Professional Documents

Culture Documents

L1 Book-Keeping S2 2000

Uploaded by

Fung Hui YingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

L1 Book-Keeping S2 2000

Uploaded by

Fung Hui YingCopyright:

Available Formats

Examiners Report and Model Answers for

Book-keeping

FIRST LEVEL

Series 2 (Code 1006) 2000

LCCI Examinations Board

MH N T131 9 RNM >f2[EW2r@o2`5^B^3]E]2r2[SV#

Book-keeping First Level

Series 2 2000

How to use this booklet Examiners Reports and Model Answers have been developed by LCCIEB to offer additional information and guidance to Centres, teachers and candidates as they prepare for LCCIEB examinations. The contents of this booklet are divided into 5 elements: (1) General Comments assessment of overall candidate performance in this examination, providing general guidance where it applies across the examination as a whole reproduced from the printed examination paper summary of the main points that the Chief Examiner expected to see in the answers to each question in the examination paper constructive analysis of candidate error, areas of weakness and other comments that apply to each question in the examination paper where appropriate, additional guidance relating to individual questions or to examination technique

(2) (3) (4)

Questions Model Answers Examiners Report

(5)

Helpful Hints

Teachers and candidates should find this booklet an invaluable teaching tool and an aid to success. The London Chamber of Commerce and Industry Examinations Board provides Model Answers to help candidates gain a general understanding of the standard required. The Board accepts that candidates may offer other answers that could be equally valid.

Note LCCIEB reserves the right not to produce an Examiners Report, either for an examination paper as a whole or for individual questions, if too few candidates were involved to make an Examiners Report meaningful.

LCCI CET 2000 All rights reserved; no part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior written permission of the Publisher. The book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover, other than that in which it is published, without the prior consent of the Publisher. Typeset, printed and bound by the London Chamber of Commerce and Industry Examinations Board.

Book-keeping First Level

Series 2 2000

GENERAL COMMENTS The performance at this examination produced a pass rate broadly in line with others in recent series. The following comments are intended to be of help to both candidates and tutors alike: Each of the 4 set questions should be answered. Even though a candidate may find a particular question difficult, an attempt should always be made at an answer as marks are usually available for such things as headings and preliminary calculations. Examiners prefer to pass rather than fail a candidate and are always looking for justifying evidence. An incorrect answer can still earn a substantial proportion of the available marks and it is therefore important for a candidate to show all of their workings and thus enable the Examiner to award those marks. First Level Book-keeping represents an introduction to the subject. It is here that a candidate learns the good habits necessary for success not only at this First Level but also at higher levels. Particular attention should be paid to presentational matters such as ledger account narratives, dates and the headings for final accounts. It is important, for example, to remember that the narrative in a ledger account indicates where the opposite side of the double entry is to be found. Sloppy and incomplete work will lead to a heavy loss of marks in the examination.

Book-keeping First Level

Series 2 2000

QUESTION 1 Delia Tremett commenced in business on 1 April Year 9. She decided to offer to credit customers a cash

1 1 discount of 2 2 % for payment within 14 days of the sale or 1 4 % for payment within 15 to 30 days.

The following details are from the books of Delia Tremett: Year 9 2 April Bought goods on credit from County Services at a list price of 480, subject to a trade

1 discount of 10% and a cash discount of 2 2 % for payment within 30 days.

4 April 7 April

1 Sold goods on credit to M Foxley at a list price of 320, subject to a trade discount of 12 2 %. 1 Sold goods on credit to K Weston, at a list price of 480, subject to a trade discount of 12 2

%. 10 April 13 April K Weston returned goods purchased on 7 April with a list price of 80. Bought goods on credit from Kingseast Limited at a list price of 360, subject to a trade

1 1 discount of 15% and a cash discount of 2 2 % for payment within 14 days or 1 4 % for

payment within 15 to 30 days. 20 April 21 April 24 April 29 April 30 April Sold goods to M Foxley at a list price of 600, subject to a trade discount of 15%. Received a cheque from M Foxley in settlement of the invoice dated 4 April. Sent Kingseast Limited a cheque in settlement of the invoice dated 13 April. Sent County Services a cheque in settlement of the invoice dated 2 April. Received a cheque from M Foxley in settlement of the invoice dated 20 April.

REQUIRED (a) Show the entries for the above transactions in the: (i) (ii) (iii) (b) Purchases Day Book Sales Day Book Sales Returns Day Book (7 marks) From the above transactions, record the entries in the accounts of the two debtors and two creditors. Balance the accounts at 30 April Year 9. (15 marks) Show the transfer of the totals of the three Day Books to the respective General Ledger Accounts at 30 April Year 9. (3 marks) (Total 25 marks)

(c)

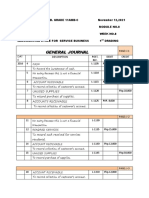

Model Answer to Question 1 (a) (i) Year 9 2 April 13 April County Services Kingseast Limited306.00 To Purchases Account Sales Day Book (ii) Year 9 4 April 7 April 20 April M Foxley K Weston M Foxley To Sales Account Sales Returns Day Book (iii) Year 9 10 April K Weston To Sales Returns Account 70.00 280.00 420.00 510.00 1,210.00 Purchases Day Book 432.00 738.00

(b) Year 9 4 April 20 April Sales Sales

Sales Ledger M Foxley Year 9 21 April 21 April 30 April 30 April K Weston Year 9 7 April 1 May Sales Balance b /d 420.00 420.00 350.00 Year 9 10 April 30 April Sales Returns Balance c/d 70.00 350.00 420.00 Bank Discount allowed Bank Discount allowed 276.50 3.50 497.25 12.75 790.00

280.00 510.00 790.00

CONTINUED ON NEXT PAGE

Model Answer to Question 1 continued Purchases Ledger County Services Year 9 29 April 29 April Bank Discount received 421.20 10.80 432.00 Year 9 2 April Purchases 432.00 432.00

Kingseast Limited Year 9 24 April 24 April Bank Discount received 298.35 7.65 306.00 Year 9 13 April Purchases 306.00 306.00

(c)

General Ledger Purchases Year 9 30 April Sundries 738.00 Sales Year 9 30 April Sales Returns Year 9 30 April Sundries 70.00 Sundries 1,210.00

Examiners Report on Question 1 Many candidates provided good answers to this question and as a result they achieved high marks. Common errors were: (i) Producing ledger accounts in part (a) rather than day books. This resulted in the loss of the entire 7 marks allowed for the section.

(ii) Deducting settlement discount when calculating the value of invoices to be included in the day books. This resulted in the loss of between 1 and 7 marks. (iii) Part (b) required the posting of the day books to accounts in the Sales Ledger, however some candidates were guilty of reversing the entries. Sales were therefore posted to the credit of the personal accounts and returns and cash received to the debit side. This resulted in the loss of all the available 15 marks. (iv) Candidates frequently rounded up cash discount values to produce whole pounds and no pence. This resulted in the loss of 1 mark for each occurrence. (v) In part (c), a number of candidates were guilty of reversing entries in the Purchases, Sales and Sales Returns Accounts and, as a consequence, lost 1 mark for each error. Descriptions were often inadequate and this also resulted in the loss of marks.

Question 1 Helpful Hints Candidates must provide the Examiner with what the question requires. Offering unrealistic alternatives, such as ledger accounts in place of day books or journals, will not impress the Examiner but will result in the loss of marks. Understand what is required to provide adequate descriptions in ledger accounts. Simply repeating the name of the account in which the entry is appearing will fail to earn any marks even though the figure being entered is both correct in value and entered on the correct side of the account.

QUESTION 2 James Moorhead, a trader, had the following transactions during the financial year ended 31 December Year 5. (1) (2) (3) 17 May 23 July 11 Oct Purchased a motor vehicle for 13,700 from Cheshunt Motors. James Moorhead paid a deposit of 4,000 by cheque, the balance of the purchase being on credit. Henry Small, a debtor, paid 270 towards a debt of 630. The balance of the debt was written off as irrecoverable. James Moorhead took from stock, for his own private use, goods which had been purchased during Year 5, for 510.

At 31 December Year 5, James Moorhead prepared a Trial Balance but it did not balance. After investigation he found the following errors: (4) (5) (6) (7) REQUIRED Prepare Journal entries, without narrations: (a) (b) to record each of the transactions (1), (2) and (3) to correct, at 31 December Year 5, the errors stated in (4), (5), (6) and (7). (25 marks) A payment of 738 to a creditor, T Larken, had been posted to another creditors account in the name of K Ladburn. The payment by cheque of an invoice for 465 for motor vehicle repairs had been recorded correctly in the Cash Book but had been debited to Motor Vehicles Account. The total of the discount column on the credit side of the Cash Book, 63, had been posted to the debit of Discount Received Account. Rent receivable of 650 for the month of November had been correctly entered in the Cash Book but was posted to the credit of Rent Payable Account.

Model Answer to Question 2 James Moorhead Journal Year 5 (1) 17 May Motor vehicle Bank Cheshunt Motors Bank Bad Debts Henry Small Drawings Purchases T Larken K Ladburn Motor vehicle repairs Motor vehicles Discount received (7) 31 Dec Rent payable Rent receivable 650 650 Dr 13,700 Cr 4,000 9,700 270 360 630 510 510 738 738 465 465 126

(2)

23 July

(3) (4) (5) (6)

11 Oct 31 Dec 31 Dec 31 Dec

10

Examiners Report on Question 2 Candidates often find questions involving journal entries difficult to tackle but such questions are popular with Examiners. Journal entries examine a candidates knowledge of double entry without the need to spend time on neatly drawing up ledger accounts. Common errors made by candidates were: (i) Reversing journal entries and thereby doubling the effect of the original error. This resulted in the loss of all the marks available for the entry/entries concerned.

(ii) Incorrect usage of account names. Debt Gone Bad Account, for example, is not an acceptable alternative for Bad Debts Account and would have resulted in the loss of half a mark. A half mark would also have been lost for every other account incorrectly/inadequately named. (iii) Goods removed by an owner for his/her own personal use should be credited to the Purchases Account and not to the Sales Account. It is also incorrect to credit the Stock Account. The loss of 1 marks would have resulted from crediting sales or stock. (iv) An original entry placed on the wrong side of an account will need to be doubled up in order to correct it. This was the case in respect of the Discount Received Account where a required credit entry of 63 was incorrectly posted as 63 debit. Many candidates corrected this error by posting a credit of 63 to the account, which simply resulted in the discount not being recorded at all. As a result, 1 mark was lost. (v) Far too many candidates produced ledger accounts rather than journal entries. This would have resulted in the loss of all marks.

Question 2 Helpful Hints Questions of this type appear regularly at First Level and candidates should therefore be prepared to tackle them. Remember that simply repeating existing incorrect entries will result in a doubling up of the error and a heavy loss of marks. It is often useful to draw up simple T accounts that reflect the entry/entries described in the question. This will help the candidate to understand what entries are needed to correct any errors.

11

QUESTION 3 On 1 May Year 4, the Cash Book balances of Claire Stewart, a trader, were: Cash Bank 236 (Current Account) 6,154 (Dr)

During May Year 4, the following transactions took place: (1) Cheques were received from the following debtors who all took advantage of the cash discount available Amount Cash discount Amount owed allowed received 17 May 21 May 27 May 29 May (2) T Lake W Ruscombe N Paul F Anderson 320 960 240 1,280

1 22%

312 912 234 1,216

5% 2 % 5%

1 2

Cheques were paid to the following suppliers; and Claire Stewart took advantage of the cash discount available Amount Cash discount Amount owed allowed paid 22 May 28 May 29 May R Felton K Dougall D Beaney 78 800 100 1,500 1,800 145 412 980 1,760 1,920 560 740 280

1 22%

546 703 273

5% 2 %

1 2

(3)

Cash payments 7 May 12 May 14 May 20 May 26 May Stationery Into bank Drawings Into bank Into bank

(4)

Other payments made by cheque 10 May 30 May Equipment repairs Salaries

(5)

Cash sales amounted to 11 May 19 May 25 May

In addition, on 27 May Claire Stewart drew a cheque for 5,000 on the firms Current Account and paid this into the firms Deposit Account at the bank.

12

CONTINUED ON NEXT PAGE

QUESTION 3 CONTINUED REQUIRED (a) Write up the 3-column Cash Book of Claire Stewart for May Year 4, bringing down the closing balances. (22 marks) Prepare the Bank Deposit Account for May Year 4 in the General Ledger. On 1 May Year 4 the balance on the Bank Deposit Account was 11,208 (Dr) (3 marks) (Total 25 marks)

(b)

13

Model Answer to Question 3 (a) Year 4 CLAIRE STEWART CASH BOOK Discount Allowed 1 May 11 May 12 May 17 May 19 May 20 May 21 May 25 May 26 May 27 May 29 May Balance b/d Sales Cash T Lake Sales Cash W Ruscombe Sales Cash N Paul F Anderson 5,849 126 1 June Balance b/d 4,896 618 12,928 5,849 58 4,896 12,928 6 64 48 1,920 1,800 234 1,216 8 1,760 1,500 912 Cash 236 980 800 312 Bank 6,154 Year 4 Discount Received 7 May 10 May 12 May 14 May 20 May 22 May 26 May 27 May 28 May 29 May 30 May 31 May Stationery Equipment repairs Bank Drawings Bank R Felton Bank Bank Deposit K Dougall D Beaney Salaries Balance c/d 618 37 7 14 1,800 5,000 703 273 412 800 100 1,500 546 Cash 78 145 Title Case Bank

14

CONTINUED ON NEXT PAGE

Model Answer to Question 3 continued (b) General Ledger Bank Deposit Account Year 4 1 May 27 May 16,208 1 June Balance b/d Bank Current Balance b/d 11,208 5,000 16,208 Year 4 31 May 16,208 Balance c/d 16,208

Examiners Report on Question 3 The writing up of a cash book usually proves a popular question with candidates and this question was no exception. Common errors made by candidates were: (i) Poor or incorrect descriptions resulting in the loss of the marks allocated to the entry. An example of this was the treatment of the 5,000 transfer to the firms Deposit Account which many candidates recorded as being transferred to drawings. A half mark was lost as a result.

(ii) Classifying bank entries as cash entries and vice versa and, as a result, losing the marks available for each one. (iii) Reversing the entries required to record the three cash/bank contras. This resulted in the loss of up to 3 marks. (iv) Adding the various discounts allowed and discounts received figures to the net cash received and net cash paid amounts and then entering the resultant gross receipts/gross payments in the cash book. This resulted in the loss of up to 7 marks. (v) Failure to bring cash and bank balances down to the beginning of the new period, 1 June, thereby losing 1 mark. (vi) Many candidates omitted to tackle part (b) of the question, entering up the Deposit Account and, as a result, lost 3 marks.

Question 3 Helpful Hints Examiners will reward a neat presentation but struggle to award marks where a candidate produces untidy and, at times, unreadable work. Pay attention to dates and brought down balances as these will always attract marks. Remember that the details column must state the name of the account in which the opposite side of the double entry will be found.

15

QUESTION 4 The following Trial Balance was extracted from the books of Tim Paradine at 30 June Year 6: Dr Stock, 1 July Year 5 Purchases and sales Returns inwards and outwards Debtors and creditors Bank Cash in hand Fixtures and fittings at cost Provision for depreciation on fixtures and fittings Motor vehicles at cost Provision for depreciation on motor vehicles Discounts Wages and salaries Insurances Motor vehicle running costs Advertising Bad debts written off Provision for doubtful debts Drawings Capital The following points applied at 30 June Year 6: (1) Closing stock valued at cost (2) Wages and salaries accrued (3) Insurance prepaid 13,940 1,480 360 4,612 147,380 340 36,350 5,510 125 21,400 36,000 3,640 32,240 3,680 4,790 1,100 730 15,600 313,497 73,255 313,497 7,200 1,620 Cr 212,630 3,962 8,520

5,350

960

(4) Depreciation was to be provided as follows:

1 Fixtures and fittings - 12 2 % on cost

Motor vehicles - 40% on reducing balance. (5) It was decided to write off a further 550 as a bad debt and to adjust the provision for doubtful debts to 4% of the remaining balance of debtors. REQUIRED Prepare for Tim Paradine: (a) a Trading and Profit & Loss Account for the year ended 30 June Year 6 (13 marks) (b) the Balance Sheet at 30 June Year 6. (12 marks) (Total 25 marks)

16

Model Answer to Question 4 (a) Tim Paradine Trading and Profit & Loss Account for the year ended 30 June Year 6 Stock, 1 July Year 5 Purchases Less Returns outwards Less Stock 30 June Year 6 Cost of goods sold Gross Profit c/d Discount allowed Wages and salaries (+1,480) Insurances (-360) Motor vehicle running costs 4,790 Advertising Bad debts written off (+550) Provision for doubtful debts 472 Depreciation: Fixtures and fittings 2,675 Motor vehicles 11,520 Net Profit 147,380 3,962 143,418 148,030 13,940 134,090 78,200 212,290 3,640 33,720 3,320 1,100 1,280 Gross Profit b/d Discount received 4,612 Sales Less Returns inwards 212,630 340 212,290

212,290 78,200 1,620

14,195 17,303 79,820

79,820

(b) Fixed Assets

Balance Sheet at 30 June Year 6 Cost Fixtures and Fittings Motor vehicles Current Assets Stock Debtors Less Provision for doubtful debts Prepayment (insurance) Bank Cash 21,400 36,000 57,400 35,800 1,432 Aggregate depreciation 8,025 18,720 26,745 13,940 34,368 360 5,510 125 54,303 10,000 44,303 74,958 17,303 15,600 73,255 1,703 74,958 Net book value 13,375 17,280 30,655

Less Amounts due within 1 year (Current Liabilities) Creditors 8,520 Accrual (wages and salaries) 1,480 Net Current Assets Financed as follows: Capital Balance at 1 July Year 5 Add Net Profit Less Drawings

17

Examiners Report on Question 4 The preparation of final accounts is examined very regularly at this level but, unfortunately, the same mistakes keep recurring. Common errors made by candidates at this examination were: Using incorrect titles and thereby losing an easy 1 marks. The Trading and Profit & Loss Account reports on the results of trading for the year ending whilst the Balance Sheet reports on the value of assets and liabilities at the specific year end date. Trading and Profit & Loss Account (i) Returns inwards and returns outwards should be deducted from sales and purchases respectively and the result clearly shown as a separate and identifiable figure. Failure to do so at this examination resulted in the loss of up to 2 marks.

(ii) The Cost of Goods Sold or, alternatively, Cost of Sales must be clearly shown or the loss of marks will result. (iii) A large number of candidates added prepayments to, and deducted accruals from, given trial balance figures. This resulted in the loss of up to 3 marks. (iv) The Provision for Doubtful Debts was often included at the revised account balance. It is only the difference between the opening and the closing balance that should appear in the Profit & Loss Account. This error resulted in the loss of 1 mark. (v) Those candidates who reflected the adjustment correctly, frequently omitted to deduct the additional bad debts before calculating the revised provision. This resulted in the loss of up to 2 marks. (vi) Discounts allowed and discounts received were often reversed resulting in the loss of 1 mark. (vii) The straight line method of calculating depreciation was frequently applied to motor vehicles despite the question stating that the reducing balance method was to be used. This resulted in the loss of 1 mark. Balance Sheet (i) (ii) Failure to increase the aggregate depreciation by the amount charged in the Profit & Loss Account resulted in the loss of a maximum of 2 marks. The same mistake was made in relation to the Provision for Doubtful Debts thus resulting in the loss of 1 mark.

(iii) Omitting to reduce the value of Debtors by the value of the additional bad debt write off resulted in the loss of 1 mark. (iv) Including accruals under Current Assets and prepayments under Current Liabilities/Creditors amounts due within one year resulted in the loss of 2 marks. (v) Failing to show sub-totals for both Current Assets and Current Liabilities resulted in the loss of 2 marks.

18

Question 4 Helpful Hints Given the popularity of this type of question, candidates should thoroughly revise the topic. Accruals and prepayments must be accurately dealt with not only in the Profit & Loss Account but also in the Balance Sheet. The same comment applies to both depreciation and doubtful debts. Pay close attention to the presentational style used in this model answer. Although a horizontal format is acceptable for the Balance Sheet, the vertical format allows for the calculation of Net Current Assets and is to be preferred.

19

You might also like

- Book-Keeping & Accounts/Series-2-2005 (Code2006)Document14 pagesBook-Keeping & Accounts/Series-2-2005 (Code2006)Hein Linn Kyaw100% (2)

- Lcci Level 1Document32 pagesLcci Level 1Gloria100% (7)

- 2010 LCCI Bookkeeping and Accounts Series 3Document8 pages2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- LCCI First Level Revision NotesDocument20 pagesLCCI First Level Revision NotesLinda Martin100% (2)

- 2008 LCCI Level1 Book-Keeping (1517-4)Document13 pages2008 LCCI Level1 Book-Keeping (1517-4)JessieChuk100% (2)

- Chapter (1) The Accounting EquationDocument46 pagesChapter (1) The Accounting Equationtunlinoo.067433100% (3)

- LCCI Accounting First Level 笔记 - 百度文库Document23 pagesLCCI Accounting First Level 笔记 - 百度文库Asok Kumar50% (2)

- Lcci Level I Que and Ans (1606) MALDocument13 pagesLcci Level I Que and Ans (1606) MALThuzar Lwin100% (2)

- November 2015Document16 pagesNovember 2015Κλαίρη Πρωτοπαπά100% (1)

- Pearson LCCI: Certificate in Bookkeeping and Accounting (VRQ)Document20 pagesPearson LCCI: Certificate in Bookkeeping and Accounting (VRQ)Aung Zaw Htwe100% (2)

- +-LCCI Level 1 - How To Pass Book-Keeping (Recommeded Book) - +Document334 pages+-LCCI Level 1 - How To Pass Book-Keeping (Recommeded Book) - +rock300785% (26)

- Examiner Report ASE20104 January 2018Document22 pagesExaminer Report ASE20104 January 2018Aung Zaw HtweNo ratings yet

- LCCI Chp02Document11 pagesLCCI Chp02richardchan001100% (1)

- Book-Keeping and Accounts/Series-4-2011 (Code2007)Document16 pagesBook-Keeping and Accounts/Series-4-2011 (Code2007)Hein Linn Kyaw100% (1)

- LCCI LEVEL 1&2 TextbookDocument100 pagesLCCI LEVEL 1&2 TextbookJohn Sue Han100% (1)

- LCCI Level I (Book-Keeping) : Course OutlineDocument5 pagesLCCI Level I (Book-Keeping) : Course OutlineGergana DraganovaNo ratings yet

- Book-Keeping Level 1Document13 pagesBook-Keeping Level 1Hein Linn Kyaw88% (17)

- Book-Keeping and Accounts/Series-2-2004 (Code2006)Document16 pagesBook-Keeping and Accounts/Series-2-2004 (Code2006)Hein Linn Kyaw100% (4)

- Lcci Book Keeping 2008Document6 pagesLcci Book Keeping 2008Jill Priya KeshyapNo ratings yet

- Level 1 Certificate in Book-Keeping: SyllabusDocument20 pagesLevel 1 Certificate in Book-Keeping: Syllabusvincentho2k100% (1)

- Book-Keeping and Accounts L2Document18 pagesBook-Keeping and Accounts L2Wing Yan Katie100% (1)

- Proposal To Conduct Accounting Courses: Diploma in Book-Keeping and Accounts Level 2Document2 pagesProposal To Conduct Accounting Courses: Diploma in Book-Keeping and Accounts Level 2Bhutan Chay100% (3)

- Chapter 1 - Business Transactions and DocumentationDocument40 pagesChapter 1 - Business Transactions and Documentationshemida86% (7)

- Review of Some Key Fundalmentals: Suggested Study Notes For F3 ACCA ExaminationsDocument11 pagesReview of Some Key Fundalmentals: Suggested Study Notes For F3 ACCA Examinationsserge222100% (2)

- Book-Keeping and Accounts Level 2/series 4 2008 (2006)Document14 pagesBook-Keeping and Accounts Level 2/series 4 2008 (2006)Hein Linn Kyaw100% (2)

- Code 2007 Accounting Level 2 2010 Series 4Document15 pagesCode 2007 Accounting Level 2 2010 Series 4apple_syih100% (1)

- Unity University Group Accounting AssignmentDocument2 pagesUnity University Group Accounting AssignmenttotiNo ratings yet

- LCCI - Level 3 Diploma in AccountingDocument2 pagesLCCI - Level 3 Diploma in AccountingWinnieOngNo ratings yet

- 2008 LCCI Level 1 (1017) Specimen Paper AnswersDocument4 pages2008 LCCI Level 1 (1017) Specimen Paper AnswersTszkin PakNo ratings yet

- ASE20104 Examiner Report - March 2018Document20 pagesASE20104 Examiner Report - March 2018Aung Zaw HtweNo ratings yet

- Book-Keeping and Accounts Level 2Document16 pagesBook-Keeping and Accounts Level 2Hein Linn Kyaw87% (15)

- Book-Keeping & Accounts Level 2/series 2 2008 (Code 2007)Document12 pagesBook-Keeping & Accounts Level 2/series 2 2008 (Code 2007)Hein Linn KyawNo ratings yet

- 2006 LCCI Level 2 Series 2Document16 pages2006 LCCI Level 2 Series 2mandyc_2650% (2)

- LCCI L2 Bookkeeping and Accounting ASE20093 Jan 2017Document16 pagesLCCI L2 Bookkeeping and Accounting ASE20093 Jan 2017chee pin wongNo ratings yet

- Final Mock ExamDocument16 pagesFinal Mock Examsalome75% (4)

- CFAB - Accounting - QB - Chapter 10Document14 pagesCFAB - Accounting - QB - Chapter 10Huy NguyenNo ratings yet

- Book-Keeping and Accounts/Series-3-2004 (Code2006)Document16 pagesBook-Keeping and Accounts/Series-3-2004 (Code2006)Hein Linn Kyaw100% (1)

- Code 2006 Accounting Level 2 2001 Series 2Document22 pagesCode 2006 Accounting Level 2 2001 Series 2apple_syih100% (3)

- Question Paper1 2005 AccountsDocument12 pagesQuestion Paper1 2005 Accountspankhaniahirensv150No ratings yet

- MSIN0004A4UADocument12 pagesMSIN0004A4UAErika MajorosNo ratings yet

- Accounting/Series 2 2007 (Code3001)Document16 pagesAccounting/Series 2 2007 (Code3001)Hein Linn Kyaw100% (3)

- Int1 Accounting All 2014Document32 pagesInt1 Accounting All 2014Illharm SherrifNo ratings yet

- ABE Dip 1 - Financial Accounting JUNE 2005Document19 pagesABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- 0452 s14 QP 11Document20 pages0452 s14 QP 11ATEFNo ratings yet

- Acct 220 Final Exam UmucDocument10 pagesAcct 220 Final Exam UmucOmarNiemczyk0% (2)

- Lesson 2 HND in Business Unit 5 Management AccountingDocument13 pagesLesson 2 HND in Business Unit 5 Management AccountingAnish Nair0% (1)

- Business Junior CertDocument9 pagesBusiness Junior CertCathal O' GaraNo ratings yet

- 4IA Specimen QPDocument7 pages4IA Specimen QPhskxxNo ratings yet

- TX UK June 2023 Examiner's Report - FinalDocument19 pagesTX UK June 2023 Examiner's Report - FinalMUHAMMAD KAMRANNo ratings yet

- Advanced Financial Accounting Sample Paper 1 QuestionsDocument28 pagesAdvanced Financial Accounting Sample Paper 1 QuestionsSherla Mae AlfonsoNo ratings yet

- SummerAssignmentClass11th (2014 15)Document18 pagesSummerAssignmentClass11th (2014 15)Niti AroraNo ratings yet

- Ffa12efmq A Low ResDocument34 pagesFfa12efmq A Low ResAdi StănescuNo ratings yet

- BAO3309 2015SAMPLEBv2Document6 pagesBAO3309 2015SAMPLEBv2zakskt1No ratings yet

- 2007 LCCI Level 2 Series 3 (HK) Model AnswersDocument12 pages2007 LCCI Level 2 Series 3 (HK) Model AnswersChoi Kin Yi Carmen67% (3)

- Introduction To Accounting - AbeDocument17 pagesIntroduction To Accounting - AbePatriqKaruriKimbo100% (1)

- Chapter 4 5 6Document4 pagesChapter 4 5 6nguyen2190No ratings yet

- 01. PP FFA Chapter wise - DEC'23 UpdatedDocument5 pages01. PP FFA Chapter wise - DEC'23 Updatedaonabbasabro786No ratings yet

- Financial AccountingDocument17 pagesFinancial Accountingashibhallau100% (1)

- Book Keeping & Accounts/Series-2-2007 (Code2006)Document12 pagesBook Keeping & Accounts/Series-2-2007 (Code2006)Hein Linn Kyaw100% (2)

- Aat FSTP Tutor QB 2015-16 - QsDocument26 pagesAat FSTP Tutor QB 2015-16 - Qskbassignment100% (1)

- Book Keeping and Accounts Past Paper Series 4 2012Document6 pagesBook Keeping and Accounts Past Paper Series 4 2012Fung Hui YingNo ratings yet

- L3 ACC 2009 S2 (M) (New)Document16 pagesL3 ACC 2009 S2 (M) (New)Fung Hui YingNo ratings yet

- L3 ACC 2008 S2 (M) (New)Document17 pagesL3 ACC 2008 S2 (M) (New)Fung Hui YingNo ratings yet

- Lcci 3012Document21 pagesLcci 3012alee200No ratings yet

- Lecture 6 - Pricing DecisionDocument30 pagesLecture 6 - Pricing DecisionRaeka AriyandiNo ratings yet

- Customer Relationship Management ROIDocument19 pagesCustomer Relationship Management ROIHồng PhúcNo ratings yet

- Class 1Document108 pagesClass 1kevior2100% (1)

- Accounting Cycle for a Service BusinessDocument5 pagesAccounting Cycle for a Service BusinessKristel Mae PayotNo ratings yet

- Industrial Management AssignmentDocument34 pagesIndustrial Management AssignmentGR FaisalNo ratings yet

- Acctg 2a 1st ExaminationDocument3 pagesAcctg 2a 1st ExaminationJessa BeloyNo ratings yet

- Group12 - Section C - HRM - Wrapitup PDFDocument8 pagesGroup12 - Section C - HRM - Wrapitup PDFAMITESH RANJANNo ratings yet

- mcq1 PDFDocument15 pagesmcq1 PDFjack100% (1)

- Current Issues in Marketing (Teaching Plan)Document5 pagesCurrent Issues in Marketing (Teaching Plan)Eric KongNo ratings yet

- How To Succeed As An Independent Marketing ConsultantDocument147 pagesHow To Succeed As An Independent Marketing Consultantdade872No ratings yet

- Auditing-23 A 1Document5 pagesAuditing-23 A 1Johnfree VallinasNo ratings yet

- Project Report - CG - Urvashi SharmaDocument73 pagesProject Report - CG - Urvashi SharmacomplianceNo ratings yet

- CTS SummaryDocument3 pagesCTS SummaryEngr Muhammad Javid NawazNo ratings yet

- Sexton7e Chapter 03 MacroeconomicsDocument49 pagesSexton7e Chapter 03 MacroeconomicscourtneyNo ratings yet

- Entreo Exam First PeriodicalDocument4 pagesEntreo Exam First PeriodicalPrince Dkalm PolishedNo ratings yet

- The Customer Has EscapedDocument11 pagesThe Customer Has EscapedChiranjibi DalabeharaNo ratings yet

- Clarkson Lumber SolutionDocument9 pagesClarkson Lumber SolutionDiego F. Guty JadueNo ratings yet

- 0452 s07 QP 3 PDFDocument20 pages0452 s07 QP 3 PDFAbirHudaNo ratings yet

- Management Information Systems: ITEC 1010 Information and OrganizationsDocument33 pagesManagement Information Systems: ITEC 1010 Information and OrganizationsSoumya Jyoti BhattacharyaNo ratings yet

- I W e T e I M P: Aidil Hanafi Amirrudin, Nur Syuhadah Kamaruddin, Nurshahirah Salehuddin, Suraiya IbrahimDocument15 pagesI W e T e I M P: Aidil Hanafi Amirrudin, Nur Syuhadah Kamaruddin, Nurshahirah Salehuddin, Suraiya IbrahimJoselyn CerveraNo ratings yet

- CMPC Joint ArrangementsDocument2 pagesCMPC Joint ArrangementsAdell Anne OngNo ratings yet

- S.No Issues Under Consideration Desired Information Available Information Gap Possible Sources of InformationDocument1 pageS.No Issues Under Consideration Desired Information Available Information Gap Possible Sources of InformationSUALI RAVEENDRA NAIKNo ratings yet

- Dungca, Jomyro Atadero: ObjectiveDocument3 pagesDungca, Jomyro Atadero: ObjectiveJomyro DungcaNo ratings yet

- Filmore Furniture ExDocument11 pagesFilmore Furniture ExLou100% (1)

- Hydrocarbon Accounting Solutions For KPOGCLDocument11 pagesHydrocarbon Accounting Solutions For KPOGCLasadnawazNo ratings yet

- Contemporary Business 16th Edition Boone Solutions Manual DownloadDocument36 pagesContemporary Business 16th Edition Boone Solutions Manual DownloadMarcos Roberson100% (30)

- Sip-PresentationDocument12 pagesSip-PresentationBharadwaja JoshiNo ratings yet

- Executives' Guide to Addressing Services' IntangibilityDocument19 pagesExecutives' Guide to Addressing Services' IntangibilityRudrakshNo ratings yet

- BYD CASE ANALYSI1-期末個人報告Document2 pagesBYD CASE ANALYSI1-期末個人報告Huang-Cheng LaiNo ratings yet

- Acctg For LTCC - IllustrationsDocument13 pagesAcctg For LTCC - IllustrationsGalang, Princess T.No ratings yet