Professional Documents

Culture Documents

Fair Value Options Coco

Uploaded by

Alwi MagrobyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fair Value Options Coco

Uploaded by

Alwi MagrobyCopyright:

Available Formats

FAIR VALUE OPTIONS The FV Option, however, has altered accounting for available-for-sale debt and equity securities.

Although availablefor-sale instruments (AfSI) were reported at their respective FVs on the balance sheet previously, unrealized gains and losses were recorded in stockholders equity as other comprehensive income (OCI), and never included in net income. OCI represents all changes in stockholders equity, with the exception of contributions by owners and distributions to the owners, during an accounting period. Under the provisions of FAS159, AfSI can be reclassified as trading securities at the initial application date. At this time, the accumulated unrealized gains/losses will be reflected as a cumulative-effect adjustment to the opening balance of retained earnings. Thus, at the original recognition, unrealized losses would have no effect on the income statement. Earnings would be unchanged before and after the reclassification as cumulative unrealized holding gains/losses would increase/decrease only other comprehensive income. Newly acquired AfSI securities, if the FV Option is applied, would always need to be reported at FV. Held-to-maturity securities (HtMS), conversely, are comprised e.of financial instruments consisting only of debt (notes and bonds) that has been carried on the balance sheet at their acquisition cost adjusted for the amortization of [a] discount or premium. In order for a security to qualify as HtM, an entity must be capable of and fully intend to hold a security until its maturity. The FV Option allows for these securities to also go through a re-classification as trading securities. At the time of initial recognition, the cumulative unrealized gain/loss will be applied as an adjustment to the beginning retained earnings balance as well. However, at this time, the asset will [also] be reported as a trading security, but managements intention to hold the asset until maturity will not be called into question. Unrealized holding losses are debited to (decrease) retained earnings, and unrealized holding gains are credited to (increase) retained earnings at the initial recognition. Accordingly, at the initial FV measurement date, there is (was) no net effect on the balance sheet or the income statement. Effectively, after the initial recognition, securities could be sold in the future, and the book loss will not be reported as it has already been absorbed by the opening balance of retained earnings. Therefore, net income could be artificially bolstered. Nonetheless, the FV Option can be applied to newly purchased financial assets or financial liabilities incurred by an entity, subsequent to the initial application. All increases and decreases here will flow through to net income.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Series 7Document112 pagesSeries 7Mike DeeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Right To SubrogationDocument21 pagesRight To SubrogationAanchal Kashyap80% (5)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Convertible Shareholder Loan AgreementDocument11 pagesConvertible Shareholder Loan Agreementbertspamintuan100% (1)

- José Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1Document8 pagesJosé Rizal's Declaration and Proclamation of The Gift of Love Twitter11.18.18.1karen hudes100% (1)

- Fintech100 2018 Report - Final - 22 11 18sm PDFDocument112 pagesFintech100 2018 Report - Final - 22 11 18sm PDFAndrés Ricardo FloresNo ratings yet

- THEORIES OF CAPITAL STRUCTUREDocument9 pagesTHEORIES OF CAPITAL STRUCTURESoumendra RoyNo ratings yet

- Investments in Associates FA AC OverviewDocument85 pagesInvestments in Associates FA AC OverviewHannah Shaira Clemente73% (11)

- Chap 022Document44 pagesChap 022jmsmartinsNo ratings yet

- Capital Market: Unit II: PrimaryDocument55 pagesCapital Market: Unit II: PrimaryROHIT CHHUGANI 1823160No ratings yet

- Aphria Class Action Amended Securities Fraud Complaint 5.28.19Document90 pagesAphria Class Action Amended Securities Fraud Complaint 5.28.19Teri Buhl100% (1)

- ABC - PFRS 3 Final Exam ReviewDocument17 pagesABC - PFRS 3 Final Exam ReviewCristel TannaganNo ratings yet

- Sumit KumarDocument27 pagesSumit KumarMayank jainNo ratings yet

- Banking Laws Chapters 19 21Document40 pagesBanking Laws Chapters 19 21john uyNo ratings yet

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- Financial Analysis SourcesDocument16 pagesFinancial Analysis Sourcesrishav agarwalNo ratings yet

- VCICPlayer HandbookDocument17 pagesVCICPlayer HandbookKarma TsheringNo ratings yet

- Exercícios Valuation 825453Document3 pagesExercícios Valuation 825453Cristiano NunesNo ratings yet

- EQIF LatestDocument4 pagesEQIF LatestBryan SalamatNo ratings yet

- Trading The TUT Spread-CMEDocument2 pagesTrading The TUT Spread-CMEJaphy100% (1)

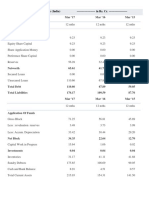

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- User Manual For Dealer TerminalDocument64 pagesUser Manual For Dealer TerminalBirender Pal SikandNo ratings yet

- Title Companies - Which Ones Did Fidelity Acquire?Document4 pagesTitle Companies - Which Ones Did Fidelity Acquire?83jjmack100% (1)

- DepreciationDocument14 pagesDepreciationprjiviNo ratings yet

- MCQDocument19 pagesMCQMhiletNo ratings yet

- Multi-Ventures v. StalwartDocument1 pageMulti-Ventures v. StalwartKeren del RosarioNo ratings yet

- Answer KeyDocument6 pagesAnswer KeyClaide John OngNo ratings yet

- Notes On Cash and Cash EquivalentsDocument1 pageNotes On Cash and Cash EquivalentsMariz Julian Pang-aoNo ratings yet

- Boral Annual Report 2015Document137 pagesBoral Annual Report 2015kim007No ratings yet