Professional Documents

Culture Documents

Wall Street Rpt9-2013

Uploaded by

Celeste KatzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wall Street Rpt9-2013

Uploaded by

Celeste KatzCopyright:

Available Formats

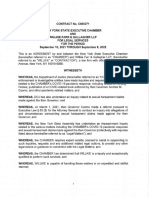

The Securities Industry in New York City

Thomas P. DiNapoli

New York State Comptroller Report 9-2013

Highlights The securities industry directly accounts for only 5.3 percent of all private sector jobs in New York City, but its impact is much broader. OSC estimates that 1 in 7 jobs in the City and 1 in 12 jobs in New York State can be linked to the securities industry. Last fiscal year, securities-related activities accounted for 14 percent of New York States tax revenues and 7 percent of New York Citys. Securities industry revenues declined by more than 20 percent from 2009 to 2011, and by more than 7 percent in the first half of 2012. The securities industry reported very strong profits in the first half of 2011 ($12.6 billion), but large losses in the second half ($4.9 billion) resulted in a disappointing year for profits overall ($7.7 billion). The securities industry earned $10.5 billion in the first half of 2012, the fifth-best start on record. Profitability has been volatile, however, which makes predicting the full years results difficult. OSC estimates that the securities industry in New York City lost 28,100 jobs during the financial crisis and has added 7,900 jobs during the recovery, for a net loss of 20,200 jobs since November 2007. OSC estimates that the securities industry in New York City lost 4,800 jobs (seasonally adjusted) between May and August 2012. Since the beginning of 2012, the industry has lost a net of 1,200 jobs. The average salary in the securities industry in New York City reached $362,950 in 2011, 5.3 times higher than the average in the rest of the private sector. While only one-third of the rules required by the Dodd-Frank Act have been completed, the industry has begun to modify its practices in anticipation of further regulatory changes. Office of the State Comptroller

Kenneth B. Bleiwas

Deputy Comptroller October 2012

Five years after the beginning of the financial crisis, the securities industry remains in transition. The industry is still working through the fallout from the financial crisis and many business patterns and practices are changing as a result of regulatory, technological and economic factors. However, the transformation is not yet complete. Only a fraction of the new regulations called for under the Dodd-Frank Act and the Basel III Accord have taken effect, and economic conditions remain weak and vulnerable. Securities industry revenues have declined in recent years and profits (as measured by broker/dealer profits of the member firms of the New York Stock Exchange) have been volatile, with record losses in 2007 and 2008 followed by the two most profitable years on record. Last year, the industry was very profitable in the first half, but reported large losses in the second half as the European debt crisis deepened and global economies weakened. The industry has gotten off to a strong start in 2012, but weaker economic conditions or some other adverse development could quickly erode profitability again. The average salary of employees in the securities industry in New York City grew by 16.6 percent over the past two years, to $362,950 in 2011, which was higher than in any year before the peak in 2007. Based on data for the first half of 2012, the cash bonus pool is likely to decline for the second consecutive year, although it is still too early to predict by how much. Employment in the securities industry has fluctuated during 2012, but there has been a steep decline in recent months, and modest losses are likely for the year. Unlike past economic recoveries, the current recovery in New York City is being driven by other industries, many of which offer much lower pay. The securities industry is still adjusting to changes in its regulatory and economic environment. Whether the changes will fundamentally alter profitability, employment or compensation remains to be seen. Nonetheless, New York City remains the worlds premier financial center, as its rivals in other cities face similar or even greater challenges.

Dodd-Frank Regulatory Reforms

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the Act), which became law in July 2010, is the nations most wide-ranging financial reform since the Great Depression. Major provisions of the law were designed to reduce systemic risk in the financial industry, improve oversight, limit proprietary trading (the Volcker Rule), increase transparency and oversight of derivatives, and provide greater protections for consumers and investors. The Act is complex and lengthy (848 pages), and requires numerous regulatory changes. According to the Dodd-Frank Progress Report, produced by the law firm Davis Polk, the law calls for 87 studies and requires 398 new rules. 1 The progress report reflects that as of October 1, 2012, only one-third (127) of the rules had been completed. Another 135 rules have been proposed but not finalized, and 136 rules have yet to be proposed. The Volcker Rule, which modifies the Bank Holding Company Act of 1956, greatly restricts banks from engaging in proprietary trading and from sponsoring or holding an ownership stake in a hedge fund or private equity fund. The rule has been one of the most heavily debated sections of the law. While the Volcker Rule was expected to be finalized by July 2012, regulators are still revising the draft rule that was issued in 2011 (after the public comment period yielded thousands of responses). The final version of the rule is now expected to be completed by the end of 2012. Banks will not have to comply with the Volcker Rule until July 2014, but they have begun to change their practices in response to the rule even though it has not yet been finalized.

The Act also requires certain contracts for derivatives to be executed on an exchange and processed through a clearinghouse to increase transparency. For example, most credit default swaps, which were a major factor in the financial crisis, will now be subject to these rules. Additionally, major market participants will be subject to new capital and margin requirements and increased disclosures. Most of the rulemaking requirements for derivatives have been drafted, and half have been finalized. To comply with the rules called for under the Act, financial firms have hired more employees in risk management, revised their compensation practices, increased capital reserves and spun off certain operations. Financial firms have expressed concerns that, as written, the Act will limit their ability to hedge risk and make profits. Some financial firms, lobbyists and lawmakers are working to roll back all or parts of the Act, or to limit the funding necessary to monitor compliance. Proponents of the law argue that a properly regulated financial market is necessary to protect American taxpayers, and will encourage innovative and profitable new products.

Systemic Risk

Excessive risk was a major factor in the financial crisis, and subsequent regulatory changes have sought to reduce the amount of risk in the financial system and end the perception that some firms were too big to fail because of the massive impact that their failure would have on the larger economy. New regulations require large firms to create safeguards to protect taxpayers and avert bailouts, and regulators now have the authority to break up firms if their failure would threaten the economy. Stress tests are one of the methods being used to evaluate whether financial firms can withstand economic disruptions given their capital levels and the amount of risk on their books. The DoddFrank Act created two types of stress tests: the nations largest financial institutions are subject to tests carried out by the Federal Reserve Board; and smaller firms must conduct their own stress tests.

The total number of rulemaking requirements is based on estimates. Where multiple agencies are required to issue a rule or study jointly, the requirement has been counted more than once.

Office of the State Comptroller

The most recent stress test conducted by the Federal Reserve Board (which assumes a scenario in which a severe recession occurs in the United States, along with a slowdown in global economic activity) concluded that the six largest financial firms could withstand a severe economic decline in 2013 and still meet the Basel III capital requirements that take effect in 2014.2 The test also concluded, however, that under such circumstances the six firms could experience additional cumulative losses that could reach $188 billion by the end of 2013. The Dodd-Frank Act requires banks (with consolidated assets of $50 billion or more) and certain nonbank financial firms to create living wills, or detailed plans to liquidate operations in a manner that would have the least impact on the financial system. The first deadline (for the largest firms) was in July 2012, and nine banks have completed living wills for the current year. In August 2012, the Federal Reserve also directed the nations five largest bank holding companies to develop recovery plans for surviving a future financial crisis without government assistance.

Figure 1

Wall Street Revenues and Expenses

400 350 300 Gross Revenues Gross Expenses

Billions of Dollars

250 200 150 100 50 0

Note: Results are for broker/dealer operations of New York Stock Exchange member firms. Sources: Securities Industry and Financial Markets Association; NYSE Euronext; OSC analysis

Revenue and Expense Trends

Profitability is the difference between gross revenue and expenses. As shown in Figure 1, the gross revenue from the broker/dealer operations of New York Stock Exchange member firms surged during the 2005-2007 period (rising by 120 percent), before collapsing in 2008. 3 The buildup reflected rising levels of leverage and risktaking that were unsustainable in the long term. In 2008, revenue was cut nearly in half (falling by 49 percent), but total expenses declined more slowly (39 percent) because the industry was slow to cut compensation and other costs, resulting in a record loss of $42.6 billion for the year. 4

In 2009, the industry returned to profitability and reported record profits ($61.4 billion). The rebound was primarily the result of a large reduction in interest expenses due to actions taken by the Federal Reserve. In the two years that followed, revenues resumed their decline (although at a slower rate), but expenses (driven by higher compensation and other costs) began to rise, eroding profitability. Revenues fell by 22 percent during this period, and by another 7.7 percent in the first half of 2012 as a result of weaker trading and investment banking activity. Expenses fell by 6.2 percent during the first half of 2012, driven primarily by reductions in compensation and interest expenses. 5 Securities firms revenues from trading on their own accounts (including proprietary trading) have fallen off, reflecting a scaling back of activity as a result of regulatory changes and trading losses. In 2011, revenue gains from firms trading on their own accounts during the first half of the year were virtually erased by losses in the second half. Revenues from this source declined by 15 percent during the first half of 2012 compared to the same period last year.

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

The Basel III Accord is a set of standards and practices created by the worlds 20 largest economies in response to the 2007 financial crisis to ensure that international banks maintain adequate capital to sustain themselves during periods of economic strain. The exact amount of capital depends on the amount of risk associated with particular types of assets, with riskier assets requiring more capital. Expenses also rose sharply during the 2005-2007 period, driven by increased borrowing. The losses occurred despite an infusion of federal funds and actions by the Federal Reserve to lower interest rates.

Net revenues (i.e., excluding interest expenses) fell by 24 percent between 2009 and 2011, and by another 7.4 percent in the first half of 2012. Net expenses declined by 5.6 percent during the first half of 2012, driven primarily by a reduction in compensation.

Office of the State Comptroller

Wall Street Profits

Profits in the securities industry have been traditionally measured by the profitability of the broker/dealer operations of the member firms of the New York Stock Exchange (although these firms engage in a broader range of activities, which are not fully captured by this measure). Profits have been volatile in recent years, with large losses in 2007 and 2008 due to the financial crisis, followed by the two most profitable years on record as the industry benefited from federal support. In 2011, the member firms were very profitable in the first half of the year ($12.6 billion) with the fourth-best start on record, but then reported large losses for the second half of the year ($4.9 billion) as the European debt crisis deepened, market volatility increased, investment banking activity sagged and international economies weakened. The financial markets have improved this year, but they have followed an erratic path. The Dow Jones Industrial Average, for example, rose by 8.7 percent between December 31, 2011, and the beginning of May 2012, but then fell by nearly 1,200 points by the beginning of June. Since then, the Dow has rebounded, and it reached a new postrecession peak on September 20, 2012. Although the Dow has since eased, as of October 4, 2012 it remained close to the post-recession peak and was up 10 percent for the year. The member firms reported a strong start in 2012 with profits of $10.5 billion for the first half of the year (see Figure 2).6 OSC estimates that the member firms are on pace to earn more than $15 billion for all of 2012, which would be twice the 2011 level and in line with levels of profitability before the financial crisis. However, a weaker economy (either domestically or internationally), a failure to avoid the impending fiscal cliff or some other adverse development could quickly erode profitability in the second half again this year. In an example of the uncertainties affecting the securities industry, Bank of America recently announced that it would pay $2.43 billion to settle

6

a shareholder lawsuit related to its acquisition of Merrill Lynch, of which $1.6 billion would be charged against earnings in the third quarter of 2012. Similarly, the New York State Attorney General recently filed suit against JPMorgan Chase over alleged fraud surrounding mortgagebacked securities issued by Bear Stearns before the firm was acquired by Chase in 2008. Industry profitability has benefited in recent years from the Federal Reserves low interest rate policies. While the Federal Reserve has committed to keeping rates low through mid-2015, economic conditions will eventually bring about higher rates, which will increase the industrys cost of doing business. A period of low interest rates will provide the industry with an opportunity to restructure and position itself for the long term.

Figure 2

Pretax Profits at Securities Firms

70 60 50 40 30 20 10 0 -10 -20 -30 -40 -50 First Half Second Half

Billions of Dollars

Total Wages

Total wages, which is a function of the number of jobs and the average salary of those jobs, is an important measure of the economic impact of the securities industry. As OSC has noted in past reports, the securities industry accounts for a disproportionate share of wages in New York City. In 2011, the securities industry accounted for 23.2 percent of all private sector wages, even though it accounted for only 5.3 percent of private sector jobs. 7 The total amount of wages (including bonuses) paid to securities industry employees located in New York City grew by 4 percent in 2011 to reach $60.7 billion, which is the highest level since the financial crisis and among the highest on record (see Figure 3).

7

2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990

Note: Results are for broker/dealer operations of New York Stock Exchange member firms. Sources: Securities Industry and Financial Markets Association; NYSE Euronext

The member firms of the NYSE reported earnings from their broker/dealer operations of nearly $7.3 billion for the first quarter of 2012 and nearly $3.3 billion for the second quarter.

The industrys share of private sector wages exceeded 28 percent in 2007 at the start of the financial crisis.

Office of the State Comptroller

Figure 3

Securities Industry Wages in New York City

80 70 60

50 40 30 20 10 0

Note: 1981-1999 data are on the Standard Industrial Classification (SIC) basis; 20002011 are on the North American Industrial Classification System (NAICS) basis. Source: NYS Department of Labor

Total wage growth in the securities industry has outperformed the rest of the private sector in New York City during the current economic recovery. Between 2009 and 2011, wages in the securities industry grew at an average annual rate of 8.7 percent, while total wages for all other private sector jobs grew at an average annual rate of 5.3 percent. These figures reflect changes in both employment and average compensation.

Employment

Employment in the securities industry in New York City rose steadily throughout 2010 and most of 2011. While job levels have fluctuated during 2012, in recent months there has been a sharp decline. OSC estimates that there were 168,700 jobs in the securities industry in August 2012 (seasonally adjusted), which was 4,800 fewer jobs than in May 2012 (see Figure 4). Since the beginning of 2012, the industry has lost a net of 1,200 jobs.

Figure 4

New York City Securities Employment

180 175

Thousands of Jobs

Wall Street firms are adjusting their staffing levels as they restructure in response to pressures from the financial crisis and subsequent regulatory changes. While firms are reportedly hiring staff to assist with new regulatory and risk-management standards, several firms have announced further staff reductions, including higher-paid positions (e.g., investment banking). In light of these developments and recent employment trends, OSC believes employment in the securities industry in New York City will continue to contract slowly during the rest of 2012. Wall Streets contribution to New York Citys job growth has been much lower in the current economic recovery than in prior recoveries. The securities industry has so far accounted for only 3 percent of the jobs added since November 2009, which is much less than its share at this point in the recovery following the 1990-1992 recession (18.6 percent) and the 2001-2003 recession (11.8 percent). While New York City has gained more private sector jobs than it lost during the downturn (179 percent), the securities industry has regained only 28 percent of the jobs it lost during its downturn. Despite industry job losses, New York State has more securities jobs than any other state in the nation (nearly two and a half times that of secondranked California), and nearly 90 percent of the industrys jobs in the State are located in New York City (see Figure 5). The Citys share of statewide securities employment declined slowly during the 1990s and early 2000s as back-office operations moved to lower-cost areas and firms sought geographic diversity after the terrorist attacks of September 11, 2001. Since then, the Citys share of securities employment has remained relatively stable.

Figure 5

Billions of Dollars

2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990

170

New York Citys Share of Securities Jobs

165

Percentage of Jobs in New York State

100 95 90 85 80 75 70 65 60

Jan-90 Jan-91 Jan-92 Jan-93 Jan-94 Jan-95 Jan-96 Jan-97 Jan-98 Jan-99 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12

40 Share of New York State (left axis scale) 35

Percentage of Jobs in the U.S.

160 155 150

Jul Jul Jul Mar Mar Mar May May May Jan 10 Jan 12 Sep Sep Nov Nov Jan 11

30 Share of the U.S. (right axis scale) 25 20 15 10 5 0

Note: Data have been seasonally adjusted. Sources: NYS Department of Labor; OSC analysis

Sources: U.S. Bureau of Labor Statistics; NYS Department of Labor; OSC analysis

Office of the State Comptroller

The Citys share of national securities industry jobs fell sharply during the 1990s, but stabilized at about 21 percent during the 2000s, despite an increase in electronic trading and geographic diversification. While the Citys share eroded during the financial crisis, it has since rebounded as industry jobs in other parts of the nation (such as California, Illinois, Massachusetts and New Jersey) have declined.

chief executives and investment bankers, on Wall Street. The average salaries in the rest of New York State and in the nation as a whole, however, experienced stronger growth in 2011 than in the City (rising by 9 percent and 4.6 percent, respectively). Nationally, the average salary in the securities industry reached a new record in 2011.

Bonuses

Financial firms, like most businesses, report compensation (i.e., base salaries, fringe benefits, and bonuses, including deferred remuneration) on an accrual basis of accounting. As such, cash bonuses paid in January through March of one year (for work performed during the prior calendar year) are included in the compensation figures reported in the prior years financial statements. For example, most of the resources that are being set aside for cash bonuses in 2012 will be paid out during the first quarter of 2013. The Dodd-Frank Act and other regulations have led Wall Street firms to change their policies on compensation, including variable compensation (i.e., bonuses). To reduce excessive risk-taking, a greater share of bonuses is now deferred (usually for a period of three years). 8 The increased use of deferred compensation is creating a pipeline of bonuses that will be paid in future years, which will reduce volatility in industry tax payments. In February 2012, OSC estimated that the cash bonus pool for securities industry workers in New York City (for work done in 2011 and paid during the traditional bonus season) declined by 13.5 percent, to $19.7 billion (see Figure 7), reflecting heavy losses in the second half of 2011 and changes in compensation practices.

Figure 7

Average Salaries

The average salary (including bonuses) paid to securities industry employees in New York City fell sharply in 2009, but rose by 16 percent in 2010 and by another 0.5 percent in 2011 to reach $362,950. This was a higher average than before the financial crisis (see Figure 6), and was the highest average among New York Citys major industries.

Figure 6

Average Salaries in New York City

Securities Industry vs. All Other Private Sector Industries

Securities All Other Private Sector

450 400

Thousands of Dollars

350 300 250 200 150 100 50 0

The disparity between the average salary in the securities industry and in the rest of the Citys private sector remains wide, even though it has narrowed slightly since the financial crisis. In 2011, the average salary in the securities industry was 5.3 times greater than the average in the rest of the private sector ($67,900). At its peak in 2007, the average securities industry salary was 6.2 times greater than in other industries. Over the past three decades, the gap has generally widened. In 1981, for example, the average salary in the securities industry was only twice as high as the average in the rest of the private sector. The average salary in the securities industry in New York City remained substantially higher in 2011 than for the industry in the rest of New York State ($228,300) and in the rest of the nation ($161,800), reflecting the greater concentration of the most highly compensated positions, such as 6

Billions o Dollars

1981

Note: 1981-1999 data are on the SIC basis; 2000-2011 are on the NAICS basis. Sources: NYS Department of Labor; OSC analysis

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

2011

Wall Street Cash Bonus Pool

40 35 30 25 20 15 10 5 0

Note: Cash bonuses for securities jobs located in New York City; excludes deferred components that have not yet been paid. Source: OSC analysis

2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990

If these deferrals are paid outside the traditional bonus season, however, they are harder to identify.

Office of the State Comptroller

Total compensation for the broker/dealer operations of member firms of the New York Stock Exchange declined by 5.5 percent during the first half of 2012, and a OSC survey of compensation trends at a sample of large and small financial firms (including firms that engage in a broader range of activities than traditional broker/dealer operations) found that aggregate compensation declined by 2.7 percent during this same period. 9 In addition, industry revenues continue to decline, as previously discussed. These trends suggest that the total cash bonus pool for work performed in 2012 is likely to decline for the second consecutive year (although it is still too early to predict by how much because personal income tax withholding data will not be available until early 2013). While the total cash bonus may be smaller than last year, some employees may receive higher cash bonuses based on the performance of their particular business activities. Johnson Associates (a financial services compensation consulting firm), for example, forecasts that bond and equity traders could see the largest bonus increases, while investment bankers may see declines.

The financial crisis caused City tax revenues to drop abruptly in CFY 2009, and since then industry profitability has been volatile and difficult to predict. Last year, profitability fell short of the Citys forecast, but the industrys performance so far this year has been largely consistent with the assumptions in the Citys current financial plan, although OSC believes that industry profitability could exceed the Citys current forecast. 11

Figure 8

Securities Industry-Related Tax Payments

7 6

Billions of Dollars

New York City

Share of City Tax Collections (right axis scale) Industry-Related Tax Payments (left axis scale)

14 12 10

Percentage

5 4 3 2 1 0

8 6 4 2 0

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2012 2011

City Fiscal Year

Note: Includes revenue from the personal income, general corporation and unincorporated business taxes. Personal income taxes include capital gains realizations. Sources: NYC Department of Finance; NYS Department of Taxation and Finance; OSC analysis

Tax Revenues

The securities industry generates income (including capital gains) that is subject to New York City and New York State taxes. OSC estimates that City tax payments (specifically in the general corporation, unincorporated business, and personal income taxes) that are attributable to the securities industry fell to $2.8 billion in City Fiscal Year (CFY) 2012. This was a decline of 5 percent from one year earlier, and 40 percent less than the peak in CFY 2008 (see Figure 8). 10 Consequently, the securities industrys share of City tax revenues declined to less than 7 percent in CFY 2012 from a peak of more than 12 percent in CFY 2008. The decline reflects reduced profitability as well as stronger growth in the rest of the Citys economy.

New York State depends on Wall Street even more than New York City does, because the State relies more heavily on personal and business taxes. The State also receives tax payments from the many industry employees who commute into the City from the surrounding suburbs (including those outside of New York State), and from the larger statewide pool of capital gains realizations. OSC estimates that securities industryrelated personal income and corporate Article 9A tax payments to New York State fell to $8.7 billion in State Fiscal Year (SFY) 2011-2012, a modest decline from our estimate for the prior year. Collections, however, remain 30 percent below their peak in SFY 2007-2008 (see Figure 9). OSC further estimates that revenue derived from the securities industry accounted for almost 14 percent of all State tax revenue in SFY 2011-2012, down from more than 20 percent in SFY 2007-2008.

These figures include payments to employees in cities around the world, but they suggest that compensation could decline slightly for employees located in the City. 10 The estimate excludes revenue from real property taxes, real estate transaction taxes and sales taxes.

11

The Citys financial plan assumes that Wall Street profits will total $10 billion in 2012, employment will decline by 2,600 jobs in 2012, and cash bonuses will contract slightly.

Office of the State Comptroller

Figure 9

Securities Industry-Related Tax Payments

14 12 10 Share of State Tax Collections (right axis scale)

New York State

Industry-Related Tax Payments (left axis scale)

28 24 20

Percentage

Billions of Dollars

8 6 4 2 0

1995-1996 1996-1997 1997-1998 1998-1999 1999-2000 2000-2001 2001-2002 2002-2003 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012

16 12 8 4 0

State Fiscal Year

Note: Includes revenue from the personal income and corporate Article 9A taxes. Personal income taxes include capital gains realizations. Sources: NYS Department of Taxation and Finance; OSC analysis

Economic Multiplier

OSC estimates that each new job created (or lost) in the securities industry leads to the creation (or loss) of two additional jobs in other industries in the City. 12 The size of the multiplier reflects the high income levels associated with the industry and its importance in the Citys economy. These additional (or fewer) jobs result from Wall Street firms engaging in additional (or fewer) businessto-business transactions with other companies (e.g., professional service firms and other financial firms), and from Wall Street employees increasing (or decreasing) their household spending on such things as restaurants, stores, travel and personal services. OSC also estimates that each Wall Street job created (or lost) results in one additional (or fewer) job elsewhere in New York State, mostly in the Citys suburbs. Many Wall Street employees are commuters, who live and spend in the suburbs, thereby supporting local businesses and generating jobs. Based on these multipliers and the current level of securities industry employment, OSC estimates that 1 in 7 jobs in the City and 1 in 12 jobs in the State are either directly or indirectly associated with Wall Street.

12

The estimate is derived from the IMPLAN input/output model.

For additional copies of this report, please visit our website at www.osc.state.ny.us or write to us at: Office of the State Comptroller, New York City Public Information Office 633 Third Avenue, New York, NY 10017 (212) 681-4840

You might also like

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- Embargoed Securities Industry October 2013 ReportDocument8 pagesEmbargoed Securities Industry October 2013 ReportNick ReismanNo ratings yet

- The Securities Industry in New York City: Thomas P. DinapoliDocument8 pagesThe Securities Industry in New York City: Thomas P. DinapoliNick ReismanNo ratings yet

- Putnam White Paper: The Outlook For U.S. and European BanksDocument12 pagesPutnam White Paper: The Outlook For U.S. and European BanksPutnam InvestmentsNo ratings yet

- BANK OF AMERICA TO ACQUIRE DISCOVERDocument63 pagesBANK OF AMERICA TO ACQUIRE DISCOVERreegent_9No ratings yet

- Weekly Economic Commentary 5-09-12Document9 pagesWeekly Economic Commentary 5-09-12monarchadvisorygroupNo ratings yet

- Dodd-Frank Bill: A Year and A Half LaterDocument32 pagesDodd-Frank Bill: A Year and A Half LaterHofstraUniversityNo ratings yet

- Capital Reserves and Bank Profitability AnalysisDocument49 pagesCapital Reserves and Bank Profitability Analysisjen18612No ratings yet

- Three Models of Financial RegulationDocument16 pagesThree Models of Financial RegulationRamjunum RandhirsinghNo ratings yet

- Ans:-The Determinants of Structure of Financial Markets AreDocument3 pagesAns:-The Determinants of Structure of Financial Markets Aresajeev georgeNo ratings yet

- Static PPM156 Johnson Testimony 120711Document7 pagesStatic PPM156 Johnson Testimony 120711000000tvNo ratings yet

- Basel 2.5, Basel III. Their Tasks Are To Identify Risks To The Financial Stability of TheDocument5 pagesBasel 2.5, Basel III. Their Tasks Are To Identify Risks To The Financial Stability of TheSahoo SKNo ratings yet

- Dodd Frank Explained - CNBCDocument3 pagesDodd Frank Explained - CNBCAks SukhtankarNo ratings yet

- Corporate Governance Is The Set ofDocument16 pagesCorporate Governance Is The Set ofMazhar SarwashNo ratings yet

- Broyhill Letter (Q2-08)Document3 pagesBroyhill Letter (Q2-08)Broyhill Asset ManagementNo ratings yet

- HPS Mergers AheadDocument13 pagesHPS Mergers AheadHamilton Place StrategiesNo ratings yet

- The Changing Landscape of The Financial Services Industry: What Lies Ahead?Document17 pagesThe Changing Landscape of The Financial Services Industry: What Lies Ahead?saadsaaidNo ratings yet

- Policy Brief AssessmentDocument5 pagesPolicy Brief AssessmentAnish PadalkarNo ratings yet

- Determinants of The Structure of Financial MarketsDocument3 pagesDeterminants of The Structure of Financial MarketsAbhishek MauryaNo ratings yet

- Guidelines to Prevent Future Financial CrisesDocument3 pagesGuidelines to Prevent Future Financial CrisesHsevnat KumarNo ratings yet

- Transformation in The European Financial Industry: Opportunities and RisksDocument21 pagesTransformation in The European Financial Industry: Opportunities and Riskswerner71No ratings yet

- XBRL: Enabling Faster, More Transparent Financial ReportingDocument12 pagesXBRL: Enabling Faster, More Transparent Financial ReportingPrasad VeeraNo ratings yet

- M&A in Financial Sector May Provide Boost After Slow StartDocument7 pagesM&A in Financial Sector May Provide Boost After Slow StartAnjalika SinghNo ratings yet

- Radar 05 2014 1117 DeepDive Red Tape in OzDocument3 pagesRadar 05 2014 1117 DeepDive Red Tape in OzzeronomicsNo ratings yet

- Wall Street Bonus ReleaseDocument2 pagesWall Street Bonus ReleaseNick ReismanNo ratings yet

- Speech - Address by Governor Patrick Honohan To International Financial Services Summit 2010 - 10 November 2010Document8 pagesSpeech - Address by Governor Patrick Honohan To International Financial Services Summit 2010 - 10 November 2010irishpoliticsNo ratings yet

- The Savings and Loan Crisis: Deregulation and its ConsequencesDocument2 pagesThe Savings and Loan Crisis: Deregulation and its ConsequencestylerNo ratings yet

- Banking Regulations: Reasons For The Regulation of BanksDocument6 pagesBanking Regulations: Reasons For The Regulation of BanksMarwa HassanNo ratings yet

- Cato Handbook Congress: Washington, D.CDocument9 pagesCato Handbook Congress: Washington, D.CDiscoverupNo ratings yet

- Goldman Sachs Presentation To The Sanford Bernstein Strategic Decisions Conference Comments by Gary Cohn, President & COODocument7 pagesGoldman Sachs Presentation To The Sanford Bernstein Strategic Decisions Conference Comments by Gary Cohn, President & COOapi-102917753No ratings yet

- FIRE 441 Summer 2015 Final Examination Review Guide.Document3 pagesFIRE 441 Summer 2015 Final Examination Review Guide.Osman Malik-FoxNo ratings yet

- FRBSF E L: Conomic EtterDocument4 pagesFRBSF E L: Conomic Ettertariq74739No ratings yet

- New Financial Products' Impacts on Asian MarketsDocument6 pagesNew Financial Products' Impacts on Asian Marketslalit2roamNo ratings yet

- International Tax and Business Guide: MexicoDocument16 pagesInternational Tax and Business Guide: MexicoChristian PerezNo ratings yet

- Chapter 12 IMSMDocument19 pagesChapter 12 IMSMZachary Thomas CarneyNo ratings yet

- Answer 1:: Financial Management Assignment 1 Discussion Question (1-5)Document4 pagesAnswer 1:: Financial Management Assignment 1 Discussion Question (1-5)Preeti KapurNo ratings yet

- UHY Government Contractor Newsletter - September 2011Document2 pagesUHY Government Contractor Newsletter - September 2011UHYColumbiaMDNo ratings yet

- Global CrisisDocument21 pagesGlobal Crisishema sri mediNo ratings yet

- A Structural View of U.S. Bank Holding Companies: Dafna Avraham, Patricia Selvaggi, and James VickeryDocument17 pagesA Structural View of U.S. Bank Holding Companies: Dafna Avraham, Patricia Selvaggi, and James VickeryForeclosure FraudNo ratings yet

- E Risk - USSLCaseStudyDocument6 pagesE Risk - USSLCaseStudymadanishkanna5677No ratings yet

- Regulation Impact on Investment and JobsDocument20 pagesRegulation Impact on Investment and JobsaureliaNo ratings yet

- 2011 Jan Wells Fargo CMBS OutlookDocument81 pages2011 Jan Wells Fargo CMBS OutlookRyan JinNo ratings yet

- Dessertation TopicsDocument3 pagesDessertation TopicsTanveer AhmadNo ratings yet

- Preqin Private Equity Spotlight June 2012Document17 pagesPreqin Private Equity Spotlight June 2012richard_dalaudNo ratings yet

- Chap 012Document20 pagesChap 012Hemali MehtaNo ratings yet

- Sarbanes Oxley Act: - Oxley Act of 2002, Also Known As The 'Public Company AccountingDocument4 pagesSarbanes Oxley Act: - Oxley Act of 2002, Also Known As The 'Public Company AccountingRavi MarwahNo ratings yet

- The B.E. Journal of Economic Analysis & Policy: TopicsDocument30 pagesThe B.E. Journal of Economic Analysis & Policy: TopicsShahban KhanNo ratings yet

- Gruber Corporate Profits and SavingDocument60 pagesGruber Corporate Profits and SavingeconstudentNo ratings yet

- Capital Raising in The U.S. - The Significance of Unregistered Offerings Using The Regulation D ExemptionDocument9 pagesCapital Raising in The U.S. - The Significance of Unregistered Offerings Using The Regulation D ExemptionVanessa SchoenthalerNo ratings yet

- The Savings and Loan Crisis of the 1980s: An Overview of the Regulatory Structure and Relationship to BankingDocument22 pagesThe Savings and Loan Crisis of the 1980s: An Overview of the Regulatory Structure and Relationship to BankingClara MwangolaNo ratings yet

- Assignment 5 Financial Statements.Document4 pagesAssignment 5 Financial Statements.yarielizurena03No ratings yet

- LSE - The Future of FinanceDocument294 pagesLSE - The Future of FinancethirdeyepNo ratings yet

- Liberalization and Unification of World EconomicsDocument2 pagesLiberalization and Unification of World EconomicsMaheen KhanNo ratings yet

- Vietnam Deals Review 2011: High Capital Inflows From Japanese CorporationsDocument53 pagesVietnam Deals Review 2011: High Capital Inflows From Japanese CorporationsManh Cuong Nguyen TuNo ratings yet

- PWC Financial Institution Continuous Cost ManagementDocument40 pagesPWC Financial Institution Continuous Cost ManagementhellowodNo ratings yet

- Weekly Economic Commentary 9/17/2012Document6 pagesWeekly Economic Commentary 9/17/2012monarchadvisorygroupNo ratings yet

- Dimension of Financial and Management Finance EssayDocument11 pagesDimension of Financial and Management Finance EssayHND Assignment HelpNo ratings yet

- Global Market Outlook - Trends in Real Estate Private EquityDocument20 pagesGlobal Market Outlook - Trends in Real Estate Private EquityYana FominaNo ratings yet

- U-4 Insolvency and Bankruptcy Code 2016Document26 pagesU-4 Insolvency and Bankruptcy Code 2016HIMANI PALAKSHANo ratings yet

- Death of Big LawDocument55 pagesDeath of Big Lawmaxxwe11No ratings yet

- Matter of Demetriou V New York State Department of Health 2022-00532Document2 pagesMatter of Demetriou V New York State Department of Health 2022-00532Nick ReismanNo ratings yet

- E2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Document18 pagesE2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Nick ReismanNo ratings yet

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONDocument56 pagesAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanNo ratings yet

- OCM LawsuitDocument29 pagesOCM LawsuitNick Reisman100% (1)

- Economic Benefits of Coverage For AllDocument2 pagesEconomic Benefits of Coverage For AllNick ReismanNo ratings yet

- Notice of Appeal Nassau County Mask RulingDocument8 pagesNotice of Appeal Nassau County Mask RulingNick ReismanNo ratings yet

- As Filed PetitionDocument67 pagesAs Filed PetitionNick ReismanNo ratings yet

- EndorsementsDocument4 pagesEndorsementsNick ReismanNo ratings yet

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONDocument56 pagesAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanNo ratings yet

- Hochul Housing Coalition Letter PrsDocument4 pagesHochul Housing Coalition Letter PrsNick ReismanNo ratings yet

- SNY0122 Crosstabs011822Document8 pagesSNY0122 Crosstabs011822Nick ReismanNo ratings yet

- Letter - FL Region - Booster Healthcare Mandate 1-12-22Document2 pagesLetter - FL Region - Booster Healthcare Mandate 1-12-22Nick ReismanNo ratings yet

- Lottery Commission Increase Letter To Governor HochulDocument3 pagesLottery Commission Increase Letter To Governor HochulNick ReismanNo ratings yet

- SNY1221 CrosstabsDocument9 pagesSNY1221 CrosstabsNick ReismanNo ratings yet

- Contract c000271Document21 pagesContract c000271Nick ReismanNo ratings yet

- Covid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21Document3 pagesCovid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21News10NBCNo ratings yet

- Cuomo ReportDocument63 pagesCuomo ReportCasey Seiler100% (2)

- Accountability Waiver Announcement Memo 062221Document5 pagesAccountability Waiver Announcement Memo 062221Nick ReismanNo ratings yet

- ICS0921 CVCrosstabsDocument4 pagesICS0921 CVCrosstabsNick ReismanNo ratings yet

- SNY0921 CrosstabsDocument9 pagesSNY0921 CrosstabsNick ReismanNo ratings yet

- Letter To Gov Hochul 8.31Document2 pagesLetter To Gov Hochul 8.31Nick Reisman100% (1)

- SNY1021 CrosstabsDocument8 pagesSNY1021 CrosstabsNick ReismanNo ratings yet

- Ics 0621 CV Cross TabsDocument7 pagesIcs 0621 CV Cross TabsNick ReismanNo ratings yet

- NY State Groups Sign-On Letter Supporting Biden's Tax & Investment Plans 8-9-21Document4 pagesNY State Groups Sign-On Letter Supporting Biden's Tax & Investment Plans 8-9-21Nick ReismanNo ratings yet

- S Ny 0621 Cross TabsDocument8 pagesS Ny 0621 Cross TabsNick ReismanNo ratings yet

- NY Gig Labor Clergy LetterDocument3 pagesNY Gig Labor Clergy LetterNick ReismanNo ratings yet

- News Release Redistricting August 2021 FinalDocument2 pagesNews Release Redistricting August 2021 FinalNick ReismanNo ratings yet

- New York Right To Bargain Bill LetterDocument2 pagesNew York Right To Bargain Bill LetterNick ReismanNo ratings yet

- Cuomo Nyiva 050321 PMDocument3 pagesCuomo Nyiva 050321 PMNick ReismanNo ratings yet

- SNY0521 CrosstabsDocument7 pagesSNY0521 CrosstabsNick ReismanNo ratings yet

- Silicon Valley Bank PDFDocument33 pagesSilicon Valley Bank PDFM.Fazha QolbiNo ratings yet

- Final Report On Guidelines On ICAAP ILAAP (EBA-GL-2016-10)Document70 pagesFinal Report On Guidelines On ICAAP ILAAP (EBA-GL-2016-10)Herbert BurgstallerNo ratings yet

- Financial Resource Management IACPM 2017Document27 pagesFinancial Resource Management IACPM 2017J Andrea JacaNo ratings yet

- Accenture Stress Testing 101 in BanksDocument22 pagesAccenture Stress Testing 101 in Bankssathya_41095No ratings yet

- RWCS Roundtable Meeting Notes on Climate ScenariosDocument12 pagesRWCS Roundtable Meeting Notes on Climate ScenariosRisk MavenNo ratings yet

- A-75 Shivani Bhimallu Reserve Bank of India Functions and WorkingDocument76 pagesA-75 Shivani Bhimallu Reserve Bank of India Functions and WorkingRuchi PantNo ratings yet

- Comprehensive Assessment Disclosure Template 201407 en enDocument11 pagesComprehensive Assessment Disclosure Template 201407 en enSky voice RecordsNo ratings yet

- 2023 Fed Stress TestsDocument58 pages2023 Fed Stress TestsZerohedgeNo ratings yet

- Top 1000 world banks profits jump to $920 billionDocument8 pagesTop 1000 world banks profits jump to $920 billionPhương Anh TrầnNo ratings yet

- Derivative IBBL Stress Testing 2012-16 AatiqDocument56 pagesDerivative IBBL Stress Testing 2012-16 AatiqMD ATIQULLAH KHANNo ratings yet

- K Dna Financial Services LTD Pillar III Disclosure For 2019Document29 pagesK Dna Financial Services LTD Pillar III Disclosure For 2019hyenadogNo ratings yet

- 10 Modeling Loan Loss Provisions Under IFRS 9 in The Top-Down Solvency Stress Test of The Central Bank of HungaryDocument12 pages10 Modeling Loan Loss Provisions Under IFRS 9 in The Top-Down Solvency Stress Test of The Central Bank of HungaryA MohsenNo ratings yet

- Commercial Bank Management PDFDocument42 pagesCommercial Bank Management PDFaparajita promaNo ratings yet

- Transforming Data Collection From The UK Fnancial Sector: Discussion PaperDocument56 pagesTransforming Data Collection From The UK Fnancial Sector: Discussion PaperRaad AbwiniNo ratings yet

- House Financial Services Committee Report On RobinhoodDocument138 pagesHouse Financial Services Committee Report On RobinhoodTechCrunchNo ratings yet

- Ecb Recovery PlanningDocument20 pagesEcb Recovery PlanningMohamed MostafaNo ratings yet

- JPMorgan Chase Bank 2017 Financial StatementsDocument139 pagesJPMorgan Chase Bank 2017 Financial StatementsNikita GoswamiNo ratings yet

- Syndicate Bank Risk Assessment and Inspection Reports Shared by RBIDocument276 pagesSyndicate Bank Risk Assessment and Inspection Reports Shared by RBIMoneylife Foundation100% (5)

- NAIC ORSA ManualDocument10 pagesNAIC ORSA ManualGagan SawhneyNo ratings yet

- Risk V9a Sample PaperDocument39 pagesRisk V9a Sample PaperRaj KumarNo ratings yet

- Week 1Document49 pagesWeek 1marianaNo ratings yet

- R70.P2.T7.BaselII - Global - v7.1 - Study NotesDocument11 pagesR70.P2.T7.BaselII - Global - v7.1 - Study NotesdouglasNo ratings yet

- B00o56n3bs EbokDocument387 pagesB00o56n3bs EboksaeedayasminNo ratings yet

- Maybank Integrated AR 2023 - Part 2Document123 pagesMaybank Integrated AR 2023 - Part 2yennielimclNo ratings yet

- Federal Register / Vol. 77, No. 195 / Tuesday, October 9, 2012 / Rules and RegulationsDocument11 pagesFederal Register / Vol. 77, No. 195 / Tuesday, October 9, 2012 / Rules and RegulationsMarketsWikiNo ratings yet

- A Brief Discussion With AI About LaRDocument2 pagesA Brief Discussion With AI About LaRZiyad SabourNo ratings yet

- 高盛报告Document78 pages高盛报告oakpacificNo ratings yet

- The 2021 Biennial Exploratory Scenario On The Financial Risks From Climate ChangeDocument33 pagesThe 2021 Biennial Exploratory Scenario On The Financial Risks From Climate ChangeValerio ScaccoNo ratings yet

- Elizabeth Warrens Letter To Silicon Valley Bank CEODocument5 pagesElizabeth Warrens Letter To Silicon Valley Bank CEOLuis FieldmanNo ratings yet

- Basel Committee On Banking SupervisionDocument14 pagesBasel Committee On Banking SupervisionRijesh RNNo ratings yet