Professional Documents

Culture Documents

A Study of Financial Management in Small Scale Industries in India

Uploaded by

Niraj ThakurOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study of Financial Management in Small Scale Industries in India

Uploaded by

Niraj ThakurCopyright:

Available Formats

International Journal of Exclusive Management Research August 2011-Vol 1 Issue 3

ISSN 2249 2585

A study of Financial Management in Small Scale Industries in India

*Prof. Jayshri J Kadam **Prof. Dr. V.N. Laturkar * Lecturer, IBMRD, A.Nagar, India **Reader, SRTMU, Nanded, India

Abstract Small Scale industries encompass vast scope covering activities like manufacturing, servicing, financing, construction, infrastructure etc. In view of Government of Indias ever increasing importance given to the small scale industries in the national economy more & more small scale industries are to be set up in the years to come. By contributing its increasing share to the national production, employment & exports, small scale industries also contribute to the economic development of the country. However, these industries are also plagued by the problems of raw material, finance, marketing, underutilization of capacity, etc. cash has become a big problem for small & even big businesses today. Lack of finance has driven many small business units into bankruptcy. Unfortunately many small businesses will become bankrupt because their owners have neglected the principal of cash management which normally determines their successes or failure. Cash is like oxygen to a business. Small scale enterprises, given their small resources find it difficult to have these own. Finance has been the important resource to start & run an enterprise4because it facilitates the entrepreneur to procure land, labour, material, machine& so on from different parties to run his/her enterprise. Report of third all India censuses also clearly indicate that lack of demand& shortage of working capital are the main reasons behind sickness/ incipient sickness of registered & unregistered small scale industries. Developing cash forecast is essential for new business because early sales do not generate enough cash to keep the company afloat. Better financial management can lead the company ahead in competition as well as it will help the entrepreneur to avoid the situation of bankruptcy & industrial sickness. This paper is an attempt to understand various financial techniques to help the entrepreneurs to avoid the situation of industrial sickness. Key Words: Cash Management, Small scale entrepreneurs, Industrial sickness

http://www.exclusivemba.com/ijemr

Page 1

International Journal of Exclusive Management Research August 2011-Vol 1 Issue 3

ISSN 2249 2585

Introduction: Finance is the key input of production distribution& development. It is therefore aptly described as the life- blood of industry& is prerequisite for accelerating the process of industrial development. Especially in case of small scale industries, finance is the key input in growth & development. The financial investment of these small units comes mainly from within; most of them invest their own funds or borrowed funds. Much less comes from banks & government channels. Small scale entrepreneurs face a lot of problem while availing loan facility form commercial banks as well as Government agencies. Financial institutions ask for a lot of information& data, state financial corporation takes several months to take decision on extending term loans small scale sector are not in a position to offer guarantee required by the banking sector. Even when small loans can be raised from Government agencies the procedure is so cumbersome that most of the entrepreneurs, who either are illiterate or semiliterate, hesitate to make use of these facilities. This makes matter very difficult for the small industrialist, particularly when he is new to this way of life, & he has to deal with both state financial corporation as well as banks. Quite often few get fed up at this stage & give up.

The importance of Cash Management to the success of Small BusinessManaging cash flow which is a struggle for many business owners involvesForecasting Collecting Disbursing Investing & planning for the cash a company needs to operate smoothly. A business must have enough cash to meet its obligations as they come due or it will experience bankruptcy. Creditors, employees & lenders expected to be paid on time, which require cash. Proper cash management permeates entrepreneurs to adequately meet their cash demands of their businesses avoid unnecessarily large cash balances & stretch the profit-generating power of each credit or dollar their companies own. Entrepreneurs must have the discipline to manage cash flow from the first day of its operation. Although cash problem affect all companies young businesses are more prone to suffer cash shortages because all the available cash is used for their productive activities& their cash generating activities have not reached the level to generate enough cash to cover rapidly growing expenses. Cash Management Role of the EntrepreneurThe five key cash management roles every entrepreneur must fulfill are1) Cash finder- This is the entrepreneurs first & the foremost responsibility. Must make sure there is enough capital to meet present as well as future bills. This is not a one time task but an ongoing job.

http://www.exclusivemba.com/ijemr

Page 2

International Journal of Exclusive Management Research August 2011-Vol 1 Issue 3

ISSN 2249 2585

2) Cash planner- As a cash planner an Entrepreneur makes sure the companies cash used properly & efficiently. Must keep track of its cash make sure that it is available to pay bills & plan for its future use. Planning requires ones to forecast the companys inflows & outflows for the month ahead with the help of a cash budget. 3) Cash Distributor- The role require entrepreneur to control the cash needed to pay the companies bills &the priority & the timing to those payments. Forecasting cash disbursements accurately & making sure the cash is available when payments come due are essential to keep the business solvent. 4) Cash collector-The role require entrepreneur to make sure customers pay their bills on time. Too often entrepreneurs focus on pumping of sales while neglecting to collect the cash from these sales. Uncollected accounts drain a small companys pool of cash very quickly. 5) Cash conserver- The role require entrepreneur to make sure the company gain maximum value for the dollar it spends. Avoiding unnecessary expenditure is an important part of this task. The goal is to spend cash so it will produce a return for the company.

Type of industrial FinanceDepending upon the type of activity entrepreneur require three type of Finance 1) Short term finance- For the period of less than one year. It is usually required to meet variable, seasonal or temporary working capital needs. 2) Medium Term finance-The period of 1-5 years. Medium term finance is usually required for permanent working capital, small expansions, replacements, modifications etc. 3) Long Term Finance- Period exceeding 5 years. Long term finance is usually required for procuring fixed assets, for the establishment of a new business, for substantial expansion of existing business, modernization.

http://www.exclusivemba.com/ijemr

Page 3

International Journal of Exclusive Management Research August 2011-Vol 1 Issue 3

ISSN 2249 2585

Sources of finance for small scale sectorSources of finance

Fixed Working capital

State Govt. banks

SFCs

NSIC

SSICS

SIDCS

Commercial

Commercial Banks

Industrial

co-operative banks

Indigenous banks Money lender

Investment corporations

http://www.exclusivemba.com/ijemr

Page 4

International Journal of Exclusive Management Research August 2011-Vol 1 Issue 3

ISSN 2249 2585

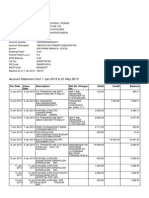

Magnitude of sickness in the SSI sector in countryThe incidence of sickness in the small scale industries sector has declined from the year 1999 to 2003, as per the data compiled by the RBI from scheduled commercial banks. The number of sick units in the country has come down from 158226 as at the end of March 1987 to85187 as at the end of March 2008( provisional) The total sick SSI units, , with the amounts outstanding against them for years ending March 1987 to 2008 were as given in following tableYear

1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000

Sick SSI Units

158226 217436 186441 218828 221472 245575 238176 256452 268815 262376 235032 221536 306221 304235

Amount outstanding

1542 1980 2243 2427 2792 3101 3443 3680 3547 3722 3609 3857 4313 4608

2001 2002 2003 2004 2005 2006 2007 2008

249630 177336 167980 138811 138041 126824 114132 85187

4506 4819 5706 5285 5380 4981 5267 13849

Page 5

http://www.exclusivemba.com/ijemr

International Journal of Exclusive Management Research August 2011-Vol 1 Issue 3

ISSN 2249 2585

Notes: 1. 2008 data are provisional 2. 1987&1988 data relate to end June. 3. 1989 data relates to end September The incidence of sickness in SSI sector has declined from the year 1987 to 2008 as per the data compiled by RBI from scheduled commercial banks. The number of sick units come down from 158226 at the end of March 1987 to 85187 at the end of March 2008, but at the same time amount outstanding continuously goes on increasing this is mainly due to lack of proper cash management by small scale entrepreneurs.

http://www.exclusivemba.com/ijemr

Page 6

International Journal of Exclusive Management Research August 2011-Vol 1 Issue 3

ISSN 2249 2585

Conclusion: For entrepreneurs, small business financial management is a vital aspect of growing a profitable company. Implementing sound economic principles and keeping a close watch on cash flow will help lay a solid financial foundation for the new venture. Monetary policies and procedures for effective cash management need to be part of the entrepreneur's business plan. Though it may be more exciting for the entrepreneur to dream about the actual services or products that the company will provide, a business cannot thrive, and may not survive, if the financing aspects are left to chance. In order to arrest sickness at the incipient stage banks & financial institutions should periodically review the accounts of the small scale industr8ies borrowers to identify units which are becoming sick or are prone to sickness. The Government of India & the RBI should be requested to direct commercial banks & financial institutions to provide information on sickness to the agencies like BIFR implementing the rehabilitation programme to facilitate them to take up appropriate action. It is also suggested that Government should conduct special EDPs for training the entrepreneurs in financial aspects. References: 1)I. M. pandey: Financial Management, ( sixth revised edition ), vikas publishing House Ltd. , New Dehli, 1994, p.755 2)Vasant Desai; Small scale Industries & entrepreneurship, first edition, Himalaya publishing House Ltd., New Dehli, Oct, 1994 p.94,95,179-181. 3) John Argenti: Symptoms of sickness, Accountancy.

http://www.exclusivemba.com/ijemr

Page 7

You might also like

- BHEL Case StudyDocument2 pagesBHEL Case StudyBhavesh RathiNo ratings yet

- A Study of Working Capital Management in Small Scale IndustriesDocument13 pagesA Study of Working Capital Management in Small Scale IndustriesIAEME PublicationNo ratings yet

- 1cr17mba61 ProjectDocument19 pages1cr17mba61 ProjectPraveen Kumar100% (2)

- Dena BankDocument37 pagesDena Bankamit_ruparelia28100% (2)

- Objective: Fundamental Analysis of Real Estate Sector in IndiaDocument44 pagesObjective: Fundamental Analysis of Real Estate Sector in IndiaDnyaneshwar DaundNo ratings yet

- Credit Rating GROUP 11Document11 pagesCredit Rating GROUP 11Siddharth Shah0% (1)

- Project Report on Risk Analysis of ICICI Prudential Life Insurance Portfolio ManagementDocument72 pagesProject Report on Risk Analysis of ICICI Prudential Life Insurance Portfolio ManagementTbihva Aviirsa100% (1)

- Financial Literacy Project Final FileDocument70 pagesFinancial Literacy Project Final Fileaddusaiki9999No ratings yet

- India's Industrial Policies from 1948-1991Document34 pagesIndia's Industrial Policies from 1948-1991MANDEEP KAURNo ratings yet

- Accident Insurance: An Overview of Coverage, Benefits and ConsiderationsDocument9 pagesAccident Insurance: An Overview of Coverage, Benefits and Considerationsbhavika_08_1680844570% (1)

- Working Capital ITCDocument75 pagesWorking Capital ITCsaur1No ratings yet

- Financial Analysis of WiproDocument23 pagesFinancial Analysis of WiproVishal RebelsNo ratings yet

- Role of Banks in Working Capital ManagementDocument59 pagesRole of Banks in Working Capital Managementswati29mishra100% (6)

- Market Strategy of LG Regarding Sales of LCDDocument52 pagesMarket Strategy of LG Regarding Sales of LCDMohit AgarwalNo ratings yet

- A Study of Consumer Awareness Towards EDocument7 pagesA Study of Consumer Awareness Towards EJatinder KaurNo ratings yet

- Financial Institutions in IndiaDocument4 pagesFinancial Institutions in Indiaabhishekaw02No ratings yet

- Understanding Business EconomicsDocument18 pagesUnderstanding Business EconomicsPitabash BeheraNo ratings yet

- A Comparitive Study On Mutual FundsDocument58 pagesA Comparitive Study On Mutual Fundsarjunmba119624No ratings yet

- BM FinalDocument22 pagesBM FinalRobin BhartiaNo ratings yet

- IFRS: International Financial Reporting StandardsDocument31 pagesIFRS: International Financial Reporting StandardsKewal GalaNo ratings yet

- Blinkit StrategyDocument34 pagesBlinkit Strategyvishiva04No ratings yet

- DENA BANK REPORTDocument25 pagesDENA BANK REPORTJaved ShaikhNo ratings yet

- Finance ProjectDocument61 pagesFinance Projecthiren9090No ratings yet

- Nisaraga ProjectDocument82 pagesNisaraga ProjectSidda SiNo ratings yet

- Credit RatingDocument81 pagesCredit RatingPreedy ChesterNo ratings yet

- A Study On Effects of Demonetization OnDocument14 pagesA Study On Effects of Demonetization OnDaniel MaddipatiNo ratings yet

- Fundamental Analysis of Indian Banking SectorDocument17 pagesFundamental Analysis of Indian Banking SectorDipesh AprajNo ratings yet

- Consumer Buying Behaviour in Automobile IndustriesDocument47 pagesConsumer Buying Behaviour in Automobile Industriessai rocksNo ratings yet

- Subject: Entrepreneurship and Small Business Development: Course Code: MC-202Document40 pagesSubject: Entrepreneurship and Small Business Development: Course Code: MC-202rajeeevaNo ratings yet

- Project Report On Basel IIIDocument8 pagesProject Report On Basel IIICharles DeoraNo ratings yet

- Risk and Return Analysis PPT 2Document24 pagesRisk and Return Analysis PPT 2Vaibhav GuptaNo ratings yet

- Black Money in IndiaDocument24 pagesBlack Money in IndiasweetfeverNo ratings yet

- RM NOTES, UNIT 1 To 5, SYBAFDocument81 pagesRM NOTES, UNIT 1 To 5, SYBAFHimanshu UtekarNo ratings yet

- LIC Case StudyDocument6 pagesLIC Case StudymayuriNo ratings yet

- Financial RiskDocument68 pagesFinancial RiskGouravNo ratings yet

- Micro Finance ProjectDocument56 pagesMicro Finance ProjectSandip KarNo ratings yet

- A Project On M.P of RbiDocument37 pagesA Project On M.P of RbiUmesh Soni100% (1)

- Parallel EconomyDocument8 pagesParallel EconomyAnith GhoshNo ratings yet

- Report On Dena BankDocument107 pagesReport On Dena Bankmeetu_s_200089% (9)

- Akij Group AIS AnalysisDocument11 pagesAkij Group AIS Analysismd.jewel rana100% (1)

- A Study On Working Capital Management - AVA Cholayil Health Care Pvt. LTDDocument77 pagesA Study On Working Capital Management - AVA Cholayil Health Care Pvt. LTDRohithNo ratings yet

- A Study On Impact of Covid-19 Pandemic On Unemployment in IndiaDocument13 pagesA Study On Impact of Covid-19 Pandemic On Unemployment in Indiaamit chavariaNo ratings yet

- Project ON ETHICAL VALUESDocument20 pagesProject ON ETHICAL VALUESRiaz Ahmed50% (2)

- Role of Behavioural Finance in Investment DecisionsDocument7 pagesRole of Behavioural Finance in Investment Decisionsmukul14143529No ratings yet

- IDEA CELLULAR LIMITED INDUSTRY PROFILEDocument85 pagesIDEA CELLULAR LIMITED INDUSTRY PROFILEjkd4550% (6)

- Wavin Plastics Manufacturer Targets Markets Through SegmentationDocument18 pagesWavin Plastics Manufacturer Targets Markets Through SegmentationAndreas Vinther PoulsenNo ratings yet

- Reliance Industries Financial Report AnalysisDocument52 pagesReliance Industries Financial Report Analysissagar029No ratings yet

- Project Report Infosys RevisedDocument38 pagesProject Report Infosys RevisedHack ManiaNo ratings yet

- A Study On Deposit Mobilization With Reference To Indian Overseas Bank, Velachery byDocument44 pagesA Study On Deposit Mobilization With Reference To Indian Overseas Bank, Velachery byvinoth_17588No ratings yet

- EXIMDocument17 pagesEXIMTrichy MaheshNo ratings yet

- Innovative Financial ServicesDocument9 pagesInnovative Financial ServicesShubham GuptaNo ratings yet

- Cash ManagementDocument45 pagesCash ManagementRahul NishadNo ratings yet

- NTCC REPORT Hero Motocorp LTDDocument31 pagesNTCC REPORT Hero Motocorp LTDsagar sharmaNo ratings yet

- Awareness of E-Banking Services Among Rural CustomersDocument10 pagesAwareness of E-Banking Services Among Rural CustomersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Credit Rating Agencies (1 FinalDocument88 pagesCredit Rating Agencies (1 FinalAvtaar SinghNo ratings yet

- Working Capital Management and Funds Flow AnalysisDocument113 pagesWorking Capital Management and Funds Flow AnalysisDr.P. Siva RamakrishnaNo ratings yet

- A Study of Financial Management in Small Scale Industries in IndiaDocument4 pagesA Study of Financial Management in Small Scale Industries in IndiaVinay Gowda D MNo ratings yet

- Pro-The Contribution of Banking Industries For TheDocument29 pagesPro-The Contribution of Banking Industries For TheCALEB ALHASSANNo ratings yet

- Working Capital FinanceDocument54 pagesWorking Capital FinanceAnkur RazdanNo ratings yet

- Price ListDocument21 pagesPrice ListNiraj ThakurNo ratings yet

- Approval SheetDocument2 pagesApproval SheetNiraj ThakurNo ratings yet

- Weekly grocery shopping list and expensesDocument1 pageWeekly grocery shopping list and expensesNiraj ThakurNo ratings yet

- UT Small Business QuestionnaireDocument3 pagesUT Small Business QuestionnaireNiraj ThakurNo ratings yet

- Introduction To MukandDocument25 pagesIntroduction To MukandNiraj ThakurNo ratings yet

- Optical Satellite CommunicationDocument1 pageOptical Satellite CommunicationNiraj ThakurNo ratings yet

- Optical Satellite Communication SlidDocument4 pagesOptical Satellite Communication SlidRobin RajanNo ratings yet

- AssignmentsDocument4 pagesAssignmentsNiraj ThakurNo ratings yet

- Financial Position of Last 5 YearsDocument3 pagesFinancial Position of Last 5 YearsNiraj ThakurNo ratings yet

- Nanotechnology: Represented By:-1) Arpita Vashishth 2) Harshal PawarDocument1 pageNanotechnology: Represented By:-1) Arpita Vashishth 2) Harshal PawarNiraj ThakurNo ratings yet

- Fiber Optic Communication ReportDocument32 pagesFiber Optic Communication ReportNiraj ThakurNo ratings yet

- Temp InfoDocument8 pagesTemp InfoNiraj ThakurNo ratings yet

- Optical Satellite CommunicationDocument1 pageOptical Satellite CommunicationNiraj ThakurNo ratings yet

- Recent Trends in Fiber OpticsDocument22 pagesRecent Trends in Fiber OpticsNiraj Thakur100% (2)

- Nostradamus Centuries 04Document21 pagesNostradamus Centuries 04Niraj ThakurNo ratings yet

- RefDocument1 pageRefNiraj ThakurNo ratings yet

- Furnace InfoDocument23 pagesFurnace InfoNiraj ThakurNo ratings yet

- QuotationsDocument2 pagesQuotationsNiraj ThakurNo ratings yet

- AbstractDocument1 pageAbstractNiraj ThakurNo ratings yet

- Estimation of The Mathematical Model of TheDocument8 pagesEstimation of The Mathematical Model of TheNiraj ThakurNo ratings yet

- 1furnace Oil ReductionDocument32 pages1furnace Oil ReductionNiraj ThakurNo ratings yet

- Furnace Oil Reduction MaterialDocument5 pagesFurnace Oil Reduction MaterialNiraj ThakurNo ratings yet

- Innovation in Indian Small Scale Industries Case Study of Cosmetics Small Scale Industry in MumbaiDocument18 pagesInnovation in Indian Small Scale Industries Case Study of Cosmetics Small Scale Industry in MumbaiNiraj Thakur67% (3)

- Customer Satisfaction Regarding Small Scale Industries ProductsDocument22 pagesCustomer Satisfaction Regarding Small Scale Industries ProductsNiraj ThakurNo ratings yet

- Small Scale IndustriesDocument88 pagesSmall Scale IndustriesAnkit ShahNo ratings yet

- Problems and Prospects of Small Scale IndustryDocument19 pagesProblems and Prospects of Small Scale IndustryNiraj ThakurNo ratings yet

- Biodata Application Form For Small Scale IndustriesDocument2 pagesBiodata Application Form For Small Scale IndustriesRoshen KaushalaNo ratings yet

- Harshal Raosaheb Pawar: Class (Year) University/Board School/College Percentage SubjectsDocument2 pagesHarshal Raosaheb Pawar: Class (Year) University/Board School/College Percentage SubjectsNiraj ThakurNo ratings yet

- Dr. B.R. Ambedkar's contributions as economist, reformer and architect of Indian ConstitutionDocument3 pagesDr. B.R. Ambedkar's contributions as economist, reformer and architect of Indian ConstitutionBirjit ThokchomNo ratings yet

- The Noble Group: Brienne Bowen, Emily Phipps, Adam Foley, Jeff Schroeder, Michael MalloyDocument12 pagesThe Noble Group: Brienne Bowen, Emily Phipps, Adam Foley, Jeff Schroeder, Michael MalloyKshitishNo ratings yet

- IMF and World BankDocument100 pagesIMF and World BankMohsen SirajNo ratings yet

- Revised SWORN STATEMENT FormDocument2 pagesRevised SWORN STATEMENT Formanaliza elliNo ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of MoneyQuỳnh NguyễnNo ratings yet

- Documentary Stamp TaxDocument2 pagesDocumentary Stamp TaxMary Therese Anne DequiadoNo ratings yet

- Macro Lecture08Document64 pagesMacro Lecture08Lê Văn KhánhNo ratings yet

- 04 ReceivablesDocument12 pages04 ReceivablesNina100% (1)

- Afar-03: Corporate Liquidation: - T R S ADocument4 pagesAfar-03: Corporate Liquidation: - T R S AJenver BuenaventuraNo ratings yet

- NI Act 1881Document11 pagesNI Act 1881AngelinaGuptaNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/22 October/November 2017Document12 pagesCambridge Assessment International Education: Accounting 0452/22 October/November 2017pyaaraasingh716No ratings yet

- TNEB Online Payment PDFDocument2 pagesTNEB Online Payment PDFGeetha SoundaryaNo ratings yet

- TVS CreditDocument4 pagesTVS CreditAkhil RajNo ratings yet

- Country Hill CaseDocument2 pagesCountry Hill CaseAlisha Anand [JKBS]No ratings yet

- Syllabus Math InvestmentDocument8 pagesSyllabus Math InvestmentMphilipTNo ratings yet

- Account StatementDocument6 pagesAccount StatementDeepaBabukumarNo ratings yet

- Corporate Finance and The Financial ManagerDocument69 pagesCorporate Finance and The Financial ManagerHuy PanhaNo ratings yet

- Auditing and Assurance Services Louwers 4th Edition Solutions ManualDocument26 pagesAuditing and Assurance Services Louwers 4th Edition Solutions ManualRichardThomasrfizy100% (26)

- USAA HackingDocument6 pagesUSAA Hackingayina100% (1)

- VE Banking Tests Unit05Document2 pagesVE Banking Tests Unit05Andrea CosciaNo ratings yet

- Marketing of Banking Services (Urban Areas)Document82 pagesMarketing of Banking Services (Urban Areas)ganga123456No ratings yet

- Purchase Order Sheet: Unico Global IncDocument1 pagePurchase Order Sheet: Unico Global IncSang HàNo ratings yet

- Banking Law Project PDFDocument24 pagesBanking Law Project PDFDarpan MaganNo ratings yet

- Case Analysis: Muhammad Fahad SohailDocument5 pagesCase Analysis: Muhammad Fahad Sohailtempi tampaNo ratings yet

- SCF WorksheetDocument19 pagesSCF WorksheetAngelo Gian CoNo ratings yet

- 02 Financial Statements Case StudyDocument3 pages02 Financial Statements Case StudyanitalauymNo ratings yet

- Merit Enterprise Corp's $4B Expansion OptionsDocument3 pagesMerit Enterprise Corp's $4B Expansion OptionsEufemia MabingnayNo ratings yet

- Dilemma Company Financial Position Statement 2021Document2 pagesDilemma Company Financial Position Statement 2021lizzie patauegNo ratings yet

- Petronesa 5.99%Document6 pagesPetronesa 5.99%akaiNo ratings yet

- E&P companies "painted with different perspectiveDocument13 pagesE&P companies "painted with different perspectiveFahad HussainNo ratings yet