Professional Documents

Culture Documents

GSAA Home Equity Trust 2005-15, Tranche 2A1 - JP Morgan Chase 401K Savings Plan

Uploaded by

Tim Bryant0 ratings0% found this document useful (0 votes)

64 views1 pageSEC filing, schedule of assets, JPM Chase 401K Savings Plan, dated June 27, 2011.

Original Title

GSAA Home Equity Trust 2005-15, Tranche 2A1 - JP Morgan Chase 401K Savings Plan

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSEC filing, schedule of assets, JPM Chase 401K Savings Plan, dated June 27, 2011.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

64 views1 pageGSAA Home Equity Trust 2005-15, Tranche 2A1 - JP Morgan Chase 401K Savings Plan

Uploaded by

Tim BryantSEC filing, schedule of assets, JPM Chase 401K Savings Plan, dated June 27, 2011.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

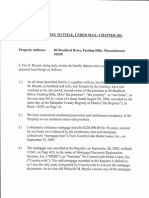

THE JPMORGAN CHASE 401(k) SAVINGS PLAN

Plan number: 002 EIN: 13/4994650

Schedule of Assets (Held at End of Year) at December 31, 2006

(IRS Form 5500 Schedule H Part IV Line 4i)

(a)

(b) Identity of Issue, Borrower, Lessor, or Similar Party

CORPORATE DEBT INSTRUMENTS (continued):

GSAA 2005-15 2A1

GSAA 2005-5 A-1

GSAA 2005-5 A-1

GSAA 2005-6 A-1

GSAA 2005-6 A-1

GSAA 2006 19 A1

GSAA 2006 19 A1

HARBORVIEW MORTGAGE LOAN TRUST

HARRAHS OPERATING CO INC

HARRAHS OPERATING CO INC

HARRY & DAVID OPERATIONS CORP

HASC 2006 OPT1 2A1

HASC 2006 OPT1 2A1

HASC 2006 OPT2 IIA1

HASC 2006 OPT2 IIA1

HBOS TREASURY SERV P

HBOS TREASURY SERV PLC ZCP

HBOS TREASURY SERVICES PLC

HBOS TREASURY SERVICES PLC

HCA INC

HCA INC

HCA INC

HCA INC

HCA INC

HCA INC

HEAT 2005-4 2A1

HEAT 2005-4 2A1

HEAT 2005-6 2A1

HEAT 2005-6 2A1

HEAT 2006-1 2A1

HEAT 2006-1 2A1

HELLAS TELECOM FINANCE

HERTZ CORP

HERTZ CORP

HEXION U S FIN CORP

HONDA AUTO RECEIVABLES 2006-3 OWNER

HONDA AUTO RECEIVABLES OWNER TRUST 2005-1 CL A3

HONDA AUTO RECEIVABLES OWNER TRUST 43811UAC6

HOST MARRIOTT L P

HOUGHTON MIFFLIN CO

(c) Description of Investment including Maturity Date,

Rate of Interest, Collateral, Par, or Maturity Value

5.44%, 12/26/07

5.44%, 04/27/07

5.44%, 04/27/07

5.34%, 05/25/07

5.34%, 05/25/07

5.44%, 11/24/08

5.44%, 11/24/08

MONTHLY FLOATING 02/25/2036, 1,157,847

SEMI-ANN. 5.625% 06/01/2015, 500,000

SEMI-ANN. 6.500% 06/01/2016, 250,000

SEMI-ANN. 9.000% 03/01/2013, 319,000

5.43%, 02/01/08

5.43%, 02/01/08

5.43%, 02/28/08

5.43%, 02/28/08

0.000% 02/01/2007, 5,500,000

0.000% 03/20/2007, 3,500,000

5.40%, 01/29/08

5.40%, 01/29/08

SEMI-ANN. 6.375% 01/15/2015, 250,000

SEMI-ANN. 9.250% 11/15/2016, 500,000

SEMI-ANN. 9.625% 11/15/2016, 500,000

SEMI-ANN. 9.125% 11/15/2014, 70,000

SEMI-ANN. 9.250% 11/15/2016, 510,000

SEMI-ANN. 9.625% 11/15/2016, 550,000

5.44%, 06/25/07

5.44%, 06/25/07

5.47%, 08/31/07

5.47%, 08/31/07

5.43%, 01/04/08

5.43%, 01/04/08

QUARTERLY FLOATING 04/15/2014, 514,490

SEMI-ANN. 10.500% 01/01/2016, 500,000

SEMI-ANN. 8.875% 01/01/2014, 750,000

SEMI-ANN. 9.750% 11/15/2014, 500,000

MONTHLY 5.341% 11/15/2007, 3,398,451

MONTHLY 3.530% 10/21/2008, 638,577

MONTHLY 2.910% 10/20/2008, 216,715

SEMI-ANN. 7.000% 08/15/2012, 529,000

SEMI-ANN. 7.200% 03/15/2011, 86,000

(d) Cost

82,059

20

135

34,994

238,842

375,960

2,565,991

1,148,347

428,453

223,826

290,963

90,536

617,926

127,824

872,421

5,475,159

3,460,150

72,742

496,475

204,502

520,703

518,990

70,000

510,700

561,163

8,113

55,372

45,151

308,163

58,766

401,085

646,418

532,054

771,029

501,511

3,398,451

633,738

214,333

524,748

86,385

(e) Current Value

82,059

20

135

34,994

238,842

375,960

2,565,991

1,159,149

428,824

223,838

311,185

90,536

617,926

127,824

872,421

5,475,159

3,460,150

72,742

496,475

211,875

535,625

537,500

74,812

546,337

591,250

8,113

55,372

45,151

308,163

58,766

401,085

694,122

550,000

785,625

506,875

3,398,124

634,189

214,588

536,935

86,860

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- EFF - DocuColor Tracking Dot Decoding GuideDocument6 pagesEFF - DocuColor Tracking Dot Decoding GuideTim BryantNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Print Over SignatureDocument2 pagesPrint Over SignatureTim Bryant100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Mortgages Notes Deeds and Loans in Crime-Gary MichaelsDocument15 pagesMortgages Notes Deeds and Loans in Crime-Gary MichaelsTim Bryant100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Extracting Signatures From Bank Checks - 2003Document10 pagesExtracting Signatures From Bank Checks - 2003Tim BryantNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- MWG GuidanceDocument73 pagesMWG Guidancejordimon1234No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- GSMSC Certificate - Involuntary RevokationDocument2 pagesGSMSC Certificate - Involuntary RevokationTim BryantNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

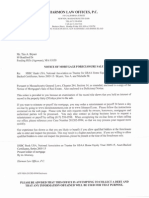

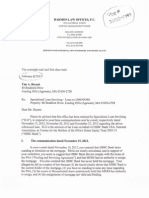

- Harmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDDocument10 pagesHarmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDTim BryantNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Mortgage Page 10 - Line Through SignatureDocument1 pageMortgage Page 10 - Line Through SignatureTim BryantNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Pinti V Emigrant 2015-Sjc-11742Document44 pagesPinti V Emigrant 2015-Sjc-11742Tim BryantNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Affidavits of Title - EXECUTED - 06 26 2015Document10 pagesAffidavits of Title - EXECUTED - 06 26 2015Tim BryantNo ratings yet

- FRB Report - 100517-Clearing Banks As Loan Funders-BONYDocument43 pagesFRB Report - 100517-Clearing Banks As Loan Funders-BONYTim BryantNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Note and Rider 2005Document8 pagesNote and Rider 2005Tim BryantNo ratings yet

- 2015 Copy of Note - HarmonLaw - BryantDocument6 pages2015 Copy of Note - HarmonLaw - BryantTim Bryant100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Paths of Notes and Mortgages - Loan 114726037Document24 pagesPaths of Notes and Mortgages - Loan 114726037Tim BryantNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- MA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Document1 pageMA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Tim BryantNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- BofA To Nationstar 07 30 2013-80 BradfordDocument1 pageBofA To Nationstar 07 30 2013-80 BradfordTim BryantNo ratings yet

- GSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Document1 pageGSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Tim BryantNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Nationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodDocument7 pagesNationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodTim BryantNo ratings yet

- 2013 Copy of Note - HarmonLaw - BryantDocument6 pages2013 Copy of Note - HarmonLaw - BryantTim BryantNo ratings yet

- MERS To BAC Assignment 05 11 2011Document1 pageMERS To BAC Assignment 05 11 2011Tim BryantNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bryant Mortgage 2005 - RODDocument16 pagesBryant Mortgage 2005 - RODTim BryantNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Bryant Mortgage PG 2Document1 pageBryant Mortgage PG 2Tim BryantNo ratings yet

- Closing Version Mortgage-Rider 2005 BryantDocument16 pagesClosing Version Mortgage-Rider 2005 BryantTim BryantNo ratings yet

- GS Mortgage Securities Corp Not Authorized To Do Business in NYDocument1 pageGS Mortgage Securities Corp Not Authorized To Do Business in NYTim BryantNo ratings yet

- GSAA HET 2005 15 Not Registered To Do Business in MADocument2 pagesGSAA HET 2005 15 Not Registered To Do Business in MATim BryantNo ratings yet

- Deutsche Bank National Trust Is Not Registered To Do Business in MADocument1 pageDeutsche Bank National Trust Is Not Registered To Do Business in MATim BryantNo ratings yet

- DBNT Not Registered To Do Business in NYDocument1 pageDBNT Not Registered To Do Business in NYTim BryantNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- GSAA HET 2005 15 Not Registered To Do Business in NYDocument1 pageGSAA HET 2005 15 Not Registered To Do Business in NYTim BryantNo ratings yet

- A0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenDocument3 pagesA0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenTim BryantNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)