Professional Documents

Culture Documents

State of New Mexico Discovery Courtcase No

Uploaded by

Mark AustinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State of New Mexico Discovery Courtcase No

Uploaded by

Mark AustinCopyright:

Available Formats

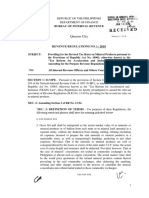

STATE OF NEW MEXICO COUNTY OF SAN JUAN MAGISTRATE COURT Case No.

Mark Everett of the family of Austin Presenter Vs. AGENT ROSE BASILE, AGENT RONALD KILTHAU, AGENT DEAN CHAVEZ, MEJ INVESTMENTS INC. Request for Production of Documents

DISCOVERY

Presenter requests production of the following: 1. Any and all records, microfilm, tape, recording, video, audio, computer generated product, documents, associated with this matter with MARK E AUSTIN Corporations name, whether associated with this matter or not. *note that use of my name is now prohibited and revoked and no one man, woman or entity has any right to any proprietary use of my name and or files associated with my name ab initio; 2. You are demanded by the undersigned to prepare and produce to the undersigned written verified, validated assessment(s) concerning all supposed liability and debt for any years questioned for account # XXX XX 0679, including, but not limited to, calendar Years 1999, 2000,2001,2002,2004,2005, and 2008; A. All records, if any, of determinations or decisions made that I, :Mark-Everett :Austin. a private American citizen, have a legal duty to furnish personal information or file a 1040 income Tax Return to you or your Service; B. All records, if any, of determinations or decisions made that I am or one who is, or was, subject to or liable for any revenue tax imposed by the national government of the United States of America; C. All records, if any, of determinations or decisions made that I am, or was, a taxpayer as that term is defined in section 1313(b) and /or 7701(a)(14) of the Internal Revenue Code; D. All records, if any, of determinations or decisions made that I have ever had a taxable year as defined in section 441(b) of the Internal Revenue Code; E. All records, if any, of determinations or decisions made that I have ever had taxable income as defined in section 63 of the Internal Revenue Code;

F. All records, if any, of determinations or decisions made that I have ever had adjusted gross income as defined in section 62 of the Internal Revenue Code; G. All records, if any, of determinations or decisions made that I am an individual who is, or was, required to pay a tax, keep records and/or submit forms to the national government of the United States of America or to the Internal Revenue Service; H. All records, if any, of determinations or decisions made that I am an individual taxable under the revenue laws of the national government of the United States of America; I. All records, if any, of determinations or decisions asserting that I am a tax protester;

J. The documents that reflect the name, title business address, bond number and delegation of authority to make such determinations or decisions of each and every person who made the determinations or decisions referred to in items lettered B through I above; K. The documents that reflect the name, title business address, bond number and delegation of authority of each and every supervisor of the persons referred to in item lettered J above; L. The specific documents of fact relied upon in the making of all the above itemized determinations or decisions referred to in items lettered B through I above, which shall include, but shall not be limited to, any contracts or waivers of rights submitted by me likely misinformed private American citizen; M. The specific documents of fact relied upon to support any determination or allegation that I am protesting a tax and which would reflect whether I am allegedly protesting a capitation tax, a property tax or a tax on a revenue taxable activity; N. Any and all documents including but not limited to statutes, which provided the basis upon which the determinations and decisions referred to in items lettered B through I above were made and which identify the subject of the purported tax and which specifically identify the subject of the purported tax as either people, property or activities; O. Any and all documents classified as returns, including, but not limited to, so-called dummy returns, so-called substitute for returns and/or so-called information returns, if any, which have been filed in my name; P. Any and all documents classified as assessments, if any, pertaining to me;

Q. Any and all documents classified as Notices and Demands, if any, for payments which pertain to me; R. Any and all documents classified as Notices sent to me to the effect that I am one who is required to pay such tax or submit forms, including, but not limited to, any and all notices which provided an opportunity for a hearing wherein certain issues of law can be addressed by an impartial person who is competent to address issues of law and wherein all due process of law requirements would be met;

S. Any and all documents that reflect the name, business address, bond number and delegation of authority of each and every person who made such returns, made such assessments, and sent such notices and demands, if any, referred to in items lettered O through R above; T. Any and all documents that reflect the name, business address, bond number and delegation of authority of each and every supervisor of the persons referred to in item lettered S above; U. Any and all documents that reflect the name, business address, bond number and delegation of authority of each and every person who provided legal counsel to the Secretary of the Treasury and/or any of his delegates regarding any and all of the determinations, decisions and documents referred to herein; V. Any and all documents, statutes or regulations, if such exist, which identify the individual, if any exist, who has the authority to determine whether or not I am subject to or liable for any revenue tax. (This is to be distinguished from authority to determine the liability (amount of tax due) from one who is subject to or liable for a revenue tax.); W. Any and all documents, statutes or regulations, if such exist, which make me subject to or liable for a revenue tax. X. Any and all documents, statutes or regulations, if such exist, which detail and explain how I came within the taxing jurisdiction or authority of the national government of the United States of America and/or to the Internal Revenue Service; Y. Any and all documents, statutes or regulations, if such exist, which show specifically how I came to have a legal obligation, if any, to the national government of the United States of America and/or to the Internal Revenue Service; Z. Any and all documents, statutes or regulations, if such exist, which show that I was required by law to make a tax return, or a report of income, and/or to pay a tax to the national government of the United States of America and/or the Internal Revenue Service; AA. Any and all documents, statutes or regulations, if such exist, which detail or show that I was involved in some activity that is a lawful subject of taxation and which statute, if any, under the laws of the national government of the United States of America, that imposes a tax on that activity; BB. Any and all documents, statutes or regulations, if such exist, which show or explain how I come within a taxable class under the laws of the national government of the United States of America; CC. Any and all documents, statutes or regulations, if such exist, which show or explain how, by merely exercising my right to work, I came within the taxing authority of the national government of the United States of America; DD. Any and all documents, statutes or regulations, if such exist, which show or explain what activity I am involved in or what event has taken place, if any, that obligates me to enter into the purview of a

taxing scheme that requires the waiver of my rights as guaranteed under the Fourth and Fifth Amendments of the United States Constitution; EE. Any and all documents, statutes or regulations, if such exist, which were signed by me, if any exist, which constitutes the basis for a presumption that I am one who is liable for or subject to a revenue tax and required to submit forms, books and records to the national government of the United States of America and/or the Internal Revenue Service; note my Notice of Revocation of Signatures and Affidavit in Support Thereof, previously submitted and recorded upon the public record. FF. All writings, including but not limited to, reports proposed to be offered into evidence in the event a case were taken to a court of law or a hearing wherein all due process of law requirements will be met; GG. All other writings or things relevant and admissible in evidence; and HH. Copies of, or the opportunity to copy all statutes, rules, regulations, procedures and all other documents affecting and relating to the procedures installed by or for the Internal Revenue Service to protect the rights of natural men and women who are neither liable for nor subject to a revenue tax.

I expect those demanded documents and/or records to be organized in an intelligible manner, such that they are capable of being read and understood by one possessing average skills, intellect and training. Note that none of the information I am requesting is privileged, and you must organize it in such a way to where each of the items requested is specifically identified. If for some reason any part of those demanded documents and/or records are codified in such a manner that they cannot be readily understood, I expect to receive, additionally, all required decoding documents and/or records. Make sure that you provide an itemized list of any of the above items you are unable to produce.

This request for Discovery is submitted with the utmost respect for the compilers of requested documents and information.

Sincerely, ___________________________ Mark-Everett :Austin Presenter

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- State of New Mexico Order Small ClaimsDocument1 pageState of New Mexico Order Small ClaimsMark AustinNo ratings yet

- Dear Ms GreenDocument16 pagesDear Ms GreenMark AustinNo ratings yet

- Temples of Baal 9th Edition by Sir David AndrewDocument15 pagesTemples of Baal 9th Edition by Sir David AndrewshamanjagNo ratings yet

- Fighting Collections 1Document1 pageFighting Collections 1Mark AustinNo ratings yet

- State of New Mexico Order Small Claims SummonsDocument1 pageState of New Mexico Order Small Claims SummonsMark AustinNo ratings yet

- Cover Letter Cease and Desist Abusive Collection IRS ScrubbedDocument2 pagesCover Letter Cease and Desist Abusive Collection IRS ScrubbedMark AustinNo ratings yet

- Exhibit C Mem of Law Bank FraudDocument39 pagesExhibit C Mem of Law Bank Fraudzigzag7842611100% (13)

- 0000 Aab - 7 Small Claims Action Mark V Irs, Mej B Third PersonDocument6 pages0000 Aab - 7 Small Claims Action Mark V Irs, Mej B Third PersonMark AustinNo ratings yet

- AA Notice and Demand 11-15-2012 ScrubbedDocument15 pagesAA Notice and Demand 11-15-2012 ScrubbedMark AustinNo ratings yet

- Incorrect Foundational Presumptions That Make You Lose in A ForeclosureDocument2 pagesIncorrect Foundational Presumptions That Make You Lose in A ForeclosureMark AustinNo ratings yet

- AA Constructive Securities Fraud Letter10!14!2012 ScrubbedDocument11 pagesAA Constructive Securities Fraud Letter10!14!2012 ScrubbedMark AustinNo ratings yet

- Four Corners Bank AffidavitDocument1 pageFour Corners Bank AffidavitMark AustinNo ratings yet

- IRS Commissioner Letter Disputing Tax LevyDocument3 pagesIRS Commissioner Letter Disputing Tax LevyMark Austin83% (6)

- Maritime LienDocument1 pageMaritime LienMark Austin100% (6)

- Amendments Bullet Point Fred and NinaDocument3 pagesAmendments Bullet Point Fred and NinaMark AustinNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Larken Rose: Taxable IncomeDocument48 pagesLarken Rose: Taxable Incomefredlox100% (1)

- Widow Appeals Deficiency Tax Assessments Due to Lack of Accounting RecordsDocument2 pagesWidow Appeals Deficiency Tax Assessments Due to Lack of Accounting RecordsLDNo ratings yet

- Va Grantor Trust Outline 010711Document48 pagesVa Grantor Trust Outline 010711Bob MasonNo ratings yet

- Solution Manual For Pearsons Federal Taxation 2019 Corporations Partnerships Estates and Trusts 32nd Edition Timothy J Rupert Kenneth e AndersonDocument37 pagesSolution Manual For Pearsons Federal Taxation 2019 Corporations Partnerships Estates and Trusts 32nd Edition Timothy J Rupert Kenneth e Andersonalwalshyq40100% (13)

- Part2 Revenue Regulations 2018Document194 pagesPart2 Revenue Regulations 2018April CaringalNo ratings yet

- PAGCOR v. BIRDocument26 pagesPAGCOR v. BIRAronJamesNo ratings yet

- X Western Vs Cir Case Digest OkDocument2 pagesX Western Vs Cir Case Digest OkIvan Montealegre ConchasNo ratings yet

- ITAD Ruling No 018-09Document11 pagesITAD Ruling No 018-09Peggy SalazarNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 3-2013 Issued On January 9, 2013 ClarifiesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 3-2013 Issued On January 9, 2013 ClarifiesmonarequillasNo ratings yet

- 12 568bk PDFDocument60 pages12 568bk PDFAReliableSourceNo ratings yet

- ID: Office: Uilc: CCA - 2009022415150040 Number: 200912025 Release Date: 3/20/2009Document1 pageID: Office: Uilc: CCA - 2009022415150040 Number: 200912025 Release Date: 3/20/2009taxcrunchNo ratings yet

- Sample Research Memo#1 ACC430Document4 pagesSample Research Memo#1 ACC430jakeieNo ratings yet

- Republic Act No. 10026Document2 pagesRepublic Act No. 10026Jesse Myl MarciaNo ratings yet

- People Vs Sindiong & PastorDocument4 pagesPeople Vs Sindiong & PastorErby Jennifer Sotelo-GesellNo ratings yet

- CIR v. Cebu Portland Cement CoDocument4 pagesCIR v. Cebu Portland Cement CoPaddy PaulinNo ratings yet

- Myrna Labow v. Commissioner of Internal Revenue, Ronald Labow v. Commissioner of Internal Revenue, 763 F.2d 125, 2d Cir. (1985)Document12 pagesMyrna Labow v. Commissioner of Internal Revenue, Ronald Labow v. Commissioner of Internal Revenue, 763 F.2d 125, 2d Cir. (1985)Scribd Government DocsNo ratings yet

- IRC Section 7701Document18 pagesIRC Section 7701EDC AdminNo ratings yet

- Dev Evidence of CitizenshipDocument84 pagesDev Evidence of CitizenshipElisabeth JohnsonNo ratings yet

- Tax CodeDocument160 pagesTax CodeMark Anthony ManuelNo ratings yet

- The Tax Freedom Solutions Manual PDFDocument72 pagesThe Tax Freedom Solutions Manual PDFcioparNo ratings yet

- Oregon Revenue Bulletin Explains State Tax Disconnect from Federal LawDocument3 pagesOregon Revenue Bulletin Explains State Tax Disconnect from Federal Lawrahul anjaliNo ratings yet

- Taxation Law by Abelardo DomondonDocument85 pagesTaxation Law by Abelardo DomondonDonna Hill100% (2)

- 508 Vs 501Document6 pages508 Vs 501Koop Got Da KeysNo ratings yet

- HB04102 Third Reading Sent To Senate ApprovedDocument3 pagesHB04102 Third Reading Sent To Senate ApprovedGladys Eleonor SaulonNo ratings yet

- PLDT Legislative FranchiseDocument6 pagesPLDT Legislative FranchiseTetay MendozaNo ratings yet

- Db2012 UCC Security Agreement TemplateDocument26 pagesDb2012 UCC Security Agreement TemplateMaryann Wallace100% (5)

- Audit Reconsideration Memorandum Baker SCRIBDDocument7 pagesAudit Reconsideration Memorandum Baker SCRIBDMichael AlaoNo ratings yet

- Tax Law Review CasesDocument9 pagesTax Law Review CasesJohn Patrick IsraelNo ratings yet

- G.R. No. L-45425 Income Tax CaseDocument12 pagesG.R. No. L-45425 Income Tax Casemar corNo ratings yet

- United States v. Joseph Aracri, John Papandon, and Anthony Zummo, 968 F.2d 1512, 2d Cir. (1992)Document19 pagesUnited States v. Joseph Aracri, John Papandon, and Anthony Zummo, 968 F.2d 1512, 2d Cir. (1992)Scribd Government DocsNo ratings yet