Professional Documents

Culture Documents

Public Finance Glossary

Uploaded by

Jamal Hossain ShuvoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Public Finance Glossary

Uploaded by

Jamal Hossain ShuvoCopyright:

Available Formats

Short Notes (Public Finance)

Capital gain tax: A capital gains tax is a tax on capital gains the profit realized on the sale of a non-inventory asset that was purchased at a cost amount that lower than the amount realized on the sale. Expenditure tax: It is a taxation plan that replaces the income tax. Instead of applying as taxed based on the income earned, tax is allocated based on the rate of spending. This is different from the sales tax, which is applied at the time the goods or service are provided and is considered a consumption tax. VAT: VAT is an indirect tax which is imposed on goods and services at each stage of production, starting from raw materials to final product. Direct tax: Direct taxes are those taxes which are paid entirely by those persons on whom they are imposed. Proportional tax: It is a type of tax in which whatever the size of income the rate of taxes remain constant. Progressive tax: It is a type of tax in which the rate of taxation increases as the taxable income increase. Regressive tax: Its burden falls more heavily on the poor than the rich since the tax rate decreases as the tax base increases. Digressive tax: A tax may be slowly progressive up to a certain limit, after that it may be charged at a flat rate. Pareto optimum: A Pareto optimum is said to exist when recourses are allocated in such a way that no individual can be made better off without making another worse off and in the production no commodity is increased without reducing the production of another. Social optimum: A social optimum is said to exist if the allocation of resources not only represent a pareto optimum, but also represent the highest level of attainable social welfare given the constraints of resources endowments technology tastes attitudes of the society toward income, distribution and so forth. Public goods: It is an item whose consumption is not decided by the individual consumer but by the society as a whole and which is financed by taxation. Pure public goods: It is an Economic concept of goods or services that provides non-excludable and non-rival benefit to all people in the society. Externalities: Externality is a cost or benefit from production or consumption activities that affect people who are not part of the original activity. Coase Theorem: The Coase theorem states that where there is a conflict of property rights, the involved parties can bargain or negotiate terms that are more beneficial to both parties than the outcome of any assigned property rights. The theorem also asserts that in order for this to occur, bargaining must be costless in a competitive market. Pigovian taxes: A special tax that is often levied on companies that pollute the environment or create excess social costs, called negative externalities, through business practices. In a true market economy, a Pigovian tax is the most efficient and effective way to correct negative externalities. Negative externalities: A negative externality (also called "external cost" or "external diseconomy") is an action of a product on consumers that imposes a negative side effect on a third party; it is "social cost"

Jamal Hossain Shuvo

Page 1

Short Notes (Public Finance)

Pecuniary externalities: Situation where the input prices of one producer are affected favorable or unfavorable by the operations of the other producers. Technological externalities: Economic situation where the production functions of one firm is favorably or unfavorably affected by the production function of other firms.

Spillover effect: A secondary effect that follows from a primary effect, and may be far removed in time or place from the event that caused the primary effect. Spillover effects are externalities of economic activity or processes that affect those who are not directly involved.

Jamal Hossain Shuvo

Page 2

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Bbo Complaint Against Mark Lee - 11-3-22 FinalDocument288 pagesBbo Complaint Against Mark Lee - 11-3-22 FinalJohn WallerNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Trial of Warrant CasesDocument23 pagesTrial of Warrant CasesirampeerzadaNo ratings yet

- Class 11 Political Science - EqualityDocument30 pagesClass 11 Political Science - EqualityRamita Udayashankar100% (2)

- Powerpoint MCQ Bank PDFDocument21 pagesPowerpoint MCQ Bank PDFquickincometips0% (1)

- Powerpoint MCQ Bank PDFDocument21 pagesPowerpoint MCQ Bank PDFquickincometips0% (1)

- Punish The Crime - UNESCO Report On Journalists' SafetyDocument18 pagesPunish The Crime - UNESCO Report On Journalists' SafetyRafister2k13No ratings yet

- Internship Report - CRM (Credit Risk Management) Practice of BASIC Bank Limited, BangladeshDocument67 pagesInternship Report - CRM (Credit Risk Management) Practice of BASIC Bank Limited, BangladeshJamal Hossain Shuvo100% (2)

- Dissecting Anti-Terror Bill in The Philippines: A Swot AnalysisDocument15 pagesDissecting Anti-Terror Bill in The Philippines: A Swot AnalysisAdie LadnamudNo ratings yet

- Private individuals liable under RA 3019 for conspiring with public officersDocument3 pagesPrivate individuals liable under RA 3019 for conspiring with public officersMax RamosNo ratings yet

- Operating Systems MCQ BankDocument21 pagesOperating Systems MCQ BankJamal Hossain Shuvo100% (1)

- JSC composition suggestionsDocument3 pagesJSC composition suggestionsJamal Hossain ShuvoNo ratings yet

- Main Body Part - CRGDocument24 pagesMain Body Part - CRGJamal Hossain ShuvoNo ratings yet

- Bear Call Spread Strategy ExplainedDocument2 pagesBear Call Spread Strategy ExplainedJamal Hossain ShuvoNo ratings yet

- Comparative Short NotesDocument1 pageComparative Short NotesJamal Hossain ShuvoNo ratings yet

- CRM Slide Jamal50duDocument18 pagesCRM Slide Jamal50duJamal Hossain ShuvoNo ratings yet

- Essay Mid-Semester Exam - 6 August 2013Document2 pagesEssay Mid-Semester Exam - 6 August 2013Jamal Hossain ShuvoNo ratings yet

- Bbbaa VivaDocument4 pagesBbbaa VivaJamal Hossain ShuvoNo ratings yet

- Ent MGT Assignment 1 Detailed GuidelineDocument2 pagesEnt MGT Assignment 1 Detailed GuidelineJamal Hossain ShuvoNo ratings yet

- Interpersonal CommunicationDocument2 pagesInterpersonal CommunicationJamal Hossain ShuvoNo ratings yet

- Arif's CVDocument3 pagesArif's CVJamal Hossain ShuvoNo ratings yet

- Management Foundations Assessment 2 Business Report 2013Document7 pagesManagement Foundations Assessment 2 Business Report 2013Jamal Hossain ShuvoNo ratings yet

- Statistics Term Paper FINALDocument60 pagesStatistics Term Paper FINALJamal Hossain ShuvoNo ratings yet

- 1 Managing-ProjectsDocument9 pages1 Managing-ProjectsJamal Hossain ShuvoNo ratings yet

- Ethics Case Study ADocument2 pagesEthics Case Study AJamal Hossain ShuvoNo ratings yet

- HRMDocument5 pagesHRMJamal Hossain ShuvoNo ratings yet

- Shantii Marketing AssignmentDocument4 pagesShantii Marketing AssignmentJamal Hossain ShuvoNo ratings yet

- Assessment 2 International Marketing StrategyDocument4 pagesAssessment 2 International Marketing StrategyJamal Hossain ShuvoNo ratings yet

- Investment BankingDocument3 pagesInvestment BankingJamal Hossain ShuvoNo ratings yet

- AuditDocument3 pagesAuditJamal Hossain ShuvoNo ratings yet

- Assessment 1 International Marketing StrategyDocument2 pagesAssessment 1 International Marketing StrategyJamal Hossain ShuvoNo ratings yet

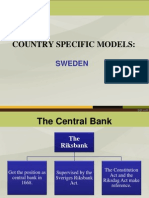

- SWEDEN'S CENTRAL BANK AND PARLIAMENTARY OVERSIGHTDocument8 pagesSWEDEN'S CENTRAL BANK AND PARLIAMENTARY OVERSIGHTJamal Hossain ShuvoNo ratings yet

- Audit FinalDocument4 pagesAudit FinalJamal Hossain ShuvoNo ratings yet

- AuditDocument3 pagesAuditJamal Hossain ShuvoNo ratings yet

- Step10 PlagiarismDocument15 pagesStep10 PlagiarismJamal Hossain Shuvo100% (1)

- Islamic BankingDocument1 pageIslamic BankingJamal Hossain ShuvoNo ratings yet

- CV of Jamal HossainDocument2 pagesCV of Jamal HossainJamal Hossain ShuvoNo ratings yet

- Nikole Read Appointed Chairperson of International Trade Council in CanadaDocument2 pagesNikole Read Appointed Chairperson of International Trade Council in CanadaMary Joy Dela MasaNo ratings yet

- FS - Courtesy Copy of The Partial AwardDocument549 pagesFS - Courtesy Copy of The Partial AwardNatalia CheleNo ratings yet

- Land Bank of The Philippines Vs Eugenio Dalauta DigestDocument2 pagesLand Bank of The Philippines Vs Eugenio Dalauta DigestLawrence Y. CapuchinoNo ratings yet

- Judicial Activism OR PILDocument26 pagesJudicial Activism OR PILShaman KingNo ratings yet

- MC 2016 Hypothetical Case PDFDocument8 pagesMC 2016 Hypothetical Case PDFMulugeta BarisoNo ratings yet

- IJCIET (International Journal of Civil Engineering and Technology)Document1 pageIJCIET (International Journal of Civil Engineering and Technology)Andi Nurul Annisaa FirdausiNo ratings yet

- Barangay Budget Self Evaluation No. 2018-000 TemplateDocument3 pagesBarangay Budget Self Evaluation No. 2018-000 Templatejuliet comia canino100% (1)

- Social Movement CoalitionsDocument17 pagesSocial Movement CoalitionsgmNo ratings yet

- Summary Sheet NFPA 1710 StandardDocument2 pagesSummary Sheet NFPA 1710 StandardNicoNo ratings yet

- Philippine Courts, Justices and Judges: Politics and Governance With The New ConstitutionDocument11 pagesPhilippine Courts, Justices and Judges: Politics and Governance With The New ConstitutionDominick DiscargaNo ratings yet

- Top TipsDocument2 pagesTop TipsPeter GriffinNo ratings yet

- Raghav Sehgal - 1 Mar. 2021Document3 pagesRaghav Sehgal - 1 Mar. 2021Raghav SehgalNo ratings yet

- Digital Roadmap For Ruslan VodkaDocument14 pagesDigital Roadmap For Ruslan VodkaShrinesh PoudelNo ratings yet

- Fazle Rabbi Annoor Id-05 MBA Mid Exam Answer MTM-5201Document3 pagesFazle Rabbi Annoor Id-05 MBA Mid Exam Answer MTM-5201Fazle-Rabbi AnnoorNo ratings yet

- Promotional ToolsDocument36 pagesPromotional ToolsKyla LimNo ratings yet

- Chandru Tro ResearchDocument2 pagesChandru Tro ResearchJoey JawidNo ratings yet

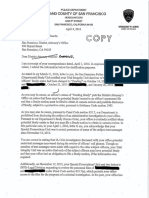

- SFPD Chief Greg Suhr April 4 Letter To DA George Gascón Re: Bigoted TextsDocument2 pagesSFPD Chief Greg Suhr April 4 Letter To DA George Gascón Re: Bigoted TextsKQED NewsNo ratings yet

- SPEC PRO 255. Republic v. Cantor, GR No. 184621, December 10, 2013Document15 pagesSPEC PRO 255. Republic v. Cantor, GR No. 184621, December 10, 2013Claudia LapazNo ratings yet

- Dinesh Kumar Yadav Vs State of UP and Ors 27102016UP2016151216163121274COM512213Document14 pagesDinesh Kumar Yadav Vs State of UP and Ors 27102016UP2016151216163121274COM512213Geetansh AgarwalNo ratings yet

- Court acquits Negros radio anchor of libel chargesDocument6 pagesCourt acquits Negros radio anchor of libel chargesPrincessNo ratings yet

- Gallardo vs. Judge TabamoDocument8 pagesGallardo vs. Judge TabamoAlyssa Alee Angeles JacintoNo ratings yet

- QAI Counter Terrorism Finance and Anti Money Laundering Discussion ReportDocument7 pagesQAI Counter Terrorism Finance and Anti Money Laundering Discussion ReportQatar-America InstituteNo ratings yet

- DOJ Report On BPD PDFDocument164 pagesDOJ Report On BPD PDFMichael LindenbergerNo ratings yet

- Court upholds denial of petition seeking relief from legal mistakesDocument3 pagesCourt upholds denial of petition seeking relief from legal mistakesEFGNo ratings yet