Professional Documents

Culture Documents

Market Commentary 10-22-12

Uploaded by

CLORIS4Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Commentary 10-22-12

Uploaded by

CLORIS4Copyright:

Available Formats

MarketCommentary October22,2012

TheMarkets

Twentyfiveyearslater,arethereanylastinglessonsfromtheOctober1987stockmarketcrash? YoumayrecallthatonOctober19,1987,theDowJonesIndustrialAverageplummeted22.6percent. Thisdropwasfarsteeperthanthe12.8percentdeclineonOctober28,1929,thedaymanyconsider thestartoftheGreatDepressionanditimmediatelyraisedfearsofaninternationaleconomiccrisis andarecessionintheUnitedStates,accordingtotheLosAngelesTimes. Althoughthecrashwasmindbogglingandisfirmlyetchedininvestmentlore,onalongterm performancechart,itshowsupasjustablip.Infact,inthefirsteightmonthsof1987,theDowrose morethan40percent,and,despitethecrash,theDowamazinglyfinishedtheyearwithagain. Withthebenefitof25years,hereareafewinvestmentlessonstoremember: 1. Dontpanic.Thecrashwaspainful,butthemarketwasbacktobreakevenjusttwoyearslater. 2. Valuationmatters.Traditionalvaluationmetricssuchaspriceearningsratiosanddividend yieldswereflashingredbackin1987whichsuggestedthemarketwasripeforafallsopay attentiontovaluation. 3. Staydiversified.Eventhoughcorrelationamongassetclassestendstoriseduringtimesof marketstress,itsstillimportanttoownavarietyofassetclassesasovertime,itmayhelp balanceyourportfolio. 4. Investresponsibly.Peoplewhoborrowedmoneytoinvestinthestockmarketormadehigh riskbetsgotburnedwhenthemarketcrashed.Alwaysinvestwithinyourrisktolerancesoa repeatof1987wontputyououtofbusiness.

Sources:LosAngelesTimes;TheMotleyFool;Forbes

Whenaskedwhatthestockmarketwilldo,thegreatbankerJ.P.Morganreplied,Itwillfluctuate. Indeed,asOctober1987shows,stocksdofluctuatesometimesdramatically.Knowingthatand rememberingthefourlessonsabovecouldhelpmakeyouabetterinvestor.

Dataasof10/19/12

Standard&Poor's500(DomesticStocks) DJGlobalexUS(ForeignStocks) 10yearTreasuryNote(YieldOnly) Gold(perounce) DJUBSCommodityIndex DJEquityAllREITTRIndex

1Week

0.3% 1.9 1.8 1.7 0.4 1.5

YTD

14.0% 9.8 N/A 10.3 4.1 17.4

1Year 3Year 5Year

18.5% 6.6 2.2 5.1 1.0 29.5 9.3% 0.0 3.4 18.3 2.3 20.6 0.9% 6.4 4.4 17.9 4.0 3.2

10Year

4.8% 7.4 4.2 18.7 3.3 12.2

Notes:S&P500,DJGlobalexUS,Gold,DJUBSCommodityIndexreturnsexcludereinvesteddividends(golddoesnotpayadividend)andthe three,five,and10yearreturnsareannualized;theDJEquityAllREITTRIndexdoesincludereinvesteddividendsandthethree,five,and10 yearreturnsareannualized;andthe10yearTreasuryNoteissimplytheyieldatthecloseofthedayoneachofthehistoricaltimeperiods. Sources:Yahoo!Finance,Barrons,djindexes.com,LondonBullionMarketAssociation. Pastperformanceisnoguaranteeoffutureresults.Indicesareunmanagedandcannotbeinvestedintodirectly.N/Ameansnotapplicable.

HOWGOODAREYOUatpredictingthefuture?Well,despiteabazillionbitsofinformationatour

fingertipsandunbelievablecomputingpower,humansarestillprettybadatit. Letsuseanexamplethatgetstotheheartofthefinancialcrisis.AsdescribedinNateSilversbook,The SignalandtheNoise,backin2007Standard&PoorsCorporation(S&P)gaveinvestmentratingstoa particularlycomplextypeofsecuritycalledcollateralizeddebtobligation(CDO).ForCDOsthatwere ratedAAAthehighestratingpossibleS&Psaidthelikelihoodthatapieceofdebtwithinthose CDOswoulddefaultwithinfiveyearswasaminiscule0.12percent.Thatsaboutonechancein850. Now,youprobablyknowwherethisisgoing.Guesswhattheactualdefaultratewas?Accordingto S&P,itwasaround28percent.Simplemathsaystheactualdefaultratewasmorethan200times higherthanS&Ppredictedand,asSilverwrote,Thisisjustaboutascompleteafailureasitispossible tomakeinaprediction. Itseasytopokefunatbadpredictions;however,thereisalargerpointhere.First,wecantpredictthe futuresowealwaysneedaplanB.And,second,weneedtodifferentiatebetweenriskand uncertainty. EconomistFrankKnightsaidriskinvolvessituationswherewecancalculatetheprobabilityofa particularoutcome.Forexample,actuariescancalculatetheprobabilityofa60yearoldmaledying within10yearsbecausetheyhavehistoricalmortalitystatisticsthatdontchangemuchfromyearto year. Bycontrast,uncertaintyhasnohistoricaldatatouseasasolidbasisformakingaprediction.For example,predictingtheoutcomeofwarinSyriaisnotknowablebecausetheresnosetofhistorical dataorprobabilitydistributiononwhichtobasetheprediction. Itsjustourluckthatthefinancialmarketsseemtocontainelementsofriskanduncertainty.However, wecantrytousethattoourbenefitbybeingcognizantwhentherisk/rewardseemstobeinourfavor whileatthesametime,havingplanBincaseuncertaintytriestospoiltheparty.

WeeklyFocusThinkAboutIt

Itisatruthverycertainthatwhenitisnotinourpowertodeterminewhatistrueweoughttofollow whatismostprobable. Descartes,Frenchphilosopher,mathematician,writer

Bestregards,

PattyLoris,MBA,CFP LPLFinancialAdvisor

P.S.Pleasefeelfreetoforwardthiscommentarytofamily,friends,orcolleagues.Ifyouwouldlikeus toaddthemtothelist,pleasereplytothisemailwiththeiremailaddressandwewillaskfortheir permissiontobeadded. SecuritiesofferedthroughLPLFinancial,MemberFINRA/SIPC.

*ThisnewsletterwaspreparedbyPeakAdvisorAlliance. *TheStandard&Poor's500(S&P500)isanunmanagedgroupofsecuritiesconsideredtoberepresentativeof thestockmarketingeneral. *TheDJGlobalexUSisanunmanagedgroupofnonU.S.securitiesdesignedtoreflecttheperformanceofthe globalequitysecuritiesthathavereadilyavailableprices. *The10yearTreasuryNoterepresentsdebtowedbytheUnitedStatesTreasurytothepublic.SincetheU.S. Governmentisseenasariskfreeborrower,investorsusethe10yearTreasuryNoteasabenchmarkforthe longtermbondmarket. *GoldrepresentstheLondonafternoongoldpricefixasreportedbytheLondonBullionMarketAssociation. Preciousmetalinvestingissubjecttosubstantialfluctuationandpotentialforloss. *TheDJCommodityIndexisdesignedtobeahighlyliquidanddiversifiedbenchmarkforthecommodityfutures market.TheIndexiscomposedoffuturescontractson19physicalcommoditiesandwaslaunchedonJuly14, 1998. *TheDJEquityAllREITTRIndexmeasuresthetotalreturnperformanceoftheequitysubcategoryoftheReal EstateInvestmentTrust(REIT)industryascalculatedbyDowJones. *Yahoo!Financeisthesourceforanyreferencetotheperformanceofanindexbetweentwospecificperiods. *Opinionsexpressedaresubjecttochangewithoutnoticeandarenotintendedasinvestmentadviceorto predictfutureperformance. *Pastperformancedoesnotguaranteefutureresults. *Youcannotinvestdirectlyinanindex. *Consultyourfinancialprofessionalbeforemakinganyinvestmentdecision. *TounsubscribefromthePattyLorisWeeklyCommentarypleasereplytothisemailwithUnsubscribein thesubjectline.

ComplianceNumber:1-111312

You might also like

- CJS INDEMNITY BOND SECTION 1 Draft Freedom DocumentsDocument44 pagesCJS INDEMNITY BOND SECTION 1 Draft Freedom DocumentsAnonymous 23VuLx95% (21)

- Respa LetterDocument17 pagesRespa LetterForeclosementor93% (27)

- Yardeni Stock Market CycleDocument36 pagesYardeni Stock Market CycleOmSilence2651100% (1)

- Standard Clauses: Reinz Book ofDocument24 pagesStandard Clauses: Reinz Book ofBob SmithNo ratings yet

- Pacific Crest 2013 SaaS SurveyDocument51 pagesPacific Crest 2013 SaaS SurveyNudyGuyNo ratings yet

- The End of An Era: Uarterly EtterDocument10 pagesThe End of An Era: Uarterly EtterthickskinNo ratings yet

- Armstrong Economics: The Coming Great Depression. Why Government Is PowerlessDocument44 pagesArmstrong Economics: The Coming Great Depression. Why Government Is PowerlessRobert Bonomo100% (1)

- PW Anatomy of The BearDocument8 pagesPW Anatomy of The BeargodlionwolfNo ratings yet

- How to Prepare for the NEXT Financial & Economic Crash A Concise Pocket GuideFrom EverandHow to Prepare for the NEXT Financial & Economic Crash A Concise Pocket GuideNo ratings yet

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsFrom EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsNo ratings yet

- Geopolitical Alpha: An Investment Framework for Predicting the FutureFrom EverandGeopolitical Alpha: An Investment Framework for Predicting the FutureNo ratings yet

- A First-Class Catastrophe: The Road to Black Monday, the Worst Day in Wall Street HistoryFrom EverandA First-Class Catastrophe: The Road to Black Monday, the Worst Day in Wall Street HistoryRating: 4 out of 5 stars4/5 (33)

- 02 Oct 08Document12 pages02 Oct 08Paweł ŁakomyNo ratings yet

- The Challenge of Global Capitalism: The World Economy in the 21st CenturyFrom EverandThe Challenge of Global Capitalism: The World Economy in the 21st CenturyRating: 3 out of 5 stars3/5 (9)

- Analysis of Financial Statements in Insurance Companies - Final VersionDocument17 pagesAnalysis of Financial Statements in Insurance Companies - Final VersionKulenović FarahNo ratings yet

- SEC - Gov - Rule 144 - Selling Restricted and Control SecuritiesDocument3 pagesSEC - Gov - Rule 144 - Selling Restricted and Control SecuritiesAlan PetzoldNo ratings yet

- Chapter 30 - PFRS For SEs, PFRS For SEs and Reporting For MicroenterprisesDocument6 pagesChapter 30 - PFRS For SEs, PFRS For SEs and Reporting For MicroenterprisesNoella Marie BaronNo ratings yet

- Global Competitiveness Report 2002/2003 Executive SummaryDocument13 pagesGlobal Competitiveness Report 2002/2003 Executive SummaryWorld Economic Forum100% (3)

- The Australian Share Market - A History of DeclinesDocument12 pagesThe Australian Share Market - A History of DeclinesNick RadgeNo ratings yet

- KrisEnergy LTD - Prospectus (Main Body)Document278 pagesKrisEnergy LTD - Prospectus (Main Body)Invest Stock100% (1)

- CIRSES 1987 Anita NikamDocument34 pagesCIRSES 1987 Anita Nikamhunalulu100% (2)

- Stock Exchange Final PresentationDocument31 pagesStock Exchange Final PresentationCHIARA DI MARTINONo ratings yet

- q.1 FMDocument15 pagesq.1 FMJhanvi Pankaj PandyaNo ratings yet

- 1987 Zero HedgeDocument9 pages1987 Zero Hedgeeliforu100% (1)

- Worried About A Recession? Don't Blame Free Trade, Cato Free Trade Bulletin No. 34Document4 pagesWorried About A Recession? Don't Blame Free Trade, Cato Free Trade Bulletin No. 34Cato InstituteNo ratings yet

- Reading Practice Set 2: Questions 1-11 Are Based On The Following Passage and Supplementary MaterialDocument8 pagesReading Practice Set 2: Questions 1-11 Are Based On The Following Passage and Supplementary MaterialTrần Minh Trang Đặng100% (1)

- Stock Market CrashDocument7 pagesStock Market CrashDorjee TseringNo ratings yet

- Market Commentary 10-08-12Document3 pagesMarket Commentary 10-08-12CLORIS4No ratings yet

- Recession vs. Depression What Is A Recession?Document2 pagesRecession vs. Depression What Is A Recession?Anna KartashyanNo ratings yet

- RecessionDocument6 pagesRecessionWilly RaoulNo ratings yet

- Dow JonesDocument5 pagesDow JonesRohan FernandezNo ratings yet

- Á Trends For Long Time Frames, Trends For Medium Time FramesDocument56 pagesÁ Trends For Long Time Frames, Trends For Medium Time FramesOzina LopesNo ratings yet

- Yardeni Stock Market Cycle - 2001 PDFDocument36 pagesYardeni Stock Market Cycle - 2001 PDFscribbugNo ratings yet

- August 022010 PostsDocument150 pagesAugust 022010 PostsAlbert L. PeiaNo ratings yet

- Dow Jones 30Document42 pagesDow Jones 30Kavitha ReddyNo ratings yet

- Equities Forecast: Q2 2020: Peter Hanks, Analyst Paul Robinson, StrategistDocument10 pagesEquities Forecast: Q2 2020: Peter Hanks, Analyst Paul Robinson, StrategistBob BlythNo ratings yet

- A Playbook From The 1980s For Dealing With InflationDocument6 pagesA Playbook From The 1980s For Dealing With InflationDito InculoNo ratings yet

- History of Recession: NtroductionDocument3 pagesHistory of Recession: Ntroduction24390No ratings yet

- Black Monday 1987: Ajmal Roshan E P201701 CutnDocument8 pagesBlack Monday 1987: Ajmal Roshan E P201701 CutnAjmal RoshanNo ratings yet

- Guggenheim PartnersDocument10 pagesGuggenheim PartnersSFinancialNo ratings yet

- World Recession Seminar Report InsightsDocument21 pagesWorld Recession Seminar Report InsightsSubhash BajajNo ratings yet

- Rogoff AER 2008Document6 pagesRogoff AER 2008maywayrandomNo ratings yet

- The Causes of The 1929 CrashDocument10 pagesThe Causes of The 1929 CrashSalah KhalifaNo ratings yet

- 2023 09 28 Your Party Our Hangover enDocument15 pages2023 09 28 Your Party Our Hangover enstieberinspirujNo ratings yet

- Assignment02 SectionA B23005Document6 pagesAssignment02 SectionA B23005b23005No ratings yet

- 2008 Bear Market Analysis Inv Perp 1969-2007Document5 pages2008 Bear Market Analysis Inv Perp 1969-2007arfwayarryNo ratings yet

- Black Monday: By: Rehan Ur Rahim Sohaib Ahmed Usama Akram Hassan AkhtarDocument17 pagesBlack Monday: By: Rehan Ur Rahim Sohaib Ahmed Usama Akram Hassan AkhtarHassan AkhtarNo ratings yet

- Daily MKT NotesDocument6 pagesDaily MKT Notescjames98No ratings yet

- Morning Review - 080410Document11 pagesMorning Review - 080410pdoorNo ratings yet

- 04 The Business CycleDocument1 page04 The Business CycleMarco Gallegos QuesnayNo ratings yet

- Why Coming Decades May Bring More Frequent Recessions and Be Good For Investors - MarketWatchDocument4 pagesWhy Coming Decades May Bring More Frequent Recessions and Be Good For Investors - MarketWatchtimNo ratings yet

- Long Waves: An Update: Tsang Shu-KiDocument8 pagesLong Waves: An Update: Tsang Shu-KiTsang Shu-kiNo ratings yet

- Global Economy: The Best and Worst of Times: Investment WeeklyDocument14 pagesGlobal Economy: The Best and Worst of Times: Investment WeeklyTung NgoNo ratings yet

- No Place To Hide: The Global Crisis in Equity Markets in 2008/09Document72 pagesNo Place To Hide: The Global Crisis in Equity Markets in 2008/09m n gNo ratings yet

- The Global Economy Is Slowing: in This Month's Issue..Document52 pagesThe Global Economy Is Slowing: in This Month's Issue..Nicolae ChisoceanuNo ratings yet

- The Political Economy of A Long Depression: International Socialism May 2018Document31 pagesThe Political Economy of A Long Depression: International Socialism May 2018miguel gamboaNo ratings yet

- The Years 1999/2000 Were A Time of ExtremesDocument9 pagesThe Years 1999/2000 Were A Time of ExtremesAlbert L. PeiaNo ratings yet

- AssignmentDocument3 pagesAssignmentSherif ElSheemyNo ratings yet

- Assignment 2 BMD B23194Document4 pagesAssignment 2 BMD B23194Divyansh Khare B23194No ratings yet

- Mgt333 Term PaperDocument18 pagesMgt333 Term PaperattractivemeNo ratings yet

- 25 Years Later - in The Crash of 1987, The Seeds of The Great Recession - TIMEDocument4 pages25 Years Later - in The Crash of 1987, The Seeds of The Great Recession - TIMEnabsNo ratings yet

- Stocks Breaking Down: Wednesday's Action Still Makes Me NervousDocument10 pagesStocks Breaking Down: Wednesday's Action Still Makes Me NervousAlbert L. PeiaNo ratings yet

- Great DepressionDocument2 pagesGreat DepressionbuffonNo ratings yet

- Financial CrisisDocument3 pagesFinancial Crisisomermirza2011No ratings yet

- Understanding Recessions: Causes, Effects and HistoryDocument7 pagesUnderstanding Recessions: Causes, Effects and Historysajimathew1104No ratings yet

- Market Commentary April 15th, 2013Document3 pagesMarket Commentary April 15th, 2013CLORIS4No ratings yet

- Market Commentary April 22, 2013Document3 pagesMarket Commentary April 22, 2013CLORIS4No ratings yet

- Market Commentary, March 8th 2013Document3 pagesMarket Commentary, March 8th 2013CLORIS4No ratings yet

- Market Commentary April 29th, 2013Document3 pagesMarket Commentary April 29th, 2013CLORIS4No ratings yet

- Market Commentary 3/18/13Document3 pagesMarket Commentary 3/18/13CLORIS4No ratings yet

- Market Commentary February 4thDocument3 pagesMarket Commentary February 4thCLORIS4No ratings yet

- Market Commentary 2/25/13Document3 pagesMarket Commentary 2/25/13CLORIS4No ratings yet

- Market Commentary 3/4/13Document3 pagesMarket Commentary 3/4/13CLORIS4No ratings yet

- Market Commentary 1.28.2013Document3 pagesMarket Commentary 1.28.2013CLORIS4No ratings yet

- Market Commentary April 1, 2013Document3 pagesMarket Commentary April 1, 2013CLORIS4No ratings yet

- Market Commentary 2.11.13Document3 pagesMarket Commentary 2.11.13CLORIS4No ratings yet

- February 19th Market CommentaryDocument3 pagesFebruary 19th Market CommentaryCLORIS4No ratings yet

- Market Commentary1!14!13Document3 pagesMarket Commentary1!14!13CLORIS4No ratings yet

- Market Commentary12!24!12Document3 pagesMarket Commentary12!24!12CLORIS4No ratings yet

- Market Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearDocument4 pagesMarket Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearCLORIS4No ratings yet

- Market Commentary 12-17-12Document4 pagesMarket Commentary 12-17-12CLORIS4No ratings yet

- Market Commentary 10-01-12Document3 pagesMarket Commentary 10-01-12CLORIS4No ratings yet

- Market Commentary1!14!13Document3 pagesMarket Commentary1!14!13CLORIS4No ratings yet

- Market Commentary 11-19-12Document3 pagesMarket Commentary 11-19-12CLORIS4No ratings yet

- Market Commentary 12-03-12Document3 pagesMarket Commentary 12-03-12CLORIS4No ratings yet

- Market Commentary 12-10-12Document3 pagesMarket Commentary 12-10-12CLORIS4No ratings yet

- Market Commentary 10-08-12Document3 pagesMarket Commentary 10-08-12CLORIS4No ratings yet

- How Will Expenses Change Your RetirementDocument1 pageHow Will Expenses Change Your RetirementCLORIS4No ratings yet

- Market Commentary 11-26-12Document3 pagesMarket Commentary 11-26-12CLORIS4No ratings yet

- Market Commentary 11-12-12Document4 pagesMarket Commentary 11-12-12CLORIS4No ratings yet

- Market Commentary 10-15-12Document3 pagesMarket Commentary 10-15-12CLORIS4No ratings yet

- Market Commentary 10-29-12Document3 pagesMarket Commentary 10-29-12CLORIS4No ratings yet

- Are You A Pessimist or OptimistDocument2 pagesAre You A Pessimist or OptimistCLORIS4No ratings yet

- 2013 Federal Income Tax UpdateDocument5 pages2013 Federal Income Tax UpdateCLORIS4No ratings yet

- CLO One Pager Final 3Q17 FinalDocument3 pagesCLO One Pager Final 3Q17 FinalWooyeon ChoNo ratings yet

- .PHWP contentuploads202204RRHI SEC 17 A 2021 Audited Financial Statements PDFDocument219 pages.PHWP contentuploads202204RRHI SEC 17 A 2021 Audited Financial Statements PDFTagaca, Zybienne Yhue S.No ratings yet

- Corporate Governance in Indian Perspective: A Case of Grasim IndustriesDocument11 pagesCorporate Governance in Indian Perspective: A Case of Grasim IndustriesInternational Journal in Management Research and Social ScienceNo ratings yet

- BFM - Ch-14 - Module CDocument8 pagesBFM - Ch-14 - Module CFara MohammedNo ratings yet

- Structure of Banking System in IndiaDocument34 pagesStructure of Banking System in IndiaAyushi SinghNo ratings yet

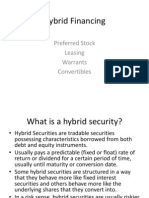

- Hybrid Financing: Understanding Preferred Stock, Leasing, Warrants and ConvertiblesDocument33 pagesHybrid Financing: Understanding Preferred Stock, Leasing, Warrants and ConvertiblesKim Aaron T. RuizNo ratings yet

- Problem 4Document4 pagesProblem 4Ashley CandiceNo ratings yet

- Order in Respect of IFSL Ltd.Document32 pagesOrder in Respect of IFSL Ltd.Shyam SunderNo ratings yet

- Financial Markets Guide to Key ConceptsDocument3 pagesFinancial Markets Guide to Key ConceptsYna Shennel MateNo ratings yet

- Annex "D": Securities and Exchange CommissionDocument4 pagesAnnex "D": Securities and Exchange CommissionaileenNo ratings yet

- Mind Map Consolidated FundsDocument1 pageMind Map Consolidated FundsNik Nur Azmina AzharNo ratings yet

- Consolidated Financial Statements June 30, 2017 and 2016 (With Independent Auditors' Report Thereon)Document63 pagesConsolidated Financial Statements June 30, 2017 and 2016 (With Independent Auditors' Report Thereon)Nadie LrdNo ratings yet

- The Role of Financial Markets in Financial ManagementDocument71 pagesThe Role of Financial Markets in Financial Managementapi-19482678No ratings yet

- Revised Schedule VI RequirementsDocument23 pagesRevised Schedule VI RequirementsBharadwaj GollapudiNo ratings yet

- Financial Issues Faced by Retail InvestorsDocument51 pagesFinancial Issues Faced by Retail InvestorsMoneylife Foundation100% (2)

- Central Banking and Monetary Policy CourseDocument16 pagesCentral Banking and Monetary Policy CourseNahidul Islam IUNo ratings yet

- Algae Dynamics: Questionable IPODocument8 pagesAlgae Dynamics: Questionable IPOChris PineNo ratings yet

- ch5 Test BankDocument41 pagesch5 Test BankTôn Nữ Hương GiangNo ratings yet

- Preference SharesDocument5 pagesPreference ShareshasnaglowNo ratings yet

- Mba 405 Unit - 3Document27 pagesMba 405 Unit - 3Jay PatelNo ratings yet

- No. 1 The Financial Market Career Landscape Summary PDFDocument4 pagesNo. 1 The Financial Market Career Landscape Summary PDFalzndlNo ratings yet

- Capital Adequacy RatioDocument5 pagesCapital Adequacy RatioHarshavardhan TummaNo ratings yet