Professional Documents

Culture Documents

Valuation Methods 00

Uploaded by

Baguma Grace GariyoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Methods 00

Uploaded by

Baguma Grace GariyoCopyright:

Available Formats

Valuation Methods

http://www.capevalue.co.za/index.php?option=com_content&view=article&id=51&Itemid=58

HOME

ABOUT CAPE VALUE

SERVICES

PORTFOLIO SAMPLES

NEWSROOM

CONTACT US

search...

MAIN MENU The Valuation Process Report Types and Content Valuation Request Form (VRF) Subscribe to Newsletter ABC of Valuations Valuation Methods Market vs Fair Value Forms of Land Tenure Property Legislation Concepts and Principals

Valuation Methods

In property valuations there are 5 generally accepted methods or approaches to value. These are the Sales Comparison-, the Income Capitalisation-, the Depreciated Replacement Cost (DRC)-, the Residual-, and the Profits method. The first method is the sales comparison approach. In a perfect market (or even a share market) a pattern or trend of prices can be observed by participants or potential participants. However, the very differentiation of a market is a collection of buyers and sellers with differing tastes and needs in terms of property. For example, the investor might be placing a premium on security rather than a higher return. Property prices needs to be analyzed and interpreted in order to obtain the true values utilized in the comparison analysis. This method is the preferred approach to value accepted by courts as less room is given to either too many variables or non-market information. Minister of Agriculture v Davey 1981 3 SA 877 (A) at 881: Mr Junod (for applicant) ARGUES: the method of using comparables as a guide to what the hypothetical buyer and seller would have agreed uponhas been held to be the most reliable methodIt is seldom, if ever, that our courts are confronted with a situation where the comparable material is a mirror-like reflection of the expropriated property (to be valued). What the valuer is looking for is a sale of a property which is similar, not identical. The second method is applied when income generating capabilities is present and is considered by the market as forming the primary basis for value. The capital value arrived at is the value attributed to the right to an annual income stream. This approach, to name a few, entails a research and analysis of transaction prices of similar or comparably substituting properties, rental rates, expense ratios, yields, capitalization rates, tenant covenants, and risk. In essence this approach entails an income stream from which expenses are deducted, the net income is then capitalized (income is converted to capital) by dividing it with a capitalization factor. Although the value is determined by capitalization, the basis of information researched and analyzed by utilizing the comparison approach. This method, therefore, is a combination of income and expense data though valued by processes of comparison. The third method, known as the depreciated replacement cost (DRC) method, is appropriate when little to no market evidence is available and the property does not transact readily in the market. A specialised property is a type of property that is rarely, if ever, sold in the market, due to the uniqueness of its specialised nature, design, configuration, size, and/or location. The approach entails the measuring of the improvements (buildings, site works) to which the appropriate construction costs are applied, resulting in the new replacement (or reproduction) cost. A depreciation factor (being composed of three factors namely physical deterioration, functional obsolescence, and external or economical obsolescence) is applied to the replacement values per category or segment in order to arrive at the present day value for the improvements. The market value of the land as if unimproved is then to be determined and added to this depreciated amount with the total amount reflecting the market value for the property.

1 of 2

2/11/2013 1:51 PM

Valuation Methods

http://www.capevalue.co.za/index.php?option=com_content&view=article&id=51&Itemid=58

The fourth method, known as the residual method, is widely used by developers to determine the value of land or the bid amount (the amount which the developer is willing to pay) for a piece of land given the proposed development. This approach, therefore, is applicable where a valuation is to be conducted for undeveloped land or where redevelopment of an obsolescent piece of land demands it. The first step is to estimate the value of the development as complete, whether its a township development or residential development or any other use or type of building. Then an allowance for development costs, professional fees, advertising and marketing costs, financing costs, developers profit and risk is deducted from the value as complete which results in the residual value. The fifth method is the profits method and is sometimes referred to as the accounting method. In general, the rental amounts and capital values are usually influenced by the potential to generate profit. Resultantly, profits can be used as a basis to determine the value of a property. The method entails an estimation of the gross annual income or turnover from which cost of sales and operating expenses are deducted. The net balance is then divided into a rent and profit split. The rental split is capitalized at an appropriate capitalization factor. In addition, the goodwill is to be ascertained at a market related multiplier with the market represented by the total of these two amounts. The second approach takes the estimated net profit only, divides it into a rental and profit split, and capitalizes the rental amount in order to determine the value of the business lock, stock and barrel. In certain circumstance it may be necessary to value on non-market based information. For example: a.) a number of buildings can be compared on a cost basis to ascertain whether the property will be obtained at a bargain or a premium. Its useful to note that this approach centres on the property while costs can possibly not be market related. b.) An owner may be willing to pay a premium for an adjoining property due to the potential or utility also known as Plottage Value i.e. where the whole represents more than the sum of the individuals. c.) The owner may require the application of a rate of return in an income capitalisation approach which is non-market related and specific to that investor or Portfolio Company and their financial capabilities. d.) It has been said that any method will be accepted, in the occasion of alternative approaches not being applicable, if it can be suitably motivated. Whenever a valuation is conducted on a non-market basis, then the definition of value should be provided i.e. investment value, synergistic value, etc.

Last Updated on Monday, 17 January 2011 15:54

Cape Value Property Valuers - Webdesign and SEO by Webmedie - Valid XHTML - Valid CSS

2 of 2

2/11/2013 1:51 PM

You might also like

- Structural Bio-D - LOO.3Document1 pageStructural Bio-D - LOO.3Baguma Grace GariyoNo ratings yet

- Steelwork Achwa Certificate No.1Document3 pagesSteelwork Achwa Certificate No.1Baguma Grace GariyoNo ratings yet

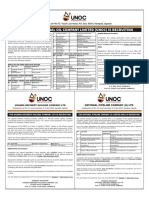

- UnocDocument1 pageUnocBaguma Grace GariyoNo ratings yet

- What Is The Difference Between Qualitative Research and Quantitative ResearchDocument1 pageWhat Is The Difference Between Qualitative Research and Quantitative ResearchBaguma Grace GariyoNo ratings yet

- How To Construct Houses With Plastic BottlesDocument4 pagesHow To Construct Houses With Plastic BottlesBaguma Grace GariyoNo ratings yet

- Estimating & Measuring Work Within A Construction EnvironmentDocument29 pagesEstimating & Measuring Work Within A Construction EnvironmentBaguma Grace GariyoNo ratings yet

- Pavement (Architecture) ..., The Free EncyclopediaDocument3 pagesPavement (Architecture) ..., The Free EncyclopediaBaguma Grace GariyoNo ratings yet

- What Is LeadershipDocument3 pagesWhat Is LeadershipBaguma Grace GariyoNo ratings yet

- Scaffolding - Wikipedia, The Free EncyclopediaDocument12 pagesScaffolding - Wikipedia, The Free EncyclopediaBaguma Grace GariyoNo ratings yet

- Kuroiler - Wikipedia, The Free EncyclopediaDocument2 pagesKuroiler - Wikipedia, The Free EncyclopediaBaguma Grace GariyoNo ratings yet

- Steel Grades - Wikipedia, The Free EncyclopediaDocument7 pagesSteel Grades - Wikipedia, The Free EncyclopediaBaguma Grace GariyoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ias 7 Statement of Cash Flows - 2. Preparing A SocfsDocument46 pagesIas 7 Statement of Cash Flows - 2. Preparing A SocfsK58 Nguyễn Hương GiangNo ratings yet

- Accounts - Past Years Que CompilationDocument393 pagesAccounts - Past Years Que CompilationSavya SachiNo ratings yet

- Syllabus - International Investment Management (ICertIM)Document25 pagesSyllabus - International Investment Management (ICertIM)dhanendrapardhiNo ratings yet

- CE409 Quantity Surveying and ValuationDocument2 pagesCE409 Quantity Surveying and ValuationBala GopalNo ratings yet

- Auditing Cup FINALS Nfjpia Bsa CpaDocument13 pagesAuditing Cup FINALS Nfjpia Bsa CpaJohn LuNo ratings yet

- Project Report - GarmentsDocument13 pagesProject Report - GarmentsGirish Sharma67% (3)

- Set No. 1Document11 pagesSet No. 1andhracollegesNo ratings yet

- T02 - Capital BudgetingDocument107 pagesT02 - Capital BudgetingSuehNo ratings yet

- Leases (Pas 17) PDFDocument4 pagesLeases (Pas 17) PDFRon GumapacNo ratings yet

- AMDocument42 pagesAMMatt Li50% (2)

- B7AF102 Financial Accounting May 2020Document9 pagesB7AF102 Financial Accounting May 2020dayahNo ratings yet

- FRFforSMEs Illustrative Financial Statements PDFDocument60 pagesFRFforSMEs Illustrative Financial Statements PDFMhiltz Ibarra De GuiaNo ratings yet

- R&D Project Grant Cost TemplateDocument9 pagesR&D Project Grant Cost Templatealfaroq_almsry100% (1)

- Accounting For PpeDocument37 pagesAccounting For PpeJohn Francis Idanan40% (5)

- Chapter 4 Financial PlanningDocument46 pagesChapter 4 Financial PlanningMustafa EyüboğluNo ratings yet

- MANSCI Final Exam QuestionnaireDocument10 pagesMANSCI Final Exam QuestionnaireChristine NionesNo ratings yet

- Presentation For Feasibility StudyDocument33 pagesPresentation For Feasibility StudyAnonymous xU8wDw83% (6)

- Entrep12 Q2 Mod10 Bookkeeping v2Document80 pagesEntrep12 Q2 Mod10 Bookkeeping v2MrBigbozz21No ratings yet

- Fixed Assets Interview Questions in R12Document21 pagesFixed Assets Interview Questions in R12devender143No ratings yet

- BBA & B.com 1 (1) AccountingDocument30 pagesBBA & B.com 1 (1) AccountingFaizan ChNo ratings yet

- HW2 Worksheet Ch09-2Document6 pagesHW2 Worksheet Ch09-2cyc135790cycNo ratings yet

- Pas 16 - Property, Plant, & Equipment: Conceptual Framework and Accounting StandardsDocument5 pagesPas 16 - Property, Plant, & Equipment: Conceptual Framework and Accounting StandardsMeg sharkNo ratings yet

- Financial Statement AnalysisDocument59 pagesFinancial Statement AnalysisRishu SinghNo ratings yet

- CFAS Unit 1 - Module 4Document12 pagesCFAS Unit 1 - Module 4Ralph Lefrancis DomingoNo ratings yet

- A Project Report On Direct TaxDocument53 pagesA Project Report On Direct Taxrani26oct84% (44)

- An Organisation Study of Gasha Steels Industry PVTDocument73 pagesAn Organisation Study of Gasha Steels Industry PVTdeepakparlil75% (4)

- United States v. The Motorlease Corporation, 334 F.2d 617, 2d Cir. (1964)Document4 pagesUnited States v. The Motorlease Corporation, 334 F.2d 617, 2d Cir. (1964)Scribd Government DocsNo ratings yet

- Tutorial ExcelDocument119 pagesTutorial Excelleucocit0No ratings yet

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- Colegio de San Juan de Letran: The Accountancy ProfessionDocument2 pagesColegio de San Juan de Letran: The Accountancy ProfessionRed YuNo ratings yet