Professional Documents

Culture Documents

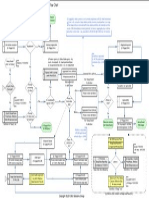

Dodd-Frank Act - Final and Proposed Rules Compliance Matrix and Calendar

Uploaded by

IQ3 Solutions GroupCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dodd-Frank Act - Final and Proposed Rules Compliance Matrix and Calendar

Uploaded by

IQ3 Solutions GroupCopyright:

Available Formats

CFTC Rulem aking Area

Rule - Short Description

Title of Federal Register Rule

FR Final Rule

FR Correction

FR Proposed

Effective Date

Com pliance Date

Com pliance Date Notes As of the compliance date, DCOs must begin submitting to the Commission any sw ap, or group, category, type, or class of sw aps that they plan to accept for clearing.

Description The CFTC adopted regulations to implement certain provisions of the Dodd-Frank Act. These regulations establish the process by w hich the CFTC w ill review sw aps to determine w hether the sw aps are required to be cleared. Final regulations to implement certain provisions of Title VII and Title VIII of the Dodd-Frank Act governing derivatives clearing organization (DCO) activities. Regulations establish the regulatory standards for compliance w ith DCO Core Principles A (Compliance), B (Financial Resources), C (Participant and Product Eligibility), D (Risk Management), E (Settlement Procedures), F (Treatment of Funds), G (Default Rules and Procedures), H (Rule Enforcement), I (System Safeguards), J (Reporting), K (Recordkeeping), L (Public Information), M (Information Sharing), N (Antitrust Considerations), and R (Legal Risk) set forth in Section 5b of the CEA. CFTC also updated and added related definitions; adopted implementing rules for DCO chief compliance officers (CCOs); revised procedures for DCO applications including the required use of a new Form DCO; adopted procedural rules applicable to the transfer of a DCO registration; and added requirements for approval of DCO rules establishing a portfolio margining program for customer accounts carried by a FCM that is also registered as a securities broker-dealer. In addition, CFTC adopted certain technical amendments to parts 21 and 39, and adopted certain delegation provisions under part 140.

Clearing

Process for Review of Sw aps

Process for Review of Sw aps for Mandatory Clearing

76 FR 44464

9/26/2011

9/26/2011

1/9/2012

All provisions except those for w hich there is a compliance date of May 7, 2012 or November 8, 2012.

5/7/2012

39.11, 39.12, 39.13 (except for 39.13(g)(8)(i)), 39.14

Clearing

DCO Core Principles

Derivatives Clearing Organization General Provisions and Core Principles

76 FR 69334

1/9/2012

11/8/2012

39.10(c), 39.13(g)(8)(i), 39.18, 39.19, 39.20 Parties w ho chose to elect the exception in this rule w ill need to comply w ith the requirements applicable upon such election only after compliance w ith the proposed clearing requirement rule begins.

Clearing

Exemptions - End-User of Sw aps

End-User Exception to the Clearing Requirement for Sw aps

77 FR 42559

9/17/2012

See Notes

Final regulations to implement certain provisions of the Dodd-Frank Act. These regulations govern the exception to the clearing requirement available to sw ap counterparties meeting certain conditions under the CEA, as amended by the Dodd-Frank Act. CFTC is adopting regulations to establish a schedule to phase in compliance w ith the clearing requirement under new section 2(h)(1)(A) of the CEA, enacted under Title VII of the Dodd-Frank Act. The schedule w ill provide additional time for compliance w ith this requirement. This additional time is intended to facilitate the transition to the new regulatory regime established by the DoddFrank Act in an orderly manner that does not unduly disrupt markets and transactions.

Clearing

Sw ap Clearing Requirement

Sw ap Transaction Compliance and Implementation Schedule: Clearing Requirement under Section 2(h) of the CEA

77 FR 44441

9/28/2012

See Notes

See clearing requirement rules w hen finalized. For SDs and MSPs, the compliance date is the later of October 1, 2012 or the date the SD/MSP registration rules are effective.

10/1/2012

See Notes Customer Clearing Documentation, Timing of Acceptance for Clearing, and Clearing Member Risk Management

For FCMs, DCMs, and DCOs, these rules are effective October 1, 2012. For SEFs, the rules are effective on the later of October 1, 2012 or the date the rules implementing the core principles for SEFs are effective.

Clearing

Risk Management - DCOs

77 FR 21278

10/1/2012

See Notes

The CFTC adopted rules to implement new statutory provisions enacted by Title VII of the Dodd-Frank Act. These rules address: documentation betw een a customer and a futures commission merchant that clears on behalf of the customer; timing of acceptance or rejection of trades for clearing by derivatives clearing organizations and clearing members; and risk management procedures of futures commission merchants, sw ap dealers, and major sw ap participants that are clearing members. Proposed regulations to further implement new statutory provisions enacted by Title VII of the Dodd-Frank Act. Specifically, the CFTC proposes requirements on the resolution of conflicts of interest in order to further implement core principles applicable to DCOs, DCMs, and SEFs. Such substantive requirements address reporting, transparency in decision-making, and limitations on use or disclosure of non-public information, among other things. For DCOs and DCMs, the CFTC also proposes regulations to implement core principles concerning governance fitness standards and the composition of governing bodies. Finally, for publicly-traded DCMs, the CFTC proposes regulations to implement the core principle on diversity of Boards of Directors. Proposed rules to implement new statutory provisions enacted by Title VII and Title VIII of the Dodd-Frank Act. The proposed regulations establish financial resources requirements for DCOs for the purpose of ensuring that they maintain sufficient financial resources to enable them to perform their functions in compliance w ith the CEA and the Dodd-Frank Act.

Clearing

Governance & Conflicts of Interest

Governance Requirements for Derivatives Clearing Organizations, Designated Contract Markets, and Sw ap Execution Facilities; Additional Requirements Regarding the Mitigation of Conflicts of Interest

76 FR 722

N/A

Clearing

Systemically Important DCO Rules

Financial Resources Requirements for Derivatives Clearing Organizations

75 FR 63113

N/A

Clearing

Exemptions - Affiliated Entities

Clearing Exemption for Sw aps Betw een Certain Affiliated Entities

77 FR 50425

N/A

Proposed rule to exempt sw aps betw een certain affiliated entities w ithin a corporate group from the clearing requirement (the ``inter-affiliate clearing exemption'' or the ``proposed exemption'') under Section 2(h)(1)(A) of the CEA. The CFTC also is proposing rules that detail specific conditions counterparties must satisfy to elect the proposed inter-affiliate clearing exemption, as w ell as reporting requirements for affiliated entities that avail themselves of the proposed exemption. The CFTC has finalized a rule that addresses sw aps that are subject to the end-user exception. Counterparties to inter-affiliate sw aps that qualify for the end-user exception w ould be able to elect to not clear sw aps pursuant to the end-user exception or the proposed rule. The proposed rule does not address sw aps that an affiliate enters into w ith a third party that are related to inter-affiliate sw aps that are subject to the end-user exception. The CFTC intends separately to propose a rule addressing sw aps betw een an affiliate and a third party w here the sw aps are used to hedge or mitigate commercial risk arising from inter-affiliate sw aps for w hich the end-user exception has b Proposed regulations to establish a clearing requirement under new section 2(h)(1)(A) of the CEA, enacted under Title VII of the Dodd-Frank Act. The regulations w ould require that certain classes of credit default sw aps (CDS) and interest rate sw aps (IRS), described herein, be cleared by a derivatives clearing organization (DCO) registered w ith the CFTC. The CFTC also is proposing regulations to prevent evasion of the clearing requirement and related provisions. Proposed rule pursuant to its authority under Section 4(c) of the CEA allow ing cooperatives meeting certain conditions to elect not to submit for clearing certain sw aps that such cooperatives w ould otherw ise be required to clear in accordance w ith Section 2(h)(1) of the CEA. The CFTC published an interim final rule to implement new statutory provisions introduced by Title VII of the Dodd-Frank Act. Section 729 of the Dodd-Frank Act requires the CFTC to adopt, w ithin 90 days of enactment of the Dodd-Frank Act, an interim final rule for the reporting of sw ap transactions entered into before July 21, 2010 w hose terms had not expired as of that date ("preenactment unexpired sw aps"). Pursuant to this mandate, the CFTC adopted an interim final rule requiring specified counterparties to pre-enactment unexpired sw ap transactions to report certain information related to such transactions to a registered sw ap data repository or to the CFTC by the compliance date to be established in reporting rules required under Section2(h)(5) of the CEA, or w ithin 60 days after an SDR becomes registered under Section 21 of the CEA, w hichever occurs first. An interpretive note to the rule advises that counterparties that may be required to report to an SDR or the CFTC w ill need to preserve information pertaining to the terms of such sw aps. The CFTC published for comment an interim final rule to implement new statutory provisions introduced by Title VII of the DoddFrank Act. Section 723 of the Dodd-Frank Act amends Section 2 of the CEA by adding new Section 2(h)(5)(B), w hich directs that rules adopted by the CFTC under this section shall provide for the reporting of "transition" sw aps--that is, sw aps entered into on or after the date of enactment of the Dodd-Frank Act and prior to the effective date of sw ap data reporting rules to implement Section 2(h)(5)(B)--to a registered SDR or to the CFTC Each category of data is subject to a reporting timetable specified in Section 2(h)(5). In order to ensure the preservation of data pending implementation of rules implementing the sw ap data reporting provisions of Section 2(h)(5)(B), the CFTC adopted an interim final rule directing specified counterparties to post-enactment, or transition, sw ap transactions entered into prior to the effective date of the sw ap data reporting and recordkeeping rules implementing Section 2(h)(5)(B) of the CEA to retain information pertaining to the terms of such sw aps

Clearing

Clearing Determination - CEA Section 2(h)

Clearing Requirement Determination Under Section 2(h) of the CEA

77 FR 47169

N/A

Clearing

Exemptions - Cooperatives

Clearing Exemption for Certain Sw aps Entered Into by Cooperatives

77 FR 41940

N/A

Data

Sw ap Data Requirements

Interim Final Rule for Reporting Pre-Enactment Sw ap Transactions

75 FR 63080

10/14/2010

See Notes

60 days from the date the appropriate SDR is registered w ith the Commission.

Data

Post-Enactment Sw ap Transactions

Reporting Certain Post-Enactment Sw ap Transactions

75 FR 78892

12/17/2010

12/17/2010

The compliance date and effective date are the same. Division of Market Oversight Conditional Relief for Reporting: issued September 16, 2011; provided relief from reporting until November 21, 2011 and January 20, 2012, respectively, for cleared and uncleared sw aps (see below ). Reporting Date for Clearing Organizations and Clearing Members w ith Respect to Cleared Sw aps. Reporting Date for Clearing Organizations and Clearing Members w ith Respect to Uncleared Sw aps. Division of Market Oversight Conditional No-Action Relief for Less than Fully Compliant Reporting: issued March 20, 2012; provides relief from fully compliant reporting until July 2, 2012.

9/20/2011

11/21/2011

1/20/2012

Data

Physical Sw aps - Large Trader Reporting

Large Trader Reporting for Physical Commodity Sw aps

76 FR 43851

9/20/2011

See Notes

The CFTC adopted reporting regulations that require physical commodity sw ap and sw aption reports. The new regulations require routine position reports from clearing organizations, clearing members and sw ap dealers and also apply to reportable sw ap trader positions.

10/31/2012

Provisional registration accepted. Mandatory registration and compliance must occur on the effective date of the final rule providing further definition of "sw ap". Later of 7/16/2012 or 60 days after the final rules related to the further definition of the term "sw ap" for sw aps executed on a SEF or DCM, and the later of 7/16/2012 or 60 days after the final rules related to the further definitions of the terms "sw ap", "sw ap dealer" and "major sw ap participant" for sw aps that are not executed pursuant to the rules of a SEF or DCM. SEFs, DCMs, SDs and MSPs must report interest rates and credit asset classes executed on a SEF or DCM or "off-facility" sw aps w here one counterparty is an SD or MSP. All SDRs for interest rate and credit classes must accept sw ap transaction and pricing data for those asset classes. 90 days after Compliance date 1. SEFs, DCMs, SDs and MSPs must report equity, FOREX, and other commodity asset classes executed on a SEF or DCM or "off-facility" sw aps w here one counterparty is an SD or MSP. SDRs for interest rate, credit, equity, FOREX, and other commodity asset classes must accept and disseminate transactions for those asset classes. 90 days after Compliance date 2. Reporting and public dissemination of all publicly reportable sw ap transactions in all asset classes by SEFs, DCMs, SDs and MSPS, and CFTC adopted regulations to implement certain statutory provisions enacted by the Dodd-Frank Act. Specifically, the CFTC adopted non-SD/MSP to non-SD/MSP off facility transactions. rules to implement a framew ork for the real-time public reporting of sw ap transaction and pricing data for all sw ap transactions. Credit sw aps and interest rate sw aps: the later of July 16, 2012, or 60 calendar days after the publication in the Federal Register of the later of the Commission's final rule providing further definition of "sw ap dealer" or "major sw ap participant", or the Commission's final rule providing further definition of "sw ap" (Compliance Date 1). Equity sw aps, foreign exchange sw aps, and other commodity sw aps. Compliance date 2, the compliance date w ith respect to equity sw aps, foreign exchange sw aps, and other commodity sw aps, shall be 90 calendar days after compliance date 1. Compliance date for non-SD/MSP counterparties. Non-SD/MSP counterparties shall commence full compliance w ith all provisions of this part for all sw aps on compliance date 3, w hich shall be 90 calendar days after compliance date 2. Credit sw aps and interest rate sw aps: the later of July 16, 2012, or 60 calendar days after the publication in the Federal Register of the later of the Commission's final rule providing further definition of "sw ap dealer" or "major sw ap participant", or the Commission's final rule providing further definition of "sw ap" (Compliance Date 1). Equity sw aps, foreign exchange sw aps, and other commodity sw aps. Compliance date 2, the compliance date w ith respect to equity sw aps, foreign exchange sw aps, and other commodity sw aps, shall be 90 calendar days after compliance date 1. Compliance date for non-SD/MSP counterparties. Non-SD/MSP counterparties shall commence full compliance w ith all provisions of this part for all sw aps on compliance date 3, w hich shall be 90 calendar days after compliance date 2. The CFTC is adopting rules to further implement the CEA w ith respect to the new statutory framew ork regarding sw ap data recordkeeping and reporting established by the Dodd-Frank Act. The Dodd-Frank Act, w hich amended the CEA, directs that rules adopted by the CFTC shall provide for the reporting of data relating to sw aps entered into before the date of enactment of the Dodd-Frank Act, the terms of w hich have not expired as of the date of enactment of the Dodd-Frank Act (``pre-enactment sw aps'') and data relating to sw aps entered into on or after the date of enactment of the Dodd-Frank Act and prior to the compliance date specified in the Commission's final sw ap data reporting rules (``transition sw aps''). These final rules establish sw ap data recordkeeping and reporting requirements for pre-enactment sw aps and transition sw aps. CFTC is proposing this interpretative statement to provide guidance regarding the applicability of confidentiality and indemnification provisions set forth in new section 21(d) of the CEA added by section 728 of the Dodd-Frank Act. The CFTC requests comment on all aspects of the proposed interpretative statement. The interpretative statement clarifies that the provisions of section 21(d) should not operate to inhibit or prevent foreign regulatory authorities from accessing data in w hich they have an independent and sufficient regulatory interest, even if that data also has been reported pursuant to the CEA and CFTC regulations. The CFTC is proposing regulations to implement certain statutory provisions enacted by Title VII of the Dodd-Frank Act. Specifically, in accordance w ith section 727 of the Dodd-Frank Act, the CFTC is proposing regulations that w ould define the criteria for grouping sw aps into separate sw ap categories and w ould establish methodologies for setting appropriate minimum block sizes for each sw ap category. In addition, the CFTC is proposing further measures under the CFTC's regulations to prevent the public disclosure of the identities, business transactions and market positions of sw ap market participants. The CFTC adopted final rules pursuant to section 753 of the Dodd-Frank Act to implement amended subsections (c)(1) and (c)(3) of section 6 of the CEA. These rules broadly prohibit fraud and manipulation in connection w ith any sw ap, or contract of sale of any commodity in interstate commerce, or contract for future delivery on or subject to the rules of any registered entity. The CFTC adopted final rules and new forms to implement Section 23 of the CEA, entitled "Commodity Whistleblow er Incentives and Protection." The rules implement the Dodd-Frank Acts requirement that the CFTC establish a Whistleblow er program that requires the CFTC to pay an aw ard, under regulations prescribed by the CFTC and subject to certain limitations, to eligible Whistleblow ers w ho voluntarily provide the CFTC w ith original information about a violation of the CEA that leads to the successful enforcement of a covered judicial or administrative action, or a related action. The CFTC is proposing this interpretive order to provide interpretive guidance regarding the three statutory disruptive practices set forth in new section 4c(a)(5) of the CEA pursuant to section 747 of the Dodd-Frank Act. The CFTC requests comment on all aspects of the proposed interpretive order. The CFTC adopted regulations to implement new statutory provisions enacted by Title X of the Dodd-Frank Act. These regulations apply to futures commission merchants, retail foreign exchange dealers, commodity trading advisors, commodity pool operators, introducing brokers, sw ap dealers and major sw ap participants. The Dodd-Frank Act provides the CFTC w ith authority to implement regulations under sections 624 and 628 of the Fair Credit Reporting Act. The regulations implementing section 624 of the Fair Credit Reporting Act require CFTC-regulated entities to provide consumers w ith the opportunity to prohibit affiliates from using certain information to make marketing solicitations to consumers. The regulations implementing section 628 of the FCRA require CFTC-regulated entities that possess or maintain consumer report information in connection w ith their business activities to develop and implement w ritten policies and procedures for the proper disposal of such information. The CFTC amended its rules to implement new statutory provisions enacted by titles VII and X of the Dodd-Frank Act. Section 1093 of the Dodd-Frank Act provides for certain amendments to title V of the Gramm-Leach-Bliley Act (the "GLB Act"). The GLB Act sets forth certain protections for the privacy of consumer financial information and w as amended by the Dodd-Frank Act to affirm the CFTCs jurisdiction in this area. The amendments broaden the scope of part 160 to cover tw o new entities created by title VII of the Dodd-Frank Act: sw ap dealers and major sw ap participants. The CFTC implemented new provisions of Title IX of the Dodd-Frank Act by removing references to or reliance on credit ratings, and replacing any such reference w ith an appropriate alternative standard. Division of Market Oversight Conditional No-Action Relief for Less than Fully Compliant Reporting: issued March 20, 2012; provides relief from fully compliant reporting until July 2, 2012.

Data

SDR Core Principles

Sw ap Data Repositories: Registration Standards, Duties and Core Principles

76 FR 54538

10/31/2011

See Notes

See Notes

See Notes

Data

Sw aps Real-Time Reporting

Real-Time Reporting for Sw aps

77 FR 1182

3/9/2012

See Notes

See Notes

See Notes

Data

Sw ap Data - Recordkeeping

Sw ap Data Recordkeeping and Reporting

77 FR 2136

3/13/2012

See Notes

The CFTC adopted rules to implement the CEA relating to sw ap data recordkeeping and reporting requirements. These sections of the CEA w ere added by the Dodd-Frank Act. The rules adopted apply to sw ap data recordkeeping and reporting requirements for sw ap data repositories, derivatives clearing organizations, designated contract markets, sw ap execution facilities, sw ap dealers, major sw ap participants, and sw ap counterparties w ho are neither sw ap dealers nor major sw ap participants.

See Notes

See Notes

Data

Sw ap Data - Pre-Enactment

Sw ap Data Recordkeeping and Reporting Requirements: Pre-Enactment and Transition Sw aps

77 FR 35200

8/13/2012

See Notes

Data

SDR Confidentiality

Sw ap Data Repositories: Interpretative Statement Regarding the Confidentiality and Indemnification Provisions of Section 21(d) of the Commodity Exchange Act

77 FR 26709

N/A

Data

Minimum Block Sizes

Procedures to Establish Appropriate Minimum Block Sizes for Large Notional Off-Facility Sw aps and Block Trades

77 FR 15460

N/A

Enforcement

Anti-Manipulation

Prohibition on the Employment, or Attempted Employment, of Manipulative and Deceptive Devices - Prohibition on Price Manipulation

76 FR 41398

8/15/2011

8/15/2011

The compliance date and effective date are the same.

Enforcement

Whistleblow er Provisions

Final Rules for Implementing the Whistleblow er Provisions of Section 23 of the Commodity Exchange Act

76 FR 53172

10/24/2011

10/24/2011

For information regarding the Commissions w histleblow er program, see http://w w w .cftc.gov/ConsumerProtection/Whistleblow erInformation/index.htm

Enforcement

Disruptive Trading Practices

Antidisruptive Practices Authority (Proposed Interpretive Order)

76 FR 14943

N/A

9/21/2012

Phase 1: FCMs, CPOs, CTAs, IBs, RFEDs

Other

Business Affiliate Marketing and Disposal of Consumer Information

76 FR 43879

9/20/2011

See Notes

Phase 2: SDs and MSPs (60 days after the effective date of the final rule providing further definition of "sw ap dealer" and "Major sw ap participant")

11/21/2011

Phase 1: FCMs, CPOs, CTAs, IBs, RFEDs Phase 2: SDs and MSPs (60 days after the final rule providing further definition of "sw ap dealer" and "major sw ap participant" is effective)

Other

Privacy of Consumer Financial Information

Privacy of Consumer Financial Information; Conforming Amendments under Dodd-Frank Act Removing Any Reference to or Reliance on Credit Ratings in Commission Regulations; Proposing Alternatives to the Use of Credit Ratings

76 FR 43874

9/20/2011

See Notes

Other

Reliance on Credit Ratings

76 FR 44262

9/23/2011

9/23/2011

The compliance date and effective date are the same.

Other

Investment of Customer Funds (1.25)

Investment of Customer Funds and Funds Held in an Account for Foreign Futures and Foreign Options Transactions

76 FR 78776

2/17/2012

6/18/2012

The CFTC amended its regulations regarding the investment of customer segregated funds subject to CFTC Regulation 1.25 A futures commission merchant (FCM) or derivatives clearing organization (DCO) that (Regulation 1.25) and funds held in an account subject to CFTC Regulation 30.7 (Regulation 30.7, and funds subject thereto, 30.7 w as already in compliance w ith Regulation 1.25 as of the effective date may not invest funds). Certain amendments reflect the implementation of new statutory provisions enacted under Title IX of the Dodd-Frank Act. funds during the period of time betw een the effective date and the compliance date The amendments address: certain changes to the list of permitted investments (including the elimination of in-house transactions), (the Compliance Period) if such investments w ould cause the FCM or DCO to move out a clarification of the liquidity requirement, the removal of rating requirements, and an expansion of concentration limits including of compliance. An FCM or DCO that did not comply w ith Regulation 1.25 as of the asset-based, issuer-based, and counterparty concentration restrictions. They also address revisions to the acknow ledgment effective date has until the compliance date to fully comply. How ever, during the letter requirement for investment in a money market mutual fund (MMMF), revisions to the list of exceptions to the next-day Compliance Period such an FCM or DCO may only alter its investments in a manner that redemption requirement for MMMFs, the elimination of repurchase and reverse repurchase agreements w ith affiliates, the advances its efforts to come into compliance it may not pursue investments that application of customer segregated funds investment limitations to 30.7 funds, the removal of ratings requirements for depositories w ould move it further out of compliance. of 30.7 funds, the elimination of the option to designate a depository for 30.7 funds, and certain technical changes.

Other

CPO / CTA Compliance Obligations

Commodity Pool Operators and Commodity Trading Advisors: Compliance Obligations

77 FR 17328

3/26/2012

See Notes

See 77 FR 11252

77 FR 17328 is correction to 77 FR 11252. The CFTC and the CFTC (collectively, Commissions) adopted rules under the CEA and the IAA of 1940 to implement provisions of Title IV of the Dodd-Frank Act. The new SEC rule requires investment advisers registered w ith the SEC that advise one or more private funds and have at least $150 million in private fund assets under management to file Form PF w ith the SEC. The new CFTC rule requires commodity pool operators (CPOs) and commodity trading advisors (CTAs) registered w ith the CFTC to satisfy certain CFTC filing requirements w ith respect to private funds, should the CFTC adopt such requirements, by filing Form PF w ith the SEC, but only if those CPOs and CTAs are also registered w ith the SEC as investment advisers and are required to file Form PF under the Advisers Act. The new CFTC rule also allow s such CPOs and CTAs to satisfy certain CFTC filing requirements w ith respect to commodity pools that are not private funds, should the CFTC adopt such requirements, by filing Form PF w ith the SEC. Advisers must file Form PF electronically, on a confidential basis.

6/15/2012

Phase 1: Advisers w ith assets under management greater than or equal to $5 billion.

Other

Reporting on Form PF

Reporting by Investment Advisers to Private Funds and Certain Commodity Pool Operators and Commodity Trading Advisors on Form PF

76 FR 71128

3/31/2012

12/15/2012

Phase 2: All entities reporting on Form PF w ith AUM betw een $150 million and $1.5 billion.

9/15/2012

4.27: Phase 1: CPOs w ith assets under management greater than or equal to $5 Bn.

12/15/2012

4.27: Phase 2: All other registered CPOs and CTAs. 12/31/2012 or 60 days after the effective date of the final rulemaking further defining "sw ap". Registration required for entities subject to 4.5. 60 days follow ing the final rule implementing the Commission's proposed harmonization effort for registered investment companies. Entities required to register due to the The CFTC adopted amendments to its existing part 4 regulations and promulgated one new regulation regarding Commodity Pool amendments to 4.5 shall be subject to the Commission's recordkeeping, reporting, and Operators (CPOs) and Commodity Trading Advisors (CTAs). The CFTC also adopted new data collections for CPOs and CTAs that disclosure requirements under Part 4. are consistent w ith a data collection required under the Dodd-Frank Act for entities registered w ith both the CFTC and the SEC. 4.13(a)(4) (for CPOs claiming exemption prior to 4/24/2012), 4.13(a)(3), 4.7, 4.24, 4.34, The adopted amendments rescind the exemption from registration; rescind relief from the certification requirement for annual reports provided to operators of certain pools offered only to qualified eligible persons (QEPs; modify the criteria for claiming 4.14, 4.5 Compliance Date 6: 4/24/2012. relief); and require the annual filing of notices claiming exemptive relief under several sections of the CFTC's regulations. Finally, the adopted amendments include new risk disclosure requirements for CPOs and CTAs regarding sw ap transactions. Please also 4.13(a)(4) compliance for all entities not previously exempt under this provision see 77 FR 17328 (correction). The CFTC is adopting regulations to further implement new statutory provisions enacted by Title VII of the Dodd-Frank Act regarding registration of intermediaries. Specifically, the CFTC is adopting certain conforming amendments to the CFTC's regulations regarding the registration of intermediaries, consistent w ith other CFTC rulemakings issued pursuant to the Dodd-Frank Act, and other non- substantive, technical amendments to its regulations. The CFTC is amending its regulations governing the operations and activities of commodity pool operators (CPOs) and commodity trading advisors (CTAs) in order to have those regulations reflect changes made to the CEA by the Dodd-Frank Act. The Dodd-Frank Act established a comprehensive new statutory framew ork for sw aps and security-based sw aps. The DoddFrank Act repeals some sections of the CEA, amends others, and adds a number of new provisions. The Dodd-Frank Act also requires the CFTC to promulgate a number of rules to implement the new framew ork. The Commission has proposed and finalized numerous rules to satisfy its obligations under the Dodd-Frank Act. This rulemaking makes a number of conforming amendments to integrate the CFTCs regulations more fully w ith the new framew ork created by the Dodd-Frank Act. This rulemaking contains amendments of three different types: ministerial, accommodating, and substantive. The CFTC is proposing amendments to its regulations regarding requirements applicable to investment companies registered under the Investment Company Act of 1940 (``registered investment companies'') w hose advisors w ill be subject to registration as commodity pool operators due to changes that the CFTC is adopting. The CFTC is requesting comment on a proposed rule that w ould implement Section 619 of the Dodd-Frank Act w hich contains certain prohibitions and restrictions on the ability of a banking entity and nonbank financial company supervised by the Board of Governors of the Federal Reserve System (``Board'') to engage in proprietary trading and have certain interests in, or relationships w ith, a hedge fund or private equity fund (``CFTC Rule''). On November 7, 2011, the Office of the Comptroller of the Currency, Treasury (``OCC''); the Board; the Federal Deposit Insurance Corporation (``FDIC''); and the SEC published a joint proposed rule implementing Section 619 of the Dodd-Frank Act (the ``Joint Release''). The CFTC is adopting the entire text of the proposed common rules section from the Joint Release (the ``Joint Rule'') as part of its proposed rule Similar to the OCC, the Board, the FDIC, and the SEC in the Joint Release, the CFTC is modifying the Joint Rule w ith CFTC-specific rule text. The CFTC Rule also contains additional questions specific to the CFTC in Section III and does not include Subpart E of the Joint Release because Subpart E deals exclusively w ith the Board. The Commission solicits comments on all aspects of this proposed rule. Phase 1: Spot month limits in 28 commodities and non-spot month limits in 9 legacy agricultural commodities. (60 days after the final rule providing further definition of "sw ap" is published in the Federal Register). Phase 2: Non-spot month limits in 19 commodities (1st calendar day of 3rd calendar month follow ing publication of order after collecting 12 months of sw ap positional data).

See Notes

See Notes

12/31/2012 Commodity Pool Operators and Commodity Trading Advisors: Amendments to Compliance Obligations

Other

CPO / CTA Amendments

77 FR 11252

4/24/2012

4/24/2012

Other

Registration of Intermediaries

Registration of Intermediaries Amendments to Commodity Pool Operator and Commodity Trading Advisor Regulations Resulting From the Dodd-Frank Act

77 FR 51898

10/29/2012

See Notes

The Part 3 regulations only impact a firm once it initiates the registration process as required by other rules. Persons w ho come w ithin the CPO or CTA definition by virtue of sw aps activity become subject to applicable disclosure, reporting and recordkeeping requirements.

Other

Part 4 Conforming Amendments

77 FR 54355

11/5/2012

11/5/2012

Other

Adaptation to Incorporate Sw aps

Adaptation of Regulations To Incorporate Sw aps

77 FR 66288

1/2/2013

1/2/2013

The compliance date and effective date are the same.

Other

Harmonization of CPOs and RIAs

Harmonization of Compliance Obligations for Registered Investment Companies Required to Register as Commodity Pool Operators

77 FR 11345

N/A

Other

Volcker Rule

Prohibitions and Restrictions on Proprietary Trading and Certain Interests in, and Relationships With, Hedge Funds and Covered Funds

77 FR 8332

N/A

See Notes

Position Limits

Position Limits - Futures and Sw aps

Position Limits for Futures and Sw aps, including Bona Fide Hedging Definition & Aggregate Limits

76 FR 71626

1/17/2012

See Notes

The CFTC adopted regulations establishing position limits for 28 exempt and agricultural commodity futures and options contracts and the physical commodity sw aps that are economically equivalent to such contracts. On November 18, 2011, the CFTC published in the Federal Register a final rule and interim final rule, w hich establish a position limits regime for 28 exempt and agricultural commodity futures and options contracts and the physical commodity sw aps that are economically equivalent to such contracts. In response to a petition for exemptive relief under the CEA and certain comments to the CFTC's interim final rule for spot-month limits for cash-settled contracts, this notice proposes certain modifications to the CFTC's policy for aggregation under the position limits regime in CFTC regulations. The CFTC is authorizing the National Futures Association (NFA), effective September 10, 2010, to process and grant applications for initial registration, renew ed registration and w ithdraw als of retail foreign exchange dealers (RFEDs) and their associated persons (APs) and to issue temporary licenses to eligible APs; to conduct proceedings to deny, condition, suspend, restrict or revoke the registration of any RFED or AP of an RFED, or an applicant for registration in either category; and to maintain records regarding RFEDs and their APs, and to serve as the official custodian of those CFTC records. The CFTC is adopting a comprehensive regulatory scheme to implement the provisions of the Dodd-Frank Act of 2010 and the CFTC Reauthorization Act of 2008 w ith respect to offexchange transactions in foreign currency w ith members of the retail public (i.e., retail forex transactions). The new regulations and amendments to existing regulations published today establish requirements for, among other things, registration, disclosure, recordkeeping, financial reporting, minimum capital, and other operational standards. The CFTC adopted regulations and amendments to existing regulations to establish requirements for, among other things, registration, disclosure, recordkeeping, financial reporting, minimum capital, and other operational standards w ith respect to offexchange transactions in foreign currency w ith members of the retail public. The CFTC amended its regulations governing off-exchange foreign currency transactions w ith members of the retail public (i.e., retail forex transactions). These amendments incorporate into Part 5 of the CFTC's regulations changes made to the CEA by the Dodd-Frank Act. The CFTC also issued certain related technical interpretations of various provisions of the CEA as amended by the Dodd-Frank Act w ith respect to retail forex transactions. The CFTC adopted rules to implement new statutory provisions enacted by Title VII of the Dodd-Frank Act. The Dodd-Frank Act, w hich amends the CEA, includes provisions applicable to "a sw ap in an agricultural commodity (as defined by the CFTC)." This release defined that term for purposes of the CEA or CFTC regulations. The CFTC amended its regulations governing off-exchange foreign currency transactions w ith members of the retail public (i.e., retail forex transactions). These amendments incorporate into Part 5 of the CFTC's regulations changes made to the CEA by the Dodd-Frank Act. The CFTC also issued certain related technical interpretations of various provisions of the CEA as amended by the Dodd-Frank Act w ith respect to retail forex transactions. The CFTC finalized rules to implement new statutory provisions enacted by Title VII of the Dodd-Frank Act. The Dodd-Frank Act provides that sw aps in an agricultural commodity (as defined by the CFTC) are prohibited unless entered into pursuant to a rule, regulation or order of the CFTC adopted pursuant to certain provisions of the CEA. The CFTC finalized rules that w ould, among other things, implement regulations w hereby sw aps in agricultural commodities may transact subject to the same rules as all other sw aps. The rules for sw aps in an agricultural commodity repealed and replaced the CFTCs regulations concerning the exemption of sw ap agreements.

Position Limits

Position Limits - Aggregation

Aggregation, Position Limits for Futures and Sw aps

77 FR 31767

N/A

Products

NFA Forex Registration Functions

Performance of Registration Functions by National Futures Association With Respect to Retail Foreign Exchange Dealers and Associated Persons

75 FR 55310

9/10/2010

9/10/2010

The compliance date and effective date are the same.

Products

Off-Exchnage Forex Transactions

Regulation of Off-Exchange Retail Foreign Exchange Transactions and Intermediaries

75 FR 55409

10/18/2010

10/18/2010

The compliance date and effective date are the same.

Products

Off-Exchnage Forex Regulation

Regulation of Off-Exchange Retail Foreign Exchange Transactions and Intermediaries

75 FR 55410

10/18/2010

10/18/2010

The compliance date and effective date are the same.

Products

Conforming Amendments for Forex

Retail Foreign Exchange Transactions; Conforming Changes to Existing Regulations in Response to the Dodd-Frank Wall Street Reform and Consumer Protection Act

76 FR 56103

9/12/2011

9/12/2011

The compliance date and effective date are the same.

Products

Agricultural Commodity Definition

Agricultural Commodity Definition

76 FR 41048

9/12/2011

9/12/2011

The compliance date and effective date are the same.

Products

Retail Forex Transactions

Retail Foreign Exchange Transactions; Conforming Changes to Existing Regulations in Response to the Dodd-Frank Wall Street Reform and Consumer Protection Act

76 FR 56103

9/12/2011

9/12/2011

The compliance date and effective date are the same.

Products

Agricultural Sw aps

Agricultural Sw aps

76 FR 49291

12/31/2011

See Notes

Effective date of the final rule providing further definition of "sw ap."

1/9/2012

All provisions except those for w hich there is a compliance date of May 7, 2012 or November 8, 2012.

5/7/2012

39.11, 39.12, 39.13 (except for 39.13(g)(8)(i)), 39.14

Products

Portfolio Margining Procedures

Derivatives Clearing Organization General Provisions and Core Principles

76 FR 69334

1/9/2012

11/8/2012

39.10(c), 39.13(g)(8)(i), 39.18, 39.19, 39.20 For the final rule and interim final rule 60 days after the term "sw ap" is further defined pursuant to section 721 of the Dodd-Frank Act. For purposes of complying w ith rules 32.2(a) (permitting commodity options subject to the CEA and CFTC rules, including the sw aps rules) and 32.3 (permitting trade options), the compliance date shall be the compliance date for the rules further defining the term "sw ap". For Form TO, "Annual Notice Filing for Counterparties to Unreported Trade Options," the compliance date is March 1, 2014. Form TO, the notice filing requirement that requires annual reports regarding otherw ise unreported trade options, is effective w ith respect to calendar year 2013. Therefore, on March 1, 2014, 60 days after the end of calendar year 2013, the first Forms TO, covering unreported trade options during calendar year 2013, are due. There is no Form TO filing requirement for unreported trade options entered into betw een the effective date of the commodity options rules and December 31, 2012.

The CFTC adopted final regulations to implement certain provisions of Title VII and Title VIII of the Dodd-Frank Act governing derivatives clearing organization (DCO) activities. The regulations establish the regulatory standards for compliance w ith DCO Core Principles A (Compliance), B (Financial Resources), C (Participant and Product Eligibility), D (Risk Management), E (Settlement Procedures), F (Treatment of Funds), G (Default Rules and Procedures), H (Rule Enforcement), I (System Safeguards), J (Reporting), K (Recordkeeping), L (Public Information), M (Information Sharing), N (Antitrust Considerations), and R (Legal Risk) set forth in Section 5b of the Commodity Exchange Act. The CFTC also updated and added related definitions; adopted implementing rules for DCO chief compliance officers (CCOs); revised procedures for DCO applications including the required use of a new Form DCO; adopted procedural rules applicable to the transfer of a DCO registration; and added requirements for approval of DCO rules establishing a portfolio margining program for customer accounts carried by a futures commission merchant that is also registered as a securities broker-dealer. In addition, the CFTC is adopted certain technical amendments to parts 21 and 39, and adopted c

See Notes

See Notes

Products

Commodity Options

Commodity Options

77 FR 25320

6/26/2012

See Notes

17 CFR Parts 3, 32, and 33 Commodity Options. The CFTC is issuing a final rule to repeal and replace the CFTC's current regulations concerning commodity options. The CFTC is also issuing an interim final rule (w ith a request for additional comment) that incorporates a trade option exemption into the final rules for commodity options (added Sec. 32.3). For a transaction to be w ithin the trade option exemption, the option, the offeror (seller), and the offeree (buyer), as applicable, must satisfy certain eligibility requirements, including that the option, if exercised, be physically settled, that the option seller meet certain eligibility requirements, and that the option buyer be a commercial user of the commodity underlying the option, and certain other regulatory conditions. Only comments pertaining to the interim final rule w ill be considered in any further action related to these rules.

10/12/2012

Final Rules and Interpretations, w ith certain exceptions described below . Effective date of rules to be proposed w ith regard to the regulatory implications of the interpretation regarding guarantees of sw aps. Solely for the purposes of the Order Granting Temporary Exemptions under the Securities Exchange Act of 1934 in Connection w ith the Pending Revision of the Definition of "Security" to Encompass Security-Based Sw aps and the Exemptions for Security-Based Sw aps. Persons w ho come w ithin the SD or MSP definition must apply for registration as an SD or MSP, respectively, by no later than the latest effective date of the regulations adopted to further define the terms sw ap dealer, major sw ap participant, and sw aps. Persons w ho believe they w ill come w ithin the MSP or SD definition may apply for registration as an SD or MSP, respectively, from and after March 19, 2012. In accordance w ith section 712(a)(8), section 712(d)(1), sections 712(d)(2)(B) and (C), sections 721(b) and (c), and section 761(b) of the Dodd-Frank Act, the CFTC and the SEC (collectively, "Commissions"), in consultation w ith the Board of Governors of the Federal Reserve System ("Board"), are jointly adopting new rules and interpretations under the CEA and the Securities Exchange Act of 1934 ("Exchange Act") to further define the terms "sw ap," "security-based sw ap," and "security-based sw ap agreement" (collectively, "Product Definitions"); regarding "mixed sw aps;" and governing books and records w ith respect to "security-based sw ap agreements." The CFTC requests comment on its interpretation concerning forw ards w ith embedded volumetric optionality, contained in Section II.B.2.(b)(ii) of this release. The CFTC adopted regulations under the CEA that establish the process for the registration of sw ap dealers (SDs) and major sw ap participants (MSPs) and that require SDs and MSPs to become and remain members of a registered futures association. The CFTC also adopted regulations that define an "associated person" of an SD or MSP as a natural person and that implement the prohibition on an SD or MSP permitting an associated person w ho is statutorily disqualified from registration from effecting or being involved in effecting sw aps on behalf of the SD or MSP. The CFTC adopted final regulations to implement new statutory provisions enacted by Title VII of the Dodd-Frank Act. Specifically, these regulations impose requirements on futures commission merchants and derivatives clearing organizations regarding the treatment of cleared sw aps customer contracts (and related collateral), and make conforming amendments to bankruptcy provisions applicable to commodity brokers under the CEA.

See Notes

Products

Further Definition of ``Sw ap,'' ``Security-Based Sw ap,'' and ``Security-Based Sw ap Definition of Sw ap & Security-Based Sw ap Agreement''; Mixed Sw aps; Security-Based Sw ap Agreement Recordkeeping

77 FR 48207

10/12/2012

2/11/2013

SD / MSP

Registration - SD / MSP

Registration of Sw ap Dealers and Major Sw ap Participants

77 FR 2613

3/19/2012

See Notes

SD / MSP

Segregation & Bankruptcy for Sw aps

Protection of Cleared Sw aps Customer Contracts and Collateral; Conforming Amendments to the Commodity Broker Bankruptcy Provisions

77 FR 6336

4/9/2012

11/8/2012

The rules w ill become effective April 9, 2012. All parties must comply w ith the Part 22 rules by November 8, 2012, and w ith the Part 190 rules by April 9, 2012. Sw ap dealers and major sw ap participants must comply w ith the rules in subpart H of part 23 on the later of 180 days after the effective date of these rules or the date on w hich sw ap dealers or major sw ap participants are required to apply for registration pursuant to Commission rule 3.10. Compliance w ith the follow ing provisions of subpart H is deferred until January 1, 2013: 23.402; 23.410(c); 23.430; 23.431(a)-(c); 23.432; 23.434(a)(2), (b), and (c); 23.440; and 23.450. 23.200 through 23.205 (Reporting, Recordkeeping, and Daily Trading Records Requirements for SDs and MSPs): SDs and MSPs currently regulated by U.S. prudential regulator or registered w ith SEC: The later of 7/2/12 or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. SDs and MSPs not currently regulated by U.S. prudential regulator and not registered w ith SEC: The later of 9/30/12 or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. 23.600 (Risk Management Program for SDs and MSPs): SDs and MSPs currently regulated by U.S. prudential regulator or registered w ith SEC: The later of 7/2/12 or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. SDs and MSPs not currently regulated by U.S. prudential regulator and not registered w ith SEC: The later of 9/30/12 or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. 23.603 (Business Continuity and Disaster Recovery): SDs and MSPs currently regulated by U.S. prudential regulator or registered w ith SEC: The later of 9/30/12 or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. SDs and MSPs not currently regulated by U.S. prudential regulator and not registered w ith SEC: The later of 12/29/12 or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. 23.601 (Monitoring of Position Limits), 23.602 (Diligent Supervision), 23.605 (Conflicts of Interest Policies and Procedures), 23.606 (General Information: Availability for Disclosure and Inspection), and 23.607 (Antitrust Considerations):The later of 6/4/12 or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. 1.71 (Conflicts of Interest Policies and Procedures by FCMs and IBs):FCMs and IBs registered w ith CFTC as of 6/4/12 must comply by 6/4/12, except that such FCMs need not comply w ith 1.71(d) until the later of 6/4/12 or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. FCMs and IBs not registered w ith CFTC as of 6/4/12 must comply upon registration w ith the CFTC, except that such FCMs need not comply w ith 1.71(d) until the later of their registration or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. 3.3 (Chief Compliance Officer FCMs, SDs, and MSPs): SDs and MSPs currently regulated by US prudential regulator or registered w ith SEC: The later of 9/30/12 or the date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. SDs and MSPs not currently regulated by US prudential regulator and not registered w ith SEC: The later of 3/29/13 or date on w hich SDs and MSPs are required to apply for registration pursuant to 3.10. FCMs (1) registered w ith CFTC as of 6/4/12, and (2) currently regulated by US prudential regulator or registered w ith SEC: 9/30/12. FCMs (1) registered w ith CFTC as of 6/4/12, and (2) not currently regulated by US prudential regulator and not registered w ith SEC: 3/29/13. FCMs not registered w ith CFTC as of 6/4/12 must comply w ith 3.3 upon registration w ith the CFTC. The effective date for the definition of sw ap dealer, major sw ap participant and eligible contract participant is 60 days after publication in the Federal Register. How ever, mandatory compliance w ith the registration and other substantive requirements is contingent on the effective date of the further definition of the term sw ap. Generally, compliance w ith the ECP retail forex regime is December 31, 2012. This compliance date includes the operation of CFTC Regulations 1.3(m)(5) and 1.3(m)(6) as w ell as the element of 1.3(m)(8)(iii) requiring that a commodity pool be formed by a registered CPO for any person seeking to rely on such regulation. The effective date of Sw ap Trading Relationship Documentation 23.504 w ill be the date that is 60 days after publication of the final rules in the Federal Register. The effective date of 23.500 and Sw ap Confirmation 23.501 w ill be the date that is 60 days after publication of the final rules in the Federal Register. The effective date of Portfolio Reconciliation & Compression 23.502 and 23.503 w ill be the date that is 60 days after publication of the final rules in the Federal Register. Compliance Date Extension for Certain Business Conduct Standards With Counterparties. ISDA members have requested that the CFTC align the compliance dates for the provisions of subpart H of part 23 that involve documentation 50 w ith the trading relationship documentation rules in this release. ISDA members have represented that industry-led efforts are underw ay to facilitate compliance w ith new Dodd-Frank Act documentation requirements and an alignment of compliance dates w ould allow the most efficient transition to compliance w ith part 23s documentation requirements. The CFTC has decided to defer the compliance dates for certain provisions of subpart H until January 1, 2013. Compliance w ith the follow ing provisions w ill be deferred until January 1, 2013: 23.402; 23.410(c); 23.430; 23.431(a)(c); 23.432; 23.434(a)(2), (b), and (c); 23.440; and 23.450. Compliance w ith all other provisions w ill continue to be required by October 15, 2012.

See Notes

SD / MSP

External Business Conduct - SD / MSP

Business Conduct Standards for Sw ap Dealers and Major Sw ap Participants With Counterparties

77 FR 9734

4/17/2012

See Notes

The CFTC adopted final rules to implement Section 4s(h) of the CEA pursuant to Section 731 of Title VII of the Dodd-Frank Act of 2010. These rules prescribe external business conduct standards for sw ap dealers and major sw ap participants.

SD / MSP

Internal Business Conduct - SD / MSP

Sw ap Dealer and Major Sw ap Participant Recordkeeping, Reporting, and Duties Rules; Futures Commission Merchant and Introducing Broker Conflicts of Interest Rules; and Chief Compliance Officer Rules for Sw ap Dealers, Major Sw ap Participants, and Futures Commission Merchants

77 FR 20128

6/4/2012

The CFTC adopted regulations to implement certain provisions of Title VII of the Dodd-Frank Act. These regulations set forth reporting and recordkeeping requirements and daily trading records requirements for sw ap dealers (SDs) and major sw ap participants (MSPs). These regulations also set forth certain duties imposed upon SDs and MSPs registered w ith the CFTC w ith regard to: Risk management procedures; monitoring of trading to prevent violations of applicable position limits; diligent supervision; business continuity and disaster recovery; disclosure and the ability of regulators to obtain general information; and antitrust considerations. In addition, these regulations establish conflicts-of-interest requirements for SDs, MSPs, futures commission merchants (FCMs), and introducing brokers (IBs) w ith regard to firew alls betw een research and trading and betw een clearing and trading. Finally, these regulations also require each FCM, SD, and MSP to designate a chief compliance officer, prescribe qualifications and duties of the chief compliance officer, and require that the chief compliance officer prepare, certify, and furnish to the CFTC an annual report containing an assessment of the registrant's compliance activities.

10/12/2012

SD / MSP

Definition - SD / MSP / ECP

Further Definition of Sw ap Dealer, Security-Based Sw ap Dealer, Major Sw ap Participant, Major Security-Based Sw ap Participant and Eligible Contract Participant

77 FR 30596

77 FR 39626

7/23/2012

12/31/2012

The CFTC and SEC, in consultation w ith the Board of Governors of the Federal Reserve System, adopted new regulations and interpretive guidance under the Commodity Exchange Act, and the Securities Exchange Act of 1934, to further define the terms "sw ap dealer," "security-based sw ap dealer," "major sw ap participant," "major security-based sw ap participant," and "eligible contract participant."

See Notes

See Notes

See Notes

SD / MSP

Internal Business Conduct - SD / MSP

Confirmation, Portfolio Reconciliation, Portfolio Compression, and Sw ap Trading Relationship Documentation Requirements for Sw ap Dealers and Major Sw ap Participants

77 FR 55904

11/13/2012

See Notes

The CFTC is adopting regulations to implement certain provisions of Title VII of the Dodd-Frank Act. Section 731 of the Dodd-Frank Act added a new section 4s(i) to the CEA, w hich requires the CFTC to prescribe standards for sw ap dealers (SDs) and major sw ap participants (MSPs) related to the timely and accurate confirmation, processing, netting, documentation, and valuation of sw aps. These regulations set forth requirements for sw ap confirmation, portfolio reconciliation, portfolio compression, and sw ap trading relationship documentation for SDs and MSPs. The CFTC is proposing regulations that w ould implement the new statutory framew ork in the CEA, added by the Dodd-Frank Act. These new provisions of the CEA require, among other things, the Commission to adopt capital requirements for certain sw ap dealers (SDs) and major sw ap participants (MSPs). The proposed rules also provide for related financial condition reporting and recordkeeping by SDs and MSPs. The CFTC further proposes to amend existing capital and financial reporting regulations for futures commission merchants (FCMs) that also register as SDs or MSPs. The proposed regulations also include requirements for supplemental FCM financial reporting to reflect section 724 of the Dodd-Frank Act. In order to align the comment periods for this proposed rule and the CFTC 's earlier proposed rulemaking on margin requirements for uncleared sw aps, the comment period for the proposed margin rulemaking is being extended elsew here in the Federal Register today, so that commenters w ill have the opportunity to review the proposed capital and margin rules together before the expiration of the comment periods for either proposed rule. The CFTC is proposing regulations that w ould establish a schedule to phase in compliance w ith previously proposed requirements, including the sw ap trading relationship documentation requirement under proposed 17 CFR 23.504, 76 FR 6715 (Feb. 8, 2011) and the margin requirements for uncleared sw aps under proposed 17 CFR 23.150 through 23.158, 76 FR 23732 (Apr. 28, 2011). This release is a continuation of those rulemakings. The proposed schedules w ould provide relief in the form of additional time for compliance w ith these requirements. This relief is intended to facilitate the transition to the new regulatory regime established by the Dodd-Frank Act in an orderly manner that does not unduly disrupt markets and transactions. The CFTC is requesting comment on the proposed compliance schedules, Sec. Sec. 23.175 and 23.575, described in this release. The CFTC adopted regulations to implement certain statutory provisions of the Dodd-Frank Act. The CFTC also is amended its existing regulations governing the submission of new products, rules, and rule amendments. The final regulations establish the procedural framew ork for the submission of new products, rules, and rule amendments by designated contract markets, derivatives clearing organizations, sw ap execution facilities, and sw ap data repositories. In addition, the final regulations prohibit event contracts involving certain excluded commodities, establish special submission procedures for certain rules proposed by systemically important derivatives clearing organizations, and stay the certifications and the approval review periods of novel derivative products pending jurisdictional determinations. The Commodity Futures Trading Commission (Commission) issued final rules to implement new statutory provisions enacted by Title VII of the Dodd-Frank Wall Street Reform and Consumer Protection Act to establish a registration system for foreign boards of trade that w ish to provide their identified members or other participants located in the United States w ith direct access to their electronic trading and order matching systems. The CFTC is adopting new and amended rules, guidance, and acceptable practices to implement certain statutory provisions enacted by Title VII of the Dodd-Frank Act. The final rules, guidance and acceptable practices, w hich apply to the designation and operation of contract markets, implement the Dodd-Frank Act's new statutory framew ork that, among other things, amends section 5 of the CEA concerning designation and operation of contract markets, and adds a new CEA section 2(h)(8) to mandate the listing, trading and execution of certain sw aps on designated contract markets ("DCMs"). The CFTC is proposing new rules and amended guidance and acceptable practices to implement the new statutory provisions enacted by Title VII of the Dodd-Frank Act. The proposed rules, guidance and acceptable practices, w hich apply to the designation and operation of contract markets, implement the Dodd-Frank Acts new statutory framew ork that, among other things, amends Section 5 of the CEA concerning designation and operation of contract markets, and adds a new CEA Section 2(h)(8) to include the listing, trading and execution of sw aps on designated contract markets. The CFTC requests comment on all aspects of the proposed rules, guidance and acceptable practices. The CFTC is proposing regulations that establish a process for a designated contract market (``DCM'') or sw ap execution facility (``SEF'') to make a sw ap ``available to trade'' as set forth in new Section 2(h)(8) of the CEA pursuant to Section 723 of the DoddFrank Act. Only comments pertaining to the regulations proposed in this document w ill be considered as part of this further notice of proposed rulemaking (``Notice''). The CFTC is proposing regulations that w ould establish a schedule to phase in compliance w ith certain new statutory provisions enacted under Title VII of the Dodd-Frank Act. These provisions include the clearing requirement under new section 2(h)(1)(A) of the CEA, and the trade execution requirement under new section 2(h)(8)(A) of the CEA. The proposed schedules w ould provide relief in the form of additional time for compliance w ith these requirements. This relief is intended to facilitate the transition to the new regulatory regime established by the Dodd-Frank Act in an orderly manner that does not unduly disrupt markets and transactions. The CFTC requests comment on the proposed compliance schedules for these clearing and trade execution requirements. The CFTC is proposing new rules, and guidance and acceptable practices to implement the new statutory provisions enacted by Title VII of the Dodd-Frank Act. The proposed rules, guidance, and acceptable practices, w hich apply to the registration and operation of a new type of regulated entity named a sw ap execution facility, implement the new statutory framew ork that, among other things, adds a new Section 5h to the CEA concerning the registration and operation of sw ap execution facilities, and new Section 2(h)(8) to the CEA concerning the listing, trading and execution of sw aps on sw ap execution facilities. The CFTC requests comment on all aspects of the proposed rules, guidance and acceptable practices.

SD / MSP

Capital and Margin for Non-Banks

Capital Requirements of Sw ap Dealers and Major Sw ap Participants

76 FR 27802

N/A

SD / MSP

Capital and Margin for Non-Banks

Sw ap Transaction Compliance and Implementation Schedule: Trading Documentation and Margining Requirements under Section 4s of the CEA

76 FR 58176

N/A

Trading

Rule Certification - DCMs, DCOs, SEFs

Provisions Common to Registered Entities

76 FR 44776

76 FR 45666

9/26/2011

9/26/2011

The compliance date and effective date are the same. Foreign Boards of Trade currently providing for direct access under Commission staff no-action relief letters that w ant to continue to provide for direct access must submit registration applications, determined in good faith by the applicant to be complete, not later than August 20, 2012. DCMs must comply w ith the rules adopted in this release (except 38.151(a)) by October 17, 2012. With respect to existing members and market participants, DCMs must comply w ith 38.151(a) w ithin 180 days follow ing the effective date. With respect to new members and market participants, DCMs must comply w ith 38.151(a) on the effective date.

Trading

Registration - FBOTs

Registration of Foreign Boards of Trade

76 FR 80674

2/21/2012

8/20/2012

10/17/2012

Trading

DCM Core Principle

Core Principles and Other Requirements for Designated Contract Markets

77 FR 36611

8/20/2012

See Notes

Trading

Designated Contract Markets

Core Principles and Other Requirements for Designated Contract Markets

75 FR 80572

N/A

Trading

DCM / SEF Sw ap Availability to Trade

Process for a Designated Contract Market or Sw ap Execution Facility to Make a Sw ap Available to Trade under Section 2(h)(8) of the Commodity Exchange Act

76 FR 77728

N/A

Trading

Sw ap Transaction Compliance

Sw ap Transaction Compliance and Implementation Schedule: Clearing and Trade Execution Requirements under Section 2(h) of the CEA

76 FR 58186

N/A

Trading

SEF Core Principles

Core Principles and Other Requirements for Sw ap Execution Facilities

76 FR 1214

N/A

You might also like

- Senate Hearing, 111TH Congress - Mortgage Fraud, Securities Fraud, and The Financial Meltdown: Prosecuting Those ResponsibleDocument124 pagesSenate Hearing, 111TH Congress - Mortgage Fraud, Securities Fraud, and The Financial Meltdown: Prosecuting Those ResponsibleScribd Government DocsNo ratings yet

- Set OffDocument9 pagesSet OffAditya MehtaniNo ratings yet

- 2017 Florida Mugshot Removal Bill: CHAPTER 130Document2 pages2017 Florida Mugshot Removal Bill: CHAPTER 130Remove ArrestsNo ratings yet

- Assignments: Banking and FinanceDocument19 pagesAssignments: Banking and FinanceAamir Hussian100% (1)

- Constitution of the State of Minnesota — 1974 VersionFrom EverandConstitution of the State of Minnesota — 1974 VersionNo ratings yet

- Majority Action-Sb 1638 BillDocument6 pagesMajority Action-Sb 1638 BillBONDCK88507No ratings yet

- A Clog On The Equity of RedemptDocument27 pagesA Clog On The Equity of Redemptamit dipankarNo ratings yet

- DDFDocument66 pagesDDFPankaj Kumar100% (2)

- Apus Theory, Part 1 PDFDocument81 pagesApus Theory, Part 1 PDFHenoAlambreNo ratings yet

- Smart Speed, Inc. By-LawsDocument7 pagesSmart Speed, Inc. By-LawsAira Dee SuarezNo ratings yet

- Convenção UPU 1906Document24 pagesConvenção UPU 1906Antonio Gilberto Ortega HartzNo ratings yet

- DF Law of ContractDocument13 pagesDF Law of ContractDarragh FivesNo ratings yet

- Example Late PaymentDocument2 pagesExample Late PaymentZsuzsa TóthNo ratings yet

- Federal Crop Ins. Corp. v. Merrill, 332 U.S. 380 (1947)Document6 pagesFederal Crop Ins. Corp. v. Merrill, 332 U.S. 380 (1947)Scribd Government DocsNo ratings yet

- FCRA Notice PDFDocument2 pagesFCRA Notice PDFLucas De Oliveira100% (1)

- CostDocument161 pagesCostMae Namoc67% (6)

- Securities and Exchange Commission (SEC) - Forms-8Document10 pagesSecurities and Exchange Commission (SEC) - Forms-8highfinanceNo ratings yet

- Basic Guide to Letters of CreditDocument40 pagesBasic Guide to Letters of CreditTran Thi Thu HuongNo ratings yet

- 1040 - Individual Tax Return Engagement LetterDocument2 pages1040 - Individual Tax Return Engagement LetterfaizurrehmanNo ratings yet

- The 8 Step Personal Selling ProcessDocument13 pagesThe 8 Step Personal Selling ProcessAdamZain788No ratings yet

- Bankruptcy Law 2Document49 pagesBankruptcy Law 2PP KPNo ratings yet

- Federal Register / Vol. 77, No. 44 / Tuesday, March 6, 2012 / Proposed RulesDocument29 pagesFederal Register / Vol. 77, No. 44 / Tuesday, March 6, 2012 / Proposed RulesMarketsWikiNo ratings yet

- House Hearing, 111TH Congress - H.R. 2351, The Credit Union Share Insurance Stabilization ActDocument116 pagesHouse Hearing, 111TH Congress - H.R. 2351, The Credit Union Share Insurance Stabilization ActScribd Government DocsNo ratings yet

- Banking LawsDocument31 pagesBanking LawsJanMarkMontedeRamosWongNo ratings yet

- Assignment Towards Fulfilment of Assessment in The Subject of Banking and FinanceDocument4 pagesAssignment Towards Fulfilment of Assessment in The Subject of Banking and FinanceshalwNo ratings yet

- OMB Form 8-K SEC FilingDocument22 pagesOMB Form 8-K SEC Filingg6hNo ratings yet

- Olmsted County Graham Park Rules and Regulations: Code of Ordinance - Chapter 3950 - 3969Document9 pagesOlmsted County Graham Park Rules and Regulations: Code of Ordinance - Chapter 3950 - 3969inforumdocsNo ratings yet

- Weintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Document12 pagesWeintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Scribd Government DocsNo ratings yet

- United States Securities and Exchange Commission Washington, D.C. 20549 Form 1-U Current Report Pursuant To Regulation ADocument8 pagesUnited States Securities and Exchange Commission Washington, D.C. 20549 Form 1-U Current Report Pursuant To Regulation AAnthony ANTONIO TONY LABRON ADAMSNo ratings yet

- Petition For Formal HearingDocument16 pagesPetition For Formal HearingAnonymous LMqBRLlKMNo ratings yet

- Maratime DissertationDocument35 pagesMaratime DissertationMayank MahlaNo ratings yet

- SEC FOIA 2011-6336 - FOIA Office Response - 5.24.2011Document3 pagesSEC FOIA 2011-6336 - FOIA Office Response - 5.24.2011Michael BrozzettiNo ratings yet

- Ratio Analysis of Rafhan FoodsDocument6 pagesRatio Analysis of Rafhan FoodsusmanazizbhattiNo ratings yet

- SEC Form 20-F Annual ReportDocument66 pagesSEC Form 20-F Annual ReportAndre KusumaNo ratings yet

- Jay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Document13 pagesJay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Scribd Government DocsNo ratings yet

- CAT 1 Module (NIAT Encoded)Document245 pagesCAT 1 Module (NIAT Encoded)UFO CatcherNo ratings yet

- Correct Application and InterpretationDocument106 pagesCorrect Application and Interpretationbiodun o100% (1)

- This Letter Is A QWRDocument3 pagesThis Letter Is A QWRCharlton PeppersNo ratings yet

- WIC EBT Testing Guidelines 060402Document63 pagesWIC EBT Testing Guidelines 060402sashank7No ratings yet

- The Conversion ProcessDocument39 pagesThe Conversion ProcessKeith Kauhi100% (1)

- Speccom-Letters of CreditDocument14 pagesSpeccom-Letters of CreditVictor Faeldon100% (1)

- Intermediate Accounting 1A 2019 by Millan Chapter 1-Summary (Accounting Process)Document5 pagesIntermediate Accounting 1A 2019 by Millan Chapter 1-Summary (Accounting Process)Shaina DellomesNo ratings yet

- Entrepreneurship Matrix Blue PrintDocument29 pagesEntrepreneurship Matrix Blue Printrohit vyas100% (3)

- 537 QuestionsDocument95 pages537 QuestionsJohnnyLarsonNo ratings yet

- Couple TX - Proposed Marketing StrategyDocument30 pagesCouple TX - Proposed Marketing StrategyHắc Lang100% (1)

- Sales Sample Q Sans F 09Document17 pagesSales Sample Q Sans F 09Tay Mon100% (1)

- CBS and Postal DepartmentDocument49 pagesCBS and Postal DepartmentK V Sridharan General Secretary P3 NFPENo ratings yet

- Virginia Power Stop FC LawsDocument3 pagesVirginia Power Stop FC LawsKNOWLEDGE SOURCENo ratings yet

- Carrie Mars v. Spartanburg Chrysler Plymouth, Inc. and First National Bank of South Carolina, 713 F.2d 65, 1st Cir. (1983)Document4 pagesCarrie Mars v. Spartanburg Chrysler Plymouth, Inc. and First National Bank of South Carolina, 713 F.2d 65, 1st Cir. (1983)Scribd Government DocsNo ratings yet

- Media RentHelpMN Dec 2021Document12 pagesMedia RentHelpMN Dec 2021Lindsey PetersonNo ratings yet

- Official Form 309A (For Individuals or Joint Debtors) : Notice of Chapter 7 Bankruptcy Case No Proof of Claim DeadlineDocument3 pagesOfficial Form 309A (For Individuals or Joint Debtors) : Notice of Chapter 7 Bankruptcy Case No Proof of Claim DeadlineCarloe Perez100% (1)

- Torren Colcord's "Promissary Note"Document6 pagesTorren Colcord's "Promissary Note"RickyRescueNo ratings yet

- Chicago Offering DocumentsDocument280 pagesChicago Offering DocumentsThe Daily LineNo ratings yet

- Used Auto BankDocument6 pagesUsed Auto Bankfabio2006No ratings yet

- Breachof ContractDocument6 pagesBreachof ContractShubham KulkarniNo ratings yet

- Compilation of Cases in Negotiable Instr PDFDocument105 pagesCompilation of Cases in Negotiable Instr PDFDanica Rizzie TolentinoNo ratings yet

- Wells Fargo Bank, N.A. v. William N. Asma, 11th Cir. (2014)Document7 pagesWells Fargo Bank, N.A. v. William N. Asma, 11th Cir. (2014)Scribd Government DocsNo ratings yet

- What Is A MortgageDocument6 pagesWhat Is A MortgagekrishnaNo ratings yet

- The Terms Lien of SharesDocument6 pagesThe Terms Lien of SharesAmit MakwanaNo ratings yet

- Mortgage Debt Validation Letter NoticeDocument1 pageMortgage Debt Validation Letter NoticeBrandy sissonNo ratings yet

- Lehman Brothers Motion To Pay SettlementDocument123 pagesLehman Brothers Motion To Pay SettlementDealBookNo ratings yet

- Rosenfield Vs HSBC - TILA Amicus Brief of The Consumer Fin. ProtectionDocument33 pagesRosenfield Vs HSBC - TILA Amicus Brief of The Consumer Fin. Protectionwinstons2311No ratings yet

- Responsibility Assignment Matrix A Complete Guide - 2020 EditionFrom EverandResponsibility Assignment Matrix A Complete Guide - 2020 EditionNo ratings yet

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithFrom EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNo ratings yet

- CFTC Final Rule on Prohibitions and Restrictions on Proprietary Trading and Certain Interests in Hedge Funds and Private Equity FundsDocument1,058 pagesCFTC Final Rule on Prohibitions and Restrictions on Proprietary Trading and Certain Interests in Hedge Funds and Private Equity FundsIQ3 Solutions GroupNo ratings yet

- Dodd Frank Visio - Definition of A Swap Dealer 1Document1 pageDodd Frank Visio - Definition of A Swap Dealer 1IQ3 Solutions GroupNo ratings yet

- A Real Option Analysis of An Oil Refinery ProjectDocument14 pagesA Real Option Analysis of An Oil Refinery ProjectIQ3 Solutions Group100% (1)

- Dependency Management in A Large Agile EnvironmentDocument6 pagesDependency Management in A Large Agile EnvironmentIQ3 Solutions GroupNo ratings yet

- Dodd Frank Visio - Definition of A Swap Dealer 2Document1 pageDodd Frank Visio - Definition of A Swap Dealer 2IQ3 Solutions GroupNo ratings yet

- Regulating OTC Derivatives - Transatlantic (Dis) Harmony After EMIR and Dodd-FrankDocument14 pagesRegulating OTC Derivatives - Transatlantic (Dis) Harmony After EMIR and Dodd-FrankIQ3 Solutions GroupNo ratings yet

- Dodd Frank Visio - Swap Dealer de Minimis ExceptionDocument1 pageDodd Frank Visio - Swap Dealer de Minimis ExceptionIQ3 Solutions GroupNo ratings yet

- The Real Option Model - Evolution and ApplicationsDocument35 pagesThe Real Option Model - Evolution and ApplicationsIQ3 Solutions GroupNo ratings yet

- Does Regulation Substitute or Complement GovernanceDocument50 pagesDoes Regulation Substitute or Complement GovernanceIQ3 Solutions GroupNo ratings yet

- EDM Council - FIBO Semantics InitiativeDocument32 pagesEDM Council - FIBO Semantics InitiativeIQ3 Solutions GroupNo ratings yet

- Canadian Oil Sands - Investor Expectations For Improving Environmental Social PerformanceDocument10 pagesCanadian Oil Sands - Investor Expectations For Improving Environmental Social PerformanceIQ3 Solutions GroupNo ratings yet

- 77 FR 21278 - Customer Clearing Documentation, Timing of Acceptance For Clearing, and Clearing Member Risk ManagementDocument33 pages77 FR 21278 - Customer Clearing Documentation, Timing of Acceptance For Clearing, and Clearing Member Risk ManagementIQ3 Solutions GroupNo ratings yet

- CFTC No-Action Letter No 12-23 - Section 4m (1) - Request For CPO Registration ReliefDocument3 pagesCFTC No-Action Letter No 12-23 - Section 4m (1) - Request For CPO Registration ReliefIQ3 Solutions GroupNo ratings yet

- SEC Release No. 34-68080 - Clearing Agency StandardsDocument254 pagesSEC Release No. 34-68080 - Clearing Agency StandardsIQ3 Solutions GroupNo ratings yet

- ISDA SIFMA V US CFTC - Civil Action 11-Cv-2146 - Memorandum OpinionDocument50 pagesISDA SIFMA V US CFTC - Civil Action 11-Cv-2146 - Memorandum OpinionIQ3 Solutions GroupNo ratings yet

- EMIR Regulation of OTC CCPDocument24 pagesEMIR Regulation of OTC CCPIQ3 Solutions GroupNo ratings yet

- Cashflow Statements - ACCA GlobalDocument3 pagesCashflow Statements - ACCA GlobalRith TryNo ratings yet

- Rohan Proj - Report Loan SyndicationDocument75 pagesRohan Proj - Report Loan Syndicationriranna100% (5)