Professional Documents

Culture Documents

Company Information and Directors' Report

Uploaded by

Zahid Khan BabaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Information and Directors' Report

Uploaded by

Zahid Khan BabaiCopyright:

Available Formats

COMPANY INFORMATION

BOARD OF DIRECTORS : EBRAHIM HAJI KARIM-CHAIRMAN UMER HAJI KARIM-CHIEF EXECUTIVE ANWAR HAJI KARIM YAKOOB HAJI KARIM PIR MUHAMMAD A. KALIYA ABID UMER SAJID HAROON AAMIR AMIN- NIT : YAKOOB HAJI KARIM- CHAIRMAN PIR MUHAMMAD A. KALIYA ABID UMER MUBBASHIR AMIN, ACA

AUDIT COMMITTEE

CHIEF FINANCIAL OFFICER/ COMPANY SECRETARY BANKERS :

HABIB BANK LIMITED HABIB METROPOLITAN BANK LIMITED BANK AL HABIB LIMITED NATIONAL BANK OF PAKISTAN MEEZAN BANK LIMITED MCB BANK LIMITED KPMG TASEER HADI & CO. CHARTERED ACCOUNTANTS TECHNOLOGY TRADE (PVT.) LTD. DAGIA HOUSE, 24-C, BLOCK-2, PECHS OFF: SHAHRAH-E-QUAIDEEN, KARACHI TASAWUR ALI HASHMI ADVOCATE 3RD FLOOR, KARACHI DOCK LABOUR BOARD BUILDING, 58-WEST WHARF ROAD, KARACHI-74000 F.1, 2, 3, & F.13, 14 & 15, HUB INDUSTRIAL TRADING ESTATE, DISTRICT LASBELLA, BALOCHISTAN PACKAGING UNIT PLOT # A-5, N.W.I.Z. PORT QASIM AUTHORITY KARACHI

AUDITORS

REGISTER

LEGAL ADVISOR

REGISTERED OFFICE

FACTORY

DRECTORS REPORT The Board of Directors is pleased to present unaudited financial information for the nine months period ended 31 March 2012 to the shareholders of the Company. OPERATING PERFORMANCE During the period under review the Company produced 17,412 M.tons of Polyester Staple Fibre as against 20,210 M.tons produced during the corresponding period last year. The Company sold 17,502 M.tons of PSF as against 20,327 M.tons during the corresponding period last year. Further the Company produced 43,193 cartons of plastic and crown caps and sold 19,537 cartons during the period. FINANCIAL RESULTS During the period under review, the Companys gross turnover decreased to Rs. 3,103.69 million from Rs. 3,397.08 million during the corresponding period last year. The Company earned gross profit of Rs. 130.07 million as compared to gross profit of Rs. 605.72 million in the corresponding period last year. The net profit was Rs. 14.17 million as against net profit of Rs. 336.90 million in the corresponding period last year. Decrease in net profit is mainly attributable to the loss incurred in packaging segment during the period under review. Further, there existed huge demand of fibre last year because of steep rise in cotton prices, whereas during the current period under review, the prices of cottons are on lower side which had affected the demand of fibre during the reporting period. EARNING PER SHARE The net earning per share for the period under review was Rs. 0.25 as compared to net earning per share of Rs. 6.01 in the corresponding period last year. FUTURE OUTLOOK Textile sector is under huge pressure because of power crisis, slackness in exports, law and order conditions and instability of raw material prices. These circumstances have affected the demand of fibre thereby affecting its prices. However, manufacturing cost is increasing day by day which would have a negative impact on the future profitability of polyester staple fibre. However, the Company is expecting that it will be able to expand its sale of packaging segment during the summer season which would have a positive impact on the earnings of the Company by the end of current financial year. ACKNOWLEDGEMENT The management recognizes sincere efforts of the employees and appreciates the pleasant relations that remained throughout the period between the management and the employees of the Company. For and on behalf of the Board of Directors Date: 25 April 2012 Karachi ___________________ UMER HAJI KARIM CHIEF EXECUTIVE

Pakistan Synthetics Limited

Condensed Interim Balance Sheet

As at 31 March 2012 31 March 30 June 2012 2011 (Unaudited) (Audited) (Rupees in '000)

Note

ASSETS Non-current assets Property, plant and equipment Long term loans to employees Long term deposits Current assets Stores and spares Stock in trade Trade debts Loans and advances Trade deposits and short term prepayments Other receivables Taxation - net Cash and bank balances Total assets EQUITY AND LIABILITIES Share capital and reserves Authorised share capital 70,000,000 ordinary shares of Rs 10 each Issued, subscribed and paid-up capital Revenue reserve Unappropriated profit Non-current liabilities Staff retirement benefits Deferred taxation Long term diminishing musharka

1,215,366 829 924 1,217,119 139,981 670,547 582,362 11,419 1,944 48,598 25,766 204,952 1,685,569 2,902,688

1,154,708 186 924 1,155,818 154,554 526,186 337,851 3,613 17 75,932 1,521 388,927 1,488,601 2,644,419

6 7 8

9 10 11

700,000 560,400 292,450 216,126 1,068,976 26,387 104,426 437,500 568,313

700,000 560,400 292,450 314,036 1,166,886 25,617 89,184 114,801

12

Current liabilities Trade and other payables Accrued markup Short term borrowings - secured Current portion of long term diminishing musharka Total equity and liabilities

13 12

608,474 8,359 586,066 62,500 1,265,399 2,902,688

271,979 2,382 1,088,371 1,362,732 2,644,419

Contingencies and commitments

14

The annexed notes 1 to 19 form an integral part of this condensed interim financial information.

________________________ UMER HAJI KARIM CHIEF EXECUTIVE

____________________ ANWAR HAJI KARIM DIRECTOR

____________________ MUBBASHIR AMIN CHIEF FINANCIAL OFFICER

Pakistan Synthetics Limited

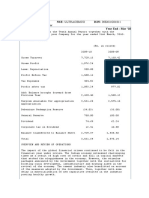

Condensed Interim Profit and Loss Account (Unaudited)

For the nine months period ended 31 March 2012 Note Nine months period ended Quarter ended 31 March 31 March 31 March 31 March 2012 2011 2012 2011 ----------------------------- (Rupees in '000) ----------------------------3,103,688 (24,933) (13,214) 3,065,541 (2,935,467) 130,074 (15,473) (22,829) (4,617) (42,919) 10,176 97,331 (67,919) 29,412 (15,242) (15,242) 14,170 3,397,078 (70,275) 3,326,803 (2,721,085) 605,718 (12,518) (48,634) (39,585) (100,737) 15,255 520,236 (2,543) 517,693 (210,073) 29,280 (180,793) 336,900 1,134,964 (10,743) (7,132) 1,117,089 (1,088,309) 28,780 (5,269) (6,670) (884) (12,823) 4,066 20,023 (25,781) (5,758) 1,990 1,990 (3,768) 1,392,537 (23,327) 1,369,210 (1,102,646) 266,564 (4,128) (6,194) (16,379) (26,701) 8,850 248,713 (1,080) 247,633 (91,846) 5,750 (86,096) 161,537

Gross sales Brokerage, discounts and freight reimbursement Sales tax Net sales Cost of sales Gross profit Selling and distribution expenses Administration expenses Other operating expenses Other operating income Operating profit before finance costs Finance costs Profit/(loss) before tax Income tax - current - deferred Profit/(loss) after tax for the period

15

---------------------------------- (Rupee) ---------------------------------Earnings per share - basic and diluted 0.25 6.01 (0.07) 2.88

Condensed Interim Statement of Comprehensive Income (Un-audited) For the nine months period ended 31 March 2012 ----------------------------- (Rupees in '000) ----------------------------Profit/(loss) after tax for the period Other comprehensive income Total comprehensive income for the period 14,170 14,170 336,900 336,900 (3,768) (3,768) 161,537 161,537

The annexed notes 1 to 19 form an integral part of this condensed interim financial information.

________________________ UMER HAJI KARIM CHIEF EXECUTIVE

________________________ ANWAR HAJI KARIM DIRECTOR

____________________ MUBBASHIR AMIN CHIEF FINANCIAL OFFICER

Pakistan Synthetics Limited

Condensed Interim Cash Flow Statement (Unaudited)

For the nine months period ended 31 March 2012

Note CASH FLOWS FROM OPERATING ACTIVITIES Profit before taxation Adjustments for: Depreciation Provision for staff retirement benefits Profit on disposal of vehicles Profit on saving accounts Finance costs (Reversal of provision) / provision for doubtful debts Movement in: Working capital Stores and spares Stock in trade Trade debts Loans and advances Trade deposits and short term prepayments Other receivables Trade and other payables Net cash generated from operations Staff retirement benefits paid Finance costs paid Long term loans to employees Taxes paid Net cash generated from operating activities CASH FLOWS FROM INVESTING ACTIVITIES Fixed capital expenditure Proceeds from disposal of vehicles Profit on saving accounts Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Long term diminishing musharka obtained Dividend paid Net cash from financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of the period Cash and cash equivalents at end of the period CASH AND CASH EQUIVALENTS COMPRISE Cash and bank balances Short term borrowings

31 March 31 March 2012 2011 (Rupees in '000) 29,412 110,766 4,875 (4,464) 67,919 (2,063) 206,445 517,693 82,365 3,600 (200) (14,505) 2,543 30,000 621,496

14,573 (144,361) (242,448) (7,806) (1,927) 30,019 335,701 190,196 (4,105) (61,942) (643) (24,245) 99,261

(17,631) (56,830) (177,580) 362 (1,200) (10,728) 125,030 482,919 (3,980) (1,864) 341 (53,142) 424,274

(174,109) 4,464 (169,645)

(230,364) 200 14,505 (215,659)

500,000 (111,286) 388,714 318,330 (699,444) (381,114)

46 46 208,661 173,384 382,045

204,952 (586,066) (381,114)

568,030 (185,985) 382,045

The annexed notes 1 to 19 form an integral part of this condensed interim financial information.

________________________ UMER HAJI KARIM CHIEF EXECUTIVE

____________________ ANWAR HAJI KARIM DIRECTOR

____________________ MUBBASHIR AMIN CHIEF FINANCIAL OFFICER

Pakistan Synthetics Limited

Condensed Interim Statement of Changes in Equity (Unaudited)

For the nine months period ended 31 March 2012

Issued, Revenue Unappropriated Total Total subscribed reserve (loss) / profit reserves and paid-up capital -----------------------------------(Rupees in '000)----------------------------------Balance as at 30 June 2010 Changes in equity for the nine months period ended 31 March 2011 Total comprehensive income for the period - profit for the period 560,400 292,450 27,732 320,182 880,582

336,900

336,900

336,900

Balance as at 31 March 2011 Balance as at 30 June 2011 Changes in equity for the nine months period ended 31 March 2012 Total comprehensive income for the period - profit for the period Transactions with owners recorded directly in equity Distribution Final dividend paid at Rs. 2 per share Balance as at 31 March 2012

560,400 560,400

292,450 292,450

364,632 314,036

657,082 606,486

1,217,482 1,166,886

14,170

14,170

14,170

560,400

292,450

(112,080) 216,126

(112,080) 508,576

(112,080) 1,068,976

The annexed notes 1 to 19 form an integral part of this condensed interim financial information.

________________________ UMER HAJI KARIM CHIEF EXECUTIVE

____________________ ANWAR HAJI KARIM DIRECTOR

____________________ MUBBASHIR AMIN CHIEF FINANCIAL OFFICER

Pakistan Synthetics Limited

Notes to the Condensed Interim Financial Information (Unaudited)

For the nine months period ended 31 March 2012

1.

STATUS AND NATURE OF BUSINESS The Company was incorporated on 18 November 1984 as a private limited company in Pakistan and subsequently converted into a public limited company on 30 December 1987. The shares of the Company are listed on all the stock exchanges of Pakistan. The principal activity of the Company is manufacturing and sale of polyester staple fiber, plastic and crown caps. The registered office of the Company is situated in Karachi.

2. 2.1

BASIS OF PREPARATION Statement of compliance This condensed interim financial information has been prepared in accordance with approved accounting standards as applicable in Pakistan for interim financial reporting. The disclosures in the condensed interim financial information do not include the information reported for full annual financial statements and should therefore be read in conjunction with the financial statements as at and for the year ended 30 June 2011 This condensed interim financial information comprises of condensed interim balance sheet as at 31 March 2012 and the related condensed interim profit and loss account, condensed interim statement of comprehensive income, condensed interim cash flow statements, condensed interim statement of changes in equity, and notes thereto, for the nine months period ended 31 March 2012. This condensed interim financial information is being submitted to the shareholders as required by the Listing regulations of Karachi, Islamabad and Lahore Stock Exchanges and section 245 of the Companies Ordinance, 1984.

2.2

Functional and presentation currency This condensed interim financial information is presented in Pakistan Rupees which is also the Company's functional currency.

3.

SIGNIFICANT ACCOUNTING POLICIES The accounting policies and methods of computation which have been used in the preparation of this condensed interim financial information are the same as those applied in preparation of the financial statements for the preceding year ended 30 June 2011. Amendments to certain existing standards and new interpretations on approved accounting standards effective during the period either were not relevant to the Company's operations or did not have any impact on the accounting policies of the Company.

4. 4.1

ACCOUNTING ESTIMATES, JUDGEMENTS AND FINANCIAL RISK MANAGEMENT The preparation of this condensed interim financial information is in conformity with the approved accounting standards as applicable in Pakistan that requires management to make estimates, assumptions and judgments that affect the application of accounting policies and reported amounts of assets, liabilities, income and expenses. Estimates, assumptions and judgements are continually evaluated and are based on historical experience and other factors, including reasonable expectations of future events. Revisions to accounting estimates are recognised prospectively commencing from the period of revision.

In preparing the condensed interim financial information, significant judgements made by management in applying the Company's accounting policies and the key sources of estimation and uncertainty were the same as those applied to the annual financial statements as at and for the year ended 30 June 2011 except that during the nine months period ended 31 March 2012, the Company has reviewed and considered revision in estimated useful life of its certain items of plant and machinery. The effect of revision has been accounted for prospectively. Had there been no change in estimate, the carrying amount of operating assets would have been lower by Rs. 26,108, stock in trade would have been lower by Rs. 235, profit before taxation would have been lower by Rs. 26,343, tax expense would have been lower by Rs. 9,220 and unappropriated profit would have been lower by Rs. 17,123. 4.2 The Company's financial risk management objectives and policies are consistent with those disclosed in the annual financial statements as at and for the year ended 30 June 2011. PROPERTY, PLANT AND EQUIPMENT 31 March 30 June 2012 2011 (Unaudited) (Audited) (Rupees in '000) 1,130,016 85,350 1,215,366 972,801 181,907 1,154,708

5.

Operating fixed assets Capital work in progress

For the nine months period ended 31 March 31 March 2012 2011 (Unaudited) (Rupees in '000) Additions in: Leasehold land Plant and machinery Vehicles Furniture and equipment Computer accessories Capital work in progress 246,369 19,639 4,495 163 59,813 330,479 14,085 1,900 2,167 128 18,280

Transfer from: Capital work in progress 156,370 -

Motor vehicles having cost of Rs. 2.99 million (written down value of Rs. 2.685 million) were disposed off during the nine months period ended 31 March 2012 (2011: motor vehicle costing Rs. 0.351 million having nil written down value). 6. STORES AND SPARES 31 March 30 June 2012 2011 (Unaudited) (Audited) (Rupees in '000)

Stores and spares [including in transit stores and spares amounting to Nil (30 June 2011: Rs.3.709 million)] Provision for slow moving and obsolete items 7. STOCK IN TRADE Raw and packing materials [including in transit of Rs. 66.079 million (30 June 2011: Rs.1.88 million)] Work-in-process Finished goods

176,484 (36,503) 139,981

191,057 (36,503) 154,554

471,114 34,944 164,489 670,547

417,960 11,012 97,214 526,186

8.

TRADE DEBTS Considered good - secured Considered good - unsecured Considered doubtful Provision for doubtful debts 61,582 520,780 582,362 97,346 679,708 (97,346) 582,362 90,928 246,923 337,851 99,410 437,261 (99,410) 337,851

9.

OTHER RECEIVABLES Sales tax recoverable 45,835 2,763 48,598 75,859 73 75,932

Others

10.

TAXATION - net

10.1 Income tax assesments of the Company have been finalised upto and including tax year 2011 (Income year ended 30 June 2011) which is deemed to be assessed and for which no further proceeding has been initiated for audit or otherwise by Income Tax department. 10.2 Minimum tax liability of Rs. 30.905 million has not been recorded as current tax expense due to future taxable profits which would result in enough tax liability to absorb this amount.

11.

CASH AND BANK BALANCES

31 March 30 June 2012 2011 (Unaudited) (Audited) (Rupees in '000)

With banks - On current accounts - On saving accounts - On deposit account - Provision for doubtful deposit Cash in hand

11.1

37,018 167,812 515 (515) 122 204,952

3,397 385,469 515 (515) 61 388,927

11.2

11.1 Rates of returns on saving accounts range from 9% to 11% (30 June 2011: 10% to 12%). 11.2 This represents provision made against Certificates of Investment of Bankers Equity Limited.

12.

LONG TERM DIMINISHING MUSHARKA from banking company - secured Opening balance Availed during the period Payable within one year shown under current liabilities 500,000 500,000 (62,500) 437,500 -

12.1 Terms: No. of Installments Installment period Installment amount Commencement of first installment Profit rate

16 Quarterly 31,250 December 2012 6 months KIBOR + 1%

12.2 Above finance are secured by hypothecation charge over plant and machinery for Rs. 800 million. 12.3 There is no long term unavailed facility. 12.4 The effective interest rate ranges from 12.91% to 14.41% ` 13. SHORT TERM BORROWINGS -secured The aggregate unavailed financing facility amount to Rs. 13,934 million (30 June 2011: Rs. 111,628). Foreign currency loan is subject to markup based on LIBOR and effective interest rate ranges from 2.5% to 4.25% (30 June 2011: 2.5% to 3.25% ). Local currency loan is subject to markup based on KIBOR and effective interest rate ranges from 12.92% to 14.49% (30 June 2011: company has not utilised this facility during the year) payable quarterly. The arrangement is secured against hypothecation of the Companys stock-in-trade, stores and spares and trade debts.

14.

CONTINGENCIES AND COMMITMENTS

31 March 30 June 2012 2011 (Unaudited) (Audited) (Rupees in '000)

14.1

- Contingencies

Bank guarantee in favour of Sui Sothern Gas Company Limited

56,547

56,547

14.2

- Commitments Letters of credit for raw material Inland bills discounted 286,935 174,640 46,929

15.

ADMINISTRATION EXPENSES This includes provision for doubtful debts amounting to Nil (2011: Rs. 30 million) for the nine months period ended 31 March 2012.

16.

RELATED PARTY TRANSACTIONS Related parties comprise of major shareholders, associated companies, directors and key management personnel. Remuneration to key management personnel is paid according to terms of their employment. Transaction with associated companies are carried out under normal commercial terms. Transactions with related parties during the nine months period ended 31 March 2012 are as follows:

Nine months ended 31 March 31 March 2012 2011 (Rupees in '000) Associated company Sale of goods Markup charged Key management personnel compensation Managerial remuneration Others Associated banking company Interest income on bank deposits Profit charged by bank on long term diminishing musharka Markup on foreign currency loan Markup on running finance Bill discounting charges

320,347 6,343

195,733 -

24,172 7,802

14,075 3,074

4,464 32,994 24,193 1,678 1,048

14,055 1,048 822

The directors and most of the executives of the Company are provided with free use of Company maintained cars.

16.1

Period end balances arising from transactions with related parties

31 March 30 June 2011 2011 (Unaudited) (Audited) (Rupees in '000) 164,388 31,566 167,798 500,000 586,066 105,722 13,075 372,598 1,088,371

Trade receivable from associated company Current account balance (bank) Saving account balance (bank) Long term diminishing musharka (bank) Foreign currency loan (bank) 17. 17.1 OPERATING SEGMENTS SEGMENT RESULTS Polyester Staple Fibre For the nine months period ended 31 March 2012 Net Revenue Segment results For the quarter ended 31 March 2012 Net Revenue Segment results 1,072,527 32,737 2,983,316 144,951

Crown and plastic caps

Total

82,225 (121,098)

3,065,541 23,853

44,562 (41,677)

1,117,089 (8,940)

Reconciliation of segment results with profit after tax is as follows Nine months Quarter ended ended 31 March 2012 23,853 (8,940) (4,617) 10,176 (15,242) 14,170 (884) 4,066 1,990 (3,768)

Total results for reportable segments Other operating expenses Other operating income Taxation Profit after tax 17.2 17.3 17.4

17.5

The company had only polyester staple fibre division in the corresponding period last year. 100% (2009: 100%) sales of the Company relates to customers in Pakistan. All non-current assets of the Company at 31 March 2012 are located in Pakistan. Sales to four customers of the Company is more than 10% of total sales of the Company during the nine months period ended 31 March 2012 (2011: sales to one of the customers was more than 10% of sales of the Company individually). DATE OF AUTHORISATION This condensed interim financial information were authorized for issue by the Board of Directors in their meeting held on 25 April 2012.

18.

19.

19.1

GENERAL Figures have been rounded off to the nearest thousand rupees.

_____________________ UMER HAJI KARIM CHIEF EXECUTIVE

____________________ ANWAR HAJI KARIM DIRECTOR

____________________ MUBBASHIR AMIN CHIEF FINANCIAL OFFICER

You might also like

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- QMar2013 Financials of Relieance WeavingDocument20 pagesQMar2013 Financials of Relieance WeavingTauraabNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Textile Mills Interim Financial Statements for Nine Months Ended 31 March 2009Document22 pagesTextile Mills Interim Financial Statements for Nine Months Ended 31 March 2009Muhammad BakhshNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDocument8 pagesJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNo ratings yet

- Quarterly Report March 31, 2012Document38 pagesQuarterly Report March 31, 2012Zubair Ahmad BhuttaNo ratings yet

- Third Quarter March 31 2014Document18 pagesThird Quarter March 31 2014major144No ratings yet

- Annual Report Highlights Strong Revenue Growth and ProfitabilityDocument43 pagesAnnual Report Highlights Strong Revenue Growth and ProfitabilityObydulRanaNo ratings yet

- 1st Quarter Ended September 30th 2013-1Document21 pages1st Quarter Ended September 30th 2013-1mustafakNo ratings yet

- Interim Condensed: Sanofi-Aventis Pakistan LimitedDocument13 pagesInterim Condensed: Sanofi-Aventis Pakistan LimitedawaisleoNo ratings yet

- Pakistan Synthetics Limited Condensed Interim Balance Sheet AnalysisDocument8 pagesPakistan Synthetics Limited Condensed Interim Balance Sheet AnalysismohammadtalhaNo ratings yet

- MitchellsDocument22 pagesMitchellsSHAHZADI AQSANo ratings yet

- Letter To Shareholders and Financial Results September 2012Document5 pagesLetter To Shareholders and Financial Results September 2012SwamiNo ratings yet

- Annual ReportDocument92 pagesAnnual ReportKumar PrinceNo ratings yet

- Half Yearly Dec09-10 PDFDocument15 pagesHalf Yearly Dec09-10 PDFSalman S. ZiaNo ratings yet

- 1st Quarter ReportDocument9 pages1st Quarter ReportammarpkrNo ratings yet

- Berger ReportsDocument17 pagesBerger ReportsanaqshabbirNo ratings yet

- Sant Goben Ratio (FINAL)Document64 pagesSant Goben Ratio (FINAL)Mihir ShahNo ratings yet

- Indian Oil Corporation Project 2Document30 pagesIndian Oil Corporation Project 2Rishika GoelNo ratings yet

- Bank Alfalah Q1 2012 Quarterly ReportDocument66 pagesBank Alfalah Q1 2012 Quarterly ReportShahid MehmoodNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- TRM 231.01 Financial Statements of Migros Assignment 1Document6 pagesTRM 231.01 Financial Statements of Migros Assignment 1Neşe RomanNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- Financial StatementDocument115 pagesFinancial Statementammar123No ratings yet

- 18 Financial StatementsDocument35 pages18 Financial Statementswsahmed28No ratings yet

- Gujarat State Petronet LimitedDocument13 pagesGujarat State Petronet LimitedAmrita Rao Bhatt100% (1)

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document22 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Condensed Interim Financial Information (Un-Audited) 31 MARCH 2012Document19 pagesCondensed Interim Financial Information (Un-Audited) 31 MARCH 2012M Hammad ManzoorNo ratings yet

- Ultratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Document7 pagesUltratech Cement Bse: 532538 Nse: Ultracemco Isin: Ine481G01011 Industry: Cement - Major Directors Report Year End: Mar '10Anushree Harshaj GoelNo ratings yet

- 56 PDFDocument80 pages56 PDFHarpreet ShergillNo ratings yet

- PDF 718201235101PMKBLAnnualReport 18.07.2012Document120 pagesPDF 718201235101PMKBLAnnualReport 18.07.2012Keshav KalaniNo ratings yet

- 5322150311Document276 pages5322150311Nikita GuptaNo ratings yet

- Half Yearly Report 2012Document44 pagesHalf Yearly Report 2012Muhammad Salman ShahNo ratings yet

- Sme Ar 22026 Rexpipes 2022 2023 17062023160713Document65 pagesSme Ar 22026 Rexpipes 2022 2023 17062023160713awuNo ratings yet

- Padaeng FS Dec2011Document35 pagesPadaeng FS Dec2011reine1987No ratings yet

- 15 Annual Report: ONGC Petro Additions LimitedDocument121 pages15 Annual Report: ONGC Petro Additions Limitedarjun SinghNo ratings yet

- HSTL Annual-Report 2021Document72 pagesHSTL Annual-Report 2021ums 3vikramNo ratings yet

- Unit 12Document200 pagesUnit 12vaghelavijay2205No ratings yet

- INTERIM FINANCIALSDocument44 pagesINTERIM FINANCIALS2friendNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- EATZU9CHJTPC898L162033 Consolidated KonsolidasiDocument18 pagesEATZU9CHJTPC898L162033 Consolidated KonsolidasikandriantoNo ratings yet

- Financial Analysis of Lucky Cement LTD For The Year 2013Document11 pagesFinancial Analysis of Lucky Cement LTD For The Year 2013Fightclub ErNo ratings yet

- AZGARD NINE LTD (Nine Months Accounts)Document32 pagesAZGARD NINE LTD (Nine Months Accounts)hammadicmapNo ratings yet

- Din Textile MillsDocument41 pagesDin Textile MillsZainab Abizer MerchantNo ratings yet

- GRP LTD (Gujarat Reclaim) Annual Report 12-13Document76 pagesGRP LTD (Gujarat Reclaim) Annual Report 12-13bhavan123No ratings yet

- 3Q JulyMar 1213Document17 pages3Q JulyMar 1213frk007No ratings yet

- Financial Analysis Report Fauji Fertilizer Bin Qasim LTDDocument15 pagesFinancial Analysis Report Fauji Fertilizer Bin Qasim LTDwaqarshk91No ratings yet

- NFL Annual Report 2011-2012Document108 pagesNFL Annual Report 2011-2012prabhjotbhangalNo ratings yet

- Bse 2Document18 pagesBse 2Aashish JainNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Working Capital ManagementDocument49 pagesWorking Capital ManagementAshok Kumar KNo ratings yet

- Bestway Annual 2010-11Document118 pagesBestway Annual 2010-11kudkhanNo ratings yet

- 007 - ASKML Annual Report 2012 13Document58 pages007 - ASKML Annual Report 2012 13JannatNoorNo ratings yet

- Elgi Rubber Company Limited - Annual Report 2012-2013Document61 pagesElgi Rubber Company Limited - Annual Report 2012-2013JayeshNo ratings yet

- Fs Q2fy13crDocument4 pagesFs Q2fy13crAisha HusaainNo ratings yet

- 2nd Quarter Accounts 2010 11Document26 pages2nd Quarter Accounts 2010 11sara24391No ratings yet

- Financial Statements For The Year Ended 31 December 2009Document64 pagesFinancial Statements For The Year Ended 31 December 2009AyeshaJangdaNo ratings yet

- Annual Report EnglishDocument17 pagesAnnual Report EnglishAhmed FoudaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Arab Women Qualitiative Study LuxuryDocument10 pagesArab Women Qualitiative Study LuxuryZahid Khan BabaiNo ratings yet

- Work-Family Conflict, Resources, and Role Set Density: Assessing Their Effects On Distress Among Working MothersDocument22 pagesWork-Family Conflict, Resources, and Role Set Density: Assessing Their Effects On Distress Among Working MothersZahid Khan BabaiNo ratings yet

- Culture, Gender, and Self - A Perspective From Individualism-Collectivism Research Triandis2001 - JOP69 - 6 - AllocentrismDocument18 pagesCulture, Gender, and Self - A Perspective From Individualism-Collectivism Research Triandis2001 - JOP69 - 6 - AllocentrismZahid Khan BabaiNo ratings yet

- Global Retail Trends 2019 WebDocument30 pagesGlobal Retail Trends 2019 WebFauzan MiracleNo ratings yet

- 7 Cs of Effective CommunicationDocument10 pages7 Cs of Effective CommunicationHemantkumar JainNo ratings yet

- Sample QuestionnaireDocument19 pagesSample QuestionnaireJanine Dela CruzNo ratings yet

- List of Journals Ratings MArketingDocument1 pageList of Journals Ratings MArketingZahid Khan BabaiNo ratings yet

- Zotero English Jan2016Document49 pagesZotero English Jan2016Zahid Khan BabaiNo ratings yet

- Chapter 2: Scientific Methods in PsychologyDocument111 pagesChapter 2: Scientific Methods in PsychologyZahid Khan BabaiNo ratings yet

- Adherence To Gender BeliefsDocument22 pagesAdherence To Gender BeliefsZahid Khan BabaiNo ratings yet

- Intro to Psychology Chapter 1 What is PsychologyDocument76 pagesIntro to Psychology Chapter 1 What is Psychologyarabelm67% (3)

- VA Veterans Health Survey Assesses Genomic Medicine ProgramDocument11 pagesVA Veterans Health Survey Assesses Genomic Medicine Programjawadg123No ratings yet

- Discuss The Implications of Cultural Differences That Help Make One Country or Region Different From OtherDocument6 pagesDiscuss The Implications of Cultural Differences That Help Make One Country or Region Different From OtherIshwar RajputNo ratings yet

- GBVDocument44 pagesGBVZahid Khan BabaiNo ratings yet

- The Greatest Money Making Secret in HistoryDocument111 pagesThe Greatest Money Making Secret in Historynwcute100% (28)

- Positive PsychologyDocument29 pagesPositive PsychologyAarthy ThangarajNo ratings yet

- Unilever Is The WorldDocument1 pageUnilever Is The WorldZahid Khan BabaiNo ratings yet

- Ratio Analysis of The CompanyDocument21 pagesRatio Analysis of The CompanyZahid Khan BabaiNo ratings yet

- Presentation 1Document1 pagePresentation 1Zahid Khan BabaiNo ratings yet

- Assignment # 1: Sir Mateeullah Khan, Lecturer Management Sciences/BUITEMS QuettaDocument3 pagesAssignment # 1: Sir Mateeullah Khan, Lecturer Management Sciences/BUITEMS QuettaZahid Khan BabaiNo ratings yet

- ProDocument7 pagesProZahid Khan BabaiNo ratings yet

- Aims and ObjectivesDocument2 pagesAims and ObjectivesZahid Khan BabaiNo ratings yet

- Wikileaks Wikileaks Is An International: The Economist Daily News Time'S Person of The YearDocument5 pagesWikileaks Wikileaks Is An International: The Economist Daily News Time'S Person of The YearZahid Khan BabaiNo ratings yet

- Quetta's Water Problems Escalating: Published: November 8, 2010Document3 pagesQuetta's Water Problems Escalating: Published: November 8, 2010Zahid Khan BabaiNo ratings yet

- EthicalfoodreportDocument8 pagesEthicalfoodreportZahid Khan BabaiNo ratings yet

- InDocument1 pageInZahid Khan BabaiNo ratings yet

- CH 02Document12 pagesCH 02courtney_cthNo ratings yet

- Social Media Marketing 356 v1 PDFDocument448 pagesSocial Media Marketing 356 v1 PDFRushal Parakh75% (4)

- Comprehensive Guide to Miller and Richmond Company FinancialsDocument12 pagesComprehensive Guide to Miller and Richmond Company FinancialsNucke Febriana Putri RZNo ratings yet

- Body GloveDocument2 pagesBody Glovesusan15785100% (3)

- Practice Final Bus331 Spring2023Document2 pagesPractice Final Bus331 Spring2023Javan OdephNo ratings yet

- Brand Equity On Purchase Intention Consumers' Willingness To Pay Premium Price JuiceDocument7 pagesBrand Equity On Purchase Intention Consumers' Willingness To Pay Premium Price JuiceThuraMinSweNo ratings yet

- Resume Randi Maulana Barkah q4 2021Document2 pagesResume Randi Maulana Barkah q4 2021Randi Maulana BarkahNo ratings yet

- Strategic Business ManagementDocument5 pagesStrategic Business Managementchamila2345No ratings yet

- CEMA Brochure PDFDocument2 pagesCEMA Brochure PDFKumar RajputNo ratings yet

- Roger's ChocolateDocument6 pagesRoger's ChocolateCatalina Tapia100% (1)

- Portfolio Management and Mutual Fund Analysis ReportDocument41 pagesPortfolio Management and Mutual Fund Analysis ReportArun AhirwarNo ratings yet

- CFA Level 1 Corporate Finance E Book - Part 2Document31 pagesCFA Level 1 Corporate Finance E Book - Part 2Zacharia VincentNo ratings yet

- Engineering Economy (Lecture 2) - Sample ProblemDocument6 pagesEngineering Economy (Lecture 2) - Sample ProblemdhesNo ratings yet

- Kort Notes ISA'sDocument49 pagesKort Notes ISA'skateNo ratings yet

- Because Cooking Souffl S Is Incredibly Difficult The Supply of Souffl SDocument2 pagesBecause Cooking Souffl S Is Incredibly Difficult The Supply of Souffl Strilocksp SinghNo ratings yet

- Effectiveness in Context - Preliminary FindingsDocument18 pagesEffectiveness in Context - Preliminary FindingsJonathan JonesNo ratings yet

- Lavigne RoofDocument7 pagesLavigne Roofusmanf87No ratings yet

- Table - 23-7: Schedule 1g: Ending Inventories Budget, First Quarter, 20XXDocument4 pagesTable - 23-7: Schedule 1g: Ending Inventories Budget, First Quarter, 20XXeahpotNo ratings yet

- Wizcraft CreditsDocument74 pagesWizcraft Creditsc_manceeNo ratings yet

- Different types of provisions and loan impairment assessmentsDocument8 pagesDifferent types of provisions and loan impairment assessmentspalmkodokNo ratings yet

- Key Concepts in Marketing: Maureen Castillo Dyna Enad Carelle Trisha Espital Ethel SilvaDocument35 pagesKey Concepts in Marketing: Maureen Castillo Dyna Enad Carelle Trisha Espital Ethel Silvasosoheart90No ratings yet

- CA career profileDocument2 pagesCA career profilepratikNo ratings yet

- CH 1Document42 pagesCH 1Rana HarisNo ratings yet

- Customer Satisfaction Survey Questions For Exide BatteriesDocument3 pagesCustomer Satisfaction Survey Questions For Exide BatteriesArihant Aski GoswamiNo ratings yet

- Sustainable Development GoalsDocument3 pagesSustainable Development GoalsDuy Phạm CôngNo ratings yet

- PuregoldDocument9 pagesPuregoldCarmina BacunganNo ratings yet

- Case Study, Material Requirement Planning.Document7 pagesCase Study, Material Requirement Planning.vinaycool12344150No ratings yet

- TG Customer Relationship WORDDocument2 pagesTG Customer Relationship WORDLouiseNo ratings yet

- Implementing Lean Six Sigma in Supply Chain Management: Combining Lean Six Sigma With Process ImprovementDocument25 pagesImplementing Lean Six Sigma in Supply Chain Management: Combining Lean Six Sigma With Process ImprovementThanh Thưởng OfficialNo ratings yet

- Using Procure To Order' To Source Buy Items Cross OrganizationsDocument46 pagesUsing Procure To Order' To Source Buy Items Cross OrganizationsNidhi SaxenaNo ratings yet

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (75)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- More Money Now: A Millennial's Guide to Financial Freedom and SecurityFrom EverandMore Money Now: A Millennial's Guide to Financial Freedom and SecurityNo ratings yet

- Finance for Nonfinancial Managers, Second Edition (Briefcase Books Series)From EverandFinance for Nonfinancial Managers, Second Edition (Briefcase Books Series)Rating: 3.5 out of 5 stars3.5/5 (6)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)

- Rich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouFrom EverandRich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouNo ratings yet

- Lean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeFrom EverandLean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeNo ratings yet

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherFrom EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherRating: 5 out of 5 stars5/5 (14)