Professional Documents

Culture Documents

Answers To Assignment 1 and Problem Exercises Taxation2

Uploaded by

anon_522320850Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answers To Assignment 1 and Problem Exercises Taxation2

Uploaded by

anon_522320850Copyright:

Available Formats

ANSWERS TO ASSIGNMENT 1 AND PROBLEM EXERCISES Taxation2 Mr.

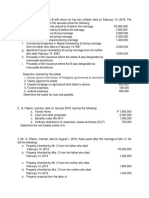

Salvador, Filipino, married on December 4, 1984, died on April 23, 1999 leaving the following property and expenses: Conjugal property: Personal property Apartment and lot Other property: Mode of acquisition: FMV-time of death Land inheritance P100,000 Jeep inheritance 20,000 San Miguel shares Donation 300,000 Claimed as deductions: Funeral expenses Mortgage on apartment and lot Loss of jeep 1. P 50,000 300,000 20,000 P1,300,000 1,000,000 date: 4/30/97 4/30/97 1/30/93 FMV-acquisition P50,000 100,000 400,000

The amount of P70,000 of the mortgage on the apartment and lot remain unpaid at the time of Mr. Salvadors death The land inherited had a mortgage of P30,000 which Mr. Salvador paid before he died The jeep was carnapped on November 4, 1999 Gross estate is:

a. 2.

P2,420,000

b. 2, 300,000

c. 2,720,000

d. 2,670,000

Vanishing Deduction is : a. P38,235 b. P 30,588 c. P 86,029.42 d. P 68,823.53

3.

Share of surviving spouse: a. P1,150,000 b. 2,180,000 c. 2,300,000 d. 1,090,000

4.

Net taxable estate is : a. P 2,569,412 b. P 419,412 c. 479,412 d.2,600,000

Solution : EXCLUSIVE TOTAL Gross Estate Personal property Apartment and Lot P 2,300,000 Land Jeep San Miguel shares 420,000 Total 2,720,000 Less: Ordinary Deductions P 1, 300,000 1,000,000 P 100,000 20,000 300,000 P420,000 CONJUGAL

_________ 2,300,000

Funeral (50,000) Unpaid mortgage on apartment & lot (70,000) Vanishing Deduction* (30,588) Net exclusive/conj estate P P 2,569,412

(50,000) (70,000) (30,588) 389,412 _________ P 2,180,000

Less: Special Deductions Standard Deduction (1,000,000) Net Estate 1,569,412 Less: share of surviving spouse (1/2 of 2180,000) ( 1,090,000) Net taxable estate P 479,412 *Schedule of Vanishing Deduction initial value Land Jeep Less: mortgage paid 40,000/2,720,000 x 120,000 Final Basis of vanishing deductions Vanishing Deductions (80%) For Nos. 24 -25, see problem below: Mr. Laurel, Filipino, married on December 4, 1989 died on Nov. 2, 1999. An inventory of the spouses property, expenses, charges and obligations follow: Acquired by purchase of Mr Laurel before the marriage: Lot with apartment in Quezon City Lot with apartment in Guadalupe, Makati P1,500,000 Farm in Nueva Ecija inherited during the marriage by Mr. Laurel 600,000 Deductions: Judicial expenses Unpaid mortgage on farm Funeral expenses Unpaid mortgage on fishpond Legacy to City of Makati Accounts payable to a communal Creditor Fire loss on apartment in Makati 5. Net Taxable Estate is: a. 6. P 350,000 b. P650,000 c. 2,950,000 d. P1,950,000 P200,000 150,000 100,000 100,000 100,000 70,000 30,000 P1,800,000 1,200,000 P 50,000 20,000

P70,000 30,000 40,000 1,765 P38,235 P30,588

Fishpond in Bulacan inherited during the marriage by Mrs. Laurel

Estate Tax is: a. P27,000 b. P7,500 c. P 239,500 d. P 131,000

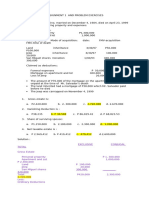

Solution:

EXCLUSIVE TOTAL Gross Estate Lot with apartment, QC Lot w/apartment, Makati P 3,000,000 Farm, nueva ecija 600,000 Total P 3,600,000

COMMUNITY

P 1, 800,000 1,200,000 P 600,000 P 600,000 P3,000,000

Less: Ordinary Deductions Funeral P 100,000 Judicial Expense 200,000 Accounts Payable 70,000 Fire Loss 30,000 Unpaid mortgage on farm P150,000 P150,000 Legacy to Makati City 100,000 100,000 Net exclusive/community estate P350,000 P2,950,000 Less: Special Deductions Standard Deduction (1,000,000) Net Estate P 1,950,000 Less: share of surviving spouse (1/2 of2,600,000) P1,300,000 Net taxable estate P 650,000 Estate Tax Due on 500,000 150,000 x 8% P650,000 15,000 12,000 27,000

P 100,000 200,000 70,000 30,000

P2, 600,000

PROBLEM EXERCISES QUESTION NO. 1 Mr. Benjamin Borja, a citizen and a resident of the Philippines, died on October 10, 2009, leaving the following properties, rights and obligations and charges: Conjugal properties (including family home of P3, 000,000 and amount receivable P6,000,000 Under RA 4917 of P200,000) Exclusive properties (including cash of P500,000 inherited 4 years ago) 4,000,000 Medical expenses unpaid, January 2009 600,000 Funeral expenses 350,000 Judicial expenses 500,000 Other obligations 100,000 The net taxable estate is:

a. P3,808,000 b. P5,058,000 c. P1,150,000 d. P2,250,000

QUESTION NO. 2 Mr. Armand Costales, a citizen and a resident of the Philippines, died on October 5, 2009. He was married and the property relationship during the marriage was the absolute community of property. He left the following properties, with the market value and the obligations and charges thereon: Agricultural land House and lot acquired by inheritance before the marriage and 4 1/2 yrs ago, used as a family home(with FMV of 420,000 and a mortgage of 120,000 when acquired, 20,000 was paid by mr. Costales before he died) Jewelry of mrs. costales, acquired during the marriage With the income of mr. Costales Clothes acquired during the marriage with income During the marriage: For use of mr. Costales For use of mrs. Costales Cash on hand and in banks: income from unidentified sources Sources Cash in bank: From a sale at a loss of exclusive property Received as gift 6 years ago and before the marriage (current account) Other properties: Owned before the marriage Acquired during the marriage Total funeral expenses of P300,000 paid from the estate Judicial expenses Unpaid mortgage (already on the property at the time acquired) on : agricultural land house and lot Other obligations Legacy to the Philippine Govt (from current account) The net taxable estate is: a. b. c. d. P 660,932.33 857,310.34 698,620.70 767,310.34 P100,000

500,000 50,000 60,000 70,000 300,000 1,500,000 40,000 90,000 20,000 P58,000 120,000 20,000 100,000 20,000 10,000

QUESTION NO. 3 Country A: Net estate of P100,000 and estate tax paid of P8,000; Country B: Net estate of P200,000 and estate tax paid of P12,000; Philippines: Net estate of P1,200,000. The decedent was a resident and a citizen of the Philippines. Estate tax paid for foreign estate taxes paid? a. b. c. d. P19,000 18,333.33 20,000 12,000

You might also like

- CH9 Estate TaxDocument40 pagesCH9 Estate TaxZtrick 123472% (18)

- 15 MCQ Estate Taxation WITH ANSWERS PDFDocument4 pages15 MCQ Estate Taxation WITH ANSWERS PDFChincel G. ANI50% (2)

- MR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheDocument3 pagesMR A, Filipino, Married To B With Whom He Has Two Children Died On February 14, 2018. TheSharjaaah100% (2)

- University of Batangas Estate Tax: Multiple Choice ExercisesDocument5 pagesUniversity of Batangas Estate Tax: Multiple Choice ExercisesEdnel Loterte100% (1)

- Taxation - Donors-Tax - Quizzer - 2018Document6 pagesTaxation - Donors-Tax - Quizzer - 2018Kenneth Bryan Tegerero Tegio67% (6)

- Estate TaxDocument21 pagesEstate Taxjustin_bb100% (7)

- CPAR - TAX7411 - Estate Tax With Answer PDFDocument6 pagesCPAR - TAX7411 - Estate Tax With Answer PDFAngelo Villadores92% (12)

- Set BDocument4 pagesSet BMeresa HernandezNo ratings yet

- Taxrev Final Exam-InovictusDocument16 pagesTaxrev Final Exam-InovictusNikki GarciaNo ratings yet

- Estate TaxDocument18 pagesEstate TaxLindbergh Sy67% (3)

- NFI Marketing Plan TemplateDocument6 pagesNFI Marketing Plan TemplateKatharina SumantriNo ratings yet

- Pe On Estate TaxDocument25 pagesPe On Estate TaxErica NicolasuraNo ratings yet

- ProblemsDocument9 pagesProblemsAiza OrdoñoNo ratings yet

- Procedure in Computing Vanishing DeductionDocument5 pagesProcedure in Computing Vanishing DeductionDon Tiansay100% (5)

- Donors' TaxDocument4 pagesDonors' TaxJohn Brian D. SorianoNo ratings yet

- Gross Estate ProblemsDocument17 pagesGross Estate ProblemsLloyd Sonica100% (1)

- TaxationDocument18 pagesTaxationMags Morten Malatamban100% (2)

- Sample Problems - Donors TaxDocument3 pagesSample Problems - Donors TaxDidhane Martinez100% (2)

- Donors Tax (Banggawan)Document11 pagesDonors Tax (Banggawan)Ja FranciscoNo ratings yet

- Donor S Tax Exam - Answers4Document5 pagesDonor S Tax Exam - Answers4Ednel Loterte100% (2)

- Financial Markets and InstitutionsDocument4 pagesFinancial Markets and InstitutionsRA T UL100% (1)

- AUP Liabilities AC42 PDFDocument26 pagesAUP Liabilities AC42 PDFRosalio RuelanNo ratings yet

- Chapter 3 - Deductions From The Gross EstateDocument22 pagesChapter 3 - Deductions From The Gross EstateAngelika BalmeoNo ratings yet

- CHAPTER 15 - Transfer Business TaxDocument9 pagesCHAPTER 15 - Transfer Business TaxKatKat Olarte67% (3)

- Chapter 15 - Estate Tax Payable: Multiple Choice - TheoryDocument12 pagesChapter 15 - Estate Tax Payable: Multiple Choice - TheorytruthNo ratings yet

- Estate Tax101Document14 pagesEstate Tax101Alexandra Garcia100% (3)

- Donor's Tax Quizzer-2Document5 pagesDonor's Tax Quizzer-2Monina Cabalag0% (1)

- Chapter 12-13A-B - EtDocument27 pagesChapter 12-13A-B - EtJCNo ratings yet

- Taxation Material 3Document11 pagesTaxation Material 3Shaira BugayongNo ratings yet

- Gross Estate of Married DecedentDocument10 pagesGross Estate of Married Decedentbeverlyrtan85% (13)

- Estate Tax ProblemDocument2 pagesEstate Tax ProblemClaricel JoyNo ratings yet

- Estate TaxDocument21 pagesEstate TaxPatrick ArazoNo ratings yet

- Taxation Atty. Macmod, C.P.A. Estate TaxDocument7 pagesTaxation Atty. Macmod, C.P.A. Estate TaxJohn Brian D. SorianoNo ratings yet

- 1 Intro DonationDocument27 pages1 Intro DonationMae NamocNo ratings yet

- CHAPTER 13A - Transfer and Business TaxDocument20 pagesCHAPTER 13A - Transfer and Business TaxKatKat Olarte80% (5)

- Estate Tax PrelimsDocument28 pagesEstate Tax PrelimsSeanmigue TomaroyNo ratings yet

- Reinforcement in Business TaxationDocument24 pagesReinforcement in Business TaxationTulungan Para sa Modular at Online Classes0% (1)

- Activity in Excise TaxDocument2 pagesActivity in Excise TaxLucy Heartfilia67% (3)

- Chapter 13B Transfer TaxDocument14 pagesChapter 13B Transfer TaxMark Gilbert Quintero100% (1)

- Deductions From Gross Estate - PhilippinesDocument70 pagesDeductions From Gross Estate - PhilippinesiLoveMarshaNo ratings yet

- Donors Tax Problem 1 With SolutionDocument4 pagesDonors Tax Problem 1 With SolutionAngel DaohogNo ratings yet

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- Computation of Net Taxable Estate & Estate Tax Due If Decedent Was Married With Surviving SpouseDocument1 pageComputation of Net Taxable Estate & Estate Tax Due If Decedent Was Married With Surviving SpouseanneNo ratings yet

- CPA RevieweDocument93 pagesCPA RevieweMARIA50% (2)

- Tax2 DQ4Document17 pagesTax2 DQ4Kurt dela Torre100% (1)

- Individual Income TaxDocument4 pagesIndividual Income TaxCristopher Romero Danlog0% (1)

- Tax2 Midterm ExamDocument13 pagesTax2 Midterm ExamRen A Eleponio100% (2)

- DONOR S Tax Multiple Choice Question 1Document13 pagesDONOR S Tax Multiple Choice Question 1Kj Banal80% (5)

- Donors Tax QuizDocument3 pagesDonors Tax QuizPrecious Diamond DeeNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Acp and CPG QuizDocument6 pagesAcp and CPG QuizCarina Mae Valdez Valencia0% (1)

- Mr. NA DEDO, A Citizen and Resident of The Philippines, Died On October 10Document3 pagesMr. NA DEDO, A Citizen and Resident of The Philippines, Died On October 10Ren A EleponioNo ratings yet

- TaxationDocument7 pagesTaxationAltair ColtraineNo ratings yet

- Practice Set 1Document4 pagesPractice Set 1Shiela Mae BautistaNo ratings yet

- Estate Tax - Exercises On Allowable Deduction and Taxable Net EstateDocument5 pagesEstate Tax - Exercises On Allowable Deduction and Taxable Net EstateGileah ZuasolaNo ratings yet

- 16Document11 pages16Sheie WiseNo ratings yet

- Integrative Course For Taxation Ateneo de Zamboanga University Accountancy Department Estate TaxDocument3 pagesIntegrative Course For Taxation Ateneo de Zamboanga University Accountancy Department Estate TaxElizabeth ApolonioNo ratings yet

- BusTax Chap 3Document16 pagesBusTax Chap 3Lisa ManobanNo ratings yet

- Transfer Taxes Multiple Choice ProblemsDocument14 pagesTransfer Taxes Multiple Choice Problemsnbragas0% (1)

- Finals Business TaxationDocument5 pagesFinals Business TaxationSherwin DueNo ratings yet

- Copy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditDocument2 pagesCopy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditMitsuke MitsukeNo ratings yet

- Donor's Tax - 1Document3 pagesDonor's Tax - 1Crayon LloydNo ratings yet

- Estate Tax (Single) ReportDocument18 pagesEstate Tax (Single) ReportPatricia RodriguezNo ratings yet

- TD1 - Time Value of Money 2018 (Solution) PDFDocument9 pagesTD1 - Time Value of Money 2018 (Solution) PDFJihen SmariNo ratings yet

- Business Law: Case Studies Law of ContractsDocument50 pagesBusiness Law: Case Studies Law of ContractsShiva MehtaNo ratings yet

- What Makes A Good LoaNDocument25 pagesWhat Makes A Good LoaNrajin_rammsteinNo ratings yet

- Maria Lachica vs. Gregorio Araneta: Page - 1Document21 pagesMaria Lachica vs. Gregorio Araneta: Page - 1charmae casilNo ratings yet

- Form of Value #8: Audience AggregationDocument3 pagesForm of Value #8: Audience Aggregationsujan tumbapoNo ratings yet

- Flores, Mariano Perez Case DigestDocument22 pagesFlores, Mariano Perez Case DigestMarianoFlores100% (1)

- Internal Management of Co.: Doctrine of Constructive NoticeDocument57 pagesInternal Management of Co.: Doctrine of Constructive NoticegauravNo ratings yet

- Legal Forms-Contracts and AgreementsDocument115 pagesLegal Forms-Contracts and AgreementsNiko Mangaoil Aguilar100% (2)

- Quijano V DBPDocument2 pagesQuijano V DBPAnsai Calugan100% (2)

- Literature On Personal Debt ManagementDocument16 pagesLiterature On Personal Debt ManagementANNKNo ratings yet

- TranspoDocument2 pagesTranspoFrancisNo ratings yet

- Financial Institutions and Markets - AssignmentDocument7 pagesFinancial Institutions and Markets - AssignmentAkshatNo ratings yet

- Solved When A College Student Complained About A Particular Course TheDocument1 pageSolved When A College Student Complained About A Particular Course TheAnbu jaromiaNo ratings yet

- OLAF N. BORLOUGH, Petitioner, vs. FORTUNE ENTERPRISESDocument1 pageOLAF N. BORLOUGH, Petitioner, vs. FORTUNE ENTERPRISESBenedict EstrellaNo ratings yet

- PA v0.25Document18 pagesPA v0.25Sai PawanNo ratings yet

- 02 FABM1 Module1 - Lesson2 Independent AssessmentDocument2 pages02 FABM1 Module1 - Lesson2 Independent AssessmentAtasha Nicole G. BahandeNo ratings yet

- CasesDocument20 pagesCasesShanon CristyNo ratings yet

- CANCELLATION OF REAL ESTATE MORTGAGE Annex ADocument3 pagesCANCELLATION OF REAL ESTATE MORTGAGE Annex ACybill Astrids Rey RectoNo ratings yet

- Equity and Trusts Lecturer Series in UgandaDocument114 pagesEquity and Trusts Lecturer Series in Ugandabrian mwereriNo ratings yet

- Villareal Vs Ramirez: FactsDocument17 pagesVillareal Vs Ramirez: FactsNaiza Mae R. BinayaoNo ratings yet

- Employee Provident Fund Act, 2019 (1962) : WWW - Lawcommission.gov - NPDocument38 pagesEmployee Provident Fund Act, 2019 (1962) : WWW - Lawcommission.gov - NPdummy accountNo ratings yet

- Contract of Lease SampleDocument7 pagesContract of Lease SampleGigi TicarNo ratings yet

- Mtu07101 Study Guide QuestionsDocument10 pagesMtu07101 Study Guide QuestionsGeorgeNo ratings yet

- Project Financing in IndiaDocument7 pagesProject Financing in IndiaShrutit21No ratings yet

- Naseman Kristina HO Pol 5.31.18Document15 pagesNaseman Kristina HO Pol 5.31.18kristinabeannNo ratings yet

- Bank Management Koch 8th Edition Solutions ManualDocument8 pagesBank Management Koch 8th Edition Solutions Manualmeghantaylorxzfyijkotm100% (48)

- LAW 3: Regulatory Framework and Legal Issues in Business: (Exit Requirement)Document6 pagesLAW 3: Regulatory Framework and Legal Issues in Business: (Exit Requirement)Jashim UsopNo ratings yet