Professional Documents

Culture Documents

Terms and Conditions

Uploaded by

Ahmad AshOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Terms and Conditions

Uploaded by

Ahmad AshCopyright:

Available Formats

Terms & Conditions Governing Standard Chartered Bank Malaysia Berhad's ("Bank") Business Gold & Business Platinum

Petrol CashBack Campaign II 2012

1. Standard Chartered Bank Malaysia Berhad's ("Bank") Business Gold & Business Platinum Petrol CashBack Campaign II 2012 ("Campaign") will run from 1 September to 31 October 2012, inclusive of both dates ("Campaign Period"). By participating in this Campaign, participants agree to be bound by all the terms and conditions below.

2.

Eligibility 3. The Campaign is open to New Customers who: 3.1 apply for any of the following credit cards (Eligible Cards) with the Bank and have them approved during the Campaign Period: Business Gold Credit Card Business Platinum Credit Card 3.2 AND maintain their accounts with the Bank in good standing, without any breach of the terms and conditions or agreements, throughout the Campaign Period. (Eligible Customers). "New Customers" mean applicants who have not held any Standard Chartered Bank Malaysia Berhad credit card whether as principal or supplementary cardholder within the past 12 months before the applicant's credit card under this Campaign is issued. However, the following persons are not eligible for this Campaign: 4.1 Permanent and/or contract employees of the Bank (including its subsidiaries and related companies) and their immediate family members (spouses, children, parents, brothers and sisters); and/or 4.2 Representatives and/or agents (including advertising and Campaign agents) of Visa or MasterCard and their immediate family members (spouses, children, parents, brothers and sisters). Customers whose card accounts are suspended, cancelled or terminated for any reason during the Campaign Period will not be entitled for any cash rebate under this Campaign.

4.

5.

CashBack 6. Eligible Customers will enjoy CashBack for petrol purchases made using the Eligible Cards within one year from the month in which the relevant cards were approved. This CashBack is in addition to the existing cashback for the Eligible Cards, as set out in the table below. CashBack Credit Card

CashBack A: Existing CashBack Business Gold / Business Platinum 0.5% of retail transactions (Petrol excluded) (Unlimited) CashBack B (this Campaign): Petrol CashBack 5% of petrol purchases (Capped at maximum of RM38 per month and RM 450 per year)

NOTE: CashBack B eligibility periods are as follows: Eligible Cards approved from 1 30 September 2012: CashBack B period is until 30 September 2013. Eligible Cards approved from 1 31 October 2012: CashBack B period is until 31 October 2013. 6.1 CashBack A: the existing 0.5% CashBack will continue in accordance with the existing terms and conditions. This CashBack will be credited and reflected in your statement within the same month. 6.2 CashBack B: the additional 5% CashBack is applicable only for petrol purchases in Malaysia. (a) Petrol purchases include transactions done at both island pumps and inside petrol kiosks, provided they are categorised by the merchant using approved petrol purchase codes. The Bank will not be responsible for any error in category codes used by the merchant. (b) CashBack is capped at RM38 per month and RM450 per year for each Eligible Customer. In addition, the Bank will pay out only up to a maximum total CashBack of RM1,370,000 from 1 September 2012 to 31 October 2013, across all Eligible Customers. (c) This CashBack will be credited to the Eligible Customers credit card account within 45 days after the end of the transaction month. (d) Each Eligible Customer is only entitled to CashBack B for one Eligible Card. If a customer took up both a Business Gold and Business Platinum Credit Card during the Campaign Period, then CashBack B will only be awarded to the Business Platinum Card. (e) The Banks records of details and dates of transactions are final and conclusive for purposes of this Campaign.

Example: Mr A had applied for a Business Platinum Card, which was approved on 9 September 2012. This means he is eligible for CashBack B from the time he activates his Card until 30 September 2013. He made the following transactions on this card. Mr A spent RM500 on retail transactions (other than petrol) on 20 September 2012. The CashBack A amount of 0.5% (RM2.50) will be credited to his card account the same month and reflected in his monthly statement for September. Mr A spent a total of RM788 on petrol transactions throughout September 2012. 5% of this amount is RM39.40. However, the CashBack cap of RM38 per month will apply, which means that Mr A will only receive a total CashBack B amount of RM38. This amount will be credited to his card account within 45 days from end September , namely by 15 November 2012. Assuming that the Bank has paid out the maximum total CashBack amount of RM1,370,000 across all Eligible Customers by 19 July 2013, Mr A will not receive any further CashBack B amounts for petrol purchases after that date. 7. Disputed transactions/billing will not be eligible for CashBack under this campaign. Reversals of disputed transactions or cancellation of any transaction will result in the corresponding CashBack being reversed.

General 8. The Bank's decision on all matters relating to this Campaign will be final and binding on all participants. If any matters arise which are not covered in these Terms and Conditions, they will be determined solely by the Bank. The Bank may vary any of these Terms and Conditions and extend the Campaign Period. Any such change will be announced on the Bank's website at standardchartered.com.my and in the Bank's branches.

9.

10. Eligible Cards under this Campaign will not be entitled to participate in other campaigns or promotions in relation to new credit card applications. 11. The Campaign and these Terms and Conditions are governed by the laws of Malaysia. The participants agree that the Courts of Malaysia have jurisdiction over all matters arising from this Campaign.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- G - The Eastern MethodDocument1 pageG - The Eastern MethodAhmad AshNo ratings yet

- RespiratorDocument4 pagesRespiratorAhmad AshNo ratings yet

- Respirator Questionnaire: Part A, Section 1Document2 pagesRespirator Questionnaire: Part A, Section 1Ahmad AshNo ratings yet

- Cong DATDocument4 pagesCong DATAhmad AshNo ratings yet

- Serum CholinesteraseDocument5 pagesSerum CholinesteraseAhmad AshNo ratings yet

- Short Version Questionnaire RWJMS2 FormDocument4 pagesShort Version Questionnaire RWJMS2 FormAhmad AshNo ratings yet

- Instruction and Questionnaire StudentDocument2 pagesInstruction and Questionnaire StudentAhmad AshNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Staff ReimbursementDocument2 pagesStaff ReimbursementAinaNo ratings yet

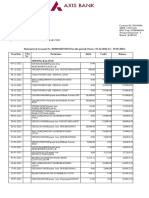

- EStmtPDFServlet PDFDocument3 pagesEStmtPDFServlet PDFYi Shu LowNo ratings yet

- Discover Cardmember Agreement Arb FullDocument13 pagesDiscover Cardmember Agreement Arb FullLUE100% (1)

- Cashless Policy and Financial Performance of Deposit Money Banks in NigeriaDocument12 pagesCashless Policy and Financial Performance of Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- Electronic CrimeDocument110 pagesElectronic CrimeClyde Louis Oliver-LinagNo ratings yet

- Congratulations! Your Booking Is Now Confirmed.: Price RP 12,442,514Document4 pagesCongratulations! Your Booking Is Now Confirmed.: Price RP 12,442,514Cyara gNo ratings yet

- How To Card Hotels (By Authorization Form-With Agent and Without)Document3 pagesHow To Card Hotels (By Authorization Form-With Agent and Without)Ruselll Potts100% (2)

- One Airtel Bill Summary for V SwathiDocument11 pagesOne Airtel Bill Summary for V Swathisandeep salavarNo ratings yet

- Risk Analysis of Personal Loans at Vijaya BankDocument90 pagesRisk Analysis of Personal Loans at Vijaya BankChethan.sNo ratings yet

- Technological Development in Banking SectorDocument5 pagesTechnological Development in Banking SectorPrabhu89% (9)

- Format - SIP Progress Report SamikshaDocument10 pagesFormat - SIP Progress Report Samikshavinuta wagheNo ratings yet

- Letter of Agreement - Capella Honda Batam - 19102019Document5 pagesLetter of Agreement - Capella Honda Batam - 19102019Bacol EntertainmentNo ratings yet

- EssaysDocument63 pagesEssaysrantharuNo ratings yet

- Garima Axis Bank SDocument3 pagesGarima Axis Bank SSajan Sharma100% (1)

- English VocabularyDocument66 pagesEnglish Vocabularyhanh nguyenNo ratings yet

- Notification For Ars-2015 and Net-2015 PDFDocument37 pagesNotification For Ars-2015 and Net-2015 PDFrock samNo ratings yet

- Civil Attorney Assisted Fee AgreeDocument7 pagesCivil Attorney Assisted Fee AgreeTitan ArumNo ratings yet

- LCCI Level 3 2009 Tests PDFDocument19 pagesLCCI Level 3 2009 Tests PDFzsoieNo ratings yet

- Srs ExampleDocument44 pagesSrs ExampleVaruna MathurNo ratings yet

- Intro S4HANA Using Global Bike Case Study SM Fiori en v4.1Document69 pagesIntro S4HANA Using Global Bike Case Study SM Fiori en v4.1harsh vardhan singhNo ratings yet

- PdfHandler AshxDocument18 pagesPdfHandler AshxphaniNo ratings yet

- Đề tháng 10_2023 - Vol 5Document44 pagesĐề tháng 10_2023 - Vol 5kissyoumybfNo ratings yet

- LS Gen Info 2019Document31 pagesLS Gen Info 2019Iya LumbangNo ratings yet

- GCASH DISPUTE FORMDocument2 pagesGCASH DISPUTE FORMLiyo100% (1)

- Debit CodesDocument2 pagesDebit CodesRicky FisherNo ratings yet

- Accounting For Merchandising BusinessDocument27 pagesAccounting For Merchandising Businessarnel barawedNo ratings yet

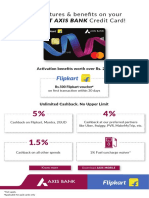

- Flipkart Axis Bank Credit Card!: Top Features & Benefits On YourDocument4 pagesFlipkart Axis Bank Credit Card!: Top Features & Benefits On YourndprajapatiNo ratings yet

- URAT PG 2019: University of Rajasthan Admission TestDocument8 pagesURAT PG 2019: University of Rajasthan Admission TestashishNo ratings yet

- 2 A Vocabulary yDocument1 page2 A Vocabulary yMaría BriñezNo ratings yet

- Canara BankDocument52 pagesCanara BankSandipto BanerjeeNo ratings yet