Professional Documents

Culture Documents

BJECTIVES To Understand The Concept of Electronic Payment System and Its Security Services

Uploaded by

guptaakash5u3097Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BJECTIVES To Understand The Concept of Electronic Payment System and Its Security Services

Uploaded by

guptaakash5u3097Copyright:

Available Formats

BJECTIVES To understand the concept of Electronic Payment System and its security services.

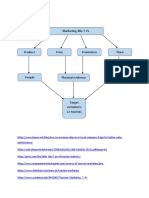

To bring out solution in the form of applications to uproot Electronic Payment. To understand working of various Electronic Payment System based applications. 3. What Electronic Payment system is? Electronic payment system is a system which helps the customer or user to make online payment for their shopping. To transfer money over the Internet. Methods of traditional payment. Check, credit card, or cash. Methods of electronic payment. Electronic cash, software wallets, smart cards, and credit/debit cards. 4. Some Examples Of EPS:- Online reservation Online bill payment Online order placing (nirulas) Online ticket booking ( Movie) 5. Two storage methods On-line Individual does not have possession personally of electronic cash Trusted third party, e.g. online bank, holds customers cash accounts Offline Customer holds cash on smart card or software wallet Fraud and double spending require tamper-proof encryption 6. Types of EPS E- CASH SMART CARDS CREDIT CARDS E- WALLETS 7. E-Cash A system that allows a person to pay for goods or services by transmitting a number from one computer to another. Like the serial numbers on real currency notes, the E-cash numbers are unique. This is issued by a bank and represents a specified sum of real money. It is anonymous and reusable. 8. Electronic Cash Security Complex cryptographic algorithms prevent double spending Anonymity is preserved unless double spending is attempted Serial numbers can allow tracing to prevent money laundering 9. E-Cash Processing 3 4 2 1 5 Bank Consumer Merchant Consumer buys e-cash from Bank 2. Bank sends e-cash bits to consumer (after charging that amount plus fee) 3. Consumer sends e-cash to merchant 4. Merchant checks with Bank that e-cash is valid (check for forgery or fraud) 5. Bank verifies that e-cash is valid 6. Parties complete transaction 10. E-Wallet The E-wallet is another payment scheme that operates like a carrier of ecash and other information. The aim is to give shoppers a single, simple, and secure way of carrying currency electronically. Trust is the basis of the e-wallet as a form of electronic payment. 11. Procedure for using an e-wallet Decide on an online site where you would like to shop. Download a wallet from the merchants website. Fill out personal information such as your credit card number, name, address and phone number, and where merchandise should be shipped. When you are ready to buy, click on the wallet button, the buying process is fully executed. 12. Smart Cards A smart card , is any pocket-sized card with embedded integrated circuits which can process data This implies that it can receive input which is processed and delivered as an output 13. Smart card Processing 14. Credit cards It is a Plastic Card having a Magnetic Number and code on it. It has Some fixed amount to spend. Customer has to repay the spend amount after sometime. 15. Processing a Credit cards payment 16. Risk in using Credit cards Operational Risk Credit Risk Legal Risk 17. Secure Electronic Transaction (SET) Protocol Jointly designed by MasterCard and Visa with backing of Microsoft, Netscape, IBM, GTE, SAIC, and others Designed to provide security for card payments as they travel on the Internet Contrasted with Secure

Socket Layers (SSL) protocol, SET validates consumers and merchants in addition to providing secure transmission SET specification Uses public key cryptography and digital certificates for validating both consumers and merchants Provides privacy, data integrity, user and merchant authentication, and consumer nonrepudiation 18. The SET protocol 19. Authentication Integrity Non-repudiation Privacy Safety Security Requirements of EPS 20. What Is payment Gateways?? A payment gateway is an e-commerce application service provider service that authorizes payments for e-businesses, online Shopping, etc. Payment gateway protects credit cards details encrypting sensitive information, such as credit card numbers, to ensure that information passes securely between the customer and the merchant and also between merchant and payment processor. 21. How It works?? 22. CONCLUSION Expand Market beyond Traditional geographic market Override traditional marketing system into digital marketing system. Made human life convenient as a person can pay his payments online while he is taking rest. )

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Warehouse For Consignment Distribution Feasibility StudyDocument14 pagesWarehouse For Consignment Distribution Feasibility Studymdsaulnier445590100% (1)

- Self-Study 1 - English For Business StudiesDocument2 pagesSelf-Study 1 - English For Business StudiesTài Huỳnh MinhNo ratings yet

- MKT Research-PepsiDocument50 pagesMKT Research-PepsiHeba Abd-AllahNo ratings yet

- Social Media Analytics-FINALDocument5 pagesSocial Media Analytics-FINALPooja BkNo ratings yet

- FMM MacDocument16 pagesFMM Macagga1111No ratings yet

- Implement Customer Feedback ProcedureDocument4 pagesImplement Customer Feedback Procedureomdkhaleel100% (4)

- Marketing Plan For Launching of JuiceDocument26 pagesMarketing Plan For Launching of JuicemuneebigiNo ratings yet

- Marketing Mix 7 Ps for Travel CompaniesDocument10 pagesMarketing Mix 7 Ps for Travel CompaniesAnum MalikNo ratings yet

- Consumer Behaviour Seminar 1: Chapter 1 and 2Document59 pagesConsumer Behaviour Seminar 1: Chapter 1 and 2Haritika Arora MahajanNo ratings yet

- Nike vs Under Armour Innovation AnalysisDocument10 pagesNike vs Under Armour Innovation Analysiseugeneyem100% (1)

- An Analysis On The Marketing Strategies OF Maggi: Presented By-Vaibhav Agarwal ROLL-44Document27 pagesAn Analysis On The Marketing Strategies OF Maggi: Presented By-Vaibhav Agarwal ROLL-44Vaibhav AgarwalNo ratings yet

- Case Project - Mountain ManDocument2 pagesCase Project - Mountain ManSubhrodeep Das100% (1)

- Strategic Direction: Chapter TopicsDocument5 pagesStrategic Direction: Chapter TopicsNorf d'GavNo ratings yet

- Case Analysis ShampooDocument6 pagesCase Analysis ShampooMEDISHETTY MANICHANDANANo ratings yet

- Hindustan Unilever Limited (HUL) IntroductionDocument3 pagesHindustan Unilever Limited (HUL) Introductionravi thapar40% (5)

- Mega BusDocument2 pagesMega BusDELSCRIBDNo ratings yet

- Economics Fresh Final ExamDocument5 pagesEconomics Fresh Final ExamTerefe Bergene bussaNo ratings yet

- 13-Classification of Firms On Market ShareDocument14 pages13-Classification of Firms On Market ShareBinu Krishnan GNo ratings yet

- Roshan project-Patanjali-AyurvedDocument66 pagesRoshan project-Patanjali-AyurvedRAJ YADAV0% (1)

- Production PossibilityDocument33 pagesProduction PossibilityManjunath ShettigarNo ratings yet

- How demand changes based on price, income and cross-price elasticityDocument6 pagesHow demand changes based on price, income and cross-price elasticityHazleen Rostam100% (3)

- Challenges of Rural MarketingDocument9 pagesChallenges of Rural MarketingDivya AgarwalNo ratings yet

- How external factors influence refrigerator purchasesDocument76 pagesHow external factors influence refrigerator purchasesDevanadhen Kaliaperumal100% (1)

- Oreo KraftDocument13 pagesOreo KraftNusrat Mohammad100% (1)

- Cic ReflectionDocument3 pagesCic ReflectionRenz Mari AcuñaNo ratings yet

- Gautam Presentation of Asian PaintsDocument21 pagesGautam Presentation of Asian PaintsGautam Maskara100% (1)

- Marketing Mix of MaggiDocument4 pagesMarketing Mix of MaggiAnwar khanNo ratings yet

- Rural Marketing PDFDocument6 pagesRural Marketing PDFAviral SankhyadharNo ratings yet

- WHIRLPOOL PPT (Autosaved)Document23 pagesWHIRLPOOL PPT (Autosaved)poorvi guptaNo ratings yet

- Gmail - RedBus Ticket - THDB83754756Document2 pagesGmail - RedBus Ticket - THDB83754756dipaliNo ratings yet