Professional Documents

Culture Documents

Strategies for Managing Business Diversification

Uploaded by

Ashok AOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategies for Managing Business Diversification

Uploaded by

Ashok ACopyright:

Available Formats

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

DIVERSIFICATION - STRATEGIES FOR MANAGING A BUSINESS

P. KANNAN*; DR. R.SARAVANAN**

*Head, Department of Management Studies, N.P.R. College of Engineering & Technology, Natham. *Research Scholar, Anna University of Technology Coimbatore, Coimbatore, Tamil Nadu, India. **Director, School of Management, Sri Krishna College of Technology, Kovaipudur, Coimbatore- 641042, Tamil Nadu, India.

ABSTRACT When thinking about building a diversified portfolio, remember the old adage, Dont put all your eggs in one basket. Diversification is not only about the number of investments in your portfolio, its also about the relationships among those investments. Diversification becomes an attractive strategy when a company runs out of profitable growth opportunities in its core business. In a diversified company the strategy making challenge involves assessing multiple industry environments and coming up with a set of business strategies, in which it operates. Multinational diversification strategies feature a diversity of business and a diversity of national markets. Despite the complexity of having to devise and manage so many strategies, these strategies have considerable appeal and more competitive potential. The study focuses on the manner in which diversification strategy is applied for different sectors like IT, FMCG etc. It deals with the core concept of diversification strategy to succeed by companies. KEYWORDS: Investments, Related Diversification, Strategy, Unrelated Diversification. ______________________________________________________________________________ INTRODUCTION www.zenithresearch.org.in Diversification is a form of growth marketing strategy for a company. It seeks to increase profitability through greater sales volume obtained from new products and new markets. A diversification strategy stands apart from the other three strategies such as merger and acquisition, internal start up, Joint Venture. These are usually pursued with the same technical, financial, and merchandise resources used for the original product line, whereas diversification strategy usually requires a company to acquire new skills, new techniques and new facilities. Therefore, diversification is meant to be the riskiest of other strategies to pursue. Whenever a single business companies faced with diminishing market opportunities and stagnating sales in its principal business, it is the indication for diversification. And a Management quote about diversification is given by Andrew Campbell as below,

64

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

Fit between a parent and its business is a two edged sword; a good fit can create value and a bad one can destroy it. WHEN TO DIVERSIFY KEY FACTORS Whenever a single business companies faced with diminishing market opportunities and stagnating sales in its principal business, it is the signal for diversification. The other key factors are, a) When it has a powerful and well-known brand name that can be transferred to the product of other business. b) When diversifying into closely related business opens new avenue for reducing costs. c) When it can expand into industries whose technologies and products complement its present business? Judgments about the timing of a companys diversification effort are best made instance by instance, according to companys own unique situation. CORE CONCEPT PATH Once the decision is made to pursue diversification, the firm must choose whether to diversify into related business, unrelated business. Businesses are said to be related when their value chains possess competitively valuable cross business value chain matchups. Business are said to be unrelated when the activities comprising their respective value chains are so dissimilar that no competitively valuable cross business relationship are present. Most companies favor related diversification strategies because of the performance enhancing potential of cross business synergies. However, some companies opted to try to build shareholder value with unrelated diversification strategies. CASES FOR DIVERSIFYING INTO RELATED BUSINESS To present opportunity for the following, www.zenithresearch.org.in a) Combining the related activities of separate businesses into a single operation to achieve lower costs. b) Transferring valuable expertise, technology, knowledge etc., marketing capabilities, managerial

c) Exploiting common use of a well known brand name. d) To create valuable resource strength and capabilities.

65

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

RELATED DIVERSIFICATION BUSINESS ACTIVITIES Related diversification thus has a strategic appeal from several angles. It allows a firm to reap the competitive advantage benefits of skills transfer, lower cost, common brand names, and stronger competitive capabilities over a broad business phase. It also provides sharper focus for managing diversification and a useful degree of strategic unity across the companys various business activities. COMPANIES THAT HAVE DIVERSIFIED INTO RELATED BUSINESS Samples of companies that have pursued a strategy of related diversification are illustrated below. TABLE 1 COMPANY IN RELATED DIVERSIFICATION JOHNSON & JOHNSON Baby products First aid products Medical devices Surgical & Hospital products Snack foods (Lays, Chee tos etc.,) Contact lenses Breakfast products Personal Care products GILLETTE Blades and Razors Tooth Brush (Oral B) Toiletries products Hair dryers, Shavers. PROCTER & GAMBLE Hair care products Household cleaning/care www.zenithresearch.org.in Beauty care products Laundry products Soft drinks Fruit juices (Tropicana) Other beverages (Aquafina bottled water etc.,) Sports drinks (Gatorade) PEPSICO

66

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

FIGURE 1 REPRESENTING VALUE CHAIN ACTIVITIES SUPPORT ACTIVITIES

Supply chain

Techno logy

operati ons

Sales & marketing

Distrib ution

Customer services

COMPETITIVE VALUE CHAINS OF A (BUSINESS A) AND B (BUSINESS B)

Supply chain

Techno logy

Operati ons

Sales & marketing

Distrib ution

Customer services

SUPPORT ACTIVITIES

Table 1 it is inferred that the factors the companies adopted while going for related diversification. From the above samples, the Core areas that the companies pursue as under: Transfer of technology, Marketing Capabilities, Managerial Knowledge Shared Skills and Competencies Exploitation of by Products Reduction in unit cost Reduces risks www.zenithresearch.org.in

67

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

CASES FOR DIVERSIFYING INTO UNRELATED BUSINESSES Companies that pursue a strategy of unrelated diversification generally exhibit a willingness to diversify into any industry where there is potential market for a company to realize consistently good financial results. CRITERIA TO KEEP OR DIVEST EXISTING BUSINESS a. Whether the business can meet corporate targets for profitability and return on investment b. Whether the business will require substantial infusions of capital to replace out-of-date plants and equipment, fund expansion etc., c. Whether the business is in an industry with significant potential growth d. Whether the business is big enough to contribute significantly to the parent firms bottom line UNRELATED BUSINESS ACTIVITIES FIGURE 2 REPRESENTATIVE VALUE CHAIN ACTIVITIES SUPPORT ACTIVITIES

Product R&D

Production

Advt & Promotion

Dealers

Supply chain

Assembly

Distribution

Customer services

SUPPORT ACTIVITIES

68

www.zenithresearch.org.in

ABSENCE OF COMPETITIVE VALUE CHAINS OF A (BUSINESS A) AND B (BUSINESS B)

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

From the below illustration of unrelated business activities says that, A strategy of unrelated diversification involves no deliberate effort to seek out businesses having strategic fit with the firms other business. COMPANIES THAT HAVE DIVERSIFIED INTO UNRELATED BUSINESS A sample of companies that have pursued a strategy of unrelated diversification are illustrated below. TABLE 2 COMPANY IN UNRELATED DIVERSIFICATION WIPRO Electrical appliances Information technology Computer accessories Toilet soap (santoor) GE medical system Baby care products TATA GROUPS Home appliances Financial services Watches Telecom services Information technology Tea products

LG Mobile Phones Television, Radio Projectors Home appliances Lamps Note books

RELIANCE Telecom services Power Petro chemical products Mobile phones Construction Textiles Mutual funds , money www.zenithresearch.org.in

69

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

From the above table it is depicts that the following are the merits of Unrelated diversification strategy for the above companies: Superior skills of top management people Business risks is scattered over a set of diverse industries. Companys financial resources can be employed to maximum advantage investing in industries offers the best profit prospects. Building share-holder value Increasing Profitability by exploiting general organization competencies DISCUSSION & FINDINGS From the above analysis of both diversification strategies the below are the findings Why is related diversification only marginally profitable than unrelated? How can diversification dissipate rather than create value? Michael Porters research(1) suggests that average related company is at best only marginally more profitable than the average unrelated company. He found that most of the companies had divested many more diversified acquisitions than they had kept. He and its team have concluded that the corporate diversifications strategies pursued by most companies can dissipate value rather than creating it. Accomplishments of unrelated diversification business are, Cutting unrelated cost Concentrating on core areas Seeking external markets www.zenithresearch.org.in

70

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

KEY BARRIERS OF UNRELATED DIVERSIFICATION Planning controls

Lack of Skills

Barriers for Unrelated Diversification

Capacity to develop a business case

Specialist business advisor

Regulatory controls

WHY RELATED COMPANIES?

DIVERSIFICATION

MOSTLY

PREFERRED

BY

THE

Boost profitability in numerous ways Involved fewer risks Top management has related knowledge about parent business KEY BARRIERS OF RELATED DIVERSIFICATION Access to finance Skilled Personnel

Barriers for Related Diversification Regulatory controls Validity of Marketing Research

Planning controls

71

www.zenithresearch.org.in

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

RESULTS Diversification Strategies Related Diversification Unrelated Diversification Characteristics Operates in a few related industries Operates in many unrelated industries Growth Low Profit High Risk Low

High

Low

Medium

DIVERSIFICATION STRATEGY MATRIX Growth High Mixed Diversification Unrelated Diversification Low Related Diversification

High Profit Low INFERENCE

Divestment

When companies mainly focusing on profit, they can prefer unrelated or mixed diversification strategy. When companies mainly focusing on growth, they can prefer related diversification or mixed diversification strategy. When the companys growth and profit are at low, suggest that they can go for disinvestment the business operations. CONCLUSION It is very tempting for a business leader to diversify with related or unrelated business activities carried out in a company. But it must be understood that it is a very complex task. Hence any such move must be planned & executed with great care. And diversification strategy matrix is given above for the business leader to help in choosing the strategy for diversifying the business activities. www.zenithresearch.org.in

72

EXCEL International Journal of Multidisciplinary Management Studies

Vol.2 Issue 5, May 2012, ISSN 2249 8834 Online available at http://zenithresearch.org.in/

REFERENCES (1) Charles W.L.Hill and Gareth R. Jones on Strategic Management, Volume- 06, Biztantra Publication. (2) Arthur .A. Thompson, A. J. Strickland, John. E. Gamble on Crafting and Execution Strategy, vol.14, Tata McGraw-Hill Publication. (3) George Stone House, David Campbell, Jim Hamill, Tony Purdie on Global and Transnational Business, 2nd Edition, Wiley Publication. (4) Sukul Lomash abd P K Mishra on Business Policy and Strategic Management 3rd Edition, Vikas Publication. WEBSITES 1. http://ideas.repec.org/p/imf/imfwpa/06-50.html 2. http://www.fao.org/docrep/006/ad689e/ad689e07.htm 3. http://www.investopedia.com/articles/02/111502.asp 4. http://www.mydigitalfc.com/personal-finance/why-diversification-strategydidn%E2%80%99t-work-crash-353 5. http://dkmt.regionalnet.org/docu/t4.htm 6. Company websites for the following: i. ii. iii. iv. v. vi. vii. viii. Johnson & Johnson Gillette Protector & Gamble PepsiCo Tata Groups Reliance Wipro LG www.zenithresearch.org.in

73

You might also like

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

- Diversification strategies for managing businessDocument11 pagesDiversification strategies for managing businessradheNo ratings yet

- First AssignmentDocument5 pagesFirst Assignmentkhang gamingNo ratings yet

- SBA-Module 6Document6 pagesSBA-Module 6Patricia ReyesNo ratings yet

- First AssignmentDocument5 pagesFirst Assignmentমুহম্মদ কামরুল ইসলামNo ratings yet

- MGT411 Business StrategyDocument4 pagesMGT411 Business Strategyprashant jain100% (1)

- Business Strategies and Competitive Advantage: The Role of Performance and InnovationDocument31 pagesBusiness Strategies and Competitive Advantage: The Role of Performance and InnovationNeeraj KumarNo ratings yet

- Article On Merger and AcquisitionDocument11 pagesArticle On Merger and AcquisitionSurbhi MishraNo ratings yet

- Standardization Vs DifferentiationDocument5 pagesStandardization Vs Differentiationloganathprasanna100% (1)

- 1714, Khitab, STM 2Document8 pages1714, Khitab, STM 2Ahmad KhitabNo ratings yet

- Growth Strategies Part 2Document18 pagesGrowth Strategies Part 2sabyasachi samalNo ratings yet

- Poters GenricDocument4 pagesPoters Genricpriyank1256No ratings yet

- CS Chapter3Document4 pagesCS Chapter3Sumanth KatagouniNo ratings yet

- STM Concepts AnsersDocument8 pagesSTM Concepts AnsersKarthick Nathan ShanmuganathanNo ratings yet

- Corporate Level StrategyDocument11 pagesCorporate Level Strategywannaplay100% (1)

- Business Policy & Strategy: Unit 4Document73 pagesBusiness Policy & Strategy: Unit 4Harsh y.No ratings yet

- Operational StrategyDocument2 pagesOperational Strategyusme314No ratings yet

- Of Enterprise Growth Showing Advantages of Each With Clear ReferencesDocument8 pagesOf Enterprise Growth Showing Advantages of Each With Clear ReferencesAdroit WriterNo ratings yet

- 2.6joel Assignment2Document18 pages2.6joel Assignment2Macfast McaNo ratings yet

- Porter Vs Ansoff StrategiesDocument15 pagesPorter Vs Ansoff StrategiesBeth Kimathi78% (9)

- Latest CH 3Document29 pagesLatest CH 3Berhe GebrezgiabherNo ratings yet

- Strategic Management Theory An Integrated Approach 9th Edition Hill Solutions ManualDocument15 pagesStrategic Management Theory An Integrated Approach 9th Edition Hill Solutions Manualdanielxavia55fok100% (23)

- Corporate Strategy: Understanding Diversification and Building Shareholder ValueDocument27 pagesCorporate Strategy: Understanding Diversification and Building Shareholder ValueMeghna SinghNo ratings yet

- S & EPM Unit 3Document34 pagesS & EPM Unit 3SaikatPatraNo ratings yet

- Strategic ManagementDocument14 pagesStrategic ManagementMAXWELL gwatiringaNo ratings yet

- Grow Through DiversificationDocument16 pagesGrow Through DiversificationAnuj KarnikNo ratings yet

- Mis Unit 2Document20 pagesMis Unit 2fitmbanotes100% (1)

- What is Corporate Strategy and How is it ManagedDocument34 pagesWhat is Corporate Strategy and How is it ManagedDecalcomani EnthusiastNo ratings yet

- BUS331 Operations Management OM Worksheet#1 (4%) Chapter 1 Introduction To Operations ManagementDocument5 pagesBUS331 Operations Management OM Worksheet#1 (4%) Chapter 1 Introduction To Operations ManagementLaboni PradhanNo ratings yet

- BUSINESS-PLANNINGDocument60 pagesBUSINESS-PLANNINGVishwa NatarajNo ratings yet

- December 2021 Examination: Concept and AnalysisDocument13 pagesDecember 2021 Examination: Concept and AnalysisAman SharmaNo ratings yet

- CHAPTER 6 REVIEW QUESTIONS - Docx STRATEGIC MANGEMENTDocument3 pagesCHAPTER 6 REVIEW QUESTIONS - Docx STRATEGIC MANGEMENTMariya BhavesNo ratings yet

- Balanced Scorecard: Introduction of The Types of StrategiesDocument13 pagesBalanced Scorecard: Introduction of The Types of StrategiesnellNo ratings yet

- Hitt Inst Manual 13e ch04 FinalDocument36 pagesHitt Inst Manual 13e ch04 FinalMonica CruzNo ratings yet

- PDF Document PDFDocument6 pagesPDF Document PDFIrine Afroza AurpaNo ratings yet

- Unit 4-Diversification & MergersDocument8 pagesUnit 4-Diversification & MergersnagamaniNo ratings yet

- Strategic ManagementDocument7 pagesStrategic ManagementvineetNo ratings yet

- Chapter Ten: Corporate-Level StrategyDocument31 pagesChapter Ten: Corporate-Level StrategyPulkit SinghalNo ratings yet

- Strategic Management: Business Strategies and Corporate StrategiesDocument22 pagesStrategic Management: Business Strategies and Corporate StrategiesRajat ShettyNo ratings yet

- Creativity and InnovationDocument9 pagesCreativity and InnovationdanielNo ratings yet

- Unit 8 Differentiation and Focus: ObjectivesDocument11 pagesUnit 8 Differentiation and Focus: ObjectivesDhinesh KumarNo ratings yet

- Diversification StrategyDocument9 pagesDiversification StrategyYashovardhan Shah ♠No ratings yet

- CHAPTER 5. Types of StrategiesDocument23 pagesCHAPTER 5. Types of StrategiesAiralyn RosNo ratings yet

- Corporate Level Strategy: Related and Unrelated DiversificationDocument48 pagesCorporate Level Strategy: Related and Unrelated DiversificationReina Erasmo SulleraNo ratings yet

- Institute of Accountancy Arusha (IAA) : Name: Programme: Reg - No: Module Name: Module Code: FacilitatorDocument7 pagesInstitute of Accountancy Arusha (IAA) : Name: Programme: Reg - No: Module Name: Module Code: FacilitatorDavid Caen MwangosiNo ratings yet

- MB0052Document5 pagesMB0052abernadeviNo ratings yet

- BPSMDocument17 pagesBPSManiket yadav0006No ratings yet

- Exam Perederii Tetiana IE-72a.en Variant 2 1. Analysis of A Corporate-Level Strategy (On The Corporate Examples)Document5 pagesExam Perederii Tetiana IE-72a.en Variant 2 1. Analysis of A Corporate-Level Strategy (On The Corporate Examples)Oleksandr SoloviovNo ratings yet

- Angelica Joy Albo Chapter 6 Strategic ManagementDocument6 pagesAngelica Joy Albo Chapter 6 Strategic ManagementMariya BhavesNo ratings yet

- M&A Basics: Types, Motives, SynergiesDocument24 pagesM&A Basics: Types, Motives, Synergiesshankarmore1990No ratings yet

- Solution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 13th Edition Michael A Hitt R Duane Ireland Robert e Hoskisson 13 978Document37 pagesSolution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 13th Edition Michael A Hitt R Duane Ireland Robert e Hoskisson 13 978BrandonBridgesqabm100% (32)

- Kathmandu Univeristy: Dhulikhel, Kavre School of Engineering Department of Civil EngineeringDocument7 pagesKathmandu Univeristy: Dhulikhel, Kavre School of Engineering Department of Civil EngineeringAnup GautamNo ratings yet

- Competitive Strategy: Lecture 6: Corporate Level StrategyDocument27 pagesCompetitive Strategy: Lecture 6: Corporate Level StrategyhrleenNo ratings yet

- Sample Questions Shortlisted by Paper Setting CommiteeDocument65 pagesSample Questions Shortlisted by Paper Setting CommiteeDivyeshNo ratings yet

- ENT 202 - Note 9Document5 pagesENT 202 - Note 9Akinyemi IbrahimNo ratings yet

- Chapter 2Document33 pagesChapter 2Wang TingNo ratings yet

- Chapter 9 - Strategic ManagementDocument35 pagesChapter 9 - Strategic ManagementGrace Versoni100% (1)

- Corporate StrategyDocument2 pagesCorporate StrategyParul VermaNo ratings yet

- Bussiness Strategy v1.0Document3 pagesBussiness Strategy v1.0Annu BabuNo ratings yet

- SM Midterm Descriptive NN Campus FA-20Document5 pagesSM Midterm Descriptive NN Campus FA-20Noshaba KashifNo ratings yet

- OnlineecDocument2 pagesOnlineecAshok ANo ratings yet

- Postman MailguardDocument12 pagesPostman MailguardPradeepNo ratings yet

- Bank AuthorazionDocument1 pageBank AuthorazionAshok ANo ratings yet

- Vacancy NoticeDocument4 pagesVacancy NoticeAnonymous ufMAGXcskMNo ratings yet

- Milk Dairy IntroDocument22 pagesMilk Dairy IntroAashik AmbawatNo ratings yet

- Milk Dairy IntroDocument22 pagesMilk Dairy IntroAashik AmbawatNo ratings yet

- Working Capital Management Study at Meenakshi Mission HospitalDocument122 pagesWorking Capital Management Study at Meenakshi Mission HospitalDinakaran DineshNo ratings yet

- EnglishDocument2 pagesEnglishAshu GuptaNo ratings yet

- PESB vacancy for Member (Finance) in Damodar Valley CorporationDocument4 pagesPESB vacancy for Member (Finance) in Damodar Valley CorporationAshok ANo ratings yet

- 18 ZIJMR Vol2 Issue5 May 2012Document16 pages18 ZIJMR Vol2 Issue5 May 2012Ashok ANo ratings yet

- Bank P.O. Mock Test: Special SupplementDocument18 pagesBank P.O. Mock Test: Special SupplementAshok ANo ratings yet

- Criteria Documents For Salaried Documents For Self-Employed Documents For ExpatDocument5 pagesCriteria Documents For Salaried Documents For Self-Employed Documents For Expatkaran182No ratings yet

- TFPC Phone NumbersDocument17 pagesTFPC Phone NumbersAshok A80% (15)

- FCI Recruitment 2013 for 158 Management Trainee PostsDocument23 pagesFCI Recruitment 2013 for 158 Management Trainee PostsGokul RajeshNo ratings yet

- Arohana Job Profile - Manager OperationsDocument2 pagesArohana Job Profile - Manager OperationsAshok ANo ratings yet

- Round: 0 Dec. 31, 2013: Selected Financial StatisticsDocument24 pagesRound: 0 Dec. 31, 2013: Selected Financial StatisticsAshok ANo ratings yet

- Business MKTG ChannelsDocument13 pagesBusiness MKTG ChannelsAshok ANo ratings yet

- List of DPS: SR - No. DP Name DP Id Address Contact Person Contact Nofax NoDocument26 pagesList of DPS: SR - No. DP Name DP Id Address Contact Person Contact Nofax NoAshok ANo ratings yet

- NIFT RTI title nominationsDocument2 pagesNIFT RTI title nominationsAshok ANo ratings yet

- Madurai CollegesDocument4 pagesMadurai CollegesAshok ANo ratings yet

- 18 ZIJMR Vol2 Issue5 May 2012Document16 pages18 ZIJMR Vol2 Issue5 May 2012Ashok ANo ratings yet

- TFPC Phone NumbersDocument17 pagesTFPC Phone NumbersAshok A80% (15)

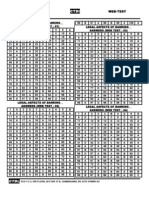

- Jaiib Web-Test Answers: Legal Aspects of Banking Answers (Web Test - 01) Legal Aspects of Banking Answers (Web Test - 03)Document2 pagesJaiib Web-Test Answers: Legal Aspects of Banking Answers (Web Test - 01) Legal Aspects of Banking Answers (Web Test - 03)Ashok ANo ratings yet

- DatabaseDocument7 pagesDatabaseBint e YameenNo ratings yet

- HyderabadDocument1 pageHyderabadAshok ANo ratings yet

- Formulation of SoapDocument4 pagesFormulation of SoapAshok ANo ratings yet

- Application For Suitable Post in The Karur Vysya Bank LimitedDocument4 pagesApplication For Suitable Post in The Karur Vysya Bank LimitedAshok ANo ratings yet

- Address Details2Document2 pagesAddress Details2Ashok ANo ratings yet

- RTM RolesDocument11 pagesRTM RolesAshok ANo ratings yet

- 2011 12 FRB Definition of RatiosDocument28 pages2011 12 FRB Definition of Ratiosa7medsamiNo ratings yet

- Promo Pricing Strategies Reduce Prices Attract CustomersDocument20 pagesPromo Pricing Strategies Reduce Prices Attract CustomersMarkDePazDiazNo ratings yet

- Engleza in AfaceriDocument293 pagesEngleza in Afacerililiana lilianaNo ratings yet

- Resa Law24Document3 pagesResa Law24NaSheengNo ratings yet

- O-1 Visa Lawyer in San JoseDocument2 pagesO-1 Visa Lawyer in San JoseAlison YewNo ratings yet

- Flavia CymbalistaDocument3 pagesFlavia Cymbalistadodona7772494No ratings yet

- Case Study 1Document5 pagesCase Study 1Abubakar MoazzamNo ratings yet

- Costco - Supplier Code of ConductDocument6 pagesCostco - Supplier Code of ConductalmariveraNo ratings yet

- Operations Management: Location StrategiesDocument18 pagesOperations Management: Location StrategiesRavi JakharNo ratings yet

- PMC BANK AR 2019 Website FinalDocument88 pagesPMC BANK AR 2019 Website FinalnewsofthemarketNo ratings yet

- Business Risk (D)Document5 pagesBusiness Risk (D)Tchao AdrienNo ratings yet

- AXONIS – Mobility Solution for SMART CitiesDocument33 pagesAXONIS – Mobility Solution for SMART CitiesrajimuruganNo ratings yet

- Case 1 Is Coca-Cola A Perfect Business PDFDocument2 pagesCase 1 Is Coca-Cola A Perfect Business PDFJasmine Maala50% (2)

- Evaluation of Print and Digital AdvertisementsDocument23 pagesEvaluation of Print and Digital AdvertisementsAshish KumarNo ratings yet

- Audit BoyntonDocument27 pagesAudit BoyntonMasdarR.MochJetrezzNo ratings yet

- Math and Logic Problems with Multiple Choice AnswersDocument4 pagesMath and Logic Problems with Multiple Choice AnswersTamara Gutierrez100% (3)

- Economic Espionage: A Framework For A Workable Solution: Mark E.A. DanielsonDocument46 pagesEconomic Espionage: A Framework For A Workable Solution: Mark E.A. DanielsonmiligramNo ratings yet

- MKT 412 Lecture 12 - Crafting The Service EnvironmentDocument34 pagesMKT 412 Lecture 12 - Crafting The Service EnvironmentEhsan Karim100% (1)

- A Project Report Submitted To: Market Survey of Consumer Perception About Cement IndustryDocument36 pagesA Project Report Submitted To: Market Survey of Consumer Perception About Cement Industryriteshgautam77No ratings yet

- Return Note - BRH12188307Document1 pageReturn Note - BRH12188307JamesNo ratings yet

- QA Modul-1 PDFDocument24 pagesQA Modul-1 PDFFarhan ShinigamiNo ratings yet

- Affidavit of GiftDocument2 pagesAffidavit of GiftAnonymous puqCYDnQNo ratings yet

- FM11 CH 10 Capital BudgetingDocument56 pagesFM11 CH 10 Capital Budgetingm.idrisNo ratings yet

- EMBMDocument14 pagesEMBMapi-19882665No ratings yet

- Integration and Responsiveness MatrixDocument9 pagesIntegration and Responsiveness MatrixVishalNo ratings yet

- Shriram Discharge Voucher PDFDocument4 pagesShriram Discharge Voucher PDFAnonymous hFDCuqw100% (1)

- Tamaño de Los Data Files (DBA - DATA - FILES)Document9 pagesTamaño de Los Data Files (DBA - DATA - FILES)Frank HackNo ratings yet

- Amazon Service Marketing Case StudyDocument36 pagesAmazon Service Marketing Case StudyAbhiNo ratings yet

- DESIGNER BASKETS Vs Air Sea TransportDocument1 pageDESIGNER BASKETS Vs Air Sea TransportMarco CervantesNo ratings yet

- Disputed Invoice CreationDocument13 pagesDisputed Invoice CreationSrinivas Girnala100% (1)

- SACCO Budgeting and Business Planning ManualDocument54 pagesSACCO Budgeting and Business Planning ManualFred IlomoNo ratings yet