Professional Documents

Culture Documents

Daily Agri Report Dec 7

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Agri Report Dec 7

Uploaded by

Angel BrokingCopyright:

Available Formats

Commodities Daily Report

Friday| December 7, 2012

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/Cotton

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Analyst anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Friday| December 7, 2012

Agricultural Commodities

News in brief

Japan, S. Korea demand boosts oilmeal exports

Oilmeal export increased 21% to 641,285 tonnes in November compared with 530,456 tonnes in the same period last year. The jump in export was largely due to improved demand from Japan and South Korea. However, in the first eight months of this fiscal, export was down 21% to 2,366,269 tonnes (2,981,955 tonnes) due to sharp fall in shipments to West Asia and Europe. Japan was the top importer with 128,218 tonnes (81,467 tonnes) of soyabean extract in November. It was followed by South Korea with a total import of 86,145 tonnes (55,054 tonnes). France imported 158,799 tonnes (21 tonnes) of oilmeals while total shipments to European countries more than trebled to 247,472 tonnes (64,441 tonnes). (Source: Business Line)

Market Highlights (% change)

Last Prev. day

as on Dec 6, 2012

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

19487 5931 54.24 86.26 1700

0.49 0.52 -0.37 -1.84 0.47

1.65 1.82 -0.89 -2.06 -1.56

3.56 3.61 -0.35 -2.76 -0.81

18.19 19.97 4.88 -12.28 -0.56

.Source: Reuters

El Nio unlikely before Northern Hemisphere spring -US forecast

The U.S. national weather forecaster said on Thursday the much-feared El Nio weather phenomenon is unlikely to appear before the Northern Hemisphere spring, further reducing the chances of a drought in Asia and flooding in South America. The U.S. Climate Prediction Center (CPC)'s latest forecast is later than previously expected - last month it said the pattern that can wreak havoc on weather would not appear until the end of the 2012/13 winter. "It is considered unlikely that a fully coupled El Nio will develop during the next several months. (El Nio) neutral is now favored through the Northern Hemisphere winter 2012-13 and into spring 2013," the CPC said in its monthly report. (Source: Reuters)

Normal tur output to drag prices

With normal tur production expected in Karnataka, Maharashtra and Andhra Pradesh, prices are to dip by 20 per cent around mid-February. Rains at regular intervals in all the tur producing States have facilitated normal to good tur production this year compared to previous years production, Ramesh Chandra Lahoti, President, Bangalore Wholesale Food Grains and Pulses Association, told Business Line. Compared to previous years, this years crop is not damaged by rains. In contrast, late rains has only facilitated good crop production, he added. Karnatakas crop is expected to enter the market in a weeks time and Maharashtra and Andhra Pradesh are to follow in January. (Source: Business Line)

EU licenses biggest wheat export volume in over 2 years

The European Union this week granted export licences for 712,000 tn of soft wheat, the biggest volume in more than two years, in a sign of brisk demand for EU wheat at a time when importers have few alternatives. The volume granted this week was the largest since the 1.0 mn tn cleared in the week of Sept. 21-28, 2010. It took the total since the start of the 2012/13 season to 8.0 mn tn, against 6.6 mn tn of licences cleared at the same stage in 2011/12, even though the EU harvested a smaller wheat crop this summer. (Source: Reuters)

Hike in cotton export registrations cap may boost dispatches

The Governments move to hike registration limits for cotton exports to 30,000 bales may help boost the fibre shipments. Cotton exports are under open general license and the move to hike registration limits comes ahead of the likely announcement of import quota by China, a large consumer. (Source: Business Line)

No immediate plans to hike import duty on edible oil: Thomas

Food Minister K V Thomas today said the Government has no immediate plans to hike import duty on edible oils even as the industry has expressed concern over cheap imports of vegetable oil affecting oilseeds farmers. India, the worlds largest edible oil importer, has zero import tariff on crude oil and 7.5% on refined oil. Last week, industry body Solvent Extractors Association of India (SEA) in its representation to Finance, Commerce and Food Ministries had sought increase in import duty to 20% on refined vegetable oil and 10% on crude. (Source: Business Line)

U.S. winter wheat abandonment may top 25 pct-experts

U.S. winter wheat farmers could abandon more than a quarter of the new wheat crop due to devastating weather, though decisions on abandonment will not be made until spring, experts said this week. Historic drought, coupled with record warm weather and high winds sweeping across the Plains, have left the new crop in the worst condition in decades. With no significant improvement soon, many farmers could give up on their wheat acres. Abandonment levels could exceed 25%, said Mark Hodges, a wheat industry consultant. (Source: Reuters)

Ethanol manufacturers bat for Rs. 40 per litre

Ethanol manufacturers have welcomed the Centres decision on five per cent mandatory blending with petrol but with riders. They have demanded a payment of Rs. 40 per litre considering the current rate of alcohol of Rs. 37 a litre and Rs. 5,500 to Rs. 6,000 a tonne of molasses. Besides, ethanol manufacturers want consistency in procurement from the oil marketing companies (OMCs). The Ethanol Manufacturers Association of India, has conveyed to OMCs that they would be able to supply 1,016.6 million (mn) litre by end- October next year. (Source: Buisness

Standard)

Global grain reserves tighten even as food prices fall

Global food markets face further volatility in 2013 as stocks and supply of key cereals have tightened, the United Nations food agency said on Thursday, even as world food prices fell for a second month in November to their lowest since June. The Food and Agriculture Organisation's (FAO) index measuring prices of foods from grains and oilseeds to meat and dairy averaged 211 points in November, down 3 points from October as sugar, oils and cereals prices declined. However, the Rome-based agency trimmed its forecast for global cereal production in 2012, estimating a 2.8% decline from the previous year to 2.282 billion tonnes. (Source: Reuters)

War time flexi-bags now move edible oil in bulk

Flexi-bags, which were used to transport whisky, wine and juices in bulk to American troops during wars in Vietnam, Iraq and Afghanistan has been put to a different use now. They are now being used to move edible oil in shipping containers. Also called flexi-tanks, these bags have become an alternative to transport oils, juices, wines, food-grade liquids and non-hazardous chemicals in shipping containers across the globe. The flexi-bags were first used by the Americans in the 1969 Vietnam War to transport fluids for its troops. They are made of linear low density polyethylene (four layers) and high density polyethylene that is safe to transport non-hazardous liquid. (Source: Business Line)

Vietnam to nearly triple 2013 sugar import duty to 40 pc

Vietnam will nearly triple its import duty on sugar to 40% from next year to help protect domestic production as the country forecasts a surplus in 2013, the Finance Ministry said in a statement. The new duty on white sugar is up from 15% currently and will come into force from Jan. 1, the ministry said. Vietnam is a small producer on a world scale but output this year has outpaced demand and is expected at between 1.5 million and 1.6 million tonnes for the 2012/2013 season, the statement said. Domestic demand has been stable at 1.3 million to 1.4 million tonnes a year in Vietnam, industry reports have said. (Source: Reuters)

www.angelcommodities.com

Commodities Daily Report

Friday| December 7, 2012

Agricultural Commodities

Chana

Chana January contract declined 1.31% on expectations of sowing to improve further in the coming weeks. However, spot remained firm on expectations of demand to improve at lower prices. Total pulses acreage as on 30th November is down by 6.4% to 102.49 lakh ha from 109.56 lakh ha last season. Acreage was down by almost 17% till the week ended 16th Nov and by 7% till the previous week thus showing marginal recovery in the sowing. Chana sowing stood at 58.85 lakh hectares as on 30 Nov, down by 7.5% yoy. In Maharashtra Chana acreage is up by 31% at 7.03 lakh ha as on th 30th Nov 2012. While in AP it is up by 22.8% at 5.22 lakh ha as on 28 Nov. However, in Rajasthan, sowing is down by 19.2% at 12.18 lakh ha as th on 30 Nov. In Australia, total chickpea production in 201213 is estimated to have increased to a record of around 746000 tones as compared with 485000 tones in 2011-12. The Commission for Agriculture Costs and Prices (CACP) has suggested 10 per cent import duty on pulses to encourage domestic production. in the first six months of the new fiscal that is from April to September this year, imports were an estimated 12 lakh tonnes.

th

Market Highlights

Unit Rs/qtl Rs/qtl Last 4259 4143 Prev day 1.26 0.24

as on Dec 6, 2012 % change WoW MoM -4.01 -7.41 -2.22 -10.03 YoY 32.48 30.90

Chana Spot - NCDEX (Delhi) Chana- NCDEX Dec'12 Futures

Source: Reuters

Technical Chart - Chana

NCDEX Jan contract

Sowing progress and demand supply fundamentals

Improved rains towards the end of monsoon season coupled with hike in MSP have raised prospects of Chana sowing in the 2012-13 season. Also, farm ministry has targeted 7.9 mn tn chana output for 2012-13 season, higher compared to 7.58 mn tn in 2011-12. Except for Wheat, minimum support price of all other Rabi crops has been increased by CCEA for 2012-13 season. MSP of Chana/Gram is raised by Rs 400 per qtl for 2012-13 season to Rs 3200. Higher returns and favorable soil condition will definitely boost acreage in the coming season. According to the Ministry of Agriculture 99.81 Lakh hectare area has been planted under Kharif pulses in 2012-13 compared to 108.28 lakh hectare (ha) in the previous year. According to the first advance estimates of 2012-13 season, kharif pulses output is estimated lower by 14.6% at 5.26 million tonnes compared with 6.16 mn tn last year. Kharif pulses harvesting would commence from next month. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source: Agriwatch)

Source: Telequote

Technical Outlook

Contract Chana Jan Futures Unit Rs./qtl Support

valid for Dec 7, 2012 Resistance 4070-4130

3925-3960

Outlook

Chana January contract may extend the losses of the previous session on expectations of chana sowing to gain momentum. Market shall take cues from the sowing progress data of Rabi pulses, to be released today evening by the ministry of agriculture. Expectations of ease in supplies amid higher shipments coupled with subdued demand may keep prices under check and limit sharp gains.

www.angelcommodities.com

Commodities Daily Report

Friday| December 7, 2012

Agricultural Commodities

Sugar

Sugar spot as well as futures declined sharply on account of huge supplies in the domestic as well global markets. Demand continues to remain subdued in the domestic markets. Government has allocated total 70 lac tons of non-levy sugar quota for Dec-March 2012-13 period which is higher from 59.5 lac tons last year. According to the food minister, free sugar exports under OGL has ceased after Sept 30, 2012, and exports, when allowed in the existing season, can happen only through the previous system in which the government allocated export quota to a mill based on its sugar production during the previous three years. According to food ministry, Sugar production in the country is expected to decline to 23 million tonnes in 2012-13 due to delayed monsoon and drought situation in Maharashtra and Karnataka. 23.30 lakh tn has been already produced in the first two months of the 2012-13 season against 23.92 lakh tonnes same period last year. Liffe white sugar as well as ICE sugar settled 0.38% and 1.07% lower on Thursday on account of higher pace of crushing in Brazil coupled with higher sugar surplus forecast for fourth straight year, which has led to a sharp decline in international sugar prices.

Market Highlights

Unit Sugar Spot- NCDEX (Kolhapur) Sugar M- NCDEX Dec '12 Futures Rs/qtl Last 3341

as on Dec 6, 2012 % Change Prev. day WoW -1.04 -3.04 MoM -3.51 YoY 7.68

Rs/qtl

3258

-0.18

-1.81

-3.32

9.96

Source: Reuters

International Prices

Unit Sugar No 5- LiffeMar'13 Futures Sugar No 11-ICE Mar '13 Futures $/tonne $/tonne Last 518.5 430.22

as on Dec 5, 2012 % Change Prev day WoW -0.38 -1.07 1.01 0.10 MoM -4.23 -1.17 YoY -16.83 -19.77

.Source: Reuters

Domestic Production and Exports

According to the first advance estimates by agriculture ministry, Sugarcane output is pegged at 335.3 mn tn, down by 6.2% compared to 357.6 mn tn last year. Despite of higher acreage, the producers body has estimated next years sugar output lower at 24 mn tn, down by 2mn tn compared to the current year. Industry body ISMA has estimated 6 mn tn stocks for the new season beginning October 01, 2012 compared to 5.5 mn tn year ago. India may export 2.5-3 mn tn sugar in 2012-13. With the opening stocks of 6 mn tn, domestic Sugar supplies are estimated at 30mn tn against the domestic consumption of around 22.523 mln tn for 2012-13.

Technical Chart - Sugar

NCDEX Jan contract

Source: Telequote

Global Sugar Updates

Brazil exported 2.3 mn tn raw sugar in November, down from 3.17 mln tn in October. Sugar output in brazil which was lower compared to last year since the beginning of the crushing season in May, is now up marginally by 0.1% at 29.3 mn tn. Thailand, the world's second-largest exporter after Brazil, has slashed its output forecast in the year to October 2013 to 9.4 million tonnes from 10 million due to poor rain. About 1 mn tn of cane have been crushed in Thailand as the harvest progresses, producing up to 56,000 tn of sugar so far, a 28% increase from the same year-ago period. The International Sugar Organization said it expected a global sugar surplus of 5.86 million tonnes in the season running from October 2012 to September 2013, up from the prior season's surplus of 5.19 million tonnes. The ISO said the stocks/consumption ratio could rise to around 40 percent in 2012/13, from 37.6 percent in 2011/12. (Source: Reuters) Vietnam will nearly triple its import duty on sugar to 40% from next year, the Finance Ministry said. The new duty on white sugar is up from 15% currently and will come into force from Jan. 1, the ministry said.

Technical Outlook

Contract Sugar Jan NCDEX Futures Unit Rs./qtl Support

valid for Dec 7, 2012 Resistance 3290-3300

3255-3265

Outlook

Sugar prices may remain under downside pressure on account of sufficient supplies along with subdued demand. However, delay in cane crushing in UP may restrict prices from falling sharply in the near term. International markets may continue to trade with downward bias on account of global supply glut.

www.angelcommodities.com

Commodities Daily Report

Friday| December 7, 2012

Agricultural Commodities

Oilseeds

Soybean: Soybean December remained in the positive territory

during the most part of the session on account of higher soy meal export figures for November released by the Solvent Extractors Association of India. December futures settled higher by 1.11% and spot by 1.41% on Thursday. Exports of soy meal rose to 517,103 tonnes in November from 397,659 tonnes a year ago. Overall oil meal exports in the first eight months of the year beginning April fell to 2.4 million tonnes from 3 million tonnes in the previous year. Arrivals remained stable at around 3.35 lakh bags on Tuesday, while demand from solvent extractors also remained strong. According to first advance estimates, Soybean output is pegged at 126.2 lakh tn for 2012-13.

Market Highlights

Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Dec '12 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soy oil- NCDEX Dec '12 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 3228 3194 733.1 724.1

as on Dec 6, 2012 % Change Prev day 1.41 1.11 1.22 -0.02 WoW -1.91 -2.35 -1.20 -0.92 MoM -3.24 -2.58 5.26 6.82 YoY 43.72 40.89 13.78 11.53

Source: Reuters

International Markets

CBOT soybean settled higher by 0.81% on Thursday on account of robust demand from exporters as well as domestic processors. Also, analysts at FCStone do Brasil reduced their forecast for Brazil's 2012/13 soybean crop to 80.01 mn tn, down from the firm's September estimate of 81.98 mn tn. Beneficial rains are expected in Brazil's southern grain belt over the weekend, boosting crop prospects after the main corn and soy region received far less rain than usual in November. December will start with more concentrated rains over Brazil's center and south. Growers advanced seedings by 11% points during the week through Thursday, covering 58% of the 19.4 mn ha expected to be sown this season. Although, the rate of planting picked up as the weather moderated after the Pampas was lashed by harsh August-October storms, it is still 8% below last years level.

International Prices Soybean- CBOTJan'13 Futures Soybean Oil - CBOTDec'12 Futures Unit USc/ Bushel USc/lbs Last 1491 50.87

as on Dec 6, 2012 Prev day 0.81 0.41 WoW 2.99 2.21 MoM -1.68 4.50

Source: Reuters

YoY 31.68 1.33

Crude Palm Oil

as on Dec 6, 2012 % Change Prev day WoW 0.48 -0.74 -2.53 -2.06

Unit

CPO-Bursa Malaysia Dec '12 Contract CPO-MCX- Dec '12 Futures

Last 2115 414.1

MoM -10.76 -3.16

YoY -30.88 -19.67

MYR/Tonne Rs/10 kg

Refined Soy Oil: Ref soy oil and CPO that remained in the positive

territory during the early part of the session on Thursday settled lower by 0.02% and 0.74% towards the end on reports that India has no proposals to raise import duty on edible oils. The country's oilseed crushing industry had made a proposal to Farm Minister Sharad Pawar in November, seeking a 10 percent tax on imports of crude edible oil. However, Food Minister rejected the same. Dorab Mistry, head of edible oils trading, Godrej is predicting CPO futures on BMD to trade in a range of 2300 and 2600 from now until February 2013. This will ensure high stock levels in both countries but particularly in Malaysia. Prices may plunge further if India imposes a 10% import duty on CPO and a 20% import duty on Refined Palm products. Palm oil output in the world's biggest producer Indonesia is expected to climb 7% next year to 27 mn tn.

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Dec'12 Futures Rs/100 kgs Rs/100 kgs Last 4218 4102 Prev day -0.76 -0.49

as on Dec 6, 2012 WoW -0.18 -2.66 MoM -0.18 -0.49

Source: Reuters

YoY 35.18 27.59

Technical Chart Soybean

NCDEX Jan contract

Rape/mustard Seed: RM seed futures also declined sharply

towards the end of the session on expected improvement in sowing figures to be released on Friday by ministry of agriculture. So far, mustard has been covered on 57.1 lakh ha up from last seasons 56.42. MSP for Mustard seed is increased to Rs 3000/qtl. Indias rapeseed output is expected to rise by 5% to 6.5 mn tn from 6 mn tn last year.

Source: Telequote

Outlook

Soybean complex may trade with downward bias during the intraday on higher sowing prospects of Rabi oilseeds. Palm oil may trade in a range bound manner on account of weak outlook given by the top industry analyst amid higher stocks.

Technical Outlook

Contract Soy Oil Jan NCDEX Futures Soybean NCDEX Jan Futures RM Seed NCDEX Jan Futures CPO MCX Jan Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Dec 7, 2012 Support 704-708 3170-3200 4110-4140 410-414 Resistance 722-730 3270-3310 4215-4260 423-428

www.angelcommodities.com

Commodities Daily Report

Friday| December 7, 2012

Agricultural Commodities

Black Pepper

Pepper February Futures which had consolidated over the last couple of days corrected sharply yesterday. Higher production estimates have kept prices under check. Prices have corrected sharply over the last one month over reports that FMC is probing into complaints against movement in the pepper market. Better output expectations in the domestic as well as the international markets have also pressurized prices. Farmers are trying to liquidate their stocks ahead of the commencement of harvesting of the fresh crop. Exports demand for Indian pepper in the international markets is also weak due to price parity. However, festive as well as and winter demand has supported prices in the spot markets. Also, stocks in the domestic markets are also reported to be low. The Spot settled 0.77% higher while the February Futures settled 1.74% lower on Thursday. Pepper prices in the international market are being quoted at $7,300/tn(C&F) for December, $6,700/tn for February and $6,600/tn for March, while Vietnam was offering Austa at $7,000/tn, Brazil Austa at $6,700/tn, and Indonesia Austa at $6,500/tn (FOB).

Market Highlights

Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Dec '12 Futures Rs/qtl Rs/qtl Last 38847 39910 % Change Prev day 0.77 1.79

as on Dec 6, 2012 WoW 1.44 4.30 MoM -7.60 -6.36 YoY 10.95 12.66

Source: Reuters

Technical Chart Black Pepper

NCDEX Feb contract

Exports and Imports

According to Spices Board of India, exports of pepper in April 2012 fell by 47% and stood at 1,200 tonnes as compared to 2,266 tonnes in April 2011. India imported 1,848 tonnes of pepper till March 2012 and has become the third country to import such large quantity after UAE and Singapore. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of pepper during Jan-Oct 2012 stood at 102,340 mt, lower by 12% as compared to 1,15,780 mt in the same period last year. Total exports in 2012 are forecasted at around 1,10,000 tonnes. Exports of Pepper from Brazil during January till May 2012 are estimated around 13369 mt. (Source: Peppertradeboard). Pepper imports by U.S. the largest consumer of the spice declined 26% during January-September 2012 period to 41,923 tn as compared to 52,489 tn in the same period previous year. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. During May 2012 Brazil exported 1,705 tonnes of pepper as against 1600 tn in May 2011.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Feb Futures Unit Rs/qtl

valid for Dec 7, 2012 Support 32500-33000 Resistance 34210-34910

Production and Arrivals

The arrivals in the spot market were reported at 20 tonnes while offtakes were reported at 20 tonnes on Thursday. As per IPC, Global pepper production in 2012 is projected at 3.27 lk tn, up compared with 3.18 lk tn in 2011. Production for 2013 is projected at 316832 tn. Indonesian pepper output is expected to rise by 24% and in Vietnam by 10%. According to previous estimates, pepper output in Vietnam is estimated to be 1 lakh tonne in 2012 as compared to 1.1 lakh tonne in 2011. Brazil is also expected to produce 22,000 tn this year. Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) Pepper production in 2012-13 is expected around 60,000-63,000 tonnes. Currently, pepper is in the fruit formation stage in Kerala.

Outlook

Pepper is expected to trade on a sideways note with a positive bias in the February contract today. Festive demand coupled with winter buying may support prices at lower levels. However, higher output expectations as well as reports that FMC is probing into complaints against price movement may cap sharp gains.

www.angelcommodities.com

Commodities Daily Report

Friday| December 7, 2012

Agricultural Commodities

Jeera

Jeera Futures traded on a negative note yesterday due to sluggish demand in the domestic market. Sowing in Gujarat is lower by 25-30%, but it is expected to gain momentum in the coming days. Higher stocks for delivery on the exchange warehouses have pressurized prices. However, regular export demand has supported prices in the spot markets. Exporters are buying due to tensions between Syria and Turkey as they are not offering. The spot as well as the March Futures settled 0.13% and 1.04% lower on Thursday. According to markets sources about 75% exports target has already been achieved due to a supply crunch in the global markets. Supply concerns from Syria and Turkey still exists. Expectations are that export orders may still be diverted to India from the international markets due to lack of supplies from Syria on back of the ongoing civil war. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices of Indian origin are being offered in the international market at $2,750 tn (c&f) while Syria and Turkey are not offering. Carryover stocks of Jeera in the domestic market is expected to be around 6-7 lakh bags compared with 5-6 lakh bags last year.

Market Highlights

Unit Jeera SpotNCDEX(Unjha) Jeera- NCDEX Dec '12 Futures Rs/qtl Rs/qtl Last 14909 14140 Prev day -0.13 0.12

as on Dec 6, 2012 % Change WoW -1.28 -1.21 MoM -0.76 -2.31 YoY 5.05 5.30

Source: Reuters

Technical Chart Jeera

NCDEX March contract

Production, Arrivals and Exports

Unjha markets witnessed arrivals of 6,000 bags, while off-takes stood at 6,000 bags on Wednesday. Production of Jeera in 2011-12 is expected around 40 lakh bags as against 29 lakh bags in 2010-11 (each bag weighs 55 kgs). (Source: spot market traders). According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Market Highlights

Prev day 0.81 4.04

as on Dec 6, 2012 % Change

Outlook

Jeera futures may trade on a negative note as higher stocks for delivery on the exchange warehouses are expected to mount pressure. However, downside may be limited as tensions between Syria and Turkey have escalated further. In the medium term (December-January), prices are likely to stay firm as there are limited stocks with Syria and Turkey.

Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Dec '12 Futures

Unit Rs/qtl Rs/qtl

Last 4972 5152

WoW -0.92 3.54

MoM -2.37 -4.63

YoY -7.85 13.08

Turmeric

Turmeric Futures bounced back sharply and hit the upper circuit breaker on account of lower stocks in Nizamabad at 6.5 lakh bags, compared to Erode. Traders also expect fresh orders from North India in the coming days. There are reports that many farmers Tamil Nadu have shifted to sugarcane, while in Sangli, they have shifted to maize. Market sources expect Turmeric production to increase to 64-65 lakh bags from their earlier estimates of 61-62 lakh bags. Improved weather conditions in Andhra Pradesh and Karnataka has led to the revision in the production estimates. Stockists have good carryover stocks with them. It is estimated that next years carryover stocks would be around 10 lakh bags. There are reports that Turmeric Farmers Association of India have decided to fix their own MSP of Rs.10000/qtl, support prices at lower levels. The Spot as well as the April Futures settled 0.81% and 3.76% higher on Thursday. Production, Arrivals and Exports Arrivals in Erode and Nizamabad mandi stood at 6,000 bags and 500 bags respectively on Thursday. Turmeric production in 2012-13 is expected around 64-65 lakh bags. Production in 2011-12 is projected at historical high of 10.62 lakh tn. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011. Outlook Turmeric prices are expected to trade on a positive note today as farmers may be unwilling to sell at lower levels. However, higher production estimates, higher carryover stocks and weak upcountry demand might cap sharp gains.

Technical Chart Turmeric

NCDEX April contract

Source: Telequote

Technical Outlook

Unit Jeera NCDEX March Futures Turmeric NCDEX April Futures Rs/qtl Rs/qtl

Valid for Dec 7, 2012

Support 14750-14870 5450-5595 Resistance 15190-15380 5830-5900

www.angelcommodities.com

Commodities Daily Report

Friday| December 7, 2012

Agricultural Commodities

Kapas

NCDEX Kapas Futures opened on a positive note yesterday on the back of easing in quantitative restrictions on exports. Demand also, remains robust which are seen limiting the downside despite arrival pressure. However, prices corrected towards the end of account of profit booking and settled 0.25% lower on Thursday The government has procured 20.74 lakh quintals of cotton at the minimum support price (MSP) so far in the 2012-13. As per the DGFT notification dated 30 Nov 2012, the government has eased quantitative restrictions on exporters applying for permits to sell cotton in the overseas market and set the cap at 30,000 bales from 10,000 bales per exporter before. An exporter can apply for RC (registration certificate) for a maximum quantity of 30,000 bales (1 bale=170kg) or actual quantity exported in the previous cotton season, whichever is less. (DGFT) Cotton export registrations for the 2012-13 season stood at 4.5 lakh bales as of November 5, 2012. Cotton exports are currently on Open General License subject to a prescribed procedure of registration. As on 18th Nov 2012, 22.66 lakh bales of Cotton has arrived so far, down by 29% compared to last year 31.97 lakh bales during the same period. U.S. cotton futures settled higher by 0.28% on Wednesday as bargain hunting by mills helped offset speculative short selling on expectations of a record global surplus.

th

Market Highlights

Unit Rs/20 kgs Rs/Bale Last 969.5 16270

as on Dec 6, 2012 % Change Prev. day WoW -0.46 0.73 -0.25 0.37 MoM -1.22 0.37 YoY #N/A -4.07

NCDEX Kapas Futures MCX Cotton Futures

Source: Reuters

International Prices

ICE Cotton Cot look A Index Unit Usc/Lbs Last 72.24 81.35

as on Dec 6, 2012 % Change Prev day WoW 0.28 0.68 0.00 0.00 MoM 3.05 0.00 YoY -21.52 -29.20

Source: Reuters

Technical Chart - Kapas

NCDEX April contract

Domestic Production and Consumption

According to Cotton Advisory Boards (CAB) latest estimates for 2012-13 season that commenced in October, domestic cotton production is pegged 334 lakh bales, down 5.6% from the previous years estimates of 353 lakh bales. Lower opening stocks coupled with estimated lower output will result in lower supplies this season at 374 lakh bales, a decline of 8.7% compared with last years 410.77 lakh bales. On the consumption front, domestic consumption is estimated higher at 270 lakh bales on the back of higher mill consumption. However, after witnessing record exports in 2011-12 season, Indian exports could witness significant fall this season on the back of lower availability along with unattractive domestic cotton prices. CAB estimates cotton exports at 70 lakh bales this season, compared with 128.8 lakh bales last year.

Source: Telequote

Technical Chart - Cotton

MCX Dec contract

Global Cotton Updates

Higher global ending stocks are seen capping the upside in the cotton prices this year too. However, downside is also limited as prices are again nearing its 12 year average price of 65 cents per pound. Markets will now take cues from the Chinese demand for cotton and trade policies of India with respect to cotton exports. Cotton harvesting is 84% completed in US, versus 85% same period a year ago. Cotton crop condition is 43% in Good/Excellent state compared to 29% same period a year ago as on 20th Nov 2012. According to USDA attach report, forecast of Australias 2012-13 cotton crop has been revised downward (nearly 6 percent) to 4 mn bales. Planting of the 2012-13 cotton crop is largely complete with total area expected to be down by as much as 25-30 percent compared to last year. Brazils 2012-13 cotton production forecast at 6.3 million bales, down 27 percent from 2011/12 production now estimated at 8.6 million bales. (USDA Attach report)

Source: Telequote

Technical Outlook

Contract Kapas NCDEX April Cotton MCX January Unit Rs/20 kgs Rs/bale

valid for Dec 7, 2012 Support 955-960 16300-16340 Resistance 980-985 16430-16500

Outlook

Domestic cotton prices are expected to trade on sideways with a positive bias taking cues from the international markets. Downside is expected to be limited in the domestic markets as farmers will not sell their stocks at very low prices. Also demand remains strong at such low prices.

www.angelcommodities.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Effective Skin Care For WomenDocument7 pagesEffective Skin Care For WomenFeirniadoll100% (1)

- KRON. Food Production - Expanded VersionDocument47 pagesKRON. Food Production - Expanded Versionliuia drusillaNo ratings yet

- Detailed Lesson Plan in Tle Kitchen Utensils and EquipmentDocument7 pagesDetailed Lesson Plan in Tle Kitchen Utensils and EquipmentAprildhee Del Mundo Peña81% (88)

- Fruit and Vegetable Canning Business PlanDocument67 pagesFruit and Vegetable Canning Business Plankyaq001100% (1)

- Tim Ekberg Co-Ordinator PH 0357273931 Mobile 0427573535: 96 Milawa-Bobinawarrah RD, Milawa, Victoria, 3678Document5 pagesTim Ekberg Co-Ordinator PH 0357273931 Mobile 0427573535: 96 Milawa-Bobinawarrah RD, Milawa, Victoria, 3678api-25932006No ratings yet

- Reading ComprehensionDocument22 pagesReading Comprehensionwawa6462No ratings yet

- Collection of Easy To Follow Salad RecipesDocument52 pagesCollection of Easy To Follow Salad RecipesmasurimasoodNo ratings yet

- Listener Responding Milestones DataDocument21 pagesListener Responding Milestones DataCamyDelia100% (2)

- Ethnic Culture of The Khasia and Mendi: Prof. Dr. Ashit Boran PaulDocument17 pagesEthnic Culture of The Khasia and Mendi: Prof. Dr. Ashit Boran PaulWorld's GalleryNo ratings yet

- Acceptability and Use of Cereal-Based Foods in Refugee Camps: Case-Studies From Nepal, Ethiopia, and TanzaniaDocument137 pagesAcceptability and Use of Cereal-Based Foods in Refugee Camps: Case-Studies From Nepal, Ethiopia, and TanzaniaOxfamNo ratings yet

- MM Module 1 A Prelude To The World of MarketingDocument11 pagesMM Module 1 A Prelude To The World of MarketingAbhishek MukherjeeNo ratings yet

- BBQ Chicken Tenders: IngredientsDocument18 pagesBBQ Chicken Tenders: IngredientsBawen MuralitharanNo ratings yet

- Coco Leaf NutrientDocument3 pagesCoco Leaf NutrientLive LikeNo ratings yet

- Creature Feature Burskan GundarkDocument3 pagesCreature Feature Burskan GundarkSW-FanNo ratings yet

- Internships Development MicroprojectDocument14 pagesInternships Development MicroprojectAvi BorkarNo ratings yet

- X12 - Skarda's MirrorDocument54 pagesX12 - Skarda's Mirrormadcap01100% (3)

- Forest Protection PDFDocument98 pagesForest Protection PDFAbhiroop RoyNo ratings yet

- Fatty Acid Composition of Some Major OilsDocument18 pagesFatty Acid Composition of Some Major OilsChoice OrganoNo ratings yet

- Coca-Cola (Often Referred To Simply As Coke) Is ADocument10 pagesCoca-Cola (Often Referred To Simply As Coke) Is ATrúc HoàngNo ratings yet

- Easy Exercises On Reported SpeechDocument4 pagesEasy Exercises On Reported SpeechminhanhNo ratings yet

- Aа reading drillDocument2 pagesAа reading drillДіана МатковаNo ratings yet

- Vegetarian Cook Book 97 RecipesDocument101 pagesVegetarian Cook Book 97 Recipesvelocityspark100% (1)

- 8 1 Biotic Abiotic Components PDFDocument78 pages8 1 Biotic Abiotic Components PDFparamesvary kannanNo ratings yet

- 4ds0315e P2 (F)Document1 page4ds0315e P2 (F)nagravNo ratings yet

- Upt Laboratorium Lingkungan BantenDocument2 pagesUpt Laboratorium Lingkungan BantenPandeglang laboratoriumNo ratings yet

- Feed Manufacturing Technology (Driqbal)Document18 pagesFeed Manufacturing Technology (Driqbal)Dr Anais AsimNo ratings yet

- Our Food 1. Fill in The BlanksDocument5 pagesOur Food 1. Fill in The BlanksSatish BhadaniNo ratings yet

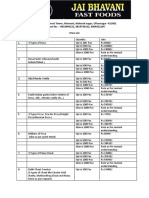

- Jai Bhavani Catering ServiceDocument3 pagesJai Bhavani Catering ServiceLaxmikant TradingNo ratings yet

- Gess 209Document6 pagesGess 209api-309501342No ratings yet

- Cafe Imports Sensory Analysis Analytic Cupping Score CardDocument1 pageCafe Imports Sensory Analysis Analytic Cupping Score CardHissatsu86No ratings yet