Professional Documents

Culture Documents

Stonewall Resources Limited (ASX:SWJ) Announces Refurbishment of Theta Mine

Uploaded by

Tina WhiteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stonewall Resources Limited (ASX:SWJ) Announces Refurbishment of Theta Mine

Uploaded by

Tina WhiteCopyright:

Available Formats

Media Release 31 January 2013

REFURBISHMENT OF THETA MINE

HIGHLIGHTS Refurbishment of Theta Mine has commenced Metallurgy well understood due to the treatment of the material in the TGME bulk test site Production to commence by May 2013* Targeting annualised production from Theta Mine of 10,500 oz per annum by the fourth quarter of 2013* Targeting a combined production from the Theta and Frankfort mining complex of 22,000 oz per annum by the first quarter of 2014* Targeted cash cost of less than $800 per ounce Capital cost of only $2.7m required for the Theta Mine delivering an excellent capital to gold ratio Targeting revenue of approximately $1.4m per month upon full production

THETA MINE Stonewall Resources Limited (ASX: SWJ) is pleased to announce that the refurbishment of Theta Mine commenced in December 2012. With the refurbishment going according to plan, Stonewall expects the Theta Mine to be in full production by August 2013. In Commenting on the refurbishment of Theta Mine, CEO Lloyd Birrell said: Stonewalls strength remains the speed at which we can roll out production at very low levels of capital cost. The reopening of Theta is occurring within budget and on time at this stage. Theta Mine is one of the areas of gold mineralisation held under the Greater TGME Mining Right of Transvaal Gold Mining Estates (TGME), a subsidiary of Stonewall. The re-opening of the mine is an important part of Stonewalls overall strategy to reopen historical mines that meet the following key criteria: Are shallow underground, with easily accessible reefs Have existing development Will generate ore that can be treated at the existing operating plant Require limited capital cost Have a well understood resource Can be rolled out in a relatively short timeframe

BULK TEST WORK ON METALLURGY In 2010 Stonewall recommissioned, and from April 2010 operated the plant at Pilgrims Rest in order to: Have a fully operational metallurgical plant and deposition and gold recovery infrastructure available to process ore Prove the effectiveness of the Stonewall process flow Operate the plant at 20,000tpm, to ensure operational capability and processing capacity Generate an operating profit

The process flow for Stonewall that will apply to the Theta ore is based upon the current metallurgical plant operation, which has been treating tailings over the past 18 months. These tailings originated from mining the Theta and Frankfort mining complex and the residue grade now achieved translates to an overall 90% recovery. In addition, with a series of improvements to the Dense Media Separator (DMS) process and the mining methodology, Stonewall is confident that the loss in the DMS can be decreased from 10% to 7% and the dilution from 30% to 10%. Therefore, Stonewall anticipates good overall recoveries from mining the Theta and Frankfort mining complex. PROGRESS SINCE WORK COMMENCED Since listing on the ASX on 30th November 2012 and gaining the approval of the Board of Directors to proceed, Theta Mine has been dewatered, debris removed the adit enlarged and the rock bolting checked and upgraded. Stonewall has also installed compression and ventilation, commenced on-reef development, with mining of first stope underway and two LHDs operating underground. The planned reopening of the mine is on time and within budget. The refurbishment of Theta Mine is scheduled for completion by April 2013 after which production will be ramped up over four months on a capital budget of $2.7m. EXPLORATION AND DEVELOPMENT Extensive drilling has already taken place and a resource of 210,900 ounces identified by the Competent Person (see Table 1 below). The Theta Mine is part of the Theta and Frankfort mining complex which was mined from 2008 to 2009 and where there is significant underground infrastructure in place. Over 800m of lateral development and several stoping panels have been mined and supported. The two ore bodies, namely the Theta reef and the Bevetts reef at Frankfort Mine were operated as one mine and Stonewall will follow a similar approach, but schedule the development over time. Due to Theta development being on-reef, the average grade being highest in the complex and the reefs containing less carbon (making metallurgical processing easier), the Theta Mine will be developed first. After it has been commissioned, the development of the Frankfort Mine will begin. In addition, the ore body and metallurgical process is well understood by management due to the experience of past mining, and the availability of historical records and plans.

Table 1: The Theta and Frankfort mining complex resource statement The current known Mineral Resource is adequate to sustain the mining of this complex for a minimum of 4-5 years. During this period, additional exploration drilling will continue in the Theta area in order to extend the mine life. The exploration program will focus on the extension of the Theta and Bevetts reef as well as looking for parallel reef structures. TARGETED PRODUCTION Theta Mine is expected to be in full production by August 2013, producing up to 10,500 ounces per annum. This project is an important component in order to achieve the Stonewall near-term production target of 41,000 ounces per annum by the end of 2013.* The Theta Mine operation will produce 875 ounces per month, and generate revenue of approximately $1.4m per month at a cash cost of less than $800 per ounce. FRANKFORT MINE Following the commissioning of the Theta Mine, the development at Frankfort Mine will commence. The Theta and Frankfort Mines are adjacent and fall within the same mining complex. Combined, the two mines are expected to produce 22,000 ounces per annum by the first quarter of 2014.* *Refer forward looking statement disclaimer on page 5

Conveyor belt at Theta and Frankfort mining complex

Development plan for the Theta and Frankfort mining complex:

TRANSVAAL GOLD MINING ESTATES Transvaal Gold Mining Estates is situated within the Sabie-Pilgrims Rest Goldfield in the Mpumalanga Province of South Africa, and stretches for over 65 km between the towns of Pilgrims Rest and Sabie. Transvaal Gold Mining Estates has been mined since 1886 with estimated historical production of 200 t of gold (6 Moz). Stonewall has identified excellent surface deposits, which include old tailings dams, rock dumps and open pits, and underground exploration targets, which include flat dipping, near-horizontal mineralised zones and one near-vertical mineralised zone.

ABOUT STONEWALL RESOURCES LIMITED Stonewall Resources Limited (ASX: SWJ) is a gold mining company making the transition from explorer to producer. The Company holds a range of prospective gold assets, most of which are located in the worldrenowned South African gold mining regions. These South African assets, which include several surface and nearsurface gold mineralisations, provide cost advantages relative to other gold producers in the region. With significant infrastructure already in place, Stonewall is uniquely positioned to make the transition to producer through highly efficient utilization of capital and within short lead times. Stonewalls three key projects are the TGME Project, located around the towns of Pilgrims Rest and Sabie in the Mpumalanga Province of South Africa (one of South Africas oldest gold mining districts), the Bosveld Project, located in South Africas KwaZulu-Natal Province, and the Lucky Draw Project, located in Australia, near the township of Burraga in New South Wales. Stonewall owns 74% of TGME, Sabie Mines and Bosveld Mines. The Companys exploration program is designed to identify additional potential Mineral Resources to establish longterm mining plans. Stonewall is currently processing gold from tailings dumps located within its TGME and Bosveld Projects, from which it is earning revenue and aims to introduce two additional near term production targets during 2013. For more information please visit: www.stonewallresources.com

For further information please contact: Rod North, Managing Director, Bourse Communications Pty Ltd T: (03) 9510 8309, M: 0408 670 706, E: rod@boursecommunications.com.au

Competent Persons Statement The information in this Presentation that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Charles Muller, who is a Member or Fellow of the South African Council for Natural Scientific Professions, which is a Recognised Overseas Professional Organisation (ROPO) included in a list promulgated by the ASX from time to time. Charles Muller is employed by Minxcon and has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Charles Muller consents to the inclusion in this Presentation of the matters based on his information in the form and context in which it appears. Forward looking statements Statements in this announcement regarding the Companys plans with respect to its mineral properties are or may be forward-looking statements. There can be no assurance that the plans for development of its mineral properties will proceed as currently expected. There can also be no assurance that the Company will be able to convert Inferred resources to Indicated resources or Indicated resources to Measured resources, that any mineralisation will prove to be economic, or that a mine will successfully be developed at any of the Companys mineral properties. The potential quantity and grade of exploration targets is conceptual in nature at this stage as there has been insufficient exploration to define a Mineral Resource quantity under the JORC code. Further, it is uncertain if future exploration will result in the determination of a Mineral Resource.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ninja's Guide To OnenoteDocument13 pagesNinja's Guide To Onenotesunil100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Understanding Power Dynamics and Developing Political ExpertiseDocument29 pagesUnderstanding Power Dynamics and Developing Political Expertisealessiacon100% (1)

- Smell Detectives: An Olfactory History of Nineteenth-Century Urban AmericaDocument35 pagesSmell Detectives: An Olfactory History of Nineteenth-Century Urban AmericaUniversity of Washington PressNo ratings yet

- Silicon ManufacturingDocument132 pagesSilicon ManufacturingAndrea SottocornolaNo ratings yet

- What Is A Lecher AntennaDocument4 pagesWhat Is A Lecher AntennaPt AkaashNo ratings yet

- Inventory ManagementDocument60 pagesInventory Managementdrashti0% (1)

- Return of The Original PDFDocument2 pagesReturn of The Original PDFTina WhiteNo ratings yet

- Premiere Launches Prospectus To Raise Up To $15milDocument3 pagesPremiere Launches Prospectus To Raise Up To $15milTina WhiteNo ratings yet

- Atlas Appoints Nelson Rocher As Alternate DirectorDocument1 pageAtlas Appoints Nelson Rocher As Alternate DirectorTina WhiteNo ratings yet

- NewSat Finalist For 2014 Satellite Provider of The YearDocument1 pageNewSat Finalist For 2014 Satellite Provider of The YearTina WhiteNo ratings yet

- Atlas Announce Collaboration With Tina ArenaDocument2 pagesAtlas Announce Collaboration With Tina ArenaTina WhiteNo ratings yet

- Stonewall Secures Financing For $3 Million Convertible NoteDocument2 pagesStonewall Secures Financing For $3 Million Convertible NoteTina WhiteNo ratings yet

- Company UpdateDocument2 pagesCompany UpdateTina WhiteNo ratings yet

- New Us$5m Compumedics Deal With China Takes Ehealth Business Focus in Asia To Us$9mDocument2 pagesNew Us$5m Compumedics Deal With China Takes Ehealth Business Focus in Asia To Us$9mTina WhiteNo ratings yet

- Atlas Announce Collaboration With Tina ArenaDocument2 pagesAtlas Announce Collaboration With Tina ArenaTina WhiteNo ratings yet

- Atlas Subsidiary EOT Spearheads Consortium Driving Commercialisation of Bioactive ExtractsDocument2 pagesAtlas Subsidiary EOT Spearheads Consortium Driving Commercialisation of Bioactive ExtractsTina WhiteNo ratings yet

- World-First EHealth Contracts To Benefit CompumedicsDocument2 pagesWorld-First EHealth Contracts To Benefit CompumedicsTina WhiteNo ratings yet

- Business Update - Preliminary Indicative 30 June 2014 GuidanceDocument2 pagesBusiness Update - Preliminary Indicative 30 June 2014 GuidanceTina WhiteNo ratings yet

- Stonewall Receives Key Approval in Shandong TransactionDocument1 pageStonewall Receives Key Approval in Shandong TransactionTina WhiteNo ratings yet

- Atlas Sells A Record $2 5 Million of Pearls at Kobe Auction FinalDocument2 pagesAtlas Sells A Record $2 5 Million of Pearls at Kobe Auction FinalTina WhiteNo ratings yet

- NewSat and Lockheed Martin Achieve Significant Construction Milestone For Jabiru-1 SatelliteDocument2 pagesNewSat and Lockheed Martin Achieve Significant Construction Milestone For Jabiru-1 SatelliteTina WhiteNo ratings yet

- Atlas Pearls and Perfumes Announces New Key Positions in The CompanyDocument2 pagesAtlas Pearls and Perfumes Announces New Key Positions in The CompanyTina WhiteNo ratings yet

- Major Contract Win in The US Gives Compumedics Access To 1,400 HospitalsDocument2 pagesMajor Contract Win in The US Gives Compumedics Access To 1,400 HospitalsTina WhiteNo ratings yet

- PR and Communications Intern May 2014Document1 pagePR and Communications Intern May 2014Tina WhiteNo ratings yet

- Stonewall Receives South African Ministerial ApprovalDocument2 pagesStonewall Receives South African Ministerial ApprovalTina WhiteNo ratings yet

- Compumedics Wins Key $0.7m Deal in FranceDocument2 pagesCompumedics Wins Key $0.7m Deal in FranceTina WhiteNo ratings yet

- NewSat Reaches Financial Closes For Jabiru-1 Satellite ProjectDocument2 pagesNewSat Reaches Financial Closes For Jabiru-1 Satellite ProjectTina WhiteNo ratings yet

- Compumedics Gets Boost in China With Key $2 Million ContractsDocument2 pagesCompumedics Gets Boost in China With Key $2 Million ContractsTina WhiteNo ratings yet

- Atlas Experiences $1.7 Million Increase in RevenueDocument2 pagesAtlas Experiences $1.7 Million Increase in RevenueTina WhiteNo ratings yet

- Atlas Pearls and Perfumes Announces 110% Increase in Net ProfitDocument2 pagesAtlas Pearls and Perfumes Announces 110% Increase in Net ProfitTina WhiteNo ratings yet

- Global Safety Index - World's First Benchmark For Organisational Safety PerformanceDocument2 pagesGlobal Safety Index - World's First Benchmark For Organisational Safety PerformanceTina WhiteNo ratings yet

- Sunbridge To List On The ASX Today With Market Cap of $94MDocument2 pagesSunbridge To List On The ASX Today With Market Cap of $94MTina WhiteNo ratings yet

- Global Health Announces 31 December 2013 Half Year ResultsDocument3 pagesGlobal Health Announces 31 December 2013 Half Year ResultsTina WhiteNo ratings yet

- Sunbridge (ASX: SBB) Wins Two China Brand Enterprise AwardsDocument2 pagesSunbridge (ASX: SBB) Wins Two China Brand Enterprise AwardsTina WhiteNo ratings yet

- NewSat Signs $1 1 Million Contract To Support US Government Custom SATCOM Solutions (CS2)Document2 pagesNewSat Signs $1 1 Million Contract To Support US Government Custom SATCOM Solutions (CS2)Tina WhiteNo ratings yet

- Emerchants Signs 5 Year Agreement With QLDDocument2 pagesEmerchants Signs 5 Year Agreement With QLDTina WhiteNo ratings yet

- Adb Wind ConeDocument4 pagesAdb Wind ConeSulistyo WidodoNo ratings yet

- HRM Assignment Final - Case StudyDocument7 pagesHRM Assignment Final - Case StudyPulkit_Bansal_2818100% (3)

- HR MasterlistDocument6 pagesHR MasterlistLeychelle AnnNo ratings yet

- Advanced Scan I21no2Document29 pagesAdvanced Scan I21no2Jaiber SosaNo ratings yet

- Materials For Oxygen ServicesDocument4 pagesMaterials For Oxygen Services陳0鴻No ratings yet

- Kavanaugh On Philosophical EnterpriseDocument9 pagesKavanaugh On Philosophical EnterprisePauline Zoi RabagoNo ratings yet

- Math 101Document3 pagesMath 101Nitish ShahNo ratings yet

- Action Plan On GadDocument1 pageAction Plan On GadCherish Devora ArtatesNo ratings yet

- Measuring Algorithm Efficiency Using Time and Space ComplexityDocument8 pagesMeasuring Algorithm Efficiency Using Time and Space ComplexityGovind RathoreNo ratings yet

- CROCI Focus Intellectual CapitalDocument35 pagesCROCI Focus Intellectual CapitalcarminatNo ratings yet

- Pricelist Hardware Jayacom Disember 2018Document2 pagesPricelist Hardware Jayacom Disember 2018ContempGamelan PerformingGroupNo ratings yet

- Margin Philosophy For Science Assessment Studies: EstecDocument11 pagesMargin Philosophy For Science Assessment Studies: EstecFeyippNo ratings yet

- Volvo S6 66 Manual TransmissionDocument2 pagesVolvo S6 66 Manual TransmissionCarlosNo ratings yet

- Hackathon Statements V1Document10 pagesHackathon Statements V1AayushNo ratings yet

- TM500 Design Overview (Complete ArchitectureDocument3 pagesTM500 Design Overview (Complete ArchitectureppghoshinNo ratings yet

- 9.tools and Equipment 1Document13 pages9.tools and Equipment 1NKH Mega GasNo ratings yet

- The Godfather Term One Sample Basic Six Annual Scheme of Learning Termly Scheme of Learning WEEK 1 - 12Document313 pagesThe Godfather Term One Sample Basic Six Annual Scheme of Learning Termly Scheme of Learning WEEK 1 - 12justice hayfordNo ratings yet

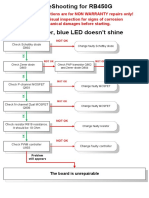

- RB450G Trouble ShootingDocument9 pagesRB450G Trouble Shootingjocimar1000No ratings yet

- Xiaomi Mi Drone 4K User Manual GuideDocument47 pagesXiaomi Mi Drone 4K User Manual GuideΜιχάλης ΛαχανάςNo ratings yet

- Alaris 8210 and 8220 SpO2 Module Service ManualDocument63 pagesAlaris 8210 and 8220 SpO2 Module Service ManualNaveen Kumar TiwaryNo ratings yet

- SO CF, Internal Fault Map Class 1A SO CF, Internal Fault Map Class 2A SO CF, External Condition Map Class 1BDocument15 pagesSO CF, Internal Fault Map Class 1A SO CF, Internal Fault Map Class 2A SO CF, External Condition Map Class 1BATMMOBILISNo ratings yet

- The Ethological Study of Glossifungites Ichnofacies in The Modern & Miocene Mahakam Delta, IndonesiaDocument4 pagesThe Ethological Study of Glossifungites Ichnofacies in The Modern & Miocene Mahakam Delta, IndonesiaEry Arifullah100% (1)

- CommunicationDocument5 pagesCommunicationRyan TomeldenNo ratings yet

- Symbiosis Skills and Professional UniversityDocument3 pagesSymbiosis Skills and Professional UniversityAakash TiwariNo ratings yet