Professional Documents

Culture Documents

Important Points For Salaried Persons For Availing Bank Loan

Uploaded by

dox4useOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Important Points For Salaried Persons For Availing Bank Loan

Uploaded by

dox4useCopyright:

Available Formats

Important Points For Salaried Persons For Availing Bank Loan As the Financial Year of 2012-13 is about to end,

most of the employees get busy with their income-tax planning, increment calculation etc but if they are wishing to avail Home Loan, Personal Loan or any other loan from Financial Institutions and are NOT regular in filing Income Tax Returns, then they are surely missing out some of the important compliances. This article is an effort to explain the importance of documents for SALARIED Persons who are desirous of taking Bank Loan in near future and have not filed previous 2 years Income Tax Returns. General Documents requirement for availing Bank Loan:1 2 3 4 Proof of Identity (KYC Norms) Proof of Address of Residence & Employment Proof of Income (Salary & Non-Salary) Property Documents

As this articles focus on documentation of Income Proofs:List of Important Financial Documents:1 2 3 4 desirable) 5 6 PAN Card Employment Profile Latest 3 Salary Slips Bank Statements/Passbook for latest 6 months (1 Year is Form 16 of 2 Previous Years (3 Years are desirable) Latest 2 Years Income-Tax Returns (3 Years are desirable)

Lets see how Banks scrutinize the above documents and suggestions through which one can improve financial eligibility. 1 PAN CARD:-

PAN is the basic identity of person from the view-point of Income-Tax & Financial Institutions. Your Credit History is verified from CIBIL {Credit Information Bureau India Limited). CIBIL is linked with PAN. The credit report is given in terms of SCORES. Higher the score, better the eligibility! The most important thing for improving the Score is to avoid default in any credit card/loan repayment. Even settlement of the same leads to negative scores. It is a myth that holding a credit card gives adverse effect. It is very good to use credit cards with regular payments.

EMPLOYMENT PROFILE:-

It includes Appointment Letters with Package Details, Experience Letters of Current as well as Previous Employers, Education Qualification Certificates, if any etc. It helps the Bankers to determine your qualification, experience and estimate your increased earning capacity. 3 LATEST 3 SALARY SLIPS:-

Form 16 (point-5) is given only at the completion of Financial Year i.e. 31 st March. So, the Banks generally ask the applicants to provide latest 3 salary slips in order to determine the current status of salary, continuation of job, specific deductions which started for the period after last Form 16 etc. One should plan to avoid any deduction in his/her last 3 salary slips in order to avoid any misapprehension by the bank. 4 BANK STATEMENTS/PASSBOOK:- (Latest 6-12 months)

Bank statements are one of the strongest presenters of your financial stability. Through bank passbook, the Banks verify many factors e.g. regular salary credits, existing loan/credit card installments payments, cheque bounce/return, other recurring savings payouts like LIC premiums, recurring deposits, bank interest income, fixed deposits etc. It is good that in major companies, the salary is directly credited to employees salary bank accounts but in case of smaller companies which pays cheques, the employees should deposit the cheques in one specific bank only in order avoid confusions to bankers. Further where the salaries are paid in cash, the employees should take the best care that they deposit the full amount in the bank account and then start spending from there. As a safe-guard, the employees should ask for salary slips or salary certificates from employers. 5 FORM 16 of 2 Previous Years (3 Years are desirable)

Form 16 is basically a TDS certificate given by employer to employee (even if TDS is deducted or not). But it serves as a greater Income Proof in terms of finances. It provides the income details as per Income-Tax format. One point must be noted for low salaried persons that when they get salary in structures i.e. Basic, DA, HRA, other allowances etc, it is not compulsory to claim every allowance deduction as it reduces your On-Paper Income calculated for the Loan Purpose. For example, suppose your Gross Income is Rs. 2,00,000/- p.a and your allowance deductions come to Rs. 80,000/- p.a. In case, you opt to claim all deductions, then your Income (as per IT Return) will be taken as Rs. 1,20,000/-. But if you dont claim any deduction, your Income (as per IT Return) will be Rs. 2,00,000/-. The Banks generally calculate your loan eligibility on the basis of your IT Returns and not on your CTC Package. 6 desirable) LATEST 2 YEARS INCOME-TAX RETURNS:- (3 Years are

What is the need of giving Income-Tax returns if Form 16 are given? Well, Form 16 compulsorily includes the Income from paid by employer to employee but the employer cannot force the employee to disclose his other incomes like Interest Income, Shares Income, Capital Gains or other Business Incomes etc. But in

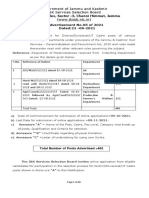

Income-Tax Returns, every person must disclose all incomes from all sources even if some or all the incomes are exempt. Further as per Income-Tax Rules, the salaried persons with salary not exceeding salary of Rs. 5,00,000/- are not required to file Income-Tax Return if the employer has filed. It is important to note that even if Income-Tax gives relief, Banks prefer to insist on Income-Tax Returns. Banks guidelines give priority to Income-Tax Assessees and by filing Income-Tax Return and even with Rs. 1 IT payment, your profile can gain weight! Further, after filing IT Returns, an Income-Tax Assessment Order {i.e. Intimation u/s. 143(1)} is received and this adds your strength. One mistake is generally done by the employees that they are not serious about filing of IT Returns regularly so at the time of taking loan, they are forced to file 2-3 years IT Returns together as per the banks requirement. But as per IncomeTax Rules, only 2 years IT Returns can be filed so the employees miss their chance of getting benefit of filing 3 years IT Returns and lose their Higher Loan Eligibility Calculation criteria. Further, the gap between the returns should be more than 6 months and when returns are filed on same day or with a time gap of less than 6 months, they have to face negative remarks in their loan procedure. But in any case, you should file the returns as some banks consider your case on the basis of supplementary documents So it becomes important to note the Time-Limits to file IT Returns as per IncomeTax:Financial Year Assessment Year to FY Normal Belated Return

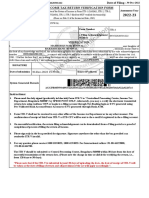

(i.e. Income Period) Due Date Due Date (###) 2010-11 (01/04/2010 to 31/03/2011) 2011-12 31/07/2011 31/03/2013 2011-12 (01/04/2011 to 31/03/2012) 2012-13 31/07/2012 31/03/2014 (###) After Due Date of Belated Return, the returns cannot be filed by persons except in case where they get notice from Income-Tax Department u/s/ 142(1) So, if you are one of them who has not filed IT Return for FY 2010-11(i.e. AY 2011-12), then hurry up, the last date is 31/03/2013 and if you miss this opportunity, you may find hurdles getting loans. It is worthwhile to note that now Income-Tax department advises to file IT Returns ONLINE through e-filing facility. It helps quick filing of return and faster processing of return. It is easy to e-file your return but it is always advisable to get the same filed through Professionals to avoid any technical issues. In case of any query, please mail us at cabhargav@gmail.com Happy e-filing of Income Tax Returns!!! CA Bhargav Bhatt | 09879305799 | Chartered Accounts | Ahmedabad

You might also like

- Package II Part I.3 Civil BOQ For Security BuildingDocument20 pagesPackage II Part I.3 Civil BOQ For Security Buildingdox4useNo ratings yet

- DPR EPCM013 - Plant Building 29 .01.2013Document5 pagesDPR EPCM013 - Plant Building 29 .01.2013dox4useNo ratings yet

- Package II Part I.4.2, Boq OhtDocument10 pagesPackage II Part I.4.2, Boq Ohtdox4useNo ratings yet

- Package II Part I.4.1 BOQ SumpDocument4 pagesPackage II Part I.4.1 BOQ Sumpdox4useNo ratings yet

- Inotes Jul12Document8 pagesInotes Jul12dox4useNo ratings yet

- Package II Part II.5.2 BOQ 25 Users Pre-Fabricated Septic TankDocument2 pagesPackage II Part II.5.2 BOQ 25 Users Pre-Fabricated Septic Tankdox4useNo ratings yet

- Package II Part II.5.1BOQ External Service (Sewer)Document3 pagesPackage II Part II.5.1BOQ External Service (Sewer)dox4useNo ratings yet

- Package II Part I.2 Civil BOQ For Service BlockDocument22 pagesPackage II Part I.2 Civil BOQ For Service Blockdox4useNo ratings yet

- Package II Part I.1 Civil BOQ For Transit House BuildingDocument29 pagesPackage II Part I.1 Civil BOQ For Transit House Buildingdox4useNo ratings yet

- Package II Part II.3 PH BOQ For Security BuildingDocument6 pagesPackage II Part II.3 PH BOQ For Security Buildingdox4useNo ratings yet

- Package II Part II.5.2 BOQ 25 Users Pre-Fabricated Septic TankDocument2 pagesPackage II Part II.5.2 BOQ 25 Users Pre-Fabricated Septic Tankdox4useNo ratings yet

- Guide to Sealed Tender SubmissionDocument2 pagesGuide to Sealed Tender Submissiondox4useNo ratings yet

- Package II Part I.4.1 BOQ SumpDocument10 pagesPackage II Part I.4.1 BOQ Sumpdox4useNo ratings yet

- Package II Part I.1 Civil BOQ For Transit House BuildingDocument29 pagesPackage II Part I.1 Civil BOQ For Transit House Buildingdox4useNo ratings yet

- Package II Part I.1 Civil BOQ For Transit House BuildingDocument29 pagesPackage II Part I.1 Civil BOQ For Transit House Buildingdox4useNo ratings yet

- ITL-Nandi PipesDocument1 pageITL-Nandi Pipesdox4useNo ratings yet

- 9.0 Customer's Technical Specifications, FQP & DrawingsDocument124 pages9.0 Customer's Technical Specifications, FQP & Drawingsdox4use100% (2)

- DPR EPCM011 - Non Plant Building 29-1-2013Document4 pagesDPR EPCM011 - Non Plant Building 29-1-2013dox4useNo ratings yet

- Guide to Sealed Tender SubmissionDocument2 pagesGuide to Sealed Tender Submissiondox4useNo ratings yet

- 9.0 Customer's Technical Specifications, FQP & DrawingsDocument124 pages9.0 Customer's Technical Specifications, FQP & Drawingsdox4use100% (2)

- 2.pre Qualifying RequirementsDocument2 pages2.pre Qualifying RequirementsKrm ChariNo ratings yet

- 14.drawings For Earthing WorksDocument5 pages14.drawings For Earthing Worksdox4useNo ratings yet

- BOQDocument65 pagesBOQkrmcharigdcNo ratings yet

- Hse SpecificationDocument6 pagesHse Specificationdox4useNo ratings yet

- Annexure To Conditions of Contract For Civil WorksDocument2 pagesAnnexure To Conditions of Contract For Civil Worksdox4useNo ratings yet

- 2.pre Qualifying RequirementsDocument2 pages2.pre Qualifying RequirementsKrm ChariNo ratings yet

- 9.0 Customer's Technical Specifications, FQP & DrawingsDocument124 pages9.0 Customer's Technical Specifications, FQP & Drawingsdox4use100% (2)

- 17.no Deviation CertificateDocument1 page17.no Deviation Certificatedox4useNo ratings yet

- BOQ For Civil Works (Annexure-I)Document2 pagesBOQ For Civil Works (Annexure-I)dox4useNo ratings yet

- Temporary Structures DesignDocument4 pagesTemporary Structures Designdox4useNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Proforma For Revision of Pension/Family PensionDocument2 pagesProforma For Revision of Pension/Family PensionHriday AgarwalNo ratings yet

- ERS-Normal User Booked TBM to NCJDocument2 pagesERS-Normal User Booked TBM to NCJMohan Raj VeerasamiNo ratings yet

- 21 2022 Drug Inspector Notification20221208213538Document24 pages21 2022 Drug Inspector Notification20221208213538Harsha KumarNo ratings yet

- JKSSB JR Engineer Recruitment 2021Document26 pagesJKSSB JR Engineer Recruitment 2021Rajesh K KumarNo ratings yet

- Zupto Vendor FirmDocument1 pageZupto Vendor FirmpavanNo ratings yet

- Business Plan GSK 2020Document16 pagesBusiness Plan GSK 2020Nadeem ManzoorNo ratings yet

- FIDELITY KYC FORMDocument20 pagesFIDELITY KYC FORMChinmay RaikarNo ratings yet

- Overseas Direct Investment ChecklistDocument5 pagesOverseas Direct Investment ChecklistAnil Palan0% (1)

- Home Study Report of Resident Indian ParentDocument6 pagesHome Study Report of Resident Indian ParentAnonymous 7hO0VHB5No ratings yet

- CID Check ListDocument2 pagesCID Check ListRomit Garg100% (1)

- Oct2019Document3 pagesOct2019Surya PhaniNo ratings yet

- Ajeet Ongc Hall-TicketDocument1 pageAjeet Ongc Hall-TicketarunbharatNo ratings yet

- CompliancemanualDocument302 pagesCompliancemanualjadayuNo ratings yet

- Aptdc Hotels AP Tourism HotelsDocument38 pagesAptdc Hotels AP Tourism HotelsTourism TimesNo ratings yet

- Omega External Career Portal CareersDocument5 pagesOmega External Career Portal CareersAdityaNo ratings yet

- Letter of Authorization For Filing in FIRMS ApplicationDocument2 pagesLetter of Authorization For Filing in FIRMS Applicationmicro man0% (1)

- Tax Declaration Form (Image Infotainment LTD)Document2 pagesTax Declaration Form (Image Infotainment LTD)ramakotiNo ratings yet

- Customer Relationship - Axis Bank Project MohitDocument101 pagesCustomer Relationship - Axis Bank Project Mohitdeepak GuptaNo ratings yet

- ManualDocument53 pagesManualmadhulavNo ratings yet

- HDFC Claim Care - Without StandardV2Document6 pagesHDFC Claim Care - Without StandardV2raviNo ratings yet

- EC - MODULE 3-NBFC - PPT - Procedure NBFCDocument10 pagesEC - MODULE 3-NBFC - PPT - Procedure NBFCAnanya ChaudharyNo ratings yet

- HCJXDocument4 pagesHCJXAdi GuptaNo ratings yet

- APSRTC Official Website For Online Bus Ticket Booking - APSRTConlineDocument2 pagesAPSRTC Official Website For Online Bus Ticket Booking - APSRTConlinemkris070% (1)

- Name of Proprietor/partner(s) Category SC/ST/Other S Alive / Deceased / Incapacitated Existing % Share Wish To Continue / Retire Proposed % ShareDocument9 pagesName of Proprietor/partner(s) Category SC/ST/Other S Alive / Deceased / Incapacitated Existing % Share Wish To Continue / Retire Proposed % ShareDiwakar Minz100% (1)

- Form 60Document1 pageForm 60AzImmNo ratings yet

- MBBS Fees 2020 (4 Jan21)Document8 pagesMBBS Fees 2020 (4 Jan21)Bir Bahadur MishraNo ratings yet

- ICICI GMC - Reimbursement FormDocument5 pagesICICI GMC - Reimbursement Formnagarajtakraw14No ratings yet

- Faculty PerformaDocument8 pagesFaculty Performadrnisha008No ratings yet

- Acvpg9128n 2021Document4 pagesAcvpg9128n 2021SRI KALALAYA CHARITABLE TRUSTNo ratings yet

- Ack Aggpr0859n 2022-23 893522620301222Document1 pageAck Aggpr0859n 2022-23 893522620301222CMA RAJESH RunwalNo ratings yet