Professional Documents

Culture Documents

Basel II

Uploaded by

Imran ShikdarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basel II

Uploaded by

Imran ShikdarCopyright:

Available Formats

Three steps of Governance Mayur Sharad Joshi- CA,CFE(USA)

Consultant-Risk Management Group , KPCA

BASEL-II

26.06.2004 Basel Committee released the much awaited Document called International convergence of capital measurement and capital standards.

History of Basel

Regulatory capital requirement is crucial in reducing the risk of insolvency, and the damage for banks and financial institutions worldwide. In 1988, the Basel Committee for Banking Supervision defined credit risk and the minimum amount of capital that should be held by the bank. In 1998, the Basel Committee incorporated market risk into the framework. This classification was ratified by over 100 signatories within the G-10 countries and is still used today to define the minimum amount of capital a bank must hold to cover loss arising from obligor default. The accord required that banks must hold a minimum of 8% capital. The figure of 8% is not changed anywhere however the considerations to arrive at this figure have radically changed. The reason was simple.Banking, risk management practices, supervisory approaches and financial markets have seen a sea change over the years. Recent operational risk failures in financial institutions around the globe have accentuated the dangers of poor risk management. This was the fillip for Basel II, a new accord that has a more risksensitive framework.

BASEL-II vis a vis BASLE-I

Existing Capital Accord Focus on single risk measure Proposed New Capital Accord More emphasis on banks own internal risk management methodologies, supervisory review, and market discipline Flexibility; menu of approaches; capital incentives for better risk management; granularity in the valuation of assets and type of businesses and in the risk profiles of their systems and operations More risk sensitivity by business class and asset class; multidimensional; focus on all operational components of a bank

One size fits all

Broad brush structure

2005.All rights reserved. RISK MANAGEMENT GROUP,KPCA

Basel II emphasises risk management, which can be accomplished by aligning an organisations capital requirements with prevailing risk and ensuring that the emphasis on risk makes the way into supervisory practices and market discipline through enhanced risk and capital-related disclosures. For the first time, the Basel committee addresses operational risk. It also urges higher transparency and disclosure among banks that expect to benefit from Basel IIs capital incentives.

Three Pillar Approach

How capital requirements for credit risk are calculated makes it obvious that organisations will now reconsider who they wish to deal with and what services they offer clients. Basel-II follows the threepillar approach.

Minimum Capital requirements

Supervisory Review

Market Discipline ( Disclosure )

Minimum Capital Requirements

As in the current accord, the new accord will have the same provisions relating to the regulatory capital requirement: 8%. However, the difference is in the method of calculating bank risk, which would, in turn, affect capital requirement. Regulatory Capital / Risk weighted assets > 8% Risk weighted assets = {Capital requirements for Market Risk + Capital requirements for Operational Risk} * 12.5 + (Risk weighted assets for credit risk ) The accord covers two risks Credit Risk: The potential that a bank borrower or counter party fails to meet the financial obligations on the agreed terms. External Rating Based Calibrated on the basis of the External Ratings. Internal Ratings Based Foundation IRB Advanced IRB Function provided by Function provided BASEL committee by BASEL Committee

2005.All rights reserved. RISK MANAGEMENT GROUP,KPCA

Operational Risk: The risk loss arising from the various types of human or technical error, failed internal process, fraud or the legal hurdles. Standardized Capital Charge = 12%-18% of the gross income per regulatory business line Advanced Measurement Capital Charge = Internally generated data on internal & External loss data, Scenario analysis business environment & internal Control

Basic Indicator Capital Charge = 15% of the three years average gross income

Market Risk: The standardized approach which specifies the standards in five categories 1. Interest Rate risk 2. Equity Position Risk 3. Foreign Exchange risk 4. Commodities Risk 5. Options risk The second approach to deal in the market risk is based on the internal assessments of the banks. The bank needs to consider following five elements in calculating the internal model based risk structure. 1. General criteria, where the approval from the supervisory authority of the bank is mandatory. 2. Qualitative standards regarding the maintenance of the Risk management unit 3. Specification of Market Risk Factors 4. Quantitative standards 5. Stress testing to identify the events that could impact the banks. 6. External Validation by External auditors and Supervisory authorities

Supervisory Review Process

The supervisory review process of the framework is intended not only to ensure that banks have adequate capital to support all the risks in their business but also to encourage the banks to develop and use better risk management techniques. The key principles of Supervisory review 1.Banks should have the process for assessing their overall capital adequacy in relation to their risk profile and a strategy for maintaining their capital levels. 2.Intervention at the early stage to prevent capital from declining to below benchmark level. 3.Review of internal capital adequacy assessment and strategy 4.Assessment of overall capital in relation with risk profile.

2005.All rights reserved. RISK MANAGEMENT GROUP,KPCA

Market Discipline

With the adoption of the IRB approach of the New Accord, according to which banks have greater discretion in determining their capital needs, market discipline through public disclosure is called for. This pillar is complementary to the first two pillars of the Model. It seeks to encourage the market discipline and the public disclosure, so as to allow shareholders, stakeholders and market players to know about key information about risk profile and available capital resources. The disclosure of capital structure, risk measurement and management practices, disclosure of risk profile of the bank are expected to improve the disclosures of the banks using the Internal Risk based approaches.

Implementation of the BASEL

The framework is applicable to wide range of the banking system of G-10 countries. In respect of other countries Basel committee provides that supervisors of the nation should strengthen the supervisory system and then develop the road map for due implementation, through proper planning to switch over to BASEL. There are some benefits of proper compliance with the provisions of Basel II. If banks and financial institutions develop sophisticated internal risk-measurement processes and can show them to be sufficiently accurate, they will be allowed to use these to calculate the capital they must hold against their exposures Improved credit rating systems and improved management of operational risk will also be of benefit. Organisations that address compliance effectively will see the up-side to Basel II to be significant improvements in customer service, risk management, decision-making, operational efficiency and cost reduction. All such improvements build consumer confidence and enhance brand and reputation. The liability cost of non-compliance will be high, but there is equally a potential cost of attaining compliance in the wrong way, and there are no prizes for over compliance. Instead over compliance can create barriers to your customers and so the key will be to identify best business practice and implement rigorously.

6 things Banks Should Note

1. Review existing frameworks. This may be the right time to review the entire structure of enterprise-wide risk management and consolidate disparate risk management systems. 2. Decide the approach for IRB risk measurement and management. Build models and systems around this for credit risk and operational risk. 3. Build a flexible, scalable system. This system should accommodate future amendments to the new Accord. 4. Develop reliable and efficient disclosure reporting. These systems are required by Pillar 3 of Basel II. 5. Communicate your organisations approach Reiterate the advantages and power of Basel II, including its initiatives and strategies, to employees, customers and shareholders. 6. Find the right IT partner for Basel II compliance. Given the huge complexities involved in preparing for Basel II on time, your need not just system or application vendors but expert IT partners.

2005.All rights reserved. RISK MANAGEMENT GROUP,KPCA

2005.All rights reserved. RISK MANAGEMENT GROUP,KPCA

You might also like

- 7.GARP Code of ConductDocument2 pages7.GARP Code of ConductImran ShikdarNo ratings yet

- 11.2 Continuous Probability DistributionsDocument4 pages11.2 Continuous Probability DistributionsImran ShikdarNo ratings yet

- 11.1 Discrete Probability DistributionsDocument5 pages11.1 Discrete Probability DistributionsImran ShikdarNo ratings yet

- Basel 3Document26 pagesBasel 3Imran ShikdarNo ratings yet

- 11.2 Continuous Probability DistributionsDocument4 pages11.2 Continuous Probability DistributionsImran ShikdarNo ratings yet

- TCCC 2010 Annual ReviewDocument36 pagesTCCC 2010 Annual ReviewImran ShikdarNo ratings yet

- Basel 1 To Basel 2Document40 pagesBasel 1 To Basel 2Imran ShikdarNo ratings yet

- DraftDocument4 pagesDraftImran ShikdarNo ratings yet

- Ten Questions About BottomDocument8 pagesTen Questions About BottomImran ShikdarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CSS Screening Test Challan Form 2023Document1 pageCSS Screening Test Challan Form 2023AdeelBaigNo ratings yet

- Adat Farmers' Service Co-Operative Bank Ltd. - A Profile: TH THDocument4 pagesAdat Farmers' Service Co-Operative Bank Ltd. - A Profile: TH THJayasankar MallisseriNo ratings yet

- How To Invest in Treasury BillsDocument3 pagesHow To Invest in Treasury BillskisasharifhNo ratings yet

- Assignment - Aduit of CashDocument5 pagesAssignment - Aduit of CashEdemson NavalesNo ratings yet

- Risk Management - Sample QuestionsDocument11 pagesRisk Management - Sample QuestionsSandeep Spartacus100% (1)

- Fact Sheet On Iran SanctionsDocument7 pagesFact Sheet On Iran SanctionsThe American Security ProjectNo ratings yet

- Glossary of Financial Terms English Traditional ChineseDocument160 pagesGlossary of Financial Terms English Traditional ChinesehwmawNo ratings yet

- SAP Business ByDesign - ServiceDocument136 pagesSAP Business ByDesign - ServicekameswarkumarNo ratings yet

- FRM Practice Exam Part 2 NOVDocument139 pagesFRM Practice Exam Part 2 NOVkennethngai100% (2)

- Law and Practice of BankingDocument151 pagesLaw and Practice of BankingAshok KumarNo ratings yet

- PT Bank Rakyat Indonesia (Persero)Document380 pagesPT Bank Rakyat Indonesia (Persero)RyanSoetopoNo ratings yet

- TITLE PAYMENTDocument10 pagesTITLE PAYMENTJeff FernandezNo ratings yet

- Procedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarDocument57 pagesProcedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarAarti Kulkarni0% (2)

- ICICI Prudential ProjectDocument52 pagesICICI Prudential Projectapi-3830923100% (13)

- Optimize Cash Flow With Electronic PaymentsDocument22 pagesOptimize Cash Flow With Electronic Paymentshendraxyzxyz100% (1)

- Dhiraagu IPO Prospectus - English EditionDocument110 pagesDhiraagu IPO Prospectus - English EditionDhiraagu Marcoms100% (2)

- $6,975.36 Total Assets: Balances and HoldingsDocument2 pages$6,975.36 Total Assets: Balances and Holdingsnnenna26No ratings yet

- Fourth Corner Credit Union v. Federal Reserve Bank of Kansas City - Dismissal OrderDocument9 pagesFourth Corner Credit Union v. Federal Reserve Bank of Kansas City - Dismissal OrderBen AdlinNo ratings yet

- General Insurance-Big Benefit But OverburdenedDocument59 pagesGeneral Insurance-Big Benefit But OverburdenedChandra UddhatayudhaNo ratings yet

- Press Release - Dec 2019Document2 pagesPress Release - Dec 2019RISHI KESHNo ratings yet

- Credit RiskDocument32 pagesCredit RiskDrNisa SNo ratings yet

- FILE 20231105 224350 KIỂM-TRA-T6Document60 pagesFILE 20231105 224350 KIỂM-TRA-T6vanpth20404cNo ratings yet

- Bs 50119003519779Document2 pagesBs 50119003519779janice corderoNo ratings yet

- Important Simple Interest Practice Questions for Bank ExamsDocument15 pagesImportant Simple Interest Practice Questions for Bank ExamsKothapalli VinayNo ratings yet

- Provisions Applicable Only To Pledge DigestsDocument9 pagesProvisions Applicable Only To Pledge DigestsMikkaEllaAnclaNo ratings yet

- Thesis On Debt FinancingDocument8 pagesThesis On Debt Financingheidimaestassaltlakecity100% (2)

- 2007 Resume Book TuckDocument92 pages2007 Resume Book TuckKang-Li Cheng100% (3)

- Maphar Constructions Private LimitedDocument2 pagesMaphar Constructions Private LimitedSWARUPANo ratings yet

- Sample MotionDocument3 pagesSample MotionRizza Angela Mangalleno100% (1)

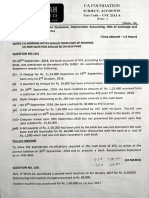

- K - J.K. Shah: TOPICS: Bank ReconclatlonDocument3 pagesK - J.K. Shah: TOPICS: Bank ReconclatlonJpNo ratings yet