Professional Documents

Culture Documents

Internal Control For Rev Cycle

Uploaded by

Hannah AngOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal Control For Rev Cycle

Uploaded by

Hannah AngCopyright:

Available Formats

General

Policies and procedures for credit and collections management should be clearly documented and communicated.

Credit Assessment The credit worthiness of all new credit customers should be evaluated and documented for approvals in the credit assessment forms. Credit limits of customers must be approved in accordance with the DOA. The credit assessments should include at least two of the following: - Analysis of customers latest available financial statements or credit rating agencys reviews - Understanding customers management and business - Personal guarantee - Site visit Credit ratings of one to six should be specified for each customer based on the credit assessments. Customer credit terms and limits should be granted based on the credit ratings. Overrides to the credit rules should be approved in accordance with the authority levels. Credit assessments for all major customers should be updated annually.

No delivery order should be generated by the system if the relevant customers had trade debts exceeding either their credit terms or credit limits. Overrides require pre-approval from both the Divisional Director and Finance Manager before the orders can be processed.

Sales, Invoicing and Recording Price and volume discounts should be approved in accordance with the authority levels. Sales orders should be evaluated to ensure compliance with approved credit limits. Outstanding sales orders should be monitored daily for their progress and status. All Delivery Orders should be matched with Invoices and Customers Purchase Orders. All Credit Notes should be supported and approved in accordance with the authority levels. There should be sequential control over all Invoices, Credit Notes, Delivery Orders and Goods Returned Notes. Collections and Bad debts

Monthly debtors ageing reports showing old debts beyond credit period should be generated for monthly credit review.

Follow up actions for long outstanding debts should be established and documented during credit review meetings. Follow-up actions should include sending of reminder/warning letters and, ultimately legal letters as a last resort.

All debtors write-off should be approved by both the Group MD or Group FD in accordance with the DOA.

Customer statements should be mailed monthly to customers. Disputes must be investigated and resolved within two weeks and monitored by Functional Manager independent of sales function.

Credit Notes Issue

Credit notes should be approved by Functional Managers independent of sales function. Credit notes are sequentially controlled.

Reconciliation

Debtors ageing report should be reconciled to the GL monthly and reviewed by Finance Manager.

Segregation of Duties

There should be segregation of duties between the following functions:

- Credit control - Credit notes - Collections - Accounts receivable Delegation of Authority (DOA)

The documented DOA should cover the authority to:

- New credit customers - Credit limits and terms, and overrides to the credit rule - Sales orders - Bad debt provision and write-off - Credit note issues

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 76 - Going To The Bank - USDocument12 pages76 - Going To The Bank - USCarlos Muñoz100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- UGRD ENG6203 Engineering Economics Legit Not QuiezessDocument8 pagesUGRD ENG6203 Engineering Economics Legit Not QuiezessJitlee PapaNo ratings yet

- Corporate LiquidationDocument9 pagesCorporate Liquidationacctg2012100% (2)

- Gaas and SQCDocument5 pagesGaas and SQCemc2_mcv100% (1)

- Audit of ReceivableDocument26 pagesAudit of ReceivableHannah AngNo ratings yet

- Joint Rules Implementing R.A. 9520 or The Cooperative Code of The PhilippinesDocument14 pagesJoint Rules Implementing R.A. 9520 or The Cooperative Code of The PhilippinesEdd N Ros AdlawanNo ratings yet

- Audit PlanningDocument26 pagesAudit PlanningHannah AngNo ratings yet

- @ Palangkaraya - Swiss Bel HotelDocument2 pages@ Palangkaraya - Swiss Bel Hotelyasa sabaNo ratings yet

- FRP - MoA For BanksDocument104 pagesFRP - MoA For BanksHannah AngNo ratings yet

- Auditing TheoryDocument2 pagesAuditing TheoryHannah AngNo ratings yet

- Albaran, Ian Christopher BSA - 4C Ang, Hannah Jay PHILO 107 Talite, LouieDocument2 pagesAlbaran, Ian Christopher BSA - 4C Ang, Hannah Jay PHILO 107 Talite, LouieHannah AngNo ratings yet

- Audit and AssuranceDocument18 pagesAudit and AssuranceHannah AngNo ratings yet

- Chapter 07 AnsDocument5 pagesChapter 07 AnsDave Manalo100% (1)

- PhiloDocument6 pagesPhiloHannah AngNo ratings yet

- Feasibility StudyDocument6 pagesFeasibility StudyHannah AngNo ratings yet

- UC Davis Eye Department Newsletter Fall 2003Document8 pagesUC Davis Eye Department Newsletter Fall 2003Hannah AngNo ratings yet

- Run With SAP Business One: Simple Yet PowerfulDocument8 pagesRun With SAP Business One: Simple Yet PowerfulHannah AngNo ratings yet

- Moral DescriptionDocument13 pagesMoral DescriptionHannah AngNo ratings yet

- The Power of Love - Essay by Dr. Benito FDocument6 pagesThe Power of Love - Essay by Dr. Benito FHannah AngNo ratings yet

- AssetsDocument2 pagesAssetsHannah AngNo ratings yet

- Solution - INCOME Problems 9 To 15Document2 pagesSolution - INCOME Problems 9 To 15Hannah AngNo ratings yet

- Essentials of Strategic ManagementDocument22 pagesEssentials of Strategic ManagementManivannancNo ratings yet

- Sources of Short-Term Financing: Mcgraw-Hill/IrwinDocument35 pagesSources of Short-Term Financing: Mcgraw-Hill/IrwinHannah AngNo ratings yet

- Delena PlaylistDocument2 pagesDelena PlaylistHannah AngNo ratings yet

- Natl NGAS AnnexesDocument21 pagesNatl NGAS AnnexesJulmane Plaza100% (1)

- JOURNAL, LEDGER AND TRIAL BALANCEDocument6 pagesJOURNAL, LEDGER AND TRIAL BALANCEZargham Durrani50% (2)

- Research ProposalDocument11 pagesResearch ProposalHabtemichael ShimalesNo ratings yet

- Friday, 26 Aug 2016, 03:55Pm: Efixed Deposit/Eterm Deposit-I: Account Number: Principal AmountDocument4 pagesFriday, 26 Aug 2016, 03:55Pm: Efixed Deposit/Eterm Deposit-I: Account Number: Principal AmountIDA MUSZNo ratings yet

- TH4457CDDocument131 pagesTH4457CDSharad AcharyaNo ratings yet

- IIHMR Question PapersDocument1 pageIIHMR Question PapersRishi TripathiNo ratings yet

- Module Far1 Unit-1 Part-1c.1Document6 pagesModule Far1 Unit-1 Part-1c.1Hazel Jane EsclamadaNo ratings yet

- Maximize EPSDocument19 pagesMaximize EPSPrashant SharmaNo ratings yet

- Australiansuper: Product Disclosure StatementDocument32 pagesAustraliansuper: Product Disclosure StatementNick KNo ratings yet

- Financial StatementDocument6 pagesFinancial StatementErmias Assaminew AlmazNo ratings yet

- The Impact of Stock Market On Indian EconomyDocument6 pagesThe Impact of Stock Market On Indian EconomyIJRASETPublicationsNo ratings yet

- Accounting Class Test: Topic: Depreciation-1Document2 pagesAccounting Class Test: Topic: Depreciation-1Radia Khandaker ProvaNo ratings yet

- Karakteristik Perjanjian Jual Beli Medium Term Notes: Universitas AirlanggaDocument20 pagesKarakteristik Perjanjian Jual Beli Medium Term Notes: Universitas AirlanggaMuhammad Rexel Abdi ZulfikarNo ratings yet

- LN-Session 2-Chapter 3-How Securities Are TradedDocument72 pagesLN-Session 2-Chapter 3-How Securities Are Tradedchaudhari vishalNo ratings yet

- 2307 PDFDocument2 pages2307 PDFAnonymous BVowhxQPNo ratings yet

- Arima Kousei QuizDocument2 pagesArima Kousei QuizKen Alob100% (1)

- Cyprus Isn't Even Such A Big Offshore Bank HavenDocument2 pagesCyprus Isn't Even Such A Big Offshore Bank HavenAna MariaNo ratings yet

- Final Doc of Management AssignmentDocument10 pagesFinal Doc of Management AssignmentrasithapradeepNo ratings yet

- Understanding Yield Curves and How They Impact InvestingDocument8 pagesUnderstanding Yield Curves and How They Impact InvestingThúy LêNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- Summer Internship ProjectDocument9 pagesSummer Internship Projectpranjali shindeNo ratings yet

- Corporate ValuationDocument42 pagesCorporate ValuationPrasannakumar SNo ratings yet

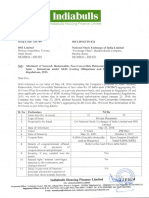

- Allotment of NCD's (Company Update)Document2 pagesAllotment of NCD's (Company Update)Shyam SunderNo ratings yet

- Economics+3 04+Making+a+Budget+and+Savings+PlanDocument6 pagesEconomics+3 04+Making+a+Budget+and+Savings+Plansylvia seletoNo ratings yet

- Petitioner vs. vs. Respondents Agapito S. Fajardo Marino E. Eslao Leovillo C. AgustinDocument6 pagesPetitioner vs. vs. Respondents Agapito S. Fajardo Marino E. Eslao Leovillo C. AgustinKarina GarciaNo ratings yet

- IFM 2023 24 Session 1 SlidesDocument20 pagesIFM 2023 24 Session 1 SlidesAaryan SarupriaNo ratings yet

- Philstocks - PH: Customer Account Information FormDocument3 pagesPhilstocks - PH: Customer Account Information FormJayson Moreto VillavicencioNo ratings yet