Professional Documents

Culture Documents

New Accepted for Value Process

Uploaded by

Bryant GeorgenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Accepted for Value Process

Uploaded by

Bryant GeorgenCopyright:

Available Formats

New Accepted for Value Process

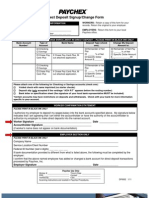

Take the statement, and separate the check/coupon portion from the statement (top) portion. Make a copy for your records. (If there is no coupon, then copy it and use one copy as the coupon.) On the face of the statement write or stamp, at a 45 degree angle: For credit card, utility and all accounts you wish to be continuing:

ACCEPTED FOR VALUE RETURNED FOR VALUE (DATE-use date of birth) BOND NUMBER (9 digit routing # & bond # back of SS card: drop letter, do not add any zeros) Sign it, or, just put A.R., then sign

On coupon/voucher: Put date again, anywhere on face In the box for amount paid enter the amount youre paying, like all of it, especially if they show an account balance. In lower right hand corner, below the amount paid box, sign name , if you had no coupon then put on the amount paid box and sign below it. (Nothing else, just regular signature.) On Back: Endorse it on the right as a normal check: regular signature For closing an account, on the face of the statement, right under accepted for value, returned for value, as above in red, add the following: FOR SETTLEMENT AND CLOSURE Place both the statement and the coupon in the same envelope and mark the outside of the envelope Private and Confidential, in red, and to the left side of the (to:) address and under your return address, put Priority/Confidential, send Registered Mail with electronic signature confirmation service requested or Certified/Registered with return Receipt Requested and mail to: (May also add on envelope flap: ATTN: CFO) For mortgage, auto loan, credit card, utility and other bills the CFO of the company. For tax bills, send to the top person at the agency. (Kansas City, for IRS, is supposedly the best for getting them accepted).

(Or Stop 4440, PO Box 9036, Ogden, UT 84021) The reason we do this is because we are giving the CFO permission to access our DTC account and get asset funds to offset the debt. FRNs are liability and public funds, and are just another debt.

We are allowed to do this under the contract we signed with our signature and SS #, for services or whatever. The CFO is allowed to go to the DTC under HJR192 to offset the account. If you pay by check, money order, etc, you are paying with public/liability funds and the CFO will do a 1099-A on the abandoned credit you neglected to claim, and youll have paid them twice. The CFO is licensed to do an ACH transfer from the private side of the DTC, hes getting real money, which strengthens the dollar and will help to slow down the issuance of the Amero. If they dont credit the account with this A4Vd statement and voucher, then send it back with a form 28 only. They cant rebut the Affidavit, and it stands as good under contract law.

You might also like

- Accepted For Value Tutorial 2018Document7 pagesAccepted For Value Tutorial 2018Pratus Williams100% (16)

- A4v MethodsDocument2 pagesA4v Methodsambassadors100% (22)

- Latest Formats:: "Accepted For Value"Document10 pagesLatest Formats:: "Accepted For Value"Stephen L. Smith80% (5)

- Latest Formats:: "Accepted For Value"Document10 pagesLatest Formats:: "Accepted For Value"Stephen L. Smith100% (6)

- Latest Accepted For Value Formats Rev 8Document4 pagesLatest Accepted For Value Formats Rev 8SovereignCC97% (223)

- Latest Formats:: "Accepted For Value"Document10 pagesLatest Formats:: "Accepted For Value"Stephen L. SmithNo ratings yet

- Latest A4VDocument10 pagesLatest A4VStephen L. SmithNo ratings yet

- Latest A4VDocument10 pagesLatest A4VStephen L. SmithNo ratings yet

- My AFV SuccessDocument10 pagesMy AFV SuccessRachel Rey92% (51)

- Audio Title: Beneficiary: Jack Smith Audio Download For February 23, 2009Document54 pagesAudio Title: Beneficiary: Jack Smith Audio Download For February 23, 2009marisolchavez88% (32)

- Jean Keating A4V process redeems debt in lawful moneyDocument7 pagesJean Keating A4V process redeems debt in lawful moneyDannyHeaggans98% (41)

- IRS Payment Acceptance LanguageDocument2 pagesIRS Payment Acceptance Languagethegocp100% (58)

- Doug Riddle AFV-A4V PatchedDocument41 pagesDoug Riddle AFV-A4V PatchedGalina Novahova96% (80)

- Accepted For Value RulesDocument6 pagesAccepted For Value RulesChad Lange96% (28)

- A4V Cover LetterDocument2 pagesA4V Cover LetterDennis-Jospeh94% (88)

- Accepted For Value Part 2. Does It WorkDocument5 pagesAccepted For Value Part 2. Does It WorkLews Matin79% (19)

- The Evolved A4VDocument3 pagesThe Evolved A4Vlyocco1100% (16)

- A4V Procedure - Accept For Value, Return For ValueDocument6 pagesA4V Procedure - Accept For Value, Return For ValueBob Hurt97% (91)

- A4V Processes and ProceduresDocument4 pagesA4V Processes and Proceduresrmaq100% (4)

- A4v EndorsementDocument1 pageA4v Endorsementjmjdawg1440583% (6)

- What Does "Accepted For Value" Mean?: in ALL Penal Actions For Violations of STATUTES, TheDocument53 pagesWhat Does "Accepted For Value" Mean?: in ALL Penal Actions For Violations of STATUTES, TheJason Lemmon90% (10)

- Acceptance of Presentment for Value Discharges DebtDocument2 pagesAcceptance of Presentment for Value Discharges Debtali100% (17)

- 1040V Tender SetoffDocument2 pages1040V Tender Setoffhelenmckane98% (87)

- Accept It For ValueDocument8 pagesAccept It For ValueTom Harkins95% (19)

- SCRIBD Acceptance For Value Great InfoDocument6 pagesSCRIBD Acceptance For Value Great InfoJose Castillo0% (1)

- A4V Perfecting Setoff NotesDocument3 pagesA4V Perfecting Setoff NotesKonan Snowden82% (11)

- 014 - Acceptance For Value A4vDocument2 pages014 - Acceptance For Value A4vDavid E Robinson95% (43)

- Handling PresentmentsDocument16 pagesHandling PresentmentsAnthony Juice Gaston Bey100% (17)

- A 4 VDocument3 pagesA 4 VRebecca Turner83% (6)

- 0 - How To A4vDocument2 pages0 - How To A4vWaverly AndLatriese Guyton100% (6)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- Separate statement coupon and endorse for valueDocument2 pagesSeparate statement coupon and endorse for valueMihai Piuaru100% (2)

- Direct Deposit FormDocument3 pagesDirect Deposit FormRabindra ShakyaNo ratings yet

- Paying Taxes With Coupon 112903Document4 pagesPaying Taxes With Coupon 112903Ya Boy React100% (5)

- Direct Deposit FormDocument3 pagesDirect Deposit FormSreenivas RaoNo ratings yet

- Orchard Bank 288451024 - AgreementNPI2701ADocument15 pagesOrchard Bank 288451024 - AgreementNPI2701AKestrel1940No ratings yet

- Payments Screens: This Document Describes How The Payments Screens in The Financials Application WorkDocument3 pagesPayments Screens: This Document Describes How The Payments Screens in The Financials Application WorkKui MangusNo ratings yet

- Noc Ip Payroll CH AgreementDocument7 pagesNoc Ip Payroll CH AgreementAlejuanchis Kamacho GarciaNo ratings yet

- 2 Amex Platinum ContractDocument8 pages2 Amex Platinum ContractterencehkyungNo ratings yet

- Hilton Credit Card Authorization Form TemplateDocument1 pageHilton Credit Card Authorization Form TemplateSam BojanglesNo ratings yet

- Guideline For GRIPSDocument5 pagesGuideline For GRIPSBishwakarma SahNo ratings yet

- Payment Information Summary of Account ActivityDocument3 pagesPayment Information Summary of Account ActivityTyrone J PalmerNo ratings yet

- Credit/Debit Card Dispute FormDocument2 pagesCredit/Debit Card Dispute FormJonny BabloNo ratings yet

- Statement DisclosureDocument1 pageStatement DisclosureShi Fu Michael ShafferNo ratings yet

- Payments and Receipts TallyDocument25 pagesPayments and Receipts Tallyanishsahu526No ratings yet

- Statement Aug 2013Document10 pagesStatement Aug 2013berstuck100% (2)

- Apply prepayment and record manual receiptDocument2 pagesApply prepayment and record manual receiptЭльнур ТагиевNo ratings yet

- How To Request Direct DepositDocument1 pageHow To Request Direct DepositalithebigbossNo ratings yet

- Pay Credit Card Bill OnlineDocument3 pagesPay Credit Card Bill OnlineYusuf OmarNo ratings yet

- Minimum Payment Due: $62.00 New Balance: $4,144.92 Payment Due Date: 11/02/13Document3 pagesMinimum Payment Due: $62.00 New Balance: $4,144.92 Payment Due Date: 11/02/13nates280100% (1)

- Feb 2012Document8 pagesFeb 2012Donna J ForgasNo ratings yet

- 7 - Wording For Accepting Future Offers of ContractDocument1 page7 - Wording For Accepting Future Offers of Contractapi-3744408100% (42)

- New Balance: Minimum Payment Due: Payment Due Date:: Account Activity Account Member How To Reach Us Customer ServiceDocument3 pagesNew Balance: Minimum Payment Due: Payment Due Date:: Account Activity Account Member How To Reach Us Customer ServiceChadd ThompsonNo ratings yet

- Direct Deposit Form A-24 Updated 1-3-20Document2 pagesDirect Deposit Form A-24 Updated 1-3-20james pearsonNo ratings yet

- Get Your Tax Refund Fast with RT TaxDocument8 pagesGet Your Tax Refund Fast with RT TaxRodion ChesovNo ratings yet

- Rewards Plus Gold Card Summary and Minimum Payment DueDocument14 pagesRewards Plus Gold Card Summary and Minimum Payment Dueksj5368100% (2)

- Discover Statement 20150825 5843Document6 pagesDiscover Statement 20150825 5843teudyNo ratings yet

- F 9465Document3 pagesF 9465Pat PlanteNo ratings yet

- Challenge Bill Collector With Proof Of Claim RequestDocument2 pagesChallenge Bill Collector With Proof Of Claim RequestBryant Georgen100% (7)

- OffertoPay Set2Document34 pagesOffertoPay Set2Bryant Georgen100% (3)

- 5 Ways To Handle A PresentmentDocument9 pages5 Ways To Handle A Presentmenttoski_tech5051100% (4)

- Emergency Foreclosure DefenseDocument23 pagesEmergency Foreclosure DefenseKNOWLEDGE SOURCE100% (2)

- January 20, 2016 Tribune-PhonographDocument16 pagesJanuary 20, 2016 Tribune-PhonographcwmediaNo ratings yet

- 14OTCA BrochureDocument11 pages14OTCA BrochurePrabhakar TiwariNo ratings yet

- IGNOU AOM-01 Free Solved Assignment 2012Document9 pagesIGNOU AOM-01 Free Solved Assignment 2012lubeans0% (1)

- Wiltron 67XXB MM PDFDocument503 pagesWiltron 67XXB MM PDF4x6uj100% (1)

- (Insert Document Code (If in District Court) )Document3 pages(Insert Document Code (If in District Court) )Anonymous 4F8cmsZKKNNo ratings yet

- Moda Dil DenemeDocument262 pagesModa Dil Denemenewbiology90No ratings yet

- 07-PS - External Confirmations AS2 V12Document10 pages07-PS - External Confirmations AS2 V12Carlota Nicolas VillaromanNo ratings yet

- Judgment Entered Against GOFF VUME and ITECDocument3 pagesJudgment Entered Against GOFF VUME and ITECGeorge SharpNo ratings yet

- Governor General Award Nomination FormDocument1 pageGovernor General Award Nomination FormRevelstoke EditorNo ratings yet

- TCS Joining ChecklistDocument2 pagesTCS Joining ChecklistAvinay SharmaNo ratings yet

- Too Busy For God? (Part 1) - 2014-10-12Document5 pagesToo Busy For God? (Part 1) - 2014-10-12John PartridgeNo ratings yet

- Reader 39 S Digest Canada - 05 2021Document100 pagesReader 39 S Digest Canada - 05 2021Mon Lay100% (1)

- NTS Application FormDocument4 pagesNTS Application FormMirza Muneeb AhsanNo ratings yet

- Attachment "A" - Property ListDocument6 pagesAttachment "A" - Property ListBrian Gillespie75% (12)

- OxfordPictureDictionary TextDocument131 pagesOxfordPictureDictionary TextMega AlemaniaNo ratings yet

- Report On Ms WordDocument48 pagesReport On Ms WordSamir GhimireNo ratings yet

- South Hackensack OPRA Request FormDocument4 pagesSouth Hackensack OPRA Request FormThe Citizens CampaignNo ratings yet

- United States International University - Africa: Other Name(s) /maiden Name, If AnyDocument4 pagesUnited States International University - Africa: Other Name(s) /maiden Name, If AnyPatrick MwaliliNo ratings yet

- Avuni's Completed Project 221109Document29 pagesAvuni's Completed Project 221109godpeoplesNo ratings yet

- Bosch Gms 100 63 LucasDocument4 pagesBosch Gms 100 63 Lucastordos7183No ratings yet

- Apply for Trinidad Birth Certificate OnlineDocument2 pagesApply for Trinidad Birth Certificate OnlineKellie PacanowskiNo ratings yet

- Motion To Quash Service - Doc - 1Document9 pagesMotion To Quash Service - Doc - 1amy ferrulli100% (1)

- HogalogueDocument8 pagesHogaloguesylvisionNo ratings yet

- Sample Demand For Bill of Particulars For CaliforniaDocument3 pagesSample Demand For Bill of Particulars For CaliforniaJohnnyLarsonNo ratings yet

- Memorandum Report Brl-Mr-3867: Ballistic Research Laboratory Aberdeen Proving Ground, MarylandDocument20 pagesMemorandum Report Brl-Mr-3867: Ballistic Research Laboratory Aberdeen Proving Ground, Marylandali_raza117No ratings yet

- Architectural Record - May 2005 PDFDocument409 pagesArchitectural Record - May 2005 PDFJuan Galan MayraNo ratings yet

- Western Health Trust Application TipsDocument10 pagesWestern Health Trust Application TipsAl HasanNo ratings yet

- The World of Interiors PDFDocument264 pagesThe World of Interiors PDFbiomedmaulik100% (3)

- MVA Fund Act 10 Regulations of 2008Document30 pagesMVA Fund Act 10 Regulations of 2008André Le RouxNo ratings yet