Professional Documents

Culture Documents

Working Capital Management: by MR AR Parasuraman

Uploaded by

vb_krishnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Working Capital Management: by MR AR Parasuraman

Uploaded by

vb_krishnaCopyright:

Available Formats

11/5/2011

Welcome to Our Seminar on

Working Capital Management

by Mr AR Parasuraman

Commencement Time 9.45 am Please have Tea/ Coffee

Indian Academy of Management

Phone: 022-3040 3400 E-mail: indianacademy@vsnl.net website: www.indianacademy.org

WHAT IS WORKING CAPITAL

WORKING CAPITAL=CURRENT ASSETS CURRENT LIABILITIES WORKING CAPITAL IS THE FUNDS THAT ARE NEEDED FOR CARRYING ON THE DAY TO DAY OPERATIONS.

11/5/2011

DETERMINANTS OF WC

NATURE OF BUSINESS SEASONALITY PRODUCTION POLICY MARKET CONDITION CONDITIONS OF SUPPLY

INGREDIENTS OF WORKING CAPITAL CONTROL

Service Cost Security Liquidity

11/5/2011

SERVICE

The service function can be seen as progression of cash through other forms of current asset, back into cash The cash at the end of the working capital cycle should exceed the input at the beginning

OPERATING CYCLE

THE PROGRESSION OF CASH THROUGH RAW MATERIALS,FINISHED GOODS,DEBTORS ,CASH AND BACK INTO THE CYCLE IS CALLED OPERATING CYCLE.

11/5/2011

OPERATING CYCLE ANALYSIS

DURATION OF THE OPERATING CYCLE IS GIVEN BY: O=R+W+F+D-C O=DURATION OF OPERATING CYCLE R=RAW MATERIALS AND STORES STORAGE PERIOD W=WORK IN PROCESS PERIOD F=FINISHED GOODS STORAGE PERIOD

OPERATING CYCLE ANALYSIS

D=DEBTORS COLLECTION PERIOD C=CREDITORS PAYMENT PERIOD

11/5/2011

OPERATING CYCLECOMPONENTS

R=AVG INV OF RM &STORES/AVG RM & STORES CONSUMED PER DAY. W=AVG.WIP INV/AVG COST OF PROD PER DAY F=AVG FINISHED GOODS INV/AVG COST OF GOODS SOLD PER DAY D=AVG DEBTORS/AVG CREDIT SALES PER DAY C=AVG CRS/AVG CR PURCHASES/DAY

COST

The cost of the funds that are invested in working capital will depend upon from where the funds are sourced from. If the funds that are blocked in working capital are internally generated funds the costs will be the higher of the following 1. The interest or the dividends the internally generated funds would have commanded in the external money market 2. The returns foregone from the marginal investment opportunity

11/5/2011

COST

If the funds that are invested in working capital are externally generated funds the cost will be the higher of the following 1. The interests or the dividends that are actually paid on the externally sourced funds 2.Returns foregone from the marginal investment opportunity

SECURITY

Stock-Theft,Loss, Deterioration,Control of consumption Debtors-Integrity,Ability,Inclination,Bad debts Cash-Theft,Fraud,Embezzlement

11/5/2011

LIQUIDITY

Liquidity is the ability of an organisation to meet the short term payment obligations as and when they arise

WHY LOW INVENTORY

High cost of holding inventories Interest rates Cash flow problems Greater volatality in Business cycle Lower inflation less scope for speculative profits

11/5/2011

INVENTORY CONTROL TECHNIQUES

ABC analysis EOQ Levels Review of slow, non moving ,obsolete items Budgets Ratios Perpetual inventory systems

MANAGING DEBTORS

Credit policies Collection Policies Collection efforts Credit risk evaluation Payment terms Follow ups Legal action

11/5/2011

COLLECTION TECHNIQUES

Letters Telephone calls Personal visits Collection agencies Legal action

GOALS OF CASH MANAGEMENT

Lessen cash tied up with in the system Should not lessen the activities Should not increase risk Should increase Organisational Profitability Should increase Organisational Liquidity

11/5/2011

STEPS IN CASH MANAGEMENT

Cash Planning Cash Collection Cash Mobilisation Cash Disbursements Covering Cash Shortages Investing Surplus Cash

CASH PLANNING

Anticipating cash inflows Anticipating cash outflows Break up into days weeks and months Develop comprehensive cash budget showing anticipated liquidity at future dates Simulate alternative liquidity positions if key variables change

10

11/5/2011

CASH COLLECTION

Getting cash into the organisation as soon as possible Shorten the time between the date on which the customer remit the payment and the date on which those funds clear the banking system and are availiable with the corporate unit

CASH MOBILISATION

Having an adequate MIS Cash Transfer system Clear responsibility for the making of cash transfer decisions Minimum Foreign exchange Transaction costs Minimum risk of loss because of devaluations

11

11/5/2011

COVERING CASH SHORTAGES

Determining how much cash must be transferred from other affiliates to cover short to medium term cash deficits Amount of borrowings Cost of borrowings In case of multinational firms the currency in which loans are denominated and in which it must be repaid Determining how the surplus cash will be invested

CASH DISBURSEMENTS

Planning procedures for distributing cash Avoiding early payment Maximising float-The time it takes for your own cheques to clear back to your bank Selection of a disbursement bank that will give a wide range of services and bank credit

12

11/5/2011

MANAGING CREDITORS

Advances Statutory Essential Dependent Average payment period Negotiations Cash flows

WORKING CAPITAL FINANCING

Trade credit Loans and advances from banks and financial institutions Public deposits Inter corporate deposits Debentures Commercial paper Factoring

13

11/5/2011

RATIOS

Inventory turnover ratio Average collection period Average payment period Current ratio Quick ratio Profit as a % of sales

14

You might also like

- Understanding Principles of Accounting: A High School Student’S Companion.From EverandUnderstanding Principles of Accounting: A High School Student’S Companion.No ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- What Is Relationship Banking?Document36 pagesWhat Is Relationship Banking?llllkkkkNo ratings yet

- Working Capital Management: Executive Development ProgramDocument148 pagesWorking Capital Management: Executive Development ProgramsajjukrishNo ratings yet

- Working Capital Management: A PerspectiveDocument21 pagesWorking Capital Management: A PerspectiveSanthosh Philip GeorgeNo ratings yet

- Introduction To Financial Management: Unit 1: Assessing A New Venture Financial StrengthDocument49 pagesIntroduction To Financial Management: Unit 1: Assessing A New Venture Financial Strengthnidhitandon798686No ratings yet

- Cash Management Varun 10808154 Project OnDocument24 pagesCash Management Varun 10808154 Project Ondont_forgetme2004No ratings yet

- PRC 5 Chap 4 SlidesDocument51 pagesPRC 5 Chap 4 SlidesSyedMaazAliNo ratings yet

- Financial Management - Importance: - Financial Management Is Indispensable To Any Organization As It Helps inDocument37 pagesFinancial Management - Importance: - Financial Management Is Indispensable To Any Organization As It Helps insvsrnbNo ratings yet

- Working CapitalDocument36 pagesWorking CapitalK. SwathiNo ratings yet

- Priya WCDocument17 pagesPriya WCVidyasagar GaikwadNo ratings yet

- Cash Management Problrms SolvedDocument42 pagesCash Management Problrms SolvedKarthikNo ratings yet

- Working Capital Management 1Document74 pagesWorking Capital Management 1Mohit M GopinathNo ratings yet

- Receivables Management: "Any Fool Can Lend Money, ButDocument17 pagesReceivables Management: "Any Fool Can Lend Money, ButDebasmita SahaNo ratings yet

- FIN 302 Notes 2Document79 pagesFIN 302 Notes 2Courtney MosekiNo ratings yet

- Cash Management by Group 9Document15 pagesCash Management by Group 9Noel GeorgeNo ratings yet

- Types of Deposits Offered by BanksDocument6 pagesTypes of Deposits Offered by Banksfarhana nasreenNo ratings yet

- Receivables Management: "Any Fool Can Lend Money, But It Takes A LotDocument14 pagesReceivables Management: "Any Fool Can Lend Money, But It Takes A LotHarshit SengarNo ratings yet

- CH 11Document42 pagesCH 11Priyena MishraNo ratings yet

- Auditing Cash and Marketable Securities (Chapter 10)Document93 pagesAuditing Cash and Marketable Securities (Chapter 10)PeterSarmiento100% (2)

- Ch14 Capital BudgetingDocument20 pagesCh14 Capital BudgetingPatrick GoNo ratings yet

- Cash Flow StatementDocument26 pagesCash Flow StatementADITI BISWASNo ratings yet

- Module 2 CFMADocument57 pagesModule 2 CFMAChristine Bea LimosNo ratings yet

- FIN2004Document79 pagesFIN2004morry123No ratings yet

- Cash Flow Ind AS 7Document37 pagesCash Flow Ind AS 7Satish Kumar100% (1)

- Cash Flow Forecast NotesDocument11 pagesCash Flow Forecast NoteslebaNo ratings yet

- Unit - 4: Managing FinanceDocument27 pagesUnit - 4: Managing FinanceAnshika SinghNo ratings yet

- Receivables ManagementDocument12 pagesReceivables ManagementRajani KanthNo ratings yet

- Learning Packet FINMAN2-03 Working Capital Management and FinancingDocument10 pagesLearning Packet FINMAN2-03 Working Capital Management and Financingem cortezNo ratings yet

- EFIN542 U12 T02 PowerPointDocument78 pagesEFIN542 U12 T02 PowerPointcustomsgyanNo ratings yet

- Cost Accounting - MidhunDocument17 pagesCost Accounting - MidhunmidhunNo ratings yet

- Chap017 2Document29 pagesChap017 2coukslyneNo ratings yet

- WCMDocument12 pagesWCMShariful IslamNo ratings yet

- Name:-Muhammad Shabbir Roll No. 508194950Document11 pagesName:-Muhammad Shabbir Roll No. 508194950Muhammad ShabbirNo ratings yet

- Cash ManagementDocument49 pagesCash ManagementM. Faisal WaleedNo ratings yet

- Working Capital ManagementDocument52 pagesWorking Capital ManagementPrashanth GowdaNo ratings yet

- FAA Accounts Recievable ManagementDocument101 pagesFAA Accounts Recievable ManagementankjinzNo ratings yet

- Working Capital ManagementDocument100 pagesWorking Capital ManagementMrudula V.100% (6)

- Notes On Finance FunctionDocument10 pagesNotes On Finance FunctionNoxolo MotloungNo ratings yet

- FM Sem 03Document17 pagesFM Sem 03infervidd hustlerNo ratings yet

- Liquidity and Cash ManagementDocument9 pagesLiquidity and Cash ManagementSharath MenonNo ratings yet

- Lec 10Document27 pagesLec 10Ritik KumarNo ratings yet

- Sessions 7, 8 and 9Document17 pagesSessions 7, 8 and 9Deedra ColeNo ratings yet

- Cashflow StatementDocument14 pagesCashflow StatementUmar SulemanNo ratings yet

- Financial Accounting ppt02Document31 pagesFinancial Accounting ppt02Bikanair BikanairNo ratings yet

- Financial ManagementDocument56 pagesFinancial ManagementManima MahendranNo ratings yet

- International Finance: Concept of Multinational Working Capital ManagementDocument21 pagesInternational Finance: Concept of Multinational Working Capital ManagementGaurav AgrawalNo ratings yet

- Chapter 6 - Cash & Internal ControlDocument12 pagesChapter 6 - Cash & Internal ControlHareem Zoya WarsiNo ratings yet

- Mac2 - Current Asset ManagementDocument42 pagesMac2 - Current Asset ManagementAbigail Faye RoxasNo ratings yet

- Accounting Principles and Procedures: For Rics ApcDocument20 pagesAccounting Principles and Procedures: For Rics ApcSumayya TariqNo ratings yet

- CFS ExplanationDocument13 pagesCFS ExplanationDELFIN, LORENA D.No ratings yet

- Accounting and Financial Management in LogisticsDocument23 pagesAccounting and Financial Management in LogisticsWah KhaingNo ratings yet

- Chapter 04 Working Capital 1ce Lecture 050930Document71 pagesChapter 04 Working Capital 1ce Lecture 050930rthillai72No ratings yet

- Liquidity ManagementDocument41 pagesLiquidity Managementsmita87No ratings yet

- Presentation On Corporate Finance: By: Sunita SasankanDocument21 pagesPresentation On Corporate Finance: By: Sunita SasankanLauren MontoyaNo ratings yet

- The World of Corporate Treasury: Rounaq QaiserDocument24 pagesThe World of Corporate Treasury: Rounaq QaiserROUNAQ 11952No ratings yet

- Lecture 8 Part 2 SCF (Purpose Format) - SlidesDocument10 pagesLecture 8 Part 2 SCF (Purpose Format) - Slidesvenkatachalam radhakrishnan100% (1)

- Working Capital ManagementDocument7 pagesWorking Capital ManagementTrideo RamNo ratings yet

- Types of Investment and The Related Risk: Business FinanceDocument22 pagesTypes of Investment and The Related Risk: Business FinanceRovic NacionNo ratings yet

- Transaction Banking NotesDocument87 pagesTransaction Banking NotesAnand SrinivasanNo ratings yet

- 51 Excel TutorDocument210 pages51 Excel TutorAbhinav GuptaNo ratings yet

- Sample Internal Audit RisksDocument6 pagesSample Internal Audit RisksKarl NeoNo ratings yet

- Sample Revenue PolicyDocument6 pagesSample Revenue Policyvb_krishnaNo ratings yet

- Treasury Report: INR (Crores) INR (Crores) INR (Crores)Document1 pageTreasury Report: INR (Crores) INR (Crores) INR (Crores)vb_krishnaNo ratings yet

- Whether The Assessing Officer IsDocument2 pagesWhether The Assessing Officer Isvb_krishnaNo ratings yet

- AS 19 - LeasesDocument23 pagesAS 19 - LeasesMurali Krishna ChakralaNo ratings yet

- Word Meaning Related To Ethics & CommunicationDocument3 pagesWord Meaning Related To Ethics & Communicationvb_krishnaNo ratings yet

- Diabetes Center: Home Articles Tips CalculatorsDocument3 pagesDiabetes Center: Home Articles Tips Calculatorsvb_krishnaNo ratings yet

- Accounting Standard 17 Segment ReportingDocument37 pagesAccounting Standard 17 Segment ReportingYasir AhmedNo ratings yet

- Word Meaning Related To Ethics & CommunicationDocument3 pagesWord Meaning Related To Ethics & Communicationvb_krishnaNo ratings yet

- 10essential ForcastudentsDocument1 page10essential Forcastudentsvb_krishnaNo ratings yet

- Whether The Assessing Officer IsDocument2 pagesWhether The Assessing Officer Isvb_krishnaNo ratings yet

- AS28Document70 pagesAS28Sujit ChakrabortyNo ratings yet

- As9 RevenueDocument63 pagesAs9 RevenueRahul KhoslaNo ratings yet

- As InventoryDocument4 pagesAs Inventoryvb_krishnaNo ratings yet

- Information Required From Supplier OthersDocument1 pageInformation Required From Supplier Othersvb_krishnaNo ratings yet

- AS28Document70 pagesAS28Sujit ChakrabortyNo ratings yet

- 23 - Check List For Audit ProgrammeDocument18 pages23 - Check List For Audit Programmenilesh_v12No ratings yet

- Whether The Assessing Officer IsDocument2 pagesWhether The Assessing Officer Isvb_krishnaNo ratings yet

- New Master3cd 13 14Document22 pagesNew Master3cd 13 14vb_krishnaNo ratings yet

- Limited Revision To Accounting Standard (As) 15, Employee Benefits (Revised 2005)Document4 pagesLimited Revision To Accounting Standard (As) 15, Employee Benefits (Revised 2005)Vivek ReddyNo ratings yet

- Calculation of Hosue Rent Allowance (HRA) U/s 10 (13 A) and Rule 2ADocument1 pageCalculation of Hosue Rent Allowance (HRA) U/s 10 (13 A) and Rule 2Avb_krishnaNo ratings yet

- Standard Costing: Material Cost VarianceDocument4 pagesStandard Costing: Material Cost Variancevb_krishnaNo ratings yet

- Companies (Auditor's Report) Order, 2003Document6 pagesCompanies (Auditor's Report) Order, 2003vb_krishnaNo ratings yet

- Tax Connect May 2014Document7 pagesTax Connect May 2014vb_krishnaNo ratings yet

- Recent Changes in ST Law 2013 14Document14 pagesRecent Changes in ST Law 2013 14vb_krishnaNo ratings yet

- As26Document9 pagesAs26vb_krishnaNo ratings yet

- Dipifr 2013Document10 pagesDipifr 2013vb_krishnaNo ratings yet

- Calculation of Fees: Authorised Capital Additional A.C. Add. FeesDocument2 pagesCalculation of Fees: Authorised Capital Additional A.C. Add. Feesvb_krishnaNo ratings yet

- Ratio Calculation in An Easiest WayDocument1 pageRatio Calculation in An Easiest WayrajdeeppawarNo ratings yet

- Spaces For Conflict and ControversiesDocument5 pagesSpaces For Conflict and ControversiesVistalNo ratings yet

- Intro To LodgingDocument63 pagesIntro To LodgingjaevendNo ratings yet

- Periodic Table & PeriodicityDocument22 pagesPeriodic Table & PeriodicityMike hunkNo ratings yet

- WILDLIFEDocument35 pagesWILDLIFEnayab gulNo ratings yet

- Class 11 Class Biology Syllabus 2011-12Document5 pagesClass 11 Class Biology Syllabus 2011-12Sunaina RawatNo ratings yet

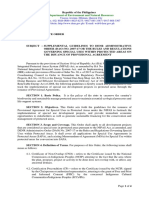

- Draft DAO SAPA Provisional AgreementDocument6 pagesDraft DAO SAPA Provisional AgreementStaff of Gov Victor J YuNo ratings yet

- Rock Type Identification Flow Chart: Sedimentary SedimentaryDocument8 pagesRock Type Identification Flow Chart: Sedimentary Sedimentarymeletiou stamatiosNo ratings yet

- Transport System in Living ThingsDocument40 pagesTransport System in Living ThingsHarijani SoekarNo ratings yet

- Al-Baraa Ibn Malik Al-AnsariDocument3 pagesAl-Baraa Ibn Malik Al-AnsariRahbarTvNo ratings yet

- Presbuteroi (Elders) and Episkopoi (Overseers) and Are Described in 1 Tim 3 and TitusDocument15 pagesPresbuteroi (Elders) and Episkopoi (Overseers) and Are Described in 1 Tim 3 and TitusNimaro Brenda100% (1)

- Jamb Crk-Past QuestionDocument59 pagesJamb Crk-Past QuestionFadele1981No ratings yet

- 17-05-MAR-037-01 凱銳FCC Part15B v1Document43 pages17-05-MAR-037-01 凱銳FCC Part15B v1Nisar AliNo ratings yet

- MF 2 Capital Budgeting DecisionsDocument71 pagesMF 2 Capital Budgeting Decisionsarun yadavNo ratings yet

- Civil Procedure Pros. Zehan Loren E. Tocao-Talipasan, RebDocument4 pagesCivil Procedure Pros. Zehan Loren E. Tocao-Talipasan, Rebxeileen08100% (2)

- Section 9 - Brickwork and BlockworkDocument6 pagesSection 9 - Brickwork and BlockworkShing Faat WongNo ratings yet

- Financial Accounting Theory Craig Deegan Chapter 7Document9 pagesFinancial Accounting Theory Craig Deegan Chapter 7Sylvia Al-a'maNo ratings yet

- Phoenix Wright Ace Attorney - Episode 2-2Document39 pagesPhoenix Wright Ace Attorney - Episode 2-2TheKayOneNo ratings yet

- Workbook Answers: AS/A-level English Literature WorkbookDocument42 pagesWorkbook Answers: AS/A-level English Literature WorkbooktelmarventuraNo ratings yet

- Money Habits - Saddleback ChurchDocument80 pagesMoney Habits - Saddleback ChurchAndriamihaja MichelNo ratings yet

- English Solution2 - Class 10 EnglishDocument34 pagesEnglish Solution2 - Class 10 EnglishTaqi ShahNo ratings yet

- Jao Vs Court of Appeals G.R. No. 128314 May 29, 2002Document3 pagesJao Vs Court of Appeals G.R. No. 128314 May 29, 2002Ma Gabriellen Quijada-TabuñagNo ratings yet

- Rapidjson Library ManualDocument79 pagesRapidjson Library ManualSai Kumar KvNo ratings yet

- CLEMENTE CALDE vs. THE COURT OF APPEALSDocument1 pageCLEMENTE CALDE vs. THE COURT OF APPEALSDanyNo ratings yet

- Children's LiteratureDocument13 pagesChildren's Literaturerexson de villaNo ratings yet

- PFASDocument8 pagesPFAS王子瑜No ratings yet

- Ogl 350 Paper 2Document5 pagesOgl 350 Paper 2api-672448292No ratings yet

- Khenpo Tsultrim Gyamtso Rinpoche - Meditation On EmptinessDocument206 pagesKhenpo Tsultrim Gyamtso Rinpoche - Meditation On Emptinessdorje@blueyonder.co.uk100% (1)

- Campos V BPI (Civil Procedure)Document2 pagesCampos V BPI (Civil Procedure)AngeliNo ratings yet

- Arthropods: Surviving The Frost: Charmayne Roanna L. GalangDocument2 pagesArthropods: Surviving The Frost: Charmayne Roanna L. GalangBabes-Rose GalangNo ratings yet

- Case Study GingerDocument2 pagesCase Study Gingersohagdas0% (1)