Professional Documents

Culture Documents

Top 100 HFs

Uploaded by

ZerohedgeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Top 100 HFs

Uploaded by

ZerohedgeCopyright:

Available Formats

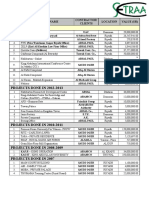

100 TOPPERFORMING

Fund, Manager(s) 1

2 3 4 5 6

LARGE HEDGE FUNDS

Strategy Mortgage-backed arbitrage Mortgage-backed arbitrage Multistrategy Mortgage-backed arbitrage Macro Asset backed Multistrategy Macro Multistrategy Long/short Asset backed Long/short Long/short Event driven Mortgage-backed arbitrage Long/short Long biased Distressed Structured credit Multistrategy Distressed Managed futures Multistrategy Distressed Distressed Fixed income Distressed Asset backed

ASSETS, IN BILLIONS YTD TOTAL RETURN 2011 RETURN

Management Firm, Location Metacapital Management, U.S. Pine River Capital Management, U.S. CQS, U.K. Pine River Capital Management, U.S. Odey Asset Management, U.K. Marathon Asset Management, U.S. Appaloosa Management, U.S. BTG Pactual Global Asset Management, U.S. Third Point, U.S. Omega Advisors, U.S. Seer Capital Management, U.S. Tiger Global Management, U.S. Eminence Capital, U.S. Jana Partners, U.S. Structured Portfolio Management, U.S. Citadel Advisors, U.S. Viking Global Investors, U.S. Cerberus Capital Management, U.S. LibreMax Capital, U.S. Pine River Capital Management, U.S. Litespeed Management, U.S. Man Investments, U.K. Citadel Advisors, U.S. Canyon Capital Advisors, U.S. Contrarian Capital Management, U.S. DoubleLine Capital, U.S. Redwood Capital Management, U.S. One William Street Capital Management, U.S.

Metacapital Mortgage Opportunities Deepak Narula Pine River Fixed Income Steve Kuhn CQS Directional Opportunities Michael Hintze Pine River Liquid Mortgage Steve Kuhn, Jiayi Chen Odey European Crispin Odey Marathon Securitized Credit Bruce Richards, Louis Hanover Palomino David Tepper BTG Pactual GEMM Team managed Third Point Ultra Daniel Loeb Seer Capital Partners Philip Weingord

$1.5 3.6 1.5 1.1 1.8 1.2 4.9 3.6 1.3 1.4 1.2 6.0 3.0 3.8 1.9 1.0 1.7 1.7 2.3 1.6 1.7 1.9 7.0 1.9 2.1 2.3 2.6 2.2

37.8% 32.9 28.9 28.0 24.1 24.0 24.0 23.1 22.1 21.7 21.6 21.0 20.9 20.4 20.3 20.0 19.4 19.0 18.5 18.5 18.1 18.0 18.0 17.7 17.6 17.4 17.4 17.1

23.6% 4.8 10.4 7.2 20.3 4.2 3.5 3.4 2.3 1.4 2.1 45.0 1.6 2.1 19.6 38.0 0.1 NA 1 2.0 5.7 4.4 10.5 20.0 4.5 1.3 20.7 2.0 4.3

8 9

10 Omega Overseas Partners A Leon Cooperman 11

12 Tiger Global Feroz Dewan, Chase Coleman 13 Eminence Ricky Sandler 14 Jana Master Barry Rosenstein, David DiDomenico 15 Structured Servicing Holdings William Mok 16 Citadel Tactical Trading Team managed 17

Viking Long Andreas Halvorsen

18 Cerberus RMBS Opportunities Steve Feinberg 19 LibreMax Partners Greg Lippmann

Pine River Aaron Yeary

21 Litespeed Master Jamie Zimmerman 22 AHL Evolution Timothy Wong

Citadel Kensington/Wellington Team managed

24 Canyon Balanced Joshua Friedman, Mitchell Julis 25 Contrarian Capital One Jon Bauer, Janice Stanton 26 DoubleLine Opportunistic Income Jeffrey Gundlach, Philip Barach

Redwood Offshore Jonathan Kolatch

28 One William Street Capital Partners David Sherr

1

Fund was launched in 2011. 2Return is for the nine months ended on Sept. 30. Returns are for the 10 months ended on Oct. 31. Includes funds with more than $1 billion in assets. Sources: Bloomberg, hedge-fund databases, hedge-fund firms, investors

100 TOP-PERFORMING LARGE HEDGE FUNDS

Fund, Manager(s)

29 Cevian Capital II Lars Forberg, Christer Gardell

Management Firm, Location Cevian Capital, Sweden D.E. Shaw & Co., U.S. Autonomy Capital, U.S. Maverick Capital Management, U.S. Structured Portfolio Management, U.S. Canyon Capital Advisors, U.S. MKP Capital Management, U.S. GoldenTree Asset Management, U.S. Fortress Investment Group, U.S. Silver Point Capital, U.S. York Capital Management Prosperity Capital Management, Russia CQS, U.K. Third Point, U.S. Bridgewater Associates, U.S. Citadel Advisors, U.S. Marathon Asset Management, U.S. OxFORD Asset Management, U.K. Spinnaker Capital, U.K. Halcyon Asset-Backed Advisors, U.S. D.E. Shaw & Co., U.S. Perry Capital, U.S. BlueMountain Capital Management, U.S. Ares Management, U.S. Cerberus Capital Management, U.S. Credit Suisse Hedging-Griffo, Brazil Vertex One Asset Management, Canada Blue Harbour Group, U.S. Viking Global Investors, U.S. DW Investment Management, U.S. Fortress Investment Group, U.S. BlackRock Alternative Investors, U.S. Beach Point Capital Management, U.S. QVT Financial, U.S. Pelham Capital Management, U.K. Zenit Asset Management, Sweden

Strategy Activist Macro Macro Long/short Mortgage-backed arbitrage Multistrategy Credit Credit Credit Distressed Distressed Emerging-markets equity Asset backed Multistrategy Macro Long/short Multistrategy Quantitative Emerging-markets debt Asset backed Macro Multistrategy Credit Fixed income Distressed Macro Distressed Activist Long/short Credit Macro Fixed income Distressed Multistrategy Long/short Long/short

ASSETS, IN BILLIONS

YTD TOTAL RETURN

2011 RETURN

$6.9 1.7 2.9 10.0 1.7 8.0 2.0 1.5 4.9 6.8 4.2 1.3 2.3 4.9 6.6 2.0 1.0 3.8 1.4 2.5 9.5 4.8 5.1 2.4 7.6 1.4 1.0 1.1 16.3 3.0 1.5 3.5 1.4 2.4 2.0 1.5

16.8% 16.8 16.0 16.0 15.7 15.6 15.4 15.3 15.1 15.0 15.0 14.9 14.3 14.1 14.0 14.0 14.0 13.7 13.7 13.4 13.4 13.4 13.3 13.2 13.2 13.1 13.0 12.9 12.7 12.6 12.5 12.3 12.1 12.1 11.9 11.8

9.9% 9.2 13.6 15.8 23.7 4.7 5.1 0.7 10.9 6.1 1.4 18.0 0.7 0.1 19.5 21.0 4.8 23.5 9.3 4.1 18.0 7.1 3.6 8.0 1.3 5.7 20.0 3.3 7.6 1.2 9.5 20.2 1.0 5.5 10.4 4.0

Heliant David E. Shaw

31 Autonomy Global Macro Robert Gibbins

Maverick Lee Ainslie

33 SPM Core William Mok 34 Canyon Value Realization Joshua Friedman, Mitchell Julis 35 MKP Credit Patrick McMahon, Anthony Lembke 36 GoldenTree Credit Opportunities Steven Tananbaum 37 Drawbridge Special Opportunities Peter Briger Jr., Constantine Dakolias 38 Silver Point Capital Edward Mule

York Credit Opportunities William Vrattos, James Dinan, Daniel Schwartz

40 Russian Prosperity Ivan Mazalov, Alexander Branis 41 CQS ABS Simon Finch (formerly Alistair Lumsden) 42 Third Point Offshore Daniel Loeb 43 All Weather 12% Ray Dalio

Citadel Global Equities Team managed Marathon Special Opportunity Bruce Richards, Louis Hanover

46 OxAM Quant Fund Andre Stern, Steve Mobbs, Steven Kurlander

Spinnaker Global Emerging Markets Bradley Wickens

48 Halcyon Asset-Backed Value Joseph Wolnick, Joseph Godley, James Coppola

Oculus David E. Shaw Perry Partners Richard Perry

51 BlueMountain Credit Alternatives Andrew Feldstein 52 Ares Enhanced Credit Opportunities Seth Brufsky, Americo Cascella

Cerberus Institutional Partners Series IV Steve Feinberg

54 Green HG Luis Stuhlberger 55 Vertex John Thiessen, Tim Logie 56 Blue Harbour Strategic Value Partners Clifton Robbins 57 Viking Global Equities Andreas Halvorsen 58 Brevan Howard Credit Catalysts David Warren 59 Fortress Macro Adam Levinson, Michael Novogratz 60 BlackRock Fixed Income Global Alpha Tim Webb 61 Beach Point Total Return Carl Goldsmith, Scott Klein

QVT Overseas-B Daniel Gold

63 Pelham Long/Short Ross Turner, Hadyn Cunningham 64 Brummer & Partners Zenit Per Josefsson, Svante Elfving

1

Fund was launched in 2011. 2Return is for the nine months ended on Sept. 30. Returns are for the 10 months ended on Oct. 31. Includes funds with more than $1 billion in assets. Sources: Bloomberg, hedge-fund databases, hedge-fund firms, investors

100 TOP-PERFORMING LARGE HEDGE FUNDS

Fund, Manager(s)

65 Egerton European Dollar John Armitage

Management Firm, Location Egerton Capital, U.K. Greenlight Capital, U.S. Rimrock Capital Management, U.S. Angelo Gordon & Co., U.S. GSO Capital Partners, U.S. Pimco, U.S. Providence Investment Management, U.S. New Mountain Capital, U.S. York Capital Management, U.S. Elliott Management, U.S. Hudson Bay Capital Management, U.S. GoldenTree Asset Management, U.S. Hayman Capital Management, U.S. King Street Capital, U.S. Paulson Partners, U.S. Loomis Sayles & Co., U.S. Columbus Hill Capital Management, U.S. Strategic Value Partners, U.S. Discovery Capital Management, U.S. Halcyon Asset Management, U.S. Lansdowne Partners, U.K. Avenue Capital Group, U.S. Highside Capital Management, U.S. SAC Capital Advisors, U.S. Senator Investment Group, U.S. Visium Asset Management, U.S. Aristeia Capital, U.S. Spinnaker Capital, U.K. Och-Ziff Capital Management Group, U.S. Carlson Capital, U.S. Monarch Alternative Capital, U.S. Elliott Management, U.S. Passport Capital, U.S. Kingdon Capital Management, U.S. Two Sigma Investments, U.S. York Capital Management, U.S.

Strategy Long/short Long/short Fixed-income arbitrage Multistrategy Distressed Long/short Mortgage-backed arbitrage Long/short Multistrategy Multistrategy Multistrategy Credit Event driven Event driven Merger arbitrage Credit Multistrategy Distressed Macro Multistrategy Long/short Distressed Long/short Long/short Multistrategy Long/short Credit Emerging-markets debt Multistrategy Multistrategy Distressed Multistrategy Long/short Long/short Managed futures Multistrategy

ASSETS, IN BILLIONS

YTD TOTAL RETURN

2011 RETURN

$1.5 7.8 1.2 3.1 1.8 2.7 1.8 1.6 1.5 7.5 1.5 2.9 1.0 10.4 2.0 1.1 1.2 1.4 6.3 1.5 6.9 2.0 1.0 9.0 3.7 2.6 1.5 1.4 21.4 4.4 1.3 13.4 1.3 1.2 2.6 5.1

11.4% 11.4 11.2 11.0 11.0 11.0 11.0 10.8 10.7 10.6 10.6 10.5 10.5 10.5 10.5 10.4 10.3 10.3 10.2 10.1 10.1 10.0 10.0 10.0 10.0 10.0 9.8 9.6 9.5 9.4 9.4 9.3 9.3 9.1 9.0 9.0

2

5.0% 2.9 7.5 0.8 8.0 1.8 25.1 12.0 7.2 4.0 4.3 0.3 1.8 1.6 21.6 0.8 4.5 11.3 3.6 5.9 20.4 12.9 1.3 8.0 0.7 2.1 2.4 11.8 0.6 0.8 0.5 3.8 18.7 18.0 3.7 7.1

Greenlight Capital David Einhorn

67 Rimrock High Income Plus Dave Edington 68 AG Super Michael Gordon, David Kamin

GSO Special Situations Overseas Louis Salvatore, Michael Whitman Pimco Absolute Return IV Bill Gross Providence MBS Russell Jeffrey

72 New Mountain Vantage Daniel Riley, David Frost 73 York Total Return Jeffrey Weber, Marc Helwani 74

Elliott Associates Paul Singer Hudson Bay Sander Gerber

76 GoldenTree Master Steven Tananbaum

Hayman Capital Master Kyle Bass King Street Francis Biondi, Brian Higgins Paulson Enhanced John Paulson

80 Loomis Sayles Credit Long/Short Team managed 81 Columbus Hill Kevin Eng

Strategic Value Restructuring Victor Khosla

83 Discovery Global Opportunity Robert Citrone 84 Halcyon Partners Offshore John Bader, Kevah Konner

Lansdowne Developed Markets Peter Davies, Stuart Roden

86 Avenue International Shawn Foley, Rob Symington

Highside Capital Partners Lee Hobson SAC Capital International Steve Cohen Senator Global Opportunity Alex Klabin, Douglas Silverman Visium Balanced Jacob Gottlieb

91 Aristeia Partners Anthony Frascella, William Techar 92 Spinnaker Global Opportunity Jorge Benjamin Rosas, Marcos Lederman 93 OZ Master Daniel Och 94 Double Black Diamond Clint Carlson

Monarch Debt Recovery M. Weinstock, A. Herenstein, C. Santana

96 Elliott International Paul Singer

Passport Global Strategy John Burbank II

98 M. Kingdon Offshore Team managed 99 Two Sigma Compass Enhanced U.S. Team managed

York Capital Management James Dinan, Daniel Schwartz

1

Fund was launched in 2011. 2Return is for the nine months ended on Sept. 30. Returns are for the 10 months ended on Oct. 31. Includes funds with more than $1 billion in assets. Sources: Bloomberg, hedge-fund databases, hedge-fund firms, investors

You might also like

- Hunter Biden ReportDocument64 pagesHunter Biden ReportZerohedge50% (2)

- Warren Buffett's Annual Letter To ShareholdersDocument16 pagesWarren Buffett's Annual Letter To ShareholdersFOX Business100% (2)

- Hunter Biden Indictment 120723Document56 pagesHunter Biden Indictment 120723New York PostNo ratings yet

- Tesla Inc Earnings CallDocument20 pagesTesla Inc Earnings CallZerohedge100% (1)

- TBAC Presentation Aug 2Document44 pagesTBAC Presentation Aug 2ZerohedgeNo ratings yet

- 3Q23 PresentationDocument12 pages3Q23 PresentationZerohedgeNo ratings yet

- NSF Staff ReportDocument79 pagesNSF Staff ReportZerohedge Janitor100% (1)

- 2023-09-14 OpinionDocument42 pages2023-09-14 OpinionZerohedgeNo ratings yet

- TSLA Q4 2023 UpdateDocument32 pagesTSLA Q4 2023 UpdateSimon AlvarezNo ratings yet

- Bloomberg Markets Magazine The Worlds 100 Richest Hedge Funds February 2011Document8 pagesBloomberg Markets Magazine The Worlds 100 Richest Hedge Funds February 2011Wall Street WanderlustNo ratings yet

- BofA The Presentation Materials - 3Q23Document43 pagesBofA The Presentation Materials - 3Q23Zerohedge100% (1)

- BTCETFDocument22 pagesBTCETFZerohedge JanitorNo ratings yet

- Earnings Presentation Q3 2023Document21 pagesEarnings Presentation Q3 2023ZerohedgeNo ratings yet

- Fomc Minutes 20231101Document10 pagesFomc Minutes 20231101ZerohedgeNo ratings yet

- X V Media Matters ComplaintDocument15 pagesX V Media Matters ComplaintZerohedge Janitor100% (1)

- Europe Hedge FundsDocument126 pagesEurope Hedge Fundsheedi0No ratings yet

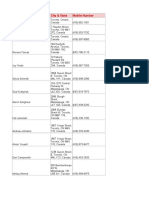

- CEO Summit Cocktail Party Attendees 1-30-14 CompaniesDocument5 pagesCEO Summit Cocktail Party Attendees 1-30-14 CompaniesSam Biddle0% (2)

- Preet Sir ProjectDocument5,296 pagesPreet Sir ProjectSalahuddin Nayan0% (1)

- JPM Q1 2024 PresentationDocument14 pagesJPM Q1 2024 PresentationZerohedgeNo ratings yet

- Fomc Minutes 20240320Document11 pagesFomc Minutes 20240320ZerohedgeNo ratings yet

- Bloomberg The 100 Best Performing Large Hedge FundsDocument3 pagesBloomberg The 100 Best Performing Large Hedge FundsMurray PriestleyNo ratings yet

- Rising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumDocument51 pagesRising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumZerohedge100% (1)

- Emerging marketsDocument3 pagesEmerging marketsleoprikhodkoNo ratings yet

- Sharjah Ceos Url LinkdinDocument21 pagesSharjah Ceos Url Linkdinusq20926No ratings yet

- Join Our Chat (Telegram) - We Help Startups Grow FasterDocument4 pagesJoin Our Chat (Telegram) - We Help Startups Grow FasterAdewuyi IsraelNo ratings yet

- IVCA Members - Alphabetical ListingDocument5 pagesIVCA Members - Alphabetical ListingRajesh PaniNo ratings yet

- Yellow Corporation Files Voluntary Chapter 11 PetitionsDocument2 pagesYellow Corporation Files Voluntary Chapter 11 PetitionsZerohedgeNo ratings yet

- Bloomberg Markets Magazine The Worlds 100 Richest Hedge Funds February 2011Document8 pagesBloomberg Markets Magazine The Worlds 100 Richest Hedge Funds February 2011VALUEWALK LLCNo ratings yet

- TBAC Basis Trade PresentationDocument34 pagesTBAC Basis Trade PresentationZerohedgeNo ratings yet

- List of Seed Companie PDFDocument116 pagesList of Seed Companie PDFmiketyson11No ratings yet

- Top 40 Wealth Management Firms 2017Document3 pagesTop 40 Wealth Management Firms 2017JonNo ratings yet

- Swiss wealth firms contact dataDocument1 pageSwiss wealth firms contact dataIZ SaintedNo ratings yet

- Fomc Minutes 20240131Document11 pagesFomc Minutes 20240131ZerohedgeNo ratings yet

- Initial Report On RJ Corp Company ProfileDocument32 pagesInitial Report On RJ Corp Company ProfilebhuaryanNo ratings yet

- Top Hedge Funds 2015Document31 pagesTop Hedge Funds 2015neman018No ratings yet

- AMD Q3'23 Earnings SlidesDocument33 pagesAMD Q3'23 Earnings SlidesZerohedgeNo ratings yet

- Consulting Hy uPE I - Bank VC ListDocument41 pagesConsulting Hy uPE I - Bank VC ListsandeepntcNo ratings yet

- Fragrances in Saudi ArabiaDocument5 pagesFragrances in Saudi Arabiaaurelie1611No ratings yet

- Guide-to-Venture-Capital IVA PDFDocument90 pagesGuide-to-Venture-Capital IVA PDFNaveen AwasthiNo ratings yet

- 75 Promising Startups NIDHI Seed Support ProgramDocument110 pages75 Promising Startups NIDHI Seed Support ProgramSachin SharmaNo ratings yet

- List of Merchant BankersDocument10 pagesList of Merchant Bankersnikee patelNo ratings yet

- Voip Re Seller ListDocument6 pagesVoip Re Seller ListShaji PhilipNo ratings yet

- Ecommerce & Marketplace VC Panels & Pitches HandoutDocument6 pagesEcommerce & Marketplace VC Panels & Pitches HandoutAndrew BottNo ratings yet

- List of GCC Countries11Document4 pagesList of GCC Countries11Ashif IqubalNo ratings yet

- Top Indian VC and PE funds by sector focusDocument4 pagesTop Indian VC and PE funds by sector focusRakesh Kumar Singh100% (1)

- Zodius Capital II Fund Launch 070414Document2 pagesZodius Capital II Fund Launch 070414avendusNo ratings yet

- MeetFounders UK EU August 2021 HandoutDocument13 pagesMeetFounders UK EU August 2021 HandoutAndrew BottNo ratings yet

- A4 9131 Doing Business Saudi ArabiaDocument50 pagesA4 9131 Doing Business Saudi ArabiameetnaushadNo ratings yet

- List of Foreign Venture Capital Investors Registered With SEBISDocument19 pagesList of Foreign Venture Capital Investors Registered With SEBISDisha NagraniNo ratings yet

- Aibi Summit 2016Document48 pagesAibi Summit 2016Anonymous KRErbYM7No ratings yet

- Fintech VC Panels & Pitches HandoutDocument7 pagesFintech VC Panels & Pitches HandoutAndrew BottNo ratings yet

- Top Consultancy ListDocument1 pageTop Consultancy ListKannanNo ratings yet

- Palm Oil ShipmentsDocument1 pagePalm Oil ShipmentsmalikmobeenNo ratings yet

- AngolaDocument19 pagesAngolaThe MaverickNo ratings yet

- List of Major Foreign Investors in Poland 2011-CommentsDocument128 pagesList of Major Foreign Investors in Poland 2011-Commentsmihaisoric16170% (1)

- UHNWI Population of The WorldDocument45 pagesUHNWI Population of The WorldchalasanimmNo ratings yet

- Sheikh Ahmed's Private Office GuideDocument12 pagesSheikh Ahmed's Private Office GuideMemo McNo ratings yet

- 2Q 15 Vcsurvey PDFDocument11 pages2Q 15 Vcsurvey PDFBayAreaNewsGroupNo ratings yet

- The Intelligent SME-Issue 7Document116 pagesThe Intelligent SME-Issue 7spiholdingNo ratings yet

- CamScanner Scans PDFs from PhotosDocument5 pagesCamScanner Scans PDFs from PhotosGoli Vamshi KrishnaNo ratings yet

- New Hedge FundDocument25 pagesNew Hedge Fundjoe smithNo ratings yet

- Budgeting, Financial Management, Procurement, Contract Management, Project Management, Gender Mainstreaming, Training Courses - Arusha, Tanzania, AfricaDocument1 pageBudgeting, Financial Management, Procurement, Contract Management, Project Management, Gender Mainstreaming, Training Courses - Arusha, Tanzania, Africaprofession100% (1)

- Emergent Dispatch Rider AbstractDocument3 pagesEmergent Dispatch Rider AbstractTelika RamuNo ratings yet

- Barron 100 HedgefundsDocument2 pagesBarron 100 Hedgefundskcchan7No ratings yet

- Right IT Solutions: Client Sector Contact Person TelephoneDocument1 pageRight IT Solutions: Client Sector Contact Person TelephonemonicafernandesNo ratings yet

- How To Contact Chase - Servicing & Mortgage Files - Chase Home Finance LLCDocument4 pagesHow To Contact Chase - Servicing & Mortgage Files - Chase Home Finance LLC83jjmackNo ratings yet

- Cuomo Donors RankedDocument18 pagesCuomo Donors RankedElizabeth BenjaminNo ratings yet

- Oman CompanyDocument7 pagesOman CompanyReetikaNo ratings yet

- The World's Billionaires List - ForbesDocument10 pagesThe World's Billionaires List - ForbesmooninjaNo ratings yet

- CORFISER SMI Fund Puesto 66 de 3,017 Fondos Segun Bloomberg Ranking May 2013Document1 pageCORFISER SMI Fund Puesto 66 de 3,017 Fondos Segun Bloomberg Ranking May 2013Finser GroupNo ratings yet

- Top 25 Venture Capital Firms in IndiaDocument8 pagesTop 25 Venture Capital Firms in IndiaRavi Singh BishtNo ratings yet

- Stone Mountain Capital Partners DDQDocument30 pagesStone Mountain Capital Partners DDQapi-276349208No ratings yet

- Parastatals in KenyaDocument8 pagesParastatals in KenyaOscar WaiharoNo ratings yet

- Seller Network IdsDocument172 pagesSeller Network IdsmikeNo ratings yet

- Amanat Prospectus EnglishDocument104 pagesAmanat Prospectus EnglishAbdoKhaledNo ratings yet

- 2019Q2 HiosDocument1,708 pages2019Q2 HiosData hi DataNo ratings yet

- Ongoing ProjectsDocument3 pagesOngoing ProjectsDeen MohammadNo ratings yet

- CRITICAL THINKING MOVEMENTDocument6 pagesCRITICAL THINKING MOVEMENTmark_torreonNo ratings yet

- Bloomberg - Richest Hedge Funds 02 2011Document6 pagesBloomberg - Richest Hedge Funds 02 2011Adam PedharNo ratings yet

- Bloomberg Top Hedge Funds 2010Document14 pagesBloomberg Top Hedge Funds 2010jackefeller100% (1)

- The world's richest hedge fundsDocument8 pagesThe world's richest hedge fundsVenkatesh VadlamaniNo ratings yet

- Earnings Presentation Q1 2024Document18 pagesEarnings Presentation Q1 2024ZerohedgeNo ratings yet

- 2404_fs_milex_2023Document12 pages2404_fs_milex_2023ZerohedgeNo ratings yet

- Fomc Minutes 20231213Document10 pagesFomc Minutes 20231213ZerohedgeNo ratings yet

- BOJ Monetary Policy Statemetn - March 2024 Rate HikeDocument5 pagesBOJ Monetary Policy Statemetn - March 2024 Rate HikeZerohedge0% (1)

- Jerome Powell SpeechDocument6 pagesJerome Powell SpeechTim MooreNo ratings yet

- Powell 20230825 ADocument16 pagesPowell 20230825 AJuliana AméricoNo ratings yet

- SCA Transit FeesDocument2 pagesSCA Transit FeesZerohedgeNo ratings yet

- Fomc Minutes 20230726Document10 pagesFomc Minutes 20230726ZerohedgeNo ratings yet

- November 2021 Secretary Schedule RedactedDocument62 pagesNovember 2021 Secretary Schedule RedactedNew York PostNo ratings yet