Professional Documents

Culture Documents

Authoritative Status of Conceptual Framework

Uploaded by

mark_somOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Authoritative Status of Conceptual Framework

Uploaded by

mark_somCopyright:

Available Formats

Authoritative status of Conceptual Framework If there is a standard or an interpretation that specifically applies to a transaction, the standard or interpretation overrides

the Conceptual Framework. In the absence of a standard or an interpretation that specifically applies to a transaction, management shall consider the applicability of the Conceptual Framework in developing and applying an accounting policy that results in information that is relevant and reliable. However, it is to be stated that the Conceptual Framework is not a Philippine Financial Reporting Standard and hence does not define standard for any particular measurements or disclosure issue. Nothing in this Conceptual Framework overrides any specific Philippine Financial Reporting Standard. In case where there is a conflict, the measurements of the Philippine Financial Reporting Standards shall prevail over the Conceptual Framework. Users of Financial information Under the new Conceptual Framework for Financial Reporting, the users of financial information may be classified into two, namely primary users and other users. The primary users include the existing and potential investors, lenders and other creditors. The other users include the employees, customers, governments and their agencies, and the public. Primary users The primary users of financial information are the parties to whom general purpose financial reports are primarily directed. Such users cannot require reporting entities to provide information directly to them and therefore must rely on general purpose financial reports for much of the financial information they need. The primary users and their information needs are as follows: 1. Existing and potential investors Existing and potential investors are concerned with the risk inherent in and return provided by their investments. They need information to help them determine whether they should buy, hold or sell. Shareholders are also interested in information which enables them to assess the ability of the entity to pay dividends. 2. Lenders and other creditors Existing and potential lenders and other creditors are interested in information which enables them to determine whether their loans, interest thereon and other amounts owing to them will be paid when due.

Other users By residual definition, other users are users of financial information other than the existing and potential investors, lenders and other creditors. Other users are so called because they are parties that may find the general purpose financial reports useful but the reports are not directed to them primarily. The other users and their information needs are as follows: 1. Employees Employees are interested in information about the stability and profitability of the entity. They are interested in information which enables them to assess the ability of the entity to provide remuneration, retirement benefits and employment opportunities. 2. Customers Customers have an interest in information about the continuance of an entity especially when they have a long-term involvement with or are dependent on the entity. 3. Governments and other agencies Governments and their agencies are interested in the allocation of resources and therefore the activities of the entity. These users require information to regulate the activities of the entity, determine taxation policies and as a basis for national income and similar statistics. 4. Public Entities affect members of the public in a variety of ways. For example, entities make substantial contribution to the local economy in many ways including the number of people they employ and their patronage of local suppliers. Financial statements may assist the public by providing information about the trend and the range of its activities. Scope of Conceptual Framework The Conceptual Framework deals with the following: a. Objective of financial reporting b. Qualitative characteristics of useful financial information c. Definition, recognition and measurement of the elements from which financial statements are constructed d. Concepts of capital and capital maintenance Financial reporting

Financial reporting is the provision of financial information about an entity to external users that is useful to them in making economic decisions and for assessing the effectiveness of the entitys management. The principal way of providing financial information to external users is through the annual financial statements. However, financial reporting encompasses not only financial statements but also other means of communicating information that relates directly or indirectly to the financial accounting process. Financial reports include not only financial statements but also other information such as financial highlights, summary of important financial figures, analysis of financial statements and significant ratios. Financial reports also include nonfinancial information such as description of major products and a listing of corporate officers and directors. OBJECTIVE OF FINANCIAL REPORTING The objective of general purpose financial reporting forms the foundation of the Conceptual Framework. Other aspects of the Conceptual Framework, such as the qualitative characteristics of useful information and measurement of the elements of financial statements, flow logically from the objective. The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions about providing resources to the entity. Target users General purpose financial reporting is directed primarily to the existing and potential investors, lenders and other creditors which compose the primary user group. The reason is that existing and potential investors, lenders and other creditors have the most critical and immediate need for information in financial reports. As a matter of fact, the primary users of financial information are the parties that provide resources to the entity. Moreover, information that meets the needs of the specified primary users is likely to meet the needs of other users such as employees, customers, governments and their agencies. The management of a reporting entity is also interested in financial information about the entity. However, management need not rely on general purpose financial reports because it is able to obtain or access additional financial information internally.

Specific objectives of financial reporting

The overall objective of financial reporting is to provide information that is useful for decision making. Specifically, the Conceptual Framework for Financial Reporting states the following objectives of financial reporting: a. To provide information useful in making decisions about providing resources to the entity. b. To provide information useful in assessing the prospects of future net cash flows to the entity. c. To provide information about entity resources, claims and changes in resources and claims. Economic decisions Existing and potential investors need general purpose financial reports in order to enable them in making decisions whether to buy, sell or hold equity investments. Existing and potential lenders and other creditors need general purpose financial reports in order to enable them in making decisions whether to provide or settle loans and other forms of credit. Assessing future cash flows Decisions by existing and potential investors about buying, selling or holding equity instruments depend on the returns that they expect from an investment, for example, dividends. Similarly, decisions by existing and potential lenders and other creditors about providing or settling loans and other forms of credit depend on the principal and interest payments or other returns that they expect. Consequently, financial reporting should provide information that is useful in assessing the amount, timing and uncertainty of prospects for future net cash inflows to the entity. Economic resources and claims General purpose financial reports provide information about the financial position of a reporting entity. Financial position is information about the entitys economic resources and the claims against the reporting entity. The economic resources are the assets and the claims are the liabilities and equity of the entity. In other words, the financial position of an entity comprises its assets, liabilities and equity at a particular moment in time. Information about the nature and amounts of an entitys economic resources and claims can help users identify the entitys financial strength and weakness. Otherwise stated, information about financial position can help users to assess the entitys liquidity, solvency and its need for additional financing. Liquidity is the availability of cash in the near future to cover currently maturing obligations.

Solvency is the availability of cash over a long term to meet financial commitments when they fall due. Information about priorities and payment requirements of existing claims can help users to predict how future cash flows will be distributed among those with a claim against the reporting entity. Changes in economic resources and claims General purpose financial reports also provide information about the effects of transactions and other events that change the entitys economic resources and claims. Changes in economic resources and claims result from the entitys financial performance and from other events or transactions, such as issuing debt or equity instruments. The financial performance of an entity comprises its revenue, expenses and net income or loss for a period of time. In other words, financial performance is the level of income earned by the entity through the efficient and effective use of its resources. The financial performance of an entity is also known as results of operations and is portrayed in the income statement and statement of comprehensive income. Information about financial performance helps users to understand the return that the entity has produced on its economic resources. Information about the return the entity has produces provides an indication how well management has discharged its responsibilities to make efficient and effective use of the entitys resources. Information about past financial performance and how management discharged its responsibilities is usually helpful in predicting the future returns on the entitys economic resources. Information about financial performance during a period is useful in assessing the entitys past and future ability to generate net cash inflows from its operations. An entitys economic resources and claims may also change for reasons other than financial performance, such as issuing additional ownership shares. Such information is necessary to give users a complete understanding of why the entitys economic resources and claims changed and the implications of those changes on future financial performance. Accrual accounting The financial performance of an entity shall be measured in accordance with accrual accounting. Accrual accounting depicts the effects of transactions and other events and circumstances on an entitys economic resources and claims in the periods in which those effects occur even if the resulting cash receipts and payments occur in a different period.

In other words, under the accrual basis, the effects of transactions and other events are recognized when they occur and not as cash or its equivalents is received or paid, and they are recorded in the accounting records and reported in the financial statements of the periods to which they relate. Simply stated, accrual accounting means that income is recognized when earned regardless of when received and expense is recognized when incurred regardless of when paid. The essence of accrual accounting is the recognition of accounts receivable, accounts payable, prepaid expenses, accrued expenses, deferred income and accrued income. Information about financial performance measured in accordance with accrual accounting provides a better basis for assessing past and future performance than information solely about cash receipts and payments during a period. Limitations of financial reporting General purpose financial reports do not and cannot provide all of the information that existing and potential investors, lenders and other creditors need. These users need to consider pertinent information from other sources, for example, general income conditions, political events and industry outlook. General purpose financial reports are not designed to show the value of an entity but they provide information to help the primary users estimate the value of the entity. General purpose financial reports are intended to provide common information to users and cannot accommodate every request for information. To a large extent, general purpose financial reports are based on estimate and judgment rather than exact depiction. QUALITATIVE CHARACTERISTICS Qualitative characteristics are the qualities or attributes that make financial accounting information useful to the users. In deciding which information to include in financial statements, the objective is to ensure that the information is useful to the users in making economic decisions. Under the new Conceptual Framework for Financial Reporting, qualitative characteristics are classified into fundamental qualitative characteristics and enhancing qualitative characteristics. Fundamental qualitative characteristics The fundamental characteristics relate to the content or substance of financial information. The fundamental qualitative characteristics are: a. Relevance

b. Faithful representation Information must be both relevant and faithfully represented if it is to be useful. Neither a faithful representation of an irrelevant phenomenon nor an unfaithful representation of a relevant phenomenon helps users make good decisions. Relevance Relevant financial information is capable of making a difference in the decisions made by users. Simply stated, relevance is the capacity of the information to influence a decision. In other words, relevance requires that the financial information should be related or pertinent to the economic decision. Information that does not bear on an economic decision is useless. To be useful, information must be relevant to the decision-making needs of users. For example, broadly, the statement of financial position is relevant in determining financial position, and the income statement is relevant in determining performance. More specifically, the earnings per share information is more relevant than book value per share in determining the attractiveness of an investment. Ingredients of relevance Financial information is capable of making a difference in decision if it has predictive value and confirmatory value. Financial information has predictive value if it can be used as an input to processes employed by users to predict future outcome. In other words, financial information has predictive value when it can help users increase the likelihood of correctly or accurately predicting or forecasting outcome of events. For example, information about financial position and past performance is frequently used in predicting dividend and wage payments and the ability of the entity to meet maturing commitments. The net cash provided by operating activities is valuable in predicting loan payment or default. Financial information has confirmatory value if it provides feedback about previous evaluations. In other words, financial information has confirmatory value when it enables users to confirm or correct earlier expectations. For example, a net income measure has confirmatory value if it can help shareholders confirm or revise their expectation about an entitys ability to generate earnings.

Often, information has both predictive and confirmatory value. The predictive and confirmatory roles of information are interrelated. An example is an interim income statement which provides feedback about income to date and serves as a basis for predicting the annual income. For example, if the interim income statement for the first quarter is P2,000,000 (confirmatory value), and this trend continues for the entire year, it is logical to assume that the net income after four quarters or one year would be P8,000,000 (predictive value). Materiality Materiality is a practical rule in accounting which dictates that strict adherence to GAAP is not required when the items are not significant enough to affect the evaluation, decision and fairness of the financial statements. This concept is also known as the doctrine of convenience. Materiality is really a quantitative threshold linked very closely to the qualitative characteristics of relevance. The relevance of information is affected by its nature and materiality. In other words, materiality is an entity-specific aspect of relevance based on the nature or magnitude or both of the items to which the information relates in the context of an individual entitys financial report. The Conceptual Framework does not specify a uniform quantitative threshold for materiality or predetermine what could be material in a particular situation. Materiality is a relativity. Materiality of an item depends on its relative size rather than absolute size. What is material for one entity may be immaterial for another. An error of P100,000 in the financial statements of a multinational entity may not be important but may be so critical for a small entity.

You might also like

- Accounting Midterm Exam (Partnership Up To Dissolution) : Answer: 103,500 346,500Document6 pagesAccounting Midterm Exam (Partnership Up To Dissolution) : Answer: 103,500 346,500JINKY MARIELLA VERGARA100% (1)

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

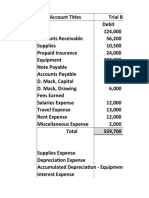

- Trial Balance Accounting RecordsDocument8 pagesTrial Balance Accounting RecordsKevin Espiritu100% (1)

- Joannamarie Uy ProblemDocument1 pageJoannamarie Uy ProblemFeiya Liu50% (2)

- Test I - Multiple Choice - TheoryDocument6 pagesTest I - Multiple Choice - Theorycute meNo ratings yet

- CFAS - Chapter 3: True or FalseDocument1 pageCFAS - Chapter 3: True or Falseagm25No ratings yet

- Cabutotan Jennifer 2ADocument12 pagesCabutotan Jennifer 2AJennifer Mamuyac CabutotanNo ratings yet

- Current Asset Current Asset Contra AssetDocument7 pagesCurrent Asset Current Asset Contra AssetAlexander QuemadaNo ratings yet

- Chapter 6 Lumpsum LiquidationDocument24 pagesChapter 6 Lumpsum LiquidationJenny BernardinoNo ratings yet

- PARCOR - 2Nature-and-Formation-of-a-PartnershipDocument30 pagesPARCOR - 2Nature-and-Formation-of-a-PartnershipHarriane Mae GonzalesNo ratings yet

- Lesson 2 Formation of PartnershipDocument27 pagesLesson 2 Formation of PartnershipheyheyNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- 01 The Accounting Environment and Accounting FrameworkDocument39 pages01 The Accounting Environment and Accounting Frameworkapostol ignacio100% (1)

- Mgt101 PApers With SolutionDocument13 pagesMgt101 PApers With Solutioncs619finalproject.com100% (7)

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- Cash EquivalentDocument9 pagesCash EquivalentMaria G. BernardinoNo ratings yet

- Romela Company (Gross Method)Document2 pagesRomela Company (Gross Method)AnonnNo ratings yet

- 26u9ofk7l - FAR - FINAL EXAMDocument18 pages26u9ofk7l - FAR - FINAL EXAMLyra Mae De BotonNo ratings yet

- PPT2.1-2 Accounting For Petty Cash Fund (2020)Document25 pagesPPT2.1-2 Accounting For Petty Cash Fund (2020)Alyson FortunaNo ratings yet

- ACFAR 1231 - Cash and Cash Equivalents AssignmentDocument2 pagesACFAR 1231 - Cash and Cash Equivalents AssignmentkakaoNo ratings yet

- It FinalsDocument11 pagesIt FinalsHea Jennifer AyopNo ratings yet

- Problem 1 Accrual of Interest ExpenseDocument1 pageProblem 1 Accrual of Interest ExpenseJhanin BuenavistaNo ratings yet

- Journal entries in a perpetual inventory systemDocument27 pagesJournal entries in a perpetual inventory systemFami FamzNo ratings yet

- Problem No 5 (Acctg. 1)Document5 pagesProblem No 5 (Acctg. 1)Ash imoNo ratings yet

- Name: Clarisse C. Borbe Section: BSA-1G Case Study 1 Formule 1Document2 pagesName: Clarisse C. Borbe Section: BSA-1G Case Study 1 Formule 1Clarisse BorbeNo ratings yet

- Additional InformationDocument2 pagesAdditional InformationKailaNo ratings yet

- PTAccountingDocument13 pagesPTAccountingLAN ONLINENo ratings yet

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- Bank Recon and PCFDocument2 pagesBank Recon and PCFAiza Ordoño0% (1)

- Acctg 3b-3cDocument4 pagesAcctg 3b-3cRizelle Louisse Cantalejo33% (3)

- Accounting 1Document3 pagesAccounting 1Kairan CrisologoNo ratings yet

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- Chapter 2 5Document36 pagesChapter 2 5Jaztine Danikka GimpayaNo ratings yet

- Understand Bank Reconciliation with 20 Multiple Choice and True or False QuestionsDocument3 pagesUnderstand Bank Reconciliation with 20 Multiple Choice and True or False QuestionsRejie AndoNo ratings yet

- Assignment # 3: Fundamentals of AccountingDocument1 pageAssignment # 3: Fundamentals of AccountingMara Shaira Siega100% (3)

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Financial Ac Counting An D Reporting: Prof. Justiniano L. Santo S, Cpa, MbaDocument41 pagesFinancial Ac Counting An D Reporting: Prof. Justiniano L. Santo S, Cpa, MbaEthan Manuel Del ValleNo ratings yet

- FAR Prelim 1st Quarter Answer KeyDocument4 pagesFAR Prelim 1st Quarter Answer KeypehikNo ratings yet

- Assignment1 M1 Transaction AnalysisDocument2 pagesAssignment1 M1 Transaction AnalysisAngel DIMACULANGANNo ratings yet

- St Anthony's College SAP Fundamentals of Accounting Exercise WorkbookDocument26 pagesSt Anthony's College SAP Fundamentals of Accounting Exercise WorkbookVILLAVERT DAINIEL MATTHEU B.No ratings yet

- Group Quiz 1Document3 pagesGroup Quiz 1Joselito Marane Jr.No ratings yet

- Acctg 7 Chap 5 Answer KeyDocument16 pagesAcctg 7 Chap 5 Answer KeyErian G. RetorianoNo ratings yet

- Perpetual System, Problem #17Document2 pagesPerpetual System, Problem #17Feiya LiuNo ratings yet

- Cfas ReviewerDocument7 pagesCfas ReviewerDarlene Angela IcasiamNo ratings yet

- Problem Set 2Document4 pagesProblem Set 2Michael Jay LingerasNo ratings yet

- Practice Questions Accounts ReceivableDocument23 pagesPractice Questions Accounts ReceivableKianJohnCentenoTuricoNo ratings yet

- Journal Entries Module 1Document7 pagesJournal Entries Module 1Jervin Maon Velasco100% (1)

- Quiz 1Document11 pagesQuiz 1Art B. EnriquezNo ratings yet

- Partnership FormationDocument13 pagesPartnership FormationPhilip Dan Jayson LarozaNo ratings yet

- Elite AISDocument70 pagesElite AISDiana Rose OrlinaNo ratings yet

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaNo ratings yet

- Chapter 1 Introduction To Cost AccountingDocument9 pagesChapter 1 Introduction To Cost AccountingSteffany RoqueNo ratings yet

- Adjusting Entries for Petty Cash Fund TransactionsDocument29 pagesAdjusting Entries for Petty Cash Fund TransactionsENCARNACION Princess MarieNo ratings yet

- University of Cebu Accounting 2 Prelim ExamDocument3 pagesUniversity of Cebu Accounting 2 Prelim ExamJM Singco Canoy100% (1)

- I. Matching Type 1: Letter OnlyDocument8 pagesI. Matching Type 1: Letter OnlyJohn Lloyd LlananNo ratings yet

- Intermediate Accounting I - Cash and Cash EquivalentsDocument2 pagesIntermediate Accounting I - Cash and Cash EquivalentsJoovs Joovho0% (1)

- Accounting defined as economic info systemDocument11 pagesAccounting defined as economic info systemKyrzen NovillaNo ratings yet

- Conceptual Framework Financial ReportingDocument8 pagesConceptual Framework Financial ReportingLaiza Mae LasutanNo ratings yet

- Conceptual Framework Module 1Document6 pagesConceptual Framework Module 1Jaime LaronaNo ratings yet

- Conceptual Framework: Objective of Financial ReportingDocument47 pagesConceptual Framework: Objective of Financial Reporting버니 모지코No ratings yet

- Sss - Gsis TableDocument4 pagesSss - Gsis Tablemark_somNo ratings yet

- Cmo 39 S2006Document39 pagesCmo 39 S2006matthewivanNo ratings yet

- SHE JeromeDocument3 pagesSHE Jeromemark_somNo ratings yet

- Spo 2Document6 pagesSpo 2mark_somNo ratings yet

- Spo 2Document6 pagesSpo 2mark_somNo ratings yet

- Intro To AcctgDocument10 pagesIntro To Acctgmark_somNo ratings yet

- 03 Quiz Bee p1 and Toa ClincherDocument2 pages03 Quiz Bee p1 and Toa ClincherHadassahFayNo ratings yet

- PeneraDocument14 pagesPeneramark_somNo ratings yet

- Art. 1380. Contracts Validly Agreed Upon May Be Rescinded in The Cases Established by LawDocument7 pagesArt. 1380. Contracts Validly Agreed Upon May Be Rescinded in The Cases Established by Lawmark_somNo ratings yet

- LadladDocument29 pagesLadladmark_somNo ratings yet

- PPE JeromeDocument3 pagesPPE Jeromemark_somNo ratings yet

- ZamoraDocument34 pagesZamoramark_somNo ratings yet

- Quiz Bowl 10Document9 pagesQuiz Bowl 10mark_somNo ratings yet

- 5S PresentationDocument3 pages5S Presentationmark_somNo ratings yet

- 5S PresentationDocument3 pages5S Presentationmark_somNo ratings yet

- Pricing exercises teach pricing processes and special pricesDocument3 pagesPricing exercises teach pricing processes and special pricesmark_somNo ratings yet

- 5S PresentationDocument3 pages5S Presentationmark_somNo ratings yet

- Scope and LimitationsDocument9 pagesScope and Limitationsmark_som100% (1)

- Pricing exercises teach pricing processes and special pricesDocument3 pagesPricing exercises teach pricing processes and special pricesmark_somNo ratings yet

- ConclusionDocument5 pagesConclusionmark_som50% (10)

- Scope of The BclteDocument74 pagesScope of The BclteGreg Marilyn100% (3)

- Mercury - Case SOLUTIONDocument36 pagesMercury - Case SOLUTIONSwaraj DharNo ratings yet

- Trust AccountingDocument13 pagesTrust AccountingPriyalaxmi Uma100% (4)

- Amartya Sen Sarma: Educational QualificationsDocument2 pagesAmartya Sen Sarma: Educational QualificationsSambit PatraNo ratings yet

- Economics McqsDocument56 pagesEconomics McqsAtif KhanNo ratings yet

- Security AnalysisDocument60 pagesSecurity AnalysisShezad Lalani [LUC]No ratings yet

- 1932Document21 pages1932api-578672468No ratings yet

- 1 Cir, vs. Pilipinas Shell Petroleum CorporationDocument32 pages1 Cir, vs. Pilipinas Shell Petroleum CorporationChristineNo ratings yet

- Audit of Bank With Respect To Syndicate BankDocument37 pagesAudit of Bank With Respect To Syndicate BankStella PaulNo ratings yet

- Lee v. Lee Air Farming Ltd.Document8 pagesLee v. Lee Air Farming Ltd.aruba ansariNo ratings yet

- Indian Aviation Industry - Indigo AirlinesDocument13 pagesIndian Aviation Industry - Indigo AirlinesArjun Pratap SinghNo ratings yet

- Mee Seva Hand Book Final PDFDocument445 pagesMee Seva Hand Book Final PDFravindraiNo ratings yet

- Ashok LeylandDocument89 pagesAshok Leylandsushanth198950% (4)

- XAT Decision Making Questions Analyze Leadership ChallengesDocument43 pagesXAT Decision Making Questions Analyze Leadership ChallengesBiswajit SahaNo ratings yet

- Labangan Calamansi PlantationDocument38 pagesLabangan Calamansi PlantationLorisa CenizaNo ratings yet

- Ch1 - What Is Strategy - Why Is It ImportantDocument37 pagesCh1 - What Is Strategy - Why Is It ImportantFrancis Jonathan F. PepitoNo ratings yet

- Roland Berger Global Automotive Supplier Study 2018Document86 pagesRoland Berger Global Automotive Supplier Study 2018Parth DMNo ratings yet

- Accounting For AttorneysDocument160 pagesAccounting For AttorneyschueneNo ratings yet

- BHELDocument14 pagesBHELMayank Gupta100% (1)

- Cash Flow.Document39 pagesCash Flow.JAPNo ratings yet

- Tax Planning for Business and IndividualsDocument109 pagesTax Planning for Business and IndividualsrahulNo ratings yet

- European Tour Operators AnalysisDocument8 pagesEuropean Tour Operators AnalysisrandoalboNo ratings yet

- CH 11Document91 pagesCH 11Putri AsmeliaNo ratings yet

- Accounting Unit 3 Notes - ATARNotesDocument22 pagesAccounting Unit 3 Notes - ATARNotesAnonymous rP0DTw58XNo ratings yet

- Parties Intrested in Financial StatementsDocument2 pagesParties Intrested in Financial StatementsAzrael BlackNo ratings yet

- Solved Assignment - Mba IIDocument135 pagesSolved Assignment - Mba IIAnoop VermaNo ratings yet

- Model Stock Purchase AgreementDocument44 pagesModel Stock Purchase AgreementFrancisco AravenaNo ratings yet

- Multiplex and Single Screen Cinemas India Sample 090625070013 Phpapp01Document10 pagesMultiplex and Single Screen Cinemas India Sample 090625070013 Phpapp01iamsmartNo ratings yet

- Notification GSR 739Document4 pagesNotification GSR 739Varinder AnandNo ratings yet