Professional Documents

Culture Documents

Form D Sample

Uploaded by

Pattiya KhanrinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form D Sample

Uploaded by

Pattiya KhanrinCopyright:

Available Formats

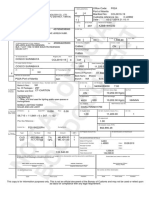

ATTACHMENT 3

Original (Duplicate/Triplicate)

Reference No. 1. Goods consigned from (Exporter's business name, address, country) ASEAN COMMON EFFECTIVE PREFERENTIAL TARIFF / ASEAN INDUSTRIAL COOPERATION SCHEME CERTIFICATE OF ORIGIN (Combined Declaration and Certificate) 2. Goods consigned to (Consignee's name, address, country) FORM D Issued in ______________ (Country) See Overleaf Notes 3. Means of transport and route (as far as known) Departure date 4. For Official Use Preferential Treatment Given Under ASEAN Common Effective Preferential Tariff Scheme Preferential Treatment Given Under ASEAN Industrial Cooperation Scheme Preferential Treatment Not Given (Please state reason/s) .................................................................................. Signature of Authorised Signatory of the Importing Country 5. Item number 6. Marks and numbers on packages 7. Number and type of packages, description of goods (including quantity where appropriate and HS number of the importing country) 8. Origin criterion (see Notes overleaf) 9. Gross weight or other quantity and value (FOB) 10. Number and date of invoices

Vessel's name/Aircraft etc.

Port of Discharge

11. Declaration by the exporter The undersigned hereby declares that the above details and statement are correct; that all the goods were produced in ........................................................... (Country) and that they comply with the origin requirements specified for these goods in the ASEAN Common Effective Preferential Tariff Scheme for the goods exported to ........................................................... (Importing Country) ........................................................... Place and date, signature of authorised signatory 13 Third-Country Invoicing Accumulation Back-to-Back CO Partial Cumulation

12. Certification It is hereby certified, on the basis of control carried out, that the declaration by the exporter is correct.

.............................................................................. Place and date, signature and stamp of certifying authority

Exhibition De Minimis Issued Retroactively

OVERLEAF NOTES 1. Member States which accept this form for the purpose of preferential treatment under the ASEAN Common Effective Preferential Tariff (CEPT) Scheme or the ASEAN Industrial Cooperation (AICO) Scheme: BRUNEI DARUSSALAM LAOS PHILIPPINES VIETNAM 2. CAMBODIA MALAYSIA SINGAPORE INDONESIA MYANMAR THAILAND

CONDITIONS: The main conditions for admission to the preferential treatment under the CEPT Scheme or the AICO Scheme are that goods sent to any Member States listed above must: (i) (ii) (iii) fall within a description of products eligible for concessions in the country of destination; comply with the consignment conditions in accordance with Article 7 of Rules of Origin for the Agreement on the Common Effective Preferential Tariff Scheme for the ASEAN Free Trade Area (CEPT-AFTA ROO); and comply with the origin criteria set out in CEPT-AFTA ROO.

3.

ORIGIN CRITERIA: For goods that meet the origin criteria, the exporter and/or producer must indicate in Box 8 of this Form, the origin criteria met, in the manner shown in the following table: Circumstances of production or manufacture in the first country named in Box 11 of this form (a) (b) Goods wholly obtained or produced in the country of exportation satisfying Article 3 of CEPT-AFTA ROO Goods satisfying Article 4(1)(a), 4(1)(b) or 5(1) of CEPT-AFTA ROO (c) Regional Value Content Change in Tariff Classification Specific Processes Percentage of ASEAN value content, example 40% The actual CTC rule, example CC or CTH or CTSH SP PC x%, where x would be the percentage of ASEAN value content of less than 40%, example PC 25% Insert in Box 8 WO

Goods satisfying Article 5(2) of CEPT-AFTA ROO

4. 5. 6. 7. 8. 9. 10. 11. 12.

EACH ARTICLE MUST QUALIFY: It should be noted that all the goods in a consignment must qualify separately in their own right. This is of particular relevance when similar articles of different sizes or spare parts are sent. DESCRIPTION OF PRODUCTS: The description of products must be sufficiently detailed to enable the products to be identified by the Customs Officers examining them. Name of manufacturer, any trade mark shall also be specified. HARMONISED SYSTEM NUMBER: The Harmonised System number shall be that of in ASEAN Harmonised Tariff Nomenclature (AHTN) Code of the importing Member State. EXPORTER: The term Exporter in Box 11 may include the manufacturer or the producer. FOR OFFICIAL USE: The Customs Authority of the importing Member State must indicate () in the relevant boxes in column 4 whether or not preferential treatment is accorded. MULTIPLE ITEMS: For multiple items declared in the same Form D, if preferential treatment is not granted to any of the items, this is also to be indicated accordingly in box 4 and the item number circled or marked appropriately in box 5. THIRD COUNTRY INVOICING: In cases where invoices are issued by a third country, the Third Country Invoicing box should be ticked () and such information as name and country of the company issuing the invoice shall be indicated in box 7. BACK-TO-BACK CERTIFICATE OF ORIGIN: In cases of Back-to-Back CO, in accordance with Article 10(2) of the Operational Certification Procedures, the Back-to-Back CO box should be ticked (). EXHIBITIONS: In cases where goods are sent from the territory of the exporting Member State for exhibition in another country and sold during or after the exhibition for importation into the territory of a Member State, in accordance with Article 19 of the Operational Certification Procedures, the Exhibitions box should be ticked () and the name and address of the exhibition indicated in box 2. ISSUED RETROACTIVELY: In exceptional cases, due to involuntary errors or omissions or other valid causes, the Certificate of Origin (Form D) may be issued retroactively, in accordance with Article 10(3) of the Operational Certification Procedures, the Issued Retroactively box should be ticked (). ACCUMULATION: In cases where originating in a Member State is used in another Member State as materials for a finished good, in accordance with Article 5(1) of the CEPT-AFTA ROO, the Accumulation box should be ticked (). PARTIAL CUMULATION (PC): If the Regional Value Content of material is less than 40%, the Certificate of Origin (Form D) may be issued for cumulation purposes, in accordance with Article 5(2) of the CEPT-AFTA ROO, the Partial Cumulation box should be ticked (). DE MINIMIS: If a good that does not undergo the required change in tariff classification does not exceed 10% of the FOB value, in accordance with Article 8 of the CEPT-AFTA ROO, the De Minimis box should be ticked ().

13.

14. 15.

16.

You might also like

- Certificate of Origin-Form DDocument2 pagesCertificate of Origin-Form DAdelia Paramitha75% (4)

- KELMNN00106EA001Document3 pagesKELMNN00106EA001joyce magpayoNo ratings yet

- Final SadDocument3 pagesFinal SadJennylyn GalloNo ratings yet

- S/I Under Philippines Law There Ar E Severe Penalties For Making False or Misleading Declarations, Including Fines And/Or IimprisonmentDocument1 pageS/I Under Philippines Law There Ar E Severe Penalties For Making False or Misleading Declarations, Including Fines And/Or IimprisonmentArrah Mae SawanoNo ratings yet

- Cao3 2006aDocument27 pagesCao3 2006aMariz Tan ParrillaNo ratings yet

- Bill of Lading 06Document2 pagesBill of Lading 06Gora PribadiNo ratings yet

- Sea Waybill: Non-Negotiable Sea Waybill For Combined Transport or Port To PortDocument1 pageSea Waybill: Non-Negotiable Sea Waybill For Combined Transport or Port To PortBozidar DavidovskiNo ratings yet

- Commercial Invoice: Reset FormDocument3 pagesCommercial Invoice: Reset FormfamabojNo ratings yet

- Manual Booking Form YUSENDocument1 pageManual Booking Form YUSENFitri Sukendar100% (1)

- Procedure - Section711 - Rev2 - 28july 2020Document3 pagesProcedure - Section711 - Rev2 - 28july 2020AceNo ratings yet

- Customs ValuationDocument9 pagesCustoms ValuationTravis OpizNo ratings yet

- Certificate of Origin: Group IVDocument16 pagesCertificate of Origin: Group IVTravis OpizNo ratings yet

- C U S T O M S: Boc Single Administrative DocumentDocument2 pagesC U S T O M S: Boc Single Administrative DocumentGwen CondezNo ratings yet

- Estimated Duties and Taxes PDFDocument1 pageEstimated Duties and Taxes PDFDianne Bernadeth Cos-agonNo ratings yet

- Commercial InvoiceDocument2 pagesCommercial InvoiceanhNo ratings yet

- Air Waybill: Routing and DestinationDocument1 pageAir Waybill: Routing and Destinationriza58No ratings yet

- Ult PDFDocument2 pagesUlt PDFalsone07No ratings yet

- CMO 18-2010 Procedure For Bulk and Break Clearance Enhancement Program. Mandated Under Adminstrative Order (AO) 243 As Ammended by AO 243-ADocument11 pagesCMO 18-2010 Procedure For Bulk and Break Clearance Enhancement Program. Mandated Under Adminstrative Order (AO) 243 As Ammended by AO 243-AMariz Tan ParrillaNo ratings yet

- BOC CMO 17 2016 Guidelines Procedures On The Implementation of The Electronic Certificate of Origin System ECOSDocument6 pagesBOC CMO 17 2016 Guidelines Procedures On The Implementation of The Electronic Certificate of Origin System ECOSPortCalls100% (1)

- Import Export ProcedureDocument13 pagesImport Export ProcedureManinder SinghNo ratings yet

- Ieird Form (Front)Document1 pageIeird Form (Front)lorennethNo ratings yet

- JAYA Logitrans Services: Bill of LadingDocument3 pagesJAYA Logitrans Services: Bill of LadingMichael Tanjaya100% (1)

- I. Abandonment: Customs Administrative Order (CAO) No. 17-2019Document5 pagesI. Abandonment: Customs Administrative Order (CAO) No. 17-2019Arya Padrino100% (1)

- Ra 9135Document20 pagesRa 9135Daley CatugdaNo ratings yet

- Goods Subject For Consumption Under Formal Entry ProcessDocument13 pagesGoods Subject For Consumption Under Formal Entry ProcessElaine Antonette RositaNo ratings yet

- Prelim Exam Tm3 Summer ClassDocument4 pagesPrelim Exam Tm3 Summer ClassPrincess Mendoza SolatorioNo ratings yet

- Ra 9280Document7 pagesRa 9280Jay-arr ValdezNo ratings yet

- Bill of Lading Guidance NotesDocument3 pagesBill of Lading Guidance NotesBajjaliNo ratings yet

- CusdecFinalSAD TaiheiyoDocument5 pagesCusdecFinalSAD TaiheiyoYre de los Reyes100% (1)

- Authorization LettersDocument1 pageAuthorization LettersElan Mae Bastasa SarsonaNo ratings yet

- Balikbayan Box Law ExplainedDocument2 pagesBalikbayan Box Law ExplainedNoel Christopher G. BellezaNo ratings yet

- Incoterms Power Point PresentationDocument39 pagesIncoterms Power Point PresentationPriyanka GuptaNo ratings yet

- Ra 8181Document5 pagesRa 8181Cons BaraguirNo ratings yet

- Import Clearance ProceduresDocument32 pagesImport Clearance ProceduresJhecyl Ann BasagreNo ratings yet

- Eu Origin Declaration of Origin PDFDocument2 pagesEu Origin Declaration of Origin PDFCraigNo ratings yet

- 769-Hawbancl070135 3ctn SharifDocument1 page769-Hawbancl070135 3ctn Sharifsantosh sitaula100% (1)

- Standard Certificate of OriginDocument1 pageStandard Certificate of Originmadu maduNo ratings yet

- Proforma Invoice - FilledDocument1 pageProforma Invoice - FilledHimanshu KushwahaNo ratings yet

- CusdecFinalSAD KZBB1900232Document5 pagesCusdecFinalSAD KZBB1900232Elan Mae Bastasa SarsonaNo ratings yet

- LC at Sight-ContractDocument4 pagesLC at Sight-Contractnobleconsultants100% (1)

- Special Duties & Trade RemediesDocument21 pagesSpecial Duties & Trade RemediesAlyanna JoyceNo ratings yet

- Request For Release Under Tentative AssessmentDocument1 pageRequest For Release Under Tentative AssessmentRusiel PanchoNo ratings yet

- Reaction PaperDocument1 pageReaction PaperMerari ValenciaNo ratings yet

- ASEAN 2025 Forging Ahead Together FinalDocument136 pagesASEAN 2025 Forging Ahead Together FinalPortCalls100% (1)

- Worldwide Freight RatesDocument38 pagesWorldwide Freight RatesChieny GalineaNo ratings yet

- I RRZ+ F) Invn Ix, - (S:: Ievn N . I Rns I Rez+Document3 pagesI RRZ+ F) Invn Ix, - (S:: Ievn N . I Rns I Rez+Lycv Montederamos Asis100% (1)

- 6 - T-6 Transit & TransshipmentDocument3 pages6 - T-6 Transit & TransshipmentKesTerJeeeNo ratings yet

- DHL Comm InvDocument4 pagesDHL Comm InvPra ChiNo ratings yet

- AllnexDocument1 pageAllnexArif Tawil PrionoNo ratings yet

- Rule of CEPTDocument8 pagesRule of CEPTCalvin KleinNo ratings yet

- Export Import DocsDocument47 pagesExport Import DocsAreej Aftab SiddiquiNo ratings yet

- BOC Client Profile Registration System (CPRS) FAQDocument7 pagesBOC Client Profile Registration System (CPRS) FAQJen CastroNo ratings yet

- 1 CV Handbook Final Nov 2012Document140 pages1 CV Handbook Final Nov 2012Thomas KidandoNo ratings yet

- Shipper and Consignee Details Air WaybillDocument1 pageShipper and Consignee Details Air WaybillAmmar AhmedNo ratings yet

- ATIGA Annex 8 OCP Amended To Accomodate e Form DDocument23 pagesATIGA Annex 8 OCP Amended To Accomodate e Form DJohan Dewa SiraitNo ratings yet

- Tax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)Document13 pagesTax 2. Q&A Compilation (R.A. 9135, 8751, 8752 & 8800)pa3ciaNo ratings yet

- (Ban hành kèm theo Thông tư số 42/2014/TT-BCT ngày 18 tháng 11 năm 2014 của Bộ trưởng Bộ Công Thương sửa đổi, bổ sung một số điều của Thông tư số 21/2010/TT-BCT)Document7 pages(Ban hành kèm theo Thông tư số 42/2014/TT-BCT ngày 18 tháng 11 năm 2014 của Bộ trưởng Bộ Công Thương sửa đổi, bổ sung một số điều của Thông tư số 21/2010/TT-BCT)Thao MacNo ratings yet

- overleafATIGA PDFDocument1 pageoverleafATIGA PDFmega samuderaNo ratings yet

- Overleaf Form EDocument1 pageOverleaf Form Ehoed2ndaNo ratings yet

- Certificate of OriginDocument2 pagesCertificate of OriginHimanshu KushwahaNo ratings yet

- HR Sip Project at HCL InfosysytemsDocument28 pagesHR Sip Project at HCL InfosysytemsSaurabh SharmaNo ratings yet

- Test Bank MidtermDocument56 pagesTest Bank MidtermmeriemNo ratings yet

- Turnaround ManagementDocument14 pagesTurnaround ManagementAlkaNo ratings yet

- 180DC KMC CaseStudyResponse RiyaManchandaDocument5 pages180DC KMC CaseStudyResponse RiyaManchandaRiya ManchandaNo ratings yet

- The Main Elements of A Good SLADocument6 pagesThe Main Elements of A Good SLAFranz Lawrenz De TorresNo ratings yet

- SALN FormDocument3 pagesSALN FormBalubad ES LagunaNo ratings yet

- Audit of Long-Term LiabilitiesDocument43 pagesAudit of Long-Term LiabilitiesEva Dagus0% (1)

- b5 Special Solving Set 5Document6 pagesb5 Special Solving Set 5MSHANA ALLYNo ratings yet

- TEST 2s - 2021 - MAC 2021Document17 pagesTEST 2s - 2021 - MAC 2021pretty jesayaNo ratings yet

- International Price List Marine b005 Ipl 2018 01Document20 pagesInternational Price List Marine b005 Ipl 2018 01RezaNo ratings yet

- Ethical Obligations and Decision Making in Accounting: Text and Cases Fifth EditionDocument174 pagesEthical Obligations and Decision Making in Accounting: Text and Cases Fifth EditionMERB Tzy0% (1)

- Sai Khant Kyaw Za - Task 2Document4 pagesSai Khant Kyaw Za - Task 2Lean CosmicNo ratings yet

- The Ethics of Corporate Governance: Donald NordbergDocument18 pagesThe Ethics of Corporate Governance: Donald NordbergTheGilmoreBuddiesNo ratings yet

- 171bus 152a 1 - 1490028794Document23 pages171bus 152a 1 - 1490028794Ahsan IqbalNo ratings yet

- 2003Document126 pages2003Jumardi SingareNo ratings yet

- Leading Global Online Food Delivery PlayerDocument12 pagesLeading Global Online Food Delivery PlayerClaudiuNo ratings yet

- CISA Exam 100 Practice QuestionDocument22 pagesCISA Exam 100 Practice Questionharsh100% (1)

- Enterprise Data Management Data Governance PlanDocument36 pagesEnterprise Data Management Data Governance PlanSujin Prabhakar89% (9)

- CS 803 (D) MIE Unit 1Document9 pagesCS 803 (D) MIE Unit 1Neha MishraNo ratings yet

- Q 2Document2 pagesQ 2lucasNo ratings yet

- SAP BW/HANA Consultant Jyoti Swanjary ResumeDocument4 pagesSAP BW/HANA Consultant Jyoti Swanjary ResumeraamanNo ratings yet

- Vakrangee LimitedDocument3 pagesVakrangee LimitedSubham MazumdarNo ratings yet

- Oracle Payments R12 User GuideDocument184 pagesOracle Payments R12 User GuideppmurilloNo ratings yet

- Sample Quiz QuestionsDocument2 pagesSample Quiz QuestionsSuperGuyNo ratings yet

- Starbucks Case AnalysisDocument17 pagesStarbucks Case Analysisytsell30No ratings yet

- Statement of Changes in Equity (SCE) : Zyriece Camille M. CentenoDocument14 pagesStatement of Changes in Equity (SCE) : Zyriece Camille M. CentenoZyriece Camille CentenoNo ratings yet

- Unilever Inmarko-CaseStudyDocument38 pagesUnilever Inmarko-CaseStudyHijab kecikNo ratings yet

- Journal of Business Valuation 2016 Final PDFDocument93 pagesJournal of Business Valuation 2016 Final PDFOren BouzagloNo ratings yet

- Flow ICM - STDocument7 pagesFlow ICM - STPatrícia Martins Gonçalves CunhaNo ratings yet

- Magic Quadrant For Cloud AI Developer Services, 2021Document32 pagesMagic Quadrant For Cloud AI Developer Services, 2021openid_dr4OPAdENo ratings yet