

Role in the competitive strategy

Use pricing strategies to improve efficiency and responsiveness

Low price and low product availability; vary prices by response times

Amazon: Faster delivery is more expensive

Components of pricing decisions

Pricing and economies of scale

Everyday low pricing versus high-low pricing

Fixed price versus menu pricing, depending on the product and services

Packaging, delivery location, time, customer pick up

Bundling products; products and services

56

utdallas.edu/~metin

Considerations for Supply Chain Drivers

Driver Efficiency Responsiveness

Inventory Cost of holding Availability

Transportation Consolidation Speed

Facilities Consolidation /

Dedicated

Proximity /

Flexibility

Information Low cost/slow/no

duplication

High cost/

streamlined/reliable

Sourcing Low cost sources Responsive sources

Pricing Constant price Low-high price

57

utdallas.edu/~metin

Major Obstacles to Achieving Fit

SC is big:

Variety of products/services

Spoiled customer

Multiple owners (Procurement, Production, Inventory,

Marketing) / multiple objectives

Globalization

Local optimization and lack of global fit

58

utdallas.edu/~metin

Dealing with Multiple Owners / Local Optimization

Information Coordination

Information sharing / Shyness / Legal and ethical issues

Contractual Coordination

Mechanisms to align local objectives with global ones

Coordination with (real) options

Rare in the practice

Without coordination, misleading reliance on metrics:

Average safety inventory, Average incoming shipment size, Average

purchase price of raw materials, Revenue

Major Obstacles to Achieving Fit

59

utdallas.edu/~metin

Major obstacles to achieving fit

Instability and Randomness:

Increasing product variety

Shrinking product life cycles

Customer fragmentation: Push for customization, segmentation

Fragmentation of Supply Chain ownership: Globalization

Increasing implied uncertainty

60

utdallas.edu/~metin

Common problems

Lack of relevant SCM metrics: How to measure

responsiveness?

How to measure efficiency, costs, worker performance, etc?

Poor inventory status information

Theft: Major problem for furniture retailers.

Transaction errors: Retailers with inaccurate inventory records

for 65% of SKUs

Information delays, dated information, incompatible info. systems

Misplaced inventory: 16% of items cannot be found at a major retailer

Spoilage: active ingredients in the products are losing their properties

Product quality and yield

Lack of visibility in SCs

Do you know the inventory your distribution centers hold?

Do you know the inventory your fellow retailer holds?

61

utdallas.edu/~metin

Common problems

Poor delivery status information

Not knowing the order status

Poor IT design

Unreliable, duplicate data

Security problems: too much or too little

Ignoring uncertainties

The flight from uncertainty and ambiguity is so motivated that we often

create pseudocertainty.

Nitin Nohra, HBR February 2006 issue, p.40.

Internal customer discrimination

Giving lower priority to internal customers than external customers

Poor integration

Elusive inventory costs

Accounting systems do not capture opportunity costs

SC-insensitive product design

62

utdallas.edu/~metin

Summary

Supply Chain Introduction

Competitiveness / Business strategy / SCM strategy

Components

Inventory, Transportation, Facilities, Information, Sourcing, Pricing

Challenges

63

utdallas.edu/~metin

Seven Eleven Japan (SEJ)

A Case Study

64

utdallas.edu/~metin

Factual Information on Seven Eleven Japan (SEJ)

Largest convenience store in Japan with market value of $95 B. The third largest

retail company in the world after Wal-Mart and Home Depot.

Established in 1974.

In 2000, total sales $18,000 M, profit $620 M.

Average inventory turnover time 7-8.5 days.

Stock value increased by 3000 times from 1974 to 2000.

In 1985, there were 2000 stores in Japan, increasing by 400-500 per year.

Return on equity 14% over 2000-2004.

A SEJ store is about the half the size of a US 7-eleven store,

that is about 110 m

2

.

Sales:

Products

32.9% Processed food: drinks, noodles, bread and snacks

31.6% Fast food: rice ball, box lunch and hamburgers

12.0% Fresh food: diary products

25.3% Non-food: magazines, ladies stockings and batteries.

Services: Utility bill paying, installment payments for credit companies, ATMs, photocopying

65

utdallas.edu/~metin

More on SEJ

More factual info:

Average sales about twice of an average US store

SKUs offered in store: Over 3,000 (change by time of day, day of week, season)

Virtually no storage space

No food cooking at the stores

Japanese Images of Seven Eleven:

Convenient

Cheerful and lively stores

Many ready made dinner items I buy

Famous for its great boxed lunch and dinner

- On weekends, when I was single, I went to buy lunch and dinner

SC strategy:

Micro matching of supply and demand (by location, time of day, day of week, season)

66

utdallas.edu/~metin

Seven Eleven - Number of Stores

0

1000

2000

3000

4000

5000

6000

85 86 87 88 89 90 91 92 93 94

Number of Stores

1999: 8,027

2004: 10,356

67

utdallas.edu/~metin

Seven Eleven - Net Sales (B Yen)

Sales 1,963 B Yen in 2000

0

200

400

600

800

1000

1200

1400

85 86 87 88 89 90 91 92 93 94

Net Sales

68

utdallas.edu/~metin

Seven Eleven - Pre tax Profit (B Yen)

0

10

20

30

40

50

60

70

80

90

100

85 86 87 88 89 90 91 92 93 94

Profit

69

utdallas.edu/~metin

Seven Eleven - Inventory turnover (days)

0

2

4

6

8

10

12

14

85 86 87 88 89 90 91 92 93 94

Inventory

70

utdallas.edu/~metin

Information Strategy

Quick access to up to date information (as opposed to data):

In 1991, SEJ implemented Integrated Service Digital Network to link stores, headquarter,

DCs and suppliers

Customer checkout process

Clerk records the customers gender, (estimated) age and purchased items. These Point of Sales

(POS) data are transmitted to database at the headquarters.

Store hardware: Store computer, POS registers linked to store computer, Graphic Order

Terminals, Scanner terminals for receiving

Daily use of the data

Headquarters aggregate the data by region, products and time and pass to suppliers and stores by

next morning. Store managers deduce trend information.

Weekly use of the data

Monday morning, the CEO chairs a weekly strategy formulation meeting attended by 100

corporate managers.

Tuesday morning, strategies are communicated to Operation Field Counselors who arrive in

Tokyo on Monday night.

Tuesday afternoon, regional elements (e.g. weather, sport events) are factored into the strategy.

Tuesday nights, field counselors return back to their regions.

71

utdallas.edu/~metin

72

utdallas.edu/~metin

Information Analysis of POS Data

Analysis of

Sales for product categories over time

SKU (stock keeping unit)

Waste or disposal

10 day (or week) sales trend by SKU

Sales trends for new product

In the early 1990s, half-prepared fresh noodle sales were going up,

new fresh noodle products were quickly developed

Sales trend by time and day

Different sales patterns for different sizes of milk at different times of the day results in

rearrangement of the milks in the fridge. Extreme store micromanagement.

Let us speculate: Flavored milks are put in front of the pure milks in the evening (or the morning?).

List of slow moving items

About half of 3000 SKUs are replaced by new ones every year

73

utdallas.edu/~metin

Facilities Strategy

Limited storage space at stores which have only 125-150 m

2

space

Frequent and small deliveries to stores

Deliveries arrive from over 200 plants.

Products are grouped by the cooling needs

Combined delivery system: frozen foods, chilled foods, room temperature and hot foods.

Such product groups are cross-docked at distribution centers (DC). Food DCs store no

inventory.

A single truck brings a group of products and visits several stores within a geographical region

Aggregation: No supplier (not even coke!) delivers direct

The number of truck deliveries per day is reduced by a factor of 7 from 1974 to 2000.

Still, at least 3 fresh food deliveries per day. Goods are received faster with the use of

scanners.

Have many outlets, at convenient locations, close to where customers can walk

Focus on some territories, not all: When they locate in a place they blanket (a.k.a.

clustering) the area with stores; stores open in clusters with corresponding DCs.

844 stores in the Tokyo region; Seven Eleven had stores in 32 out of 47 prefectures in 2004. No

stores in Kobe.

Success rate of franchise application <= 1/100

74

utdallas.edu/~metin

The Present and the Future

Is food preparation a good idea at 7-eleven locations?

e.g. Compare microwave heating vs. salad preparation.

Why SEJ does not allow direct delivery from suppliers to retailers?

Point out which of the following strategies can also be used in US (or Taiwan)

Information strategy

Facilities strategy

Discuss the differences between the Japanese and US (or Taiwanese) consumers with

regard to

Frequency and amount of grocery purchase

Use of credit cards vs. cash for purchase

7-eleven inventory turnover rate is 50 in Japan and 19 in the USA.

7-eleven growing rapidly in the US so it aims to be a web depot in both the US and Japan.

Does this make sense from a supply chain perspective?

Cost vs. Responsiveness

Business strategy

What is the risk of micro-matching strategy?

No direct deliveries to SEJ, what is the potential risk of this strategy if used in the USA?

75

utdallas.edu/~metin

Deloitte 2008 Global Retailers Survey

Excerpts from

www.deloitte.com/dtt/cda/doc/content/dtt_2008globalpowersofretailing.pdf

Downloaded on Jan 30, 2008.

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-1

Chapter 8

Aggregate

Planning

in the Supply

Chain

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-2

Outline

Role of aggregate planning in a supply chain

The aggregate planning problem

Aggregate planning strategies

Implementing aggregate planning in practice

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-3

Role of Aggregate Planning

in a Supply Chain

Capacity has a cost, lead times are greater than zero

Aggregate planning:

process by which a company determines levels of capacity,

production, subcontracting, inventory, stockouts, and pricing

over a specified time horizon

goal is to maximize profit

decisions made at a product family (not SKU) level

time frame of 3 to 18 months

how can a firm best use the facilities it has?

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-4

Role of Aggregate Planning

in a Supply Chain

Specify operational parameters over the time horizon:

production rate

workforce

overtime

machine capacity level

subcontracting

backlog

inventory on hand

All supply chain stages should work together on an

aggregate plan that will optimize supply chain

performance

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-5

The Aggregate Planning Problem

Given the demand forecast for each period in the

planning horizon, determine the production level,

inventory level, and the capacity level for each period

that maximizes the firms (supply chains) profit over

the planning horizon

Specify the planning horizon (typically 3-18 months)

Specify the duration of each period

Specify key information required to develop an

aggregate plan

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-6

Information Needed for

an Aggregate Plan

Demand forecast in each period

Production costs

labor costs, regular time ($/hr) and overtime ($/hr)

subcontracting costs ($/hr or $/unit)

cost of changing capacity: hiring or layoff ($/worker) and

cost of adding or reducing machine capacity ($/machine)

Labor/machine hours required per unit

Inventory holding cost ($/unit/period)

Stockout or backlog cost ($/unit/period)

Constraints: limits on overtime, layoffs, capital

available, stockouts and backlogs

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-7

Outputs of Aggregate Plan

Production quantity from regular time, overtime, and

subcontracted time: used to determine number of

workers and supplier purchase levels

Inventory held: used to determine how much warehouse

space and working capital is needed

Backlog/stockout quantity: used to determine what

customer service levels will be

Machine capacity increase/decrease: used to determine

if new production equipment needs to be purchased

A poor aggregate plan can result in lost sales, lost

profits, excess inventory, or excess capacity

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-8

Aggregate Planning Strategies

Trade-off between capacity, inventory,

backlog/lost sales

Chase strategy using capacity as the lever

Time flexibility from workforce or capacity

strategy using utilization as the lever

Level strategy using inventory as the lever

Mixed strategy a combination of one or more of

the first three strategies

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-9

Chase Strategy

Production rate is synchronized with demand by

varying machine capacity or hiring and laying off

workers as the demand rate varies

However, in practice, it is often difficult to vary

capacity and workforce on short notice

Expensive if cost of varying capacity is high

Negative effect on workforce morale

Results in low levels of inventory

Should be used when inventory holding costs are high

and costs of changing capacity are low

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-10

Time Flexibility Strategy

Can be used if there is excess machine capacity

Workforce is kept stable, but the number of hours

worked is varied over time to synchronize production

and demand

Can use overtime or a flexible work schedule

Requires flexible workforce, but avoids morale

problems of the chase strategy

Low levels of inventory, lower utilization

Should be used when inventory holding costs are

high and capacity is relatively inexpensive

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-11

Level Strategy

Maintain stable machine capacity and workforce

levels with a constant output rate

Shortages and surpluses result in fluctuations in

inventory levels over time

Inventories that are built up in anticipation of future

demand or backlogs are carried over from high to low

demand periods

Better for worker morale

Large inventories and backlogs may accumulate

Should be used when inventory holding and backlog

costs are relatively low

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-12

Fundamental Tradeoffs in

Aggregate Planning

Capacity (regular time, overtime, subcontract)

Inventory

Backlog / lost sales

Basic Strategies

Chase strategy

Time flexibility from workforce or capacity

Level strategy

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-13

Aggregate Planning at

Red Tomato Tools

Month Demand Forecast

January 1,600

February 3,000

March 3,200

April 3,800

May 2,200

June 2,200

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-14

Aggregate Planning at Red

Tomato Tools

Item Cost

Materials $10/unit

Inventory holding cost $2/unit/month

Marginal cost of a stockout $5/unit/month

Hiring and training costs $300/worker

Layoff cost $500/worker

Labor hours required 4/unit

Regular time cost $4/hour

Over time cost $6/hour

Cost of subcontracting $30/unit

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-15

Aggregate Planning at Red Tomato Tools

(Define Decision Variables)

W

t

= Workforce size for month t, t = 1, ..., 6

H

t

= Number of employees hired at the beginning of month t,

t = 1, ..., 6

L

t

= Number of employees laid off at the beginning of month t,

t = 1, ..., 6

P

t

= Production in month t, t = 1, ..., 6

I

t

= Inventory at the end of month t, t = 1, ..., 6

S

t

= Number of units stocked out at the end of month t,

t = 1, ..., 6

C

t

= Number of units subcontracted for month t, t = 1, ..., 6

O

t

= Number of overtime hours worked in month t, t = 1, ..., 6

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-16

Aggregate Planning at Red Tomato Tools

(Define Objective Function)

6

1

6

1

6

1

6

1

6

1

6

1

6

1

6

1

30 10 5

2 6 500

300 640

t

t

t

t

t

t

t

t

t

t

t

t

t

t

t

t

C P S

I O L

H W

Min

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-17

Aggregate Planning at Red Tomato tools

(Define Constraints Linking Variables)

Workforce size for each month is based on hiring

and layoffs

. 80 , 6 ,..., 1

0

,

0

1

1

W where t for

L H W W

or

L H W W

t t t t

t t t t

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-18

Aggregate Planning at Red Tomato Tools

(Constraints)

Production for each month cannot exceed capacity

. 6 ,..., 1

, 0 4 40

, 4 40

t for

P O W

O W P

t t t

t t t

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-19

Aggregate Planning at Red Tomato Tools

(Constraints)

Inventory balance for each month

. 500 , 0

, 000 , 1 , 6 ,..., 1

, 0

,

6 0

0

1 1

1 1

I

and

S

I

where t for

S I S D C P I

S I S D C P I

t t t t t t t

t t t t t t t

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-20

Aggregate Planning at Red Tomato Tools

(Constraints)

Over time for each month

. 6 ,..., 1

, 0 10

, 10

t for

O W

W O

t t

t t

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-21

Scenarios

Increase in holding cost (from $2 to $6)

Overtime cost drops to $4.1 per hour

Increased demand fluctuation

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-22

Increased Demand Fluctuation

Month Demand Forecast

January 1,000

February 3,000

March 3,800

April 4,800

May 2,000

June 1,400

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-23

Aggregate Planning in Practice

Think beyond the enterprise to the entire supply chain

Make plans flexible because forecasts are always

wrong

Rerun the aggregate plan as new information emerges

Use aggregate planning as capacity utilization

increases

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Aggregate Planning in Excel

Construct a table with the decision variables

Construct a table for constraints

Create a cell containing the objective function

Use Data Analysis Solver

8-24

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

INVENTORY PLANNING AND ECONOMIC

THEORY -ABERRATIONS

Available evidence indicates that Indian industries,

by and large do not show any serious concern for

inventory ordering and carrying costs. What are the

main reasons for their indifference to scientific

inventory management techniques?

What adaptations of Just In Time (JIT) practices do

you visualize emerging in the Indian environment in

the near future?

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

8-26

Summary of Learning Objectives

What types of decisions are best solved by aggregate

planning?

What is the importance of aggregate planning as a

supply chain activity?

What kinds of information are needed to produce an

aggregate plan?

What are the basic trade-offs a manager makes to

produce an aggregate plan?

How are aggregate planning problems formulated and

solved using Microsoft Excel?

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Chapter 7

Demand

Forecasting

in a Supply

Chain

7-1

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-2

Outline

The role of forecasting in a supply chain

Characteristics of forecasts

Components of forecasts and forecasting methods

Basic approach to demand forecasting

Time series forecasting methods

Measures of forecast error

Forecasting demand at Tahoe Salt

Forecasting in practice

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-3

Role of Forecasting

in a Supply Chain

The basis for all strategic and planning decisions

in a supply chain

Used for both push and pull processes

Examples:

Production: scheduling, inventory, aggregate planning

Marketing: sales force allocation, promotions, new

production introduction

Finance: plant/equipment investment, budgetary

planning

Personnel: workforce planning, hiring, layoffs

All of these decisions are interrelated

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-4

Characteristics of Forecasts

Forecasts are always wrong. Should include

expected value and measure of error.

Long-term forecasts are less accurate than short-

term forecasts (forecast horizon is important)

Aggregate forecasts are more accurate than

disaggregate forecasts

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-5

Forecasting Methods

Qualitative: primarily subjective; rely on

judgment and opinion

Time Series: use historical demand only

Static

Adaptive

Causal: use the relationship between demand and

some other factor to develop forecast

Simulation

Imitate consumer choices that give rise to demand

Can combine time series and causal methods

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-6

Components of an Observation

Observed demand (O) =

Systematic component (S) + Random component (R)

Level (current deseasonalized demand)

Trend (growth or decline in demand)

Seasonality (predictable seasonal fluctuation)

Systematic component: Expected value of demand

Random component: The part of the forecast that deviates

from the systematic component

Forecast error: difference between forecast and actual demand

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-7

Time Series Forecasting

Quarter Demand D

t

II, 2006 8000

III, 2006 13000

IV, 2006 23000

I, 2007 34000

II, 2007 10000

III, 2007 18000

IV, 2007 23000

I, 2008 38000

II, 2008 12000

III, 2008 13000

IV, 2008 32000

I, 2009 41000

Forecast demand for the

next four quarters.

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-8

Time Series Forecasting

0

20,000

40,000

60,000

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-9

Forecasting Methods

Static

Adaptive

Moving average

Simple exponential smoothing

Holts model (with trend)

Winters model (with trend and seasonality)

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-10

Basic Approach to

Demand Forecasting

Understand the objectives of forecasting

Integrate demand planning and forecasting

Identify major factors that influence the demand

forecast

Understand and identify customer segments

Determine the appropriate forecasting technique

Establish performance and error measures for the

forecast

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-11

Time Series

Forecasting Methods

Goal is to predict systematic component of demand

Multiplicative: (level)(trend)(seasonal factor)

Additive: level + trend + seasonal factor

Mixed: (level + trend)(seasonal factor)

Static methods

Adaptive forecasting

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-12

Static Methods

Assume a mixed model:

Systematic component = (level + trend)(seasonal factor)

F

t+l

= [L + (t + l)T]S

t+l

= forecast in period t for demand in period t + l

L = estimate of level for period 0

T = estimate of trend

S

t

= estimate of seasonal factor for period t

D

t

= actual demand in period t

F

t

= forecast of demand in period t

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-13

Static Methods

Estimating level and trend

Estimating seasonal factors

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-14

Estimating Level and Trend

Before estimating level and trend, demand data

must be deseasonalized

Deseasonalized demand = demand that would

have been observed in the absence of seasonal

fluctuations

Periodicity (p)

the number of periods after which the seasonal cycle

repeats itself

for demand at Tahoe Salt (Table 7.1, Figure 7.1) p = 4

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-15

Time Series Forecasting

(Table 7.1)

Quarter, Year Demand D

t

II, 1 8000

III, 1 13000

IV, 1 23000

I, 2 34000

II, 2 10000

III, 2 18000

IV, 2 23000

I, 3 38000

II, 3 12000

III, 3 13000

IV, 3 32000

I, 4 41000

Forecast demand for the

next four quarters.

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-16

Time Series Forecasting

(Figure 7.1)

0

10,000

20,000

30,000

40,000

50,000

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-17

Estimating Level and Trend

Before estimating level and trend, demand data

must be deseasonalized

Deseasonalized demand = demand that would

have been observed in the absence of seasonal

fluctuations

Periodicity (p)

the number of periods after which the seasonal cycle

repeats itself

for demand at Tahoe Salt (Table 7.1, Figure 7.1) p = 4

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-18

Deseasonalizing Demand

[D

t-(p/2)

+ D

t+(p/2)

+ 2D

i

] / 2p for p even

D

t

= (sum is from i = t+1-(p/2) to t+1+(p/2))

D

i

/ p for p odd

(sum is from i = t-(p/2) to t+(p/2)), p/2 truncated to lower integer

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-19

Deseasonalizing Demand

For the example, p = 4 is even

For t = 3:

D3 = {D1 + D5 + Sum(i=2 to 4) [2Di]}/8

= {8000+10000+[(2)(13000)+(2)(23000)+(2)(34000)]}/8

= 19750

D4 = {D2 + D6 + Sum(i=3 to 5) [2Di]}/8

= {13000+18000+[(2)(23000)+(2)(34000)+(2)(10000)]/8

= 20625

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-20

Deseasonalizing Demand

Then include trend

D

t

= L + tT

where D

t

= deseasonalized demand in period t

L = level (deseasonalized demand at period 0)

T = trend (rate of growth of deseasonalized demand)

Trend is determined by linear regression using

deseasonalized demand as the dependent variable and

period as the independent variable (can be done in

Excel)

In the example, L = 18,439 and T = 524

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-21

Time Series of Demand

(Figure 7.3)

0

10000

20000

30000

40000

50000

1 2 3 4 5 6 7 8 9 10 11 12

Period

D

e

m

a

n

d

Dt

Dt-bar

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-22

Estimating Seasonal Factors

Use the previous equation to calculate deseasonalized

demand for each period

S

t

= D

t

/ D

t

= seasonal factor for period t

In the example,

D

2

= 18439 + (524)(2) = 19487 D

2

= 13000

S

2

= 13000/19487 = 0.67

The seasonal factors for the other periods are

calculated in the same manner

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-23

Estimating Seasonal Factors

(Fig. 7.4)

t Dt Dt-bar S-bar

1 8000 18963 0.42 = 8000/18963

2 13000 19487 0.67 = 13000/19487

3 23000 20011 1.15 = 23000/20011

4 34000 20535 1.66 = 34000/20535

5 10000 21059 0.47 = 10000/21059

6 18000 21583 0.83 = 18000/21583

7 23000 22107 1.04 = 23000/22107

8 38000 22631 1.68 = 38000/22631

9 12000 23155 0.52 = 12000/23155

10 13000 23679 0.55 = 13000/23679

11 32000 24203 1.32 = 32000/24203

12 41000 24727 1.66 = 41000/24727

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-24

Estimating Seasonal Factors

The overall seasonal factor for a season is then obtained

by averaging all of the factors for a season

If there are r seasonal cycles, for all periods of the form

pt+i, 1<i<p, the seasonal factor for season i is

S

i

= [Sum

(j=0 to r-1)

S

jp+i

]/

r

In the example, there are 3 seasonal cycles in the data and

p=4, so

S1 = (0.42+0.47+0.52)/3 = 0.47

S2 = (0.67+0.83+0.55)/3 = 0.68

S3 = (1.15+1.04+1.32)/3 = 1.17

S4 = (1.66+1.68+1.66)/3 = 1.67

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-25

Estimating the Forecast

Using the original equation, we can forecast the next

four periods of demand:

F13 = (L+13T)S1 = [18439+(13)(524)](0.47) = 11,868

F14 = (L+14T)S2 = [18439+(14)(524)](0.68) = 17,527

F15 = (L+15T)S3 = [18439+(15)(524)](1.17) = 30,770

F16 = (L+16T)S4 = [18439+(16)(524)](1.67) = 44,794

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-26

Adaptive Forecasting

The estimates of level, trend, and seasonality are

adjusted after each demand observation

General steps in adaptive forecasting

Moving average

Simple exponential smoothing

Trend-corrected exponential smoothing (Holts

model)

Trend- and seasonality-corrected exponential

smoothing (Winters model)

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-27

Basic Formula for

Adaptive Forecasting

F

t+1

= (L

t

+ lT)S

t+1

= forecast for period t+l in period t

L

t

= Estimate of level at the end of period t

T

t

= Estimate of trend at the end of period t

S

t

= Estimate of seasonal factor for period t

F

t

= Forecast of demand for period t (made period t-1 or

earlier)

D

t

= Actual demand observed in period t

E

t

= Forecast error in period t

A

t

= Absolute deviation for period t = |E

t

|

MAD = Mean Absolute Deviation = average value of A

t

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-28

General Steps in

Adaptive Forecasting

Initialize: Compute initial estimates of level (L

0

), trend

(T

0

), and seasonal factors (S

1

,,S

p

). This is done as

in static forecasting.

Forecast: Forecast demand for period t+1 using the

general equation

Estimate error: Compute error E

t+1

= F

t+1

- D

t+1

Modify estimates: Modify the estimates of level (L

t+1

),

trend (T

t+1

), and seasonal factor (S

t+p+1

), given the

error E

t+1

in the forecast

Repeat steps 2, 3, and 4 for each subsequent period

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-29

Moving Average

Used when demand has no observable trend or seasonality

Systematic component of demand = level

The level in period t is the average demand over the last N

periods (the N-period moving average)

Current forecast for all future periods is the same and is based

on the current estimate of the level

L

t

= (D

t

+ D

t-1

+ + D

t-N+1

) / N

F

t+1

= L

t

and F

t+n

= L

t

After observing the demand for period t+1, revise the

estimates as follows:

L

t+1

= (D

t+1

+ D

t

+ + D

t-N+2

) / N

F

t+2

= L

t+1

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-30

Moving Average Example

From Tahoe Salt example (Table 7.1)

At the end of period 4, what is the forecast demand for periods 5

through 8 using a 4-period moving average?

L4 = (D4+D3+D2+D1)/4 = (34000+23000+13000+8000)/4 = 19500

F5 = 19500 = F6 = F7 = F8

Observe demand in period 5 to be D5 = 10000

Forecast error in period 5, E5 = F5 - D5 = 19500 - 10000 = 9500

Revise estimate of level in period 5:

L5 = (D5+D4+D3+D2)/4 = (10000+34000+23000+13000)/4 =

20000

F6 = L5 = 20000

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-31

Simple Exponential Smoothing

Used when demand has no observable trend or seasonality

Systematic component of demand = level

Initial estimate of level, L

0

, assumed to be the average of all

historical data

L

0

= [Sum(

i=1 to n

)D

i

]/n

Current forecast for all future periods is equal to the current

estimate of the level and is given as follows:

F

t+1

= L

t

and F

t+n

= L

t

After observing demand Dt+1, revise the estimate of the level:

L

t+1

= D

t+1

+ (1-)L

t

L

t+1

= Sum

(n=0 to t+1)

[(1-)

n

D

t+1-n

]

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-32

Simple Exponential Smoothing

Example

From Tahoe Salt data, forecast demand for period 1 using

exponential smoothing

L

0

= average of all 12 periods of data

= Sum

(i=1 to 12)

[D

i

]/12 = 22083

F1 = L0 = 22083

Observed demand for period 1 = D1 = 8000

Forecast error for period 1, E1, is as follows:

E1 = F1 - D1 = 22083 - 8000 = 14083

Assuming = 0.1, revised estimate of level for period 1:

L1 = D1 + (1-)L0 = (0.1)(8000) + (0.9)(22083) = 20675

F2 = L1 = 20675

Note that the estimate of level for period 1 is lower than in period 0

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-33

Trend-Corrected Exponential

Smoothing (Holts Model)

Appropriate when the demand is assumed to have a level and

trend in the systematic component of demand but no seasonality

Obtain initial estimate of level and trend by running a linear

regression of the following form:

D

t

= at + b

T

0

= a

L

0

= b

In period t, the forecast for future periods is expressed as follows:

F

t+1

= L

t

+ T

t

F

t+n

= L

t

+ nT

t

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-34

Trend-Corrected Exponential

Smoothing (Holts Model)

After observing demand for period t, revise the estimates for level

and trend as follows:

L

t+1

= D

t+1

+ (1-)(L

t

+ T

t

)

T

t+1

= (L

t+1

- L

t

) + (1-)T

t

= smoothing constant for level

= smoothing constant for trend

Example: Tahoe Salt demand data. Forecast demand for period 1

using Holts model (trend corrected exponential smoothing)

Using linear regression,

L

0

= 12015 (linear intercept)

T

0

= 1549 (linear slope)

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-35

Holts Model Example (continued)

Forecast for period 1:

F1 = L0 + T0 = 12015 + 1549 = 13564

Observed demand for period 1 = D1 = 8000

E1 = F1 - D1 = 13564 - 8000 = 5564

Assume = 0.1, = 0.2

L1 = D1 + (1-)(L0+T0) = (0.1)(8000) + (0.9)(13564) = 13008

T1 = (L1 - L0) + (1-)T0 = (0.2)(13008 - 12015) + (0.8)(1549)

= 1438

F2 = L1 + T1 = 13008 + 1438 = 14446

F5 = L1 + 4T1 = 13008 + (4)(1438) = 18760

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-36

Trend- and Seasonality-Corrected

Exponential Smoothing

Appropriate when the systematic component of

demand is assumed to have a level, trend, and seasonal

factor

Systematic component = (level+trend)(seasonal factor)

Assume periodicity p

Obtain initial estimates of level (L

0

), trend (T

0

),

seasonal factors (S

1

,,S

p

) using procedure for static

forecasting

In period t, the forecast for future periods is given by:

F

t+1

= (L

t

+T

t

)(S

t+1

) and F

t+n

= (L

t

+ nT

t

)S

t+n

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-37

Trend- and Seasonality-Corrected

Exponential Smoothing (continued)

After observing demand for period t+1, revise estimates for level,

trend, and seasonal factors as follows:

L

t+1

= (D

t+1

/S

t+1

) + (1-)(L

t

+T

t

)

T

t+1

= (L

t+1

- L

t

) + (1-)T

t

S

t+p+1

= (D

t+1

/L

t+1

) + (1-)S

t+1

= smoothing constant for level

= smoothing constant for trend

= smoothing constant for seasonal factor

Example: Tahoe Salt data. Forecast demand for period 1 using

Winters model.

Initial estimates of level, trend, and seasonal factors are obtained

as in the static forecasting case

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-38

Trend- and Seasonality-Corrected

Exponential Smoothing Example (continued)

L

0

= 18439 T

0

= 524 S

1

=0.47, S

2

=0.68, S

3

=1.17, S

4

=1.67

F1 = (L0 + T0)S1 = (18439+524)(0.47) = 8913

The observed demand for period 1 = D1 = 8000

Forecast error for period 1 = E1 = F1-D1 = 8913 - 8000 = 913

Assume = 0.1, =0.2, =0.1; revise estimates for level and trend

for period 1 and for seasonal factor for period 5

L1 = (D1/S1)+(1-)(L0+T0) = (0.1)(8000/0.47)+(0.9)(18439+524)=18769

T1 = (L1-L0)+(1-)T0 = (0.2)(18769-18439)+(0.8)(524) = 485

S5 = (D1/L1)+(1-)S1 = (0.1)(8000/18769)+(0.9)(0.47) = 0.47

F2 = (L1+T1)S2 = (18769 + 485)(0.68) = 13093

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-39

Measures of Forecast Error

Forecast error = E

t

= F

t

- D

t

Mean squared error (MSE)

MSE

n

= (Sum

(t=1 to n)

[E

t

2

])/n

Absolute deviation = A

t

= |E

t

|

Mean absolute deviation (MAD)

MAD

n

= (Sum

(t=1 to n)

[A

t

])/n

= 1.25MAD

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-40

Measures of Forecast Error

Mean absolute percentage error (MAPE)

MAPE

n

= (Sum

(t=1 to n)

[|E

t

/ D

t

|100])/n

Bias shows whether the forecast consistently under- or

overestimates demand; should fluctuate around 0

bias

n

= Sum

(t=1 to n)

[E

t

]

Tracking signal should be within the range of +6,

otherwise, possibly use a new forecasting method

TS

t

= bias / MAD

t

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-41

Forecasting Demand at Tahoe Salt

Moving average

Simple exponential smoothing

Trend-corrected exponential smoothing

Trend- and seasonality-corrected exponential

smoothing

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-42

Forecasting in Practice

Collaborate in building forecasts

The value of data depends on where you are in the

supply chain

Be sure to distinguish between demand and sales

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

7-43

Summary of Learning Objectives

What are the roles of forecasting for an enterprise and

a supply chain?

What are the components of a demand forecast?

How is demand forecast given historical data using

time series methodologies?

How is a demand forecast analyzed to estimate

forecast error?

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Chapter 5

Network

Design in the

Supply Chain

5-1

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Outline

The Role of Network Design in the Supply Chain

Factors Influencing Network Design Decisions

Framework for Network Design Decisions

Models for Facility Location and Capacity

Allocation

The Role of IT in Network Design

Making Network Design Decisions in Practice

5-2

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Network Design Decisions

Facility role

Facility location

Capacity allocation

Market and supply allocation

5-3

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Factors Influencing

Network Design Decisions

Strategic

Technological

Macroeconomic

Political

Infrastructure

Competitive

Logistics and facility costs

5-4

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

The Cost-Response Time Frontier

Local FG

Mix

Regional FG

Local WIP

Central FG

Central WIP

Central Raw Material and Custom production

Custom production with raw material at suppliers

Cost

Response Time

Hi Low

Low

Hi

5-5

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Service and Number of Facilities

Number of Facilities

Response

Time

5-6

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Costs and Number of Facilities

Costs

Number of facilities

Inventory

Transportation

Facility costs

5-7

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Percent Service

Level Within

Promised Time

Transportation

Cost Buildup as a Function of Facilities

C

o

s

t

o

f

O

p

e

r

a

t

i

o

n

s

Number of Facilities

Inventory

Facilities

Total Costs

Labor

5-8

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Framework for Network Design

Decisions

Phase I Supply Chain Strategy

Phase II Regional Facility Configuration

Phase III Desirable Sites

Phase IV Location Choices

5-9

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

A Framework for

Network Design Decisions

PHASE I

Supply Chain

Strategy

PHASE II

Regional Facility

Configuration

PHASE III

Desirable Sites

PHASE IV

Location Choices

Competitive STRATEGY

INTERNAL CONSTRAINTS

Capital, growth strategy,

existing network

PRODUCTION TECHNOLOGIES

Cost, Scale/Scope impact, support

required, flexibility

COMPETITIVE

ENVIRONMENT

PRODUCTION METHODS

Skill needs, response time

FACTOR COSTS

Labor, materials, site specific

GLOBAL COMPETITION

TARIFFS AND TAX

INCENTIVES

REGIONAL DEMAND

Size, growth, homogeneity,

local specifications

POLITICAL, EXCHANGE

RATE AND DEMAND RISK

AVAILABLE

INFRASTRUCTURE

LOGISTICS COSTS

Transport, inventory, coordination

5-10

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Conventional Network

Customer

Store

Materials

DC

Component

Manufacturing

Vendor

DC

Final

Assembly

Finished

Goods DC

Components

DC

Vendor

DC Plant

Warehouse

Finished

Goods DC

Customer

DC

Customer

DC

Customer

DC

Customer

Store

Customer

Store

Customer

Store

Customer

Store

Vendor

DC

5-11

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Tailored Network: Multi-Echelon

Finished Goods Network

Regional

Finished

Goods DC

Regional

Finished

Goods DC

Customer 1

DC

Store 1

National

Finished

Goods DC

Local DC

Cross-Dock

Local DC

Cross-Dock

Local DC

Cross-Dock

Customer 2

DC

Store 1

Store 2

Store 2

Store 3

Store 3

5-12

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Gravity Methods for Location

Ton Mile-Center Solution

x,y: Warehouse Coordinates

x

n

, y

n

: Coordinates of delivery

location n

d

n

: Distance to delivery

location n

F

n

: Annual tonnage to delivery

location n

k

n n

n

k

n n

n

n

k

n n

n

k

n n

n

n

n

d

F

D

d

F

y

D

d

F

D

d

F

x

D

y y

x

x

d

n

n

y

n

n

x

n

n

1

1

1

1

2

2

) (

) (

Min

F

D d

n n

n

5-13

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Models for Facility Location and

Capacity Allocation

Phase II

Capacitated Plant location model

Phase III

Gravity location models

5-14

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Network Optimization Models

Allocating demand to production facilities

Locating facilities and allocating capacity

Which plants to establish? How to configure the network?

Key Costs:

Fixed facility cost

Transportation cost

Production cost

Inventory cost

Coordination cost

5-15

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Demand Allocation Model

Which market is served

by which plant?

Which supply sources

are used by a plant?

x

ij

= Quantity shipped from

plant site i to customer j

0

,..., 1 ,

,..., 1 ,

. .

1

1

1 1

x

K x

D x

x c

ij

i

m

j

ij

j

n

i

ij

n

i

m

j

ij ij

n i

m j

t s

Min

5-16

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Plant Location with Multiple Sourcing

y

i

= 1 if plant is located

at site i, 0 otherwise

x

ij

= Quantity shipped

from plant site i to

customer j

} 1 , 0 { ;

,..., 1 ,

,..., 1 ,

. .

1

1

1

1 1 1

y y

y

K x

D x

x c

y f

i

m

i

i

i

i

n

j

ij

j

n

i

ij

n

i

m

j

ij ij

i

n

i

i

k

n i

m j

t s

Min

5-17

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Plant Location with Single Sourcing

y

i

= 1 if plant is located

at site i, 0 otherwise

x

ij

= 1 if market j is

supplied by factory i, 0

otherwise

} 1 , 0 {

,..., 1 ,

,..., 1 , 1

. .

,

1

1

1 1 1

y

x

y

K

x

D

x

x

c

D

y f

ij

n i

j

m j

t s

j

Min

i

i

i

n

j

ij

n

i

ij

n

i

m

j

ij

ij

i

n

i

i

5-18

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

The Role of IT in Network Design

IT systems help with network design by:

1. Making the modeling of the network design

problems easier

2. Containing high-performance optimization

technologies

3. Allowing for what-if scenarios

4. Interfacing with planning and operational

software

5-19

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

Making Network Design Decisions In

Practice

Do not underestimate the life span of facilities

Do not gloss over the cultural implications

Do not ignore quality of life issues

Focus on tariffs and tax incentives when

locating facilities

5-20

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

SOCIO ECONOMIC FACTORS IN CHOICE OF

FACILITY LOCATION

What role do socio-economic factors play in

the selection of the facility location?

How do state policies aimed at promoting

balanced regional development, shape the

supply chain network designs?

Copyright 2010 Pearson Education, Inc. Publishing as Prentice Hall.

JAIPUR RUGS

How has Jaipur Rugs knitted together the

traditional skills of widely dispersed rural

workforce, through innovative adaptation of

supply chain practices that best fit the Indian

socio economic conditions to bring quality

products to the international market and ensure