Professional Documents

Culture Documents

Talmage Kenneth Statement of Economic Interests 2012

Uploaded by

L. A. PatersonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Talmage Kenneth Statement of Economic Interests 2012

Uploaded by

L. A. PatersonCopyright:

Available Formats

I

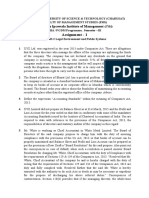

CALIFORNIA FORM 700

FAIR POLITICAL PRACTICES COMMISSION

A PUBLIC DOCUMENT

;;Mm.I1tfeBF ECONOMIC INTERESTS

PRACTICES PAGE

REGE1VcEL)

Official Use Only

JAN 12 2012

ClTYOF

CARMEL BY_ THE-SEA Please type or print in ink.

2012 JAN 23 PH 3: 21

NAME OF FILER

(MIDDLE)

-\c(e..\ \O=t;r

@

1. Office, Agency, or Court

, P Agency Name

e.\ \

Division. Board. Department. District. il applicable Your Position

II filing lor multiple positions, list below or on an attachment.

Agency: ________ _

Position: __ o--,R.--=-_____ _

2. Jurisdiction of Office (Check at least one box)

o State sz..---\..- c

Sa,......

!a.e"",.l-Io'i Se.=-

3. Type of Statement (Check at least one box)

The period covered is JanualY 1, 2011, through

Deoember 31,2011.

-or-

The period covered is ----1----1 ____ , through

Deoember 31, 2011.

o Assuming Office: Date assumed ----1----1 ___ _

o Judge or Court Commissioner (Statewide Jurisdiction)

o County 01 ______________ _

DOther ______________ _

o Leaving Office: Date Left ----1----1 ___ _

(Check one)

o The period covered is JanualY 1, 2011, through the date 01

leaving offioe.

o The period covered is ----1----1 ____ , through

the date 01 leaving offioe.

Election Year __ :J.=-=0:...':..'2-=,--

Office sought, il different than Part 1: ________________ _

4. Schedule Summary

Check applicable schedules or ''None.''

o Schedule A-1 - Investments - schedule aUached

IQ-SChedule A-2 - Investments - schedule aUached

o Schedule B - Real Property - schedule aUached

-or-

Total number of pages including this cover page: ___ _

C - Income, Loans, & Business Positions - schedule attached

o Schedule 0 - Income - Gins - schedule aUached

o Schedule E - Income - Gins - Travel Payments - schedule attached

O None - No reportable interests on any schedule

I certify under penalty of perjury under the laws of the State of California that

Date Signed __ '-\\ _\:...-z...-----;l;,\;;;;;;2;:;;;;;"'O;;;',1. ___ _

.. daJ year)

Signatur

FPPC Toll-Free Helpline: 866t275-3772 www.fppc.ca.gov

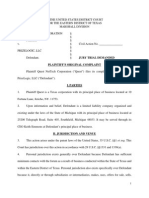

SCHEDULE A-2

Investments, Income, and Assets

of Business Entities/Trusts

(Ownership Interest is 10% or Greater)

CALIFORNIA FORM 700

FAIR POLITICAL PRACTICES COMMISSION

Name

Tal M0I.-3 l

to- 1. BUSINESS ENTITY OR TRUST

Wo..-k.e... COli>'

Name , \ 5 '0' 5. M<>.f /oJ 5-+.:1.""::

eA- '1533:1

Address (Business Address Acceptable)

Check one

Entity, complete the box, then go to 2 D Trust, go to 2

GENERAL DESCRIPTION OF BUSINESS ACTIVITY

FAIR MARKET VALUE IF APPLICABLE, LIST DATE:

D $0 - $1,999

-----' -----'--1L -----' -----'--1L

D $2,000 - $10,000

D $10,001 - $100,000

ACQUIRED DISPOSED

Over $1,000,000

- $1,000,000

ATURE OF INVESTMENT 'wi C c

o Sole Proprietorship D partnershipOe.

lA. Othe

YOUR BUSINESS POSITION L_oU-RM<LU

... 2 IrlFNTIFY THF GROSS INCOME RECEIVED (INCLUDE YOUR PRO RATA

SHARE OF THE GROSS INCOME IQ THE ENTITYfTRUST)

0$0 - $499

D $500 - $1,000

D $1,001 - $10,000

D $10,001 - $100,000

DOVER $100,000

... 3 LIST THE NAME OF EACH REPORTABLE SINGLE SOURCE OF

INCOME OF $10,000 OR MORE (Attach" SCpJl<ltc shcct 'f necessJry)

... 4 INVESTMENTS AND INTERESTS IN REAL PROPERTY HELD .ID: THE

BUSINESS ENTITY OR TRUST

Check one box:

DINVESTMENT o REAL PROPERTY

Name of Business Entity, if Investment, 2[

Assessor's Parcel Number or Street Address of Real Property

Description of Business Activity Q[

City or Other Precise Location of Real Property

FAIR MARKET VALUE

D $2,000 - $10,000

o $10,001 - $100,000

o $100,001 - $1,000,000

DOver $1,000,000

NATURE OF INTEREST

o Property Ownership/Deed of Trust

IF APPLICABLE, LIST DATE:

ACQUIRED DISPOSED

D Stock D Partnership

o Leasehold D Other __________ _

Yrs. remaining

o Check box if additional schedules reporting investments or real property

are attaChed

.. 1. BUSINESS ENTITY OR TRUST

Name

Address (Business Address Acceptable)

Check one

o Trust, go to 2 o Business Entity, complete the box, then go to 2

GENERAL DESCRIPTION OF BUSINESS ACTIVllY

FAIR MARKET VALUE IF APPLICABLE, UST DATE:

D $0 - $1,999

-----' -----'--1L

o $2,000 - $10,000

-----' -----'--1L

D $10,001 - $100,000

ACQUIRED DISPOSED

0$100,001 - $1,000,000

DOver $1,000,000

NATURE OF INVESTMENT

D Sole Proprietorship o Partnership

0

Other

YOUR BUSINESS POSITION

... 2 IDENTIFY THE GROSS INCOME RECEIVED (INCLUDE YOUR PRO RATA

SHARE OF THE GROSS INCOME IQ THE ENTITYfTRUST)

D $0 - $499

D $500 - $1.000

D $1,001 - $10,000

D $10,001 - $100,000

DOVER $100,000

... 3 LIST THE NAME OF EACH REPORTABLE SINGLE SOURCE OF

INCOME OF $10,000 OR MORE (Albch a sheet ,I necessary)

... 4 INVESTMENTS AND INTERESTS IN REAL PROPERTY HELD BY THE

BUSINESS ENTITY OR TRUST

Check one box:

o INVESTMENT o REAL PROPERTY

Name of Business Entity, if Investment, 2[

Assessor's Parcel Number or Street Address of Real Property

Description of BUsiness Activity 2[

City or Other Precise Location of Real Property

FAIR MARKET VALUE

D $2,000 - $10,000

0$10,001 - $100,000

D $100,001 - $1,000,000

DOver $1,000,000

NATURE OF INTEREST

o Property Ownership/Deed of Trust

IF APPLICABLE, LIST DATE:

-----' -----' --1L -----' -----,--1L

ACQUIRED DISPOSED

D Stock o Partnership

o Leasehold -,,------,-:-

Yrs, remaining

D Othe' _________ _

o Check box if additional schedules reporting investments or real property

are attached

Comments:: ______________________ _

FPPC Form 700 (201112012) Soh. A-2

FPPC Toll-Free Helpline: 866/275-3772 www.fppc.ca.gov

SCHEDULE C

Income, Loans, & Business

Positions

CALIFORNIA FORM 700

FAIR POLITICAL PRACTICES COMMISSION

Name

(Other than Gifts and Travel Payments)

... 1 INCOME RECEIVED ... 1 INCOME RECEIVED

NAME OF SOURCE OF INCOME

I.Oa..k C.e ""'-,f'a."'-'j.

ADDRESS

BUSINESS ACTIVITY, IF ANY, OF SOURCE

.......

YOUR BUSINESS POSITION

c.. be I!y\.a..u

GROSS INCOME RECEIVED

o $500 - $1,000

D $10,001 - $100,000

0$1,001 - $10,000

}i<OVER $100,000

SIDERATION FOR WHICH INCOME WAS RECEIVED

Salary 0 Spouse's or registered domestic partner's income

loan repayment D Partnership

o Sale of ----_--:::--,-_-,-_.,-,..-,-,-____ _

(Real property, car. boat, etc.)

D Commission or o Rental Income, list each source of $10,000 or more

o Other _______ --,,== ______ _

(Describe)

.... 2 LOANS RECEIVED OR OUTSTANDING DURING THE REPORTING PERIOD

NAME OF SOURCE OF INCOME

ADDRESS (Business Address Acceptable)

BUSINESS ACTIVITY, IF ANY, OF SOURCE

YOUR BUSINESS POSITION

GROSS INCOME RECEIVED

0$500 - $1,000 0 $1,001 - $10,000

0$10,001 - $100,000 0 OVER $100,000

CONSIDERATION FOR V\lHICH INCOME WAS RECEIVED

o Salary o Spouse's or registered domestic partner's income

o Loan repayment o Partnership

o Sale of _____ -=-,.:-:-;--;-==:-:-::-;-____ _

(Real property, car; boat, etc.)

o Commission or o Rental Income, list each source of $10,000 or mom

o Other _______ --;;;== ______ _

(Describe)

* You are not required to report loans from commercial lending institutions, or any indebtedness created as part of a

retail installment or credit card transaction, made in the lender's regular course of business on terms available to

members of the public without regard to your official status, Personal loans and loans received not in a lender's

regular course of business must be disclosed as follows:

NAME OF LENDER*

ADDRESS (Business Address Acceptable)

BUSINESS ACTIVITY, IF ANY, OF LENDER

HIGHEST BALANCE DURING REPORTING PERIOD

0$500 - $1,000

0$1,001 - $10,000

0$10,001 - $100,000

DOVER $100,000

Comments:

INTEREST RATE TERM (MonthsNears)

----,% 0 None

SECURITY FOR LOAN

o None o Personal residence

o Real Property _______ -;;;::;:;:;-:;;;;:;::;,--_____ _

Street address

City

o Guarantor _________________ _

o Other ________ :::---::--:-______ _

(Describe)

FPPC Form 700 (2011/2012) Sch, C

FPPC Toll-Free Helpline: 866/275-3772 www.fppc.ca.gov

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonNo ratings yet

- Adopting City Council Meeting Dates For 2019 12-03-18Document3 pagesAdopting City Council Meeting Dates For 2019 12-03-18L. A. PatersonNo ratings yet

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonNo ratings yet

- Minutes City Council Regular Meeting November 6, 2018 12-03-18Document5 pagesMinutes City Council Regular Meeting November 6, 2018 12-03-18L. A. PatersonNo ratings yet

- Holiday Closure 12-03-18Document3 pagesHoliday Closure 12-03-18L. A. PatersonNo ratings yet

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNo ratings yet

- Minutes 12-03-18Document7 pagesMinutes 12-03-18L. A. PatersonNo ratings yet

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument2 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNo ratings yet

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonNo ratings yet

- Mprwa Minutes April 26, 2016Document2 pagesMprwa Minutes April 26, 2016L. A. PatersonNo ratings yet

- Mprwa Minutes October 25, 2018Document2 pagesMprwa Minutes October 25, 2018L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonNo ratings yet

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNo ratings yet

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNo ratings yet

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Law On Obligations Week 2Document8 pagesLaw On Obligations Week 2Lester VerasNo ratings yet

- Counter-Proposal To A Promise To Purchase (CP)Document3 pagesCounter-Proposal To A Promise To Purchase (CP)catsdeadnow0% (1)

- 15 People's Industrial and Commercial Corp. vs. Court of AppealsDocument2 pages15 People's Industrial and Commercial Corp. vs. Court of AppealsJemNo ratings yet

- Export Checklist Expmum009623 24s 28 Aug 2023-10-04 PMDocument4 pagesExport Checklist Expmum009623 24s 28 Aug 2023-10-04 PMiffy11No ratings yet

- Watergate Land Condominium Unit Owner's Association v. Wiss, Janey, Elster Associates 111 F.R.D. 576Document2 pagesWatergate Land Condominium Unit Owner's Association v. Wiss, Janey, Elster Associates 111 F.R.D. 576crlstinaaaNo ratings yet

- Assignment - 1: Indukaka Ipcowala Institute of ManagementDocument7 pagesAssignment - 1: Indukaka Ipcowala Institute of ManagementhardikgosaiNo ratings yet

- LABOR BATCH 3 - Almeda V Asahi, Aklan V San MiguelDocument3 pagesLABOR BATCH 3 - Almeda V Asahi, Aklan V San MiguelasdfghjkattNo ratings yet

- Surat Perjanjian FounderDocument10 pagesSurat Perjanjian FounderAndy PermanaNo ratings yet

- Solution Manual For Macroeconomics 7th Edition R Glenn Hubbard Anthony Patrick ObrienDocument25 pagesSolution Manual For Macroeconomics 7th Edition R Glenn Hubbard Anthony Patrick ObrienRalphLaneifrteNo ratings yet

- 5 Meeting Partnership LiquidationDocument5 pages5 Meeting Partnership LiquidationaudreyNo ratings yet

- OpenFOAM用户指南-3 0 1Document235 pagesOpenFOAM用户指南-3 0 1施翰辰No ratings yet

- People Bank Vs SyvelDocument3 pagesPeople Bank Vs SyvelHohenheimNo ratings yet

- Acc 321Document125 pagesAcc 321Jen AustriaNo ratings yet

- Contract Law Written AssignmentDocument18 pagesContract Law Written AssignmentEunice Lee Sin YeeNo ratings yet

- Saison LawsuitDocument6 pagesSaison LawsuitEllenFortNo ratings yet

- Simplynotes - Special Contracts - Indemnity Guarantee Bailment and Pledge Agency. - Simplynotes PDFDocument5 pagesSimplynotes - Special Contracts - Indemnity Guarantee Bailment and Pledge Agency. - Simplynotes PDFMujNo ratings yet

- Form 13 CDocument1 pageForm 13 CAmit BhatiNo ratings yet

- Sunico v. Chuidian DigestDocument3 pagesSunico v. Chuidian DigestAnit EmersonNo ratings yet

- Associated Bank v. CADocument2 pagesAssociated Bank v. CANelly HerreraNo ratings yet

- LNEE DaEng 2015 - Consent To Publish Proceedings of DaEng 2015Document2 pagesLNEE DaEng 2015 - Consent To Publish Proceedings of DaEng 2015dhiecNo ratings yet

- Units of Beneficial Interest CertificateDocument1 pageUnits of Beneficial Interest CertificateRJ Landry90% (10)

- Dog Boarding ContractDocument3 pagesDog Boarding ContractIulik Bruma100% (1)

- Tort of NegligenceDocument21 pagesTort of NegligenceAtul Verma100% (1)

- Quest Nettech v. PrizeLogicDocument5 pagesQuest Nettech v. PrizeLogicPriorSmartNo ratings yet

- Obli Digests 3rd ExamDocument21 pagesObli Digests 3rd ExamelizbalderasNo ratings yet

- Duty of Reasonable CareDocument3 pagesDuty of Reasonable CareRoshi DesaiNo ratings yet

- Guijarno vs. CIR DigestDocument3 pagesGuijarno vs. CIR DigestMichelle Montenegro - Araujo100% (1)

- Car Hire Agreement - DraftDocument3 pagesCar Hire Agreement - DraftMaitri HegdeNo ratings yet

- Referral Agreement Draft 2014Document3 pagesReferral Agreement Draft 2014Maria Teresa SanromanNo ratings yet

- Philamcare Health Systems V CADocument3 pagesPhilamcare Health Systems V CAsmtm06100% (1)