Professional Documents

Culture Documents

BA 141 Ratios

Uploaded by

NigelT.LeeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BA 141 Ratios

Uploaded by

NigelT.LeeCopyright:

Available Formats

8/3/2010

To assess a firms financial condition and p performance It is of interest to shareholders, creditors, regulators and the firms own management Ratios can standardize F/S information and make it possible to compare companies of varying sizes

Ratios

Practice Problems

Anyone can crunch the numbers and generate the ratiosthe real skill is putting life into the p g numbers Establish the perspective / purpose of your analysis Benchmarks

Industry Internal past Internal forecast

Ratios

Practice Problems

8/3/2010

Ratios must be considered together: a single ratio y practically meaningless y g by itself is p Compare apples vs. apples: use F/S of companies that cover the same time period Use audited F/S whenever possible Garbage in, garbage out: the financial data being compared should have been developed in the same way

Ratios

Practice Problems

Be wary of inflation distortions Cost vs. benefit tradeoff: vs

A core set of 20 to 25 ratios will usually provide you with just about the same important information that 100 ratios will give you

Ratios

Practice Problems

8/3/2010

Balance Sheet Quality

Charging off assets Hidden liabilities Hidden assets Off balance sheet financing

Ratios

Practice Problems

Earnings Quality

Time of revenue recognition Establishment of reserves Amortization of intangible assets Including all losses and debt Pro forma profitability measures

Ratios

Practice Problems

8/3/2010

Problems Caused by Inflation

Inventory profit as a result of timing of price increases Inventory profit Choice of inventory valuation methods

LIFO FIFO

Rising interest rates causing a decline in the value of longterm debt Differences in the reporting of earnings Recognition of sales

Ratios

Practice Problems

Operating Profit Margin = ROA = Operating Income Ave. Total Assets

Operating Income Sales

Net Profit Margin =

ROE = Net Income Ave. SHE

Net Income Sales

EPS =

Net Income Wtd. Ave. C/S Outstanding

Practice Problems

8

Ratios

8/3/2010

Inventory Turnover =

Days Inventory = A/R Turnover =

Cost of Goods Sold Ave. Inventories A I t i

360 days Inventory Turnover

Credit Sales Average A/R

Ave. Collection Period =

360 days A/R Turnover

Ratios

Practice Problems

A/P Turnover =

Cost of Goods Sold Ave. Ave A/P

Ave. Payment Period =

GP Margin =

360 days A/P Turnover

Gross Profit Sales

Marketing & Admin Exp Sales

Operating Cost Ratio =

Ratios

Practice Problems

10

8/3/2010

Fixed Asset Turnover =

Equity Turnover =

Sales Ave. Fixed Assets A Fi d A t

Net Sales Ave. Equity

Total Asset Turnover =

Sales Ave. Total Assets

Ratios

Practice Problems

11

Interest Coverage =

EBIT Interest Expense

Cash Flow Coverage =

Debt Equity Ratio =

CFO + Debt Interest + Lease Interest Debt Interest + Lease Interest

Total Liabilities Total Equity

Debt Asset Ratio =

Total Liabilities Total Assets

Ratios

Practice Problems

12

8/3/2010

Current Ratio =

Current Assets Current Liabilities

Quick Ratio =

Cash + Marketable Securities + A/R Current Liabilities

Cash Flow to LTD =

CFO BV of LTD + PV of Operating Lease

Cash Flow to Total Interest-Bearing Debt = CFO Total LTD + Current Interest-Bearing Liabilities

Ratios Practice Problems

13

Net Incomet Net Incomet 1 Net Incomet 1 N I DOL = Salest Salest 1 Salest 1

Ratios

Practice Problems

14

8/3/2010

P/E Ratio =

Stock Market Price EPS

Market Book Ratio =

Market Value of Equity Book Value of Equity

Tobin's Q =

MV Equity + MV Debt Replacement Cost of All Assets

Dividend per Share Market Price per Share Dividends Per Share EPS

Practice Problems

Dividend Yield =

TobinsQ isnamed aftertheeconomist JamesTobin.Theratio J T bi Th ti isusefulforpredicting futureinvestment activity:firmsand industrieswithaq ratio>1havean incentivetoinvestsince themarkets assessment of the ROI assessmentoftheROI isgreaterthanthecost oftheinvestment.

Dividend Payout =

Ratios

15

Cash Flow per Share =

Price / CF =

Operating CF WAVE C/S Outstanding

Stock Market Price Cash Flow per Share

Market Cap = Market Price per Share x Outstanding C/S

CompoundAnnualGrowthRate(CAGR)

xn = ( x0 )(1 + g )

Ratios Practice Problems

x g = n 1 x0

16

1 n

8/3/2010

ROE =

Net income Equity

Net income Sales Profitability/ Cost Control

Sales Assets

Assets Equity Leverage

Efficiency

ROE =

Net income = Equity

Net income EBT Tax Retention Rate

EBT EBIT Interest Burden

EBIT Sales

Sales Assets

Assets Equity Leverage

Operating Efficiency Profit Margin

Ratios

Practice Problems

17

Common size Balance Sheet:

All items as a % of Total Assets Total Assets = 100%

Common size Income Statement

All items as a % of Total Revenues Total Revenues = 100%

Ratios

Practice Problems

18

8/3/2010

19

Trend Analysis

Use a base year Year to year changes

Ratios

Practice Problems

20

10

8/3/2010

Trend analysis XYZ current ratio Cross-sectional analysis XYZ current ratio Industry norms Both simultaneously XYZ current ratio Industry norms

20X0 1.9

X1 2.2

X2 2.3 20X2 2.3 2.5

20X0 1.9 2.5

X1 2.2 2.4

X2 2.3 2.5

Ratios

Practice Problems

21

Leverage Ratios

For Qualifying Capital, refer to BSP Circular 538 - Risk Based Capital BSP Adequacy Framework for the Philippine Banking System

CAR=

Tier 1 Capital + Tier 2 Capital Risk Weighted

Proxy for CAR =

Equity Total Assets Equity Customer Loan Receivables

Equity to Loans Ratio =

Ratios

Practice Problems

22

11

8/3/2010

Liquidity Ratios

QLAR =

Quasi-Liquid Assets Total Assets

Customer Loan Receivables Total Deposit Liabilities

Loans to Deposit =

Ratios

Practice Problems

23

Quasi-Liquid Assets

Cash and other cash items Due from BSP Due from other banks Interbank loans receivable and securities purchased under agreements to resell Trading securities (i.e. FVTPL) Investment securities : Available-for-Sale (AFS) Investment securities : Held-to-Maturity (HTM)

Ratios

Practice Problems

24

12

8/3/2010

Coverage Ratios Coverage Ratio =

NPL Ratio =

Allowance for Doubtful Accounts Non-Performing Loans, gross

Non-Performing Loans, gross Total Loans, gross

Non-Performing Loans Non Performing Loans, gross Fair Value of Collateral

Ratios

Practice Problems

25

Coverage Ratios

Rate of Restructured Loans = Problematic Loan Ratio = Restructured Loans Total Loans, gross

NPL + Restructured Loans Total Loans, gross NPL + Restructured Loans + ROPOA Total Loans, gross

Non-Performing Asset Ratio =

Ratios

Practice Problems

26

13

8/3/2010

Profitability Ratios

Net Interest Margin = Net Interest Income Earning Assets

Cost to Income Ratio = Cost Margin =

ROTA =

Operating Expenses Net Interest Income + Other Income

Operating Expenses Ave. Total Assets

NI + ( Interest Expense )(1 tax rate ) Ave. Total Assets

ROTE =

Ratios

Net Income Ave. SHE

Practice Problems

27

Earning Assets

Due from BSP Due from other banks Interbank loans receivables and securities purchased under agreements to resell Trading securities (i.e. FVTPL) Investment securities : Available-for-Sale (AFS) Loan Receivables and Advances

Note: Cash, in itself, is NOT an earning asset

Ratios

Practice Problems

28

14

You might also like

- Financial RatiosDocument4 pagesFinancial Ratiossarahbabe94No ratings yet

- Understanding of Financial Statements: What Is An Accounting?Document53 pagesUnderstanding of Financial Statements: What Is An Accounting?Rashmi KhatriNo ratings yet

- Ratio AnalysisDocument27 pagesRatio AnalysisPratik Thorat100% (1)

- Financial Analysis RatiosDocument34 pagesFinancial Analysis Ratioskrishna priyaNo ratings yet

- Overview of Financial AnalysisDocument6 pagesOverview of Financial AnalysisClarineRamosNo ratings yet

- 04 NotesDocument22 pages04 NotesMychael NduggaNo ratings yet

- Financial RatiosDocument5 pagesFinancial RatioszarimanufacturingNo ratings yet

- Unit V: Financial AccountingDocument31 pagesUnit V: Financial AccountingAbhishek Bose100% (2)

- Bank Fund Management - BFMDocument107 pagesBank Fund Management - BFMNur AlamNo ratings yet

- (A+F) NYU OutlineDocument14 pages(A+F) NYU OutlineShawn BuskovichNo ratings yet

- Corporate Financial Analysis NotesDocument19 pagesCorporate Financial Analysis NotesWinston WongNo ratings yet

- Fin Stat AnalysisDocument23 pagesFin Stat AnalysisSadiabcdNo ratings yet

- Jaiib Accounts PaperDocument10 pagesJaiib Accounts PapermonaNo ratings yet

- SL No Description A Liquidity RatiosDocument10 pagesSL No Description A Liquidity RatiosAshish SharmaNo ratings yet

- Understanding and Analysing Financial Statements: BY Dr. Archana SinghDocument56 pagesUnderstanding and Analysing Financial Statements: BY Dr. Archana SinghAadya SuriNo ratings yet

- Financial Statements Aim at Providing Financial Information About A Business Enterprise To Meet The Information Needs of The DecisionDocument7 pagesFinancial Statements Aim at Providing Financial Information About A Business Enterprise To Meet The Information Needs of The Decisionrupeshdahake8586No ratings yet

- 06 Evaluating Financial PerformanceDocument25 pages06 Evaluating Financial PerformanceTrần ThiNo ratings yet

- CH 11Document13 pagesCH 11Kashif AmmarNo ratings yet

- New Microsoft Office Power Point PresentationDocument12 pagesNew Microsoft Office Power Point PresentationmathadbhjNo ratings yet

- Ratios FormulasDocument6 pagesRatios FormulasvmktptNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Ratio Analysis Ideal ValuesDocument6 pagesRatio Analysis Ideal ValuesSri Royal100% (1)

- Ratio AnalysisDocument8 pagesRatio AnalysisKitty N FamNo ratings yet

- Financial RatiosDocument3 pagesFinancial Ratiospv12356No ratings yet

- R K Mohanty: Faculty Member, Sir SPBT College, Central Bank of India, MumbaiDocument30 pagesR K Mohanty: Faculty Member, Sir SPBT College, Central Bank of India, MumbaiRitesh MauryaNo ratings yet

- FinQuiz - Smart Summary - Study Session 8 - Reading 28Document3 pagesFinQuiz - Smart Summary - Study Session 8 - Reading 28RafaelNo ratings yet

- Financial Management: Chapter 2 - Financial Statement AnalysisDocument35 pagesFinancial Management: Chapter 2 - Financial Statement Analysisgeachew mihiretuNo ratings yet

- Ecnomic Notes 1Document26 pagesEcnomic Notes 1ehnzdhmNo ratings yet

- Liquidity Ratios: S. No. Ratios FormulasDocument6 pagesLiquidity Ratios: S. No. Ratios FormulasKazi Shafikull IslamNo ratings yet

- Anil Kumar Chauhan: SidebarDocument11 pagesAnil Kumar Chauhan: SidebarJeet MukherjeeNo ratings yet

- Ratio AnalysisDocument17 pagesRatio Analysisragz22100% (1)

- 21 Ratio FormulaDocument4 pages21 Ratio FormularimplebhattNo ratings yet

- 2871f Ratio AnalysisDocument24 pages2871f Ratio Analysisumar321No ratings yet

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137No ratings yet

- Formula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDocument10 pagesFormula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDilip KumarNo ratings yet

- Capital Structure DecisionsDocument25 pagesCapital Structure DecisionsSaurabh ChauhanNo ratings yet

- Analyzing The Financial StatementsDocument30 pagesAnalyzing The Financial StatementsIshan Gupta100% (1)

- 2871f Ratio AnalysisDocument24 pages2871f Ratio AnalysisHaseeb KhanNo ratings yet

- Assignment Ratio AnalysisDocument7 pagesAssignment Ratio AnalysisMrinal Kanti DasNo ratings yet

- Doubt Session Ratios 120424Document51 pagesDoubt Session Ratios 120424pre.meh21No ratings yet

- Financial Statements & AnalysisDocument14 pagesFinancial Statements & AnalysisMuntasir SizanNo ratings yet

- Chapter 1 Financial AnalysisDocument39 pagesChapter 1 Financial AnalysisRoy YadavNo ratings yet

- Evaluating Bank Performance: - OutlineDocument14 pagesEvaluating Bank Performance: - OutlineNeha AggarwalNo ratings yet

- SL No Description A Liquidity RatiosDocument21 pagesSL No Description A Liquidity RatiosvaibhavacNo ratings yet

- Ratio AnalysisDocument65 pagesRatio AnalysisAakash ChhariaNo ratings yet

- Financial Aspects of Project Analysis: ReferencesDocument40 pagesFinancial Aspects of Project Analysis: ReferencesRusty PlacinoNo ratings yet

- Ratio AnalysisDocument14 pagesRatio Analysisssindhu2743812No ratings yet

- Lecture5 6 Ratio Analysis 13Document39 pagesLecture5 6 Ratio Analysis 13Cristina IonescuNo ratings yet

- Ratio AnalysisDocument23 pagesRatio Analysisअतुल सिंहNo ratings yet

- Borisagarharsh 62Document24 pagesBorisagarharsh 62Borisagar HarshNo ratings yet

- Chapter 2Document7 pagesChapter 2John FrandoligNo ratings yet

- Financial Statement Analysis: RatiosDocument23 pagesFinancial Statement Analysis: RatiosHerraNo ratings yet

- Relative ValuationDocument29 pagesRelative ValuationOnal RautNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersRating: 5 out of 5 stars5/5 (5)

- Understanding Business Accounting For DummiesFrom EverandUnderstanding Business Accounting For DummiesRating: 3.5 out of 5 stars3.5/5 (8)

- PAPS 1005 RevisedDocument39 pagesPAPS 1005 RevisedErica BueNo ratings yet

- Preqin SVCA Special Report Singapore ASEAN Private Equity April 2014Document16 pagesPreqin SVCA Special Report Singapore ASEAN Private Equity April 2014NigelT.LeeNo ratings yet

- PAPS-1000Ph Revised FinalDocument11 pagesPAPS-1000Ph Revised FinalNigelT.LeeNo ratings yet

- Philippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresDocument6 pagesPhilippine Auditing Practice Statement 1000 Inter-Bank Confirmation ProceduresVincent JohnNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneyNigelT.LeeNo ratings yet

- Krispy Kreme BA 141Document19 pagesKrispy Kreme BA 141NigelT.LeeNo ratings yet

- BA146 - Understanding of The Equity Premium PuzzleDocument5 pagesBA146 - Understanding of The Equity Premium PuzzleNigelT.LeeNo ratings yet

- Equity Premium-Its Still A Puzzle-KocherlakotaDocument30 pagesEquity Premium-Its Still A Puzzle-KocherlakotaNigelT.LeeNo ratings yet

- Capm From CcapmDocument3 pagesCapm From CcapmNigelT.LeeNo ratings yet

- A Test of The C-CAPM in The PhilippinesDocument7 pagesA Test of The C-CAPM in The PhilippinesNigelT.LeeNo ratings yet

- Cv-Nguyen My Phuong DungDocument2 pagesCv-Nguyen My Phuong DungHuy NguyễnNo ratings yet

- Funding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionDocument10 pagesFunding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionBoboy AzanilNo ratings yet

- Business Level StrategyDocument33 pagesBusiness Level StrategyAngelica PagaduanNo ratings yet

- Lect Topic 3.2 DisinvestmentDocument23 pagesLect Topic 3.2 DisinvestmentKertik SinghNo ratings yet

- Bonifacio Street, Davao City Bonifacio Street, Davao CityDocument1 pageBonifacio Street, Davao City Bonifacio Street, Davao CityGlee Cris S. UrbiztondoNo ratings yet

- Tutorial 4 SolutionsDocument4 pagesTutorial 4 SolutionsMADHAVI BARIYA100% (1)

- Finance and Capital MarketsDocument53 pagesFinance and Capital MarketsMUNAWAR ALINo ratings yet

- Analyzing Spa CeylonDocument7 pagesAnalyzing Spa CeylonPra DheenaNo ratings yet

- Growth & Stabilization StrategiesDocument11 pagesGrowth & Stabilization StrategiesAnkit Lohiya100% (2)

- Inventory 1Document17 pagesInventory 1Dinesh SharmaNo ratings yet

- Global Supply Chain Business ProcessDocument5 pagesGlobal Supply Chain Business ProcessDeepthi PakalapatiNo ratings yet

- Reading-Product Standardization or AdaptationDocument20 pagesReading-Product Standardization or AdaptationfarbwnNo ratings yet

- Analisis Market Segmentation Targeting Dan Positio PDFDocument16 pagesAnalisis Market Segmentation Targeting Dan Positio PDFdavidkurniawanNo ratings yet

- 2015 SRC Rules Table of ContentsDocument13 pages2015 SRC Rules Table of ContentsErika delos SantosNo ratings yet

- Solution StarbucksDocument3 pagesSolution StarbucksMrityunjay Kumar PandayNo ratings yet

- ToS TaxationDocument5 pagesToS TaxationJack KiraNo ratings yet

- Herfindahl-Hirschman Index For Passenger Car Segment in IndiaDocument4 pagesHerfindahl-Hirschman Index For Passenger Car Segment in IndiaShreeni YeshodharanNo ratings yet

- KFC in International Market: Presentation OnDocument9 pagesKFC in International Market: Presentation OnRaeesa WaqarNo ratings yet

- Profit Loss DiscountDocument34 pagesProfit Loss DiscountMusicLover21 AdityansinghNo ratings yet

- Submitted By: Vivek SharmaDocument18 pagesSubmitted By: Vivek SharmaVe1kNo ratings yet

- Acfrogaavn1gx Bzyc E3dofd6mzeugia1eu61zhuyszmyu542nybwqnouwobj3nb6vvdmezdwpb9tnotax2bv Fr6pm6aukubjy6btn Njbe Wgv0wsf7f6jxcdldb3tsyochffx5gymgnna4Document10 pagesAcfrogaavn1gx Bzyc E3dofd6mzeugia1eu61zhuyszmyu542nybwqnouwobj3nb6vvdmezdwpb9tnotax2bv Fr6pm6aukubjy6btn Njbe Wgv0wsf7f6jxcdldb3tsyochffx5gymgnna4Alyssa Jane G. AlvarezNo ratings yet

- Asset Impairment - 18ADocument24 pagesAsset Impairment - 18ALinh Dang Thi ThuyNo ratings yet

- MBA 644 2019 Individual Assignment 1 - Gautam SaseedharanDocument6 pagesMBA 644 2019 Individual Assignment 1 - Gautam SaseedharanGautamNo ratings yet

- Bse Nse222Document81 pagesBse Nse222Ravi SutharNo ratings yet

- Cash ManagementDocument18 pagesCash ManagementJoshua CabinasNo ratings yet

- Role and Function of Price in EconomyDocument8 pagesRole and Function of Price in Economyahmie banezNo ratings yet

- Types of Financial InnovationsDocument16 pagesTypes of Financial InnovationsrameNo ratings yet

- Marketing Mix 4PsDocument3 pagesMarketing Mix 4Psvohuuygg1No ratings yet

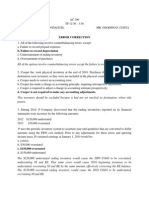

- Error CorrectionDocument8 pagesError CorrectionCharlie Magne G. SantiaguelNo ratings yet

- Retail Management Unit4Document53 pagesRetail Management Unit4Gautam DongaNo ratings yet