Professional Documents

Culture Documents

10000005760

Uploaded by

Chapter 11 DocketsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10000005760

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ---------------------------------------------------------------- x : In re : : LEHR CONSTRUCTION CORP., : : Debtor.

: : ---------------------------------------------------------------- x

Chapter 11 Case No. 11-10723 (SHL)

AMENDED ORDER PURSUANT TO SECTIONS 105(a), 363(c), 345(b) AND 364(a) OF THE BANKRUPTCY CODE AUTHORIZING DEBTOR TO (I) CONTINUE TO USE EXISTING CASH MANAGEMENT SYSTEM, (II) TO MAINTAIN EXISTING BANK ACCOUNTS AND BUSINESS FORMS, AND (III) WAIVE REQUIREMENTS OF SECTION 345(b) OF THE BANKRUPTCY CODE Upon the motion, dated February 21, 2011 (the Motion), 1 of Lehr Construction Corp. in the above-referenced chapter 11 case, as debtor and debtor in possession (the Debtor), 2 for an order, pursuant to sections 105(a), 363(c), 345(b) and 364(a) of chapter 11 of title 11 of the United States Code (the Bankruptcy Code) for (A) authorization to continue to use its existing cash management system (the Cash Management System) and to maintain existing bank accounts (the Bank Accounts) and business forms (the Business Forms), and (B) a waiver of section 345(b) of the Bankruptcy Code, all as more fully set forth in the Motion; and upon consideration of the Declaration of Frederick Coffey pursuant to Local Rule 1007-2; and the Court having jurisdiction to consider the Motion and the relief requested therein pursuant to 28 U.S.C. 157 and 1334 and the Standing Order of Referral of Cases to Bankruptcy Judges of the District Court for the Southern District of New York, dated July 19, 1984 (Ward, Acting C.J.); and consideration of the Motion and the relief requested therein being a core proceeding

1

Capitalized terms used but not defined herein shall have the respective meanings ascribed to them in the Motion. The last four digits of the Debtors federal tax identification number are 3507.

1700438 v3/NY

pursuant to 28 U.S.C. 157(b); and venue being proper before this Court pursuant to 28 U.S.C. 1408 and 1409; and notice of the Motion appearing adequate and appropriate under the circumstances, and it appearing that no other or further notice need be provided; and the Court having determined that the relief requested in the Motion being in the best interests of the Debtor, its creditors, and all parties in interest; and the Court having determined that the legal and factual bases set forth in the Motion establish just cause for the relief granted herein; and upon all of the proceedings had before the Court and after due deliberation and sufficient cause appearing therefor, IT IS HEREBY ORDERED that the Motion is granted to the extent provided herein; and it is further ORDERED that the Debtor is authorized and empowered, pursuant to sections 105(a) and 363(c)(1) of the Bankruptcy Code, to continue to manage its cash pursuant to the Cash Management System maintained by the Debtor before the commencement of this chapter 11 case and under the terms of the Service Agreements (as defined below), and to collect, concentrate, and disburse cash in accordance with that Cash Management System; and it is further ORDERED that the Debtor is authorized to: (i) designate, maintain and continue to use any or all of its existing Bank Accounts, including but not limited to the Bank Accounts with those banks (the Banks) listed on Exhibit A annexed hereto, in the names and with the account numbers existing immediately prior to the commencement of this chapter 11 case, (ii) deposit funds into and withdraw funds from such accounts by all usual means including, without limitation, checks, wire transfers, automated transfers and other debits, and (iii) treat its prepetition Bank Accounts for all purposes as debtor in possession accounts; and it is further

2

1700438 v3/NY

ORDERED that all Banks with whom the Debtor maintains Bank Accounts are authorized to maintain, service, and administer the Bank Accounts and any other accounts opened postpetition in accordance with applicable non-bankruptcy law and in accordance with the service agreements and related documentation between the Debtor and its respective Banks (the Service Agreements) 3, and the same may be amended from time to time, including by lifting any administrative or debit freeze placed on any of the Bank Accounts as a consequence of the filing of the petition commencing this case; and it is further ORDERED that unless otherwise ordered by this Court, no Bank shall honor or pay any check issued or dated prior to the Petition Date; provided, however, that any such Bank may rely on the representations of the Debtor with respect to whether any check or other transfer drawn or issued by the Debtor prior to the Petition Date should be honored pursuant to an Order of this Court; and it is further ORDERED that the Debtor is directed to maintain records of each and every transfer within the Cash Management System occurring postpetition to the same extent maintained by the Debtor prior to the Petition Date, such that all postpetition transfers and transactions shall be adequately and promptly documented in, and readily ascertainable from, the Debtors books and records; and it is further ORDERED that the Debtors continued use of its Cash Management System shall be deemed to comply with section 345 of the Bankruptcy Code, and the Debtor is relieved from the obligations pursuant to section 345(b) of the Bankruptcy Code to obtain a bond from any entity for any of the other Bank Accounts; and it is further

Notwithstanding anything contained herein to the contrary, the Debtor shall not open any new Bank Accounts at Gotham Bank of New York or Amalgamated Bank or any other depository not authorized by the United States Trustee for the Southern District of New York.

3

1700438 v3/NY

ORDERED that nothing contained herein shall prevent the Debtor from opening any additional bank accounts, or closing any existing Bank Account(s), as it may deem necessary and appropriate, and the Banks are authorized to honor the Debtors requests to open or close, as the case may be, such Bank Accounts or additional bank accounts at a depository authorized by the United States Trustee for the Southern District of New York; and it is further ORDERED that any new Bank Account opened by the Debtor shall be deemed to be a Bank Account as defined in this Order and as included on Exhibit A attached hereto and shall be subject to all terms and provisions of this Order; and it is further ORDERED that, pursuant to section 364(a) of the Bankruptcy Code, the Debtor is authorized in connection with the ordinary operation of its Cash Management System to obtain unsecured credit and incur unsecured debt in the ordinary course of business without notice and a hearing; and it is further ORDERED that the Debtor is authorized to use its existing Business Forms, including, check stock; provided, however, that as soon as practicable after the Petition Date the Debtor shall print Debtor In Possession and the chapter 11 case number under which this case is being administered on any existing or new check stock and any new Business Forms; and it is further ORDERED that the Debtor is authorized and shall (i) pay undisputed prepetition amounts outstanding as of the date hereof, if any, owed to its Banks as service charges for the maintenance of the Cash Management System, and (ii) reimburse the Banks for any claims arising, or chargebacks of deposits made, before or after the Petition Date in connection with customer checks or other deposits into the Bank Accounts that have been dishonored or returned for any reason, together with any fees and costs in connection therewith, to the same extent the

4

1700438 v3/NY

Debtor is responsible therefor by operation of non-bankruptcy law or under the terms of the Service Agreements with the Banks; and it is further ORDERED that within two (2) business days after the entry of this Order, the Debtor shall serve a copy of this Order on the Banks; and it is further ORDERED that this Court shall retain jurisdiction to hear and determine all matters arising from or related to the implementation, interpretation and/or enforcement of this Order; and it is further ORDERED that notice of the Motion as provided herein shall be deemed good and sufficient notice of such Motion. Dated: February 23, 2011 New York, New York

/s/ Sean H. Lane UNITED STATES BANKRUPTCY JUDGE

5

1700438 v3/NY

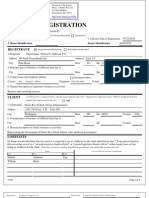

EXHIBIT A DEBTORS BANK ACCOUNTS

Bank Name and Address Capital One N.A. 99 Smithtown Bypass Hauppauge, NY 11788

Account Description Lehr Operating

Account No. xxxxxxxx72

HSBC Bank USA, N.A. 145 Fifth Avenue New York, NY 10010 212-375-1273 Citibank 100 Citibank Drive San Antonio, TX 78245-3214 JP Morgan Chase Bank, N.A. P.O. Box 659754 San Antonio, TX 78265-9754 Gotham 1412 Broadway New York, NY 10018 212-944-2599 Amalgamated Bank 52 Broadway New York, NY 10004 212-894-3000

Lehr Operating 2 Sullivan & Cromwell Fidelity Strand CBS/CRG Covington & Burling Google Amalgamated, Unite Here, Makor Kramer Levin Renaissance Technologies Goldman Sachs/AT&T The Limited Carpenters Viacom/MTV Goldman NY Warburg Pincus Economist Payroll (II) Flexplan (checking) (Smartflex) Money Market Reimburseables Project Related

xxxxxxxx67 xxxxxxxx98 xxxxxxxx06 xxxxxxxx14 xxxxxxxx22 xxxxxxxx30 xxxxxxxx48 xxxxxxxx55 xxxxxxxx63 xxxxxxxx71 xxxxxxxx66 xxxxxxxx54 xxxxxxxx97 xxxxxxxx12 xxxxxxxx52 xxxxxxxx94 xxxxxxxx54 xxxxxxxx60 xxxxxxxx89 xxxxxxxx05 xxxxxxxxx43 xxx-xxxx7-1

Project Related

xxx-xxxxx88

Project Related

xx-xxxx-x64

Employee Medical Benefits

xxx-xxx-73

Project Related

xxxxxxx48

1700438 v3/NY

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- 10000005755Document5 pages10000005755Chapter 11 DocketsNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document10 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNo ratings yet

- Original: Et Al.Document10 pagesOriginal: Et Al.Chapter 11 DocketsNo ratings yet

- States Bankruptcy Cour?Riginai.: 345 (B) COODocument5 pagesStates Bankruptcy Cour?Riginai.: 345 (B) COOChapter 11 DocketsNo ratings yet

- Hearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Objections Due: March 18, 2011 at 4:00 P.M. Eastern TimeDocument8 pagesHearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Objections Due: March 18, 2011 at 4:00 P.M. Eastern TimeChapter 11 DocketsNo ratings yet

- Original: (BAY:Ol583658vl)Document4 pagesOriginal: (BAY:Ol583658vl)Chapter 11 DocketsNo ratings yet

- For The District of Colorado: TedstatesbankruptcycourtDocument2 pagesFor The District of Colorado: TedstatesbankruptcycourtChapter 11 DocketsNo ratings yet

- Ref. Docket No. 6Document3 pagesRef. Docket No. 6Chapter 11 DocketsNo ratings yet

- PDIC MR ProformaDocument1 pagePDIC MR ProformaMacky GallegoNo ratings yet

- Boyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day Relief (The "First Day Declaration")Document3 pagesBoyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day Relief (The "First Day Declaration")Chapter 11 DocketsNo ratings yet

- FTL 108944881v2Document5 pagesFTL 108944881v2Chapter 11 DocketsNo ratings yet

- Nunc Pro Tunc To The Petition DateDocument14 pagesNunc Pro Tunc To The Petition DateChapter 11 DocketsNo ratings yet

- Order (I) Authorizing Prepetition Wage, Salary and Benefit Payments (Ii) Authorizing Employee Benefit Programs and Directing All Banks To Honor Related Prepetition ChecksDocument4 pagesOrder (I) Authorizing Prepetition Wage, Salary and Benefit Payments (Ii) Authorizing Employee Benefit Programs and Directing All Banks To Honor Related Prepetition ChecksChapter 11 DocketsNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Document24 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Chapter 11 DocketsNo ratings yet

- Interim Rules of Procedure On Corporate RehabDocument21 pagesInterim Rules of Procedure On Corporate RehabSharmen Dizon GalleneroNo ratings yet

- Presentment Date and Time: March 10, 2011 at 12:00 P.M. Eastern Time Objection Date and Time: March 10, 2011 at 11:30 A.M. Eastern TimeDocument13 pagesPresentment Date and Time: March 10, 2011 at 12:00 P.M. Eastern Time Objection Date and Time: March 10, 2011 at 11:30 A.M. Eastern TimeChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New York::::::: Case No. 11-22866 (RDD)Document3 pagesUnited States Bankruptcy Court Southern District of New York::::::: Case No. 11-22866 (RDD)Chapter 11 DocketsNo ratings yet

- Republic Bank V CA and FNCBDocument3 pagesRepublic Bank V CA and FNCBAnonymous mv3Y0KgNo ratings yet

- Ref. Docket No. 7Document3 pagesRef. Docket No. 7Chapter 11 DocketsNo ratings yet

- Honorable Carol A. DoyleDocument3 pagesHonorable Carol A. DoyleChapter 11 DocketsNo ratings yet

- MORB 03 of 16Document71 pagesMORB 03 of 16Dennis BacayNo ratings yet

- BDO V Equitable Banking Corp. G.R. No.L-74917Document6 pagesBDO V Equitable Banking Corp. G.R. No.L-74917John Basil ManuelNo ratings yet

- United States Bankruptcy Court Southern District of New York::::::: Case No. 11-22866 (RDD)Document3 pagesUnited States Bankruptcy Court Southern District of New York::::::: Case No. 11-22866 (RDD)Chapter 11 DocketsNo ratings yet

- Supreme Court Issues Directions To Change Procedure in Cheque Bounce Cases 2014 SCDocument26 pagesSupreme Court Issues Directions To Change Procedure in Cheque Bounce Cases 2014 SCSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (1)

- Collection Agency AgreementDocument18 pagesCollection Agency AgreementJannah MagtaasNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionDocument3 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyNo ratings yet

- Indian Bank Association v. Union of IndiaDocument19 pagesIndian Bank Association v. Union of IndiaBar & BenchNo ratings yet

- Et Al./: (II) (III)Document15 pagesEt Al./: (II) (III)Chapter 11 DocketsNo ratings yet

- Complaint CTB SingleDocument4 pagesComplaint CTB SingleEppie SeverinoNo ratings yet

- QWR Template - GenericDocument3 pagesQWR Template - GenericBob Ramers100% (2)

- BDO V EquitableDocument13 pagesBDO V EquitableMp CasNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (Fria) of 2010Document10 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (Fria) of 2010Benedict AlvarezNo ratings yet

- Credit Repair Letter To Send After Debt DischargeDocument6 pagesCredit Repair Letter To Send After Debt Dischargeamenelbey78% (9)

- Bank Account Agreement - Lu4shie - Uslugi - EPB - Contract - PersonalDocument4 pagesBank Account Agreement - Lu4shie - Uslugi - EPB - Contract - PersonalPhilippe ServajeanNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Document22 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Kobe BullmastiffNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument3 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Operation MuskaanDocument8 pagesOperation Muskaanaltaibkhan318No ratings yet

- A.M. No. 15-04-06-SCDocument25 pagesA.M. No. 15-04-06-SCKayee KatNo ratings yet

- Interim Rules of Procedure On Corporate Rehabilitation: en BancDocument5 pagesInterim Rules of Procedure On Corporate Rehabilitation: en BancarloNo ratings yet

- BDO vs. Equitable Banking CorporationDocument7 pagesBDO vs. Equitable Banking Corporationmia_2109No ratings yet

- Republic Bank Vs CADocument2 pagesRepublic Bank Vs CAboomonyouNo ratings yet

- Fria ProcDocument6 pagesFria ProcVIctor AlfilerNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument15 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Debt Validation Letter July 2012Document5 pagesDebt Validation Letter July 2012amenelbey100% (5)

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDocument17 pagesAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsNo ratings yet

- 12-12553-jmp Doc 12Document3 pages12-12553-jmp Doc 12oldhillbillyNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document19 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNo ratings yet

- Allied Banking vs. Equitable Pci BankDocument13 pagesAllied Banking vs. Equitable Pci BankNixrabangNo ratings yet

- Division (Grno. L-74917, Jan 20, 1988) Banco de Oro Savings V. Equitable Banking CorporationDocument12 pagesDivision (Grno. L-74917, Jan 20, 1988) Banco de Oro Savings V. Equitable Banking CorporationSocNo ratings yet

- Bản Dự Thảo Thư Tín DụngDocument5 pagesBản Dự Thảo Thư Tín DụngkenjinNo ratings yet

- Unit - 3 Structure and Formation of Bank and Financial InstitutionsDocument17 pagesUnit - 3 Structure and Formation of Bank and Financial InstitutionsAnkit AgarwalNo ratings yet

- Charles Edward Thomas343Document5 pagesCharles Edward Thomas343Dreloc16100% (1)

- Specom Cases Outline FinalsDocument29 pagesSpecom Cases Outline FinalsJas Em BejNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency ActDocument15 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency ActmowzjeyneNo ratings yet

- Loan and Security Agreement (Sample)Document53 pagesLoan and Security Agreement (Sample)Raymond AlhambraNo ratings yet

- Wire Transfer AgreementDocument9 pagesWire Transfer AgreementmeariclusNo ratings yet

- Assignment of Acounts Receivable For Security PurposeDocument5 pagesAssignment of Acounts Receivable For Security PurposeMuhammad DafisNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- 21 - FIRST UNITED CONSTRUCTORS CORPORATION AND BLUE STAR CONSTRUCTION CORPORATION v. BAYANIHAN AUTOMOTIVE CORPORATIONDocument9 pages21 - FIRST UNITED CONSTRUCTORS CORPORATION AND BLUE STAR CONSTRUCTION CORPORATION v. BAYANIHAN AUTOMOTIVE CORPORATIONcsalipio24No ratings yet

- Here DimitriDocument17 pagesHere Dimitridiamond68100% (1)

- Press Conference Directions and RubricDocument2 pagesPress Conference Directions and Rubricapi-205202796No ratings yet

- Original Copy Business Permit Application Form BPLOs PDFDocument2 pagesOriginal Copy Business Permit Application Form BPLOs PDFNicole Canarias100% (1)

- Jurors' Handbook, A Citizens Guide To Jury DutyDocument14 pagesJurors' Handbook, A Citizens Guide To Jury DutyRyan YuenNo ratings yet

- Solo-Play Adventure PDFDocument4 pagesSolo-Play Adventure PDFКарен ЗакарянNo ratings yet

- Thomas Aquinas and Vocational DiscernmentDocument11 pagesThomas Aquinas and Vocational DiscernmentJoseEscalante28100% (2)

- I Survived The American Revolution 1776 by Lauren TarshisDocument100 pagesI Survived The American Revolution 1776 by Lauren TarshisStanley Tio100% (1)

- Plaintiff-Appellee Accused-Appellant: People of The Philippines, AgustinDocument6 pagesPlaintiff-Appellee Accused-Appellant: People of The Philippines, AgustinenggNo ratings yet

- Lectue 20 Session 2Document43 pagesLectue 20 Session 2Shahzadi HiraNo ratings yet

- The Hook Sping 2002Document11 pagesThe Hook Sping 2002Larry FeldhausNo ratings yet

- Philippine Legal Forms 2015bDocument394 pagesPhilippine Legal Forms 2015bJoseph Rinoza Plazo100% (14)

- Jennings v. Stephens (2015)Document24 pagesJennings v. Stephens (2015)Scribd Government DocsNo ratings yet

- York County Court Schedule For 1/16/15Document17 pagesYork County Court Schedule For 1/16/15HafizRashidNo ratings yet

- Ruks Konsult and Construction, Petitioner, V. Adworld Sign and Advertising Corporation and Transworld Media AdsDocument2 pagesRuks Konsult and Construction, Petitioner, V. Adworld Sign and Advertising Corporation and Transworld Media Adsluis capulongNo ratings yet

- PEP - Handout - Modern History 1Document27 pagesPEP - Handout - Modern History 1anon_463330020No ratings yet

- Alcohol Treatment CenterDocument54 pagesAlcohol Treatment CenterAnonymous ntDYikdyNo ratings yet

- Apparitions of Our Lady and Her Prophecies Being Fulfilled TODAYDocument140 pagesApparitions of Our Lady and Her Prophecies Being Fulfilled TODAYJoseph50% (2)

- Judge-Your-Neighbor Worksheet: FillDocument1 pageJudge-Your-Neighbor Worksheet: FillGrigore AnkutzaNo ratings yet

- Lcso Daily Booking Report 06292021Document2 pagesLcso Daily Booking Report 06292021WCTV Digital TeamNo ratings yet

- Assignment Insurance LawDocument5 pagesAssignment Insurance LawJetheo100% (1)

- Dela Cruz Vs Tan TorresDocument2 pagesDela Cruz Vs Tan TorresElla B.No ratings yet

- CABALLERO Vs SandiganbayanDocument4 pagesCABALLERO Vs SandiganbayanElias IbarraNo ratings yet

- Vojni CinoviDocument1 pageVojni CinoviSanda MilićNo ratings yet

- Science Club by LawsDocument5 pagesScience Club by LawsMarjorie Baya BidlanNo ratings yet

- Use of English: Causative Form - 'Document3 pagesUse of English: Causative Form - 'Susana PérezNo ratings yet

- Drug Clearing Report v2.0Document20 pagesDrug Clearing Report v2.0Jervel GuanzonNo ratings yet

- Registration by Stanton D. Anderson, P.C. To Lobby For Puerto Rico Federal Affairs Administration (300304667)Document2 pagesRegistration by Stanton D. Anderson, P.C. To Lobby For Puerto Rico Federal Affairs Administration (300304667)Sunlight FoundationNo ratings yet

- Jaropillo Verdad - v. - Casals20220323 11 17ao8ndDocument2 pagesJaropillo Verdad - v. - Casals20220323 11 17ao8ndMaddison YuNo ratings yet

- Lectures On Code of Civil Procedure: by Ashutosh Kumar Shukla Asst - Prof. Amity Law SchoolDocument9 pagesLectures On Code of Civil Procedure: by Ashutosh Kumar Shukla Asst - Prof. Amity Law Schoolchhaayaachitran akshuNo ratings yet